Using JSON Data API in your MQL projects

Introduction and Background

Mixing external data could improve decision-making in algorithm trading. APIs enable data transfer between different systems and help traders access different data sources like real-time market data from other brokers and banks, access economic indicators not just economic calendars, access news feeds or social sentiment analysis, online artificial intelligence tools, online forecast system or anything you can imagine that are available in API services. In this article, we will show you how to use this tool in the best way.

Using API data in Expert Advisors (EA) can give you new and more insight into the trading market that helps you make informed decisions, create more dynamic trading strategies, and manage risks better. Using API data, traders can improve the accuracy of trading signals using advanced technical indicators and sophisticated charting tools. This integration extends the capabilities of platforms like MetaTrader and provides access to valuable market intelligence such as natural language processing (NLP) for market sentiment analysis and access to fundamental data and news.

Introduction to Ziwox API

Ziwox is a data analysis system in Forex that contain a free API services. This API provides traders with comprehensive market data including prices, technical indicators, sentiment analysis, and fundamental data. It supports major and minor forex pairs and provides important metrics such as fundamental currency bias, AI-based forecasts, retail trader statistics, COT reports, technical support and resistance, market sentiment (risk-on and risk-off), bond yields, and VIX index. This rich data set enables multi-faceted market analysis, combining technical, fundamental, and Sentiment insights to create game-changing tools.

The interesting part of this data is that beyond price and technical data, we will have access to data generated by artificial intelligence or real analysts. Some of that data included: Fundamental analysis for forex pairs by an analysts team, NLP (Natural Language Processing) system outputs as a forex news sentiment, Price forecast generated by AI.

The API is easy to use, requiring a simple sign-up to generate an API key and access data in JSON or text format. This accessibility, along with its extensive data coverage, makes it an invaluable tool for enhancing trading strategies and developing custom indicators or automated trading systems.

Let's get a little more familiar: What is API?

APIs are mechanisms that enable two software components to communicate with each other using a set of definitions and protocols. For example, the weather bureau's software system contains daily weather data. The weather app on your phone “talks” to this system via an API and shows you the daily weather update on your phone.

API stands for Application Programming Interface. An interface can be thought of as a service contract between two applications. This contract defines how the two communicate with each other using requests and responses. Their API documentation contains information about how developers structure these requests and responses.

API architecture is usually described in terms of client and server. The program that sends the request is called the client and the program that sends the response is called the server. So in the weather example, the office's weather database is the server and the mobile app is the client.

API responses formats:

There are various formats for the responses or data exchange of an API. Depending on what purpose the API is made for, what other Applications is connected with, the format can change.These responses could be in JSON, HTML, TEXT, XML or CSV standards format.

For a brief introduction to this standard model:

1. JSON: JSON is a lightweight, human-readable data interchange format that used in API responses due to its simplicity and flexibility. It represents data as key-value pairs, making it easy to parse and manipulate in various programming languages.

An example of JSON response:

"id": 5687,

"source": "oanda",

"symbol": "EURUSD",

"price": "1.08562",

"high": "1.09211",

"low": "1.08154"

}

2. XML: XML or "eXtensible Markup Language" is another widely accepted format for representing structured data in API responses. Unlike JSON, XML uses tags to define hierarchical data structures, providing a more precise but structured representation. Its like HTML tags in web design and web structures. While JSON is preferred for its simplicity and readability, XML remains relevant in certain areas such as enterprise systems and legacy integrations.

Example of XML in Forex Factory News API:

<title>German Trade Balance</title>

<country>EUR</country>

<![CDATA[ 07-07-2024 ]]> </date>

<![CDATA[ 8:30am ]]>

</time>

<forecast><![CDATA[ 19.9B ]]></forecast>

<previous><![CDATA[ 22.1B ]]></previous>

<url>

<![CDATA[ https://www.forexfactory.com/calendar/125-eur-german-trade-balance ]]>

</url>

3. Other Formats: Addition to JSON and XML, APIs may use other response formats, such as plain text, HTM, protocol buffers, or CSV file, depending on domain-specific requirements and conventions. Each format has its own advantages and uses, from efficiency and performance to human readability and adaptability.

The JSON format has become a popular choice in web development due to its simplicity, readability, and easy to use. Fortunately, the service in question also uses this model for data exchange.

Setting up your environment and developement

To set up an environment in MQL5 for using JSON APIs, you'll need to follow a few steps.

MQL5 is a programming language for creating trading robots, technical indicators, scripts, and function libraries for the MetaTrader 5 trading platform.

Here's a general guide on how to set up an environment to work with JSON APIs in MQL5:

- Understand MQL5 Basics: Make sure you have a good understanding of the basics of MQL5 programming language, as well as basic concepts related to trading and financial markets. Familiarize yourself with the MQL4 documentation and MQL5 Reference to understand language syntax and functions.

- Choose a JSON Library: MQL5 does not have native support for JSON parsing, so you'll need to use a third-party library. You can find these libraries on forums such as the MQL5 community or GitHub. JSON Serialization and JSON Parser.

- Download and Install the JSON Library: Download the chosen JSON library and follow the installation instructions provided by the library. This typically involves placing the library file (mqh or mq5) in the Include folder of your MetaTrader installation.

- Include the Library in Your Code: At the beginning of your MQL script or EA (Expert Advisor), include the JSON library using the #include directive:

- Make HTTP Requests: To interact with JSON APIs, you'll need to make HTTP requests. Popular choices include WinHTTP or WebRequest. If you need other type of HTTP usage, Download and include an HTTP library that fits your needs.

- Save HTTP response to a file: Because most of these APIs are limited in terms of the number of requests, and concerned about the limit of API requests it is better to save the requested data in a file and use our saved file instead of repeated and unnecessary requests.

- Parse JSON Responses: Once you receive a response from the API, use the JSON library to parse the JSON data. The specific syntax will depend on the library you're using.

- Mixing: After classifying the JSON data, you can now combine the desired data with your program according to the model, strategy, or type.

//Use this type of file include if the file is in MQL include follder #include <JAson.mqh> // Use this type of file include If this file is next to your EA file/follder #include "JAson.mqh"

An instruction for API functions code

MQL5 offers the WebRequest function for HTTP requests, enabling interaction with APIs.

You can read more about Webrequest documentation > Webrequest and HTTP data exchange

Below is an example of MQL code for requesting JSON data from an API address use GET method:

// Required variables string cookie=NULL, headers="", apikey="your api key", value1="value 1", value2="value 2"; char post[],result[]; int res; string URL = "https://www.example.com/API?apikey="+apikey+"&data1=value1&data2="+value2; // Rest API address ResetLastError(); // Reset ast error // HTTP request via MQL Webrequest, GET method with apikey, value1, and value2 and 2000 millisecond timeout res=WebRequest("GET", URL, cookie, NULL, 2000, post, 0, result, headers); if(res==-1) // WebRequest error handling { int error = GetLastError(); if(error==4060) Print("Webrequest Error ",error); else if(error==5203) Print("HTTP request failed!"); else Print("Unknow HTTP request error("+string(error)+")! "); LastHTTPError=error; } else if (res==200) // The HTTP 200 status response code indicates that the request has succeeded { Print("HTTP request successful!"); // Use CharArrayToString to convert HTTP result array to a string string HTTP_Result = CharArrayToString(result, 0, 0, CP_UTF8); Print(HTTP_Result); }

This code sends a GET request to the specified API URL, demonstrating the simplicity of integrating API calls in MQL4.

Case Study: Successful MQL Expert Advisor with API Data Access

How to Use the Ziwox Forex Data API to Create an Auto Trade System by Using Fundamental and Real-time AI Forecast Data

In this article, we will explore how to use the Ziwox Forex Data API to build fundamental and real-time data-based tools in MetaQuotes Language (MQL). There are a lot of information on their API, But, we chose AI forecast for our project.

The AI forecast system on Ziwox terminal, According to their information, is based on the aggregation of data such as news, economic calendar data, interest rates and their rate changes, monetary and economic policies of central banks, market sentiment, strength of forex currencies, COT data and the retail trader's data. As a result, the whole market is analyzed so that this prediction can be used as valuable data.

We'll walk through the process of obtaining API data, Saving JSON data to a file, parsing JSON responses, and using this information to create an automated Expert Advisor (EA).

Our plan is to make an Expert Advisor, use a simple MA strategy as our technical signal, and trade if the AI forecast is in our direction as an AI filter.

Let's do our best.

Step 1: Signing Up and Generating an API Key

To start using the Ziwox Forex Data API, follow these steps:

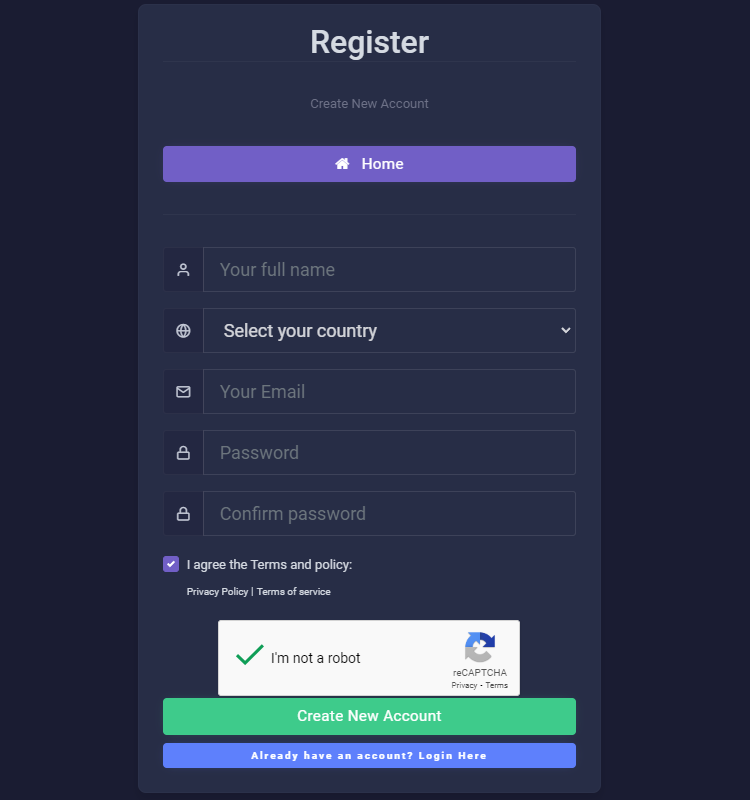

1. Sign up on the Ziwox Terminal HERE

2. Fill out the form with your information, read the terms and policies, and accept it, click on “I'm not a robot”, then click on “Create a new account”.

3. A verifying email is sent to your mailbox, verify your email.

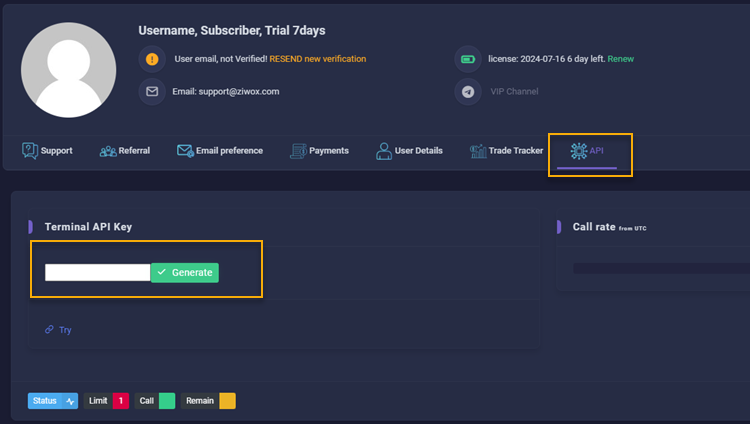

3. Login to your account here, navigate to the profile page, API tab here, and generate your API key by clicking on green Generate button

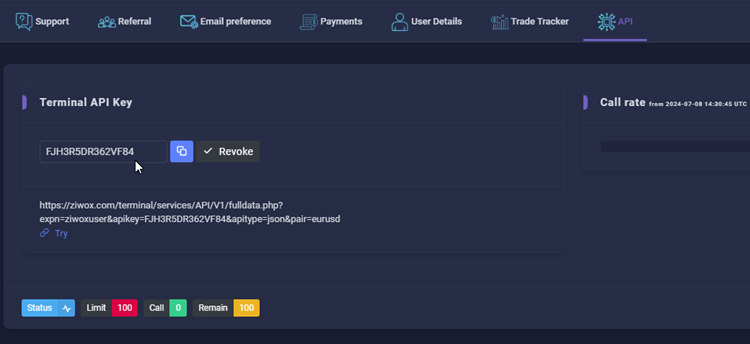

4. By generating an API key, now you get access to Ziwox API data. Copy that generated API code to use it on our project.

Step 2: Understanding the API Structure

The API link structure is as follows:

https://ziwox.com/terminal/services/API/V1/fulldata.php?expn=ziwoxuser&apikey={API_KEY}&apitype={REQUEST_TYPE}&pair={PAIR}

- {API_KEY}: Your unique API key from last step

- {REQUEST_TYPE}: The format of the response, either JSON or text.

- {PAIR}: The desired Forex pair in a standard format, without prefix or suffix, like as EURUSD, USDJPY, GBPUSD, XAUUSD, WTI…

Step 3: Test your API structure

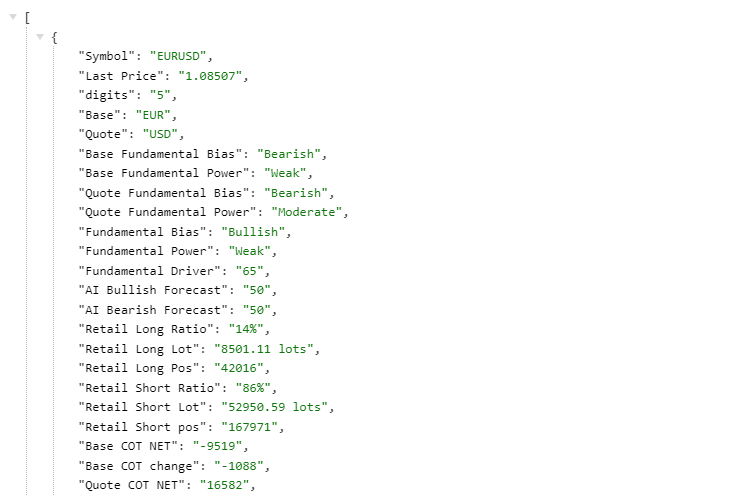

Now we want to check the API link structure and request a sample from Ziwox API. Simply, use the API link in Step 2, edit the parameters with your parameters, open your browser, enter the API link on the address bar and press enter.

If you edit the API link correctly, what we have on the HTTP response is like this:

With an incorrect API key, you have an error response like this:

{

"status": "error",

"desc": "invalid api key"

}

or if you enter the asset name incorrectly you may see this response:

{

"status": "error",

"desc": "invalid asset name!!"

}

Step 4: Implement an HTTP API Request function

If you succeed in step 3, now we are ready to implement a function to automate this part. Check this code:

datetime LastWebRequest = 0; // use this datetime var for limit failed request API bool GetAPI(string symbolname, string apikey, string filename) { Print("Get API Update"); bool NeedToUpdate = false; // Check if the API data file available if(FileGetInteger(filename,FILE_EXISTS,true)>=0) { // Check the latest update time from file modify date time if(TimeLocal()-(datetime)FileGetInteger(filename,FILE_MODIFY_DATE,true)>900) // update data every 15 min becasue of API call rate limitation NeedToUpdate = true; } else NeedToUpdate = true; if(NeedToUpdate && TimeLocal()-LastWebRequest>300) // retry failed API request every 5 min to avoid firewall IP block { string cookie=NULL,headers; char post[],result[]; int res; string URL = "https://www.ziwox.com/terminal/services/API/V1/fulldata.php?expn=ziwoxuser&apikey="+apikey+"&apitype=json&pair="+symbolname; ResetLastError(); int timeout=5000; res=WebRequest("GET", URL, cookie, NULL, timeout, post, 0, result, headers); if(res==-1) { LastWebRequest = TimeLocal(); int error = GetLastError(); if(error==4060) Print("API data Webrequest Error ",error, " Check your webrequest on Metatrader Expert option."); else if(error==5203) Print("HTTP request for "+symbolname+" Data failed!"); else Print("Unknow HTTP request error("+string(error)+")! "+symbolname+" Data"); return(false); } else if(res==200) { LastWebRequest = TimeLocal(); string HTTPString = CharArrayToString(result, 0, 0, CP_UTF8); Print("HTTP request for "+symbolname+" Data successful!"); Print(HTTPString); if (StringFind(HTTPString,"invalid api key",0)!=-1) { Alert("invalid api key"); return(false); } // Store the API data into a common folder file int filehandle=FileOpen(filename,FILE_READ|FILE_SHARE_READ|FILE_WRITE|FILE_SHARE_WRITE|FILE_BIN|FILE_COMMON); if(filehandle!=INVALID_HANDLE) { FileWriteArray(filehandle,result,0,ArraySize(result)); FileClose(filehandle); } } } return(true); }

This function takes an authentication API key (apikey), assets name (symbolname) and a file name (filename) as inputs from you. It embeds "apikey" and "symbolname" into the url to prepair the API request link.

Then it uses the Webrequest function to makes an HTTP request similar to what you did in the previous step and finaly it gets a response from server and put the related information in a file with "filename" name.

We call the API function like this:

string APIfilename = symbolname+"_API_Data.json"; // API store file name string APIKey = "76thfd67a6f867df7"; // Our unic API Key, change it with your API Key string SymbolRequest = "EURUSD"; // Symbol request, without prefix or suffix string APIJSON[]; bool APIGET = GetAPI(SymbolRequest, APIKey, APIfilename);

Step 5: Parsing JSON Data

As you remember in Step 3, the data received from the API contains an array of data. You can see the full explanation of this data in the table below.

| JSON Object name | Data type | Description |

|---|---|---|

| Symbol | string | Return the same asset/symbol name |

| Last Price | number | Last price of asset |

| digits | number | Digits of asset price |

| Base | string | Base name of pair |

| Quote | string | Quote name of pair |

| Base Fundamental Bias | string | Base currency fundamental bias or fundamental outlook. It could be Bullish or Bearish |

| Base Fundamental Power | string | Base fundamental bias power. It could be Weak, Moderate or Strong |

| Quote Fundamental Bias | string | Quote currency fundamental bias or fundamental outlook. It could be Bullish or Bearish |

| Quote Fundamental Power | string | Quote fundamental bias power. It could be Weak, Moderate or Strong |

| Fundamental Bias | string | Asset Fundamental bias, or Long-Term fundamental outlook of assets. Bullish or Bearish |

| Fundamental Power | string | Asset Fundamental power. Weak, Moderate or Strong |

| Fundamental Driver | string | Same as the asset fundamental bias, it a number, 50=Neutral, Bigger than 50 is Bullish and lower than 50 is Bearish |

| AI Bullish Forecast | Percentage | Asset price bull movement Forecast, bigger number more Bullish |

| AI Bearish Forecast | Percentage | Asset price bear movement Forecast, bigger number more Bearish |

| Retail Long Ratio | Percentage | Retail traders Long percentage |

| Retail Long Lot | number | Retail traders Long lot (order volume) |

| Retail Long Pos | number | Number of Retail traders Long positions |

| Retail Short Ratio | Percentage | Retail traders Short percentage |

| Retail Short Lot | number | Retail traders Short lot (order volume) |

| Retail Short pos | number | Number of Retail traders Short positions |

| Base COT NET | number | COT net position of Base currency |

| Base COT change | number | COT net position changes (weekly) of Base currency |

| Quote COT NET | number | COT net position of Quote currency |

| Quote COT change | number | COT net position changes (weekly) of Quote currency |

| COT chng Ratio | number | Large speculators Net position change ratio, positive number = Long sentiment, Negative number = Short sentiment |

| Risk Sentiment | string | Market risk sentiment, It would be Risk-ON, Risk-OFF or MIX |

| D1 Trend | string | Technical data, Daily Trend, Buy or Sell trend |

| D1 RSI | number | Indicator data, Daily RSI indicator value |

| D1 Stoch | number | Indicator data, Daily Stochastic indicator value |

| cci | numbers | CCI indicator values and |

| cci signal | string | CCI indicator signal |

| supports | numbers | Asset supports levels |

| resistance | numbers | Asset resistance levels |

| pivot | numbers | Pivot point/levels of asset |

| VIX Value | number | VIX, volatility index value |

| VIX Direction | number | VIX sentiment direction, upside = Fear and risky market, downside = greed market |

| VIX Buy driver | number | Positive number = greed market |

| VIX Sell driver | number | Negative number = Fear and risky market |

| Base Bond | number | Bond yield value of Base currency |

| Base Bond chg | number | Base currency Bond yield value change |

| Quote Bond | number | Bond yield value of Quote currency |

| Quote Bond chg | number | Quote currency Bond yield value change |

| US10Y | number | Value of United States 10 years bond yield |

| US10Y chg | number | H1 US10Y value change |

| Yield Driver | number | Positive number, favor to the base, negative number favor to the Quote |

| Allow To Trade | boolean | Ziwox Suggestion, trade ot better to stop trading |

| Stop Reason | String | If no trade is suggested, then you can see the reason here. |

| riskriversal | number | Value of Risk Reversal for this asset. Determine the PUT/CALL value |

| cesi | number | CESI value |

| yielddiff | number | Base currency yield value - Quote currency yield value |

| banksposition | number | Bank institutions position ratio |

| macrofundamental | number | Macro economic value, a positive number is a bullish driver, a negative number is a bearish driver for asset |

| longtermsentiment | number | Long-term sentiment of asset, based on Economy, Politics... |

| seasonal | Percentage | The possibility of asset growth or decline in terms of seasonal data |

In this Case Study/example, we like to use Bearish/Bullish AI forecast. Now, to design this function, we read the data stored in the file (step 4) by the JSON library and extract what we need.

The function would be like this:

#include "JAson.mqh" // include the JSON librery in our project CJAVal JsonValue; void JsonDataParse(string filename, string &_APIJSON[]) { bool UpdateData = false; for (int arraIn=0; arraIn<ArraySize(APIJSON); arraIn++) APIJSON[arraIn]=""; if(FileGetInteger(filename,FILE_EXISTS,true)>=0) { int FileHandle =FileOpen(filename,FILE_READ|FILE_SHARE_READ|FILE_WRITE|FILE_SHARE_WRITE|FILE_BIN|FILE_COMMON); char jsonarray[]; FileReadArray(FileHandle,jsonarray); FileClose(FileHandle); JsonValue.Clear(); JsonValue.Deserialize(CharArrayToString(jsonarray, 0, 0, CP_UTF8)); _APIJSON[0] = JsonValue[0]["Symbol"].ToStr(); _APIJSON[1] = JsonValue[0]["Fundamental Bias"].ToStr(); _APIJSON[2] = JsonValue[0]["Fundamental Power"].ToStr(); _APIJSON[3] = JsonValue[0]["AI Bullish Forecast"].ToStr(); _APIJSON[4] = JsonValue[0]["AI Bearish Forecast"].ToStr(); _APIJSON[5] = JsonValue[0]["Retail Long Ratio"].ToStr(); _APIJSON[6] = JsonValue[0]["Retail Short Ratio"].ToStr(); _APIJSON[7] = JsonValue[0]["Retail Short Lot"].ToStr(); _APIJSON[8] = JsonValue[0]["Retail Short pos"].ToStr(); _APIJSON[9] = JsonValue[0]["Base COT NET"].ToStr(); _APIJSON[10] = JsonValue[0]["Base COT change"].ToStr(); _APIJSON[11] = JsonValue[0]["Quote COT NET"].ToStr(); _APIJSON[12] = JsonValue[0]["Quote COT change"].ToStr(); _APIJSON[13] = JsonValue[0]["COT chng Ratio"].ToStr(); _APIJSON[14] = JsonValue[0]["Risk Sentiment"].ToStr(); } }

And we call the JSON function like this:

string APIfilename = symbolname+"_API_Data.json"; // API store file name string API_DATA[]; // define an array variable to store API details JsonDataParse( APIfilename,API_DATA);

Step 6: Creating a Simple Moving Average Crossover Strategy

Using the extracted data, stored in “APIJSON” variable, we can now create automated trading strategies and mix our strategy with an AI forecast system. Here’s a basic example of how to use the data in an EA:

You can choose any strategy that you like, But in this article, we try to choose a simple strategy because our goal here is to guide and teach you how to use such a tool in your projects so that you can make it one step better.

A Moving Average Crossover strategy is a popular technique used by traders to identify potential buy and sell signals.

This strategy uses two moving averages. A short-term and a long-term to determine the market trend.

When the short-term MA crosses above the long-term MA, it signals a buy, and when it crosses below, it signals a sell.

Let's do that:

shortMA = iMA(Symbol(), 0, shortMAPeriod, 0, MODE_SMA, PRICE_CLOSE, 0); longMA = iMA(Symbol(), 0, longMAPeriod, 0, MODE_SMA, PRICE_CLOSE, 0); // Check for crossover signals if ( int(APIJSON[3])>=60 ) // if bullish forecast is higher than 60% if (shortMA > longMA) // BUY trend { if (OrdersTotal() == 0) { ticket = OrderSend(Symbol(), OP_BUY, Lots, Ask, 3, 0, 0, "Buy Order", 0, 0, Green); if (ticket < 0) Print("Error opening buy order: ", GetLastError()); } } if ( int(APIJSON[4])>=60 ) // if bearish forecast is higher than 60% if (shortMA < longMA) // Sell trend { if (OrdersTotal() == 0) { ticket = OrderSend(Symbol(), OP_SELL, Lots, Bid, 3, 0, 0, "Sell Order", 0, 0, Red); if (ticket < 0) Print("Error opening sell order: ", GetLastError()); } }

Step 7: Using JSON Data for Signal Filtering

To improve the MA crossover strategy, we use the JSON data, and AI forecast ratio from the Ziwox API to filter signals.

For example, if MA cross shows a buy trend, and if the AI forecast is over 50% that signs bullish/upward movement, it's a good idea to enter a buy. On the contrary, if the technical analysis ( MA ) has a sell signal, we will only sell where the analytical and forecast data are in the same direction as the sell. In this way, the entry risk can be reduced and the win rate can be increased

Based on the arrangement of the JSON data in step 4, the AI Forecast, Bullish percentage is in 3rd/third element of our array and the Bearish Forecast is in the fourth element.

The code may like this:

void OnTick() { if (!APIOK) return; double shortMA, longMA; long ticket = -1; if(IsNewCandle()) { shortMA = iMA(Symbol(), 0, shortMAPeriod, 0, MODE_SMA, PRICE_CLOSE, 0); longMA = iMA(Symbol(), 0, longMAPeriod, 0, MODE_SMA, PRICE_CLOSE, 0); // Check for crossover signals if ( int(APIJSON[3])>=60 ) // if bullish forecast is higher than 60% if (shortMA > longMA) // BUY trend { if (OrdersTotal() == 0) { ticket = OrderSend(Symbol(), OP_BUY, Lots, Ask, 3, 0, 0, "Buy Order", 0, 0, Green); if (ticket < 0) Print("Error opening buy order: ", GetLastError()); } } if ( int(APIJSON[4])>=60 ) // if bearish forecast is higher than 60% if (shortMA < longMA) // Sell trend { if (OrdersTotal() == 0) { ticket = OrderSend(Symbol(), OP_SELL, Lots, Bid, 3, 0, 0, "Sell Order", 0, 0, Red); if (ticket < 0) Print("Error opening sell order: ", GetLastError()); } } } }

Conclusion

Integrating API data with MQL4 empowers traders to create more adaptive and data-driven Expert Advisors. By leveraging real-time information from external sources, traders can enhance their strategies and make more informed trading decisions in dynamic market conditions. You can access data beyond raw market prices. This approach allows you to combine technical and fundamental analysis, increasing the effectiveness of your trading strategies.

Final Code is ready to download below.

I am here, Ready to answer any question, suggestion, or criticism.

Best regards and trade well.

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Creating an Interactive Graphical User Interface in MQL5 (Part 2): Adding Controls and Responsiveness

Creating an Interactive Graphical User Interface in MQL5 (Part 2): Adding Controls and Responsiveness

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

Price Driven CGI Model: Theoretical Foundation

Price Driven CGI Model: Theoretical Foundation

Using PatchTST Machine Learning Algorithm for Predicting Next 24 Hours of Price Action

Using PatchTST Machine Learning Algorithm for Predicting Next 24 Hours of Price Action

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

If necessary, you can use the JAson.mqh library, which can be found in the original code of our companion.

What a horrible way for google translator to work.

Without the JAson library, of course, it won't work.

The library is not in his code, it's here, and the author has specified that.

Yes, I completely understand it. Additionally, we are required to use this standard because nearly all financial data providers use this method.

Hello, here it is, so what I asked for is for me to post it in the mql5 community =

Version for MQL5 METATRADER 5 I made changes to the code so that it would work in Metatrader 5. The changes were also made regarding the coding for better conditions in the current commercial situation. All the changes were to adapt the code to Metatrader 5. It is functional. And just download this file and run it. If necessary, the JAson.mqh library, which is found in the original code of our companion. My name is Ney Borges. I am from Brazil, state of Goiás, city of Caldas Novas, in the middle of the forest of Brazil. It was very difficult to learn alone without anyone to help, but here in the community I learned a lot. Thank you.

Version for MQL5 METATRADER 5 I made changes to the code so that it would work in Metatrader 5. The changes were also made regarding the coding for better conditions in the current commercial situation. All the changes were to adapt the code to Metatrader 5. It is functional. And just download this file and run it. If necessary, the JAson.mqh library, which is found in the original code of our companion. My name is Ney Borges. I am from Brazil, state of Goiás, city of Caldas Novas, in the middle of the forest of Brazil. It was very difficult to learn alone without anyone to help, but here in the community I learned a lot. Thank you.

Brasil - Goiás - Caldas Novas - Ney Borges

Fiz algumas correçoes ao codigo para funcionar no MQL5 gostaria que por gentilesa verificasse e retornar, obrigado - Sara Sabaghi

Fiz algumas correçoes ao codigo para funcionar no MQL5 gostaria que por gentilesa verificasse e retornar, obrigado - Sara Sabaghi

Hi dude

Thank you for sharing your code. Yeah, I tested it. It works fine

Switched to binary. The size of the same data is now 1.2 Mb. Parsing into required arrays of structures now takes 5 milliseconds.

That's a bit too much for you. Here it takes 12 ms, but the data is 80 Mb.

That's a bit much. It's 12 ms here, but the data is 80 Mb.