Reversing: The holy grail or a dangerous delusion?

In this article, we will study the reverse martingale technique and will try to understand whether it is worth using, as well as whether it can help improve your trading strategy. We will create an Expert Advisor to operate on historic data and to check what indicators are best suitable for the reversing technique. We will also check whether it can be used without any indicator as an independent trading system. In addition, we will check if reversing can turn a loss-making trading system into a profitable one.

Expert Advisor based on the "New Trading Dimensions" by Bill Williams

In this article I will discuss the development of Expert Advisor, based on the book "New Trading Dimensions: How to Profit from Chaos in Stocks, Bonds, and Commodities" by Bill Williams. The strategy itself is well known and its use is still controversial among traders. The article considers trading signals of the system, the specifics of its implementation, and the results of testing on historical data.

Basic math behind Forex trading

The article aims to describe the main features of Forex trading as simply and quickly as possible, as well as share some basic ideas with beginners. It also attempts to answer the most tantalizing questions in the trading community along with showcasing the development of a simple indicator.

MQL5 Wizard for Dummies

In early 2011 we released the first version of the MQL5 Wizard. This new application provides a simple and convenient tool to automatically generate trading robots. Any MetaTrader 5 user can create a custom Expert Advisor without even knowing how to program in MQL5.

DiNapoli trading system

The article describes the Fibo levels-based trading system developed by Joe DiNapoli. The idea behind the system and the main concepts are explained, as well as a simple indicator is provided as an example for more clarity.

Comparative analysis of 10 flat trading strategies

The article explores the advantages and disadvantages of trading in flat periods. The ten strategies created and tested within this article are based on the tracking of price movements inside a channel. Each strategy is provided with a filtering mechanism, which is aimed at avoiding false market entry signals.

Genetic Algorithms - It's Easy!

In this article the author talks about evolutionary calculations with the use of a personally developed genetic algorithm. He demonstrates the functioning of the algorithm, using examples, and provides practical recommendations for its usage.

Evaluation of Trade Systems - the Effectiveness of Entering, Exiting and Trades in General

There are a lot of measures that allow determining the effectiveness and profitability of a trade system. However, traders are always ready to put any system to a new crash test. The article tells how the statistics based on measures of effectiveness can be used for the MetaTrader 5 platform. It includes the class for transformation of the interpretation of statistics by deals to the one that doesn't contradict the description given in the "Statistika dlya traderov" ("Statistics for Traders") book by S.V. Bulashev. It also includes an example of custom function for optimization.

Learn how to design different Moving Average systems

There are many strategies that can be used to filter generated signals based on any strategy, even by using the moving average itself which is the subject of this article. So, the objective of this article is to share with you some of Moving Average Strategies and how to design an algorithmic trading system.

Library for easy and quick development of MetaTrader programs (part XXVIII): Closure, removal and modification of pending trading requests

This is the third article about the concept of pending requests. We are going to complete the tests of pending trading requests by creating the methods for closing positions, removing pending orders and modifying position and pending order parameters.

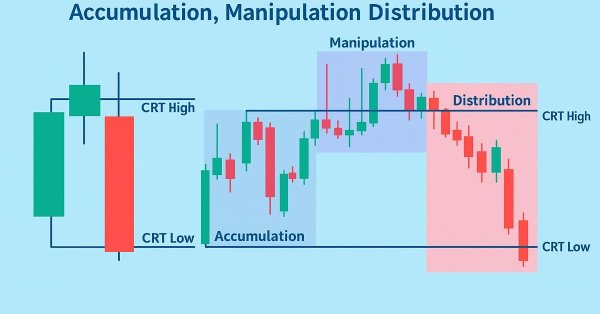

Automating Trading Strategies in MQL5 (Part 41): Candle Range Theory (CRT) – Accumulation, Manipulation, Distribution (AMD)

In this article, we develop a Candle Range Theory (CRT) trading system in MQL5 that identifies accumulation ranges on a specified timeframe, detects breaches with manipulation depth filtering, and confirms reversals for entry trades in the distribution phase. The system supports dynamic or static stop-loss and take-profit calculations based on risk-reward ratios, optional trailing stops, and limits on positions per direction for controlled risk management.

Learn how to design a trading system by Fibonacci

In this article, we will continue our series of creating a trading system based on the most popular technical indicator. Here is a new technical tool which is the Fibonacci and we will learn how to design a trading system based on this technical indicator.

Forecasting Time Series (Part 1): Empirical Mode Decomposition (EMD) Method

This article deals with the theory and practical use of the algorithm for forecasting time series, based on the empirical decomposition mode. It proposes the MQL implementation of this method and presents test indicators and Expert Advisors.

Library for easy and quick development of MetaTrader programs (part XXXIV): Pending trading requests - removing and modifying orders and positions under certain conditions

In this article, we will complete the description of the pending request trading concept and create the functionality for removing pending orders, as well as modifying orders and positions under certain conditions. Thus, we are going to have the entire functionality enabling us to develop simple custom strategies, or rather EA behavior logic activated upon user-defined conditions.

Developing a self-adapting algorithm (Part II): Improving efficiency

In this article, I will continue the development of the topic by improving the flexibility of the previously created algorithm. The algorithm became more stable with an increase in the number of candles in the analysis window or with an increase in the threshold percentage of the overweight of falling or growing candles. I had to make a compromise and set a larger sample size for analysis or a larger percentage of the prevailing candle excess.

Indicator for Constructing a Three Line Break Chart

This article is dedicated to the Three Line Break chart, suggested by Steve Nison in his book "Beyond Candlesticks". The greatest advantage of this chart is that it allows filtering minor fluctuations of a price in relation to the previous movement. We are going to discuss the principle of the chart construction, the code of the indicator and some examples of trading strategies based on it.

Exploring Seasonal Patterns of Financial Time Series with Boxplot

In this article we will view seasonal characteristics of financial time series using Boxplot diagrams. Each separate boxplot (or box-and-whiskey diagram) provides a good visualization of how values are distributed along the dataset. Boxplots should not be confused with the candlestick charts, although they can be visually similar.

Machine Learning: How Support Vector Machines can be used in Trading

Support Vector Machines have long been used in fields such as bioinformatics and applied mathematics to assess complex data sets and extract useful patterns that can be used to classify data. This article looks at what a support vector machine is, how they work and why they can be so useful in extracting complex patterns. We then investigate how they can be applied to the market and potentially used to advise on trades. Using the Support Vector Machine Learning Tool, the article provides worked examples that allow readers to experiment with their own trading.

Trading Signal Generator Based on a Custom Indicator

How to create a trading signal generator based on a custom indicator? How to create a custom indicator? How to get access to custom indicator data? Why do we need the IS_PATTERN_USAGE(0) structure and model 0?

Plotting trend lines based on fractals using MQL4 and MQL5

The article describes the automation of trend lines plotting based on the Fractals indicator using MQL4 and MQL5. The article structure provides a comparative view of the solution for two languages. Trend lines are plotted using two last known fractals.

How to quickly develop and debug a trading strategy in MetaTrader 5

Scalping automatic systems are rightfully regarded the pinnacle of algorithmic trading, but at the same time their code is the most difficult to write. In this article we will show how to build strategies based on analysis of incoming ticks using the built-in debugging tools and visual testing. Developing rules for entry and exit often require years of manual trading. But with the help of MetaTrader 5, you can quickly test any such strategy on real history.

Create Your Own Expert Advisor in MQL5 Wizard

The knowledge of programming languages is no longer a prerequisite for creating trading robots. Earlier lack of programming skills was an impassable obstacle to the implementation of one's own trading strategies, but with the emergence of the MQL5 Wizard, the situation radically changed. Novice traders can stop worrying because of the lack of programming experience - with the new Wizard, which allows you to generate Expert Advisor code, it is not necessary.

How to use MQL5 to detect candlesticks patterns

A new article to learn how to detect candlesticks patterns on prices automatically by MQL5.

Automating Trading Strategies in MQL5 (Part 42): Session-Based Opening Range Breakout (ORB) System

In this article, we create a fully customizable session-based Opening Range Breakout (ORB) system in MQL5 that lets us set any desired session start time and range duration, automatically calculates the high and low of that opening period, and trades only confirmed breakouts in the direction of the move.

Testing patterns that arise when trading currency pair baskets. Part III

In this article, we finish testing the patterns that can be detected when trading currency pair baskets. Here we present the results of testing the patterns tracking the movement of pair's currencies relative to each other.

Library for easy and quick development of MetaTrader programs (part XV): Collection of symbol objects

In this article, we will consider creation of a symbol collection based on the abstract symbol object developed in the previous article. The abstract symbol descendants are to clarify a symbol data and define the availability of the basic symbol object properties in a program. Such symbol objects are to be distinguished by their affiliation with groups.

Strategy builder based on Merrill patterns

In the previous article, we considered application of Merrill patterns to various data, such as to a price value on a currency symbol chart and values of standard MetaTrader 5 indicators: ATR, WPR, CCI, RSI, among others. Now, let us try to create a strategy construction set based on Merrill patterns.

Library for easy and quick development of MetaTrader programs (part I). Concept, data management and first results

While analyzing a huge number of trading strategies, orders for development of applications for MetaTrader 5 and MetaTrader 4 terminals and various MetaTrader websites, I came to the conclusion that all this diversity is based mostly on the same elementary functions, actions and values appearing regularly in different programs. This resulted in DoEasy cross-platform library for easy and quick development of МetaТrader 5 and МetaТrader 4 applications.

Thomas DeMark's Sequential (TD SEQUENTIAL) using artificial intelligence

In this article, I will tell you how to successfully trade by merging a very well-known strategy and a neural network. It will be about the Thomas DeMark's Sequential strategy with the use of an artificial intelligence system. Only the first part of the strategy will be applied, using the Setup and Intersection signals.

Exploring Trading Strategy Classes of the Standard Library - Customizing Strategies

In this article we are going to show how to explore the Standard Library of Trading Strategy Classes and how to add Custom Strategies and Filters/Signals using the Patterns-and-Models logic of the MQL5 Wizard. In the end you will be able easily add your own strategies using MetaTrader 5 standard indicators, and MQL5 Wizard will create a clean and powerful code and fully functional Expert Advisor.

Developing a cross-platform grid EA: testing a multi-currency EA

Markets dropped down by more that 30% within one month. It seems to be the best time for testing grid- and martingale-based Expert Advisors. This article is an unplanned continuation of the series "Creating a Cross-Platform Grid EA". The current market provides an opportunity to arrange a stress rest for the grid EA. So, let's use this opportunity and test our Expert Advisor.

Timeseries in DoEasy library (part 42): Abstract indicator buffer object class

In this article, we start the development of the indicator buffer classes for the DoEasy library. We will create the base class of the abstract buffer which is to be used as a foundation for the development of different class types of indicator buffers.

Simple Trading Systems Using Semaphore Indicators

If we thoroughly examine any complex trading system, we will see that it is based on a set of simple trading signals. Therefore, there is no need for novice developers to start writing complex algorithms immediately. This article provides an example of a trading system that uses semaphore indicators to perform deals.

Martingale as the basis for a long-term trading strategy

In this article we will consider in detail the martingale system. We will review whether this system can be applied in trading and how to use it in order to minimize risks. The main disadvantage of this simple system is the probability of losing the entire deposit. This fact must be taken into account, if you decide to trade using the martingale technique.

The Indicators of the Micro, Middle and Main Trends

The aim of this article is to investigate the possibilities of trade automation and the analysis, on the basis of some ideas from a book by James Hyerczyk "Pattern, Price & Time: Using Gann Theory in Trading Systems" in the form of indicators and Expert Advisor. Without claiming to be exhaustive, here we investigate only the Model - the first part of the Gann theory.

Creating MQL5 Expert Advisors in minutes using EA Tree: Part One

EA Tree is the first drag and drop MetaTrader MQL5 Expert Advisor builder. You can create complex MQL5 using a very easy to use graphical user interface. In EA Tree, Expert Advisors are created by connecting boxes together. Boxes may contain MQL5 functions, technical indicators, custom indicators, or values. Using the "tree of boxes", EA Tree generates the MQL5 code of the Expert Advisor.

Library for easy and quick development of MetaTrader programs (part XX): Creating and storing program resources

The article deals with storing data in the program's source code and creating audio and graphical files out of them. When developing an application, we often need audio and images. The MQL language features several methods of using such data.

Library for easy and quick development of MetaTrader programs (part XXXII): Pending trading requests - placing orders under certain conditions

We continue the development of the functionality allowing users to trade using pending requests. In this article, we are going to implement the ability to place pending orders under certain conditions.

Deep Neural Networks (Part VIII). Increasing the classification quality of bagging ensembles

The article considers three methods which can be used to increase the classification quality of bagging ensembles, and their efficiency is estimated. The effects of optimization of the ELM neural network hyperparameters and postprocessing parameters are evaluated.

Indicator for Point and Figure Charting

There are lots of chart types that provide information on the current market situation. Many of them, such as Point and Figure chart, are the legacy of the remote past. The article describes an example of Point and Figure charting using a real time indicator.