- BLODIUM strategy - Candle work!

- Very slow calculation time for LWMA, I need help optimising MA on Array

- Asking for advice from knowledgeable people. About hedging to avoid MS

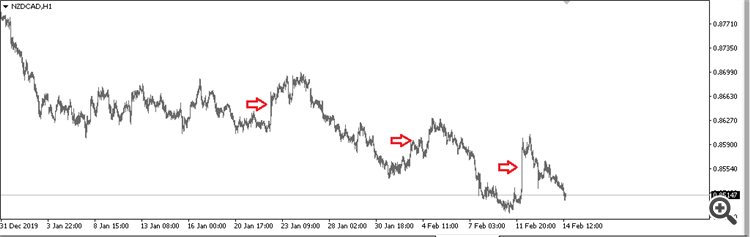

I have a few observations, I will write about them gradually. Here is one of them.

When the price has not been in the area for a long time, it seems to have a hard time moving forward. But it comes back very quickly and easily. That is, these pullbacks can be the size of halfway through, and can be lightning fast. Probably to lick off stops. But most importantly, there is resistance to price ahead and no resistance behind.

I have a few observations, I will write about them gradually. Here is one of them.

When the price has not been in the area for a long time, it seems to have a hard time moving forward. But it comes back very quickly and easily. That is, these pullbacks can be the size of halfway through, and can be lightning fast. Probably to lick off stops. But most importantly, there is resistance to price ahead and no resistance behind.

Time in the market is non-linear

Time is linear)) but price movement within an hour is non-linear. The point: in an hour the price can make 100 steps or 10 steps, it depends on the intensity of trading. Let's assume that 1 step is 1 transaction between market participants. It becomes obvious that if there are 1000 trades per hour, the price can go very far and may go only 10 deals and we will see it as a flat. True time is expressed in trades for the market, and time sampling introduces sampling noise... This is where that "noise" comes in.

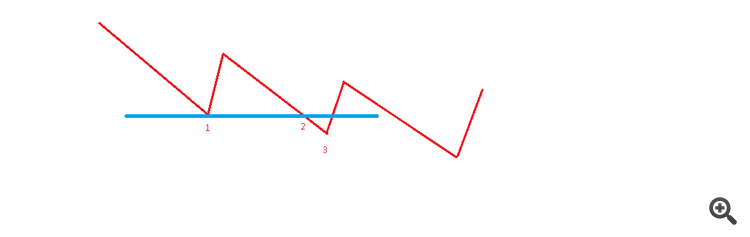

This is correct. I also wanted to point out that after point 1 and up to point 2, price moves quite freely over the blue line. Sometimes it can take a long time, other times it comes quickly to point 2. But obviously this swing is looser and bigger than the actual advance from point 2 to point 3.

Of course not in all cases. Sometimes price flies a rock. But most trends look like that in the picture. I think so. I will try to check it statistically.

Time is linear)) but price movement within an hour is non-linear. The point: in an hour the price can make 100 steps or 10 steps, it depends on the intensity of trading. Let's assume that 1 step is 1 transaction between market participants. It becomes obvious that if there are 1000 trades per hour, the price can go very far and may go only 10 deals and we will see it as a flat. True time is expressed in trades for the market, and time sampling introduces sampling noise... This is where that "noise" comes in.

You are definitely right) it is non-linear with reference to the astronomical time, i.e. a regular graph in the terminal, while the market time is of course linear due to discreteness, but here you have already described everything in detail))

I invite everyone to share the patterns they find.

Can I contribute money straight away?

Can I pay you in cash?

Secret, are you going to hide your secret knowledge from us? No way, now we've found you! Spill it![]()

The main rule is that no matter how much you trade, you'll end up losing

Eugene, great! How to put it to good use now![]()

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use