OK, previous thread here

There is a currency futures and an option on a currency.

What is the correlation if the first one is more likely to be bought than the option, and does it mean that the price of the currency will go up?

By the way, if the price at H1 jumped for a certain period of time, for example 15 minutes, by a certain number of points (20 or more) then a small pullback at the same candle is very likely. Is it worth checking or is it nonsense?

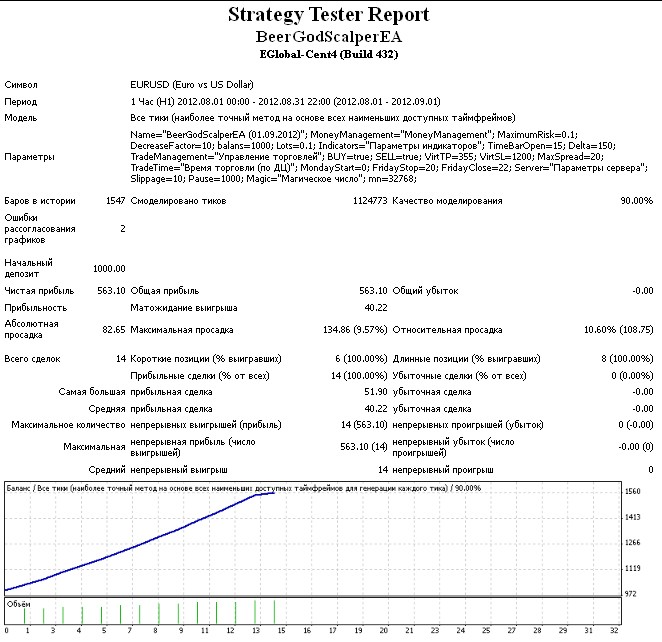

In general another experiment with bicycle invention ended like this... I'll put it on the demo on Monday.

What a silly and funny thing to do, there is only price and time and speed of price change over time, everything is in the plus, though with drawdowns, moose was there but a virtual one as well as takeprofit too ... ![]()

The first of September is the day of knowledge !

Can we calculate dynamic TP on this basis?

No. The spread varies too. It all depends on whether people believe in the movement or have doubts... . Plus, resistance (support) lines from the past interfere in the process up to the reversal. Although they can be calculated at least...

Is it necessary to fit a tricky trailing arm, or is it not worth complicating the design?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use