MQL5 Cookbook - Multi-Currency Expert Advisor and Working with Pending Orders in MQL5

Introduction

This time we are going to create a multi-currency Expert Advisor with a trading algorithm based on work with the pending orders Buy Stop and Sell Stop. The pattern we are going to create will be designed for the intra-day trade/tests. The article considers the following matters:

- Trading in a specified time range. Let's create a feature that will allow us to set up the time of the beginning and the end of trading. For instance, it can be the time of the European or American trading sessions. For sure there will be an opportunity to find the most suitable time range when optimizing parameters of the Expert Advisor.

- Placing/modifying/deleting pending orders.

- Processing of trade events: checking if the last position was closed at Take Profit or Stop Loss and control over the history of the deals for each symbol.

Expert Advisor Development

We are going to use the code from the article MQL5 Cookbook: Multi-Currency Expert Advisor - Simple, Neat and Quick Approach as a template. Though the essential structure of the pattern will remain the same, some significant changes will be introduced. The Expert Advisor will be designed for the intra-day trade, however, this mode could be switched off should the necessity arise. Pending orders, in such case, will always be placed immediately (on New Bar event) if a position has been closed.

Let's start with the external parameters of the expert advisor. At first we will create a new enumeration ENUM_HOURS in the include file Enums.mqh. The number of identifiers in this enumeration is equal to the number of hours in a day:

//--- Hours Enumeration enum ENUM_HOURS { h00 = 0, // 00 : 00 h01 = 1, // 01 : 00 h02 = 2, // 02 : 00 h03 = 3, // 03 : 00 h04 = 4, // 04 : 00 h05 = 5, // 05 : 00 h06 = 6, // 06 : 00 h07 = 7, // 07 : 00 h08 = 8, // 08 : 00 h09 = 9, // 09 : 00 h10 = 10, // 10 : 00 h11 = 11, // 11 : 00 h12 = 12, // 12 : 00 h13 = 13, // 13 : 00 h14 = 14, // 14 : 00 h15 = 15, // 15 : 00 h16 = 16, // 16 : 00 h17 = 17, // 17 : 00 h18 = 18, // 18 : 00 h19 = 19, // 19 : 00 h20 = 20, // 20 : 00 h21 = 21, // 21 : 00 h22 = 22, // 22 : 00 h23 = 23 // 23 : 00 };

Then in the list of external parameters we will create four parameters related to trading in a time range:

- TradeInTimeRange - enabling/disabling the mode. As already mentioned, we are going to make work of the Expert Advisor possible not only within a certain time range but also around the clock, that is in a continuous mode.

- StartTrade - the hour when a trading session starts. As soon as the server time is equal to this value, the Expert Advisor will place pending orders, providing that the TradeInTimeRange mode is on.

- StopOpenOrders - the hour of the end of placing orders. When the server time is equal to this value the Expert Advisor will stop placing pending orders if a position is closed.

- EndTrade - the hour when a trading session stops. Once the server time is equal to this value the Expert Advisor stops trading. An open position for the specified symbol will be closed and pending orders will be deleted.

The list of the external parameters will look as shown below. The given example is for two symbols. In the parameter PendingOrder we set up a distance from the current price in points.

//--- External parameters of the Expert Advisor sinput long MagicNumber = 777; // Magic number sinput int Deviation = 10; // Slippage //--- sinput string delimeter_00=""; // -------------------------------- sinput string Symbol_01 ="EURUSD"; // Symbol 1 input bool TradeInTimeRange_01 =true; // | Trading in a time range input ENUM_HOURS StartTrade_01 = h10; // | The hour of the beginning of a trading session input ENUM_HOURS StopOpenOrders_01 = h17; // | The hour of the end of placing orders input ENUM_HOURS EndTrade_01 = h22; // | The hour of the end of a trading session input double PendingOrder_01 = 50; // | Pending order input double TakeProfit_01 = 100; // | Take Profit input double StopLoss_01 = 50; // | Stop Loss input double TrailingStop_01 = 10; // | Trailing Stop input bool Reverse_01 = true; // | Position reversal input double Lot_01 = 0.1; // | Lot //--- sinput string delimeter_01=""; // -------------------------------- sinput string Symbol_02 ="AUDUSD"; // Symbol 2 input bool TradeInTimeRange_02 =true; // | Trading in a time range input ENUM_HOURS StartTrade_02 = h10; // | The hour of the beginning of a trading session input ENUM_HOURS StopOpenOrders_02 = h17; // | The hour of the end of placing orders input ENUM_HOURS EndTrade_02 = h22; // | The hour of the end of a trading session input double PendingOrder_02 = 50; // | Pending order input double TakeProfit_02 = 100; // | Take Profit input double StopLoss_02 = 50; // | Stop Loss input double TrailingStop_02 = 10; // | Trailing Stop input bool Reverse_02 = true; // | Position reversal input double Lot_02 = 0.1; // | Lot

Also correspondent changes have to be made in the list of arrays which will be filled with the values of external parameters:

//--- Arrays for storing external parameters string Symbols[NUMBER_OF_SYMBOLS]; // Symbol bool TradeInTimeRange[NUMBER_OF_SYMBOLS]; // Trading in a time range ENUM_HOURS StartTrade[NUMBER_OF_SYMBOLS]; // The hour of the beginning of a trading session ENUM_HOURS StopOpenOrders[NUMBER_OF_SYMBOLS]; // The hour of the end of placing orders ENUM_HOURS EndTrade[NUMBER_OF_SYMBOLS]; // The hour of the end of a trading session double PendingOrder[NUMBER_OF_SYMBOLS]; // Pending order double TakeProfit[NUMBER_OF_SYMBOLS]; // Take Profit double StopLoss[NUMBER_OF_SYMBOLS]; // Stop Loss double TrailingStop[NUMBER_OF_SYMBOLS]; // Trailing Stop bool Reverse[NUMBER_OF_SYMBOLS]; // Position Reversal double Lot[NUMBER_OF_SYMBOLS]; // Lot

Now we are going to arrange that in the reversal mode (the Reverse parameter value is true) the opposite pending order is deleted and placed anew, when one of the pending orders is triggered. We can not change the volume of the pending order as we would do in case of changing its price levels (order price, Stop Loss, Take Profit). We, therefore, have to delete it and place a new pending order with the required volume.

Moreover, if the reversal mode is enabled and Trailing Stop level is set up at the same time, then the pending order will be following the price. If, on top of that, Stop Loss is placed, its price value will be calculated and specified based on the pending order.

On the global scope let's create two string variables for the pending order comments:

//--- Pending order comments string comment_top_order ="top_order"; string comment_bottom_order ="bottom_order";

At the initialization in the function OnInit() during Expert Advisor loading, we will check the external parameters for correctness. Criteria for the assessment are as follows. When the TradeInTimeRange mode is enabled, the hour of the beginning of a trade session must not be one hour less than the hour of the end of placing pending orders. The hour of the end of placing pending orders, in its turn, must not be one hour less than the hour of the end of a trade session. Let's write the function CheckInputParameters() that will carry out such a check:

//+------------------------------------------------------------------+ //| Checks external parameters | //+------------------------------------------------------------------+ bool CheckInputParameters() { //--- Loop through the specified symbols for(int s=0; s<NUMBER_OF_SYMBOLS; s++) { //--- If there is no symbol and the TradeInTimeRange mode is disabled, move on to the following symbol. if(Symbols[s]=="" || !TradeInTimeRange[s]) continue; //--- Check the accuracy of the start and the end of a trade session time if(StartTrade[s]>=EndTrade[s]) { Print(Symbols[s], ": The hour of the beginning of a trade session("+IntegerToString(StartTrade[s])+") " "must be less than the hour of the end of a trade session"("+IntegerToString(EndTrade[s])+")!"); return(false); } //--- A trading session is to start no later that one hour before the hour of placing pending orders. // Pending orders are to be placed no later than one hour before the hour of the end of a trading session. if(StopOpenOrders[s]>=EndTrade[s] || StopOpenOrders[s]<=StartTrade[s]) { Print(Symbols[s], ": The hour of the end of placing orders ("+IntegerToString(StopOpenOrders[s])+") " "is to be less than the hour of the end ("+IntegerToString(EndTrade[s])+") and " "greater than the hour of the beginning of a trading session ("+IntegerToString(StartTrade[s])+")!"); return(false); } } //--- Parameters are correct return(true); }

To implement this pattern we will need the functions that will carry out checks for staying within the specified time ranges for trade and placing pending orders. We shall name those functions IsInTradeTimeRange() and IsInOpenOrdersTimeRange(). They both work the same, the only difference is in the upper limit of the range in check. Further along we shall see where these functions will be used.

//+------------------------------------------------------------------+ //| Checks if we are within the time range for trade | //+------------------------------------------------------------------+ bool IsInTradeTimeRange(int symbol_number) { //--- If TradeInTimeRange mode is enabled if(TradeInTimeRange[symbol_number]) { //--- Structure of the date and time MqlDateTime last_date; //--- Get the last value of the date and time data set TimeTradeServer(last_date); //--- Outside of the allowed time range if(last_date.hour<StartTrade[symbol_number] || last_date.hour>=EndTrade[symbol_number]) return(false); } //--- Within the allowed time range return(true); } //+------------------------------------------------------------------+ //| Checks if we are within the time range for placing orders | //+------------------------------------------------------------------+ bool IsInOpenOrdersTimeRange(int symbol_number) { //--- If the TradeInTimeRange mode if enabled if(TradeInTimeRange[symbol_number]) { //--- Structure of the date and time MqlDateTime last_date; //--- Get the last value of the date and time data set TimeTradeServer(last_date); //--- Outside the allowed time range if(last_date.hour<StartTrade[symbol_number] || last_date.hour>=StopOpenOrders[symbol_number]) return(false); } //--- Within the allowed time range return(true); }

Previous articles already considered functions for receiving properties of position, symbol and the history of the deals. In this article we will need a similar function for getting properties of a pending order. In the include file Enums.mqh we are going to create an enumeration with properties of a pending order:

//--- Enumeration of the properties of a pending order enum ENUM_ORDER_PROPERTIES { O_SYMBOL = 0, O_MAGIC = 1, O_COMMENT = 2, O_PRICE_OPEN = 3, O_PRICE_CURRENT = 4, O_PRICE_STOPLIMIT = 5, O_VOLUME_INITIAL = 6, O_VOLUME_CURRENT = 7, O_SL = 8, O_TP = 9, O_TIME_SETUP = 10, O_TIME_EXPIRATION = 11, O_TIME_SETUP_MSC = 12, O_TYPE_TIME = 13, O_TYPE = 14, O_ALL = 15 };

Then in the include file TradeFunctions.mqh we need to write a structure with the properties of a pending order and then instantiate it:

//-- Properties of a pending order struct pending_order_properties { string symbol; // Symbol long magic; // Magic number string comment; // Comment double price_open; // Price specified in the order double price_current; // Current price of the order symbol double price_stoplimit; // Limit order price for the Stop Limit order double volume_initial; // Initial order volume double volume_current; // Current order volume double sl; // Stop Loss level double tp; // Take Profit level datetime time_setup; // Order placement time datetime time_expiration; // Order expiration time datetime time_setup_msc; // The time of placing an order for execution in milliseconds since 01.01.1970 datetime type_time; // Order lifetime ENUM_ORDER_TYPE type; // Position type }; //--- Variable of the order features pending_order_properties ord;

To get a property or even all properties of a pending order we are going to write the function GetPendingOrderProperties(). After the pending order has been selected, we can use this function for retrieving the properties of the order. The way to do it will be described further down.

//+------------------------------------------------------------------+ //| Retrieves the properties of the previously selected pending order| //+------------------------------------------------------------------+ void GetPendingOrderProperties(ENUM_ORDER_PROPERTIES order_property) { switch(order_property) { case O_SYMBOL : ord.symbol=OrderGetString(ORDER_SYMBOL); break; case O_MAGIC : ord.magic=OrderGetInteger(ORDER_MAGIC); break; case O_COMMENT : ord.comment=OrderGetString(ORDER_COMMENT); break; case O_PRICE_OPEN : ord.price_open=OrderGetDouble(ORDER_PRICE_OPEN); break; case O_PRICE_CURRENT : ord.price_current=OrderGetDouble(ORDER_PRICE_CURRENT); break; case O_PRICE_STOPLIMIT : ord.price_stoplimit=OrderGetDouble(ORDER_PRICE_STOPLIMIT); break; case O_VOLUME_INITIAL : ord.volume_initial=OrderGetDouble(ORDER_VOLUME_INITIAL); break; case O_VOLUME_CURRENT : ord.volume_current=OrderGetDouble(ORDER_VOLUME_CURRENT); break; case O_SL : ord.sl=OrderGetDouble(ORDER_SL); break; case O_TP : ord.tp=OrderGetDouble(ORDER_TP); break; case O_TIME_SETUP : ord.time_setup=(datetime)OrderGetInteger(ORDER_TIME_SETUP); break; case O_TIME_EXPIRATION : ord.time_expiration=(datetime)OrderGetInteger(ORDER_TIME_EXPIRATION); break; case O_TIME_SETUP_MSC : ord.time_setup_msc=(datetime)OrderGetInteger(ORDER_TIME_SETUP_MSC); break; case O_TYPE_TIME : ord.type_time=(datetime)OrderGetInteger(ORDER_TYPE_TIME); break; case O_TYPE : ord.type=(ENUM_ORDER_TYPE)OrderGetInteger(ORDER_TYPE); break; case O_ALL : ord.symbol=OrderGetString(ORDER_SYMBOL); ord.magic=OrderGetInteger(ORDER_MAGIC); ord.comment=OrderGetString(ORDER_COMMENT); ord.price_open=OrderGetDouble(ORDER_PRICE_OPEN); ord.price_current=OrderGetDouble(ORDER_PRICE_CURRENT); ord.price_stoplimit=OrderGetDouble(ORDER_PRICE_STOPLIMIT); ord.volume_initial=OrderGetDouble(ORDER_VOLUME_INITIAL); ord.volume_current=OrderGetDouble(ORDER_VOLUME_CURRENT); ord.sl=OrderGetDouble(ORDER_SL); ord.tp=OrderGetDouble(ORDER_TP); ord.time_setup=(datetime)OrderGetInteger(ORDER_TIME_SETUP); ord.time_expiration=(datetime)OrderGetInteger(ORDER_TIME_EXPIRATION); ord.time_setup_msc=(datetime)OrderGetInteger(ORDER_TIME_SETUP_MSC); ord.type_time=(datetime)OrderGetInteger(ORDER_TYPE_TIME); ord.type=(ENUM_ORDER_TYPE)OrderGetInteger(ORDER_TYPE); break; //--- default: Print("Retrieved feature of the pending order was not taken into account in the enumeration "); return; } }

Now we are going to write basic functions for placing, modifying and deleting pending orders. The function SetPendingOrder() places a pending order. If the pending order failed to be placed, the mentioned function will make an entry in the journal with an error code and its description:

//+------------------------------------------------------------------+ //| Places a pending order | //+------------------------------------------------------------------+ void SetPendingOrder(int symbol_number, // Symbol number ENUM_ORDER_TYPE order_type, // Order type double lot, // Volume double stoplimit_price, // Level of the StopLimit order double price, // Price double sl, // Stop Loss double tp, // Take Profit ENUM_ORDER_TYPE_TIME type_time, // Order Expiration string comment) // Comment //--- Set magic number in the trade structure trade.SetExpertMagicNumber(MagicNumber); //--- If a pending order failed to be placed, print an error message if(!trade.OrderOpen(Symbols[symbol_number], order_type,lot,stoplimit_price,price,sl,tp,type_time,0,comment)) Print("Error when placing a pending order: ",GetLastError()," - ",ErrorDescription(GetLastError())); }

The function ModifyPendingOrder() modifies a pending order. We are going to arrange so that we can change not only the price of the order but also its volume and pass it as the last parameter of the function. If the passed volume value is greater than zero, it means that the pending order has to be deleted and a new one with a required volume value placed. In all other cases we simply modify the existing order by changing the price value.

//+------------------------------------------------------------------+ //| Modifies a pending order | //+------------------------------------------------------------------+ void ModifyPendingOrder(int symbol_number, //Symbol number ulong ticket, // Order ticket ENUM_ORDER_TYPE type, // Order type double price, // Order price double sl, // Stop Loss of the order double tp, // Take Profit of the order ENUM_ORDER_TYPE_TIME type_time, // Order expiration datetime time_expiration, // Order expiration time double stoplimit_price, // Price string comment, // Comment double volume) // Volume { //--- If the passed volume value is non-zero, delete the order and place it again if(volume>0) { //--- If the order failed to be deleted, exit if(!DeletePendingOrder(ticket)) return; //--- Place a pending order SetPendingOrder(symbol_number,type,volume,0,price,sl,tp,type_time,comment); //--- Adjust Stop Loss of position as related to the order CorrectStopLossByOrder(symbol_number,price,type); } //--- If the passed volume value is zero, modify the order else { //--- If the pending order failed to be modified, print a relevant message if(!trade.OrderModify(ticket,price,sl,tp,type_time,time_expiration,stoplimit_price)) Print("Error when modifying the pending order price: ", GetLastError()," - ",ErrorDescription(GetLastError())); //--- Otherwise adjust Stop Loss of position as related to the order else CorrectStopLossByOrder(symbol_number,price,type); } }

In the code above highlighted are two new functions DeletePendingOrder() and CorrectStopLossByOrder(). The first one deletes a pending order and the second one adjusts Stop Loss of the position as related to the pending order.

//+------------------------------------------------------------------+ //| Deletes a pending order | //+------------------------------------------------------------------+ bool DeletePendingOrder(ulong ticket) { //--- If a pending order failed to get deleted, print a relevant message if(!trade.OrderDelete(ticket)) { Print("Error when deleting a pending order: ",GetLastError()," - ",ErrorDescription(GetLastError())); return(false); } //--- return(true); } //+------------------------------------------------------------------+ //| Modifies StopLoss of the position as related to the pending order| //+------------------------------------------------------------------+ void CorrectStopLossByOrder(int symbol_number, // Symbol number double price, // Order Price ENUM_ORDER_TYPE type) // Order Type { //--- If Stop Loss disabled, exit if(StopLoss[symbol_number]==0) return; //--- If Stop Loss enabled double new_sl=0.0; // New Stop Loss value //--- Get a Point value GetSymbolProperties(symbol_number,S_POINT); //--- Number of decimal places GetSymbolProperties(symbol_number,S_DIGITS); //--- Get Take Profit of position GetPositionProperties(symbol_number,P_TP); //--- Calculate as related to the order type switch(type) { case ORDER_TYPE_BUY_STOP : new_sl=NormalizeDouble(price+CorrectValueBySymbolDigits(StopLoss[symbol_number]*symb.point),symb.digits); break; case ORDER_TYPE_SELL_STOP : new_sl=NormalizeDouble(price-CorrectValueBySymbolDigits(StopLoss[symbol_number]*symb.point),symb.digits); break; } //--- Modify the position if(!trade.PositionModify(Symbols[symbol_number],new_sl,pos.tp)) Print("Error when modifying position: ",GetLastError()," - ",ErrorDescription(GetLastError())); }

Before placing a pending order, it is also necessary to check if a pending order with the same comments already exists. As mentioned in the beginning of this article, we shall place the top Buy Stop order with a comment "top_order" and the Sell Stop order with a comment "bottom_order". To facilitate such a check let's write a function named CheckPendingOrderByComment():

//+------------------------------------------------------------------+ //| Checks existence of a pending order by a comment | //+------------------------------------------------------------------+ bool CheckPendingOrderByComment(int symbol_number,string comment) { int total_orders =0; // Total number of pending orders string order_symbol =""; // Order Symbol string order_comment =""; // Order Comment //--- Get the total number of pending orders total_orders=OrdersTotal(); //--- Loop through the total orders for(int i=total_orders-1; i>=0; i--) { //---Select the order by the ticket if(OrderGetTicket(i)>0) { //--- Get the symbol name order_symbol=OrderGetString(ORDER_SYMBOL); //--- If the symbols are equal if(order_symbol==Symbols[symbol_number]) { //--- Get the order comment order_comment=OrderGetString(ORDER_COMMENT); //--- If the comments are equal if(order_comment==comment) return(true); } } } //--- Order with a specified comment not found return(false); }

The code above shows that the total number of orders can be obtained using the system function OrdersTotal(). However, to get the total number of pending orders for a specified symbol we are going to write a user-defined function. We shall name it OrdersTotalBySymbol():

//+------------------------------------------------------------------+ //| Returns the total number of orders for the specified symbol | //+------------------------------------------------------------------+ int OrdersTotalBySymbol(string symbol) { int count =0; // Order counter int total_orders =0; // Total number of pending orders //--- Get the total number of pending orders total_orders=OrdersTotal(); //--- Loop through the total number of orders for(int i=total_orders-1; i>=0; i--) { //--- If an order has been selected if(OrderGetTicket(i)>0) { //--- Get the order symbol GetOrderProperties(O_SYMBOL); //--- If the order symbol and the specified symbol are equal if(ord.symbol==symbol) //--- Increase the counter count++; } } //--- Return the total number of orders return(count); }

Before placing a pending order it is necessary to calculate a price for it as well as Stop Loss and Take Profit levels if required. If the reversal mode is enabled, we will need separate user-defined functions for recalculating and changing Trailing Stop levels.

To calculate a pending order price let's write the function CalculatePendingOrder():

//+------------------------------------------------------------------+ //| Calculates the pending order level(price) | //+------------------------------------------------------------------+ double CalculatePendingOrder(int symbol_number,ENUM_ORDER_TYPE order_type) { //--- For the calculated pending order value double price=0.0; //--- If the value for SELL STOP order is to be calculated if(order_type==ORDER_TYPE_SELL_STOP) { //--- Calculate level price=NormalizeDouble(symb.bid-CorrectValueBySymbolDigits(PendingOrder[symbol_number]*symb.point),symb.digits); //--- Return calculated value if it is less than the lower limit of Stops level // If the value is equal or greater, return the adjusted value return(price<symb.down_level ? price : symb.down_level-symb.offset); } //--- If the value for BUY STOP order is to be calculated if(order_type==ORDER_TYPE_BUY_STOP) { //--- Calculate level price=NormalizeDouble(symb.ask+CorrectValueBySymbolDigits(PendingOrder[symbol_number]*symb.point),symb.digits); //--- Return the calculated value if it is greater than the upper limit of Stops level // If the value is equal or less, return the adjusted value return(price>symb.up_level ? price : symb.up_level+symb.offset); } //--- return(0.0); }

Below is the function code for calculating Stop Loss and Take Profit levels in a pending order.

//+------------------------------------------------------------------+ //| Calculates Stop Loss level for a pending order | //+------------------------------------------------------------------+ double CalculatePendingOrderStopLoss(int symbol_number,ENUM_ORDER_TYPE order_type,double price) { //--- If Stop Loss is required if(StopLoss[symbol_number]>0) { double sl =0.0; // For the Stop Loss calculated value double up_level =0.0; // Upper limit of Stop Levels double down_level =0.0; // Lower limit of Stop Levels //--- If the value for BUY STOP order is to be calculated if(order_type==ORDER_TYPE_BUY_STOP) { //--- Define lower threshold down_level=NormalizeDouble(price-symb.stops_level*symb.point,symb.digits); //--- Calculate level sl=NormalizeDouble(price-CorrectValueBySymbolDigits(StopLoss[symbol_number]*symb.point),symb.digits); //--- Return the calculated value if it is less than the lower limit of Stop level // If the value is equal or greater, return the adjusted value return(sl<down_level ? sl : NormalizeDouble(down_level-symb.offset,symb.digits)); } //--- If the value for the SELL STOP order is to be calculated if(order_type==ORDER_TYPE_SELL_STOP) { //--- Define the upper threshold up_level=NormalizeDouble(price+symb.stops_level*symb.point,symb.digits); //--- Calculate the level sl=NormalizeDouble(price+CorrectValueBySymbolDigits(StopLoss[symbol_number]*symb.point),symb.digits); //--- Return the calculated value if it is greater than the upper limit of the Stops level // If the value is less or equal, return the adjusted value. return(sl>up_level ? sl : NormalizeDouble(up_level+symb.offset,symb.digits)); } } //--- return(0.0); } //+------------------------------------------------------------------+ //| Calculates the Take Profit level for a pending order | //+------------------------------------------------------------------+ double CalculatePendingOrderTakeProfit(int symbol_number,ENUM_ORDER_TYPE order_type,double price) { //--- If Take Profit is required if(TakeProfit[symbol_number]>0) { double tp =0.0; // For the calculated Take Profit value double up_level =0.0; // Upper limit of Stop Levels double down_level =0.0; // Lower limit of Stop Levels //--- If the value for SELL STOP order is to be calculated if(order_type==ORDER_TYPE_SELL_STOP) { //--- Define lower threshold down_level=NormalizeDouble(price-symb.stops_level*symb.point,symb.digits); //--- Calculate the level tp=NormalizeDouble(price-CorrectValueBySymbolDigits(TakeProfit[symbol_number]*symb.point),symb.digits); //--- Return the calculated value if it is less than the below limit of the Stops level // If the value is greater or equal, return the adjusted value return(tp<down_level ? tp : NormalizeDouble(down_level-symb.offset,symb.digits)); } //--- If the value for the BUY STOP order is to be calculated if(order_type==ORDER_TYPE_BUY_STOP) { //--- Define the upper threshold up_level=NormalizeDouble(price+symb.stops_level*symb.point,symb.digits); //--- Calculate the level tp=NormalizeDouble(price+CorrectValueBySymbolDigits(TakeProfit[symbol_number]*symb.point),symb.digits); //--- Return the calculated value if it is greater than the upper limit of the Stops level // If the value is less or equal, return the adjusted value return(tp>up_level ? tp : NormalizeDouble(up_level+symb.offset,symb.digits)); } } //--- return(0.0); }

To calculate the Stops level (price)of a reversed pending order and pulling it up we are going to write the following functions CalculateReverseOrderTrailingStop() and ModifyPendingOrderTrailingStop(). You can find the codes of the functions below.

The code of the function CalculateReverseOrderTrailingStop():

//+----------------------------------------------------------------------------+ //| Calculates the Trailing Stop level for the reversed order | //+----------------------------------------------------------------------------+ double CalculateReverseOrderTrailingStop(int symbol_number,ENUM_POSITION_TYPE position_type) { //--- Variables for calculation double level =0.0; double buy_point =low[symbol_number].value[1]; // Low value for Buy double sell_point =high[symbol_number].value[1]; // High value for Sell //--- Calculate the level for the BUY position if(position_type==POSITION_TYPE_BUY) { //--- Bar's low minus the specified number of points level=NormalizeDouble(buy_point-CorrectValueBySymbolDigits(PendingOrder[symbol_number]*symb.point),symb.digits); //--- If the calculated level is lower than the lower limit of the Stops level, // the calculation is complete, return the current value of the level if(level<symb.down_level) return(level); //--- If it is not lower, try to calculate based on the bid price else { level=NormalizeDouble(symb.bid-CorrectValueBySymbolDigits(PendingOrder[symbol_number]*symb.point),symb.digits); //--- If the calculated level is lower than the limit, return the current value of the level // otherwise set the nearest possible value return(level<symb.down_level ? level : symb.down_level-symb.offset); } } //--- Calculate the level for the SELL position if(position_type==POSITION_TYPE_SELL) { // Bar's high plus the specified number of points level=NormalizeDouble(sell_point+CorrectValueBySymbolDigits(PendingOrder[symbol_number]*symb.point),symb.digits); //--- If the calculated level is higher than the upper limit of the Stops level, // then the calculation is complete, return the current value of the level if(level>symb.up_level) return(level); //--- If it is not higher, try to calculate based on the ask price else { level=NormalizeDouble(symb.ask+CorrectValueBySymbolDigits(PendingOrder[symbol_number]*symb.point),symb.digits); //--- If the calculated level is higher than the limit, return the current value of the level // Otherwise set the nearest possible value return(level>symb.up_level ? level : symb.up_level+symb.offset); } } //--- return(0.0); }

The code of the function ModifyPendingOrderTrailingStop():

//+------------------------------------------------------------------+ //| Modifying the Trailing Stop level for a pending order | //+------------------------------------------------------------------+ void ModifyPendingOrderTrailingStop(int symbol_number) { //--- Exit, if the reverse position mode is disabled and Trailing Stop is not set if(!Reverse[symbol_number] || TrailingStop[symbol_number]==0) return; //--- double new_level =0.0; // For calculating a new level for a pending order bool condition =false; // For checking the modification condition int total_orders =0; // Total number of pending orders ulong order_ticket =0; // Order ticket string opposite_order_comment =""; // Opposite order comment ENUM_ORDER_TYPE opposite_order_type =WRONG_VALUE; // Order type //--- Get the flag of presence/absence of a position pos.exists=PositionSelect(Symbols[symbol_number]); //--- If a position is absent if(!pos.exists) return; //--- Get a total number of pending orders total_orders=OrdersTotal(); //--- Get the symbol properties GetSymbolProperties(symbol_number,S_ALL); //--- Get the position properties GetPositionProperties(symbol_number,P_ALL); //--- Get the level for Stop Loss new_level=CalculateReverseOrderTrailingStop(symbol_number,pos.type); //--- Loop through the orders from the last to the first one for(int i=total_orders-1; i>=0; i--) { //--- If the order selected if((order_ticket=OrderGetTicket(i))>0) { //--- Get the order symbol GetPendingOrderProperties(O_SYMBOL); //--- Get the order comment GetPendingOrderProperties(O_COMMENT); //--- Get the order price GetPendingOrderProperties(O_PRICE_OPEN); //--- Depending on the position type, check the relevant condition for the Trailing Stop modification switch(pos.type) { case POSITION_TYPE_BUY : //---If the new order value is greater than the current value plus set step then condition fulfilled condition=new_level>ord.price_open+CorrectValueBySymbolDigits(TrailingStop[symbol_number]*symb.point); //--- Define the type and comment of the reversed pending order for check. opposite_order_type =ORDER_TYPE_SELL_STOP; opposite_order_comment =comment_bottom_order; break; case POSITION_TYPE_SELL : //--- If the new value for the order if less than the current value minus a set step then condition fulfilled condition=new_level<ord.price_open-CorrectValueBySymbolDigits(TrailingStop[symbol_number]*symb.point); //--- Define the type and comment of the reversed pending order for check opposite_order_type =ORDER_TYPE_BUY_STOP; opposite_order_comment =comment_top_order; break; } //--- If condition fulfilled, the order symbol and positions are equal // and order comment and the reversed order comment are equal if(condition && ord.symbol==Symbols[symbol_number] && ord.comment==opposite_order_comment) { double sl=0.0; // Stop Loss double tp=0.0; // Take Profit //--- Get Take Profit and Stop Loss levels sl=CalculatePendingOrderStopLoss(symbol_number,opposite_order_type,new_level); tp=CalculatePendingOrderTakeProfit(symbol_number,opposite_order_type,new_level); //--- Modify order ModifyPendingOrder(symbol_number,order_ticket,opposite_order_type,new_level,sl,tp, ORDER_TIME_GTC,ord.time_expiration,ord.price_stoplimit,ord.comment,0); return; } } } }

Sometimes it may be necessary to find out if a position was closed at Stop Loss or Take Profit. In this particular case we are going to come across such a requirement. Therefore let's write functions that will identify this event by the last deal comment. To retrieve the last deal comment for a specified symbol we are going to write a separate function named GetLastDealComment():

//+------------------------------------------------------------------+ //| Returns a the last deal comment for a specified symbol | //+------------------------------------------------------------------+ string GetLastDealComment(int symbol_number) { int total_deals =0; // Total number of deals in the selected history string deal_symbol =""; // Deal symbol string deal_comment =""; // Deal comment //--- If the deals history retrieved if(HistorySelect(0,TimeCurrent())) { //--- Receive the number of deals in the retrieved list total_deals=HistoryDealsTotal(); //--- Loop though the total number of deals in the retrieved list from the last deal to the first one. for(int i=total_deals-1; i>=0; i--) { //--- Receive the deal comment deal_comment=HistoryDealGetString(HistoryDealGetTicket(i),DEAL_COMMENT); //--- Receive the deal symbol deal_symbol=HistoryDealGetString(HistoryDealGetTicket(i),DEAL_SYMBOL); //--- If the deal symbol and the current symbol are equal, stop the loop if(deal_symbol==Symbols[symbol_number]) break; } } //--- return(deal_comment); }

Now it is easy to write functions that will determine the reason of closing of the last position for the specified symbol. Below are the codes of the functions IsClosedByTakeProfit() and IsClosedByStopLoss():

//+------------------------------------------------------------------+ //| Returns the reason for closing position at Take Profit | //+------------------------------------------------------------------+ bool IsClosedByTakeProfit(int symbol_number) { string last_comment=""; //--- Get the last deal comment for the specified symbol last_comment=GetLastDealComment(symbol_number); //--- If the comment contain a string "tp" if(StringFind(last_comment,"tp",0)>-1) return(true); //--- If the comment does not contain a string "tp" return(false); } //+------------------------------------------------------------------+ //| Returns the reason for closing position at Stop Loss | //+------------------------------------------------------------------+ bool IsClosedByStopLoss(int symbol_number) { string last_comment=""; //--- Get the last deal comment for the specified symbol last_comment=GetLastDealComment(symbol_number); //--- If the comment contains the string "sl" if(StringFind(last_comment,"sl",0)>-1) return(true); //--- If the comment does not contain the string "sl" return(false); }

We are going to carry out another check to determine if the last deal in the history is truly a deal for the specified symbol. We want to keep last deal ticket in memory. To achieve that we are going to add an array on the global scope:

//--- Array for checking the ticket of the last deal for each symbol. ulong last_deal_ticket[NUMBER_OF_SYMBOLS];

The function IsLastDealTicket() for checking the last deal ticket will look as shown in the code below:

//+------------------------------------------------------------------+ //| Returns the event of the last deal for the specified symbol | //+------------------------------------------------------------------+ bool IsLastDealTicket(int symbol_number) { int total_deals =0; // Total number of deals in the selected history list string deal_symbol =""; // Deal symbol ulong deal_ticket =0; // Deal ticket //--- If the deal history was received if(HistorySelect(0,TimeCurrent())) { //--- Get the total number of deals in the received list total_deals=HistoryDealsTotal(); //--- Loop through the total number of deals from the last deal to the first one for(int i=total_deals-1; i>=0; i--) { //--- Get deal ticket deal_ticket=HistoryDealGetTicket(i); //--- Get deal symbol deal_symbol=HistoryDealGetString(deal_ticket,DEAL_SYMBOL); //--- If deal symbol and the current one are equal, stop the loop if(deal_symbol==Symbols[symbol_number]) { //--- If the tickets are equal, exit if(deal_ticket==last_deal_ticket[symbol_number]) return(false); //--- If the tickets are not equal report it else { //--- Save the last deal ticket last_deal_ticket[symbol_number]=deal_ticket; return(true); } } } } //--- return(false); }

If the current time is outside the specified trade range, the position will be forced to close no matter whether it is at loss or at profit. Let's write the function ClosePosition() for closing a position:

//+------------------------------------------------------------------+ //| Closes position | //+------------------------------------------------------------------+ void ClosePosition(int symbol_number) { //--- Check if position exists pos.exists=PositionSelect(Symbols[symbol_number]); //--- If there is no position, exit if(!pos.exists) return; //--- Set the slippage value in points trade.SetDeviationInPoints(CorrectValueBySymbolDigits(Deviation)); //--- If the position was not closed, print the relevant message if(!trade.PositionClose(Symbols[symbol_number])) Print("Error when closing position: ",GetLastError()," - ",ErrorDescription(GetLastError())); }

When a position is closed at going outside the trade time range, all pending orders must be deleted. The function DeleteAllPendingOrders() that we are about to write, will be deleting all pending orders for the specified symbol:

//+------------------------------------------------------------------+ //| Deletes all pending orders | //+------------------------------------------------------------------+ void DeleteAllPendingOrders(int symbol_number) { int total_orders =0; // Total number of pending orders ulong order_ticket =0; // Order ticket //--- Get the total number of pending orders total_orders=OrdersTotal(); //--- Loop through the total number of pending orders for(int i=total_orders-1; i>=0; i--) { //--- If the order selected if((order_ticket=OrderGetTicket(i))>0) { //--- Get the order symbol GetOrderProperties(O_SYMBOL); //--- If the order symbol and the current symbol are equal if(ord.symbol==Symbols[symbol_number]) //--- Delete the order DeletePendingOrder(order_ticket); } } }

So now we have all functions necessary for the structural scheme. Let's take a look at the familiar function TradingBlock(), which has gone through some significant changes and a new one for managing pending orders ManagePendingOrders(). Full control over the current situation concerning pending orders will be carried out in it.

The function TradingBlock() for the current pattern looks as follows:

//+------------------------------------------------------------------+ //| Trade block | //+------------------------------------------------------------------+ void TradingBlock(int symbol_number) { double tp=0.0; // Take Profit double sl=0.0; // Stop Loss double lot=0.0; // Volume for position calculation in case of reversed position double order_price=0.0; // Price for placing the order ENUM_ORDER_TYPE order_type=WRONG_VALUE; // Order type for opening position //--- If outside of the time range for placing pending orders if(!IsInOpenOrdersTimeRange(symbol_number)) return; //--- Find out if there is an open position for the symbol pos.exists=PositionSelect(Symbols[symbol_number]); //--- If there is no position if(!pos.exists) { //--- Get symbol properties GetSymbolProperties(symbol_number,S_ALL); //--- Adjust the volume lot=CalculateLot(symbol_number,Lot[symbol_number]); //--- If there is no upper pending order if(!CheckPendingOrderByComment(symbol_number,comment_top_order)) { //--- Get the price for placing a pending order order_price=CalculatePendingOrder(symbol_number,ORDER_TYPE_BUY_STOP); //--- Get Take Profit and Stop Loss levels sl=CalculatePendingOrderStopLoss(symbol_number,ORDER_TYPE_BUY_STOP,order_price); tp=CalculatePendingOrderTakeProfit(symbol_number,ORDER_TYPE_BUY_STOP,order_price); //--- Place a pending order SetPendingOrder(symbol_number,ORDER_TYPE_BUY_STOP,lot,0,order_price,sl,tp,ORDER_TIME_GTC,comment_top_order); } //--- If there is no lower pending order if(!CheckPendingOrderByComment(symbol_number,comment_bottom_order)) { //--- Get the price for placing the pending order order_price=CalculatePendingOrder(symbol_number,ORDER_TYPE_SELL_STOP); //--- Get Take Profit and Stop Loss levels sl=CalculatePendingOrderStopLoss(symbol_number,ORDER_TYPE_SELL_STOP,order_price); tp=CalculatePendingOrderTakeProfit(symbol_number,ORDER_TYPE_SELL_STOP,order_price); //--- Place a pending order SetPendingOrder(symbol_number,ORDER_TYPE_SELL_STOP,lot,0,order_price,sl,tp,ORDER_TIME_GTC,comment_bottom_order); } } }

Code of the function ManagePendingOrders() for managing pending orders:

//+------------------------------------------------------------------+ //| Manages pending orders | //+------------------------------------------------------------------+ void ManagePendingOrders() { //--- Loop through the total number of symbols for(int s=0; s<NUMBER_OF_SYMBOLS; s++) { //--- If trading this symbol is forbidden, go to the following one if(Symbols[s]=="") continue; //--- Find out if there is an open position for the symbol pos.exists=PositionSelect(Symbols[s]); //--- If there is no position if(!pos.exists) { //--- If the last deal on current symbol and // position was exited on Take Profit or Stop Loss if(IsLastDealTicket(s) && (IsClosedByStopLoss(s) || IsClosedByTakeProfit(s))) //--- Delete all pending orders for the symbol DeleteAllPendingOrders(s); //--- Go to the following symbol continue; } //--- If there is a position ulong order_ticket =0; // Order ticket int total_orders =0; // Total number of pending orders int symbol_total_orders =0; // Number of pending orders for the specified symbol string opposite_order_comment =""; // Opposite order comment ENUM_ORDER_TYPE opposite_order_type =WRONG_VALUE; // Order type //--- Get the total number of pending orders total_orders=OrdersTotal(); //--- Get the total number of pending orders for the specified symbol symbol_total_orders=OrdersTotalBySymbol(Symbols[s]); //--- Get symbol properties GetSymbolProperties(s,S_ASK); GetSymbolProperties(s,S_BID); //--- Get the comment for the selected position GetPositionProperties(s,P_COMMENT); //--- If the position comment belongs to the upper order, // then the lower order is to be deleted, modified/placed if(pos.comment==comment_top_order) { opposite_order_type =ORDER_TYPE_SELL_STOP; opposite_order_comment =comment_bottom_order; } //--- If the position comment belongs to the lower order, // then the upper order is to be deleted/modified/placed if(pos.comment==comment_bottom_order) { opposite_order_type =ORDER_TYPE_BUY_STOP; opposite_order_comment =comment_top_order; } //--- If there are no pending orders for the specified symbol if(symbol_total_orders==0) { //--- If the position reversal is enabled, place a reversed order if(Reverse[s]) { double tp=0.0; // Take Profit double sl=0.0; // Stop Loss double lot=0.0; // Volume for position calculation in case of reversed positio double order_price=0.0; // Price for placing the order //--- Get the price for placing a pending order order_price=CalculatePendingOrder(s,opposite_order_type); //---Get Take Profit и Stop Loss levels sl=CalculatePendingOrderStopLoss(s,opposite_order_type,order_price); tp=CalculatePendingOrderTakeProfit(s,opposite_order_type,order_price); //--- Calculate double volume lot=CalculateLot(s,pos.volume*2); //--- Place the pending order SetPendingOrder(s,opposite_order_type,lot,0,order_price,sl,tp,ORDER_TIME_GTC,opposite_order_comment); //--- Adjust Stop Loss as related to the order CorrectStopLossByOrder(s,order_price,opposite_order_type); } return; } //--- If there are pending orders for this symbol, then depending on the circumstances delete or // modify the reversed order if(symbol_total_orders>0) { //--- Loop through the total number of orders from the last one to the first one for(int i=total_orders-1; i>=0; i--) { //--- If the order chosen if((order_ticket=OrderGetTicket(i))>0) { //--- Get the order symbol GetPendingOrderProperties(O_SYMBOL); //--- Get the order comment GetPendingOrderProperties(O_COMMENT); //--- If order symbol and position symbol are equal, // and order comment and the reversed order comment are equal if(ord.symbol==Symbols[s] && ord.comment==opposite_order_comment) { //--- If position reversal is disabled if(!Reverse[s]) //--- Delete order DeletePendingOrder(order_ticket); //--- If position reversal is enabled else { double lot=0.0; //--- Get the current order properties GetPendingOrderProperties(O_ALL); //--- Get the current position volume GetPositionProperties(s,P_VOLUME); //--- If the order has been modified already, exit the loop. if(ord.volume_initial>pos.volume) break; //--- Calculate double volume lot=CalculateLot(s,pos.volume*2); //--- Modify (delete and place again) the order ModifyPendingOrder(s,order_ticket,opposite_order_type, ord.price_open,ord.sl,ord.tp, ORDER_TIME_GTC,ord.time_expiration, ord.price_stoplimit,opposite_order_comment,lot); } } } } } } }

Now we are only to make minor adjustments in the main program file. We shall add the trade events handler OnTrade(). Assessment of the current situation in relation to the pending orders against the trading event will be carried out in this function.

//+------------------------------------------------------------------+ //| Processing of trade events | //+------------------------------------------------------------------+ void OnTrade() { //--- Check the state of pending orders ManagePendingOrders(); }

The function ManagePendingOrders() will also be used in the user event handler OnChartEvent():

//+------------------------------------------------------------------+ //| User events and chart events handler | //+------------------------------------------------------------------+ void OnChartEvent(const int id, // Event identifier const long &lparam, // Parameter of long event type const double &dparam, // Parameter of double event type const string &sparam) // Parameter of string event type { //--- If it is a user event if(id>=CHARTEVENT_CUSTOM) { //--- Exit, if trade is prohibited if(CheckTradingPermission()>0) return; //--- If it is a tick event if(lparam==CHARTEVENT_TICK) { //--- Check the state of pending orders ManagePendingOrders(); //--- Check signals and trade according to them CheckSignalsAndTrade(); return; } } }

Some changes were made in the function CheckSignalsAndTrade() as well. In the code below highlighted are strings featuring new functions considered in this article.

//+------------------------------------------------------------------+ //| Checks signals and trades based on New Bar event | //+------------------------------------------------------------------+ void CheckSignalsAndTrade() { //--- Loop through all specified signals for(int s=0; s<NUMBER_OF_SYMBOLS; s++) { //--- If trading this symbol is prohibited, exit if(Symbols[s]=="") continue; //--- If the bar is not new, move on to the following symbol if(!CheckNewBar(s)) continue; //--- If there is a new bar else { //--- If outside the time range if(!IsInTradeTimeRange(s)) { //--- Close position ClosePosition(s); //--- Delete all pending orders DeleteAllPendingOrders(s); //--- Move on to the following symbol continue; } //--- Get bars data GetBarsData(s); //--- Check conditions and trade TradingBlock(s); //--- If position reversal if enabled if(Reverse[s]) //--- Pull up Stop Loss for pending order ModifyPendingOrderTrailingStop(s); //--- If position reversal is disabled else //--- Pull up Stop Loss ModifyTrailingStop(s); } }

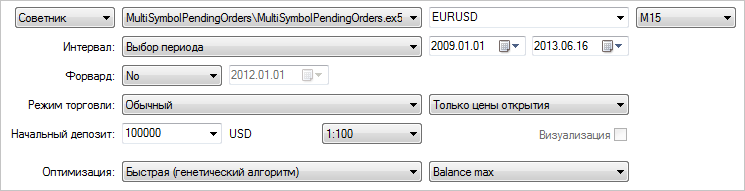

Now everything is ready and we can try to optimize parameters of this multi-currency Expert Advisor Let's set up the strategy Tester as shown below:

Fig. 1 - Tester settings for parameters optimization.

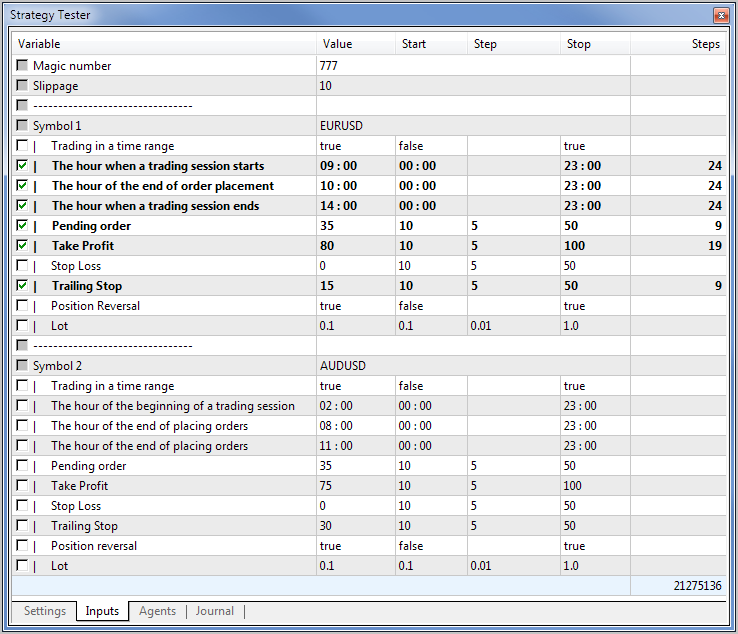

First we shall optimize parameters for the currency pair EURUSD, and then for AUDUSD. The screen shot below shows what parameters we shall select for optimization of EURUSD:

Fig. 2 - Setting up parameters for optimization of multi-currency Expert Advisor

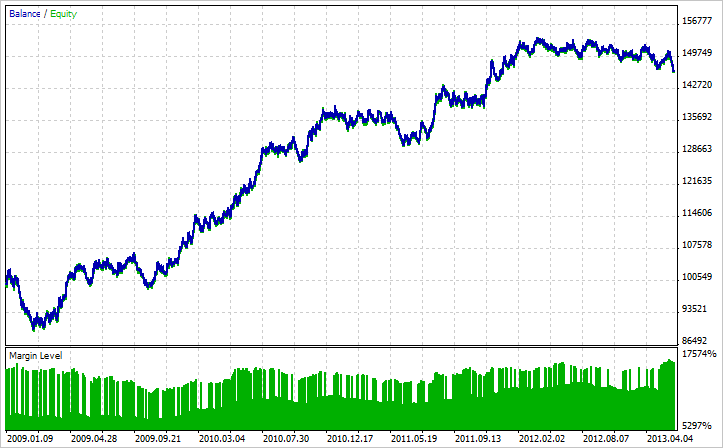

After the parameters of the currency pair EURUSD have been optimized, the same parameters should be optimized for AUDUSD. Below is the result for both symbols tested together. Results were selected by the maximum recovery factor. For the test, the lot value was set to 1 for both symbols.

Fig. 3 - test result for the two symbols together.

Conclusion

That's pretty much about it. With ready functions at hand, you can concentrate on developing the idea of making trade decisions. In this case changes will have to be implemented in the functions TradingBlock() and ManagePendingOrders(). For those who started learning MQL5 recently, we recommend to practice adding more symbols and change the trade algorithm scheme.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/755

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Tips for an Effective Product Presentation on the Market

Tips for an Effective Product Presentation on the Market

How we developed the MetaTrader Signals service and Social Trading

How we developed the MetaTrader Signals service and Social Trading

Freelance Jobs on MQL5.com - Developer's Favorite Place

Freelance Jobs on MQL5.com - Developer's Favorite Place

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Otto ...now you can use it :-)

It makes trades for me.

That's quite a response. Thank you!

I just wanted to point out that the authors of the articles should take care of them.

All you have to do is

and all the MQL5xxx rubbish and it will work;)That's quite a response. Thank you!

I just wanted to point out that the authors of the articles should take care of them.

Mmmhhh ... yes, we know.

And I gave it some expression.

Something like that works, you notice it in other places, even if nobody says anything about it :-)

Mmmhhh ... yes, we know.

And I've given it some expression.

Something like that works, you notice it in other places, even if nobody says anything about it :-)

My intention was to reprogramme the MarketOrders into PendigOrders.

Whoever can use it, here is the code how it works.

This is not a useful EA but just an example of how to calculate it. I hope it is correct, it works in the tester.

It's also not my real programming style, but kept very simple.