Sentiment Analysis and Deep Learning for Trading with EA and Backtesting with Python

Introduction

Integrating deep learning and sentiment analysis into trading strategies in MetaTrader 5 (MQL5) represents a sophisticated advancement in algorithmic trading. Deep learning, a subset of machine learning, involves neural networks with multiple layers that can learn and make predictions from vast and complex datasets. Sentiment analysis, on the other hand, is a natural language processing (NLP) technique used to determine the sentiment or emotional tone behind a body of text. By leveraging these technologies, traders can enhance their decision-making processes and improve trading outcomes.

For this article, we will integrate Python into MQL5 using a DLL shell32.dll, which executes what we need for Windows. By installing Python and running it through shell32.dll, we will be able to launch Python scripts from the MQL5 Expert Advisor (EA). There are two Python scripts: one to run the trained ONNX model from TensorFlow, and another script that uses libraries to fetch news from the internet, read the headlines, and quantify media sentiment using AI. This is one possible solution, but there are many ways and different sources to obtain the sentiment of a stock or symbol. Once the model and sentiment are obtained, if both values are in agreement, the order is executed by the EA.

Can we perform a test in Python to understand the results of combining sentiment analysis and deep learning? The answer is yes, and we will proceed to study the code.

Backtesting Sentiment Analysis with Deep Learning using Python

To perform the backtesting of this strategy, we will use the following libraries. I will use my other article as a starting point. Anyway, here I will also provide the required explanations.

We will use the following libraries:import ccxt import pandas as pd import numpy as np import onnx import onnxruntime as ort import matplotlib.pyplot as plt from sklearn.metrics import mean_absolute_error, mean_squared_error, r2_score, mean_absolute_percentage_error from sklearn.model_selection import TimeSeriesSplit from sklearn.preprocessing import MinMaxScaler import requests from datetime import datetime, timedelta import nltk from nltk.sentiment import SentimentIntensityAnalyzer from newsapi import NewsApiClient

First of all, we ensure that nltk is updated.

nltk.download('vader_lexicon') nltk (Natural Language Toolkit) is a library used for working with human language data (text). It provides easy-to-use interfaces to over 50 corpora and lexical resources, such as WordNet, along with a suite of text processing libraries for classification, tokenization, stemming, tagging, parsing, and semantic reasoning, as well as wrappers for industrial-strength NLP libraries.

Readers must adapt the python backtesting script to specify where to obtain data, news feed and data for ONNX models.

We will use the following to obtain the sentiment analysis:

def get_news_sentiment(symbol, api_key, date): try: newsapi = NewsApiClient(api_key=api_key) # Obtener noticias relacionadas con el símbolo para la fecha específica end_date = date + timedelta(days=1) articles = newsapi.get_everything(q=symbol, from_param=date.strftime('%Y-%m-%d'), to=end_date.strftime('%Y-%m-%d'), language='en', sort_by='relevancy', page_size=10) sia = SentimentIntensityAnalyzer() sentiments = [] for article in articles['articles']: text = article.get('title', '') if article.get('description'): text += ' ' + article['description'] if text: sentiment = sia.polarity_scores(text) sentiments.append(sentiment['compound']) avg_sentiment = np.mean(sentiments) if sentiments else 0 return avg_sentiment except Exception as e: print(f"Error al obtener el sentimiento para {symbol} en la fecha {date}: {e}") return 0

For the backtest, we will use news-api as a feed, because their free API lets us get 1 month look-back of news. If you need more, you can buy a subscription.

The rest of the code will be to obtain the predictions from the ONNX model to predict next close prices. We will just compare the sentiment with the deep learning predictions, and if both conclude with same results, an order will be created. It looks like this:

investment_df = comparison_df.copy() investment_df['price_direction'] = np.where(investment_df['prediction'].shift(-1) > investment_df['prediction'], 1, -1) investment_df['sentiment_direction'] = np.where(investment_df['sentiment'] > 0, 1, -1) investment_df['position'] = np.where(investment_df['price_direction'] == investment_df['sentiment_direction'], investment_df['price_direction'], 0) investment_df['strategy_returns'] = investment_df['position'] * (investment_df['actual'].shift(-1) - investment_df['actual']) / investment_df['actual'] investment_df['buy_and_hold_returns'] = (investment_df['actual'].shift(-1) - investment_df['actual']) / investment_df['actual']

The code first creates a copy of `comparison_df` and names it `investment_df`. Then it adds a new column called `price_direction` which takes the value of 1 if the next prediction is higher than the current prediction and -1 otherwise. Next it adds another column called `sentiment_direction` which takes the value of 1 if the sentiment is positive and -1 if it's negative. Then it adds a column named `position` which takes the value of `price_direction` if it matches `sentiment_direction` and 0 otherwise. The code then calculates `strategy_returns` by multiplying `position` with the relative change in the actual values from one row to the next. Finally it calculates `buy_and_hold_returns` as the relative change in the actual values from one row to the next without considering the positions.

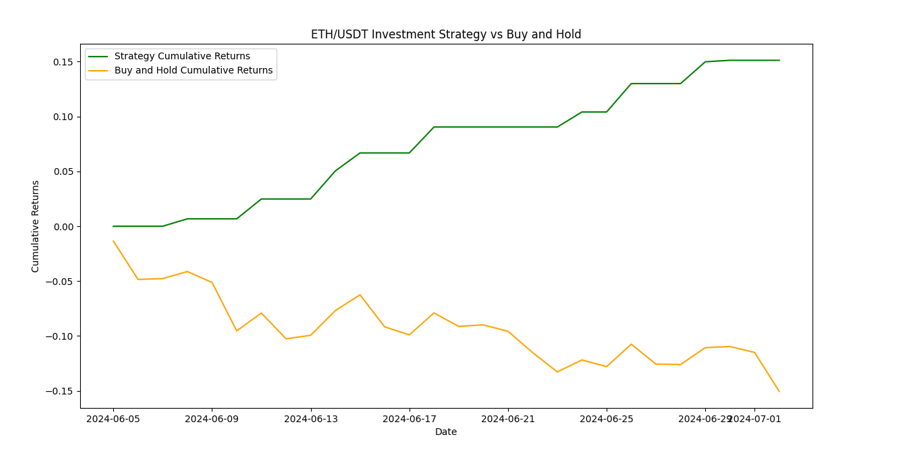

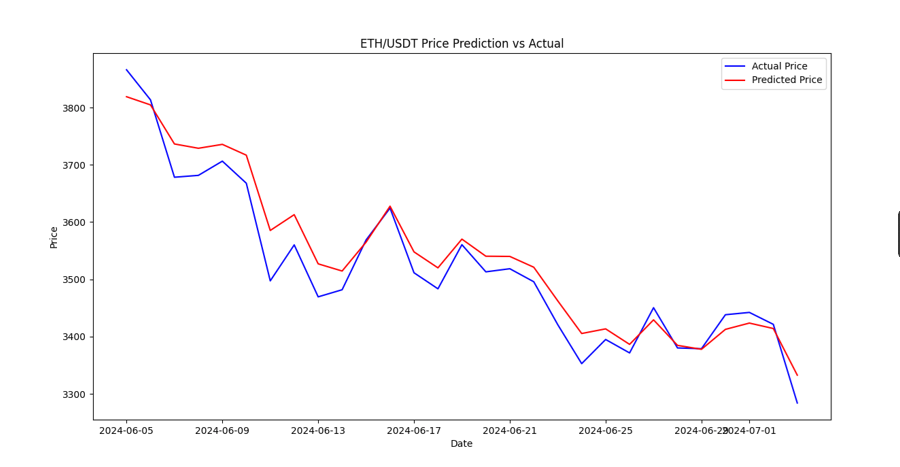

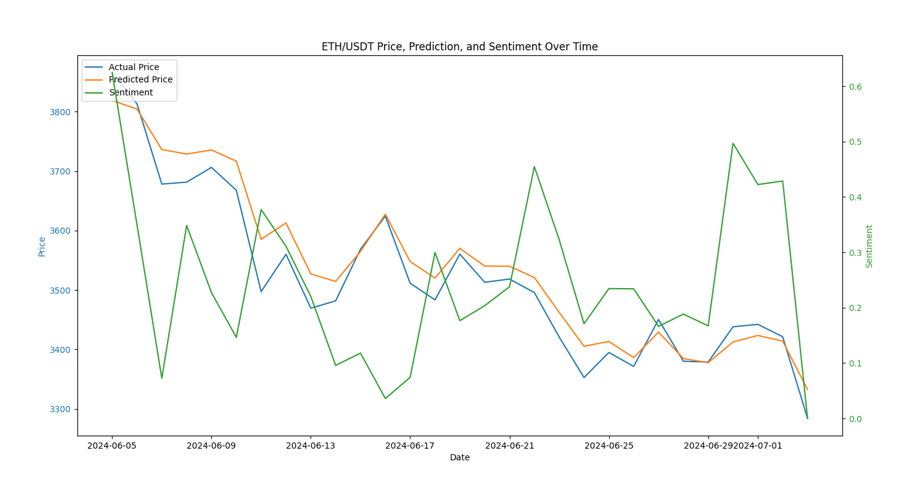

Results from this backtest look like this:

Datos normalizados guardados en 'binance_data_normalized.csv' Sentimientos diarios guardados en 'daily_sentiments.csv' Predicciones y sentimiento guardados en 'predicted_data_with_sentiment.csv' Mean Absolute Error (MAE): 30.66908467315391 Root Mean Squared Error (RMSE): 36.99641752814565 R-squared (R2): 0.9257591918098058 Mean Absolute Percentage Error (MAPE): 0.00870572230484879 Gráfica guardada como 'ETH_USDT_price_prediction.png' Gráfica de residuales guardada como 'ETH_USDT_residuals.png' Correlation between actual and predicted prices: 0.9752007459642241 Gráfica de estrategia de inversión guardada como 'ETH_USDT_investment_strategy.png' Gráfica de drawdown guardada como 'ETH_USDT_drawdown.png' Sharpe Ratio: 9.41431958149606 Sortino Ratio: 11800588386323879936.0000 Número de rendimientos totales: 28 Número de rendimientos en exceso: 28 Número de rendimientos negativos: 19 Media de rendimientos en exceso: 0.005037 Desviación estándar de rendimientos negativos: 0.000000 Sortino Ratio: nan Beta: 0.33875104783408166 Alpha: 0.006981197358213854 Cross-Validation MAE: 1270.7809910146143 ± 527.5746657573876 SMA Mean Absolute Error (MAE): 344.3737716856061 SMA Mean Absolute Error (MAE): 344.3737716856061 SMA Root Mean Squared Error (RMSE): 483.0396130996611 SMA R-squared (R2): 0.5813550203375846 Gráfica de predicción SMA guardada como 'ETH_USDT_sma_price_prediction.png' Gráfica de precio, predicción y sentimiento guardada como 'ETH_USDT_price_prediction_sentiment.png' Gráfica de drawdown guardada como 'ETH_USDT_drawdown.png' Maximum Drawdown: 0.00%

As results say, the correlation between the predicted prices and the real prices are very good. R2, that is a metric to measure how good the predictions of the model, also looks good. Sharpe ratio is higher than 5, which is excellent, as well as Sortino. Also, other results are shown in graphs.

The graph that compares the strategy vs hold looks like this:

Other graphs like price prediction vs actual price

and, actual price, price prediction and sentiment

The results show that this strategy is very profitable, so we are now using this argument to create an EA.

This EA should have two Python scripts that make the sentiment analysis and the Deep Learning Model, and should be all merged to function in the EA.

ONNX Model

The code for the data acquisition, training, and ONNX model remains the same as we used in previous articles. Therefore, I will proceed to discuss the Python code for sentiment analysis.

Sentiment Analysis with Python

We will use the libraries `requests` and `TextBlob` to fetch forex news and perform sentiment analysis, along with the `csv` library for reading and writing data. Additionally, the `datetime` and `time` libraries will be utilized.

import requests from textblob import TextBlob import csv from datetime import datetime import time from time import sleep

The idea for this script is first to delay for a few seconds upon starting (to ensure that the next part of the script can function properly). The second part of the script will read the API key we want to use. For this case, we will use the Marketaux API, which offers a series of free news and free calls. There are more options such as News API, Alpha Vantage, or Finhub, some of which are paid but provide more news, including historical news, allowing a backtesting of the strategy in MT5. As mentioned earlier, we will use Marketaux for now since it has a free API to obtain daily news. If we want to use other sources, we will need to adapt the code.

Here is a draft of how the script could be structured:

Here's the function to read the api key from the input of the EA:

api_file_path = 'C:/Users/jsgas/AppData/Roaming/MetaQuotes/Terminal/24F345EB9F291441AFE537834F9D8A19/MQL5/Files/Files/api.txt' print(api_file_path) def read_api_from_file(): try: with open(api_file_path, 'r', encoding='utf-16') as file: raw_data = file.read() print(f"Raw data from file: {repr(raw_data)}") # Print raw data api = raw_data.strip() # Lee el contenido y elimina espacios en blanco adicionales api = api.replace('\ufeff', '') # Remove BOM character if present print(f"API after stripping whitespace: {api}") time.sleep(5) return api except FileNotFoundError: print(f"El archivo {api_file_path} no existe.") time.sleep(5) return None # Configuración de la API de Marketaux api=read_api_from_file() MARKETAUX_API_KEY = api

Before reading the news, we need to know what to read, and for that, we will have this Python script read from a text file created by the EA, so that the Python script knows what to read or which symbol to study and obtain news about, and, what api key is input in the EA, what date is today so the model gets done and for the news to arrive for this date.

It must also be capable of writing a txt or csv so it serves as input to the EA, with the results of the Sentiment.

def read_symbol_from_file(): try: with open(symbol_file_path, 'r', encoding='utf-16') as file: raw_data = file.read() print(f"Raw data from file: {repr(raw_data)}") # Print raw data symbol = raw_data.strip() # Lee el contenido y elimina espacios en blanco adicionales symbol = symbol.replace('\ufeff', '') # Remove BOM character if present print(f"Symbol after stripping whitespace: {symbol}") return symbol except FileNotFoundError: print(f"El archivo {symbol_file_path} no existe.") return None

def save_sentiment_to_txt(average_sentiment, file_path='C:/Users/jsgas/AppData/Roaming/MetaQuotes/Terminal/24F345EB9F291441AFE537834F9D8A19/MQL5/Files/Files/'+str(symbol)+'sentiment.txt'):

with open(file_path, 'w') as f:

f.write(f"{average_sentiment:.2f}") if symbol: news, current_rate = get_forex_news(symbol) if news: print(f"Noticias para {symbol}:") for i, (title, description) in enumerate(news, 1): print(f"{i}. {title}") print(f" {description[:100]}...") # Primeros 100 caracteres de la descripción print(f"\nTipo de cambio actual: {current_rate if current_rate else 'No disponible'}") # Calcular el sentimiento promedio sentiment_scores = [TextBlob(title + " " + description).sentiment.polarity for title, description in news] average_sentiment = sum(sentiment_scores) / len(sentiment_scores) if sentiment_scores else 0 print(f"Sentimiento promedio: {average_sentiment:.2f}") # Guardar resultados en CSV #save_to_csv(symbol, current_rate, average_sentiment) # Guardar sentimiento promedio en un archivo de texto save_sentiment_to_txt(average_sentiment) print("Sentimiento promedio guardado en 'sentiment.txt'") else: print("No se pudieron obtener noticias de Forex.") else: print("No se pudo obtener el símbolo del archivo.")

Readers must adapt the whole script depending on what the study, forex, stocks or crypto.

The Expert Advisor

We must include shell32.dll as here to run the python scripts

#include <WinUser32.mqh> #import "shell32.dll" int ShellExecuteW(int hwnd, string lpOperation, string lpFile, string lpParameters, string lpDirectory, int nShowCmd); #import

We must add the python scripts to the File folder

string script1 = "C:\\Users\\jsgas\\AppData\\Roaming\\MetaQuotes\\Terminal\\24F345EB9F291441AFE537834F9D8A19\\MQL5\\Files\\Files\\dl model for mql5 v6 Final EURUSD_bien.py"; string script2 = "C:\\Users\\jsgas\\AppData\\Roaming\\MetaQuotes\\Terminal\\24F345EB9F291441AFE537834F9D8A19\\MQL5\\Files\\Files\\sentiment analysis marketaux v6 Final EURUSD_bien.py";

And all the paths to the inputs and outputs of the python scripts,

// Ruta del archivo donde se escribirá el símbolo string filePathSymbol = "//Files//symbol.txt"; // Ruta del archivo donde se escribirá el timeframe string filePathTimeframe = "//Files//timeframe.txt"; string filePathTime = "//Files//time.txt"; string filePathApi = "//Files//api.txt"; string fileToSentiment = "//Files//"+Symbol()+"sentiment.txt"; string file_add = "C://Users//jsgas//AppData//Roaming//MetaQuotes//Terminal//24F345EB9F291441AFE537834F9D8A19//MQL5//Files"; string file_str = "//Files//model_"; string file_str_final = ".onnx"; string file_str_nexo = "_"; string file_add2 = "C:\\Users\\jsgas\\AppData\\Roaming\\MetaQuotes\\Terminal\\24F345EB9F291441AFE537834F9D8A19\\MQL5\\Files"; string file_str2 = "\\Files\\model_"; string file_str_final2 = ".onnx"; string file_str_nexo2 = "_";

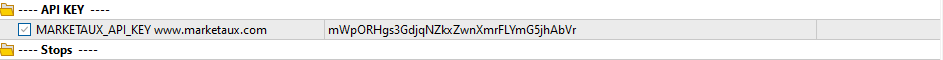

We must input the Marketaux api key

input string api_key = "mWpORHgs3GdjqNZkxZwnXmrFLYmG5jhAbVrF"; // MARKETAUX_API_KEY www.marketaux.com

We can obtain that from here, and it will look as this:

I don't work for marketaux, so you can use any other news feed, or subscription you want/need.

You will have to setup a Magic Number, so orders don't get mixed up

int OnInit() { ExtTrade.SetExpertMagicNumber(Magic_Number);

You can also add it here

void OpenBuyOrder(double lotSize, double slippage, double stopLoss, double takeProfit) { // Definir la estructura MqlTradeRequest MqlTradeRequest request; MqlTradeResult result; // Inicializar la estructura de la solicitud ZeroMemory(request); // Establecer los parámetros de la orden request.action = TRADE_ACTION_DEAL; request.symbol = _Symbol; request.volume = lotSize; request.type = ORDER_TYPE_BUY; request.price = SymbolInfoDouble(_Symbol, SYMBOL_ASK); request.deviation= slippage; request.sl = stopLoss; request.tp = takeProfit; request.magic = Magic_Number; request.comment = "Buy Order"; // Enviar la solicitud de comercio if(!OrderSend(request,result)) { Print("Error al abrir orden de compra: ", result.retcode);

That last snippet of the code is how the order is made, you can also use trade from CTrade for making orders.

This will write a file (to use as input in the .py scritps):

void WriteToFile(string filePath, string data) { Print("Intentando abrir el archivo: ", filePath); // Abre el archivo en modo de escritura, crea el archivo si no existe int fileHandle = FileOpen(filePath, FILE_WRITE | FILE_TXT); if(fileHandle != INVALID_HANDLE) { // Escribe los datos en el archivo FileWriteString(fileHandle, data); FileClose(fileHandle); // Cierra el archivo Print("Archivo escrito exitosamente: ", filePath); } else { Print("Error al abrir el archivo ", filePath, ". Código de error: ", GetLastError()); } }

This will write the symbol, timeframe and current date in the file:

void WriteSymbolAndTimeframe() { // Obtén el símbolo actual currentSymbol = Symbol(); // Obtén el período de tiempo del gráfico actual string currentTimeframe = GetTimeframeString(Period()); currentTime = TimeToString(TimeCurrent(), TIME_DATE); // Escribe cada dato en su respectivo archivo WriteToFile(filePathSymbol, currentSymbol); WriteToFile(filePathTimeframe, currentTimeframe); WriteToFile(filePathTime, currentTime); WriteToFile(filePathApi,api_key); Sleep(10000); // Puedes ajustar o eliminar esto según sea necesario }

The function WriteSymbolAndTimeframe performs the following tasks:

- First, it retrieves the current trading symbol and stores it in currentSymbol

- Then, it gets the current chart's timeframe as a string using GetTimeframeString(Period()) and stores it in currentTimeframe

- It also gets the current time in a specific format using TimeToString(TimeCurrent(), TIME_DATE) and stores it in currentTime

- Next, it writes each of these values to their respective files:

- currentSymbol is written to filePathSymbol

- currentTimeframe is written to filePathTimeframe

- currentTime is written to filePathTime

- api_key is written to filePathApi

- Finally, the function pauses for 10 seconds using Sleep(10000) which can be adjusted or removed as needed.

We can launch the scripts with this:

void OnTimer() { datetime currentTime2 = TimeCurrent(); // Verifica si ha pasado el intervalo para el primer script if(currentTime2 - lastExecutionTime1 >= interval1) { // Escribe los datos necesarios antes de ejecutar el script WriteSymbolAndTimeframe(); // Ejecuta el primer script de Python int result = ShellExecuteW(0, "open", "cmd.exe", "/c python \"" + script1 + "\"", "", 1); if(result > 32) Print("Script 1 iniciado exitosamente"); else Print("Error al iniciar Script 1. Código de error: ", result); lastExecutionTime1 = currentTime2; }

The function `OnTimer` is executed periodically and performs the following tasks:

- First, it retrieves the current time and stores it in `currentTime2`.

- It then checks if the time elapsed since the last execution of the first script (`lastExecutionTime1`) is greater than or equal to a predefined interval (`interval1`).

- If the condition is met, it writes the necessary data by calling `WriteSymbolAndTimeframe`.

- Next, it executes the first Python script by running a command via `ShellExecuteW` which opens `cmd.exe` and runs the Python script specified by `script1`.

- If the script execution is successful (indicated by a result greater than 32), it prints a success message; otherwise, it prints an error message with the corresponding error code.

- Finally, it updates `lastExecutionTime1` to the current time (`currentTime2`).

We can read the file with this function:

string ReadFile(string file_name) { string result = ""; int handle = FileOpen(file_name, FILE_READ|FILE_TXT|FILE_ANSI); // Use FILE_ANSI for plain text if(handle != INVALID_HANDLE) { int file_size = FileSize(handle); // Get the size of the file result = FileReadString(handle, file_size); // Read the whole file content FileClose(handle); } else { Print("Error opening file: ", file_name); } return result; }

The code defines a function named ReadFile which takes a file name as an argument and returns the file content as a string first it initializes an empty string result then it attempts to open the file with read permissions and in plain text mode using FileOpen if the file handle is valid it gets the file size using FileSize reads the entire file content into result using FileReadString and then closes the file using FileClose if the file handle is invalid it prints an error message with the file name finally it returns the result containing the file content.

By changing this condition, we can add the sentiment as one more:

if(ExtPredictedClass==PRICE_DOWN && Sentiment_number<0) signal=ORDER_TYPE_SELL; // sell condition else { if(ExtPredictedClass==PRICE_UP && Sentiment_number>0) signal=ORDER_TYPE_BUY; // buy condition else Print("No order possible"); }

The sentiment in this case goes from 10 to -10, being 0 a neutral signal. You can modify as you want this strategy.

The rest of the code is the simple EA used from the article How to use ONNX models in MQL5 with a few modifications.

This is not a complete finished EA, this is just a simple example of how to use python and mql5 to create a sentiment & deep learning Expert Advisor. As more time you invest in this EA, you will get less errors and problems. This is a cutting edge case study, and backtesting shows promising results. I hope you find this article helpful, and if someone can manage to get a good sample of news or makes it work for some time, please share results. In order to test the strategy, you should use a demo account.

Conclusion

In conclusion, the integration of deep learning and sentiment analysis into MetaTrader 5 (MQL5) trading strategies exemplifies the advanced capabilities of modern algorithmic trading. By leveraging Python scripts through a DLL shell32.dll interface, we can seamlessly execute complex models and obtain valuable sentiment data, thereby enhancing trading decisions and outcomes. The process outlined includes using Python to fetch and analyze news sentiment, running ONNX models for price predictions, and executing trades when both indicators align.

The backtesting results demonstrate the strategy's potential profitability, as indicated by strong correlation metrics, high R-squared values, and excellent Sharpe and Sortino ratios. These findings suggest that combining sentiment analysis with deep learning can significantly improve the accuracy of trading signals and overall strategy performance.

Moving forward, the development of a fully functional Expert Advisor (EA) involves meticulous integration of various components, including Python scripts for sentiment analysis and ONNX models for price prediction. By continually refining these elements and adapting the strategy to different markets and data sources, traders can build a robust and effective trading tool.

This study serves as a foundation for those interested in exploring the convergence of machine learning, sentiment analysis, and algorithmic trading, offering a pathway to more informed and potentially profitable trading decisions.

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

Reimagining Classic Strategies in Python: MA Crossovers

Reimagining Classic Strategies in Python: MA Crossovers

Creating an Interactive Graphical User Interface in MQL5 (Part 1): Making the Panel

Creating an Interactive Graphical User Interface in MQL5 (Part 1): Making the Panel

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

If you want me to do a complete bot, you can say it to me here, and I could make one to sell in the store. Articles are for every one to learn. If you want me to compromise with the bot and you don't want to learn, please tell me so, and tell me how many of you would be interested in buying a monthly subscription to the bot, and I would make one and keep it tuned up and actualized. I don't have one at the moment, because I have tried that and have not made sales. So I don't want to invest time in something its not going to give me back sales. Pleas give me back feedback. If there are sufficient subscribers for a bot made by me, I could do a bot that works, give back returns (past results don't mean future results ... but if you don't like the bot you could unsubscribe), and would not be very expensive. I'm telling you this, because I spent lots of money in bots, that now even don't exist, so I lost all that money. I can make one for my readers that would be the same one I would use for me, but to invest time, I would need to know first how much people are interested (I can do a bot for me easy, but to pass mql5.com controls you you need to work on it harder).

I know people that read articles will probably want to make his own bot, but, I don't know where to get feedback for this, and I find this place a good one to ask.

hi Javier, exactly. I went on to review and experiment with the code. Did the dl model found in backtesting folder first. in this model we create a neural network to predict price of etherium based on the close history right? -> i adapted it to see if we can get the direction right. that model itself does perform little better than the toss of a coin it seems, but i look forward to adding the sentiment data to it. Or did i misunderstand the purpose of that model?

I am currently handling the issues i get saving it as ONNX model. Helpful I guess, for learning.

Thank you for this. I will share with you once i managed to get an implementation of this going.

hi Javier, exactly. I went on to review and experiment with the code. Did the dl model found in backtesting folder first. in this model we create a neural network to predict price of etherium based on the close history right? -> i adapted it to see if we can get the direction right. that model itself does perform little better than the toss of a coin it seems, but i look forward to adding the sentiment data to it. Or did i misunderstand the purpose of that model?

I am currently handling the issues i get saving it as ONNX model. Helpful I guess, for learning.

Thank you for this. I will share with you once i managed to get an implementation of this going.

I just added sentiment to the trading logic.

I just added sentiment to the trading logic.

Can I please have your model please it can change my life, I don't have the resources and ability you possess,not the money too, but please help me with your model

Hi, you should aim to get a cpu or gpu to compute models, you could use the ones from articles (but search for the timeframe validity) (one 1day time frame model for one symbol holds on for 3 -6 months) ... or you could post a freelance to someone make the models for you. (Each symbol must have its own model for the correct time frame).

Hello,

Are you trading with this model? If so please can you share with me it's performance.

Thank you.