Decoding Opening Range Breakout Intraday Trading Strategies

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Neural Networks in Trading: Transformer for the Point Cloud (Pointformer)

In this article, we will talk about algorithms for using attention methods in solving problems of detecting objects in a point cloud. Object detection in point clouds is important for many real-world applications.

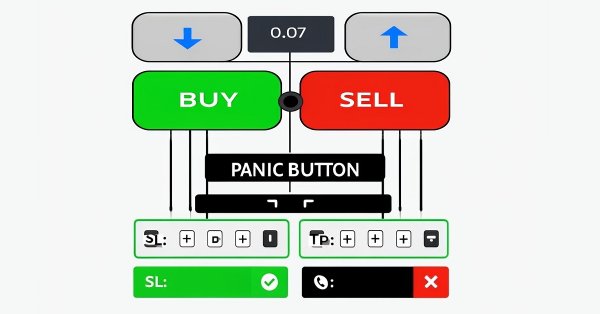

Manual Backtesting Made Easy: Building a Custom Toolkit for Strategy Tester in MQL5

In this article, we design a custom MQL5 toolkit for easy manual backtesting in the Strategy Tester. We explain its design and implementation, focusing on interactive trade controls. We then show how to use it to test strategies effectively

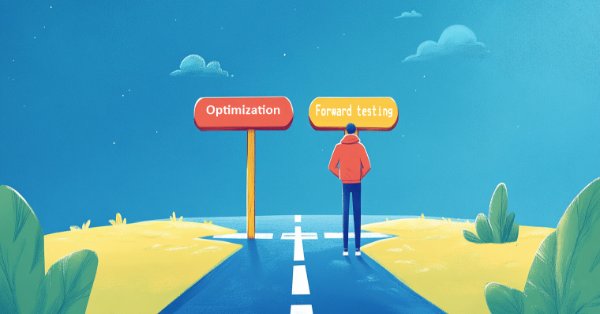

Developing a multi-currency Expert Advisor (Part 18): Automating group selection considering forward period

Let's continue to automate the steps we previously performed manually. This time we will return to the automation of the second stage, that is, the selection of the optimal group of single instances of trading strategies, supplementing it with the ability to take into account the results of instances in the forward period.

Automating Trading Strategies in MQL5 (Part 14): Trade Layering Strategy with MACD-RSI Statistical Methods

In this article, we introduce a trade layering strategy that combines MACD and RSI indicators with statistical methods to automate dynamic trading in MQL5. We explore the architecture of this cascading approach, detail its implementation through key code segments, and guide readers on backtesting to optimize performance. Finally, we conclude by highlighting the strategy’s potential and setting the stage for further enhancements in automated trading.

Neural Networks in Trading: Hierarchical Feature Learning for Point Clouds

We continue to study algorithms for extracting features from a point cloud. In this article, we will get acquainted with the mechanisms for increasing the efficiency of the PointNet method.

Statistical Arbitrage Through Mean Reversion in Pairs Trading: Beating the Market by Math

This article describes the fundamentals of portfolio-level statistical arbitrage. Its goal is to facilitate the understanding of the principles of statistical arbitrage to readers without deep math knowledge and propose a starting point conceptual framework. The article includes a working Expert Advisor, some notes about its one-year backtest, and the respective backtest configuration settings (.ini file) for the reproduction of the experiment.

Neural Networks in Trading: Point Cloud Analysis (PointNet)

Direct point cloud analysis avoids unnecessary data growth and improves the performance of models in classification and segmentation tasks. Such approaches demonstrate high performance and robustness to perturbations in the original data.

Neural Networks in Trading: Hierarchical Vector Transformer (Final Part)

We continue studying the Hierarchical Vector Transformer method. In this article, we will complete the construction of the model. We will also train and test it on real historical data.

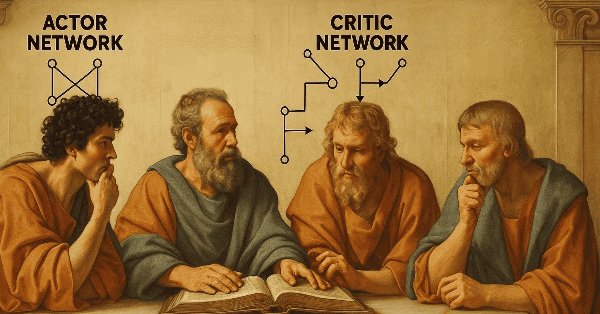

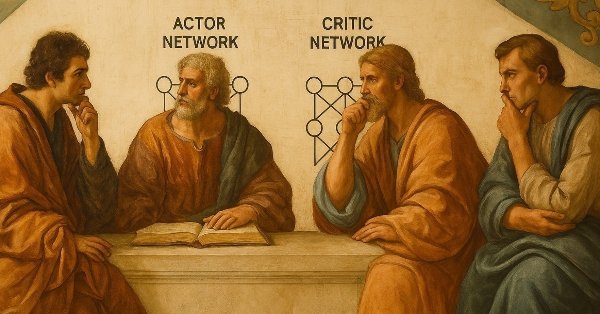

MQL5 Wizard Techniques you should know (Part 59): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

We continue our last article on DDPG with MA and stochastic indicators by examining other key Reinforcement Learning classes crucial for implementing DDPG. Though we are mostly coding in python, the final product, of a trained network will be exported to as an ONNX to MQL5 where we integrate it as a resource in a wizard assembled Expert Advisor.

Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

In this article, we automate the Head and Shoulders pattern in MQL5. We analyze its architecture, implement an EA to detect and trade it, and backtest the results. The process reveals a practical trading algorithm with room for refinement.

MQL5 Wizard Techniques you should know (Part 58): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

Moving Average and Stochastic Oscillator are very common indicators whose collective patterns we explored in the prior article, via a supervised learning network, to see which “patterns-would-stick”. We take our analyses from that article, a step further by considering the effects' reinforcement learning, when used with this trained network, would have on performance. Readers should note our testing is over a very limited time window. Nonetheless, we continue to harness the minimal coding requirements afforded by the MQL5 wizard in showcasing this.

Neural Networks in Trading: Hierarchical Vector Transformer (HiVT)

We invite you to get acquainted with the Hierarchical Vector Transformer (HiVT) method, which was developed for fast and accurate forecasting of multimodal time series.

Automating Trading Strategies in MQL5 (Part 12): Implementing the Mitigation Order Blocks (MOB) Strategy

In this article, we build an MQL5 trading system that automates order block detection for Smart Money trading. We outline the strategy’s rules, implement the logic in MQL5, and integrate risk management for effective trade execution. Finally, we backtest the system to assess its performance and refine it for optimal results.

Neural Networks in Trading: Unified Trajectory Generation Model (UniTraj)

Understanding agent behavior is important in many different areas, but most methods focus on just one of the tasks (understanding, noise removal, or prediction), which reduces their effectiveness in real-world scenarios. In this article, we will get acquainted with a model that can adapt to solving various problems.

Data Science and ML (Part 35): NumPy in MQL5 – The Art of Making Complex Algorithms with Less Code

NumPy library is powering almost all the machine learning algorithms to the core in Python programming language, In this article we are going to implement a similar module which has a collection of all the complex code to aid us in building sophisticated models and algorithms of any kind.

Price Action Analysis Toolkit Development (Part 18): Introducing Quarters Theory (III) — Quarters Board

In this article, we enhance the original Quarters Script by introducing the Quarters Board, a tool that lets you toggle quarter levels directly on the chart without needing to revisit the code. You can easily activate or deactivate specific levels, and the EA also provides trend direction commentary to help you better understand market movements.

Exploring Advanced Machine Learning Techniques on the Darvas Box Breakout Strategy

The Darvas Box Breakout Strategy, created by Nicolas Darvas, is a technical trading approach that spots potential buy signals when a stock’s price rises above a set "box" range, suggesting strong upward momentum. In this article, we will apply this strategy concept as an example to explore three advanced machine learning techniques. These include using a machine learning model to generate signals rather than to filter trades, employing continuous signals rather than discrete ones, and using models trained on different timeframes to confirm trades.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (III): Communication Module

Join us for an in-depth discussion on the latest advancements in MQL5 interface design as we unveil the redesigned Communications Panel and continue our series on building the New Admin Panel using modularization principles. We'll develop the CommunicationsDialog class step by step, thoroughly explaining how to inherit it from the Dialog class. Additionally, we'll leverage arrays and ListView class in our development. Gain actionable insights to elevate your MQL5 development skills—read through the article and join the discussion in the comments section!

Developing a multi-currency Expert Advisor (Part 17): Further preparation for real trading

Currently, our EA uses the database to obtain initialization strings for single instances of trading strategies. However, the database is quite large and contains a lot of information that is not needed for the actual EA operation. Let's try to ensure the EA's functionality without a mandatory connection to the database.

Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM)

In this article, I would like to introduce you to an interesting trajectory prediction method developed to solve problems in the field of autonomous vehicle movements. The authors of the method combined the best elements of various architectural solutions.

Automating Trading Strategies in MQL5 (Part 11): Developing a Multi-Level Grid Trading System

In this article, we develop a multi-level grid trading system EA using MQL5, focusing on the architecture and algorithm design behind grid trading strategies. We explore the implementation of multi-layered grid logic and risk management techniques to handle varying market conditions. Finally, we provide detailed explanations and practical tips to guide you through building, testing, and refining the automated trading system.

Neural Networks in Trading: State Space Models

A large number of the models we have reviewed so far are based on the Transformer architecture. However, they may be inefficient when dealing with long sequences. And in this article, we will get acquainted with an alternative direction of time series forecasting based on state space models.

Multiple Symbol Analysis With Python And MQL5 (Part 3): Triangular Exchange Rates

Traders often face drawdowns from false signals, while waiting for confirmation can lead to missed opportunities. This article introduces a triangular trading strategy using Silver’s pricing in Dollars (XAGUSD) and Euros (XAGEUR), along with the EURUSD exchange rate, to filter out noise. By leveraging cross-market relationships, traders can uncover hidden sentiment and refine their entries in real time.

MQL5 Wizard Techniques you should know (Part 56): Bill Williams Fractals

The Fractals by Bill Williams is a potent indicator that is easy to overlook when one initially spots it on a price chart. It appears too busy and probably not incisive enough. We aim to draw away this curtain on this indicator by examining what its various patterns could accomplish when examined with forward walk tests on all, with wizard assembled Expert Advisor.

Introduction to MQL5 (Part 13): A Beginner's Guide to Building Custom Indicators (II)

This article guides you through building a custom Heikin Ashi indicator from scratch and demonstrates how to integrate custom indicators into an EA. It covers indicator calculations, trade execution logic, and risk management techniques to enhance automated trading strategies.

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

Price Action Analysis Toolkit Development (Part 15): Introducing Quarters Theory (I) — Quarters Drawer Script

Points of support and resistance are critical levels that signal potential trend reversals and continuations. Although identifying these levels can be challenging, once you pinpoint them, you’re well-prepared to navigate the market. For further assistance, check out the Quarters Drawer tool featured in this article, it will help you identify both primary and minor support and resistance levels.

Trading with the MQL5 Economic Calendar (Part 6): Automating Trade Entry with News Event Analysis and Countdown Timers

In this article, we implement automated trade entry using the MQL5 Economic Calendar by applying user-defined filters and time offsets to identify qualifying news events. We compare forecast and previous values to determine whether to open a BUY or SELL trade. Dynamic countdown timers display the remaining time until news release and reset automatically after a trade.

Automating Trading Strategies in MQL5 (Part 9): Building an Expert Advisor for the Asian Breakout Strategy

In this article, we build an Expert Advisor in MQL5 for the Asian Breakout Strategy by calculating the session's high and low and applying trend filtering with a moving average. We implement dynamic object styling, user-defined time inputs, and robust risk management. Finally, we demonstrate backtesting and optimization techniques to refine the program.

MQL5 Wizard Techniques you should know (Part 55): SAC with Prioritized Experience Replay

Replay buffers in Reinforcement Learning are particularly important with off-policy algorithms like DQN or SAC. This then puts the spotlight on the sampling process of this memory-buffer. While default options with SAC, for instance, use random selection from this buffer, Prioritized Experience Replay buffers fine tune this by sampling from the buffer based on a TD-score. We review the importance of Reinforcement Learning, and, as always, examine just this hypothesis (not the cross-validation) in a wizard assembled Expert Advisor.

Automating Trading Strategies in MQL5 (Part 8): Building an Expert Advisor with Butterfly Harmonic Patterns

In this article, we build an MQL5 Expert Advisor to detect Butterfly harmonic patterns. We identify pivot points and validate Fibonacci levels to confirm the pattern. We then visualize the pattern on the chart and automatically execute trades when confirmed.

Neural Networks in Trading: Injection of Global Information into Independent Channels (InjectTST)

Most modern multimodal time series forecasting methods use the independent channels approach. This ignores the natural dependence of different channels of the same time series. Smart use of two approaches (independent and mixed channels) is the key to improving the performance of the models.

Neural Networks in Trading: Practical Results of the TEMPO Method

We continue our acquaintance with the TEMPO method. In this article we will evaluate the actual effectiveness of the proposed approaches on real historical data.

Automating Trading Strategies in MQL5 (Part 7): Building a Grid Trading EA with Dynamic Lot Scaling

In this article, we build a grid trading expert advisor in MQL5 that uses dynamic lot scaling. We cover the strategy design, code implementation, and backtesting process. Finally, we share key insights and best practices for optimizing the automated trading system.

MQL5 Wizard Techniques you should know (Part 54): Reinforcement Learning with hybrid SAC and Tensors

Soft Actor Critic is a Reinforcement Learning algorithm that we looked at in a previous article, where we also introduced python and ONNX to these series as efficient approaches to training networks. We revisit the algorithm with the aim of exploiting tensors, computational graphs that are often exploited in Python.

Neural Networks in Trading: Using Language Models for Time Series Forecasting

We continue to study time series forecasting models. In this article, we get acquainted with a complex algorithm built on the use of a pre-trained language model.

Robustness Testing on Expert Advisors

In strategy development, there are many intricate details to consider, many of which are not highlighted for beginner traders. As a result, many traders, myself included, have had to learn these lessons the hard way. This article is based on my observations of common pitfalls that most beginner traders encounter when developing strategies on MQL5. It will offer a range of tips, tricks, and examples to help identify the disqualification of an EA and test the robustness of our own EAs in an easy-to-implement way. The goal is to educate readers, helping them avoid future scams when purchasing EAs as well as preventing mistakes in their own strategy development.

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Lightweight time series forecasting models achieve high performance using a minimum number of parameters. This, in turn, reduces the consumption of computing resources and speeds up decision-making. Despite being lightweight, such models achieve forecast quality comparable to more complex ones.