Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

Introduction

In our previous article (Part 12), we implemented the Mitigation Order Blocks (MOB) Strategy in MetaQuotes Language 5 (MQL5) to leverage institutional price zones for trading. Now, in Part 13, we shift our focus to building a Head and Shoulders trading algorithm, automating a classic reversal pattern to capture market turns with precision. We will cover the following topics:

- Understanding the Head and Shoulders Pattern Architecture

- Implementation in MQL5

- Backtesting

- Conclusion

By the end of this article, you’ll have a fully functional Expert Advisor ready to trade the Head and Shoulders pattern—let’s dive in!

Understanding the Head and Shoulders Pattern Architecture

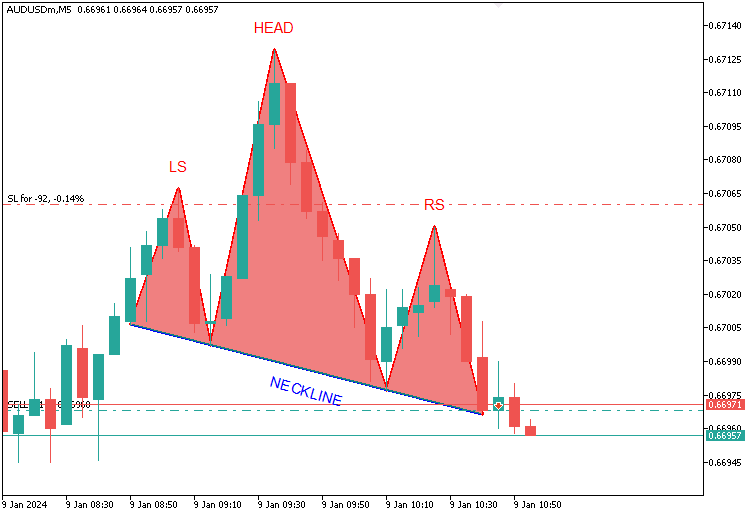

The Head and Shoulders pattern is a classic chart formation widely recognized in technical analysis for predicting trend reversals, appearing in both standard (bearish) and inverse (bullish) variations, each defined by a unique sequence of price peaks or troughs. In the standard pattern, in our program, an uptrend will give way to three peaks: the left shoulder will establish a high, the head will tower distinctly higher as the trend’s climax (surpassing both shoulders significantly), and the right shoulder will form lower than the head yet close in height to the left, all tied together by a neckline linking the two troughs—once price breaks below this line, we’ll enter a bearish trade at the breakout, set a stop-loss above the right shoulder, and target a take-profit by projecting the head-to-neckline height downward as illustrated below.

For the inverse pattern, a downtrend will yield three troughs: a left shoulder will mark a low, a head will plunge notably deeper (below both shoulders), and a right shoulder will align near the left’s level, with a neckline across the peaks—price breaking above it will trigger a bullish entry, with a stop-loss below the right shoulder and a take-profit extending upward by the neckline-to-head distance, all built on the head’s standout height and the shoulders’ near symmetry as our guiding rules. Here is its visualization.

As for the risk management, we will integrate an optional trailing stop feature to lock in profits maximizing gains. Let's go.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Indicators folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will need to declare some global variables that we will use throughout the program.

//+------------------------------------------------------------------+ //| Head & Shoulders Pattern EA.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Copyright 2025, Allan Munene Mutiiria." #property link "https://youtube.com/@ForexAlgo-Trader?" #property version "1.00" #include <Trade\Trade.mqh> //--- Include the Trade.mqh library for trading functions CTrade obj_Trade; //--- Trade object for executing and managing trades // Input Parameters input int LookbackBars = 50; // Number of historical bars to analyze for pattern detection input double ThresholdPoints = 70.0; // Minimum price movement in points to identify a reversal input double ShoulderTolerancePoints = 15.0; // Maximum allowable price difference between left and right shoulders input double TroughTolerancePoints = 30.0; // Maximum allowable price difference between neckline troughs or peaks input double BufferPoints = 10.0; // Additional points added to stop-loss for safety buffer input double LotSize = 0.1; // Volume of each trade in lots input ulong MagicNumber = 123456; // Unique identifier for trades opened by this EA input int MaxBarRange = 30; // Maximum number of bars allowed between key pattern points input int MinBarRange = 5; // Minimum number of bars required between key pattern points input double BarRangeMultiplier = 2.0; // Maximum multiple of the smallest bar range for pattern uniformity input int ValidationBars = 3; // Number of bars after right shoulder to validate breakout input double PriceTolerance = 5.0; // Price tolerance in points for matching traded patterns input double RightShoulderBreakoutMultiplier = 1.5; // Maximum multiple of pattern range for right shoulder to breakout distance input int MaxTradedPatterns = 20; // Maximum number of patterns stored in traded history input bool UseTrailingStop = false; // Toggle to enable or disable trailing stop functionality input int MinTrailPoints = 50; // Minimum profit in points before trailing stop activates input int TrailingPoints = 30; // Distance in points to maintain behind current price when trailing

Here, we start with "#include <Trade\Trade.mqh>" and a "CTrade" object, "obj_Trade", to include extra trading files for trade management. We set inputs like "LookbackBars" (default 50) for historical analysis, "ThresholdPoints" (default 70.0) for reversal confirmation, and "ShoulderTolerancePoints" (default 15.0) and "TroughTolerancePoints" (default 30.0) for symmetry. The rest of the inputs are self-explanatory. We have added detailed comments for ease of understanding. Next, we need to define some structures we will use to find the patterns and manage the considered trades.

// Structure to store peaks and troughs struct Extremum { int bar; //--- Bar index where extremum occurs datetime time; //--- Timestamp of the bar double price; //--- Price at extremum (high for peak, low for trough) bool isPeak; //--- True if peak (high), false if trough (low) }; // Structure to store traded patterns struct TradedPattern { datetime leftShoulderTime; //--- Timestamp of the left shoulder double leftShoulderPrice; //--- Price of the left shoulder };

We set up two key structures using struct keyword to drive our Head and Shoulders trading algorithm: "Extremum" will store peaks and troughs with "bar" (index), "time" (timestamp), "price" (value), and "isPeak" (true for peaks, false for troughs) to pinpoint pattern components, while "TradedPattern" will track executed trades using "leftShoulderTime" and "leftShoulderPrice" to prevent duplicates. To ensure we trade once per bar and keep track of the running trades, we declare a variable and an array as follows.

// Global Variables static datetime lastBarTime = 0; //--- Tracks the timestamp of the last processed bar to avoid reprocessing TradedPattern tradedPatterns[]; //--- Array to store details of previously traded patterns

With that, we are all set. However, since we will need to display the pattern on the chart, we will need to get the chart architecture and bar components to ensure it adapts to the pattern requirements.

int chart_width = (int)ChartGetInteger(0, CHART_WIDTH_IN_PIXELS); //--- Width of the chart in pixels for visualization int chart_height = (int)ChartGetInteger(0, CHART_HEIGHT_IN_PIXELS); //--- Height of the chart in pixels for visualization int chart_scale = (int)ChartGetInteger(0, CHART_SCALE); //--- Zoom level of the chart (0-5) int chart_first_vis_bar = (int)ChartGetInteger(0, CHART_FIRST_VISIBLE_BAR); //--- Index of the first visible bar on the chart int chart_vis_bars = (int)ChartGetInteger(0, CHART_VISIBLE_BARS); //--- Number of visible bars on the chart double chart_prcmin = ChartGetDouble(0, CHART_PRICE_MIN, 0); //--- Minimum price visible on the chart double chart_prcmax = ChartGetDouble(0, CHART_PRICE_MAX, 0); //--- Maximum price visible on the chart //+------------------------------------------------------------------+ //| Converts the chart scale property to bar width/spacing | //+------------------------------------------------------------------+ int BarWidth(int scale) { return (int)pow(2, scale); } //--- Calculates bar width in pixels based on chart scale (zoom level) //+------------------------------------------------------------------+ //| Converts the bar index (as series) to x in pixels | //+------------------------------------------------------------------+ int ShiftToX(int shift) { return (chart_first_vis_bar - shift) * BarWidth(chart_scale) - 1; } //--- Converts bar index to x-coordinate in pixels on the chart //+------------------------------------------------------------------+ //| Converts the price to y in pixels | //+------------------------------------------------------------------+ int PriceToY(double price) { //--- Function to convert price to y-coordinate in pixels if (chart_prcmax - chart_prcmin == 0.0) return 0; //--- Return 0 if price range is zero to avoid division by zero return (int)round(chart_height * (chart_prcmax - price) / (chart_prcmax - chart_prcmin) - 1); //--- Calculate y-pixel position based on price and chart dimensions }

We prepare and equip the program with visualization by defining variables like "chart_width" and "chart_height" using the ChartGetInteger function for chart dimensions, "chart_scale" for zoom, "chart_first_vis_bar" and "chart_vis_bars" for bar details, and "chart_prcmin" and "chart_prcmax" via ChartGetDouble for price range. We use the "BarWidth" function with pow to calculate bar spacing from "chart_scale", the "ShiftToX" function to convert bar indices to x-coordinates using "chart_first_vis_bar" and "chart_scale", and the "PriceToY" function with round to map prices to y-coordinates based on "chart_height", "chart_prcmax", and "chart_prcmin", enabling precise pattern display. We are now fully set. We can proceed to initialize the program in the OnInit event handler.

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- Expert Advisor initialization function obj_Trade.SetExpertMagicNumber(MagicNumber); //--- Set the magic number for trades opened by this EA ArrayResize(tradedPatterns, 0); //--- Initialize tradedPatterns array with zero size return(INIT_SUCCEEDED); //--- Return success code to indicate successful initialization }

In the OnInit, we use the "SetExpertMagicNumber" method on the "obj_Trade" object to assign "MagicNumber" as the unique identifier for all trades, ensuring our program’s positions are distinguishable, and call the ArrayResize function to set the "tradedPatterns" array to zero sizes, clearing any prior data for a fresh start. We then conclude by returning INIT_SUCCEEDED to confirm the successful setup, preparing the Expert Advisor to detect and trade the pattern effectively. We can now move on to the OnTick event handler and make sure we do analysis once per bar.

//+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- Main tick function executed on each price update datetime currentBarTime = iTime(_Symbol, _Period, 0); //--- Get the timestamp of the current bar if (currentBarTime == lastBarTime) return; //--- Exit if the current bar has already been processed lastBarTime = currentBarTime; //--- Update the last processed bar time // Update chart properties chart_width = (int)ChartGetInteger(0, CHART_WIDTH_IN_PIXELS); //--- Update chart width in pixels chart_height = (int)ChartGetInteger(0, CHART_HEIGHT_IN_PIXELS); //--- Update chart height in pixels chart_scale = (int)ChartGetInteger(0, CHART_SCALE); //--- Update chart zoom level chart_first_vis_bar = (int)ChartGetInteger(0, CHART_FIRST_VISIBLE_BAR); //--- Update index of the first visible bar chart_vis_bars = (int)ChartGetInteger(0, CHART_VISIBLE_BARS); //--- Update number of visible bars chart_prcmin = ChartGetDouble(0, CHART_PRICE_MIN, 0); //--- Update minimum visible price on chart chart_prcmax = ChartGetDouble(0, CHART_PRICE_MAX, 0); //--- Update maximum visible price on chart // Skip pattern detection if a position is already open if (PositionsTotal() > 0) return; //--- Exit function if there are open positions to avoid multiple trades }

In the OnTick event handler, which activates on each price update to monitor and respond to market changes, we use the iTime function to fetch "currentBarTime" for the latest bar and compare it with "lastBarTime" to avoid reprocessing, updating "lastBarTime" only for new bars; then, we refresh chart visuals by calling ChartGetInteger to update "chart_width", "chart_height", "chart_scale", "chart_first_vis_bar", and "chart_vis_bars", and ChartGetDouble for "chart_prcmin" and "chart_prcmax". We also employ the PositionsTotal function to check for open trades, exiting early if any exist to prevent overlapping positions, setting the stage for pattern detection and trading. We can then define a function to find the extremum points or the key pattern points.

//+------------------------------------------------------------------+ //| Find extrema in the last N bars | //+------------------------------------------------------------------+ void FindExtrema(Extremum &extrema[], int lookback) { //--- Function to identify peaks and troughs in price history ArrayFree(extrema); //--- Clear the extrema array to start fresh int bars = Bars(_Symbol, _Period); //--- Get total number of bars available if (lookback >= bars) lookback = bars - 1; //--- Adjust lookback if it exceeds available bars double highs[], lows[]; //--- Arrays to store high and low prices ArraySetAsSeries(highs, true); //--- Set highs array as time series (newest first) ArraySetAsSeries(lows, true); //--- Set lows array as time series (newest first) CopyHigh(_Symbol, _Period, 0, lookback + 1, highs); //--- Copy high prices for lookback period CopyLow(_Symbol, _Period, 0, lookback + 1, lows); //--- Copy low prices for lookback period bool isUpTrend = highs[lookback] < highs[lookback - 1]; //--- Determine initial trend based on first two bars double lastHigh = highs[lookback]; //--- Initialize last high price double lastLow = lows[lookback]; //--- Initialize last low price int lastExtremumBar = lookback; //--- Initialize last extremum bar index for (int i = lookback - 1; i >= 0; i--) { //--- Loop through bars from oldest to newest if (isUpTrend) { //--- If currently in an uptrend if (highs[i] > lastHigh) { //--- Check if current high exceeds last high lastHigh = highs[i]; //--- Update last high price lastExtremumBar = i; //--- Update last extremum bar index } else if (lows[i] < lastHigh - ThresholdPoints * _Point) { //--- Check if current low indicates a reversal (trough) int size = ArraySize(extrema); //--- Get current size of extrema array ArrayResize(extrema, size + 1); //--- Resize array to add new extremum extrema[size].bar = lastExtremumBar; //--- Store bar index of the peak extrema[size].time = iTime(_Symbol, _Period, lastExtremumBar); //--- Store timestamp of the peak extrema[size].price = lastHigh; //--- Store price of the peak extrema[size].isPeak = true; //--- Mark as a peak //Print("Extrema added: Bar ", lastExtremumBar, ", Time ", TimeToString(extrema[size].time), ", Price ", DoubleToString(lastHigh, _Digits), ", IsPeak true"); //--- Log new peak isUpTrend = false; //--- Switch trend to downtrend lastLow = lows[i]; //--- Update last low price lastExtremumBar = i; //--- Update last extremum bar index } } else { //--- If currently in a downtrend if (lows[i] < lastLow) { //--- Check if current low is below last low lastLow = lows[i]; //--- Update last low price lastExtremumBar = i; //--- Update last extremum bar index } else if (highs[i] > lastLow + ThresholdPoints * _Point) { //--- Check if current high indicates a reversal (peak) int size = ArraySize(extrema); //--- Get current size of extrema array ArrayResize(extrema, size + 1); //--- Resize array to add new extremum extrema[size].bar = lastExtremumBar; //--- Store bar index of the trough extrema[size].time = iTime(_Symbol, _Period, lastExtremumBar); //--- Store timestamp of the trough extrema[size].price = lastLow; //--- Store price of the trough extrema[size].isPeak = false; //--- Mark as a trough //Print("Extrema added: Bar ", lastExtremumBar, ", Time ", TimeToString(extrema[size].time), ", Price ", DoubleToString(lastLow, _Digits), ", IsPeak false"); //--- Log new trough isUpTrend = true; //--- Switch trend to uptrend lastHigh = highs[i]; //--- Update last high price lastExtremumBar = i; //--- Update last extremum bar index } } } }

Here, we pinpoint the peaks and troughs that define our head and shoulders pattern by implementing the "FindExtrema" function, which analyzes the last "lookback" bars to build an "extrema" array of critical price points. We begin by resetting the "extrema" array with the ArrayFree function to ensure a clean slate, then use the "Bars" function to fetch the total available bars and cap "lookback" if it exceeds this limit, guaranteeing we stay within the chart’s data range. Next, we prepare "highs" and "lows" arrays to hold price data, setting them as time series with the ArraySetAsSeries function (newest first), and populate them using CopyHigh and CopyLow to extract high and low prices over "lookback + 1" bars.

In a loop from oldest to newest bar, we determine the trend with "isUpTrend" based on initial price movement, then track "lastHigh" or "lastLow" and their "lastExtremumBar"; when a reversal exceeds "ThresholdPoints", we expand "extrema" with the ArrayResize function, store details like "bar", "time" (via "iTime"), "price", and "isPeak" (true for peaks, false for troughs), and switch the trend, enabling precise pattern identification. We can now take the identified price levels and store them for further use.

Extremum extrema[]; //--- Array to store identified peaks and troughs FindExtrema(extrema, LookbackBars); //--- Find extrema in the last LookbackBars bars

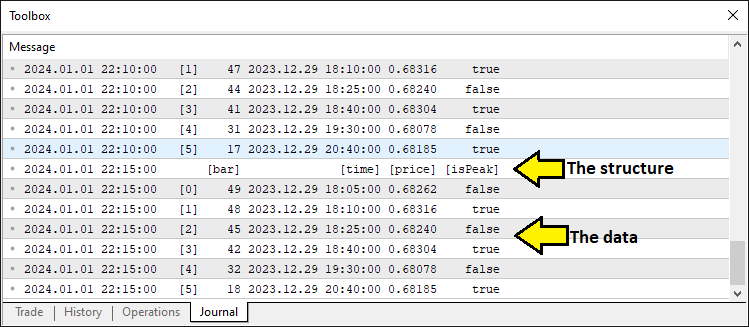

Here, we declare an "extrema" array of type "Extremum" to hold identified peaks and troughs, which will store the pattern’s shoulders and head. We then call the "FindExtrema" function, passing "extrema" and "LookbackBars" as arguments, to scan the last "LookbackBars" bars and populate the array with key extrema, laying the groundwork for pattern recognition and subsequent trading decisions. When we print the array values using the ArrayPrint function, we have something that depicts the below structure.

This confirms we have the necessary data points. So we can proceed to identifying the pattern components. To make the code modularized, we employ functions.

//+------------------------------------------------------------------+ //| Detect standard Head and Shoulders pattern | //+------------------------------------------------------------------+ bool DetectHeadAndShoulders(Extremum &extrema[], int &leftShoulderIdx, int &headIdx, int &rightShoulderIdx, int &necklineStartIdx, int &necklineEndIdx) { //--- Function to detect standard H&S pattern int size = ArraySize(extrema); //--- Get the size of the extrema array if (size < 6) return false; //--- Return false if insufficient extrema for pattern (need at least 6 points) for (int i = size - 6; i >= 0; i--) { //--- Loop through extrema to find H&S pattern (start at size-6 to ensure enough points) if (!extrema[i].isPeak && extrema[i+1].isPeak && !extrema[i+2].isPeak && //--- Check sequence: trough, peak (LS), trough extrema[i+3].isPeak && !extrema[i+4].isPeak && extrema[i+5].isPeak) { //--- Check sequence: peak (head), trough, peak (RS) double leftShoulder = extrema[i+1].price; //--- Get price of left shoulder double head = extrema[i+3].price; //--- Get price of head double rightShoulder = extrema[i+5].price; //--- Get price of right shoulder double trough1 = extrema[i+2].price; //--- Get price of first trough (neckline start) double trough2 = extrema[i+4].price; //--- Get price of second trough (neckline end) bool isHeadHighest = true; //--- Flag to verify head is the highest peak in range for (int j = MathMax(0, i - 5); j < MathMin(size, i + 10); j++) { //--- Check surrounding bars (5 before, 10 after) for higher peaks if (extrema[j].isPeak && extrema[j].price > head && j != i + 3) { //--- If another peak is higher than head isHeadHighest = false; //--- Set flag to false break; //--- Exit loop as head is not highest } } int lsBar = extrema[i+1].bar; //--- Get bar index of left shoulder int headBar = extrema[i+3].bar; //--- Get bar index of head int rsBar = extrema[i+5].bar; //--- Get bar index of right shoulder int lsToHead = lsBar - headBar; //--- Calculate bars from left shoulder to head int headToRs = headBar - rsBar; //--- Calculate bars from head to right shoulder if (lsToHead < MinBarRange || lsToHead > MaxBarRange || headToRs < MinBarRange || headToRs > MaxBarRange) continue; //--- Skip if bar ranges are out of bounds int minRange = MathMin(lsToHead, headToRs); //--- Get the smaller of the two ranges for uniformity check if (lsToHead > minRange * BarRangeMultiplier || headToRs > minRange * BarRangeMultiplier) continue; //--- Skip if ranges exceed uniformity multiplier bool rsValid = false; //--- Flag to validate right shoulder breakout int rsBarIndex = extrema[i+5].bar; //--- Get bar index of right shoulder for validation for (int j = rsBarIndex - 1; j >= MathMax(0, rsBarIndex - ValidationBars); j--) { //--- Check bars after right shoulder for breakout if (iLow(_Symbol, _Period, j) < rightShoulder - ThresholdPoints * _Point) { //--- Check if price drops below RS by threshold rsValid = true; //--- Set flag to true if breakout confirmed break; //--- Exit loop once breakout is validated } } if (!rsValid) continue; //--- Skip if right shoulder breakout not validated if (isHeadHighest && head > leftShoulder && head > rightShoulder && //--- Verify head is highest and above shoulders MathAbs(leftShoulder - rightShoulder) < ShoulderTolerancePoints * _Point && //--- Check shoulder price difference within tolerance MathAbs(trough1 - trough2) < TroughTolerancePoints * _Point) { //--- Check trough price difference within tolerance leftShoulderIdx = i + 1; //--- Set index for left shoulder headIdx = i + 3; //--- Set index for head rightShoulderIdx = i + 5; //--- Set index for right shoulder necklineStartIdx = i + 2; //--- Set index for neckline start (first trough) necklineEndIdx = i + 4; //--- Set index for neckline end (second trough) Print("Bar Ranges: LS to Head = ", lsToHead, ", Head to RS = ", headToRs); //--- Log bar ranges for debugging return true; //--- Return true to indicate pattern found } } } return false; //--- Return false if no pattern detected }

Here, we spot the standard pattern through the "DetectHeadAndShoulders" function, which examines the "extrema" array to find a valid sequence of six points: a trough, a peak (left shoulder), a trough, a peak (head), a trough, and a peak (right shoulder), requiring at least six entries as checked by the ArraySize function. We loop through "extrema" starting at "size - 6", verifying the pattern’s alternating peak-trough structure, then extract prices for "leftShoulder", "head", "rightShoulder", and neckline troughs ("trough1", "trough2"); a nested loop ensures the head is the highest peak within a range using the MathMax and MathMin functions, while bar distances between points are constrained by "MinBarRange" and "MaxBarRange" and uniformity by "BarRangeMultiplier".

We confirm the right shoulder breakout by checking the iLow function against "ThresholdPoints" over "ValidationBars", and if the head exceeds both shoulders and tolerances ("ShoulderTolerancePoints", "TroughTolerancePoints") are met, we assign indices like "leftShoulderIdx", "headIdx", and "necklineStartIdx", log bar ranges with the Print function for debugging, and return true to signal a detected pattern, otherwise returning false. We use the same logic to find the inversed pattern.

//+------------------------------------------------------------------+ //| Detect inverse Head and Shoulders pattern | //+------------------------------------------------------------------+ bool DetectInverseHeadAndShoulders(Extremum &extrema[], int &leftShoulderIdx, int &headIdx, int &rightShoulderIdx, int &necklineStartIdx, int &necklineEndIdx) { //--- Function to detect inverse H&S pattern int size = ArraySize(extrema); //--- Get the size of the extrema array if (size < 6) return false; //--- Return false if insufficient extrema for pattern (need at least 6 points) for (int i = size - 6; i >= 0; i--) { //--- Loop through extrema to find inverse H&S pattern if (extrema[i].isPeak && !extrema[i+1].isPeak && extrema[i+2].isPeak && //--- Check sequence: peak, trough (LS), peak !extrema[i+3].isPeak && extrema[i+4].isPeak && !extrema[i+5].isPeak) { //--- Check sequence: trough (head), peak, trough (RS) double leftShoulder = extrema[i+1].price; //--- Get price of left shoulder double head = extrema[i+3].price; //--- Get price of head double rightShoulder = extrema[i+5].price; //--- Get price of right shoulder double peak1 = extrema[i+2].price; //--- Get price of first peak (neckline start) double peak2 = extrema[i+4].price; //--- Get price of second peak (neckline end) bool isHeadLowest = true; //--- Flag to verify head is the lowest trough in range int headBar = extrema[i+3].bar; //--- Get bar index of head for range check for (int j = MathMax(0, headBar - 5); j <= MathMin(Bars(_Symbol, _Period) - 1, headBar + 5); j++) { //--- Check 5 bars before and after head if (iLow(_Symbol, _Period, j) < head) { //--- If any low is below head isHeadLowest = false; //--- Set flag to false break; //--- Exit loop as head is not lowest } } int lsBar = extrema[i+1].bar; //--- Get bar index of left shoulder int rsBar = extrema[i+5].bar; //--- Get bar index of right shoulder int lsToHead = lsBar - headBar; //--- Calculate bars from left shoulder to head int headToRs = headBar - rsBar; //--- Calculate bars from head to right shoulder if (lsToHead < MinBarRange || lsToHead > MaxBarRange || headToRs < MinBarRange || headToRs > MaxBarRange) continue; //--- Skip if bar ranges are out of bounds int minRange = MathMin(lsToHead, headToRs); //--- Get the smaller of the two ranges for uniformity check if (lsToHead > minRange * BarRangeMultiplier || headToRs > minRange * BarRangeMultiplier) continue; //--- Skip if ranges exceed uniformity multiplier bool rsValid = false; //--- Flag to validate right shoulder breakout int rsBarIndex = extrema[i+5].bar; //--- Get bar index of right shoulder for validation for (int j = rsBarIndex - 1; j >= MathMax(0, rsBarIndex - ValidationBars); j--) { //--- Check bars after right shoulder for breakout if (iHigh(_Symbol, _Period, j) > rightShoulder + ThresholdPoints * _Point) { //--- Check if price rises above RS by threshold rsValid = true; //--- Set flag to true if breakout confirmed break; //--- Exit loop once breakout is validated } } if (!rsValid) continue; //--- Skip if right shoulder breakout not validated if (isHeadLowest && head < leftShoulder && head < rightShoulder && //--- Verify head is lowest and below shoulders MathAbs(leftShoulder - rightShoulder) < ShoulderTolerancePoints * _Point && //--- Check shoulder price difference within tolerance MathAbs(peak1 - peak2) < TroughTolerancePoints * _Point) { //--- Check peak price difference within tolerance leftShoulderIdx = i + 1; //--- Set index for left shoulder headIdx = i + 3; //--- Set index for head rightShoulderIdx = i + 5; //--- Set index for right shoulder necklineStartIdx = i + 2; //--- Set index for neckline start (first peak) necklineEndIdx = i + 4; //--- Set index for neckline end (second peak) Print("Bar Ranges: LS to Head = ", lsToHead, ", Head to RS = ", headToRs); //--- Log bar ranges for debugging return true; //--- Return true to indicate pattern found } } } return false; //--- Return false if no pattern detected }

We define the "DetectInverseHeadAndShoulders" function to identify the inverse pattern, which sifts through the "extrema" array to locate a sequence of six points—peak, trough (left shoulder), peak, trough (head), peak, trough (right shoulder)—needing at least six entries as verified by the ArraySize function. We iterate from "size - 6" downward, confirming the pattern’s peak-trough alternation, then pull prices for "leftShoulder", "head", "rightShoulder", and neckline peaks ("peak1", "peak2"); a nested loop checks if the head is the lowest trough within a five-bar range around "headBar" using the MathMax, MathMin, and iLow functions, while "Bars" ensures we stay within chart limits.

We enforce bar spacing with "MinBarRange" and "MaxBarRange", calculate uniformity with the MathMin function and "BarRangeMultiplier", and validate the right shoulder breakout using the iHigh function against "ThresholdPoints" over "ValidationBars"; if "head" is below both shoulders and tolerances ("ShoulderTolerancePoints", "TroughTolerancePoints") are satisfied, we set indices like "leftShoulderIdx" and "necklineStartIdx", log ranges, and return true, otherwise returning false. With these 2 functions now, we can proceed to identify the patterns as below.

int leftShoulderIdx, headIdx, rightShoulderIdx, necklineStartIdx, necklineEndIdx; //--- Indices for pattern components // Standard Head and Shoulders (Sell) if (DetectHeadAndShoulders(extrema, leftShoulderIdx, headIdx, rightShoulderIdx, necklineStartIdx, necklineEndIdx)) { //--- Check for standard H&S pattern double closePrice = iClose(_Symbol, _Period, 1); //--- Get the closing price of the previous bar double necklinePrice = extrema[necklineEndIdx].price; //--- Get the price of the neckline end point if (closePrice < necklinePrice) { //--- Check if price has broken below the neckline (sell signal) datetime lsTime = extrema[leftShoulderIdx].time; //--- Get the timestamp of the left shoulder double lsPrice = extrema[leftShoulderIdx].price; //--- Get the price of the left shoulder //--- } }

Here, we advance by declaring variables "leftShoulderIdx", "headIdx", "rightShoulderIdx", "necklineStartIdx", and "necklineEndIdx" to store indices of the pattern’s components, then use the "DetectHeadAndShoulders" function to check the "extrema" array for a standard pattern, passing these indices as references. If detected, we retrieve "closePrice" with the iClose function for the previous bar and "necklinePrice" from "extrema[necklineEndIdx].price", triggering a sell signal if "closePrice" dips below "necklinePrice"; we then extract "lsTime" and "lsPrice" from "extrema[leftShoulderIdx]" to prepare for trade execution based on the left shoulder’s position. At this point, we need to make sure that the pattern is not traded. We define a function to do the check.

//+------------------------------------------------------------------+ //| Check if pattern has already been traded | //+------------------------------------------------------------------+ bool IsPatternTraded(datetime lsTime, double lsPrice) { //--- Function to check if a pattern has already been traded int size = ArraySize(tradedPatterns); //--- Get the current size of the tradedPatterns array for (int i = 0; i < size; i++) { //--- Loop through all stored traded patterns if (tradedPatterns[i].leftShoulderTime == lsTime && //--- Check if left shoulder time matches MathAbs(tradedPatterns[i].leftShoulderPrice - lsPrice) < PriceTolerance * _Point) { //--- Check if left shoulder price is within tolerance Print("Pattern already traded: Left Shoulder Time ", TimeToString(lsTime), ", Price ", DoubleToString(lsPrice, _Digits)); //--- Log that pattern was previously traded return true; //--- Return true to indicate pattern has been traded } } return false; //--- Return false if no match found }

Here, we ensure our program avoids duplicate trades by implementing the "IsPatternTraded" function, which checks if a pattern, identified by "lsTime" and "lsPrice", already exists in the "tradedPatterns" array. We use the ArraySize function to get the array’s "size", then loop through it, comparing each entry’s "leftShoulderTime" with "lsTime" and "leftShoulderPrice" with "lsPrice" within a "PriceTolerance" range via the MathAbs function; if a match is found, we log it with the Print function, including TimeToString and DoubleToString for readability, and return true, otherwise returning false to allow a new trade. We then call the function to do the check and proceed if none is found.

if (IsPatternTraded(lsTime, lsPrice)) return; //--- Exit if this pattern has already been traded datetime breakoutTime = iTime(_Symbol, _Period, 1); //--- Get the timestamp of the breakout bar (previous bar) int lsBar = extrema[leftShoulderIdx].bar; //--- Get the bar index of the left shoulder int headBar = extrema[headIdx].bar; //--- Get the bar index of the head int rsBar = extrema[rightShoulderIdx].bar; //--- Get the bar index of the right shoulder int necklineStartBar = extrema[necklineStartIdx].bar; //--- Get the bar index of the neckline start int necklineEndBar = extrema[necklineEndIdx].bar; //--- Get the bar index of the neckline end int breakoutBar = 1; //--- Set breakout bar index (previous bar) int lsToHead = lsBar - headBar; //--- Calculate number of bars from left shoulder to head int headToRs = headBar - rsBar; //--- Calculate number of bars from head to right shoulder int rsToBreakout = rsBar - breakoutBar; //--- Calculate number of bars from right shoulder to breakout int lsToNeckStart = lsBar - necklineStartBar; //--- Calculate number of bars from left shoulder to neckline start double avgPatternRange = (lsToHead + headToRs) / 2.0; //--- Calculate average bar range of the pattern for uniformity check if (rsToBreakout > avgPatternRange * RightShoulderBreakoutMultiplier) { //--- Check if breakout distance exceeds allowed range Print("Pattern rejected: Right Shoulder to Breakout (", rsToBreakout, ") exceeds ", RightShoulderBreakoutMultiplier, "x average range (", avgPatternRange, ")"); //--- Log rejection due to excessive breakout range return; //--- Exit function if pattern is invalid } double necklineStartPrice = extrema[necklineStartIdx].price; //--- Get the price of the neckline start point double necklineEndPrice = extrema[necklineEndIdx].price; //--- Get the price of the neckline end point datetime necklineStartTime = extrema[necklineStartIdx].time; //--- Get the timestamp of the neckline start point datetime necklineEndTime = extrema[necklineEndIdx].time; //--- Get the timestamp of the neckline end point int barDiff = necklineStartBar - necklineEndBar; //--- Calculate bar difference between neckline points for slope double slope = (necklineEndPrice - necklineStartPrice) / barDiff; //--- Calculate the slope of the neckline (price change per bar) double breakoutNecklinePrice = necklineStartPrice + slope * (necklineStartBar - breakoutBar); //--- Calculate neckline price at breakout point // Extend neckline backwards int extendedBar = necklineStartBar; //--- Initialize extended bar index with neckline start datetime extendedNecklineStartTime = necklineStartTime; //--- Initialize extended neckline start time double extendedNecklineStartPrice = necklineStartPrice; //--- Initialize extended neckline start price bool foundCrossing = false; //--- Flag to track if neckline crosses a bar within range for (int i = necklineStartBar + 1; i < Bars(_Symbol, _Period); i++) { //--- Loop through bars to extend neckline backwards double checkPrice = necklineStartPrice - slope * (i - necklineStartBar); //--- Calculate projected neckline price at bar i if (NecklineCrossesBar(checkPrice, i)) { //--- Check if neckline intersects the bar's high-low range int distance = i - necklineStartBar; //--- Calculate distance from neckline start to crossing bar if (distance <= avgPatternRange * RightShoulderBreakoutMultiplier) { //--- Check if crossing is within uniformity range extendedBar = i; //--- Update extended bar index extendedNecklineStartTime = iTime(_Symbol, _Period, i); //--- Update extended neckline start time extendedNecklineStartPrice = checkPrice; //--- Update extended neckline start price foundCrossing = true; //--- Set flag to indicate crossing found Print("Neckline extended to first crossing bar within uniformity: Bar ", extendedBar); //--- Log successful extension break; //--- Exit loop after finding valid crossing } else { //--- If crossing exceeds uniformity range Print("Crossing bar ", i, " exceeds uniformity (", distance, " > ", avgPatternRange * RightShoulderBreakoutMultiplier, ")"); //--- Log rejection of crossing break; //--- Exit loop as crossing is too far } } } if (!foundCrossing) { //--- If no valid crossing found within range int barsToExtend = 2 * lsToNeckStart; //--- Set fallback extension distance as twice LS to neckline start extendedBar = necklineStartBar + barsToExtend; //--- Calculate extended bar index if (extendedBar >= Bars(_Symbol, _Period)) extendedBar = Bars(_Symbol, _Period) - 1; //--- Cap extended bar at total bars if exceeded extendedNecklineStartTime = iTime(_Symbol, _Period, extendedBar); //--- Update extended neckline start time extendedNecklineStartPrice = necklineStartPrice - slope * (extendedBar - necklineStartBar); //--- Update extended neckline start price Print("Neckline extended to fallback (2x LS to Neckline Start): Bar ", extendedBar, " (no crossing within uniformity)"); //--- Log fallback extension } Print("Standard Head and Shoulders Detected:"); //--- Log detection of standard H&S pattern Print("Left Shoulder: Bar ", lsBar, ", Time ", TimeToString(lsTime), ", Price ", DoubleToString(lsPrice, _Digits)); //--- Log left shoulder details Print("Head: Bar ", headBar, ", Time ", TimeToString(extrema[headIdx].time), ", Price ", DoubleToString(extrema[headIdx].price, _Digits)); //--- Log head details Print("Right Shoulder: Bar ", rsBar, ", Time ", TimeToString(extrema[rightShoulderIdx].time), ", Price ", DoubleToString(extrema[rightShoulderIdx].price, _Digits)); //--- Log right shoulder details Print("Neckline Start: Bar ", necklineStartBar, ", Time ", TimeToString(necklineStartTime), ", Price ", DoubleToString(necklineStartPrice, _Digits)); //--- Log neckline start details Print("Neckline End: Bar ", necklineEndBar, ", Time ", TimeToString(necklineEndTime), ", Price ", DoubleToString(necklineEndPrice, _Digits)); //--- Log neckline end details Print("Close Price: ", DoubleToString(closePrice, _Digits)); //--- Log closing price at breakout Print("Breakout Time: ", TimeToString(breakoutTime)); //--- Log breakout timestamp Print("Neckline Price at Breakout: ", DoubleToString(breakoutNecklinePrice, _Digits)); //--- Log neckline price at breakout Print("Extended Neckline Start: Bar ", extendedBar, ", Time ", TimeToString(extendedNecklineStartTime), ", Price ", DoubleToString(extendedNecklineStartPrice, _Digits)); //--- Log extended neckline start details Print("Bar Ranges: LS to Head = ", lsToHead, ", Head to RS = ", headToRs, ", RS to Breakout = ", rsToBreakout, ", LS to Neckline Start = ", lsToNeckStart); //--- Log bar ranges for pattern analysis

Here, we enhance the pattern detection by validating a detected standard pattern and setting up a sell trade, beginning with the "IsPatternTraded" function to check if "lsTime" and "lsPrice" match a prior trade in "tradedPatterns", exiting if true to avoid duplicates. We then use the iTime function to assign "breakoutTime" as the previous bar’s timestamp and retrieve bar indices like "lsBar", "headBar", "rsBar", "necklineStartBar", and "necklineEndBar" from "extrema", calculating ranges such as "lsToHead", "headToRs", and "rsToBreakout"; if "rsToBreakout" exceeds "avgPatternRange" times "RightShoulderBreakoutMultiplier", we reject the pattern and log it with the Print function.

Next, we determine the neckline’s "slope" using "necklineStartPrice" and "necklineEndPrice" over "barDiff", compute "breakoutNecklinePrice", and extend the neckline backward with a loop, using the "NecklineCrossesBar" function to find a crossing within "avgPatternRange * RightShoulderBreakoutMultiplier", updating "extendedBar", "extendedNecklineStartTime" (via "iTime"), and "extendedNecklineStartPrice"; if no crossing fits, we fall back to "2 * lsToNeckStart", capping at "Bars" total, and log all details—bar indices, prices, and ranges—with the Print, TimeToString, and DoubleToString functions for thorough documentation. The custom function's code snippet is as below.

//+------------------------------------------------------------------+ //| Check if neckline crosses a bar's high-low range | //+------------------------------------------------------------------+ bool NecklineCrossesBar(double necklinePrice, int barIndex) { //--- Function to check if neckline price intersects a bar's range double high = iHigh(_Symbol, _Period, barIndex); //--- Get the high price of the specified bar double low = iLow(_Symbol, _Period, barIndex); //--- Get the low price of the specified bar return (necklinePrice >= low && necklinePrice <= high); //--- Return true if neckline price is within bar's high-low range }

The function checks if the "necklinePrice" intersects a bar’s price range at "barIndex" to ensure accurate neckline extension. We use the iHigh function to fetch the bar’s "high" price and the "iLow" function to get its "low" price, then return true if "necklinePrice" falls between "low" and "high", confirming the neckline crosses the bar’s range for pattern validation. If there is a validation of the pattern, we visualize it on the chart. We will need functions to draw and label it.

//+------------------------------------------------------------------+ //| Draw a trend line for visualization | //+------------------------------------------------------------------+ void DrawTrendLine(string name, datetime timeStart, double priceStart, datetime timeEnd, double priceEnd, color lineColor, int width, int style) { //--- Function to draw a trend line on the chart if (ObjectCreate(0, name, OBJ_TREND, 0, timeStart, priceStart, timeEnd, priceEnd)) { //--- Create a trend line object if possible ObjectSetInteger(0, name, OBJPROP_COLOR, lineColor); //--- Set the color of the trend line ObjectSetInteger(0, name, OBJPROP_STYLE, style); //--- Set the style (e.g., solid, dashed) of the trend line ObjectSetInteger(0, name, OBJPROP_WIDTH, width); //--- Set the width of the trend line ObjectSetInteger(0, name, OBJPROP_BACK, true); //--- Set the line to draw behind chart elements ChartRedraw(); //--- Redraw the chart to display the new line } else { //--- If line creation fails Print("Failed to create line: ", name, ". Error: ", GetLastError()); //--- Log the error with the object name and error code } } //+------------------------------------------------------------------+ //| Draw a filled triangle for visualization | //+------------------------------------------------------------------+ void DrawTriangle(string name, datetime time1, double price1, datetime time2, double price2, datetime time3, double price3, color fillColor) { //--- Function to draw a filled triangle on the chart if (ObjectCreate(0, name, OBJ_TRIANGLE, 0, time1, price1, time2, price2, time3, price3)) { //--- Create a triangle object if possible ObjectSetInteger(0, name, OBJPROP_COLOR, fillColor); //--- Set the fill color of the triangle ObjectSetInteger(0, name, OBJPROP_STYLE, STYLE_SOLID); //--- Set the border style to solid ObjectSetInteger(0, name, OBJPROP_WIDTH, 1); //--- Set the border width to 1 pixel ObjectSetInteger(0, name, OBJPROP_FILL, true); //--- Enable filling of the triangle ObjectSetInteger(0, name, OBJPROP_BACK, true); //--- Set the triangle to draw behind chart elements ChartRedraw(); //--- Redraw the chart to display the new triangle } else { //--- If triangle creation fails Print("Failed to create triangle: ", name, ". Error: ", GetLastError()); //--- Log the error with the object name and error code } } //+------------------------------------------------------------------+ //| Draw text label for visualization | //+------------------------------------------------------------------+ void DrawText(string name, datetime time, double price, string text, color textColor, bool above, double angle = 0) { //--- Function to draw a text label on the chart int chartscale = (int)ChartGetInteger(0, CHART_SCALE); //--- Get the current chart zoom level int dynamicFontSize = 5 + int(chartscale * 1.5); //--- Calculate font size based on zoom level for visibility double priceOffset = (above ? 10 : -10) * _Point; //--- Set price offset above or below the point for readability if (ObjectCreate(0, name, OBJ_TEXT, 0, time, price + priceOffset)) { //--- Create a text object if possible ObjectSetString(0, name, OBJPROP_TEXT, text); //--- Set the text content of the label ObjectSetInteger(0, name, OBJPROP_COLOR, textColor); //--- Set the color of the text ObjectSetInteger(0, name, OBJPROP_FONTSIZE, dynamicFontSize); //--- Set the font size based on chart scale ObjectSetInteger(0, name, OBJPROP_ANCHOR, ANCHOR_CENTER); //--- Center the text at the specified point ObjectSetDouble(0, name, OBJPROP_ANGLE, angle); //--- Set the rotation angle of the text in degrees ObjectSetInteger(0, name, OBJPROP_BACK, false); //--- Set the text to draw in front of chart elements ChartRedraw(); //--- Redraw the chart to display the new text Print("Text created: ", name, ", Angle: ", DoubleToString(angle, 2)); //--- Log successful creation of the text with its angle } else { //--- If text creation fails Print("Failed to create text: ", name, ". Error: ", GetLastError()); //--- Log the error with the object name and error code } }

Here, we enrich the program with visualization tools to highlight the pattern on the chart, starting with the "DrawTrendLine" function, which uses the ObjectCreate function to plot a line from "timeStart" and "priceStart" to "timeEnd" and "priceEnd", setting properties like "lineColor", "style", and "width" via ObjectSetInteger, drawing it behind bars with OBJPROP_BACK, and refreshing the display with the ChartRedraw function, logging failures with "Print" and GetLastError if needed.

We then implement the "DrawTriangle" function to shade the pattern’s structure, calling the "ObjectCreate" function with three points ("time1", "price1", etc.), applying "fillColor" and a solid border using ObjectSetInteger, filling it with OBJPROP_FILL, placing it behind the chart, and updating the view with ChartRedraw, again logging errors with "Print" if creation fails.

Finally, we add the "DrawText" function to label key points, using the ChartGetInteger function to adjust "dynamicFontSize" based on "chartscale", positioning text at "time" and "price" plus an offset via "ObjectCreate", customizing it with "ObjectSetString" for "text", "ObjectSetInteger" for "textColor" and "FONTSIZE", and "ObjectSetDouble" for "angle", drawing it in front with ChartRedraw, and confirming creation with "Print" and "DoubleToString" or noting errors. We now can call the functions to add the visibility feature, and the first thing we do is add the lines as follows.

string prefix = "HS_" + TimeToString(extrema[headIdx].time, TIME_MINUTES); //--- Create unique prefix for chart objects based on head time // Lines DrawTrendLine(prefix + "_LeftToNeckStart", lsTime, lsPrice, necklineStartTime, necklineStartPrice, clrRed, 3, STYLE_SOLID); //--- Draw line from left shoulder to neckline start DrawTrendLine(prefix + "_NeckStartToHead", necklineStartTime, necklineStartPrice, extrema[headIdx].time, extrema[headIdx].price, clrRed, 3, STYLE_SOLID); //--- Draw line from neckline start to head DrawTrendLine(prefix + "_HeadToNeckEnd", extrema[headIdx].time, extrema[headIdx].price, necklineEndTime, necklineEndPrice, clrRed, 3, STYLE_SOLID); //--- Draw line from head to neckline end DrawTrendLine(prefix + "_NeckEndToRight", necklineEndTime, necklineEndPrice, extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, clrRed, 3, STYLE_SOLID); //--- Draw line from neckline end to right shoulder DrawTrendLine(prefix + "_Neckline", extendedNecklineStartTime, extendedNecklineStartPrice, breakoutTime, breakoutNecklinePrice, clrBlue, 2, STYLE_SOLID); //--- Draw neckline from extended start to breakout DrawTrendLine(prefix + "_RightToBreakout", extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, breakoutTime, breakoutNecklinePrice, clrRed, 3, STYLE_SOLID); //--- Draw line from right shoulder to breakout DrawTrendLine(prefix + "_ExtendedToLeftShoulder", extendedNecklineStartTime, extendedNecklineStartPrice, lsTime, lsPrice, clrRed, 3, STYLE_SOLID); //--- Draw line from extended neckline to left shoulder

Here, we visually map the standard pattern by creating a unique prefix based on the head’s timestamp using the TimeToString function and drawing trend lines with the "DrawTrendLine" function to connect the left shoulder to the neckline start, neckline start to the head, head to the neckline end, and neckline end to the right shoulder in red with a width of 3, while the neckline from its extended start to the breakout point uses blue with a width of 2, and additional lines link the right shoulder to the breakout and the extended neckline back to the left shoulder in red, all in solid style to display the pattern on the chart. Upon compilation, we have the following outcome.

To add the triangles, we use the "DrawTriangle" function. Technically, we construct it within the shoulders and the head.

// Triangles DrawTriangle(prefix + "_LeftShoulderTriangle", lsTime, lsPrice, necklineStartTime, necklineStartPrice, extendedNecklineStartTime, extendedNecklineStartPrice, clrLightCoral); //--- Draw triangle for left shoulder area DrawTriangle(prefix + "_HeadTriangle", extrema[headIdx].time, extrema[headIdx].price, necklineStartTime, necklineStartPrice, necklineEndTime, necklineEndPrice, clrLightCoral); //--- Draw triangle for head area DrawTriangle(prefix + "_RightShoulderTriangle", extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, necklineEndTime, necklineEndPrice, breakoutTime, breakoutNecklinePrice, clrLightCoral); //--- Draw triangle for right shoulder area

Here, we enhance the visualization by using the "DrawTriangle" function to shade key areas in light coral, forming a triangle for the left shoulder from the left shoulder point to the neckline start and extended neckline start, another for the head from the head point to the neckline start and end, and a third for the right shoulder from the right shoulder point to the neckline end and breakout point, highlighting the pattern’s structure on the chart. Upon compilation, we have the following outcome.

Finally, we need to add labels to the pattern to make it fully visually appealing and self-illustrative.

// Text Labels DrawText(prefix + "_LS_Label", lsTime, lsPrice, "LS", clrRed, true); //--- Draw "LS" label above left shoulder DrawText(prefix + "_Head_Label", extrema[headIdx].time, extrema[headIdx].price, "HEAD", clrRed, true); //--- Draw "HEAD" label above head DrawText(prefix + "_RS_Label", extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, "RS", clrRed, true); //--- Draw "RS" label above right shoulder datetime necklineMidTime = extendedNecklineStartTime + (breakoutTime - extendedNecklineStartTime) / 2; //--- Calculate midpoint time of the neckline double necklineMidPrice = extendedNecklineStartPrice + slope * (iBarShift(_Symbol, _Period, extendedNecklineStartTime) - iBarShift(_Symbol, _Period, necklineMidTime)); //--- Calculate midpoint price of the neckline // Calculate angle in pixel space int x1 = ShiftToX(iBarShift(_Symbol, _Period, extendedNecklineStartTime)); //--- Convert extended neckline start to x-pixel coordinate int y1 = PriceToY(extendedNecklineStartPrice); //--- Convert extended neckline start price to y-pixel coordinate int x2 = ShiftToX(iBarShift(_Symbol, _Period, breakoutTime)); //--- Convert breakout time to x-pixel coordinate int y2 = PriceToY(breakoutNecklinePrice); //--- Convert breakout price to y-pixel coordinate double pixelSlope = (y2 - y1) / (double)(x2 - x1); //--- Calculate slope in pixel space (rise over run) double necklineAngle = -atan(pixelSlope) * 180 / M_PI; //--- Calculate neckline angle in degrees, negated for visual alignment Print("Pixel X1: ", x1, ", Y1: ", y1, ", X2: ", x2, ", Y2: ", y2, ", Pixel Slope: ", DoubleToString(pixelSlope, 4), ", Neckline Angle: ", DoubleToString(necklineAngle, 2)); //--- Log pixel coordinates and angle DrawText(prefix + "_Neckline_Label", necklineMidTime, necklineMidPrice, "NECKLINE", clrBlue, false, necklineAngle); //--- Draw "NECKLINE" label at midpoint with calculated angle

Finally, we annotate the pattern by using the "DrawText" function to place red "LS", "HEAD", and "RS" label above the left shoulder, head, and right shoulder points at their respective times and prices, enhancing chart readability. We then calculate the neckline’s midpoint by averaging "extendedNecklineStartTime" and "breakoutTime" for "necklineMidTime" and adjust "extendedNecklineStartPrice" with "slope" and bar differences via the iBarShift function for "necklineMidPrice"; to align the label, we convert times to x-pixels with the "ShiftToX" function and prices to y-pixels with the "PriceToY" function at the neckline’s start and breakout, compute a "pixelSlope", and derive "necklineAngle" in degrees using the atan function and "M_PI", logging these with the "Print" function and the DoubleToString function for verification.

We then draw a blue "NECKLINE" label at the midpoint with the "DrawText" function, positioned below and rotated to match "necklineAngle", ensuring the annotation follows the neckline’s tilt. Here is the outcome.

From the image, we can see that the pattern is fully visualized. We now need to detect its breakout, basically, the extended line, open a sell position, and modify the extension range to the breakout bar. Easy-peasy. We achieve that via the following logic.

double entryPrice = 0; //--- Set entry price to 0 for market order (uses current price) double sl = extrema[rightShoulderIdx].price + BufferPoints * _Point; //--- Calculate stop-loss above right shoulder with buffer double patternHeight = extrema[headIdx].price - necklinePrice; //--- Calculate pattern height from head to neckline double tp = closePrice - patternHeight; //--- Calculate take-profit below close by pattern height if (sl > closePrice && tp < closePrice) { //--- Validate trade direction (SL above, TP below for sell) if (obj_Trade.Sell(LotSize, _Symbol, entryPrice, sl, tp, "Head and Shoulders")) { //--- Attempt to open a sell trade AddTradedPattern(lsTime, lsPrice); //--- Add pattern to traded list Print("Sell Trade Opened: SL ", DoubleToString(sl, _Digits), ", TP ", DoubleToString(tp, _Digits)); //--- Log successful trade opening } }

Once the pattern is confirmed, we execute a sell trade by setting "entryPrice" to 0 for a market order, calculating "sl" above the right shoulder price with "BufferPoints", determining "patternHeight" as the difference between the head and neckline prices, and setting "tp" below "closePrice" by "patternHeight".

We validate the trade direction—ensuring "sl" is above and "tp" below "closePrice"—before using the "Sell" function on "obj_Trade" to open the trade with "LotSize", "sl", "tp", and comment; if successful, we call the "AddTradedPattern" function with "lsTime" and "lsPrice" to log the pattern and use the Print function with DoubleToString to record "sl" and "tp" details. The custom function's code snippet to mark the pattern as traded is as below.

//+------------------------------------------------------------------+ //| Add pattern to traded list with size management | //+------------------------------------------------------------------+ void AddTradedPattern(datetime lsTime, double lsPrice) { //--- Function to add a new traded pattern to the list int size = ArraySize(tradedPatterns); //--- Get the current size of the tradedPatterns array if (size >= MaxTradedPatterns) { //--- Check if array size exceeds maximum allowed for (int i = 0; i < size - 1; i++) { //--- Shift all elements left to remove the oldest tradedPatterns[i] = tradedPatterns[i + 1]; //--- Copy next element to current position } ArrayResize(tradedPatterns, size - 1); //--- Reduce array size by 1 size--; //--- Decrement size variable Print("Removed oldest traded pattern to maintain max size of ", MaxTradedPatterns); //--- Log removal of oldest pattern } ArrayResize(tradedPatterns, size + 1); //--- Increase array size to add new pattern tradedPatterns[size].leftShoulderTime = lsTime; //--- Store the left shoulder time of the new pattern tradedPatterns[size].leftShoulderPrice = lsPrice; //--- Store the left shoulder price of the new pattern Print("Added traded pattern: Left Shoulder Time ", TimeToString(lsTime), ", Price ", DoubleToString(lsPrice, _Digits)); //--- Log addition of new pattern }

We define the "AddTradedPattern" function to keep track of traded setups. It uses "lsTime" and "lsPrice" to log left shoulder details since the left shoulder does not repaint. We check the "tradedPatterns" size with the ArraySize function. If it hits "MaxTradedPatterns", we shift elements left to drop the oldest. We resize "tradedPatterns" with the "ArrayResize" function to shrink it. We log this and then expand "tradedPatterns" using the ArrayResize function for a new entry. We set "leftShoulderTime" to "lsTime" and "leftShoulderPrice" to "lsPrice". We log the addition with the Print function, the TimeToString function, and the DoubleToString function. Upon compilation, we have the following outcome.

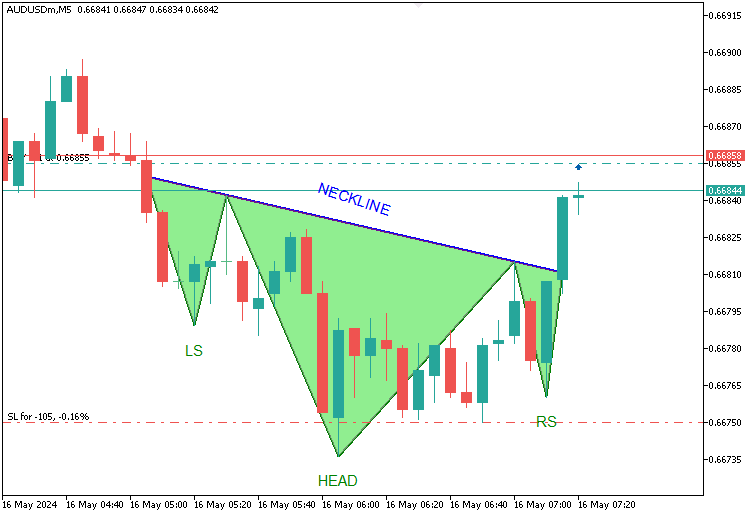

From the image, we can see that we not only visualize the setup but also trade it accordingly. The inverse head and shoulder pattern recognition, visualization, and trade operation employ the same logic, in an inversed manner. Here is its logic.

// Inverse Head and Shoulders (Buy) if (DetectInverseHeadAndShoulders(extrema, leftShoulderIdx, headIdx, rightShoulderIdx, necklineStartIdx, necklineEndIdx)) { //--- Check for inverse H&S pattern double closePrice = iClose(_Symbol, _Period, 1); //--- Get the closing price of the previous bar double necklinePrice = extrema[necklineEndIdx].price; //--- Get the price of the neckline end point if (closePrice > necklinePrice) { //--- Check if price has broken above the neckline (buy signal) datetime lsTime = extrema[leftShoulderIdx].time; //--- Get the timestamp of the left shoulder double lsPrice = extrema[leftShoulderIdx].price; //--- Get the price of the left shoulder if (IsPatternTraded(lsTime, lsPrice)) return; //--- Exit if this pattern has already been traded datetime breakoutTime = iTime(_Symbol, _Period, 1); //--- Get the timestamp of the breakout bar (previous bar) int lsBar = extrema[leftShoulderIdx].bar; //--- Get the bar index of the left shoulder int headBar = extrema[headIdx].bar; //--- Get the bar index of the head int rsBar = extrema[rightShoulderIdx].bar; //--- Get the bar index of the right shoulder int necklineStartBar = extrema[necklineStartIdx].bar; //--- Get the bar index of the neckline start int necklineEndBar = extrema[necklineEndIdx].bar; //--- Get the bar index of the neckline end int breakoutBar = 1; //--- Set breakout bar index (previous bar) int lsToHead = lsBar - headBar; //--- Calculate number of bars from left shoulder to head int headToRs = headBar - rsBar; //--- Calculate number of bars from head to right shoulder int rsToBreakout = rsBar - breakoutBar; //--- Calculate number of bars from right shoulder to breakout int lsToNeckStart = lsBar - necklineStartBar; //--- Calculate number of bars from left shoulder to neckline start double avgPatternRange = (lsToHead + headToRs) / 2.0; //--- Calculate average bar range of the pattern for uniformity check if (rsToBreakout > avgPatternRange * RightShoulderBreakoutMultiplier) { //--- Check if breakout distance exceeds allowed range Print("Pattern rejected: Right Shoulder to Breakout (", rsToBreakout, ") exceeds ", RightShoulderBreakoutMultiplier, "x average range (", avgPatternRange, ")"); //--- Log rejection due to excessive breakout range return; //--- Exit function if pattern is invalid } double necklineStartPrice = extrema[necklineStartIdx].price; //--- Get the price of the neckline start point double necklineEndPrice = extrema[necklineEndIdx].price; //--- Get the price of the neckline end point datetime necklineStartTime = extrema[necklineStartIdx].time; //--- Get the timestamp of the neckline start point datetime necklineEndTime = extrema[necklineEndIdx].time; //--- Get the timestamp of the neckline end point int barDiff = necklineStartBar - necklineEndBar; //--- Calculate bar difference between neckline points for slope double slope = (necklineEndPrice - necklineStartPrice) / barDiff; //--- Calculate the slope of the neckline (price change per bar) double breakoutNecklinePrice = necklineStartPrice + slope * (necklineStartBar - breakoutBar); //--- Calculate neckline price at breakout point // Extend neckline backwards int extendedBar = necklineStartBar; //--- Initialize extended bar index with neckline start datetime extendedNecklineStartTime = necklineStartTime; //--- Initialize extended neckline start time double extendedNecklineStartPrice = necklineStartPrice; //--- Initialize extended neckline start price bool foundCrossing = false; //--- Flag to track if neckline crosses a bar within range for (int i = necklineStartBar + 1; i < Bars(_Symbol, _Period); i++) { //--- Loop through bars to extend neckline backwards double checkPrice = necklineStartPrice - slope * (i - necklineStartBar); //--- Calculate projected neckline price at bar i if (NecklineCrossesBar(checkPrice, i)) { //--- Check if neckline intersects the bar's high-low range int distance = i - necklineStartBar; //--- Calculate distance from neckline start to crossing bar if (distance <= avgPatternRange * RightShoulderBreakoutMultiplier) { //--- Check if crossing is within uniformity range extendedBar = i; //--- Update extended bar index extendedNecklineStartTime = iTime(_Symbol, _Period, i); //--- Update extended neckline start time extendedNecklineStartPrice = checkPrice; //--- Update extended neckline start price foundCrossing = true; //--- Set flag to indicate crossing found Print("Neckline extended to first crossing bar within uniformity: Bar ", extendedBar); //--- Log successful extension break; //--- Exit loop after finding valid crossing } else { //--- If crossing exceeds uniformity range Print("Crossing bar ", i, " exceeds uniformity (", distance, " > ", avgPatternRange * RightShoulderBreakoutMultiplier, ")"); //--- Log rejection of crossing break; //--- Exit loop as crossing is too far } } } if (!foundCrossing) { //--- If no valid crossing found within range int barsToExtend = 2 * lsToNeckStart; //--- Set fallback extension distance as twice LS to neckline start extendedBar = necklineStartBar + barsToExtend; //--- Calculate extended bar index if (extendedBar >= Bars(_Symbol, _Period)) extendedBar = Bars(_Symbol, _Period) - 1; //--- Cap extended bar at total bars if exceeded extendedNecklineStartTime = iTime(_Symbol, _Period, extendedBar); //--- Update extended neckline start time extendedNecklineStartPrice = necklineStartPrice - slope * (extendedBar - necklineStartBar); //--- Update extended neckline start price Print("Neckline extended to fallback (2x LS to Neckline Start): Bar ", extendedBar, " (no crossing within uniformity)"); //--- Log fallback extension } Print("Inverse Head and Shoulders Detected:"); //--- Log detection of inverse H&S pattern Print("Left Shoulder: Bar ", lsBar, ", Time ", TimeToString(lsTime), ", Price ", DoubleToString(lsPrice, _Digits)); //--- Log left shoulder details Print("Head: Bar ", headBar, ", Time ", TimeToString(extrema[headIdx].time), ", Price ", DoubleToString(extrema[headIdx].price, _Digits)); //--- Log head details Print("Right Shoulder: Bar ", rsBar, ", Time ", TimeToString(extrema[rightShoulderIdx].time), ", Price ", DoubleToString(extrema[rightShoulderIdx].price, _Digits)); //--- Log right shoulder details Print("Neckline Start: Bar ", necklineStartBar, ", Time ", TimeToString(necklineStartTime), ", Price ", DoubleToString(necklineStartPrice, _Digits)); //--- Log neckline start details Print("Neckline End: Bar ", necklineEndBar, ", Time ", TimeToString(necklineEndTime), ", Price ", DoubleToString(necklineEndPrice, _Digits)); //--- Log neckline end details Print("Close Price: ", DoubleToString(closePrice, _Digits)); //--- Log closing price at breakout Print("Breakout Time: ", TimeToString(breakoutTime)); //--- Log breakout timestamp Print("Neckline Price at Breakout: ", DoubleToString(breakoutNecklinePrice, _Digits)); //--- Log neckline price at breakout Print("Extended Neckline Start: Bar ", extendedBar, ", Time ", TimeToString(extendedNecklineStartTime), ", Price ", DoubleToString(extendedNecklineStartPrice, _Digits)); //--- Log extended neckline start details Print("Bar Ranges: LS to Head = ", lsToHead, ", Head to RS = ", headToRs, ", RS to Breakout = ", rsToBreakout, ", LS to Neckline Start = ", lsToNeckStart); //--- Log bar ranges for pattern analysis string prefix = "IHS_" + TimeToString(extrema[headIdx].time, TIME_MINUTES); //--- Create unique prefix for chart objects based on head time // Lines DrawTrendLine(prefix + "_LeftToNeckStart", lsTime, lsPrice, necklineStartTime, necklineStartPrice, clrGreen, 2, STYLE_SOLID); //--- Draw line from left shoulder to neckline start DrawTrendLine(prefix + "_NeckStartToHead", necklineStartTime, necklineStartPrice, extrema[headIdx].time, extrema[headIdx].price, clrGreen, 2, STYLE_SOLID); //--- Draw line from neckline start to head DrawTrendLine(prefix + "_HeadToNeckEnd", extrema[headIdx].time, extrema[headIdx].price, necklineEndTime, necklineEndPrice, clrGreen, 2, STYLE_SOLID); //--- Draw line from head to neckline end DrawTrendLine(prefix + "_NeckEndToRight", necklineEndTime, necklineEndPrice, extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, clrGreen, 2, STYLE_SOLID); //--- Draw line from neckline end to right shoulder DrawTrendLine(prefix + "_Neckline", extendedNecklineStartTime, extendedNecklineStartPrice, breakoutTime, breakoutNecklinePrice, clrBlue, 2, STYLE_SOLID); //--- Draw neckline from extended start to breakout DrawTrendLine(prefix + "_RightToBreakout", extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, breakoutTime, breakoutNecklinePrice, clrGreen, 2, STYLE_SOLID); //--- Draw line from right shoulder to breakout DrawTrendLine(prefix + "_ExtendedToLeftShoulder", extendedNecklineStartTime, extendedNecklineStartPrice, lsTime, lsPrice, clrGreen, 2, STYLE_SOLID); //--- Draw line from extended neckline to left shoulder // Triangles DrawTriangle(prefix + "_LeftShoulderTriangle", lsTime, lsPrice, necklineStartTime, necklineStartPrice, extendedNecklineStartTime, extendedNecklineStartPrice, clrLightGreen); //--- Draw triangle for left shoulder area DrawTriangle(prefix + "_HeadTriangle", extrema[headIdx].time, extrema[headIdx].price, necklineStartTime, necklineStartPrice, necklineEndTime, necklineEndPrice, clrLightGreen); //--- Draw triangle for head area DrawTriangle(prefix + "_RightShoulderTriangle", extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, necklineEndTime, necklineEndPrice, breakoutTime, breakoutNecklinePrice, clrLightGreen); //--- Draw triangle for right shoulder area // Text Labels DrawText(prefix + "_LS_Label", lsTime, lsPrice, "LS", clrGreen, false); //--- Draw "LS" label below left shoulder DrawText(prefix + "_Head_Label", extrema[headIdx].time, extrema[headIdx].price, "HEAD", clrGreen, false); //--- Draw "HEAD" label below head DrawText(prefix + "_RS_Label", extrema[rightShoulderIdx].time, extrema[rightShoulderIdx].price, "RS", clrGreen, false); //--- Draw "RS" label below right shoulder datetime necklineMidTime = extendedNecklineStartTime + (breakoutTime - extendedNecklineStartTime) / 2; //--- Calculate midpoint time of the neckline double necklineMidPrice = extendedNecklineStartPrice + slope * (iBarShift(_Symbol, _Period, extendedNecklineStartTime) - iBarShift(_Symbol, _Period, necklineMidTime)); //--- Calculate midpoint price of the neckline // Calculate angle in pixel space int x1 = ShiftToX(iBarShift(_Symbol, _Period, extendedNecklineStartTime)); //--- Convert extended neckline start to x-pixel coordinate int y1 = PriceToY(extendedNecklineStartPrice); //--- Convert extended neckline start price to y-pixel coordinate int x2 = ShiftToX(iBarShift(_Symbol, _Period, breakoutTime)); //--- Convert breakout time to x-pixel coordinate int y2 = PriceToY(breakoutNecklinePrice); //--- Convert breakout price to y-pixel coordinate double pixelSlope = (y2 - y1) / (double)(x2 - x1); //--- Calculate slope in pixel space (rise over run) double necklineAngle = -atan(pixelSlope) * 180 / M_PI; //--- Calculate neckline angle in degrees, negated for visual alignment Print("Pixel X1: ", x1, ", Y1: ", y1, ", X2: ", x2, ", Y2: ", y2, ", Pixel Slope: ", DoubleToString(pixelSlope, 4), ", Neckline Angle: ", DoubleToString(necklineAngle, 2)); //--- Log pixel coordinates and angle DrawText(prefix + "_Neckline_Label", necklineMidTime, necklineMidPrice, "NECKLINE", clrBlue, true, necklineAngle); //--- Draw "NECKLINE" label at midpoint with calculated angle double entryPrice = 0; //--- Set entry price to 0 for market order (uses current price) double sl = extrema[rightShoulderIdx].price - BufferPoints * _Point; //--- Calculate stop-loss below right shoulder with buffer double patternHeight = necklinePrice - extrema[headIdx].price; //--- Calculate pattern height from neckline to head double tp = closePrice + patternHeight; //--- Calculate take-profit above close by pattern height if (sl < closePrice && tp > closePrice) { //--- Validate trade direction (SL below, TP above for buy) if (obj_Trade.Buy(LotSize, _Symbol, entryPrice, sl, tp, "Inverse Head and Shoulders")) { //--- Attempt to open a buy trade AddTradedPattern(lsTime, lsPrice); //--- Add pattern to traded list Print("Buy Trade Opened: SL ", DoubleToString(sl, _Digits), ", TP ", DoubleToString(tp, _Digits)); //--- Log successful trade opening } } } }

What now remains is managing the opened positions by applying a trailing stop logic to maximize the profits. We create a function to handle the trailing logic as below.

//+------------------------------------------------------------------+ //| Apply trailing stop with minimum profit threshold | //+------------------------------------------------------------------+ void ApplyTrailingStop(int minTrailPoints, int trailingPoints, CTrade &trade_object, ulong magicNo = 0) { //--- Function to apply trailing stop to open positions double bid = SymbolInfoDouble(_Symbol, SYMBOL_BID); //--- Get current bid price double ask = SymbolInfoDouble(_Symbol, SYMBOL_ASK); //--- Get current ask price for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Loop through all open positions from last to first ulong ticket = PositionGetTicket(i); //--- Retrieve position ticket number if (ticket > 0 && PositionSelectByTicket(ticket)) { //--- Check if ticket is valid and select the position if (PositionGetString(POSITION_SYMBOL) == _Symbol && //--- Verify position is for the current symbol (magicNo == 0 || PositionGetInteger(POSITION_MAGIC) == magicNo)) { //--- Check if magic number matches or no magic filter applied double openPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Get position opening price double currentSL = PositionGetDouble(POSITION_SL); //--- Get current stop-loss price double currentProfit = PositionGetDouble(POSITION_PROFIT) / (LotSize * SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_VALUE)); //--- Calculate profit in points if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check if position is a Buy double profitPoints = (bid - openPrice) / _Point; //--- Calculate profit in points for Buy position if (profitPoints >= minTrailPoints + trailingPoints) { //--- Check if profit exceeds minimum threshold for trailing double newSL = NormalizeDouble(bid - trailingPoints * _Point, _Digits); //--- Calculate new stop-loss price if (newSL > openPrice && (newSL > currentSL || currentSL == 0)) { //--- Ensure new SL is above open price and better than current SL if (trade_object.PositionModify(ticket, newSL, PositionGetDouble(POSITION_TP))) { //--- Attempt to modify position with new SL Print("Trailing Stop Updated: Ticket ", ticket, ", New SL: ", DoubleToString(newSL, _Digits)); //--- Log successful SL update } } } } else if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check if position is a Sell double profitPoints = (openPrice - ask) / _Point; //--- Calculate profit in points for Sell position if (profitPoints >= minTrailPoints + trailingPoints) { //--- Check if profit exceeds minimum threshold for trailing double newSL = NormalizeDouble(ask + trailingPoints * _Point, _Digits); //--- Calculate new stop-loss price if (newSL < openPrice && (newSL < currentSL || currentSL == 0)) { //--- Ensure new SL is below open price and better than current SL if (trade_object.PositionModify(ticket, newSL, PositionGetDouble(POSITION_TP))) { //--- Attempt to modify position with new SL Print("Trailing Stop Updated: Ticket ", ticket, ", New SL: ", DoubleToString(newSL, _Digits)); //--- Log successful SL update } } } } } } } }

Here, we add a trailing stop feature with the "ApplyTrailingStop" function. It uses "minTrailPoints" and "trailingPoints" to adjust open positions. We fetch "bid" and "ask" prices with the SymbolInfoDouble function. We loop through positions using the PositionsTotal function. For each, we get the "ticket" with the PositionGetTicket function and select it with the PositionSelectByTicket function. We verify the symbol and "magicNo" using the "PositionGetString" and "PositionGetInteger" functions. We retrieve "openPrice", "currentSL", and "currentProfit" with the PositionGetDouble function.

For a Buy, we calculate profit with "bid" and check against "minTrailPoints" plus "trailingPoints". If met, we set a new "newSL" with the NormalizeDouble function and update it via the "PositionModify" method on the "trade_object" object. For a Sell, we use "ask" instead and adjust "newSL" below. Successful price modification is logged. We then can call this function in the OnTick event handler.

// Apply trailing stop if enabled and positions exist if (UseTrailingStop && PositionsTotal() > 0) { //--- Check if trailing stop is enabled and there are open positions ApplyTrailingStop(MinTrailPoints, TrailingPoints, obj_Trade, MagicNumber); //--- Apply trailing stop to positions with specified parameters }

Calling the function with the input parameters is all we need to ensure trailing stop is enabled. What remains now is freeing the storage arrays once the program is no longer in use and deleting the visual objects we mapped. We handle that in the OnDeinit event handler.

//+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- Expert Advisor deinitialization function ArrayFree(tradedPatterns); //--- Free memory used by tradedPatterns array ObjectsDeleteAll(0, "HS_"); //--- Delete all chart objects with "HS_" prefix (standard H&S) ObjectsDeleteAll(0, "IHS_"); //--- Delete all chart objects with "IHS_" prefix (inverse H&S) ChartRedraw(); //--- Redraw the chart to remove deleted objects }

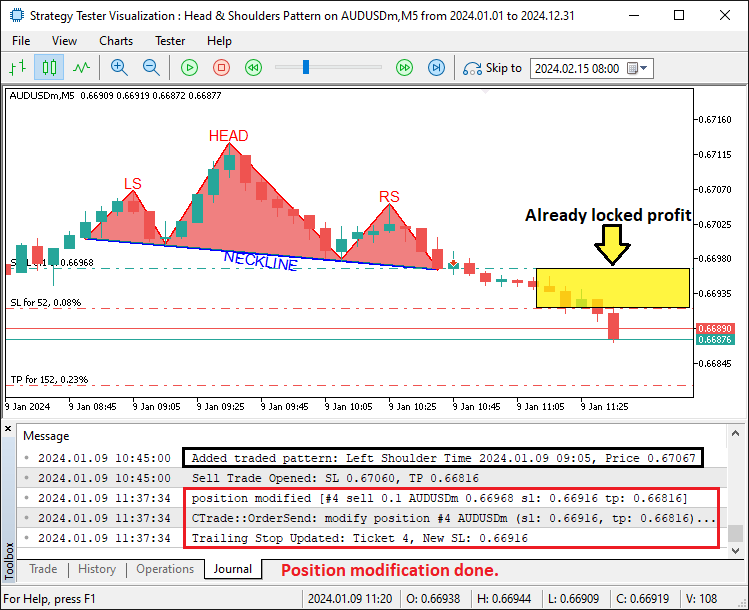

In the OnDeinit event handler, which runs when the Expert Advisor shuts down, we clean up the program and the chart it is attached to. We use the ArrayFree function to release memory from "tradedPatterns". Then, we remove all chart objects. The ObjectsDeleteAll function clears items with the "HS_" prefix for standard patterns. It also clears those with the "IHS_" prefix for inverse patterns. Finally, we refresh the chart. The ChartRedraw function updates the display to reflect these changes before total closure. Upon compilation, we have the following outcome.

From the image, we can see that we apply trailing stop to the traded setup, hence achieving our objective. The thing that remains is backtesting the program, and that is handled in the next section.

Backtesting

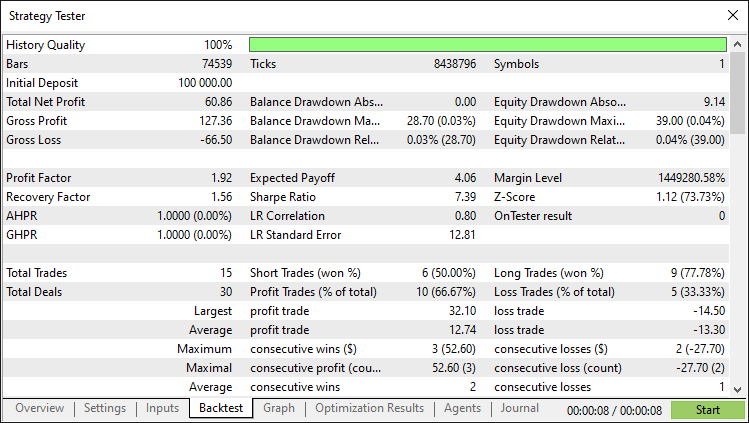

After thorough backtesting, we have the following results.

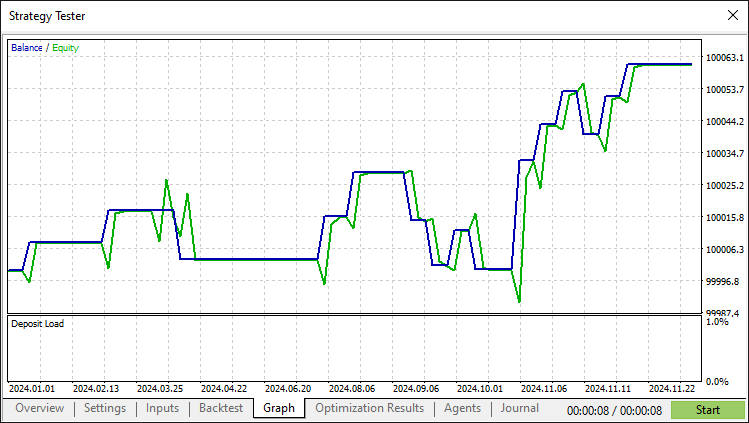

Backtest graph:

Backtest report:

Conclusion

In conclusion, we have successfully built a Head and Shoulders trading algorithm in MQL5. It features precise pattern detection, detailed visualization, and automated trade execution for the classic reversal signal. By using validation rules, neckline plotting, and trailing stops, our Expert Advisor adapts to market shifts effectively. You can use the illustrations made as a steppingstone to enhance it with extra steps like parameter tuning or advanced risk controls. Also, note that it is a rare pattern setup.

Disclaimer: This article is for educational purposes only. Trading involves significant financial risk, and market conditions can be unpredictable. Proper backtesting and risk management are essential before live deployment.

With this foundation, you can refine your trading skills and improve this algorithm. Keep testing and optimizing for success. Best of luck!

Simple solutions for handling indicators conveniently

Simple solutions for handling indicators conveniently

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Archery Algorithm (AA)

Archery Algorithm (AA)

MQL5 Wizard Techniques you should know (Part 58): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

MQL5 Wizard Techniques you should know (Part 58): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use