Multibot in MetaTrader: Launching multiple robots from a single chart

Contents

- Introduction

- Problem statement and limits of applicability

- Differences between the MetaTrader 4 and MetaTrader 5 terminals in terms of using a multibot

- The nuances of building a universal template

- Writing a universal template

- Conclusion

Introduction

In the world of financial markets, automated trading systems have become an integral part of the decision-making process. These systems can be configured to analyze the market, make entry and exit decisions, and execute trades using predefined rules and algorithms. However, setting up and running robots on multiple charts can be a time consuming task. Each robot should be configured individually for each chart, which requires additional effort.

In this article, I will show you my implementation of a simple template that allows you to create a universal robot for multiple charts in MetaTrader 4 and 5. Our template will allow you to attach the robot to one chart, while the rest of the charts will be processed inside the EA. Thus, our template greatly simplifies the process of setting up and running robots on multiple charts, saving traders time and effort. In this article, I will consider in detail the process of creating such a robot in MQL5 from the idea to the test.

Problem statement and limits of applicability

This idea came to me not so long ago, although I I have been observing similar decisions from professional sellers for a long time. In other words, I'm not the first and not the last one to come up with an idea in this field, but as always, some conditions must arise in order for the programmer to begin to come to such decisions. The main reason for developing such Expert Advisors in the MQL5 store is the desire for user comfort. However, in my case there was a slightly different motivation. My motivation was that I first had to test either several strategies simultaneously for several instruments, or the same strategy, but in order to see its multicurrency characteristics.

In addition, a very important factor when testing a strategy in the tester, especially in multi-currency mode, is a general curve of profitability, which is the basis of any evaluation of automatic trading systems when backtesting on historical data. When testing trading systems separately on one instrument, it is quite difficult to combine such reports later. I am not aware of such tools, at least for MetaTrader 5. As for the fourth version of the terminal, there is one unofficial tool for such manipulations. I used it in at least one article, but of course such an approach is not preferable.

In addition to the testing process, there is an equally important process of automatic trading itself, and synchronization of similar EAs that work independently, each on its own chart. If there are too many such charts, it may require additional computer resources slowing down or worsening trading performance and leading to unexpected errors and other unpleasant incidents that can have a detrimental effect on the final trading result. For each such EA, we need to come up with unique order IDs, protection against high-frequency server requests, as well as many other things that are not obvious at first glance.

Processing of the graphical part of the EA is a separate and very sensitive issue. Now all the more or less skillful EA creators make at least a minimal version of some indication on the chart the EA is attached to. This way the EA looks more serious and inspires more confidence, and finally, almost always, displaying some information on the chart to a user sometimes allows for more effective control over the EA trading process. Besides, it is possible to add elements for manual control if necessary. All this is called a user interface. While distributing such EAs by charts, the load on updating both graphical, textual and numerical information in the interfaces increases exponentially. Of course, when using a multi-template, we have one interface that requires the minimum amount of resources fro the terminal.

Of course, such a template does not solve all problems, but nevertheless, it helps me a lot in my projects. I use different robots and, generally, all approaches have the right to exist, but I think many novice programmers may find this pattern useful. It is not necessary to copy it completely, but if you wish, you can easily adjust it to suit your needs. My goal is not to give you something extraordinary, but to show and explain one of the options of solving such a problem.

Differences between the MetaTrader 4 and MetaTrader 5 terminals in terms of using a multibot

What I like about the latest MetaTrader 5 is the power of its tester, which gives you all the features you need to test on multiple instruments at the same time provided that you use the approach to EA development stated above. The tester auto synchronizes quotes by time providing you a clearly synchronized profitability curve on a time scale. MetaTrader 4 has no such functionality. I think, this is its biggest disadvantage. Nevertheless, it is worth noting that MetaQuotes is doing its best to support the fourth terminal and its popularity is still high. As an active user of MetaTrader 4, I can say that these shortcomings are not as significant as they may seem.

The MQL4 language was recently updated toMQL5. This means that when writing similar templates like ours, we will have a minimum of differences in the code. It is in my good tradition to try to implement things forboth terminals, so you will receive a template for both terminals. Such improvements to the old terminal, among other things, allow us to use the following functions that we really need:

- CopyClose - request for bar closing prices

- CopyOpen - request for bar opening prices

- CopyHigh - request for bar peaks

- CopyLow - request for bar lows

- CopyTime - request for bar opening time

- SymbolInfoTick - request for the last incoming tick for the requested symbol

- SymbolInfoInteger - request for symbol data, which can be described by integers and numbered lists

- SymbolInfo******* - other functions we need

These features are present in both MQL4 and MQL5. These functions allow you to get bar data for any symbol and period. Thus, the only unpleasant difference between the tester of the fourth and fifth versions is the fact that these functions in the fourth terminal will work only for the current chart on which testing is being carried out, and the rest of the requests will simply inform you that there is no data due to the peculiarities of MetaTrader 4 tester. Therefore, when testing our template, you will only get trading on the selected symbol, and only one of the profit curves for a single robot.

In the fifth terminal, you will already receive trading for all the requested symbols and the common line of profitability. As for applying in trading, when trading directly with such a robot in both terminals, you receive the full performance of such a template. In other words, the difference is only in the tester. But even in such cases, you can get away with the fact that when creating an EA, it is better to start with the version for MetaTrader 5. After all the necessary tests, you can quickly make the version for MetaTrader 4.

Of course, there are a number of differences that I have not covered. I just want to emphasize the importance of some of them, since these nuances must be known when building an elaborate structure for such a template. MetaTrader 5 is definitely better than its predecessor, but nevertheless I have no desire to get rid of the fourth terminal, becausein many situations, its demand for computational resources is not so great compared to the fifth one. Both tools are still good.

The nuances of building a universal template

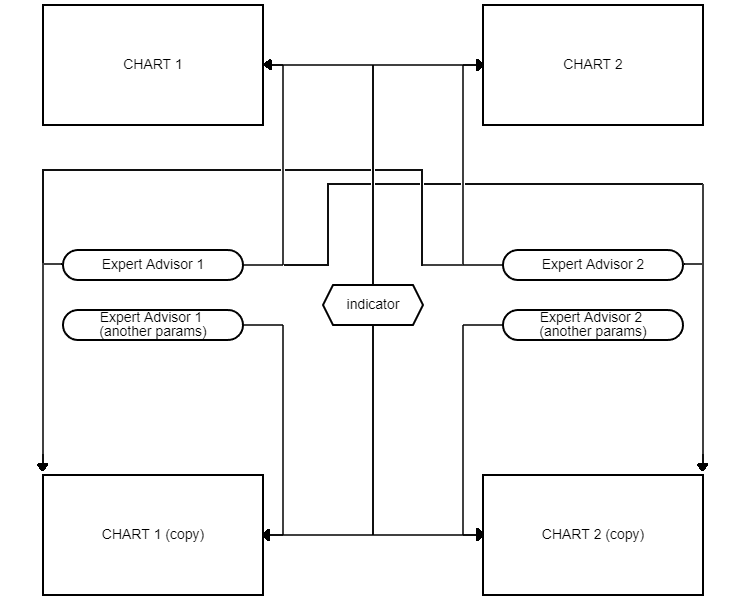

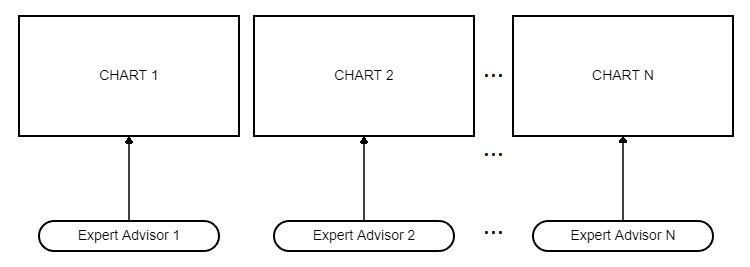

To build such a template, you should understand how the terminal works, what an Expert Advisor is, and what a MetaTrader chart is. In addition, you should understand thateach chart is a separate object. Each such chart can be associated with several indicators and only one EA. There may be several identical charts. Several charts are usually made in order to run several different EAs on onesymbol periodor to runmultiple copies of one EA with different settings. Understanding these subtleties, we should come to the conclusion that in order to abandon multiple charts in favor of our template, we will have to implement all this inside our template. This can be represented in the form of a diagram:

Separately, it should be said about ticks. The disadvantage of this approach is that we will not be able to subscribe to the handler for the appearance of a new tick for each chart. Wewill have to apply ticks from the chart our robot is working on, or use the timer. Ultimately, this will mean unpleasant moments for tick robots, which are as follows:

- We will have to write custom OnTick handlers

- These handlers will have to be implemented as a derivative of OnTimer

- Ticks will not be perfect because OnTimer works with a delay (the value of the delay is not important, but its presence is important)

- To get ticks, you need the SymbolInfoTick function

I think for those who count every millisecond, this can be an irresistible moment, especially for those who love arbitrage. However, I do not emphasize this in my template. Over the years of building different systems, I came to the bar trading paradigm. This means that trading operations and other calculations for the most part occur when a new bar appears. This approach has a number of obvious advantages:

- Inaccuracy in determining the start of a new bar does not significantly affect trading

- The longer the period of the bar, the less this influence.

- Discretization in the form of bars provides an increase in testing speed by orders of magnitude

- The same quality of testing both when testing on real ticks and on artificial ones

The approach teaches a certain paradigm of building EAs. This paradigmeliminates many problems associated with tick EAs, speeds up the testing process, provides a higher mathematical expectation of profit, which is the main obstacle, and also saves a lot of time and computing power. I think, we can find many more advantages, but I think this is enough in the context of this article.

To implement our template, it is not necessary to implementthe entire structure of the workspace of the trading terminal inside our template, but it is enough just to implement a separate chart for each robot. This is not the most optimal structure, but if we agree that each individual instrument will be present only once in the list of instruments, then this optimization is not required. It will look like this:

We have implemented the simplest structure for the implementation of charts. Now it is time to think aboutinputs of such a template, and more importantly, how to take into account the dynamic number of charts and EAs for each situation within the allowable possibilities of the MQL5 language. The only way to solve this problem isusing string input variables. A string allows us to store a very large amount of data. In fact, in order to describe all the necessary parameters for such a template, we will need dynamic arrays in the input data. Of course, no one will implement such things simply because few people would use such opportunities. The string is our dynamic array, in which we can put anything we want. So let's use it. For my simplest template, I decided to introduce three variables like this:

- Charts - our charts (list)

- Chart Lots - lots for trading (list)

- Chart Timeframes - chart periods (list)

In general, we can combine all this data into a single string, but then its structure will be complex and it will be difficult for a potential user to figure out how to correctly describe the data. In addition, it will be very easy to make mistakes in filling it out and we can get a lot of very unpleasant things when using it, not to mention the incredible complexity of the conversion function, which will take this data out of the strings. I saw similar solutions among sellers and in general they did everything right. All data is simply listed separated by commas. At the start of the EA, thesedata is taken out from a string using special functions and filled in the corresponding dynamic arrays, which are then used in the code. We will also follow this path. We can add more similar strings with identical enumeration rules. I decided to use ":" as a separator. If we use a comma, then it is not clear how to deal with double arrays such as Chart Lots. It is possible to add more of such string variables, and in general it is possible to construct even more complete and versatile template, but my task here is only to show how to implement this and give you the first version of the template you can modify quickly and easily.

It is not enough to implement such arrays, it is also necessary to implement common variables, for example:

- Work Timeframe For Unsigned - a chart period where it is not specified

- Fix Lot For Unsigned - a lot where it is not specified

The Charts list should be filled. The same action is optional for Chart Lots and Chart Timeframes. For example, we may take single lots for all charts and the same period for all charts. A similar functionality will be implemented in our template. It is desirable to apply such implementation rules wherever possible to ensure brevity and clarity when setting the input parameters of an EA built on the basis of such templates.

Let's now define a few more important variables for a minimal implementation of such a pattern:

- Last Bars Count - the number of last bars for a chart that we store for each chart

- Deposit For Lot - deposit for the use of a specified lot

- First Magic - unique ID for a separate EA's deals

I think, the first variable is pretty clear. The second variable is much harder to grasp. This is how I regulate the auto lot in my EAs. If I set it to "0", then I inform the algorithm that it only needs to trade a fixed lot specified in the corresponding string or in a shared variable we have considered above. Otherwise, I set the required deposit so that the lot specified in the settings can be applied. It is easy to understand that with a smaller or larger deposit, this lot changes its value according to the equation:

- Lot = Input Lot * ( Current Deposit / Deposit For Lot )

I think everything should be clear now. If we want a fixed lot, we set zero, and in other cases we adjust the deposit in the input settings to the risks. I think, it is cheap and cheerful. If necessary, you can change the risk assessment approach for auto lot, but I personally like this option, it makes no sense to overthink it.

It is worth mentioning about synchronization, and in particular about such an issue as setting the Expert Magic Number. When trading with EAs or even in a mixed form, all self-respecting programmers pay special attention to this particular variable. The thing is that when using multiple EAs, it is very important to ensure that each such EA has a unique ID. Otherwise, when working with orders, deals or positions, you will get a complete mess and your strategies will stop working correctly, and in most cases they will stop working completely. I hope I do not have to explain why. Each time an EA is placed on the chart, we need to configure these IDs and make sure that they do not repeat. Even a single mistake may lead to disastrous consequences. In addition, if you accidentally close the chart with the EA, you will have to reconfigure it anew. As a result, the probability of a mistake is greatly increased. In addition, it is very unpleasant in many other aspects. For example, you close the chart and forget which ID was used there. In this case, you will have to dig into the trading history to look for it. Without the ID, the newly restarted EA may work incorrectly and many more unpleasant things can happen.

Using a template like mine sets us free from such control and minimizes possible errors since we need to set only the starting ID in the EA settings, while the rest of the IDs will be automatically generated using an increment and assigned to the corresponding copies of EAs. This process will happen at each restart automatically. Anyway, remembering only one starting ID is much easier than remembering some random ID in the middle of the way.

Writing a universal template

It is time to implement the template. I will try to omit excessive elements, so everyone who needs this template may download and see the rest in the source code. Here I will show only things that are directly related to our ideas. Stop levels and other parameters are defined by users. You can find my implementation in the source code. First, let's define our input variables, which we will definitely need:

//+------------------------------------------------------------------+ //| Inputs | //+------------------------------------------------------------------+ input string SymbolsE="EURUSD:GBPUSD:USDCHF:USDJPY:NZDUSD:AUDUSD:USDCAD";//Charts input string LotsE="0.01:0.01:0.01:0.01:0.01:0.01:0.01";//Chart Lots input string TimeframesE="H1:H1:H1:H1:H1:H1:H1";//Chart Timeframes input int LastBars=10;//Last Bars Count input ENUM_TIMEFRAMES TimeframeE=PERIOD_M1;//Work Timeframe For Unsigned input double RepurchaseLotE=0.01;//Fix Lot For Unsigned input double DepositForRepurchaseLotE=0.00;//Deposit For Lot (if "0" then fix) input int MagicE=156;//First Magic

Here you can see an example of filling in string variables reflecting our dynamic arrays, just like the example of shared variables. By the way, this code will look the same both in MQL4 and in MQL5. I tried to make everything as similar as possible.

Now let's decide how we will get our string data. This will be done by the corresponding function, but first we will create arrays where our function will add the data obtained from the strings:

//+------------------------------------------------------------------+ //|Arrays | //+------------------------------------------------------------------+ string S[];// Symbols array double L[];//Lots array ENUM_TIMEFRAMES T[];//Timeframes array

The following function fills in these arrays:

//+------------------------------------------------------------------+ //| Fill arrays | //+------------------------------------------------------------------+ void ConstructArrays() { int SCount=1; for (int i = 0; i < StringLen(SymbolsE); i++)//calculation of the number of tools { if (SymbolsE[i] == ':') { SCount++; } } ArrayResize(S,SCount);//set the size of the character array ArrayResize(CN,SCount);//set the size of the array to use bars for each character int Hc=0;//found instrument index for (int i = 0; i < StringLen(SymbolsE); i++)//building an array of tools { if (i == 0)//if we just started { int LastIndex=-1; for (int j = i; j < StringLen(SymbolsE); j++) { if (StringGetCharacter(SymbolsE,j) == ':') { LastIndex=j; break; } } if (LastIndex != -1)//if no separating colon was found { S[Hc]=StringSubstr(SymbolsE,i,LastIndex); Hc++; } else { S[Hc]=SymbolsE; Hc++; } } if (SymbolsE[i] == ':') { int LastIndex=-1; for (int j = i+1; j < StringLen(SymbolsE); j++) { if (StringGetCharacter(SymbolsE,j) == ':') { LastIndex=j; break; } } if (LastIndex != -1)//if no separating colon was found { S[Hc]=StringSubstr(SymbolsE,i+1,LastIndex-(i+1)); Hc++; } else { S[Hc]=StringSubstr(SymbolsE,i+1,StringLen(SymbolsE)-(i+1)); Hc++; } } } for (int i = 0; i < ArraySize(S); i++)//assignment of the requested number of bars { CN[i]=LastBars; } ConstructLots(); ConstructTimeframe(); }

In short, here the amount of data in a string is calculated thanks to the separators. Based on the first array, the size of all other arrays is set similarly to an array with symbols, after which the symbols are filled first followed by such functions asConstruct Lots and ConstructTimeframe. Their implementation is similar to the implementation of this function with some differences. You can see their implementation in the source code. I have not added them to the article so as not to show the duplicate code.

Now we need to create the appropriate classes for the virtual chart and the virtual robot linked to it accordingly. Let's start by defining that virtual charts and EAs will be stored in arrays:

//+------------------------------------------------------------------+

//| Charts & experts pointers |

//+------------------------------------------------------------------+

Chart *Charts[];

BotInstance *Bots[]; Let's start from the chart class:

//+------------------------------------------------------------------+ //| Chart class | //+------------------------------------------------------------------+ class Chart { public: datetime TimeI[]; double CloseI[]; double OpenI[]; double HighI[]; double LowI[]; string BasicSymbol;//the base instrument that was extracted from the substring double ChartPoint;//point size of the current chart double ChartAsk;//Ask double ChartBid;//Bid datetime tTimeI[];//auxiliary array to control the appearance of a new bar static int TCN;//tcn string CurrentSymbol;//symbol ENUM_TIMEFRAMES Timeframe;//timeframe int copied;//how much data is copied int lastcopied;//last amount of data copied datetime LastCloseTime;//last bar time MqlTick LastTick;//last tick fos this instrument Chart() { ArrayResize(tTimeI,2); } void ChartTick()//this chart tick { SymbolInfoTick(CurrentSymbol,LastTick); ArraySetAsSeries(tTimeI,false); copied=CopyTime(CurrentSymbol,Timeframe,0,2,tTimeI); ArraySetAsSeries(tTimeI,true); if ( copied == 2 && tTimeI[1] > LastCloseTime ) { ArraySetAsSeries(CloseI,false); ArraySetAsSeries(OpenI,false); ArraySetAsSeries(HighI,false); ArraySetAsSeries(LowI,false); ArraySetAsSeries(TimeI,false); lastcopied=CopyClose(CurrentSymbol,Timeframe,0,Chart::TCN+2,CloseI); lastcopied=CopyOpen(CurrentSymbol,Timeframe,0,Chart::TCN+2,OpenI); lastcopied=CopyHigh(CurrentSymbol,Timeframe,0,Chart::TCN+2,HighI); lastcopied=CopyLow(CurrentSymbol,Timeframe,0,Chart::TCN+2,LowI); lastcopied=CopyTime(CurrentSymbol,Timeframe,0,Chart::TCN+2,TimeI); ArraySetAsSeries(CloseI,true); ArraySetAsSeries(OpenI,true); ArraySetAsSeries(HighI,true); ArraySetAsSeries(LowI,true); ArraySetAsSeries(TimeI,true); LastCloseTime=tTimeI[1]; } ChartBid=LastTick.bid; ChartAsk=LastTick.ask; ChartPoint=SymbolInfoDouble(CurrentSymbol,SYMBOL_POINT); } }; int Chart::TCN = 0;

The class has only one function, which controls the update of ticks and bars, as well as the necessary fields for identifying some necessary parameters of a particular chart. Some parameters are missing there. If desired, you can add the missing ones by adding their update, for example, like updating ChartPoint. Bar arrays are made in MQL4 style. I still find it very convenient to work with predetermined arrays in MQL4. It is very convenient when you know that zero bar is the current bar. Anyway, this is just my vision. You are free to follow the one of your own.

Now we need to describe the class of a separate virtual EA:

//+------------------------------------------------------------------+ //| Bot instance class | //+------------------------------------------------------------------+ class BotInstance//expert advisor object { public: CPositionInfo m_position;// trade position object CTrade m_trade;// trading object ///-------------------this robot settings---------------------- int MagicF;//Magic string CurrentSymbol;//Symbol double CurrentLot;//Start Lot int chartindex;//Chart Index ///------------------------------------------------------------ ///constructor BotInstance(int index,int chartindex0)//load all data from hat using index, + chart index { chartindex=chartindex0; MagicF=MagicE+index; CurrentSymbol=Charts[chartindex].CurrentSymbol; CurrentLot=L[index]; m_trade.SetExpertMagicNumber(MagicF); } /// void InstanceTick()//bot tick { if ( bNewBar() ) Trade(); } private: datetime Time0; bool bNewBar()//new bar { if ( Time0 < Charts[chartindex].TimeI[1] && Charts[chartindex].ChartPoint != 0.0 ) { if (Time0 != 0) { Time0=Charts[chartindex].TimeI[1]; return true; } else { Time0=Charts[chartindex].TimeI[1]; return false; } } else return false; } //////************************************Main Logic******************************************************************** void Trade()//main trade function { //Close[0] --> Charts[chartindex].CloseI[0] - example of access to data arrays of bars of the corresponding chart //Open[0] --> Charts[chartindex].OpenI[0] ----------------------------------------------------------------------- //High[0] --> Charts[chartindex].HighI[0] ----------------------------------------------------------------------- //Low[0] --> Charts[chartindex].LowI[0] ------------------------------------------------------------------------- //Time[0] --> Charts[chartindex].TimeI[0] ----------------------------------------------------------------------- if ( true ) { CloseBuyF(); //CloseSellF(); } if ( true ) { BuyF(); //SellF(); } } double OptimalLot()//optimal lot calculation { if (DepositForRepurchaseLotE != 0.0) return CurrentLot * (AccountInfoDouble(ACCOUNT_BALANCE)/DepositForRepurchaseLotE); else return CurrentLot; } //here you can add functionality or variables if the trading function turns out to be too complicated //////******************************************************************************************************************* ///trade functions int OrdersG()//the number of open positions / orders of this virtual robot { ulong ticket; bool ord; int OrdersG=0; for ( int i=0; i<PositionsTotal(); i++ ) { ticket=PositionGetTicket(i); ord=PositionSelectByTicket(ticket); if ( ord && PositionGetInteger(POSITION_MAGIC) == MagicF && PositionGetString(POSITION_SYMBOL) == CurrentSymbol ) { OrdersG++; } } return OrdersG; } /////////********/////////********//////////***********/////////trade function code block void BuyF()//buy market { double DtA; double CorrectedLot; DtA=double(TimeCurrent())-GlobalVariableGet("TimeStart161_"+IntegerToString(MagicF));//unique bot marker last try datetime if ( (DtA > 0 || DtA < 0) ) { CorrectedLot=OptimalLot(Charts[chartindex]); if ( CorrectedLot > 0.0 ) { //try buy logic } } } void SellF()//sell market { //Same logic } void CloseSellF()//close sell position { ulong ticket; bool ord; for ( int i=0; i<PositionsTotal(); i++ ) { ticket=PositionGetTicket(i); ord=PositionSelectByTicket(ticket); if ( ord && PositionGetInteger(POSITION_MAGIC) == MagicF && PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL && PositionGetString(POSITION_SYMBOL) == Charts[chartindex].CurrentSymbol ) { //Close Sell logic } } } void CloseBuyF()//close buy position { //same logic } bool bOurMagic(ulong ticket,int magiccount)//whether the magic of the current deal matches one of the possible magics of our robot { int MagicT[]; ArrayResize(MagicT,magiccount); for ( int i=0; i<magiccount; i++ ) { MagicT[i]=MagicE+i; } for ( int i=0; i<ArraySize(MagicT); i++ ) { if ( HistoryDealGetInteger(ticket,DEAL_MAGIC) == MagicT[i] ) return true; } return false; } /////////********/////////********//////////***********/////////end trade function code block };

I have removed some of the repetitive logic in order to reduce the amount of code. This is the class, in which the entire algorithm of your EA is to be implemented. The main functionality present in this class:

- Trade() - main trading function that is called in the bar handler for the corresponding chart

- BuyF() - buying by market function

- SellF() - selling by market function

- CloseBuyF() - function of closing buy positions by market

- CloseSellF() - function of closing sell positions by market

This is the minimum set of functions for demonstrating trading by bars. For this demonstration, we just need to open any position and close it on the next bar. This is sufficient within the framework of this article. There is some additional functionality from this class that should complement the understanding:

- OrdersG() - counting positions that are open on a specific symbol linked to the chart

- OptimalLot() - preparing a lot before sending it to the trading function (selecting a fixed lot or calculating an auto lot)

- bOurMagic() - checking transactions from the history for compliance with the list of allowed ones (for sorting out a custom history only)

These functions may be needed to implement trading logic. It would also be reasonable to remind of the new bar handler:

- InstanceTick() - tick simulation on a separate EA instance

- bNewBar() - predicate for checking the appearance of a new bar (used inside InstanceTick)

If the predicate shows a new bar, then the Trade function is triggered. This is the function, in which the main trading logic is to be set. The connection with the corresponding chart is carried out using the chartindex variable assigned when the instance is created. So each EA instance knows the chart it should take a quote from.

Now let's consider the process of creating the virtual charts and EAs themselves. Virtual charts are created first:

//+------------------------------------------------------------------+ //| Creation of graph objects | //+------------------------------------------------------------------+ void CreateCharts() { bool bAlready; int num=0; string TempSymbols[]; string Symbols[]; ConstructArrays();//array preparation int tempcnum=CN[0]; Chart::TCN=tempcnum;//required number of stored bars for all instruments for (int j = 0; j < ArraySize(Charts); j++)//fill in all the names and set the dimensions of all time series, each graph { Charts[j] = new Chart(); Charts[j].lastcopied=0; ArrayResize(Charts[j].CloseI,tempcnum+2);//assign size to character arrays ArrayResize(Charts[j].OpenI,tempcnum+2);//---------------------------------- ArrayResize(Charts[j].HighI,tempcnum+2);//---------------------------------- ArrayResize(Charts[j].LowI,tempcnum+2);//----------------------------------- ArrayResize(Charts[j].TimeI,tempcnum+2);//---------------------------------- Charts[j].CurrentSymbol = S[j];//symbol Charts[j].Timeframe = T[j];//timeframe } ArrayResize(Bots,ArraySize(S));//assign a size to the array of bots }

After creating charts and setting the size of the array with virtual EAs, we need to create the instances of the EAs themselves and implement the connection of virtual EAs with charts:

//+------------------------------------------------------------------+ //| create and hang all virtual robots on charts | //+------------------------------------------------------------------+ void CreateInstances() { for (int i = 0; i < ArraySize(S); i++) { for (int j = 0; j < ArraySize(Charts); j++) { if ( Charts[j].CurrentSymbol == S[i] ) { Bots[i] = new BotInstance(i,j); break; } } } }

Connection is carried out using the "j" index set in each instance of the virtual EA when creating it. The corresponding variable shown above is highlighted there. Of course, all this can be done in many ways and much more elegantly, but I think that the main thing is that the general idea is clear.

All that is left is to show how ticks are simulated on each chart and EA associated with it:

//+------------------------------------------------------------------+ //| All bcharts & all bots tick imitation | //+------------------------------------------------------------------+ void AllChartsTick() { for (int i = 0; i < ArraySize(Charts); i++) { Charts[i].ChartTick(); } } void AllBotsTick() { for (int i = 0; i < ArraySize(S); i++) { if ( Charts[Bots[i].chartindex].lastcopied >= Chart::TCN+1 ) Bots[i].InstanceTick(); } }

The only thing I want to note is that this template was obtained by reworking my more complex template, which was intended for much more serious purposes, so there may be excessive elements here and there. I think, you can easily remove them and make the code more neat if you want.

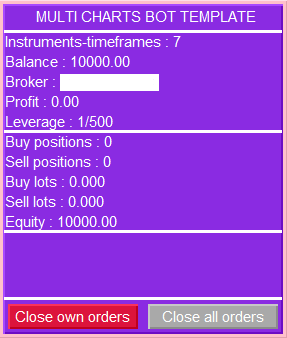

In addition to the template, there is a simple interface, which, I think, can also come in handy, for example, when writing an order in freelance or for other purposes:

I left free space in this interface, it will be enough for three entries in case you do not have enough space. You can easily expand or change its structure completely if necessary. If we want to add the three missing fields in this particular example, we need to find the following places in the code:

//+------------------------------------------------------------------+ //| Reserved elements | //+------------------------------------------------------------------+ "template-UNSIGNED1",//UNSIGNED1 "template-UNSIGNED2",//UNSIGNED2 "template-UNSIGNED3",//UNSIGNED3 //LabelCreate(0,OwnObjectNames[13],0,x+Border+2,y+17+Border+20*5+20*5+23,corner,"","Arial",11,clrWhite,0.0,ANCHOR_LEFT);//UNSIGNED1 //LabelCreate(0,OwnObjectNames[14],0,x+Border+2,y+17+Border+20*5+20*5+23+20*1,corner,"","Arial",11,clrWhite,0.0,ANCHOR_LEFT);//UNSIGNED2 //LabelCreate(0,OwnObjectNames[15],0,x+Border+2,y+17+Border+20*5+20*5+23+20*2,corner,"","Arial",11,clrWhite,0.0,ANCHOR_LEFT);//UNSIGNED3 //////////////////////////// //TempText="UNSIGNED1 : "; //TempText+=DoubleToString(NormalizeDouble(0.0),3); //ObjectSetString(0,OwnObjectNames[13],OBJPROP_TEXT,TempText); //TempText="UNSIGNED2 : "; //TempText+=DoubleToString(NormalizeDouble(0.0),3); //ObjectSetString(0,OwnObjectNames[14],OBJPROP_TEXT,TempText); //TempText="UNSIGNED3 : "; //TempText+=DoubleToString(NormalizeDouble(0.0),3); //ObjectSetString(0,OwnObjectNames[15],OBJPROP_TEXT,TempText); ///////////////////////////

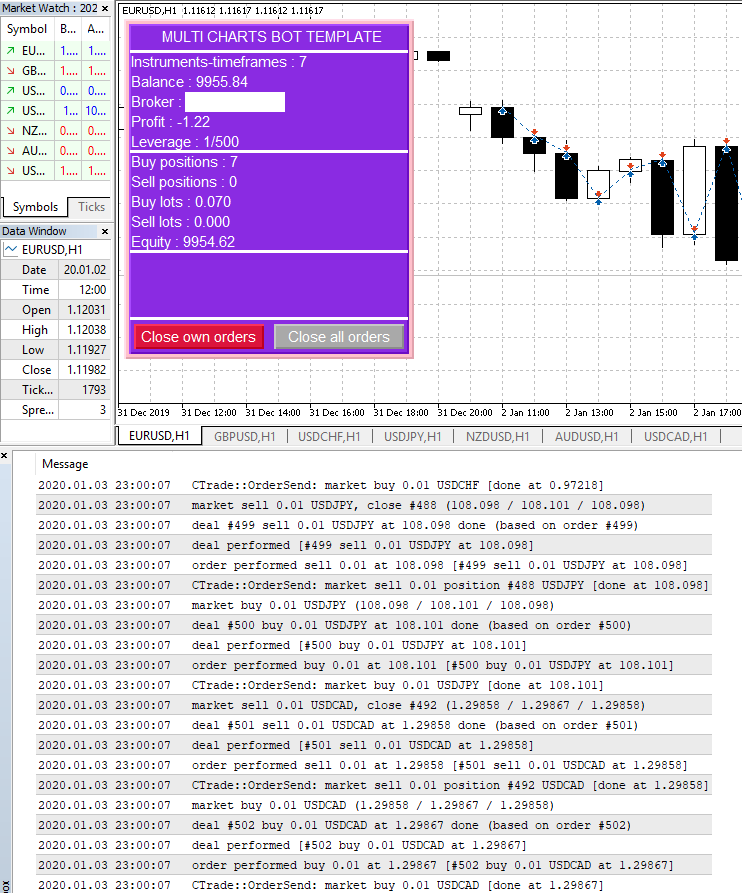

The first three entries assign names of new elements on the interface, the second three ones are used when creating the interface at the start of the EA, while the last three are used in the function to update information on the interface. Now it is time to test the performance of both templates. The tester visualizer will be sufficient for a visual demonstration. I will show only the option for MetaTrader 5, because its visualizer is much better. Besides, the result of the work will clearly show everything that is needed to confirm the efficiency:

As you can see, we have uploaded all seven charts for the major Forex pairs. The visualization log shows that trading is in progress for all listed symbols. Trading is performed independently, as required. In other words, the EAs trade each on their own chart and do not interact at all.

Conclusion

In this article, we reviewed the main nuances of building universal templates for the MetaTrader 4 and MetaTrader 5 terminals, made a simple but working template, analyzed the most important points of its work, and also confirmed its viability using the MetaTrader 5 tester visualizer. I think, it is pretty obvious by now that a template like this is not that complicated. In general, you can make various implementations of such templates, but it is obvious that such templates can be completely different while remaining applicable. The main thing is to understand the basic nuances of building such structures. If necessary, you can rework the templates for personal use.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/12434

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Multibot in MetaTrader: Launching multiple robots from a single chart has been published:

Author: Evgeniy Ilin

Hi, this is really cool. May I ask if with this template, can I use the `BotsInstance` class to attach another Expert from the terminal (external EA outside of this EA) ? If this is possible then means that we can actually backtest multiple EAs simultaneously in StrategyTester.

Hi, this is really cool. May I ask if with this template, can I use the `BotsInstance` class to attach another Expert from the terminal (external EA outside of this EA) ? If this is possible then means that we can actually backtest multiple EAs simultaneously in StrategyTester.

yes, it is possible, but you will have to rewrite the adviser code a little, for this a template was made, it will allow you to trade and test such an adviser multicurrency. you just need to place the code in the body of the BotInstance class, and fit it to it