Otherwise, you are going there without knowing where, looking for that without knowing what.

I do not know where the price will go, I can determine with a degree of probability. I do not know how far it will go, that is why tradelines and other methods are used.

>> And if you need an EA for a channel break then go here 'Channel'.

I do not know where the price will go, I can determine with a degree of probability. I do not know how far it will go either, that is why trailing and other methods are used.

And if you need an EA for breaching a channel, you'll see 'Channel' here.

The question is not about a specific Expert Advisor. I offered it here as an example to make rules for ITS self-study.

Angela.

It is unlikely that anything practical will come out of this endeavour - it will boil down to general (and obvious) points. Or it will go to the other extreme - the consideration of a particular TS, which will be interesting only to its creator and adepts.

So you started with breakout TS. Very good. Let's limit ourselves to them for now, ok? Although some general points on the adaptation may be highlighted without specialization of TS. These are the ways of adaptation. I see two of them: auto-optimization (training) and a senior indicator of some kind that shows the market character.

As for the breakout TS, there are two main points: what we break through and what (how) we break through. There are a lot of variants here.

What we break through: how levels are built.

These can be horizontal levels (I once added indicators for them to our base), which in their turn can be derived either from local price extremums or from statistical distribution. Fibo may be included here as well.

These may be channels with variable angle. There may be various types of bands, envelopes, etc. Parabolic is the same. Breakout TS in its concise form.

By the way we break through, what counts as a breakdown... Shall we continue? I don't think so.

That's all of little relevance to the topic, though, isn't it? Well, then I can say that an example of adaptability and ideality can be considered a trivial simple SS. Calculating from bar 0, the whole thing.

I don't know, Angela, what other than general words or specifics to write here.

1). One of themost important principles underlying ITS is its ability to learn and adapt to changing market phases. And secondly, 2). A minimum number of externally adjustable parameters.

At the link, there is an adaptive algorithm that satisfies your criteria:

1. ability to learn and adapt

2. only 1 optimizable parameter

At the link, there is an adaptive algorithm that meets your criteria:

1. ability to learn and adapt

2. only 1 optimizable parameter

I'm not looking for an EA (in fact, I wrote about this EA in my other thread), the essence of the topic is to develop rules, according to which ITS should work.

Angela.

I don't think anything practical will come out of it - it's all about the general (and obvious) points.

Perhaps you are right, it is just another stupid idea. As Chernomyrdin used to say: "You want what's best, but it always turns out as it is. All right, let's leave it at that.

I'm not looking for an EA (in fact, I wrote about this EA in my other thread), the point of the thread is to work out the rules by which ITS should work.

So there's not a ready-made EA, but a theory and an example of its use in the form of an EA.

I found what you've written in another topic: "Besides, I am not impressed by the results of Adaptive EA UmnickTrader.

I do not know, the results are +219% normal. Although, of course, it is not a good result for some people.

So it's not a ready-made EA, but a theory and an example of its use in the form of an EA.

I found what you wrote in another thread: "Also, I'm not impressed with the results of UmnickTrader Adaptive EA".

I do not know, the results are +219% normal. Although, of course, for some people it is not so impressive.

And the drawdown? I personally do not have enough nerves to sit through such drawdowns and put stops at a normal level and the result will be just the opposite.

And the drawdowns? I personally don't have the nerve to sit through such drawdowns, but put the stops at a normal level and the result will be just the opposite.

"Questions and Answers on Adaptive EAs

"The drawdowns at the beginning of the testing period are special - you should not pay attention to them, because until the adaptive EA fills the internal buffer, it trades almost randomly.

In other words, adaptive EA needs at least 10 trades before it starts to trade normally - it adapts to the market. Only after that it begins to more or less keep up with changes in the market.

So, you do not need to spend money on valerian, you just have to understand the theory and know how to use the tools properly.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Everyone knows that nothing in the world is perfect, but in solving a problem we strive for the ideal. But to get closer to it, we should describe it at least verbally and formalize it in the form of goals and ways to achieve them, otherwise we end up going there - without knowing where, looking for something - without knowing what. If we create TS and want to improve it, we need to define the ideal to which we strive, to make rules according to which an "ideal" TS will work (hereinafter referred to as ITS for short). Of course, we can say that ITS should bring maximum profit and minimum losses. But in this thread I put the question somewhat in a different plane, what rules should follow the ITS in its work to achieve this. In this topic I propose to make a set of rules for ITS to work, and formalize these rules in the form of algorithms for different classes of TS (under the classes in this case should be understood different principles underlying the TS, for example, assay - channel, fractal, etc.). If anyone is interested in such a formulation of the task, join the discussion, and with joint efforts we will be able to detect more nuances and crystallize them in the form of concrete principles of operation, common for all classes of TS, as well as take into account specific features of separate classes. And by developing a "code of honour" for ITS, everyone will be able to take these rules into account when designing their own TS in accordance with their tasks.

In order not to be unfounded, I will begin by putting the formulated rules in bold type so that they can be easily seen in the text.

1). One ofthe most important principles underlying ITS is its ability to learn and adapt to the changing phases of the market. And secondly, 2). The minimum number of parameters regulated from outside. To determine the principles of self-learning ITS we should probably talk about a particular class of TS. For a start I propose to consider a class of TS working on a breakdown of a channel. The question arises, how do we build the channel? We can use various indicators for that, but then a new task will appear, to make ITS adaptive to the market we should autotune indicators, decide on the criteria defining their state in the market and parameters that should be regulated and, most importantly, by what laws to adjust the parameters. In order to solve this problem, we should be more specific about the type of indicators to be used, and it will be our own challenging task. The option of self-learning of ITS without the use of external indicators is also possible.

For example, I propose to solve the problem of self-adaptation using learning of ITS on virtually executed trades on the history interval, located directly at the zero bar. For this purpose we need to set two external parameters:

1. The necessary and sufficient depth of history for learning (though this parameter can also be set in the selftuning mode later);

2. The minimum size of trades that we allow to trade. The shorter is the target for the TS, the more profit it is able to obtain, but there is a limitation, which we should consider and set in the external settings, not every brokerage company will tolerate a long trade with targets under 10 points.

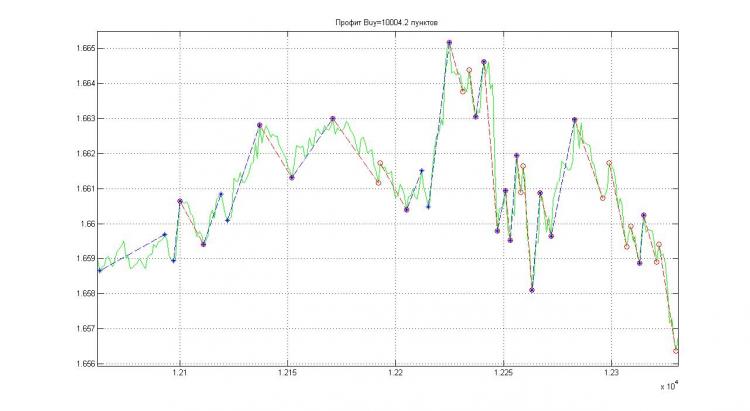

To be more specific, I will use the picture below as an example:

Fig.1

The trading channel width can be calculated as an average value of N perfect deals built, for example, with the help of Adept block mentioned by me in another topic (working results in Fig. 1) or any of Zig-Zag variants, though it will be less flexible. Next, determine the timing of opening virtual positions, e.g. when the 30% level is broken through from the midline of the channel, and the timing of closing them, there may be several options here:

a). if the border of the channel is reached;

b). if the level below the middle line of the channel has dropped below the line;

c). upon breaching the channel boundary and exceeding the level by 1/2 of the channel width, transfer the level of the average to the channel boundary, and control the position relative to the new average.

There may be many other options - suggest them.

When making Q - virtual trades, we analyze them in order to develop the rules of self-training of the TS for specific market conditions. To be continued ....

In the meantime, suggest your variants of the rules of ITS, and make additions and corrections to the material I have stated.