From Novice to Expert: Animated News Headline Using MQL5 (VIII) — Quick Trade Buttons for News Trading

While algorithmic trading systems manage automated operations, many news traders and scalpers prefer active control during high-impact news events and fast-paced market conditions, requiring rapid order execution and management. This underscores the need for intuitive front-end tools that integrate real-time news feeds, economic calendar data, indicator insights, AI-driven analytics, and responsive trading controls.

Self Optimizing Expert Advisors in MQL5 (Part 11): A Gentle Introduction to the Fundamentals of Linear Algebra

In this discussion, we will set the foundation for using powerful linear, algebra tools that are implemented in the MQL5 matrix and vector API. For us to make proficient use of this API, we need to have a firm understanding of the principles in linear algebra that govern intelligent use of these methods. This article aims to get the reader an intuitive level of understanding of some of the most important rules of linear algebra that we, as algorithmic traders in MQL5 need,to get started, taking advantage of this powerful library.

Expert Advisor based on the universal MLP approximator

The article presents a simple and accessible way to use a neural network in a trading EA that does not require deep knowledge of machine learning. The method eliminates the target function normalization, as well as overcomes "weight explosion" and "network stall" issues offering intuitive training and visual control of the results.

Price Action Analysis Toolkit Development (Part 34): Turning Raw Market Data into Predictive Models Using an Advanced Ingestion Pipeline

Have you ever missed a sudden market spike or been caught off‑guard when one occurred? The best way to anticipate live events is to learn from historical patterns. Intending to train an ML model, this article begins by showing you how to create a script in MetaTrader 5 that ingests historical data and sends it to Python for storage—laying the foundation for your spike‑detection system. Read on to see each step in action.

From Novice to Expert: Reporting EA — Setting up the work flow

Brokerages often provide trading account reports at regular intervals, based on a predefined schedule. These firms, through their API technologies, have access to your account activity and trading history, allowing them to generate performance reports on your behalf. Similarly, the MetaTrader 5 terminal stores detailed records of your trading activity, which can be leveraged using MQL5 to create fully customized reports and define personalized delivery methods.

Market Profile indicator (Part 2): Optimization and rendering on canvas

The article considers an optimized version of the Market Profile indicator, where rendering with multiple graphical objects is replaced with rendering on a canvas - an object of the CCanvas class.

From Novice to Expert: Animated News Headline Using MQL5 (VII) — Post Impact Strategy for News Trading

The risk of whipsaw is extremely high during the first minute following a high-impact economic news release. In that brief window, price movements can be erratic and volatile, often triggering both sides of pending orders. Shortly after the release—typically within a minute—the market tends to stabilize, resuming or correcting the prevailing trend with more typical volatility. In this section, we’ll explore an alternative approach to news trading, aiming to assess its effectiveness as a valuable addition to a trader’s toolkit. Continue reading for more insights and details in this discussion.

Price Action Analysis Toolkit Development (Part 33): Candle Range Theory Tool

Upgrade your market reading with the Candle-Range Theory suite for MetaTrader 5, a fully MQL5-native solution that converts raw price bars into real-time volatility intelligence. The lightweight CRangePattern library benchmarks each candle’s true range against an adaptive ATR and classifies it the instant it closes; the CRT Indicator then projects those classifications on your chart as crisp, color-coded rectangles and arrows that reveal tightening consolidations, explosive breakouts, and full-range engulfment the moment they occur.

Population ADAM (Adaptive Moment Estimation)

The article presents the transformation of the well-known and popular ADAM gradient optimization method into a population algorithm and its modification with the introduction of hybrid individuals. The new approach allows creating agents that combine elements of successful decisions using probability distribution. The key innovation is the formation of hybrid population individuals that adaptively accumulate information from the most promising solutions, increasing the efficiency of search in complex multidimensional spaces.

Reimagining Classic Strategies (Part 14): Multiple Strategy Analysis

In this article, we continue our exploration of building an ensemble of trading strategies and using the MT5 genetic optimizer to tune the strategy parameters. Today, we analyzed the data in Python, showing our model could better predict which strategy would outperform, achieving higher accuracy than forecasting market returns directly. However, when we tested our application with its statistical models, our performance levels fell dismally. We subsequently discovered that the genetic optimizer unfortunately favored highly correlated strategies, prompting us to revise our method to keep vote weights fixed and focus optimization on indicator settings instead.

Self Optimizing Expert Advisors in MQL5 (Part 9): Double Moving Average Crossover

This article outlines the design of a double moving average crossover strategy that uses signals from a higher timeframe (D1) to guide entries on a lower timeframe (M15), with stop-loss levels calculated from an intermediate risk timeframe (H4). It introduces system constants, custom enumerations, and logic for trend-following and mean-reverting modes, while emphasizing modularity and future optimization using a genetic algorithm. The approach allows for flexible entry and exit conditions, aiming to reduce signal lag and improve trade timing by aligning lower-timeframe entries with higher-timeframe trends.

From Basic to Intermediate: Recursion

In this article we will look at a very interesting and quite challenging programming concept, although it should be treated with great caution, as its misuse or misunderstanding can turn relatively simple programs into something unnecessarily complex. But when used correctly and adapted perfectly to equally suitable situations, recursion becomes an excellent ally in solving problems that would otherwise be much more laborious and time-consuming. The materials presented here are intended for educational purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 75): New Chart Trade (II)

In this article, we will talk about the C_ChartFloatingRAD class. This is what makes Chart Trade work. However, the explanation does not end there. We will complete it in the next article, as the content of this article is quite extensive and requires deep understanding. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Market Profile indicator

In this article, we will consider Market Profile indicator. We will find out what lies behind this name, try to understand its operation principles and have a look at its terminal version (MarketProfile).

From Basic to Intermediate: Union (II)

Today we have a very funny and quite interesting article. We will look at Union and will try to solve the problem discussed earlier. We'll also explore some unusual situations that can arise when using union in applications. The materials presented here are intended for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Novice to Expert: Animated News Headline Using MQL5 (V)—Event Reminder System

In this discussion, we’ll explore additional advancements as we integrate refined event‑alerting logic for the economic calendar events displayed by the News Headline EA. This enhancement is critical—it ensures users receive timely notifications a short time before key upcoming events. Join this discussion to discover more.

Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis (3) — Weighted Voting Policy

This article explores how determining the optimal number of strategies in an ensemble can be a complex task that is easier to solve through the use of the MetaTrader 5 genetic optimizer. The MQL5 Cloud is also employed as a key resource for accelerating backtesting and optimization. All in all, our discussion here sets the stage for developing statistical models to evaluate and improve trading strategies based on our initial ensemble results.

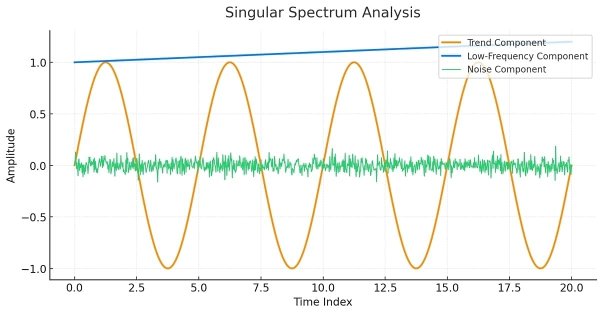

Singular Spectrum Analysis in MQL5

This article is meant as a guide for those unfamiliar with the concept of Singular Spectrum Analysis and who wish to gain enough understanding to be able to apply the built-in tools available in MQL5.

Master MQL5 from Beginner to Pro (Part VI): Basics of Developing Expert Advisors

This article continues the series for beginners. Here we will discuss the basic principles of developing Expert Advisors (EAs). We will create two EAs: the first one will trade without indicators, using pending orders, and the second one will be based on the standard MA indicator, opening deals at the current price. Here I assume that you are no longer a complete beginner and have a relatively good command of the material from the previous articles.

Developing a Replay System (Part 74): New Chart Trade (I)

In this article, we will modify the last code shown in this series about Chart Trade. These changes are necessary to adapt the code to the current replay/simulation system model. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

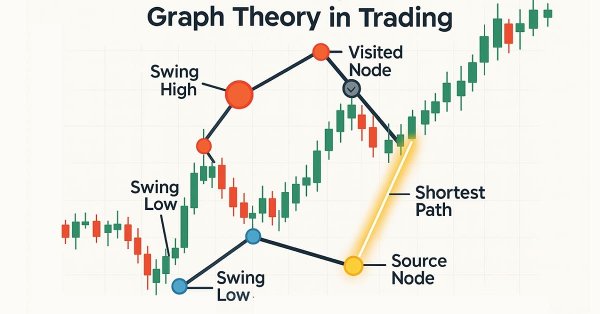

Graph Theory: Dijkstra's Algorithm Applied in Trading

Dijkstra's algorithm, a classic shortest-path solution in graph theory, can optimize trading strategies by modeling market networks. Traders can use it to find the most efficient routes in the candlestick chart data.

Formulating Dynamic Multi-Pair EA (Part 3): Mean Reversion and Momentum Strategies

In this article, we will explore the third part of our journey in formulating a Dynamic Multi-Pair Expert Advisor (EA), focusing specifically on integrating Mean Reversion and Momentum trading strategies. We will break down how to detect and act on price deviations from the mean (Z-score), and how to measure momentum across multiple forex pairs to determine trade direction.

From Basic to Intermediate: Union (I)

In this article we will look at what a union is. Here, through experiments, we will analyze the first constructions in which union can be used. However, what will be shown here is only a core part of a set of concepts and information that will be covered in subsequent articles. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Novice to Expert: Animated News Headline Using MQL5 (IV) — Locally hosted AI model market insights

In today's discussion, we explore how to self-host open-source AI models and use them to generate market insights. This forms part of our ongoing effort to expand the News Headline EA, introducing an AI Insights Lane that transforms it into a multi-integration assistive tool. The upgraded EA aims to keep traders informed through calendar events, financial breaking news, technical indicators, and now AI-generated market perspectives—offering timely, diverse, and intelligent support to trading decisions. Join the conversation as we explore practical integration strategies and how MQL5 can collaborate with external resources to build a powerful and intelligent trading work terminal.

From Novice to Expert: Animated News Headline Using MQL5 (III) — Indicator Insights

In this article, we’ll advance the News Headline EA by introducing a dedicated indicator insights lane—a compact, on-chart display of key technical signals generated from popular indicators such as RSI, MACD, Stochastic, and CCI. This approach eliminates the need for multiple indicator subwindows on the MetaTrader 5 terminal, keeping your workspace clean and efficient. By leveraging the MQL5 API to access indicator data in the background, we can process and visualize market insights in real-time using custom logic. Join us as we explore how to manipulate indicator data in MQL5 to create an intelligent and space-saving scrolling insights system, all within a single horizontal lane on your trading chart.

Moving Average in MQL5 from scratch: Plain and simple

Using simple examples, we will examine the principles of calculating moving averages, as well as learn about the ways to optimize indicator calculations, including moving averages.

Price Action Analysis Toolkit Development (Part 29): Boom and Crash Interceptor EA

Discover how the Boom & Crash Interceptor EA transforms your charts into a proactive alert system-spotting explosive moves with lightning-fast velocity scans, volatility surge checks, trend confirmation, and pivot-zone filters. With crisp green “Boom” and red “Crash” arrows guiding your every decision, this tool cuts through the noise and lets you capitalize on market spikes like never before. Dive in to see how it works and why it can become your next essential edge.

Mastering Log Records (Part 9): Implementing the builder pattern and adding default configurations

This article shows how to drastically simplify the use of the Logify library with the Builder pattern and automatic default configurations. It explains the structure of the specialized builders, how to use them with smart auto-completion, and how to ensure a functional log even without manual configuration. It also covers tweaks for MetaTrader 5 build 5100.

Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis (2)

Join us for our follow-up discussion, where we will merge our first two trading strategies into an ensemble trading strategy. We shall demonstrate the different schemes possible for combining multiple strategies and also how to exercise control over the parameter space, to ensure that effective optimization remains possible even as our parameter size grows.

Developing a Replay System (Part 73): An Unusual Communication (II)

In this article, we will look at how to transmit information in real time between the indicator and the service, and also understand why problems may arise when changing the timeframe and how to solve them. As a bonus, you will get access to the latest version of the replay /simulation app.

Developing Advanced ICT Trading Systems: Implementing Order Blocks in an Indicator

In this article, we will learn how to create an indicator that detects, draws, and alerts on the mitigation of order blocks. We will also take a detailed look at how to identify these blocks on the chart, set accurate alerts, and visualize their position using rectangles to better understand the price action. This indicator will serve as a key tool for traders who follow the Smart Money Concepts and the Inner Circle Trader methodology.

Atomic Orbital Search (AOS) algorithm

The article considers the Atomic Orbital Search (AOS) algorithm, which uses the concepts of the atomic orbital model to simulate the search for solutions. The algorithm is based on probability distributions and the dynamics of interactions in the atom. The article discusses in detail the mathematical aspects of AOS, including updating the positions of candidate solutions and the mechanisms of energy absorption and release. AOS opens new horizons for applying quantum principles to computing problems by offering an innovative approach to optimization.

Price Action Analysis Toolkit Development (Part 28): Opening Range Breakout Tool

At the start of each trading session, the market’s directional bias often becomes clear only after price moves beyond the opening range. In this article, we explore how to build an MQL5 Expert Advisor that automatically detects and analyzes Opening Range Breakouts, providing you with timely, data‑driven signals for confident intraday entries.

From Novice to Expert: Animated News Headline Using MQL5 (II)

Today, we take another step forward by integrating an external news API as the source of headlines for our News Headline EA. In this phase, we’ll explore various news sources—both established and emerging—and learn how to access their APIs effectively. We'll also cover methods for parsing the retrieved data into a format optimized for display within our Expert Advisor. Join the discussion as we explore the benefits of accessing news headlines and the economic calendar directly on the chart, all within a compact, non-intrusive interface.

Reimagining Classic Strategies (Part 13): Taking Our Crossover Strategy to New Dimensions (Part 2)

Join us in our discussion as we look for additional improvements to make to our moving-average cross over strategy to reduce the lag in our trading strategy to more reliable levels by leveraging our skills in data science. It is a well-studied fact that projecting your data to higher dimensions can at times improve the performance of your machine learning models. We will demonstrate what this practically means for you as a trader, and illustrate how you can weaponize this powerful principle using your MetaTrader 5 Terminal.

Mastering Log Records (Part 8): Error Records That Translate Themselves

In this eighth installment of the Mastering Log Records series, we explore the implementation of multilingual error messages in Logify, a powerful logging library for MQL5. You’ll learn how to structure errors with context, translate messages into multiple languages, and dynamically format logs by severity level. All of this with a clean, extensible, and production-ready design.

From Novice to Expert: Animated News Headline Using MQL5 (I)

News accessibility is a critical factor when trading on the MetaTrader 5 terminal. While numerous news APIs are available, many traders face challenges in accessing and integrating them effectively into their trading environment. In this discussion, we aim to develop a streamlined solution that brings news directly onto the chart—where it’s most needed. We'll accomplish this by building a News Headline Expert Advisor that monitors and displays real-time news updates from API sources.

From Basic to Intermediate: Array (IV)

In this article, we'll look at how you can do something very similar to what's implemented in languages like C, C++, and Java. I am talking about passing a virtually infinite number of parameters inside a function or procedure. While this may seem like a fairly advanced topic, in my opinion, what will be shown here can be easily implemented by anyone who has understood the previous concepts. Provided that they were really properly understood.

Developing a Replay System (Part 72): An Unusual Communication (I)

What we create today will be difficult to understand. Therefore, in this article I will only talk about the initial stage. Please read this article carefully, it is an important prerequisite before we proceed to the next step. The purpose of this material is purely didactic as we will only study and master the presented concepts, without practical application.

Build Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis

How best can we combine multiple strategies to create a powerful ensemble strategy? Join us in this discussion as we look to fit together three different strategies into our trading application. Traders often employ specialized strategies for opening and closing positions, and we want to know if our machines can perform this task better. For our opening discussion, we will get familiar with the faculties of the strategy tester and the principles of OOP we will need for this task.