Creating a Trading Administrator Panel in MQL5 (Part III): Enhancing the GUI with Visual Styling (I)

In this article, we will focus on visually styling the graphical user interface (GUI) of our Trading Administrator Panel using MQL5. We’ll explore various techniques and features available in MQL5 that allow for customization and optimization of the interface, ensuring it meets the needs of traders while maintaining an attractive aesthetic.

Developing a multi-currency Expert Advisor (Part 10): Creating objects from a string

The EA development plan includes several stages with intermediate results being saved in the database. They can only be retrieved from there again as strings or numbers, not objects. So we need a way to recreate the desired objects in the EA from the strings read from the database.

How to Implement Auto Optimization in MQL5 Expert Advisors

Step by step guide for auto optimization in MQL5 for Expert Advisors. We will cover robust optimization logic, best practices for parameter selection, and how to reconstruct strategies with back-testing. Additionally, higher-level methods like walk-forward optimization will be discussed to enhance your trading approach.

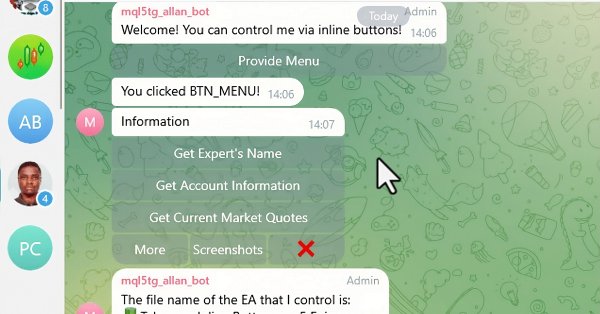

Creating an MQL5-Telegram Integrated Expert Advisor (Part 6): Adding Responsive Inline Buttons

In this article, we integrate interactive inline buttons into an MQL5 Expert Advisor, allowing real-time control via Telegram. Each button press triggers specific actions and sends responses back to the user. We also modularize functions for handling Telegram messages and callback queries efficiently.

MQL5 Wizard Techniques you should know (Part 38): Bollinger Bands

Bollinger Bands are a very common Envelope Indicator used by a lot of traders to manually place and close trades. We examine this indicator by considering as many of the different possible signals it does generate, and see how they could be put to use in a wizard assembled Expert Advisor.

Two-sample Kolmogorov-Smirnov test as an indicator of time series non-stationarity

The article considers one of the most famous non-parametric homogeneity tests – the two-sample Kolmogorov-Smirnov test. Both model data and real quotes are analyzed. The article also provides an example of constructing a non-stationarity indicator (iSmirnovDistance).

Applying Localized Feature Selection in Python and MQL5

This article explores a feature selection algorithm introduced in the paper 'Local Feature Selection for Data Classification' by Narges Armanfard et al. The algorithm is implemented in Python to build binary classifier models that can be integrated with MetaTrader 5 applications for inference.

Neural Networks Made Easy (Part 87): Time Series Patching

Forecasting plays an important role in time series analysis. In the new article, we will talk about the benefits of time series patching.

How to add Trailing Stop using Parabolic SAR

When creating a trading strategy, we need to test a variety of protective stop options. Here is where a dynamic pulling up of the Stop Loss level following the price comes to mind. The best candidate for this is the Parabolic SAR indicator. It is difficult to think of anything simpler and visually clearer.

Creating a Trading Administrator Panel in MQL5 (Part II): Enhancing Responsiveness and Quick Messaging

In this article, we will enhance the responsiveness of the Admin Panel that we previously created. Additionally, we will explore the significance of quick messaging in the context of trading signals.

Example of Stochastic Optimization and Optimal Control

This Expert Advisor, named SMOC (likely standing for Stochastic Model Optimal Control), is a simple example of an advanced algorithmic trading system for MetaTrader 5. It uses a combination of technical indicators, model predictive control, and dynamic risk management to make trading decisions. The EA incorporates adaptive parameters, volatility-based position sizing, and trend analysis to optimize its performance across varying market conditions.

Self Optimizing Expert Advisor with MQL5 And Python (Part III): Cracking The Boom 1000 Algorithm

In this series of articles, we discuss how we can build Expert Advisors capable of autonomously adjusting themselves to dynamic market conditions. In today's article, we will attempt to tune a deep neural network to Deriv's synthetic markets.

Reimagining Classic Strategies in MQL5 (Part II): FTSE100 and UK Gilts

In this series of articles, we explore popular trading strategies and try to improve them using AI. In today's article, we revisit the classical trading strategy built on the relationship between the stock market and the bond market.

MQL5 Wizard Techniques you should know (Part 37): Gaussian Process Regression with Linear and Matern Kernels

Linear Kernels are the simplest matrix of its kind used in machine learning for linear regression and support vector machines. The Matérn kernel on the other hand is a more versatile version of the Radial Basis Function we looked at in an earlier article, and it is adept at mapping functions that are not as smooth as the RBF would assume. We build a custom signal class that utilizes both kernels in forecasting long and short conditions.

Formulating Dynamic Multi-Pair EA (Part 1): Currency Correlation and Inverse Correlation

Dynamic multi pair Expert Advisor leverages both on correlation and inverse correlation strategies to optimize trading performance. By analyzing real-time market data, it identifies and exploits the relationship between currency pairs.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 5): Sending Commands from Telegram to MQL5 and Receiving Real-Time Responses

In this article, we create several classes to facilitate real-time communication between MQL5 and Telegram. We focus on retrieving commands from Telegram, decoding and interpreting them, and sending appropriate responses back. By the end, we ensure that these interactions are effectively tested and operational within the trading environment

Developing a multi-currency Expert Advisor (Part 9): Collecting optimization results for single trading strategy instances

Let's outline the main stages of the EA development. One of the first things to be done will be to optimize a single instance of the developed trading strategy. Let's try to collect all the necessary information about the tester passes during the optimization in one place.

Introduction to MQL5 (Part 9): Understanding and Using Objects in MQL5

Learn to create and customize chart objects in MQL5 using current and historical data. This project-based guide helps you visualize trades and apply MQL5 concepts practically, making it easier to build tools tailored to your trading needs.

Neural Networks Made Easy (Part 86): U-Shaped Transformer

We continue to study timeseries forecasting algorithms. In this article, we will discuss another method: the U-shaped Transformer.

Reimagining Classic Strategies (Part VIII): Currency Markets And Precious Metals on the USDCAD

In this series of articles, we revisit well-known trading strategies to see if we can improve them using AI. In today's discussion, join us as we test whether there is a reliable relationship between precious metals and currencies.

MQL5 Wizard Techniques you should know (Part 36): Q-Learning with Markov Chains

Reinforcement Learning is one of the three main tenets in machine learning, alongside supervised learning and unsupervised learning. It is therefore concerned with optimal control, or learning the best long-term policy that will best suit the objective function. It is with this back-drop, that we explore its possible role in informing the learning-process to an MLP of a wizard assembled Expert Advisor.

Neural Networks Made Easy (Part 85): Multivariate Time Series Forecasting

In this article, I would like to introduce you to a new complex timeseries forecasting method, which harmoniously combines the advantages of linear models and transformers.

Neural Networks Made Easy (Part 84): Reversible Normalization (RevIN)

We already know that pre-processing of the input data plays a major role in the stability of model training. To process "raw" input data online, we often use a batch normalization layer. But sometimes we need a reverse procedure. In this article, we discuss one of the possible approaches to solving this problem.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 4): Modularizing Code Functions for Enhanced Reusability

In this article, we refactor the existing code used for sending messages and screenshots from MQL5 to Telegram by organizing it into reusable, modular functions. This will streamline the process, allowing for more efficient execution and easier code management across multiple instances.

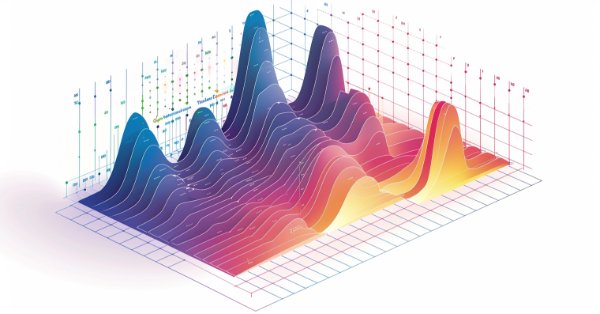

Brain Storm Optimization algorithm (Part II): Multimodality

In the second part of the article, we will move on to the practical implementation of the BSO algorithm, conduct tests on test functions and compare the efficiency of BSO with other optimization methods.

Neural Networks Made Easy (Part 83): The "Conformer" Spatio-Temporal Continuous Attention Transformer Algorithm

This article introduces the Conformer algorithm originally developed for the purpose of weather forecasting, which in terms of variability and capriciousness can be compared to financial markets. Conformer is a complex method. It combines the advantages of attention models and ordinary differential equations.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

Developing a multi-currency Expert Advisor (Part 8): Load testing and handling a new bar

As we progressed, we used more and more simultaneously running instances of trading strategies in one EA. Let's try to figure out how many instances we can get to before we hit resource limitations.

Example of Causality Network Analysis (CNA) and Vector Auto-Regression Model for Market Event Prediction

This article presents a comprehensive guide to implementing a sophisticated trading system using Causality Network Analysis (CNA) and Vector Autoregression (VAR) in MQL5. It covers the theoretical background of these methods, provides detailed explanations of key functions in the trading algorithm, and includes example code for implementation.

Reimagining Classic Strategies (Part VII) : Forex Markets And Sovereign Debt Analysis on the USDJPY

In today's article, we will analyze the relationship between future exchange rates and government bonds. Bonds are among the most popular forms of fixed income securities and will be the focus of our discussion.Join us as we explore whether we can improve a classic strategy using AI.

Developing a Replay System (Part 45): Chart Trade Project (IV)

The main purpose of this article is to introduce and explain the C_ChartFloatingRAD class. We have a Chart Trade indicator that works in a rather interesting way. As you may have noticed, we still have a fairly small number of objects on the chart, and yet we get the expected functionality. The values present in the indicator can be edited. The question is, how is this possible? This article will start to make things clearer.

Implementing a Rapid-Fire Trading Strategy Algorithm with Parabolic SAR and Simple Moving Average (SMA) in MQL5

In this article, we develop a Rapid-Fire Trading Expert Advisor in MQL5, leveraging the Parabolic SAR and Simple Moving Average (SMA) indicators to create a responsive trading strategy. We detail the strategy’s implementation, including indicator usage, signal generation, and the testing and optimization process.

MQL5 Wizard Techniques you should know (Part 35): Support Vector Regression

Support Vector Regression is an idealistic way of finding a function or ‘hyper-plane’ that best describes the relationship between two sets of data. We attempt to exploit this in time series forecasting within custom classes of the MQL5 wizard.

Developing a Replay System (Part 44): Chart Trade Project (III)

In the previous article I explained how you can manipulate template data for use in OBJ_CHART. In that article, I only outlined the topic without going into details, since in that version the work was done in a very simplified way. This was done to make it easier to explain the content, because despite the apparent simplicity of many things, some of them were not so obvious, and without understanding the simplest and most basic part, you would not be able to truly understand the entire picture.

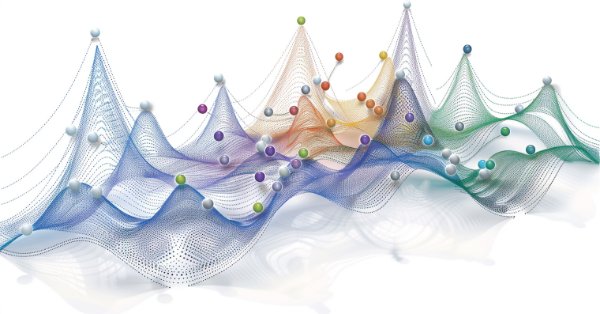

Brain Storm Optimization algorithm (Part I): Clustering

In this article, we will look at an innovative optimization method called BSO (Brain Storm Optimization) inspired by a natural phenomenon called "brainstorming". We will also discuss a new approach to solving multimodal optimization problems the BSO method applies. It allows finding multiple optimal solutions without the need to pre-determine the number of subpopulations. We will also consider the K-Means and K-Means++ clustering methods.

Matrix Factorization: The Basics

Since the goal here is didactic, we will proceed as simply as possible. That is, we will implement only what we need: matrix multiplication. You will see today that this is enough to simulate matrix-scalar multiplication. The most significant difficulty that many people encounter when implementing code using matrix factorization is this: unlike scalar factorization, where in almost all cases the order of the factors does not change the result, this is not the case when using matrices.

Gain an Edge Over Any Market (Part III): Visa Spending Index

In the world of big data, there are millions of alternative datasets that hold the potential to enhance our trading strategies. In this series of articles, we will help you identify the most informative public datasets.

Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

Neural Network in Practice: Secant Line

As already explained in the theoretical part, when working with neural networks we need to use linear regressions and derivatives. Why? The reason is that linear regression is one of the simplest formulas in existence. Essentially, linear regression is just an affine function. However, when we talk about neural networks, we are not interested in the effects of direct linear regression. We are interested in the equation that generates this line. We are not that interested in the line created. Do you know the main equation that we need to understand? If not, I recommend reading this article to understanding it.

Application of Nash's Game Theory with HMM Filtering in Trading

This article delves into the application of John Nash's game theory, specifically the Nash Equilibrium, in trading. It discusses how traders can utilize Python scripts and MetaTrader 5 to identify and exploit market inefficiencies using Nash's principles. The article provides a step-by-step guide on implementing these strategies, including the use of Hidden Markov Models (HMM) and statistical analysis, to enhance trading performance.