Money management in trading

We will look at several new ways of building money management systems and define their main features. Today, there are quite a few money management strategies to fit every taste. We will try to consider several ways to manage money based on different mathematical growth models.

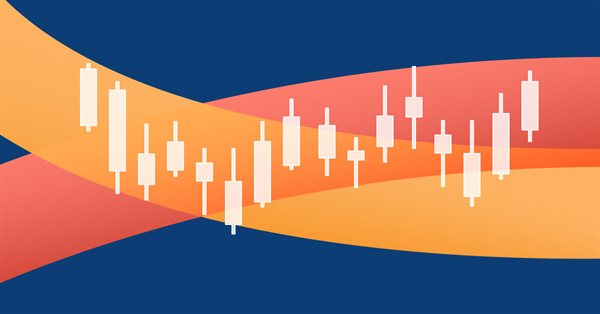

How to create a custom Donchian Channel indicator using MQL5

There are many technical tools that can be used to visualize a channel surrounding prices, One of these tools is the Donchian Channel indicator. In this article, we will learn how to create the Donchian Channel indicator and how we can trade it as a custom indicator using EA.

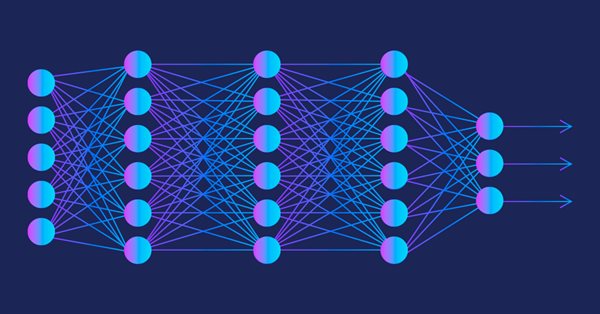

Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast

The article provides an example of using a perceptron as a self-sufficient price prediction tool by showcasing general concepts and the simplest ready-made Expert Advisor followed by the results of its optimization.

Frequency domain representations of time series: The Power Spectrum

In this article we discuss methods related to the analysis of timeseries in the frequency domain. Emphasizing the utility of examining the power spectra of time series when building predictive models. In this article we will discuss some of the useful perspectives to be gained by analyzing time series in the frequency domain using the discrete fourier transform (dft).

Category Theory in MQL5 (Part 8): Monoids

This article continues the series on category theory implementation in MQL5. Here we introduce monoids as domain (set) that sets category theory apart from other data classification methods by including rules and an identity element.

Experiments with neural networks (Part 5): Normalizing inputs for passing to a neural network

Neural networks are an ultimate tool in traders' toolkit. Let's check if this assumption is true. MetaTrader 5 is approached as a self-sufficient medium for using neural networks in trading. A simple explanation is provided.

Understand and Use MQL5 Strategy Tester Effectively

There is an essential need for MQL5 programmers or developers to master important and valuable tools. One of these tools is the Strategy Tester, this article is a practical guide to understanding and using the strategy tester of MQL5.

Multibot in MetaTrader: Launching multiple robots from a single chart

In this article, I will consider a simple template for creating a universal MetaTrader robot that can be used on multiple charts while being attached to only one chart, without the need to configure each instance of the robot on each individual chart.

Implementing an ARIMA training algorithm in MQL5

In this article we will implement an algorithm that applies the Box and Jenkins Autoregressive Integrated Moving Average model by using Powells method of function minimization. Box and Jenkins stated that most time series could be modeled by one or both of two frameworks.

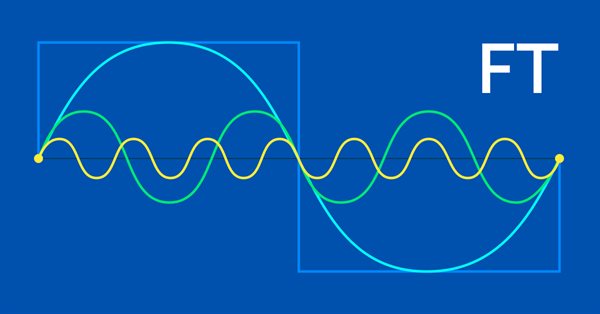

MQL5 Wizard techniques you should know (Part 06): Fourier Transform

The Fourier transform introduced by Joseph Fourier is a means of deconstructing complex data wave points into simple constituent waves. This feature could be resourceful to traders and this article takes a look at that.

Population optimization algorithms: ElectroMagnetism-like algorithm (ЕМ)

The article describes the principles, methods and possibilities of using the Electromagnetic Algorithm in various optimization problems. The EM algorithm is an efficient optimization tool capable of working with large amounts of data and multidimensional functions.

Creating an EA that works automatically (Part 12): Automation (IV)

If you think automated systems are simple, then you probably don't fully understand what it takes to create them. In this article, we will talk about the problem that kills a lot of Expert Advisors. The indiscriminate triggering of orders is a possible solution to this problem.

How to create a custom True Strength Index indicator using MQL5

Here is a new article about how to create a custom indicator. This time we will work with the True Strength Index (TSI) and will create an Expert Advisor based on it.

Category Theory in MQL5 (Part 7): Multi, Relative and Indexed Domains

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

How to connect MetaTrader 5 to PostgreSQL

This article describes four methods for connecting MQL5 code to a Postgres database and provides a step-by-step tutorial for setting up a development environment for one of them, a REST API, using the Windows Subsystem For Linux (WSL). A demo app for the API is provided along with the corresponding MQL5 code to insert data and query the respective tables, as well as a demo Expert Advisor to consume this data.

Creating an EA that works automatically (Part 11): Automation (III)

An automated system will not be successful without proper security. However, security will not be ensured without a good understanding of certain things. In this article, we will explore why achieving maximum security in automated systems is such a challenge.

Population optimization algorithms: Saplings Sowing and Growing up (SSG)

Saplings Sowing and Growing up (SSG) algorithm is inspired by one of the most resilient organisms on the planet demonstrating outstanding capability for survival in a wide variety of conditions.

Creating an EA that works automatically (Part 10): Automation (II)

Automation means nothing if you cannot control its schedule. No worker can be efficient working 24 hours a day. However, many believe that an automated system should operate 24 hours a day. But it is always good to have means to set a working time range for the EA. In this article, we will consider how to properly set such a time range.

Creating an EA that works automatically (Part 09): Automation (I)

Although the creation of an automated EA is not a very difficult task, however, many mistakes can be made without the necessary knowledge. In this article, we will look at how to build the first level of automation, which consists in creating a trigger to activate breakeven and a trailing stop level.

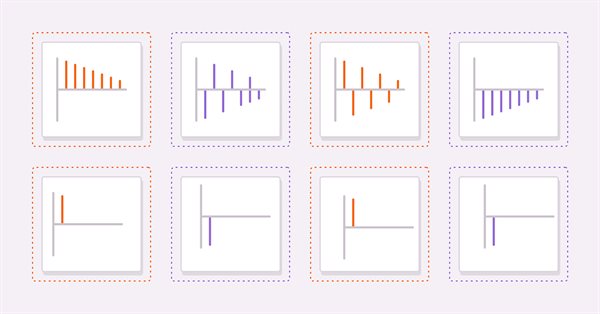

Experiments with neural networks (Part 4): Templates

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 as a self-sufficient tool for using neural networks in trading. Simple explanation.

How to create a custom indicator (Heiken Ashi) using MQL5

In this article, we will learn how to create a custom indicator using MQL5 based on our preferences, to be used in MetaTrader 5 to help us read charts or to be used in automated Expert Advisors.

Neural networks made easy (Part 36): Relational Reinforcement Learning

In the reinforcement learning models we discussed in previous article, we used various variants of convolutional networks that are able to identify various objects in the original data. The main advantage of convolutional networks is the ability to identify objects regardless of their location. At the same time, convolutional networks do not always perform well when there are various deformations of objects and noise. These are the issues which the relational model can solve.

Population optimization algorithms: Monkey algorithm (MA)

In this article, I will consider the Monkey Algorithm (MA) optimization algorithm. The ability of these animals to overcome difficult obstacles and get to the most inaccessible tree tops formed the basis of the idea of the MA algorithm.

Take a few lessons from Prop Firms (Part 1) — An introduction

In this introductory article, I address a few of the lessons one can take from the challenge rules that proprietary trading firms implement. This is especially relevant for beginners and those who struggle to find their footing in this world of trading. The subsequent article will address the code implementation.

Population optimization algorithms: Harmony Search (HS)

In the current article, I will study and test the most powerful optimization algorithm - harmonic search (HS) inspired by the process of finding the perfect sound harmony. So what algorithm is now the leader in our rating?

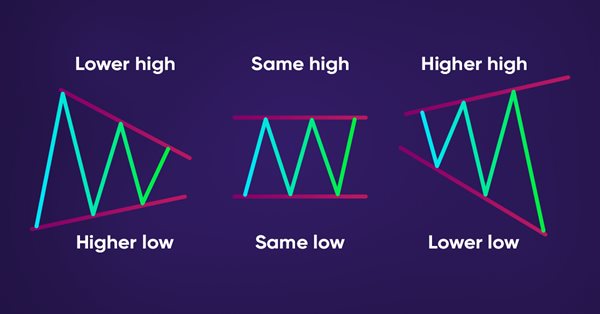

How to detect trends and chart patterns using MQL5

In this article, we will provide a method to detect price actions patterns automatically by MQL5, like trends (Uptrend, Downtrend, Sideways), Chart patterns (Double Tops, Double Bottoms).

An example of how to ensemble ONNX models in MQL5

ONNX (Open Neural Network eXchange) is an open format built to represent neural networks. In this article, we will show how to use two ONNX models in one Expert Advisor simultaneously.

Category Theory in MQL5 (Part 6): Monomorphic Pull-Backs and Epimorphic Push-Outs

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Backpropagation Neural Networks using MQL5 Matrices

The article describes the theory and practice of applying the backpropagation algorithm in MQL5 using matrices. It provides ready-made classes along with script, indicator and Expert Advisor examples.

Population optimization algorithms: Gravitational Search Algorithm (GSA)

GSA is a population optimization algorithm inspired by inanimate nature. Thanks to Newton's law of gravity implemented in the algorithm, the high reliability of modeling the interaction of physical bodies allows us to observe the enchanting dance of planetary systems and galactic clusters. In this article, I will consider one of the most interesting and original optimization algorithms. The simulator of the space objects movement is provided as well.

Understand and Efficiently use OpenCL API by Recreating built-in support as DLL on Linux (Part 2): OpenCL Simple DLL implementation

Continued from the part 1 in the series, now we proceed to implement as a simple DLL then test with MetaTrader 5. This will prepare us well before developing a full-fledge OpenCL as DLL support in the following part to come.

Alan Andrews and his methods of time series analysis

Alan Andrews is one of the most famous "educators" of the modern world in the field of trading. His "pitchfork" is included in almost all modern quote analysis programs. But most traders do not use even a fraction of the opportunities that this tool provides. Besides, Andrews' original training course includes a description not only of the pitchfork (although it remains the main tool), but also of some other useful constructions. The article provides an insight into the marvelous chart analysis methods that Andrews taught in his original course. Beware, there will be a lot of images.

How to use ONNX models in MQL5

ONNX (Open Neural Network Exchange) is an open format built to represent machine learning models. In this article, we will consider how to create a CNN-LSTM model to forecast financial timeseries. We will also show how to use the created ONNX model in an MQL5 Expert Advisor.

Implementing the Janus factor in MQL5

Gary Anderson developed a method of market analysis based on a theory he dubbed the Janus Factor. The theory describes a set of indicators that can be used to reveal trends and assess market risk. In this article we will implement these tools in mql5.

Category Theory in MQL5 (Part 5): Equalizers

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

How to use MQL5 to detect candlesticks patterns

A new article to learn how to detect candlesticks patterns on prices automatically by MQL5.

Moral expectation in trading

This article is about moral expectation. We will look at several examples of its use in trading, as well as the results that can be achieved with its help.

Canvas based indicators: Filling channels with transparency

In this article I'll introduce a method for creating custom indicators whose drawings are made using the class CCanvas from standard library and see charts properties for coordinates conversion. I'll approach specially indicators which need to fill the area between two lines using transparency.

Neural networks made easy (Part 35): Intrinsic Curiosity Module

We continue to study reinforcement learning algorithms. All the algorithms we have considered so far required the creation of a reward policy to enable the agent to evaluate each of its actions at each transition from one system state to another. However, this approach is rather artificial. In practice, there is some time lag between an action and a reward. In this article, we will get acquainted with a model training algorithm which can work with various time delays from the action to the reward.

Creating a comprehensive Owl trading strategy

My strategy is based on the classic trading fundamentals and the refinement of indicators that are widely used in all types of markets. This is a ready-made tool allowing you to follow the proposed new profitable trading strategy.