Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

Introduction

In one of the previous articles of the series, I touched on the topic of risk control and developed a risk manager class that implements basic functionality. It allows setting a maximum daily loss level and a maximum overall loss level, upon reaching which trading stops and all open positions are closed. If a daily loss was reached, trading was resumed the next day, and if an overall loss was reached, it was not resumed at all.

As you might remember, the possible areas for the risk manager development were a smoother change in the size of positions (for example, a two-fold reduction when half the limit is exceeded), and a more "intelligent" restoration of volumes (for example, only when the loss exceeds a position reduction level). We can also add a maximum target profit parameter, upon reaching which trading also stops. This parameter is unlikely to be useful when trading on a personal account. However, it will be in great demand when trading on the accounts of prop trading companies. Once the planned level of profit is reached, trading can usually be continued on another account only.

I also mentioned the introduction of time-based trading restrictions as one of the possible directions for the development of a risk manager but I will not touch on this topic here leaving it for the future. For now, let's try to implement adaptive volume changes in the risk manager and see if there can be any benefit from this.

Base case

Let's use the EA from the previous article. We will add the ability to handle the risk manager parameters to it. We will also make some other minor additions to it, which will be discussed below. For now, let's agree on the EA parameters that we will use to evaluate the results of the changes made.

First, let's fix the specific composition of single instances of trading strategies that will be used in the test EA. Set IDs of the best passes after the second optimization stage in the passes_ parameter for each of the three optimized symbols and each of the three timeframes (9 IDs in total). Each ID will hide a normalized group of 16 single instances of trading strategies. Thus, the final group will contain a total of 144 instances of trading strategies, divided into 9 groups of 16 strategies. The final group will not be normalized, since we did not select a normalizing factor for it.

Second, we will use the fixed trading balance of USD 10,000 and our standard expected maximum drawdown of 10% for the scaling factor of 1. We will try to change the latter in the range from 1 to 10. At the same time, the maximum allowable drawdown will also increase, but we will now additionally control it with our risk manager preventing it from exceeding 10%.

To do this, we turn on the risk manager and set the maximum overall loss value equal to 10% of the base balance of USD 10,000, that is, USD 1000. For the maximum daily loss, set the value to be twice as small, that is, USD 500. As the balance grows, these two parameters will remain unchanged.

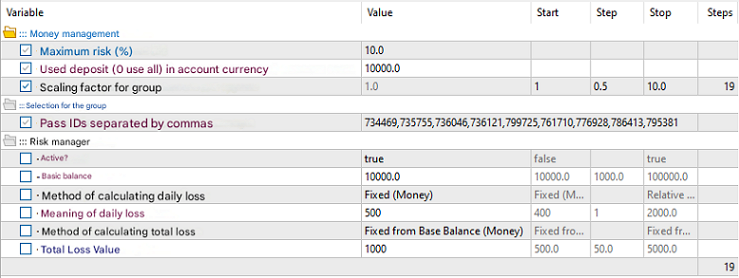

Let's set all the input values as described above:

Fig. 1. Test EA inputs for the test EA with the original risk manager

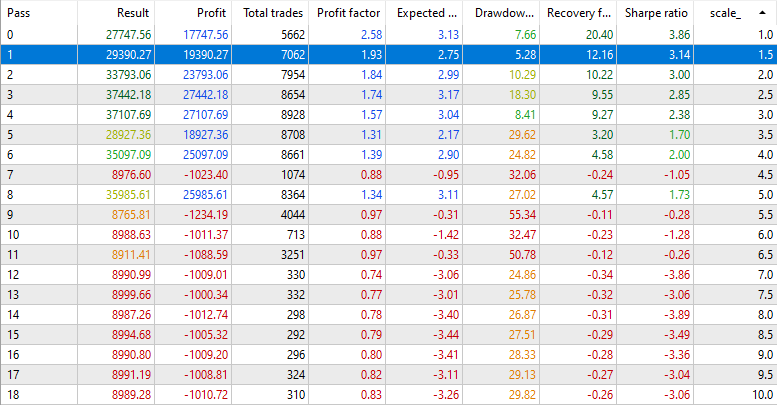

Let's run the optimization on the interval of 2021 and 2022 to see how the EA works with different values of the scaling multiplier for position sizes (scale_). We get the following results:

Fig. 2. Results of optimizing the scale_ parameter in the test EA with the original risk manager

The results are sorted in ascending order of the scale_ parameter value, that is, the lower the line, the larger the size of opened positions used by the EA. It is clearly visible that starting from a certain critical value, the final result is a loss of slightly more than 1000.

During the test interval we encountered several drawdowns of varying depths. In the passes where no drawdown dropped the equity level below USD 9000, trading continued until the end of the interval. In the passes, in which the level of funds dropped below USD 9000 during the drawdown, trading stopped at that moment and did not resume. It was in these passages that we suffered a loss of around USD 1000. Its slight excess over the calculated value is most likely explained by the fact that we used the EA's operating mode only on new minute bars. Therefore, prices had time to change a little more within a minute from the moment the specified loss was precisely reached until the moment the risk manager checked and made a decision to close all positions.

These differences are minor in most runs, and we can ignore them by agreeing to set a slightly lower limit in the parameters, or by changing, as planned, the way the risk manager works. The only passage that is of concern is the one for scale_= 5.5, when after closing all positions the loss exceeded the calculated one by more than 20% and amounted to approximately USD 1234.

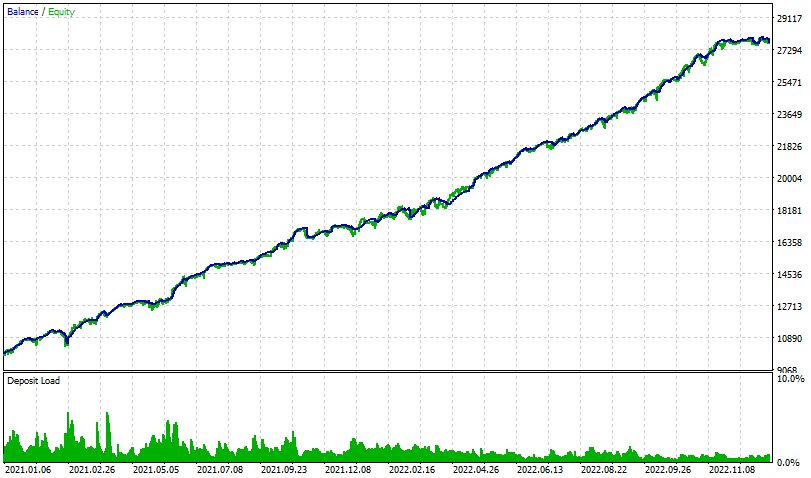

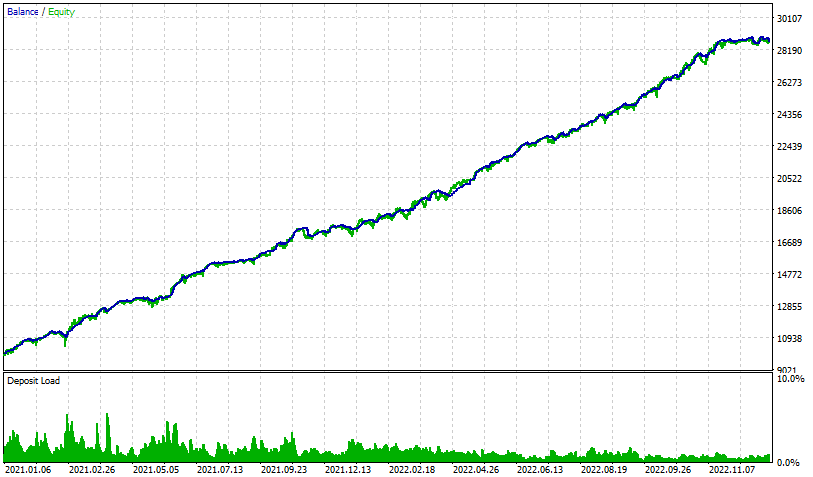

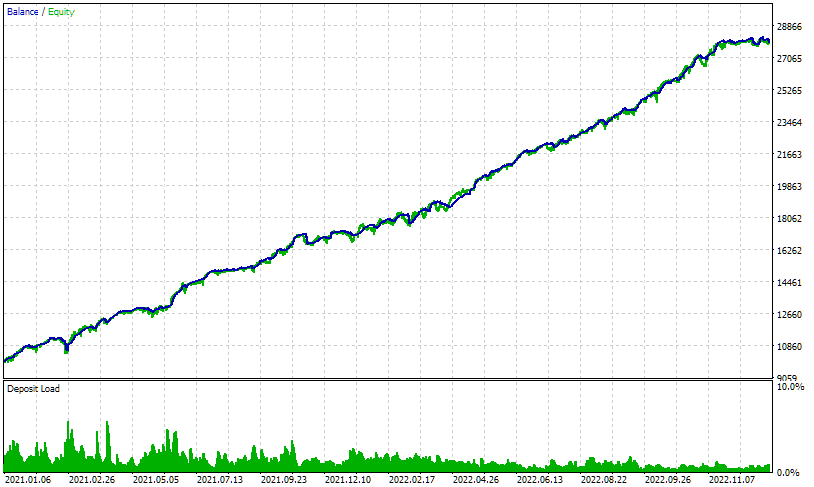

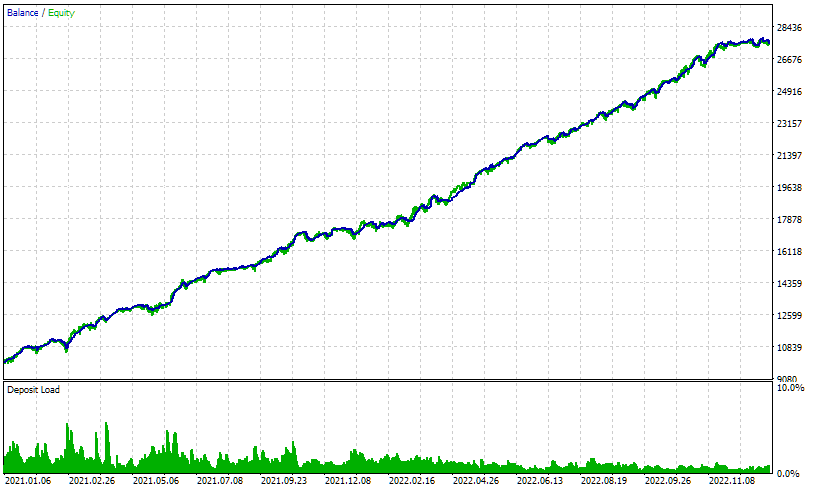

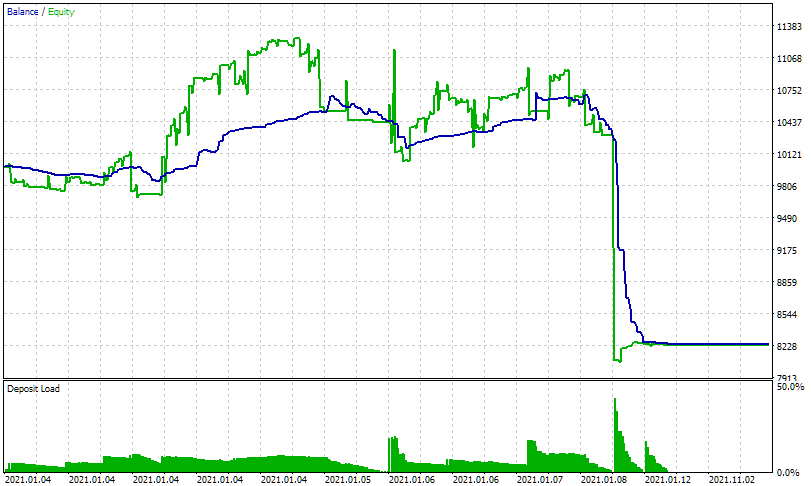

For further analysis, let's look at the balance and equity curve graph for the very first pass (scale_ = 1.0). Since the remaining passes differ only in the size of the positions opened, their balance and equity graphs will have the same appearance as for the first pass. The only difference is that they will be more stretched vertically.

Fig. 3. Pass results with scale_ = 1.0 in the test EA with the original risk manager

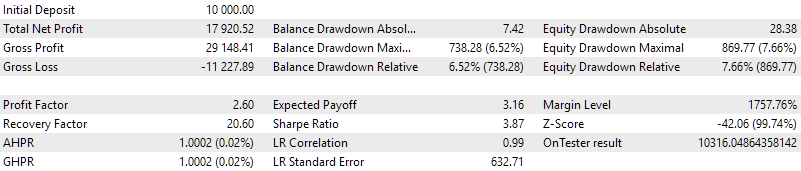

Let's compare them with the results without the risk manager:

Fig. 4. Pass results with scale_ = 1.0 in the test EA without the risk manager

Without the risk manager, the overall profit was several percent higher, and the maximum drawdown on equity remained the same. This suggests that normalizing strategies when grouping them together, as well as their subsequent joint work produces good results: the risk manager had to close positions when the daily loss was exceeded only about three times in two years.

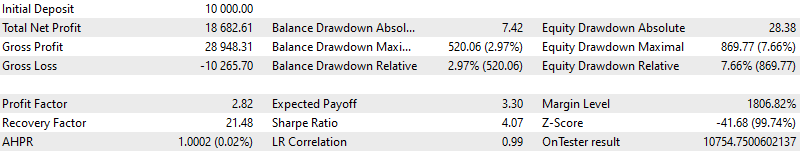

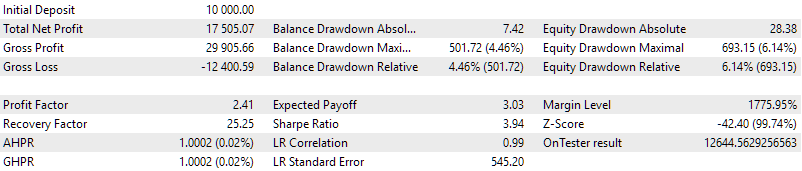

Let's now look at the results of the pass with the risk manager and scale_ = 3. The profit was about 50% higher, but the drawdown also increased three times.

Fig. 5. Pass results with scale_ = 3.0 in the test EA with the original risk manager

However, despite the drawdown increasing in absolute terms to almost USD 3000, the risk manager had to prevent the drawdown from exceeding USD 500 per day. In other words, there were several consecutive days when the risk manager closed all positions and reopened them at the beginning of the next day. From the previous maximum value of equity, the current amount eventually went into the red down to USD 3000, but the drawdown did not exceed USD 500 for each individual day relative to the maximum equity or funds at the beginning of the day. However, using such an increased position size is dangerous, as there is also a limit on the overall loss. In this case, we were lucky that the big drawdown happened some time after the start of the test period. The balance size had time to grow and thus increased the value of the maximum overall loss, which was USD 1000 at the start and was counted from the value of the initial balance. If the test period had started right before the drawdown reached USD 3000, the overall limit would have been exceeded and trading would have been stopped.

In order to take into account the impact of a possible bad start time, we will change the risk manager parameters so that the level of overall loss is calculated not from the initial balance, but from the last maximum of the balance or equity. But to do this, we will first need to make additions to the risk manager code, since the ability to set the desired parameter value is not yet implemented.

CVirtualRiskManager upgrade

We have quite a few changes planned for the risk manager class. Many of them require changes to the same methods. This makes it somewhat difficult to describe, as it is difficult to separate edits that relate to different added features. Therefore, we will describe the already completed version of the code, starting from the simplest passage.

Updating enumerations

Before the class description, we declared several enumerations to be used later. We will slightly expand the composition of these enumerations. For example, the ENUM_RM_STATE enumeration, containing possible states of the risk manager, receives two new states:

- RM_STATE_RESTORE — state that occurs after the start of a new daily period, until the moment when the sizes of open positions are fully restored. Previously, this condition did not arise, since we immediately restored the sizes of positions after the start of a new day. Now we have the option to do this not immediately, but only after prices return to more favorable values for opening. Let's look at this in more detail later.

- RM_STATE_OVERALL_PROFIT — state that occurs after the specified profit has been reached. After this event, trading stops.

We have turned the previous enumeration ENUM_RM_CALC_LIMIT into three separate enumerations: for daily loss, overall loss and overall profit. The values of these enumerations will be used to determine two things:

- how to use the number passed in the parameters: as an absolute or as a relative value specified as a percentage of (from) the daily level or the highest values of the balance or equity;

- the value to count the threshold level from (to) — the daily level or the highest balance or funds values.

These options are indicated in the comments for the enumeration values.

// Possible risk manager states enum ENUM_RM_STATE { RM_STATE_OK, // Limits are not exceeded RM_STATE_DAILY_LOSS, // Daily limit is exceeded RM_STATE_RESTORE, // Recovery after daily limit RM_STATE_OVERALL_LOSS, // Overall limit exceeded RM_STATE_OVERALL_PROFIT // Overall profit reached }; // Possible methods for calculating limits enum ENUM_RM_CALC_DAILY_LOSS { RM_CALC_DAILY_LOSS_MONEY_BB, // [$] to Daily Level RM_CALC_DAILY_LOSS_PERCENT_BB, // [%] from Base Balance to Daily Level RM_CALC_DAILY_LOSS_PERCENT_DL // [%] from/to Daily Level }; // Possible methods for calculating general limits enum ENUM_RM_CALC_OVERALL_LOSS { RM_CALC_OVERALL_LOSS_MONEY_BB, // [$] to Base Balance RM_CALC_OVERALL_LOSS_MONEY_HW_BAL, // [$] to HW Balance RM_CALC_OVERALL_LOSS_MONEY_HW_EQ_BAL, // [$] to HW Equity or Balance RM_CALC_OVERALL_LOSS_PERCENT_BB, // [%] from/to Base Balance RM_CALC_OVERALL_LOSS_PERCENT_HW_BAL, // [%] from/to HW Balance RM_CALC_OVERALL_LOSS_PERCENT_HW_EQ_BAL // [%] from/to HW Equity or Balance }; // Possible methods for calculating overall profit enum ENUM_RM_CALC_OVERALL_PROFIT { RM_CALC_OVERALL_PROFIT_MONEY_BB, // [$] to Base Balance RM_CALC_OVERALL_PROFIT_PERCENT_BB, // [%] from/to Base Balance };

Class Description

We have added new properties and methods in the protected section in the CVirtualRiskManager class description. In the public section, everything remains unchanged. Added strings are highlighted in green:

//+------------------------------------------------------------------+ //| Risk management class (risk manager) | //+------------------------------------------------------------------+ class CVirtualRiskManager : public CFactorable { protected: // Main constructor parameters bool m_isActive; // Is the risk manager active? double m_baseBalance; // Base balance ENUM_RM_CALC_DAILY_LOSS m_calcDailyLossLimit; // Method of calculating the maximum daily loss double m_maxDailyLossLimit; // Parameter of calculating the maximum daily loss double m_closeDailyPart; // Threshold part of the daily loss ENUM_RM_CALC_OVERALL_LOSS m_calcOverallLossLimit; // Method of calculating the maximum overall loss double m_maxOverallLossLimit; // Parameter of calculating the maximum overall loss double m_closeOverallPart; // Threshold part of the overall loss ENUM_RM_CALC_OVERALL_PROFIT m_calcOverallProfitLimit; // Method for calculating maximum overall profit double m_maxOverallProfitLimit; // Parameter for calculating the maximum overall profit double m_maxRestoreTime; // Waiting time for the best entry on a drawdown double m_lastVirtualProfitFactor; // Initial best drawdown multiplier // Current state ENUM_RM_STATE m_state; // State double m_lastVirtualProfit; // Profit of open virtual positions at the moment of loss limit datetime m_startRestoreTime; // Start time of restoring the size of open positions // Updated values double m_balance; // Current balance double m_equity; // Current equity double m_profit; // Current profit double m_dailyProfit; // Daily profit double m_overallProfit; // Overall profit double m_baseDailyBalance; // Daily basic balance double m_baseDailyEquity; // Daily base balance double m_baseDailyLevel; // Daily base level double m_baseHWBalance; // balance High Watermark double m_baseHWEquityBalance; // equity or balance High Watermark double m_virtualProfit; // Profit of open virtual positions // Managing the size of open positions double m_baseDepoPart; // Used (original) part of the overall balance double m_dailyDepoPart; // Multiplier of the used part of the overall balance by daily loss double m_overallDepoPart; // Multiplier of the used part of the overall balance by overall loss // Protected methods double DailyLoss(); // Maximum daily loss double OverallLoss(); // Maximum overall loss void UpdateProfit(); // Update current profit values void UpdateBaseLevels(); // Updating daily base levels void CheckLimits(); // Check for excess of permissible losses bool CheckDailyLossLimit(); // Check for excess of the permissible daily loss bool CheckOverallLossLimit(); // Check for excess of the permissible overall loss bool CheckOverallProfitLimit(); // Check if the specified profit has been achieved void CheckRestore(); // Check the need for restoring the size of open positions bool CheckDailyRestore(); // Check if the daily multiplier needs to be restored bool CheckOverallRestore(); // Check if the overall multiplier needs to be restored double VirtualProfit(); // Determine the profit of open virtual positions double RestoreVirtualProfit(); // Determine the profit of open virtual positions to restore void SetDepoPart(); // Set the values of the used part of the overall balance public: ... };

The m_closeDailyPart and m_closeOverallPart properties allow us to make smoother changes to the size of positions. Their usage is similar to each other, and the only difference is which limit (daily or general) each property refers to. For example, if we set m_closeDailyPart = 0.5, then when the loss reaches half of the daily limit, the position sizes will be halved. If the loss continues to grow and reaches half of the remaining half of the daily limit, then the position sizes (already halved earlier) will be halved again.

The reduction in the size of positions will be carried out by changing the m_dailyDepoPart and m_overallDepoPart properties. Their values are used in the method of setting the used portion of the overall balance for trading. They are included in the equation as multipliers, so halving any of them results in halving the overall volume:

//+------------------------------------------------------------------+ //| Set the value of the used part of the overall balance | //+------------------------------------------------------------------+ void CVirtualRiskManager::SetDepoPart() { CMoney::DepoPart(m_baseDepoPart * m_dailyDepoPart * m_overallDepoPart); }

The m_baseDepoPart property used in the function contains the value of the original size of the used part of the balance for trading.

The m_maxRestoreTime and m_lastVirtualProfitFactor properties are used to determine the possibility of restoring the size of open positions.

The first property specifies the time in minutes, after which the sizes will be restored even in case of a non-negative value of virtual profit. That is, after this time, the EA will again open real market positions corresponding to virtual positions, even if during the time when the real positions were closed, prices went in the right direction and the virtual profit became greater than when reaching the limits. Until that time, volume recovery only occurs if the estimated profit of virtual positions is less than some estimated value that changes over time.

The second property specifies a multiplier that determines how many times the loss of virtual positions at the start of a new daily period should be greater than the loss of virtual positions at the time the limits are reached, so that the position sizes are restored immediately. For example, a value of 1 for this parameter would mean that the recovery of sizes at the beginning of the day would only occur if the virtual positions remained in the same drawdown or went into an even deeper drawdown compared to the last moment the limits were reached.

It is also worth noting that now reaching the limit is considered to have been triggered not only when the drawdown exceeds the established limit, but also, for example, when it reaches half of the daily limit, if m_closeDailyPart is 0.5.

Calculating the profit of virtual positions

When applying partial closing and subsequent restoration of the sizes of open positions, we will need to correctly determine what the floating profit or loss would be at the moment if all positions opened according to the strategy still remained open. Therefore, the method for calculating the current profit of open virtual positions has been added to the risk manager class. They are not closed when drawdown limits are reached, so we can determine at any given time what the approximate profit would have been on open market positions corresponding to virtual positions. This calculated value does not exactly correspond to the real state of affairs due to the lack of accounting for commissions and swaps, but this accuracy will be quite sufficient for our purposes.

Last time we did not need this method for any calculations, the results of which would determine further actions. Now we need it. Besides, we should make some small additions to it for the correct calculation of the profit of virtual positions. The point is that the method used to determine the profit of one virtual position CMoney::Profit() applies the balance usage multiplier CMoney::DepoPart() for calculation. If we have reduced this multiplier, then the calculation of virtual profit will be made for the reduced position sizes, rather than for the sizes present before the reduction.

We are interested in the profit for the initial position sizes, so before calculating it, we temporarily return the initial balance utilization multiplier. After that, we calculate the profit of virtual positions and then set the current balance usage multiplier again by calling the SetDepoPart() method:

//+------------------------------------------------------------------+ //| Determine the profit of open virtual positions | //+------------------------------------------------------------------+ double CVirtualRiskManager::VirtualProfit() { // Access the receiver object CVirtualReceiver *m_receiver = CVirtualReceiver::Instance(); // Set the initial balance usage multiplier CMoney::DepoPart(m_baseDepoPart); double profit = 0; // Find the profit sum for all virtual positions FORI(m_receiver.OrdersTotal(), profit += CMoney::Profit(m_receiver.Order(i))); // Restore the current balance usage multiplier SetDepoPart(); return profit; }

High Watermark

For better analysis, we would like to add the ability to calculate the maximum loss level not only from the initial account balance, but also, for example, from the last achieved balance maximum. Therefore, we have added m_baseHWBalance and m_baseHWEquityBalance to the list of properties that should be constantly updated. In the UpdateProfit() method, we have added their calculation along with the check that the overall profit is calculated relative to the highest values of the balance or equity, rather than the base balance:

//+------------------------------------------------------------------+ //| Updating current profit values | //+------------------------------------------------------------------+ void CVirtualRiskManager::UpdateProfit() { // Current equity m_equity = AccountInfoDouble(ACCOUNT_EQUITY); // Current balance m_balance = AccountInfoDouble(ACCOUNT_BALANCE); // Maximum balance (High Watermark) m_baseHWBalance = MathMax(m_balance, m_baseHWBalance); // Maximum balance or equity (High Watermark) m_baseHWEquityBalance = MathMax(m_equity, MathMax(m_balance, m_baseHWEquityBalance)); // Current profit m_profit = m_equity - m_balance; // Current daily profit relative to the daily level m_dailyProfit = m_equity - m_baseDailyLevel; // Current overall profit relative to base balance m_overallProfit = m_equity - m_baseBalance; // If we take the overall profit relative to the highest balance, if(m_calcOverallLossLimit == RM_CALC_OVERALL_LOSS_MONEY_HW_BAL || m_calcOverallLossLimit == RM_CALC_OVERALL_LOSS_PERCENT_HW_BAL) { // Recalculate it m_overallProfit = m_equity - m_baseHWBalance; } // If we take the overall profit relative to the highest balance or equity, if(m_calcOverallLossLimit == RM_CALC_OVERALL_LOSS_MONEY_HW_EQ_BAL || m_calcOverallLossLimit == RM_CALC_OVERALL_LOSS_PERCENT_HW_EQ_BAL) { // Recalculate it m_overallProfit = m_equity - m_baseHWEquityBalance; } // Current profit of virtual open positions m_virtualProfit = VirtualProfit(); ... }

Limit check method

This method has also undergone changes: we have split its code into several auxiliary methods, so now it looks like this:

//+------------------------------------------------------------------+ //| Check loss limits | //+------------------------------------------------------------------+ void CVirtualRiskManager::CheckLimits() { if(false || CheckDailyLossLimit() // Check daily limit || CheckOverallLossLimit() // Check overall limit || CheckOverallProfitLimit() // Check overall profit ) { // Remember the current level of virtual profit m_lastVirtualProfit = m_virtualProfit; // Notify the recipient about changes CVirtualReceiver::Instance().Changed(); } }

In the method checking the daily loss limit, we first check whether the daily limit or a specified portion of it, defined through the m_closeDailyPart parameter, has been reached. If yes, then we reduce the multiplier of the used part of the overall balance by the daily loss. If it has already become too small, then we reset it completely. After this, we set the value of the used part of the overall balance and switch the risk manager to the state of achieved daily loss.

//+------------------------------------------------------------------+ //| Check daily loss limit | //+------------------------------------------------------------------+ bool CVirtualRiskManager::CheckDailyLossLimit() { // If daily loss is reached and positions are still open if(m_dailyProfit < -DailyLoss() * (1 - m_dailyDepoPart * (1 - m_closeDailyPart)) && CMoney::DepoPart() > 0) { // Reduce the multiplier of the used part of the overall balance by the daily loss m_dailyDepoPart *= (1 - m_closeDailyPart); // If the multiplier is already too small, if(m_dailyDepoPart < 0.05) { // Set it to 0 m_dailyDepoPart = 0; } // Set the value of the used part of the overall balance SetDepoPart(); ... // Set the risk manager to the achieved daily loss state m_state = RM_STATE_DAILY_LOSS; return true; } return false; }

The method for checking the overall loss limit works in a similar way. The only difference is the risk manager is switched to the state of achieved overall loss only if the multiplier of the used part of the overall balance for the overall loss has become equal to zero:

//+------------------------------------------------------------------+ //| Check the overall loss limit | //+------------------------------------------------------------------+ bool CVirtualRiskManager::CheckOverallLossLimit() { // If overall loss is reached and positions are still open if(m_overallProfit < -OverallLoss() * (1 - m_overallDepoPart * (1 - m_closeOverallPart)) && CMoney::DepoPart() > 0) { // Reduce the multiplier of the used part of the overall balance by the overall loss m_overallDepoPart *= (1 - m_closeOverallPart); // If the multiplier is already too small, if(m_overallDepoPart < 0.05) { // Set it to 0 m_overallDepoPart = 0; // Set the risk manager to the achieved overall loss state m_state = RM_STATE_OVERALL_LOSS; } // Set the value of the used part of the overall balance SetDepoPart(); ... return true; } return false; }

Checking whether the specified profit has been achieved looks even simpler: when it is achieved, we reset the corresponding multiplier and set the risk manager to the state of the achieved overall profit:

//+------------------------------------------------------------------+ //| Check if the specified profit has been achieved | //+------------------------------------------------------------------+ bool CVirtualRiskManager::CheckOverallProfitLimit() { // If overall loss is reached and positions are still open if(m_overallProfit > m_maxOverallProfitLimit && CMoney::DepoPart() > 0) { // Reduce the multiplier of the used part of the overall balance by the overall loss m_overallDepoPart = 0; // Set the risk manager to the achieved overall profit state m_state = RM_STATE_OVERALL_PROFIT; // Set the value of the used part of the overall balance SetDepoPart(); ... return true; } return false; }

All three methods return a boolean value that answers the question: has the corresponding limit been reached? If yes, we save the current level of virtual profit in the CheckLimits() method and notify the recipient of market position volumes about changes in the composition of positions.

In the daily baseline update method, we have added recalculation of daily profit and switching to recovery state if the daily loss limit was previously reached:

//+------------------------------------------------------------------+ //| Update daily base levels | //+------------------------------------------------------------------+ void CVirtualRiskManager::UpdateBaseLevels() { // Update balance, funds and base daily level m_baseDailyBalance = m_balance; m_baseDailyEquity = m_equity; m_baseDailyLevel = MathMax(m_baseDailyBalance, m_baseDailyEquity); m_dailyProfit = m_equity - m_baseDailyLevel; ... // If the daily loss level was reached earlier, then if(m_state == RM_STATE_DAILY_LOSS) { // Switch to the state of restoring the sizes of open positions m_state = RM_STATE_RESTORE; // Remember restoration start time m_startRestoreTime = TimeCurrent(); } }

Restoring position sizes

We have also divided the method that previously performed this task into several methods. The method for checking whether recovery is necessary is called at the top level:

//+------------------------------------------------------------------+ //| Check the need for restoring the size of open positions | //+------------------------------------------------------------------+ void CVirtualRiskManager::CheckRestore() { // If we need to restore the state to normal, then if(m_state == RM_STATE_RESTORE) { // Check the possibility of restoring the daily loss multiplier to normal bool dailyRes = CheckDailyRestore(); // Check the possibility of restoring the overall loss multiplier to normal bool overallRes = CheckOverallRestore(); // If at least one of them has recovered, if(dailyRes || overallRes) { ... // Set the value of the used part of the overall balance SetDepoPart(); // Notify the recipient about changes CVirtualReceiver::Instance().Changed(); // If both multipliers are restored to normal, if(dailyRes && overallRes) { // Set normal state m_state = RM_STATE_OK; } } } }

The auxiliary methods for checking whether the daily and overall multiplier should be restored currently work the same way, but in the future we might alter their behavior. For now, they are checking whether the current virtual profit value is less than the desired level. If so, then it is beneficial for us to reopen real positions at current prices, so we need to restore their sizes:

//+------------------------------------------------------------------+ //| Check if the daily multiplier needs to be restored | //+------------------------------------------------------------------+ bool CVirtualRiskManager::CheckDailyRestore() { // If the current virtual profit is less than the one desired for recovery, if(m_virtualProfit <= RestoreVirtualProfit()) { // Restore the daily loss multiplier m_dailyDepoPart = 1.0; return true; } return false; } //+------------------------------------------------------------------+ //| Check if the overall multiplier needs to be restored | //+------------------------------------------------------------------+ bool CVirtualRiskManager::CheckOverallRestore() { // If the current virtual profit is less than the one desired for recovery, if(m_virtualProfit <= RestoreVirtualProfit()) { // Restore the overall loss multiplier m_overallDepoPart = 1.0; return true; } return false; }

The RestoreVirtualProfit() method calculates the desired level of virtual profit. We used a simple linear interpolation with two parameters: the more time passes, the less profitable the level, at which we agree to reopen real positions.

//+------------------------------------------------------------------+ //| Determine the profit of virtual positions for recovery | //+------------------------------------------------------------------+ double CVirtualRiskManager::RestoreVirtualProfit() { // If the maximum recovery time is not specified, if(m_maxRestoreTime == 0) { // Return the current value of the virtual profit return m_virtualProfit; } // Find the elapsed time since the start of recovery in minutes double t = (TimeCurrent() - m_startRestoreTime) / 60.0; // Return the calculated value of the desired virtual profit // depending on the time elapsed since the start of recovery return m_lastVirtualProfit * m_lastVirtualProfitFactor * (1 - t / m_maxRestoreTime); }

Save the changes in the VirtualRiskManager.mqh file of the current folder.

Test

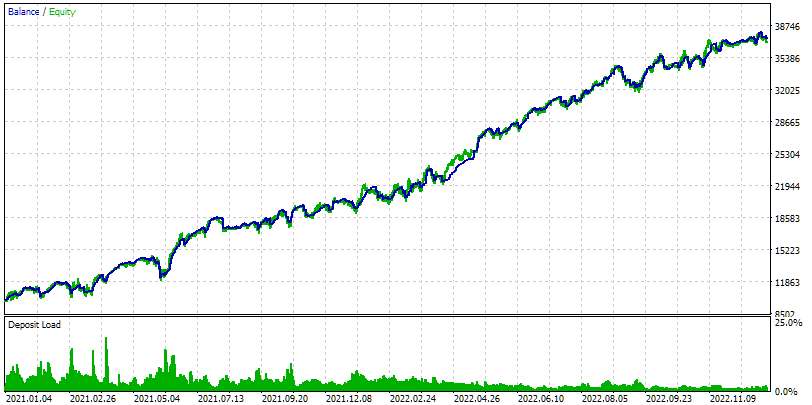

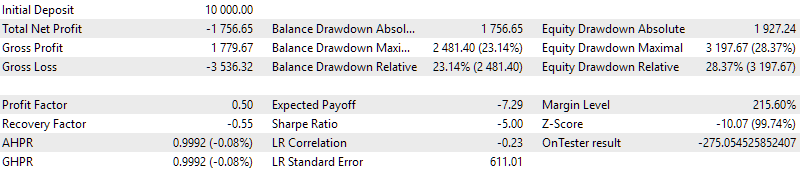

First, let's launch the EA with parameters that specify the complete closure of positions upon reaching the daily and total limits. The results should be the same as in Fig. 3.

Fig. 6. EA results with scale_ = 1.0 with the same settings as the original risk manager

The results for drawdown coincide completely, while in case of profit and normalized average annual profit (OnTester result) the result is slightly more than expected. Well, that's encouraging: we have not broken previously implemented things.

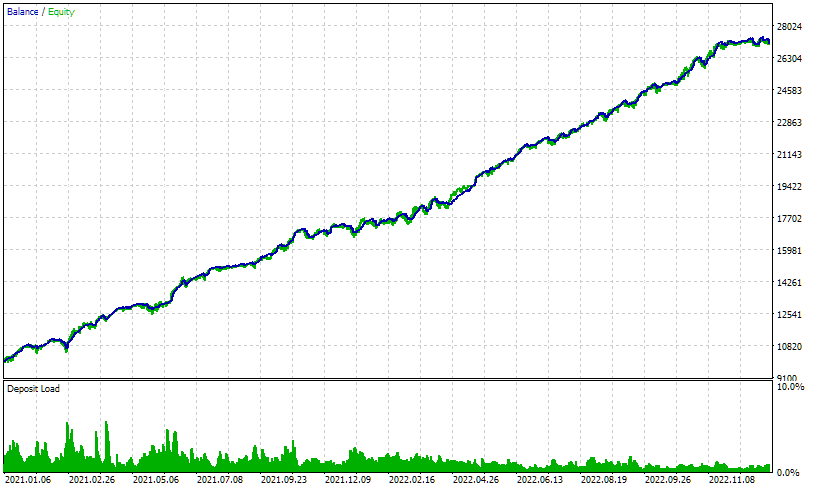

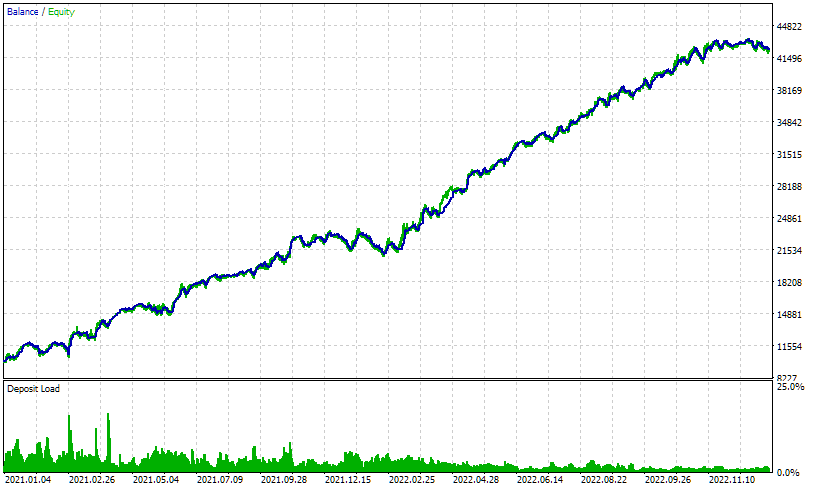

Now let's see what happens if we set adaptive closing of positions upon reaching a part of the daily and overall limits with thevalue of 0.5:

Fig. 7. EA results with scale_ = 1.0, rmCloseDailyPart_ = 0.5 and rmCloseOverallPart_ = 0.5

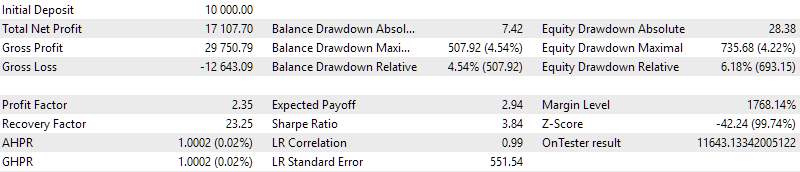

The drawdown narrowed slightly, which led to a slight increase in the normalized average annual profit. Let's now try to connect the restoration of position sizes at the best price. Let's set the waiting time for the best entry during the drawdown to 1440 minutes (1 day) in the parameters, as well as set the initial best drawdown multiplier to 1.5. These are just values taken intuitively.

Fig. 8. EA results with scale_ = 1.0, rmCloseDailyPart_ = 0.5, rmCloseOverallPart_ = 0.5, rmMaxRestoreTime_ = 1440 and rmLastVirtualProfitFactor_ = 1.5

The result of normalized average annual profit improved again by a few percentage points. It appears that the efforts to implement this mechanism are justified.

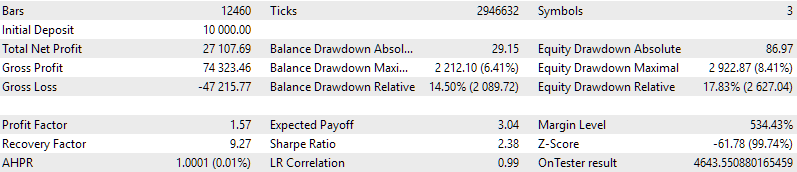

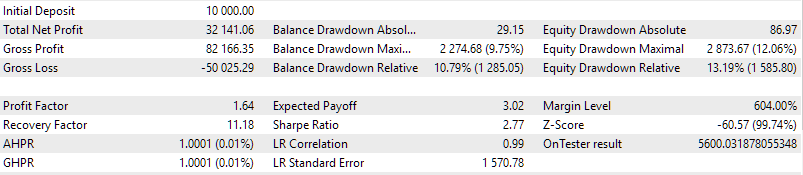

Now let's try to increase the size of the opened positions three times, without changing the risk manager parameters since the last launch. This should result in the risk manager being triggered more frequently. Let's see how it copes with the task.

Fig. 9. EA results with scale_ = 3.0, rmCloseDailyPart_ = 0.5, rmCloseOverallPart_ = 0.5, rmMaxRestoreTime_ = 1440 and rmLastVirtualProfitFactor_ = 1.5

Compared to a similar launch with the original risk manager, here we again see an improvement in results across all indicators. Compared to the previous launch, profit increased by about two times, but the drawdown increased three times, which reduced the value of the normalized average annual profit. However, for each trading day, the drawdown still did not exceed the value set in the risk manager parameters.

It is also interesting to see what happens if the size of the opened positions is increased even more, say, 10 times?

Fig. 10. EA results with scale_ = 3.0, rmCloseDailyPart_ = 0.5, rmCloseOverallPart_ = 0.5, rmMaxRestoreTime_ = 1440 and rmLastVirtualProfitFactor_ = 1.5

As we can see, with such position sizes, the risk manager was no longer able to maintain compliance with the specified maximum total loss, and trading was stopped. This means the risk manager is not a universal tool allowing you to prevent a specified maximum drawdown regardless of any quirks of a trading strategy. It only complements the mandatory money management rules that should be present in a trading strategy.

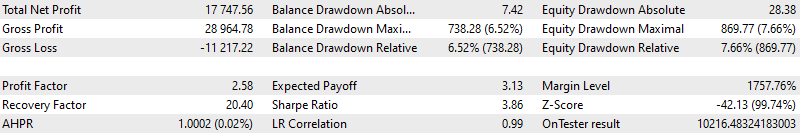

Finally, let's try to select the best parameters for the risk manager using genetic optimization. Unfortunately, each pass takes about three minutes for a two-year interval, so we will have to wait a significant amount of time for the optimization to complete. As an optimization criterion, we will select a user criterion that calculates the normalized average annual profit. After some time, the top of the table with the optimization results looks like this:

Fig. 11. EA optimization results with the risk manager

As we can see, selecting good risk manager parameters can not only protect trading from increased drawdowns, but also improve trading results: the difference for different passes amounted to 20% of additional profit. Although even the best of the already found sets of parameters is slightly inferior to the results obtained in Fig. 8 with intuitively selected values. Further optimization could probably improve this result a little more, but there is no particular need for it.

Conclusion

Let's sum it all up briefly. We have improved an important component of any successful trading system - the risk manager - making it more flexible and customizable to specific needs. We now have a mechanism that allows us to more accurately comply with the established limits on acceptable drawdown.

Although we have tried to make it as reliable as possible, its capabilities should be used wisely. It is worth remembering that this is an extreme means of protecting capital, so you need to try to select trading parameters so that the risk manager either does not have to interfere with trading at all, or it does so on a very rare occasions. As we can see from the tests, when the recommended position sizes are greatly exceeded, the rate of equity change can be so sharp that even the risk manager may not have time to save the funds from exceeding the specified drawdown level.

While working on this risk manager update, new ideas for improving it emerged. However, making it too complicated is not a good thing either. Therefore, I will put aside my work on the risk manager for a while and return to more pressing EA development issues in the following parts.

Thank you for your attention! See you soon!

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/15085

News Trading Made Easy (Part 6): Performing Trades (III)

News Trading Made Easy (Part 6): Performing Trades (III)

Forex spread trading using seasonality

Forex spread trading using seasonality

Artificial Electric Field Algorithm (AEFA)

Artificial Electric Field Algorithm (AEFA)

Econometric tools for forecasting volatility: GARCH model

Econometric tools for forecasting volatility: GARCH model

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use