MetaTrader 5 on macOS

We provide a special installer for the MetaTrader 5 trading platform on macOS. It is a full-fledged wizard that allows you to install the application natively. The installer performs all the required steps: it identifies your system, downloads and installs the latest Wine version, configures it, and then installs MetaTrader within it. All steps are completed in the automated mode, and you can start using the platform immediately after installation.

Neural Networks in Trading: Piecewise Linear Representation of Time Series

This article is somewhat different from my earlier publications. In this article, we will talk about an alternative representation of time series. Piecewise linear representation of time series is a method of approximating a time series using linear functions over small intervals.

Adaptive Social Behavior Optimization (ASBO): Schwefel, Box-Muller Method

This article provides a fascinating insight into the world of social behavior in living organisms and its influence on the creation of a new mathematical model - ASBO (Adaptive Social Behavior Optimization). We will examine how the principles of leadership, neighborhood, and cooperation observed in living societies inspire the development of innovative optimization algorithms.

Developing a Replay System (Part 55): Control Module

In this article, we will implement a control indicator so that it can be integrated into the message system we are developing. Although it is not very difficult, there are some details that need to be understood about the initialization of this module. The material presented here is for educational purposes only. In no way should it be considered as an application for any purpose other than learning and mastering the concepts shown.

Developing A Swing Entries Monitoring (EA)

As the year approaches its end, long-term traders often reflect on market history to analyze its behavior and trends, aiming to project potential future movements. In this article, we will explore the development of a long-term entry monitoring Expert Advisor (EA) using MQL5. The objective is to address the challenge of missed long-term trading opportunities caused by manual trading and the absence of automated monitoring systems. We'll use one of the most prominently traded pairs as an example to strategize and develop our solution effectively.

Build Self Optimizing Expert Advisors in MQL5 (Part 3): Dynamic Trend Following and Mean Reversion Strategies

Financial markets are typically classified as either in a range mode or a trending mode. This static view of the market may make it easier for us to trade in the short run. However, it is disconnected from the reality of the market. In this article, we look to better understand how exactly financial markets move between these 2 possible modes and how we can use our new understanding of market behavior to gain confidence in our algorithmic trading strategies.

Neural Networks Made Easy (Part 97): Training Models With MSFformer

When exploring various model architecture designs, we often devote insufficient attention to the process of model training. In this article, I aim to address this gap.

MQL5 Wizard Techniques you should know (Part 52): Accelerator Oscillator

The Accelerator Oscillator is another Bill Williams Indicator that tracks price momentum's acceleration and not just its pace. Although much like the Awesome oscillator we reviewed in a recent article, it seeks to avoid the lagging effects by focusing more on acceleration as opposed to just speed. We examine as always what patterns we can get from this and also what significance each could have in trading via a wizard assembled Expert Advisor.

Ensemble methods to enhance classification tasks in MQL5

In this article, we present the implementation of several ensemble classifiers in MQL5 and discuss their efficacy in varying situations.

Reimagining Classic Strategies (Part 13): Minimizing The Lag in Moving Average Cross-Overs

Moving average cross-overs are widely known by traders in our community, and yet the core of the strategy has changed very little since its inception. In this discussion, we will present you with a slight adjustment to the original strategy, that aims to minimize the lag present in the trading strategy. All fans of the original strategy, could consider revising the strategy in accordance with the insights we will discuss today. By using 2 moving averages with the same period, we reduce the lag in the trading strategy considerably, without violating the foundational principles of the strategy.

Artificial Electric Field Algorithm (AEFA)

The article presents an artificial electric field algorithm (AEFA) inspired by Coulomb's law of electrostatic force. The algorithm simulates electrical phenomena to solve complex optimization problems using charged particles and their interactions. AEFA exhibits unique properties in the context of other algorithms related to laws of nature.

News Trading Made Easy (Part 6): Performing Trades (III)

In this article news filtration for individual news events based on their IDs will be implemented. In addition, previous SQL queries will be improved to provide additional information or reduce the query's runtime. Furthermore, the code built in the previous articles will be made functional.

Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

The previously developed risk manager contained only basic functionality. Let's try to consider possible ways of its development, allowing us to improve trading results without interfering with the logic of trading strategies.

Forex spread trading using seasonality

The article examines the possibilities of generating and providing reporting data on the use of the seasonality factor when trading spreads on Forex.

Econometric tools for forecasting volatility: GARCH model

The article describes the properties of the non-linear model of conditional heteroscedasticity (GARCH). The iGARCH indicator has been built on its basis for predicting volatility one step ahead. The ALGLIB numerical analysis library is used to estimate the model parameters.

Neural Networks Made Easy (Part 96): Multi-Scale Feature Extraction (MSFformer)

Efficient extraction and integration of long-term dependencies and short-term features remain an important task in time series analysis. Their proper understanding and integration are necessary to create accurate and reliable predictive models.

Automating Trading Strategies in MQL5 (Part 3): The Zone Recovery RSI System for Dynamic Trade Management

In this article, we create a Zone Recovery RSI EA System in MQL5, using RSI signals to trigger trades and a recovery strategy to manage losses. We implement a "ZoneRecovery" class to automate trade entries, recovery logic, and position management. The article concludes with backtesting insights to optimize performance and enhance the EA’s effectiveness.

Price Action Analysis Toolkit Development (Part 6): Mean Reversion Signal Reaper

While some concepts may seem straightforward at first glance, bringing them to life in practice can be quite challenging. In the article below, we'll take you on a journey through our innovative approach to automating an Expert Advisor (EA) that skillfully analyzes the market using a mean reversion strategy. Join us as we unravel the intricacies of this exciting automation process.

MQL5 Trading Toolkit (Part 5): Expanding the History Management EX5 Library with Position Functions

Discover how to create exportable EX5 functions to efficiently query and save historical position data. In this step-by-step guide, we will expand the History Management EX5 library by developing modules that retrieve key properties of the most recently closed position. These include net profit, trade duration, pip-based stop loss, take profit, profit values, and various other important details.

Building a Candlestick Trend Constraint Model (Part 10): Strategic Golden and Death Cross (EA)

Did you know that the Golden Cross and Death Cross strategies, based on moving average crossovers, are some of the most reliable indicators for identifying long-term market trends? A Golden Cross signals a bullish trend when a shorter moving average crosses above a longer one, while a Death Cross indicates a bearish trend when the shorter average moves below. Despite their simplicity and effectiveness, manually applying these strategies often leads to missed opportunities or delayed trades. By automating them within the Trend Constraint EA using MQL5, these strategies can operate independently to handle market reversals efficiently, while constrained strategies align with broader trends. This approach revolutionizes performance by ensuring precise execution and seamless integration of reversal and trend-following systems.

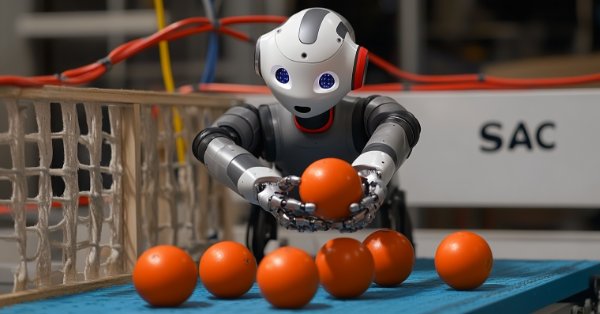

MQL5 Wizard Techniques you should know (Part 51): Reinforcement Learning with SAC

Soft Actor Critic is a Reinforcement Learning algorithm that utilizes 3 neural networks. An actor network and 2 critic networks. These machine learning models are paired in a master slave partnership where the critics are modelled to improve the forecast accuracy of the actor network. While also introducing ONNX in these series, we explore how these ideas could be put to test as a custom signal of a wizard assembled Expert Advisor.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (III) – Adapter-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Integrating Discord with MetaTrader 5: Building a Trading Bot with Real-Time Notifications

In this article, we will see how to integrate MetaTrader 5 and a discord server in order to receive trading notifications in real time from any location. We will see how to configure the platform and Discord to enable the delivery of alerts to Discord. We will also cover security issues which arise in connection with the use of WebRequests and webhooks for such alerting solutions.

Mastering File Operations in MQL5: From Basic I/O to Building a Custom CSV Reader

This article focuses on essential MQL5 file-handling techniques, spanning trade logs, CSV processing, and external data integration. It offers both conceptual understanding and hands-on coding guidance. Readers will learn to build a custom CSV importer class step-by-step, gaining practical skills for real-world applications.

Integrating MQL5 with data processing packages (Part 4): Big Data Handling

Exploring advanced techniques to integrate MQL5 with powerful data processing tools, this part focuses on efficient handling of big data to enhance trading analysis and decision-making.

How to build and optimize a volume-based trading system (Chaikin Money Flow - CMF)

In this article, we will provide a volume-based indicator, Chaikin Money Flow (CMF) after identifying how it can be constructed, calculated, and used. We will understand how to build a custom indicator. We will share some simple strategies that can be used and then test them to understand which one is better.

Automating Trading Strategies in MQL5 (Part 2): The Kumo Breakout System with Ichimoku and Awesome Oscillator

In this article, we create an Expert Advisor (EA) that automates the Kumo Breakout strategy using the Ichimoku Kinko Hyo indicator and the Awesome Oscillator. We walk through the process of initializing indicator handles, detecting breakout conditions, and coding automated trade entries and exits. Additionally, we implement trailing stops and position management logic to enhance the EA's performance and adaptability to market conditions.

Build Self Optimizing Expert Advisors in MQL5 (Part 2): USDJPY Scalping Strategy

Join us today as we challenge ourselves to build a trading strategy around the USDJPY pair. We will trade candlestick patterns that are formed on the daily time frame because they potentially have more strength behind them. Our initial strategy was profitable, which encouraged us to continue refining the strategy and adding extra layers of safety, to protect the capital gained.

Across Neighbourhood Search (ANS)

The article reveals the potential of the ANS algorithm as an important step in the development of flexible and intelligent optimization methods that can take into account the specifics of the problem and the dynamics of the environment in the search space.

Building a Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (III)

Welcome to the third installment of our trend series! Today, we’ll delve into the use of divergence as a strategy for identifying optimal entry points within the prevailing daily trend. We’ll also introduce a custom profit-locking mechanism, similar to a trailing stop-loss, but with unique enhancements. In addition, we’ll upgrade the Trend Constraint Expert to a more advanced version, incorporating a new trade execution condition to complement the existing ones. As we move forward, we’ll continue to explore the practical application of MQL5 in algorithmic development, providing you with more in-depth insights and actionable techniques.

Price Action Analysis Toolkit Development (Part 5): Volatility Navigator EA

Determining market direction can be straightforward, but knowing when to enter can be challenging. As part of the series titled "Price Action Analysis Toolkit Development", I am excited to introduce another tool that provides entry points, take profit levels, and stop loss placements. To achieve this, we have utilized the MQL5 programming language. Let’s delve into each step in this article.

Ensemble methods to enhance numerical predictions in MQL5

In this article, we present the implementation of several ensemble learning methods in MQL5 and examine their effectiveness across different scenarios.

Developing a Replay System (Part 54): The Birth of the First Module

In this article, we will look at how to put together the first of a number of truly functional modules for use in the replay/simulator system that will also be of general purpose to serve other purposes. We are talking about the mouse module.

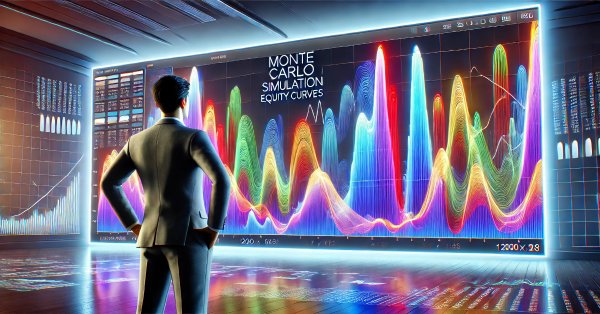

Portfolio Risk Model using Kelly Criterion and Monte Carlo Simulation

For decades, traders have been using the Kelly Criterion formula to determine the optimal proportion of capital to allocate to an investment or bet to maximize long-term growth while minimizing the risk of ruin. However, blindly following Kelly Criterion using the result of a single backtest is often dangerous for individual traders, as in live trading, trading edge diminishes over time, and past performance is no predictor of future result. In this article, I will present a realistic approach to applying the Kelly Criterion for one or more EA's risk allocation in MetaTrader 5, incorporating Monte Carlo simulation results from Python.

Neural Network in Practice: Pseudoinverse (I)

Today we will begin to consider how to implement the calculation of pseudo-inverse in pure MQL5 language. The code we are going to look at will be much more complex for beginners than I expected, and I'm still figuring out how to explain it in a simple way. So for now, consider this an opportunity to learn some unusual code. Calmly and attentively. Although it is not aimed at efficient or quick application, its goal is to be as didactic as possible.

Developing a trading robot in Python (Part 3): Implementing a model-based trading algorithm

We continue the series of articles on developing a trading robot in Python and MQL5. In this article, we will create a trading algorithm in Python.

Neural Networks Made Easy (Part 95): Reducing Memory Consumption in Transformer Models

Transformer architecture-based models demonstrate high efficiency, but their use is complicated by high resource costs both at the training stage and during operation. In this article, I propose to get acquainted with algorithms that allow to reduce memory usage of such models.

Creating a Trading Administrator Panel in MQL5 (Part VIII): Analytics Panel

Today, we delve into incorporating useful trading metrics within a specialized window integrated into the Admin Panel EA. This discussion focuses on the implementation of MQL5 to develop an Analytics Panel and highlights the value of the data it provides to trading administrators. The impact is largely educational, as valuable lessons are drawn from the development process, benefiting both upcoming and experienced developers. This feature demonstrates the limitless opportunities this development series offers in equipping trade managers with advanced software tools. Additionally, we'll explore the implementation of the PieChart and ChartCanvas classes as part of the continued expansion of the Trading Administrator panel’s capabilities.

MQL5 Trading Toolkit (Part 4): Developing a History Management EX5 Library

Learn how to retrieve, process, classify, sort, analyze, and manage closed positions, orders, and deal histories using MQL5 by creating an expansive History Management EX5 Library in a detailed step-by-step approach.

Utilizing CatBoost Machine Learning model as a Filter for Trend-Following Strategies

CatBoost is a powerful tree-based machine learning model that specializes in decision-making based on stationary features. Other tree-based models like XGBoost and Random Forest share similar traits in terms of their robustness, ability to handle complex patterns, and interpretability. These models have a wide range of uses, from feature analysis to risk management. In this article, we're going to walk through the procedure of utilizing a trained CatBoost model as a filter for a classic moving average cross trend-following strategy. This article is meant to provide insights into the strategy development process while addressing the challenges one may face along the way. I will introduce my workflow of fetching data from MetaTrader 5, training machine learning model in Python, and integrating back to MetaTrader 5 Expert Advisors. By the end of this article, we will validate the strategy through statistical testing and discuss future aspirations extending from the current approach.