In the meantime, I suggest we consider the following example from the book

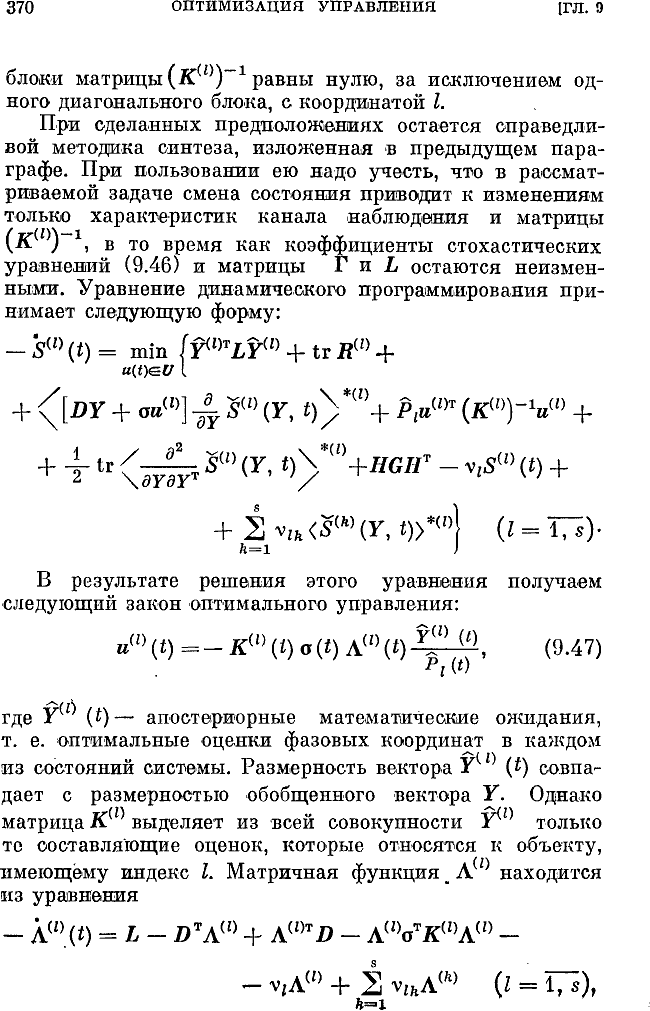

Kazakov, Artemiev. Optimisation of Dynamic Systems of Random Structure. - Moscow: Nauka. 1980.

.

.

.

.

.

.

Next I will present the simulation results for some of my models, both already implemented and new, as they appear ;))

Your own conclusions - what are they? What is "to be considered"? What is this topic about?

the first conclusion is that you can't wait :(

I guess this "topic" is clearly not for you...

In the meantime, I suggest we consider the following example from the book

Kazakov, Artemiev. Optimisation of Dynamic Systems of Random Structure. - Moscow: Nauka. 1980.

The only thing the authors are wrong - they think they can get a system of linear equations (SLE) for dynamic stochastic processes. More precisely, a system can be obtained, but its solution is a dead letter.

The point is that the solvability of the SLU is a matter of luck, i.e. it may or may not have at least one solution, or none at all.

For this very reason, we don't need to solve the SLU, but a system of linear inequalities. In this case, we would get a solution for any scenario involving process dynamics, and if the solvability is for the SLU, then the solution to the inequalities would also be a solution to the SLU.

To make a long story short, I have already solved the same problem, namely as dynamic processes I have taken FI yields for a certain period of time in bars - period, i.e.:

D(i) = (Open[i] - Open[i + period]) / Open[i + period]

Then I form a system of linear inequalities and use it to form a portfolio of assets by solving a system of optimization.

See R-Portfolio - a method of diversification

Well, as for market manageability, it depends on the volume of investments in the portfolio.

1. It would be interesting to see move from general formulas to looking at a specific example. First of all. What does your system matrix (A) look like? h ttp://bankzadach.ru/teoriya-upravleniya/index.php

Without specifying its type it's hard to move on. In your terms it is matrix D

At one time I suggested this kind of quote analysis. https://www.mql5.com/ru/forum/105740/page11

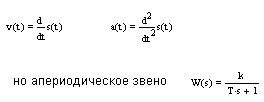

This is in discrete time. The transition from matrix A to F is done using the Laplace transform. There is information on how to make this transition further down the thread. And it is needed since we solve everything in discrete form. There are also specific kinds of matrix A (the essence of them is simple - the derivative of velocity is acceleration, the derivative of acceleration is an inertial link of the second (first) order...+noise

2 . I excluded the U matrix (controls) from the study. Considering it unimportant, because I believe the only way to control forex is currency intervention . In the past, even verbal interventions (like speeches of the Ministry of Finance of Japan, etc.) were attempted. But all these interventions can be characterised by the word Gap, for mathematical research we can say that it is a delta function. And more important for me was to investigate how the system would behave under the influence of a delta function (a single impulse or step) ... You care about the control

So more questions.

If not Gap (which is easily detected anyway) what (what) kind of control are you looking for?

Suppose you found a type of control and its parameters (for example, a sinusoid with the parameters A, f, phi (amplitude, frequency and phase). What will it give you (us) for practical trading? We don't know the ending time of the control, even if we think that the market is controlled....

...

Well, as for market manageability, it depends on the amount of investment for the portfolio.

In my experience, to shift a quote by 1 pip you need about 20 lots in a calm market. Central banks don't do it, short-term intervention and that's it ... after a while the effect is gone ...

The only thing the authors are mistaken about is that they can get a system of linear equations (SLE) for dynamic stochastic processes. More precisely, a system can be obtained, but its solution is a dead letter.

The point is that the solvability of SLU is a matter of luck, i.e. it may or may not have at least one solution.

For this very reason, you don't need to solve the SLU, but a system of linear inequalities. In this case, we would get a solution for any scenario involving process dynamics, and if the solvability is for the SLU, then the solution to the inequalities would also be a solution to the SLU.

To make a long story short, I have already solved the same problem, namely as a dynamic process I have taken FI yields for a certain period of time in bars - period, i.e.:

D(i) = (Open[i] - Open[i + period]) / Open[i + period]

Then I form a system of linear inequalities and use it to form a portfolio of assets by solving a system of optimization.

See R-Portfolio - a method of diversification

Well, as for market manageability, it depends on the volume of investments in the portfolio.

1) The authors, who are major specialists in the field, did not misunderstand at all; their work is of a high standard.

2) SLU is uniquely solvable. (assuming, of course, that it is correctly and error-free).

3) Inequalities can be entered in this case, but that would be a different problem.

4) This may be a solution to your problem, but not to the one given.

5) We are talking about optimal processes, not tester fitting -- these are totally different things.

6) it's not about market control -- it's about the control function in the optimization model -- I'll demonstrate that later.

1. It would be interesting to see move from general formulas to looking at a specific example. First of all. What does your system matrix (A) look like? h ttp://bankzadach.ru/teoriya-upravleniya/index.php

Without specifying its type, it's hard to move on. In your terms, it's a D-matrix.

At one time I suggested this kind of quote analysis. https://www.mql5.com/ru/forum/105740/page11

This is in discrete time. The transition from matrix A to F is done using the Laplace transform. There is information on how to make this transition further down the thread. And it is needed since we solve everything in discrete form. There are also specific kinds of matrix A (the essence of them is simple - the derivative of velocity is acceleration, the derivative of acceleration is an inertial link of the second (first) order...+noise

2 . I excluded the U matrix (controls) from the study. Considering it unimportant, because I believe the only way to control forex is currency intervention . In the past, even verbal interventions (like speeches of the Ministry of Finance of Japan, etc.) were attempted. But all these interventions can be characterised by the word Gap, for mathematical research we can say that it is a delta function. And more important for me was to investigate how the system would behave under the influence of a delta function (a single impulse or step) ... You care about the control

So more questions.

If not Gap (which is easily detected anyway), what (what) kind of control are you looking for?

Suppose that you found a type of control and its parameters (for example, a sinusoid with the parameters A, f, phi (amplitude, frequency and phase). What will it give you (us) for practical trading? We do not know the ending time of the control, even if we suppose that the market is controlled....

The task given is as a starting point for our purposes.

Further on I will modify this problem and bring it to a familiar form, for our needs.

.

It is only a model of a communication channel, nothing more - there is no control object, regulator etc. here yet!

Transitions over different domains (frequency - time t - time n) do not cause any difficulties in principle.

.

.

The control function is very important!

But what it will look like, and how it can be used -- let's think...

For example, like this:

.

We have time... and tomorrow's the weekend... we'll think...

and how to relate this to the market, a phenomenon that many see as random and chaotic.

read the link http://ruforum.mt5.com/threads/4326-quot-БАЗОВЫЕ%20СТРАТЕГИИ%20АЛГОРИТМИЧЕСКОЙ%20ТОРГОВЛИ-quot-%20 (general%20on%20theme%20for%20familiarity...)

it's not quite as chaotic as it seems at first glance

read http://ruforum.mt5.com/threads/4326-quot-БАЗОВЫЕ%20СТРАТЕГИИ%20АЛГОРИТМИЧЕСКОЙ%20ТОРГОВЛИ-quot-%20 (general%20on%20theme%20for%20familiarity...)

it is not quite as chaotic as it seems at first sight

I don't think so, on the contrary. But many people do see it as chaotic and random. And you have misunderstood my statement.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The first thing to do is to define what constitutes a controlled dynamic system and how this relates to the market, a phenomenon seen by many as random and chaotic.

.

.

.

I will correct this later ...

.

.