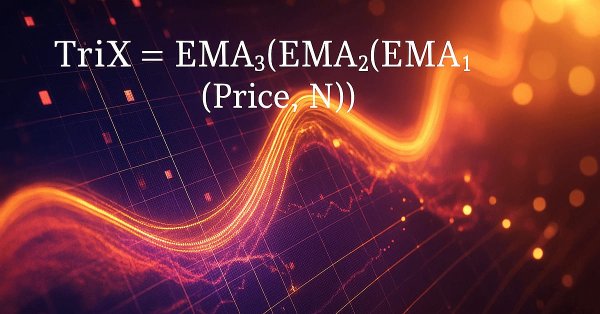

MQL5 Wizard Techniques you should know (Part 67): Using Patterns of TRIX and the Williams Percent Range

The Triple Exponential Moving Average Oscillator (TRIX) and the Williams Percentage Range Oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered recently, is also complementary given that TRIX defines the trend while Williams Percent Range affirms support and Resistance levels. As always, we use the MQL5 wizard to prototype any potential these two may have.

Introduction to MQL5 (Part 16): Building Expert Advisors Using Technical Chart Patterns

This article introduces beginners to building an MQL5 Expert Advisor that identifies and trades a classic technical chart pattern — the Head and Shoulders. It covers how to detect the pattern using price action, draw it on the chart, set entry, stop loss, and take profit levels, and automate trade execution based on the pattern.

MQL5 Wizard Techniques you should know (Part 65): Using Patterns of FrAMA and the Force Index

The Fractal Adaptive Moving Average (FrAMA) and the Force Index Oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. These two indicators complement each other a little bit because FrAMA is a trend following indicator while the Force Index is a volume based oscillator. As always, we use the MQL5 wizard to rapidly explore any potential these two may have.

Price Action Analysis Toolkit Development (Part 23): Currency Strength Meter

Do you know what really drives a currency pair’s direction? It’s the strength of each individual currency. In this article, we’ll measure a currency’s strength by looping through every pair it appears in. That insight lets us predict how those pairs may move based on their relative strengths. Read on to learn more.

Price Action Analysis Toolkit Development (Part 22): Correlation Dashboard

This tool is a Correlation Dashboard that calculates and displays real-time correlation coefficients across multiple currency pairs. By visualizing how pairs move in relation to one another, it adds valuable context to your price-action analysis and helps you anticipate inter-market dynamics. Read on to explore its features and applications.

Raw Code Optimization and Tweaking for Improving Back-Test Results

Enhance your MQL5 code by optimizing logic, refining calculations, and reducing execution time to improve back-test accuracy. Fine-tune parameters, optimize loops, and eliminate inefficiencies for better performance.

MQL5 Wizard Techniques you should know (Part 64): Using Patterns of DeMarker and Envelope Channels with the White-Noise Kernel

The DeMarker Oscillator and the Envelopes' indicator are momentum and support/ resistance tools that can be paired when developing an Expert Advisor. We continue from our last article that introduced these pair of indicators by adding machine learning to the mix. We are using a recurrent neural network that uses the white-noise kernel to process vectorized signals from these two indicators. This is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

MQL5 Wizard Techniques you should know (Part 63): Using Patterns of DeMarker and Envelope Channels

The DeMarker Oscillator and the Envelope indicator are momentum and support/resistance tools that can be paired when developing an Expert Advisor. We therefore examine on a pattern by pattern basis what could be of use and what potentially avoid. We are using, as always, a wizard assembled Expert Advisor together with the Patterns-Usage functions that are built into the Expert Signal Class.

Building a Custom Market Regime Detection System in MQL5 (Part 1): Indicator

This article details creating an MQL5 Market Regime Detection System using statistical methods like autocorrelation and volatility. It provides code for classes to classify trending, ranging, and volatile conditions and a custom indicator.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

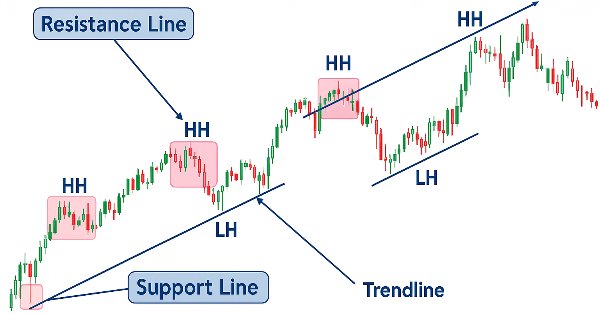

Introduction to MQL5 (Part 15): A Beginner's Guide to Building Custom Indicators (IV)

In this article, you'll learn how to build a price action indicator in MQL5, focusing on key points like low (L), high (H), higher low (HL), higher high (HH), lower low (LL), and lower high (LH) for analyzing trends. You'll also explore how to identify the premium and discount zones, mark the 50% retracement level, and use the risk-reward ratio to calculate profit targets. The article also covers determining entry points, stop loss (SL), and take profit (TP) levels based on the trend structure.

Price Action Analysis Toolkit Development (Part 19): ZigZag Analyzer

Every price action trader manually uses trendlines to confirm trends and spot potential turning or continuation levels. In this series on developing a price action analysis toolkit, we introduce a tool focused on drawing slanted trendlines for easy market analysis. This tool simplifies the process for traders by clearly outlining key trends and levels essential for effective price action evaluation.

Simple solutions for handling indicators conveniently

In this article, I will describe how to make a simple panel to change the indicator settings directly from the chart, and what changes need to be made to the indicator to connect the panel. This article is intended for novice MQL5 users.

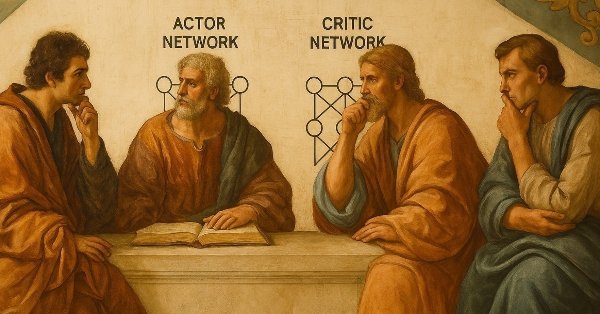

MQL5 Wizard Techniques you should know (Part 58): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

Moving Average and Stochastic Oscillator are very common indicators whose collective patterns we explored in the prior article, via a supervised learning network, to see which “patterns-would-stick”. We take our analyses from that article, a step further by considering the effects' reinforcement learning, when used with this trained network, would have on performance. Readers should note our testing is over a very limited time window. Nonetheless, we continue to harness the minimal coding requirements afforded by the MQL5 wizard in showcasing this.

Introduction to MQL5 (Part 14): A Beginner's Guide to Building Custom Indicators (III)

Learn to build a Harmonic Pattern indicator in MQL5 using chart objects. Discover how to detect swing points, apply Fibonacci retracements, and automate pattern recognition.

From Novice to Expert: Support and Resistance Strength Indicator (SRSI)

In this article, we will share insights on how to leverage MQL5 programming to pinpoint market levels—differentiating between weaker and strongest price levels. We will fully develop a working, Support and Resistance Strength Indicator (SRSI).

MQL5 Wizard Techniques you should know (Part 57): Supervised Learning with Moving Average and Stochastic Oscillator

Moving Average and Stochastic Oscillator are very common indicators that some traders may not use a lot because of their lagging nature. In a 3-part ‘miniseries' that considers the 3 main forms of machine learning, we look to see if this bias against these indicators is justified, or they might be holding an edge. We do our examination in wizard assembled Expert Advisors.

Data Science and ML (Part 34): Time series decomposition, Breaking the stock market down to the core

In a world overflowing with noisy and unpredictable data, identifying meaningful patterns can be challenging. In this article, we'll explore seasonal decomposition, a powerful analytical technique that helps separate data into its key components: trend, seasonal patterns, and noise. By breaking data down this way, we can uncover hidden insights and work with cleaner, more interpretable information.

Price Action Analysis Toolkit Development (Part 16): Introducing Quarters Theory (II) — Intrusion Detector EA

In our previous article, we introduced a simple script called "The Quarters Drawer." Building on that foundation, we are now taking the next step by creating a monitor Expert Advisor (EA) to track these quarters and provide oversight regarding potential market reactions at these levels. Join us as we explore the process of developing a zone detection tool in this article.

MQL5 Wizard Techniques you should know (Part 56): Bill Williams Fractals

The Fractals by Bill Williams is a potent indicator that is easy to overlook when one initially spots it on a price chart. It appears too busy and probably not incisive enough. We aim to draw away this curtain on this indicator by examining what its various patterns could accomplish when examined with forward walk tests on all, with wizard assembled Expert Advisor.

Price Action Analysis Toolkit Development (Part 14): Parabolic Stop and Reverse Tool

Embracing technical indicators in price action analysis is a powerful approach. These indicators often highlight key levels of reversals and retracements, offering valuable insights into market dynamics. In this article, we demonstrate how we developed an automated tool that generates signals using the Parabolic SAR indicator.

William Gann methods (Part I): Creating Gann Angles indicator

What is the essence of Gann Theory? How are Gann angles constructed? We will create Gann Angles indicator for MetaTrader 5.

Price Action Analysis Toolkit Development (Part 13): RSI Sentinel Tool

Price action can be effectively analyzed by identifying divergences, with technical indicators such as the RSI providing crucial confirmation signals. In the article below, we explain how automated RSI divergence analysis can identify trend continuations and reversals, thereby offering valuable insights into market sentiment.

Building a Keltner Channel Indicator with Custom Canvas Graphics in MQL5

In this article, we build a Keltner Channel indicator with custom canvas graphics in MQL5. We detail the integration of moving averages, ATR calculations, and enhanced chart visualization. We also cover backtesting to evaluate the indicator’s performance for practical trading insights.

Price Action Analysis Toolkit Development (Part 12): External Flow (III) TrendMap

The flow of the market is determined by the forces between bulls and bears. There are specific levels that the market respects due to the forces acting on them. Fibonacci and VWAP levels are especially powerful in influencing market behavior. Join me in this article as we explore a strategy based on VWAP and Fibonacci levels for signal generation.

Introduction to MQL5 (Part 12): A Beginner's Guide to Building Custom Indicators

Learn how to build a custom indicator in MQL5. With a project-based approach. This beginner-friendly guide covers indicator buffers, properties, and trend visualization, allowing you to learn step-by-step.

Chaos theory in trading (Part 2): Diving deeper

We continue our dive into chaos theory in financial markets. This time I will consider its applicability to the analysis of currencies and other assets.

MQL5 Wizard Techniques you should know (Part 53): Market Facilitation Index

The Market Facilitation Index is another Bill Williams Indicator that is intended to measure the efficiency of price movement in tandem with volume. As always, we look at the various patterns of this indicator within the confines of a wizard assembly signal class, and present a variety of test reports and analyses for the various patterns.

Redefining MQL5 and MetaTrader 5 Indicators

An innovative approach to collecting indicator information in MQL5 enables more flexible and streamlined data analysis by allowing developers to pass custom inputs to indicators for immediate calculations. This approach is particularly useful for algorithmic trading, as it provides enhanced control over the information processed by indicators, moving beyond traditional constraints.

Price Action Analysis Toolkit Development (Part 8): Metrics Board

As one of the most powerful Price Action analysis toolkits, the Metrics Board is designed to streamline market analysis by instantly providing essential market metrics with just a click of a button. Each button serves a specific function, whether it’s analyzing high/low trends, volume, or other key indicators. This tool delivers accurate, real-time data when you need it most. Let’s dive deeper into its features in this article.

Introduction to MQL5 (Part 11): A Beginner's Guide to Working with Built-in Indicators in MQL5 (II)

Discover how to develop an Expert Advisor (EA) in MQL5 using multiple indicators like RSI, MA, and Stochastic Oscillator to detect hidden bullish and bearish divergences. Learn to implement effective risk management and automate trades with detailed examples and fully commented source code for educational purposes!

MQL5 Wizard Techniques you should know (Part 52): Accelerator Oscillator

The Accelerator Oscillator is another Bill Williams Indicator that tracks price momentum's acceleration and not just its pace. Although much like the Awesome oscillator we reviewed in a recent article, it seeks to avoid the lagging effects by focusing more on acceleration as opposed to just speed. We examine as always what patterns we can get from this and also what significance each could have in trading via a wizard assembled Expert Advisor.

Forex spread trading using seasonality

The article examines the possibilities of generating and providing reporting data on the use of the seasonality factor when trading spreads on Forex.

Econometric tools for forecasting volatility: GARCH model

The article describes the properties of the non-linear model of conditional heteroscedasticity (GARCH). The iGARCH indicator has been built on its basis for predicting volatility one step ahead. The ALGLIB numerical analysis library is used to estimate the model parameters.

Mastering File Operations in MQL5: From Basic I/O to Building a Custom CSV Reader

This article focuses on essential MQL5 file-handling techniques, spanning trade logs, CSV processing, and external data integration. It offers both conceptual understanding and hands-on coding guidance. Readers will learn to build a custom CSV importer class step-by-step, gaining practical skills for real-world applications.

How to build and optimize a volume-based trading system (Chaikin Money Flow - CMF)

In this article, we will provide a volume-based indicator, Chaikin Money Flow (CMF) after identifying how it can be constructed, calculated, and used. We will understand how to build a custom indicator. We will share some simple strategies that can be used and then test them to understand which one is better.

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

MQL5 Wizard Techniques you should know (Part 50): Awesome Oscillator

The Awesome Oscillator is another Bill Williams Indicator that is used to measure momentum. It can generate multiple signals, and therefore we review these on a pattern basis, as in prior articles, by capitalizing on the MQL5 wizard classes and assembly.

MQL5 Wizard Techniques you should know (Part 48): Bill Williams Alligator

The Alligator Indicator, which was the brain child of Bill Williams, is a versatile trend identification indicator that yields clear signals and is often combined with other indicators. The MQL5 wizard classes and assembly allow us to test a variety of signals on a pattern basis, and so we consider this indicator as well.

Price Action Analysis Toolkit Development (Part 1): Chart Projector

This project aims to leverage the MQL5 algorithm to develop a comprehensive set of analysis tools for MetaTrader 5. These tools—ranging from scripts and indicators to AI models and expert advisors—will automate the market analysis process. At times, this development will yield tools capable of performing advanced analyses with no human involvement and forecasting outcomes to appropriate platforms. No opportunity will ever be missed. Join me as we explore the process of building a robust market analysis custom tools' chest. We will begin by developing a simple MQL5 program that I have named, Chart Projector.