Simple Mean Reversion Trading Strategy

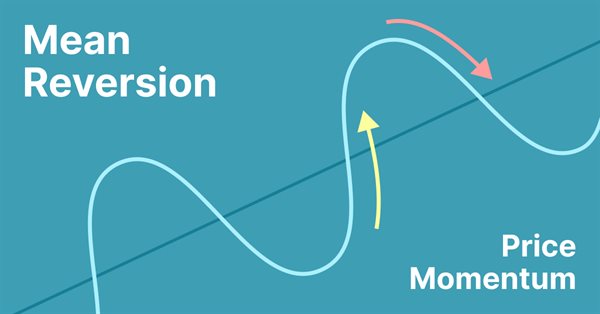

Mean reversion is a type of contrarian trading where the trader expects the price to return to some form of equilibrium which is generally measured by a mean or another central tendency statistic.

Automating Trading Strategies in MQL5 (Part 24): London Session Breakout System with Risk Management and Trailing Stops

In this article, we develop a London Session Breakout System that identifies pre-London range breakouts and places pending orders with customizable trade types and risk settings. We incorporate features like trailing stops, risk-to-reward ratios, maximum drawdown limits, and a control panel for real-time monitoring and management.

Developing Zone Recovery Martingale strategy in MQL5

The article discusses, in a detailed perspective, the steps that need to be implemented towards the creation of an expert advisor based on the Zone Recovery trading algorithm. This helps aotomate the system saving time for algotraders.

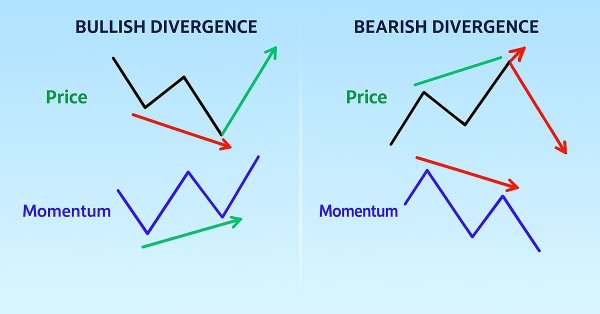

Automating Trading Strategies in MQL5 (Part 37): Regular RSI Divergence Convergence with Visual Indicators

In this article, we build an MQL5 EA that detects regular RSI divergences using swing points with strength, bar limits, and tolerance checks. It executes trades on bullish or bearish signals with fixed lots, SL/TP in pips, and optional trailing stops. Visuals include colored lines on charts and labeled swings for better strategy insights.

Separate optimization of a strategy on trend and flat conditions

The article considers applying the separate optimization method during various market conditions. Separate optimization means defining trading system's optimal parameters by optimizing for an uptrend and downtrend separately. To reduce the effect of false signals and improve profitability, the systems are made flexible, meaning they have some specific set of settings or input data, which is justified because the market behavior is constantly changing.

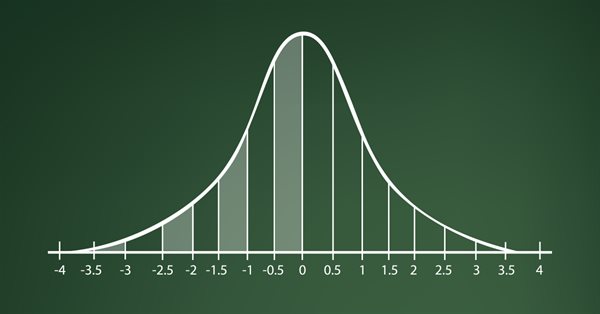

Learn how to design a trading system by Standard Deviation

Here is a new article in our series about how to design a trading system by the most popular technical indicators in MetaTrader 5 trading platform. In this new article, we will learn how to design a trading system by Standard Deviation indicator.

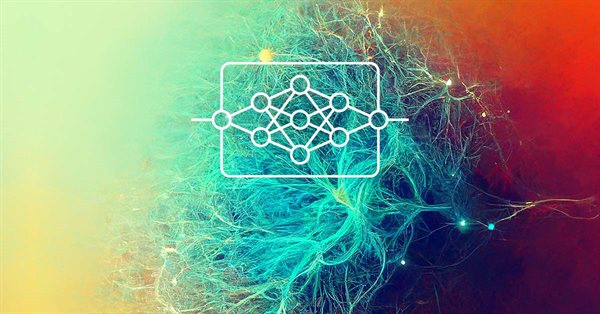

Neural networks made easy (Part 3): Convolutional networks

As a continuation of the neural network topic, I propose considering convolutional neural networks. This type of neural network are usually applied to analyzing visual imagery. In this article, we will consider the application of these networks in the financial markets.

Building AI-Powered Trading Systems in MQL5 (Part 7): Further Modularization and Automated Trading

In this article, we enhance the AI-powered trading system's modularity by separating UI components into a dedicated include file. The system now automates trade execution based on AI-generated signals, parsing JSON responses for BUY/SELL/NONE with entry/SL/TP, visualizing patterns like engulfing or divergences on charts with arrows, lines, and labels, and optional auto-signal checks on new bars.

Pair trading

In this article, we will consider pair trading, namely what its principles are and if there are any prospects for its practical application. We will also try to create a pair trading strategy.

How to deal with lines using MQL5

In this article, you will find your way to deal with the most important lines like trendlines, support, and resistance by MQL5.

Learn how to design a trading system by Williams PR

A new article in our series about learning how to design a trading system by the most popular technical indicators by MQL5 to be used in the MetaTrader 5. In this article, we will learn how to design a trading system by the Williams' %R indicator.

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

How to Integrate Smart Money Concepts (BOS) Coupled with the RSI Indicator into an EA

Smart Money Concept (Break Of Structure) coupled with the RSI Indicator to make informed automated trading decisions based on the market structure.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Brute force approach to pattern search

In this article, we will search for market patterns, create Expert Advisors based on the identified patterns, and check how long these patterns remain valid, if they ever retain their validity.

Other classes in DoEasy library (Part 66): MQL5.com Signals collection class

In this article, I will create the signal collection class of the MQL5.com Signals service with the functions for managing signals. Besides, I will improve the Depth of Market snapshot object class for displaying the total DOM buy and sell volumes.

Learn how to design a trading system by OBV

This is a new article to continue our series for beginners about how to design a trading system based on some of the popular indicators. We will learn a new indicator that is On Balance Volume (OBV), and we will learn how we can use it and design a trading system based on it.

Graphics in DoEasy library (Part 73): Form object of a graphical element

The article opens up a new large section of the library for working with graphics. In the current article, I will create the mouse status object, the base object of all graphical elements and the class of the form object of the library graphical elements.

Controlling the Slope of Balance Curve During Work of an Expert Advisor

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Somehow, you need to correct the operation of the Expert Advisor as it accumulates the results of trading. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve.

Experiments with neural networks (Part 1): Revisiting geometry

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders.

Developing a trading Expert Advisor from scratch (Part 19): New order system (II)

In this article, we will develop a graphical order system of the "look what happens" type. Please note that we are not starting from scratch this time, but we will modify the existing system by adding more objects and events on the chart of the asset we are trading.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 2): Indicator Signals: Multi Timeframe Parabolic SAR Indicator

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than 1 symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Parabolic SAR or iSAR in multi-timeframes starting from PERIOD_M15 to PERIOD_D1.

Learn how to design a trading system by Accelerator Oscillator

A new article from our series about how to create simple trading systems by the most popular technical indicators. We will learn about a new one which is the Accelerator Oscillator indicator and we will learn how to design a trading system using it.

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

Swaps (Part I): Locking and Synthetic Positions

In this article I will try to expand the classic concept of swap trading methods. I will explain why I have come to the conclusion that this concept deserves special attention and is absolutely recommended for study.

Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

Practical Use of Kohonen Neural Networks in Algorithmic Trading. Part II. Optimizing and forecasting

Based on universal tools designed for working with Kohonen networks, we construct the system of analyzing and selecting the optimal EA parameters and consider forecasting time series. In Part I, we corrected and improved the publicly available neural network classes, having added necessary algorithms. Now, it is time to apply them to practice.

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

The Liquidity Grab Trading Strategy

The liquidity grab trading strategy is a key component of Smart Money Concepts (SMC), which seeks to identify and exploit the actions of institutional players in the market. It involves targeting areas of high liquidity, such as support or resistance zones, where large orders can trigger price movements before the market resumes its trend. This article explains the concept of liquidity grab in detail and outlines the development process of the liquidity grab trading strategy Expert Advisor in MQL5.

Build Self Optimizing Expert Advisors in MQL5 (Part 4): Dynamic Position Sizing

Successfully employing algorithmic trading requires continuous, interdisciplinary learning. However, the infinite range of possibilities can consume years of effort without yielding tangible results. To address this, we propose a framework that gradually introduces complexity, allowing traders to refine their strategies iteratively rather than committing indefinite time to uncertain outcomes.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

Automating Trading Strategies in MQL5 (Part 3): The Zone Recovery RSI System for Dynamic Trade Management

In this article, we create a Zone Recovery RSI EA System in MQL5, using RSI signals to trigger trades and a recovery strategy to manage losses. We implement a "ZoneRecovery" class to automate trade entries, recovery logic, and position management. The article concludes with backtesting insights to optimize performance and enhance the EA’s effectiveness.

Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

In this article, we automate the Head and Shoulders pattern in MQL5. We analyze its architecture, implement an EA to detect and trade it, and backtest the results. The process reveals a practical trading algorithm with room for refinement.

Movement continuation model - searching on the chart and execution statistics

This article provides programmatic definition of one of the movement continuation models. The main idea is defining two waves — the main and the correction one. For extreme points, I apply fractals as well as "potential" fractals - extreme points that have not yet formed as fractals.

Prices in DoEasy library (Part 64): Depth of Market, classes of DOM snapshot and snapshot series objects

In this article, I will create two classes (the class of DOM snapshot object and the class of DOM snapshot series object) and test creation of the DOM data series.

Neural networks made easy (Part 29): Advantage Actor-Critic algorithm

In the previous articles of this series, we have seen two reinforced learning algorithms. Each of them has its own advantages and disadvantages. As often happens in such cases, next comes the idea to combine both methods into an algorithm, using the best of the two. This would compensate for the shortcomings of each of them. One of such methods will be discussed in this article.

Deep Neural Networks (Part III). Sample selection and dimensionality reduction

This article is a continuation of the series of articles about deep neural networks. Here we will consider selecting samples (removing noise), reducing the dimensionality of input data and dividing the data set into the train/val/test sets during data preparation for training the neural network.

Everything you need to learn about the MQL5 program structure

Any Program in any programming language has a specific structure. In this article, you will learn essential parts of the MQL5 program structure by understanding the programming basics of every part of the MQL5 program structure that can be very helpful when creating our MQL5 trading system or trading tool that can be executable in the MetaTrader 5.

Brute force approach to pattern search (Part III): New horizons

This article provides a continuation to the brute force topic, and it introduces new opportunities for market analysis into the program algorithm, thereby accelerating the speed of analysis and improving the quality of results. New additions enable the highest-quality view of global patterns within this approach.