MQL5 Trading Toolkit (Part 8): How to Implement and Use the History Manager EX5 Library in Your Codebase

Introduction

In previous articles, I walked you through developing a robust and comprehensive History Management EX5 library designed to streamline how you interact with trade histories in MetaTrader 5. This powerful library enables you to effortlessly scan, retrieve, sort, categorize, and filter all types of trade histories—whether it’s closed positions, pending orders, or deal histories—directly from your MetaTrader 5 account. Building on that foundation, this article takes the final step by showing you how to efficiently integrate the History Manager library into your MQL5 projects.

I will provide a detailed breakdown of the functions available in the EX5 library, complete with clear explanations and practical examples. These real-world use cases will not only help you understand how each function works but also demonstrate how to apply them in your trading strategies or analysis tools. Whether you’re a beginner looking to enhance your coding skills or an experienced developer seeking to optimize your workflow, this guide will equip you with the knowledge and tools to harness the full potential of the History Manager library. By the end of this article, you’ll be able to implement this versatile library with confidence and start leveraging its capabilities to manage trade histories more efficiently than ever before.

Benefits of Using the History Manager in MQL5

Below are the key advantages of integrating the History Manager into your MQL5 projects:

- Effortless Data Retrieval: The library provides intuitive functions to retrieve trade history data, such as deals, orders, positions, and pending orders, with minimal code. This eliminates the need for complex and repetitive coding.

- Unified Interface: All trade history data is accessible through a single, consistent interface, making it easier to manage and analyze different types of trade activities.

- Time-Saving Functions: With one-line function calls, you can quickly access critical trade data, reducing development time and allowing you to focus on strategy implementation.

- Automated Data Processing: The library automates the retrieval, sorting, and filtering of trade histories, streamlining workflows and improving overall efficiency.

- Error-Free Data Handling: The library ensures accurate retrieval of trade history data, minimizing the risk of errors that can occur with manual coding.

- Comprehensive Data Coverage: From closed positions to pending orders, the library provides access to all types of trade histories, ensuring no data is overlooked.

- Detailed Insights: Functions like GetLastClosedPositionData(), GetLastFilledPendingOrderData(), and GetLastClosedProfitablePositionData() among many others, provide granular details about trades, enabling more in-depth analysis and better decision-making.

- Customizable Filters: You can filter trade histories by symbol, magic number, or time range, allowing for targeted analysis tailored to your specific needs.

- Easy Implementation: The library is designed to integrate seamlessly into existing MQL5 projects, requiring minimal setup and configuration.

- Scalability: Whether you’re working on a small script or a large-scale trading system, the History Manager scales effortlessly to meet your requirements.

- Adaptable to Your Needs: The library’s modular design allows you to use only the functions you need, making it highly adaptable to various trading styles and strategies.

- Extendable Functionality: Developers can build on the library’s existing functions to create custom solutions for unique trading requirements.

- Pre-Built Solutions: By leveraging the library’s pre-built functions, you can significantly reduce the time and cost associated with developing custom trade history management tools.

- Open to All Skill Levels: Whether you’re a beginner or an experienced developer, the library’s straightforward design makes it accessible to users of all skill levels.

- Data-Driven Decisions: Access to comprehensive trade histories enables you to make informed decisions when developing or refining trading strategies.

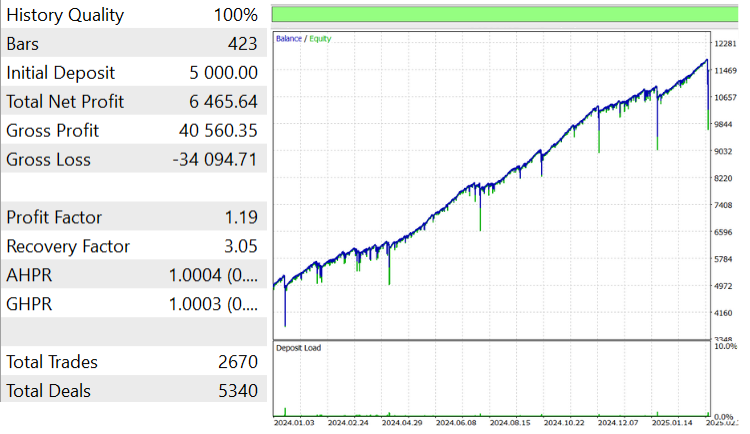

- Historical Back testing: Use the library to retrieve historical trade data for back testing, ensuring your strategies are robust and reliable.

- Clean and Readable Code: The library’s functions are designed to produce clean, readable code, making it easier to maintain and update your projects.

Importing and Setting Up the History Manager EX5 Library

Before you can start using History Manager EX5 Library's features, you need to properly import and set up the library in your MQL5 project. This section will guide you through the process step by step, ensuring a smooth and hassle-free setup.

To use the HistoryManager.ex5 library file in your MQL5 projects, it needs to be downloaded and placed in the correct directory within your MetaTrader 5 installation folder. Launch MetaEditor from your MetaTrader 5 terminal by navigating to Tools > MetaQuotes Language Editor or pressing F4 and follow the steps below:

- Step 1. Create the Necessary Directories:

Inside the Libraries' folder located in the root MQL5 directory, create the following subdirectories if they do not already exist: "\Wanateki\Toolkit\HistoryManager".

The full path in your MQL5 installation folder should look like this: "MQL5\Libraries\Wanateki\Toolkit\HistoryManager".

- Step 2. Download the HistoryManager.ex5 Binary File:

Scroll to the bottom or end of this article, locate the attached HistoryManager.ex5file, and download it. Place the file into the HistoryManager folder you created in Step 1.

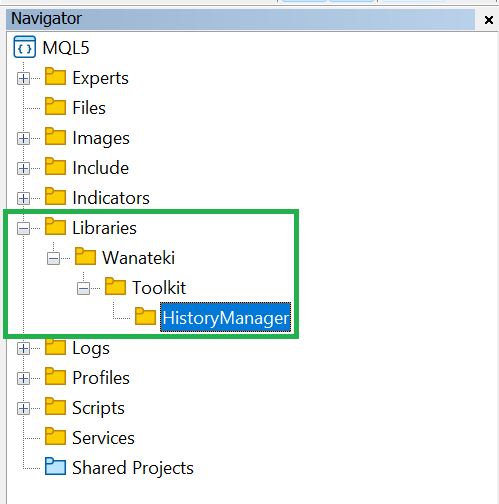

Your Libraries' folder directory structure should now resemble the image below:

- Step 3. Create the Header Library File:

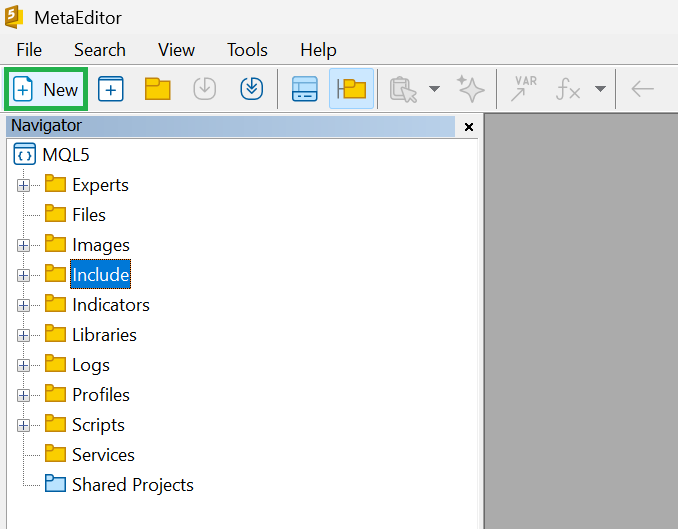

1. In MetaEditor IDE, launch MQL Wizard using the New menu item button.

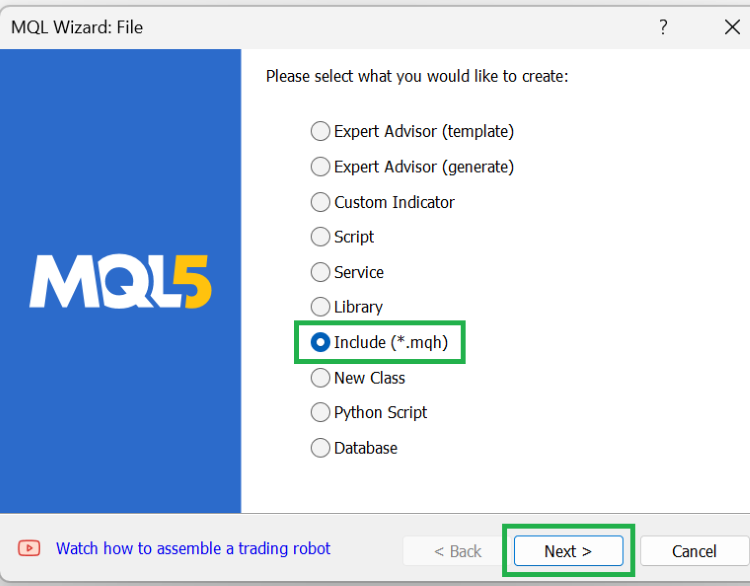

2. Select the Include (*.mqh) option and click Next.

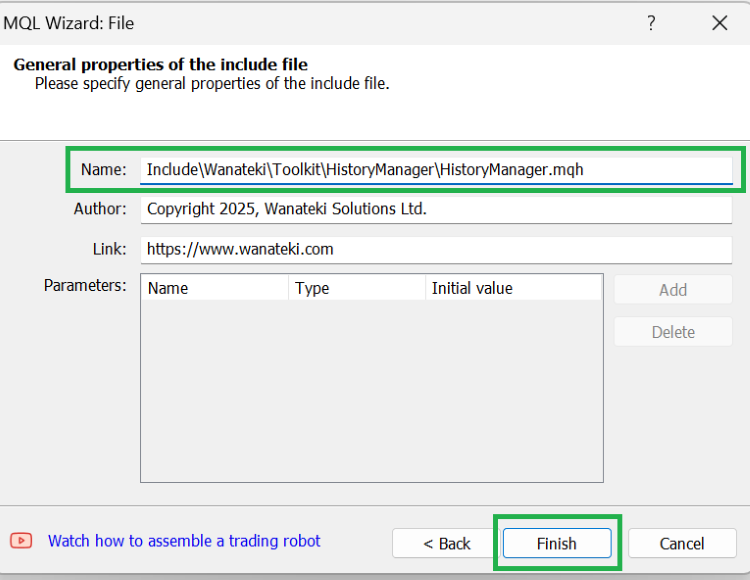

3. In the General properties of the include file window, locate the Name: input box. Clear all the text and enter the following path to specify the directory and name for the include file: Include\Wanateki\Toolkit\HistoryManager\HistoryManager.mqh

4. Press the Finish button to generate the library header file.

Coding The History Manager Header File (HistoryManager.mqh)

Now that we have successfully created a blank include file for the HistoryManager.mqh library header, the next step is to populate it with the necessary components that will define its functionality. This involves adding data structures to manage and store information efficiently, incorporating macro directives to simplify repetitive tasks and improve code readability, and importing, and declaring the library functions that will serve as the core interfaces for interacting with the HistoryManager.ex5 functionality.

Under the #property link, we will begin by declaring the DealData, OrderData, PositionData, and PendingOrderData data structures in the global scope. These structures will be responsible for storing various trade history properties and will be accessible from any part of our codebase.

struct DealData { // Add all the DealData members here } struct OrderData { // Add all the OrderData members here } struct PositionData { // Add all the PositionData members here } struct PendingOrderData { // Add all the PendingOrderData members here }

Next, we will define several constants or macros to represent key time periods in seconds. These include NOW, ONE_DAY, ONE_WEEK, ONE_MONTH, ONE_YEAR, EPOCH, TODAY, THIS_WEEK, THIS_MONTH, and THIS_YEAR which will simplify time-related calculations and improve code readability.

#define NOW datetime(TimeCurrent()) #define ONE_DAY datetime(TimeCurrent() - PeriodSeconds(PERIOD_D1)) #define ONE_WEEK datetime(TimeCurrent() - PeriodSeconds(PERIOD_W1)) #define ONE_MONTH datetime(TimeCurrent() - PeriodSeconds(PERIOD_MN1)) #define ONE_YEAR datetime(TimeCurrent() - (PeriodSeconds(PERIOD_MN1) * 12)) #define EPOCH 0 // 1st Jan 1970 //-- #define TODAY 12 #define THIS_WEEK 13 #define THIS_MONTH 14 #define THIS_YEAR 15

We will also create the ALL_SYMBOLS string macro to store an empty string. This will serve as a signal to indicate that we want to process the specified history for all symbols. Additionally, we will define the ALL_POSITIONS, ALL_ORDERS, and ALL_DEALS integer macros. These will allow us to specify the types of orders, deals, and position history we wish to process.

#define ALL_SYMBOLS "" #define ALL_POSITIONS 1110 #define ALL_ORDERS 1111 #define ALL_DEALS 1112

Now that we have created all the necessary data structures and defined the essential preprocessor directives or macros, it’s time to import the HistoryManager.ex5 library. To do this, we will use the #import directive followed by the folder path where the EX5 library is located.

#import "Wanateki/Toolkit/HistoryManager/HistoryManager.ex5"

After the #import directive, we will add the library function declarations and conclude by inserting the closing #import directive as the final line of our HistoryManager.mqh header file.

#import "Wanateki/Toolkit/HistoryManager/HistoryManager.ex5" //-- void PrintDealsHistory(datetime fromDateTime, datetime toDateTime); void PrintOrdersHistory(datetime fromDateTime, datetime toDateTime); void PrintPositionsHistory(datetime fromDateTime, datetime toDateTime); void PrintPendingOrdersHistory(datetime fromDateTime, datetime toDateTime); //-- bool GetDealsData(DealData &dealsData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); bool GetOrdersData(OrderData &ordersData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); bool GetPositionsData(PositionData &positionsData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); bool GetPendingOrdersData(PendingOrderData &pendingOrdersData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); //-- // Add all the other function declarations here... #import

Below are the essential code segments that form the HistoryManager.mqh include file. This header file provides all the necessary resources for importing and integrating the History Manager EX5 library into your MQL5 projects. By including it at the beginning of your source file, you gain access to all the data structures and library functions, making them readily available for immediate use. The complete HistoryManager.mqh source file is also attached at the end of this article for you to download.

struct DealData { ulong ticket; ulong magic; ENUM_DEAL_ENTRY entry; ENUM_DEAL_TYPE type; ENUM_DEAL_REASON reason; ulong positionId; ulong order; string symbol; string comment; double volume; double price; datetime time; double tpPrice; double slPrice; double commission; double swap; double profit; }; //-- struct OrderData { datetime timeSetup; datetime timeDone; datetime expirationTime; ulong ticket; ulong magic; ENUM_ORDER_REASON reason; ENUM_ORDER_TYPE type; ENUM_ORDER_TYPE_FILLING typeFilling; ENUM_ORDER_STATE state; ENUM_ORDER_TYPE_TIME typeTime; ulong positionId; ulong positionById; string symbol; string comment; double volumeInitial; double priceOpen; double priceStopLimit; double tpPrice; double slPrice; }; //-- struct PositionData { ENUM_POSITION_TYPE type; ulong ticket; ENUM_ORDER_TYPE initiatingOrderType; ulong positionId; bool initiatedByPendingOrder; ulong openingOrderTicket; ulong openingDealTicket; ulong closingDealTicket; string symbol; double volume; double openPrice; double closePrice; datetime openTime; datetime closeTime; long duration; double commission; double swap; double profit; double tpPrice; double slPrice; int tpPips; int slPips; int pipProfit; double netProfit; ulong magic; string comment; }; //-- struct PendingOrderData { string symbol; ENUM_ORDER_TYPE type; ENUM_ORDER_STATE state; double priceOpen; double tpPrice; double slPrice; int tpPips; int slPips; ulong positionId; ulong ticket; datetime timeSetup; datetime expirationTime; datetime timeDone; ENUM_ORDER_TYPE_TIME typeTime; ulong magic; ENUM_ORDER_REASON reason; ENUM_ORDER_TYPE_FILLING typeFilling; string comment; double volumeInitial; double priceStopLimit; }; //-- #define NOW datetime(TimeCurrent()) #define ONE_DAY datetime(TimeCurrent() - PeriodSeconds(PERIOD_D1)) #define ONE_WEEK datetime(TimeCurrent() - PeriodSeconds(PERIOD_W1)) #define ONE_MONTH datetime(TimeCurrent() - PeriodSeconds(PERIOD_MN1)) #define ONE_YEAR datetime(TimeCurrent() - (PeriodSeconds(PERIOD_MN1) * 12)) #define EPOCH 0 // 1st Jan 1970 //-- #define TODAY 12 #define THIS_WEEK 13 #define THIS_MONTH 14 #define THIS_YEAR 15 //-- #define ALL_SYMBOLS "" #define ALL_POSITIONS 1110 #define ALL_ORDERS 1111 #define ALL_DEALS 1112 //-- #import "Wanateki/Toolkit/HistoryManager/HistoryManager.ex5" //-- void PrintDealsHistory(datetime fromDateTime, datetime toDateTime); void PrintOrdersHistory(datetime fromDateTime, datetime toDateTime); void PrintPositionsHistory(datetime fromDateTime, datetime toDateTime); void PrintPendingOrdersHistory(datetime fromDateTime, datetime toDateTime); //-- bool GetDealsData(DealData &dealsData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); bool GetOrdersData(OrderData &ordersData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); bool GetPositionsData(PositionData &positionsData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); bool GetPendingOrdersData(PendingOrderData &pendingOrdersData[], datetime fromDateTime, datetime toDateTime, string symbol, ulong magic); //-- bool GetDealsData(DealData &dealsData[], datetime fromDateTime, datetime toDateTime); bool GetOrdersData(OrderData &ordersData[], datetime fromDateTime, datetime toDateTime); bool GetPositionsData(PositionData &positionsData[], datetime fromDateTime, datetime toDateTime); bool GetPendingOrdersData(PendingOrderData &pendingOrdersData[], datetime fromDateTime, datetime toDateTime); //-- bool GetAllDealsData(DealData &dealsData[]); bool GetAllOrdersData(OrderData &ordersData[]); bool GetAllPositionsData(PositionData &positionsData[]); bool GetAllPendingOrdersData(PendingOrderData &pendingOrdersData[]); //-- bool GetAllDealsData(DealData &dealsData[], string symbol, ulong magic); bool GetAllOrdersData(OrderData &ordersData[], string symbol, ulong magic); bool GetAllPositionsData(PositionData &positionsData[], string symbol, ulong magic); bool GetAllPendingOrdersData(PendingOrderData &pendingOrdersData[], string symbol, ulong magic); //-- bool GetLastClosedPositionData(PositionData &lastClosedPositionInfo); bool LastClosedPositionType(ENUM_POSITION_TYPE &lastClosedPositionType); bool LastClosedPositionVolume(double &lastClosedPositionVolume); bool LastClosedPositionSymbol(string &lastClosedPositionSymbol); bool LastClosedPositionTicket(ulong &lastClosedPositionTicket); bool LastClosedPositionProfit(double &lastClosedPositionProfit); bool LastClosedPositionNetProfit(double &lastClosedPositionNetProfit); bool LastClosedPositionPipProfit(int &lastClosedPositionPipProfit); bool LastClosedPositionClosePrice(double &lastClosedPositionClosePrice); bool LastClosedPositionOpenPrice(double &lastClosedPositionOpenPrice); bool LastClosedPositionSlPrice(double &lastClosedPositionSlPrice); bool LastClosedPositionTpPrice(double &lastClosedPositionTpPrice); bool LastClosedPositionSlPips(int &lastClosedPositionSlPips); bool LastClosedPositionTpPips(int &lastClosedPositionTpPips); bool LastClosedPositionOpenTime(datetime &lastClosedPositionOpenTime); bool LastClosedPositionCloseTime(datetime &lastClosedPositionCloseTime); bool LastClosedPositionSwap(double &lastClosedPositionSwap); bool LastClosedPositionCommission(double &lastClosedPositionCommission); bool LastClosedPositionInitiatedByPendingOrder(bool &lastClosedPositionInitiatedByPendingOrder); bool LastClosedPositionInitiatingOrderType(ENUM_ORDER_TYPE &lastClosedPositionInitiatingOrderType); bool LastClosedPositionId(ulong &lastClosedPositionId); bool LastClosedPositionOpeningOrderTicket(ulong &lastClosedPositionOpeningOrderTicket); bool LastClosedPositionOpeningDealTicket(ulong &lastClosedPositionOpeningDealTicket); bool LastClosedPositionClosingDealTicket(ulong &lastClosedPositionClosingDealTicket); bool LastClosedPositionMagic(ulong &lastClosedPositionMagic); bool LastClosedPositionComment(string &lastClosedPositionComment); bool LastClosedPositionDuration(long &lastClosedPositionDuration); //-- bool GetLastClosedProfitablePositionData(PositionData &lastClosedProfitablePositionInfo); bool GetLastClosedLossPositionData(PositionData &lastClosedLossPositionData); //-- bool GetLastFilledPendingOrderData(PendingOrderData &getLastFilledPendingOrderData); bool LastFilledPendingOrderType(ENUM_ORDER_TYPE &lastFilledPendingOrderType); bool LastFilledPendingOrderSymbol(string &lastFilledPendingOrderSymbol); bool LastFilledPendingOrderTicket(ulong &lastFilledPendingOrderTicket); bool LastFilledPendingOrderPriceOpen(double &lastFilledPendingOrderPriceOpen); bool LastFilledPendingOrderSlPrice(double &lastFilledPendingOrderSlPrice); bool LastFilledPendingOrderTpPrice(double &lastFilledPendingOrderTpPrice); bool LastFilledPendingOrderSlPips(int &lastFilledPendingOrderSlPips); bool LastFilledPendingOrderTpPips(int &lastFilledPendingOrderTpPips); bool LastFilledPendingOrderTimeSetup(datetime &lastFilledPendingOrderTimeSetup); bool LastFilledPendingOrderTimeDone(datetime &lastFilledPendingOrderTimeDone); bool LastFilledPendingOrderExpirationTime(datetime &lastFilledPendingOrderExpirationTime); bool LastFilledPendingOrderPositionId(ulong &lastFilledPendingOrderPositionId); bool LastFilledPendingOrderMagic(ulong &lastFilledPendingOrderMagic); bool LastFilledPendingOrderReason(ENUM_ORDER_REASON &lastFilledPendingOrderReason); bool LastFilledPendingOrderTypeFilling(ENUM_ORDER_TYPE_FILLING &lastFilledPendingOrderTypeFilling); bool LastFilledPendingOrderTypeTime(datetime &lastFilledPendingOrderTypeTime); bool LastFilledPendingOrderComment(string &lastFilledPendingOrderComment); //-- bool GetLastCanceledPendingOrderData(PendingOrderData &getLastCanceledPendingOrderData); bool LastCanceledPendingOrderType(ENUM_ORDER_TYPE &lastCanceledPendingOrderType); bool LastCanceledPendingOrderSymbol(string &lastCanceledPendingOrderSymbol); bool LastCanceledPendingOrderTicket(ulong &lastCanceledPendingOrderTicket); bool LastCanceledPendingOrderPriceOpen(double &lastCanceledPendingOrderPriceOpen); bool LastCanceledPendingOrderSlPrice(double &lastCanceledPendingOrderSlPrice); bool LastCanceledPendingOrderTpPrice(double &lastCanceledPendingOrderTpPrice); bool LastCanceledPendingOrderSlPips(int &lastCanceledPendingOrderSlPips); bool LastCanceledPendingOrderTpPips(int &lastCanceledPendingOrderTpPips); bool LastCanceledPendingOrderTimeSetup(datetime &lastCanceledPendingOrderTimeSetup); bool LastCanceledPendingOrderTimeDone(datetime &lastCanceledPendingOrderTimeDone); bool LastCanceledPendingOrderExpirationTime(datetime &lastCanceledPendingOrderExpirationTime); bool LastCanceledPendingOrderPositionId(ulong &lastCanceledPendingOrderPositionId); bool LastCanceledPendingOrderMagic(ulong &lastCanceledPendingOrderMagic); bool LastCanceledPendingOrderReason(ENUM_ORDER_REASON &lastCanceledPendingOrderReason); bool LastCanceledPendingOrderTypeFilling(ENUM_ORDER_TYPE_FILLING &lastCanceledPendingOrderTypeFilling); bool LastCanceledPendingOrderTypeTime(datetime &lastCanceledPendingOrderTypeTime); bool LastCanceledPendingOrderComment(string &lastCanceledPendingOrderComment); //* //-- bool GetLastClosedPositionData(PositionData &lastClosedPositionInfo, string symbol, ulong magic); bool LastClosedPositionType(ENUM_POSITION_TYPE &lastClosedPositionType, string symbol, ulong magic); bool LastClosedPositionVolume(double &lastClosedPositionVolume, string symbol, ulong magic); bool LastClosedPositionSymbol(string &lastClosedPositionSymbol, string symbol, ulong magic); bool LastClosedPositionTicket(ulong &lastClosedPositionTicket, string symbol, ulong magic); bool LastClosedPositionProfit(double &lastClosedPositionProfit, string symbol, ulong magic); bool LastClosedPositionNetProfit(double &lastClosedPositionNetProfit, string symbol, ulong magic); bool LastClosedPositionPipProfit(int &lastClosedPositionPipProfit, string symbol, ulong magic); bool LastClosedPositionClosePrice(double &lastClosedPositionClosePrice, string symbol, ulong magic); bool LastClosedPositionOpenPrice(double &lastClosedPositionOpenPrice, string symbol, ulong magic); bool LastClosedPositionSlPrice(double &lastClosedPositionSlPrice, string symbol, ulong magic); bool LastClosedPositionTpPrice(double &lastClosedPositionTpPrice, string symbol, ulong magic); bool LastClosedPositionSlPips(int &lastClosedPositionSlPips, string symbol, ulong magic); bool LastClosedPositionTpPips(int &lastClosedPositionTpPips, string symbol, ulong magic); bool LastClosedPositionOpenTime(datetime &lastClosedPositionOpenTime, string symbol, ulong magic); bool LastClosedPositionCloseTime(datetime &lastClosedPositionCloseTime, string symbol, ulong magic); bool LastClosedPositionSwap(double &lastClosedPositionSwap, string symbol, ulong magic); bool LastClosedPositionCommission(double &lastClosedPositionCommission, string symbol, ulong magic); bool LastClosedPositionInitiatingOrderType(ENUM_ORDER_TYPE &lastClosedPositionInitiatingOrderType, string symbol, ulong magic); bool LastClosedPositionId(ulong &lastClosedPositionId, string symbol, ulong magic); bool LastClosedPositionInitiatedByPendingOrder(bool &lastClosedPositionInitiatedByPendingOrder, string symbol, ulong magic); bool LastClosedPositionOpeningOrderTicket(ulong &lastClosedPositionOpeningOrderTicket, string symbol, ulong magic); bool LastClosedPositionOpeningDealTicket(ulong &lastClosedPositionOpeningDealTicket, string symbol, ulong magic); bool LastClosedPositionClosingDealTicket(ulong &lastClosedPositionClosingDealTicket, string symbol, ulong magic); bool LastClosedPositionMagic(ulong &lastClosedPositionMagic, string symbol, ulong magic); bool LastClosedPositionComment(string &lastClosedPositionComment, string symbol, ulong magic); bool LastClosedPositionDuration(long &lastClosedPositionDuration, string symbol, ulong magic); //-- bool GetLastClosedProfitablePositionData(PositionData &lastClosedProfitablePositionInfo, string symbol, ulong magic); bool GetLastClosedLossPositionData(PositionData &lastClosedLossPositionData, string symbol, ulong magic); //-- bool GetLastFilledPendingOrderData(PendingOrderData &lastFilledPendingOrderData, string symbol, ulong magic); bool LastFilledPendingOrderType(ENUM_ORDER_TYPE &lastFilledPendingOrderType, string symbol, ulong magic); bool LastFilledPendingOrderSymbol(string &lastFilledPendingOrderSymbol, string symbol, ulong magic); bool LastFilledPendingOrderTicket(ulong &lastFilledPendingOrderTicket, string symbol, ulong magic); bool LastFilledPendingOrderPriceOpen(double &lastFilledPendingOrderPriceOpen, string symbol, ulong magic); bool LastFilledPendingOrderSlPrice(double &lastFilledPendingOrderSlPrice, string symbol, ulong magic); bool LastFilledPendingOrderTpPrice(double &lastFilledPendingOrderTpPrice, string symbol, ulong magic); bool LastFilledPendingOrderSlPips(int &lastFilledPendingOrderSlPips, string symbol, ulong magic); bool LastFilledPendingOrderTpPips(int &lastFilledPendingOrderTpPips, string symbol, ulong magic); bool LastFilledPendingOrderTimeSetup(datetime &lastFilledPendingOrderTimeSetup, string symbol, ulong magic); bool LastFilledPendingOrderTimeDone(datetime &lastFilledPendingOrderTimeDone, string symbol, ulong magic); bool LastFilledPendingOrderExpirationTime(datetime &lastFilledPendingOrderExpirationTime, string symbol, ulong magic); bool LastFilledPendingOrderPositionId(ulong &lastFilledPendingOrderPositionId, string symbol, ulong magic); bool LastFilledPendingOrderMagic(ulong &lastFilledPendingOrderMagic, string symbol, ulong magic); bool LastFilledPendingOrderReason(ENUM_ORDER_REASON &lastFilledPendingOrderReason, string symbol, ulong magic); bool LastFilledPendingOrderTypeFilling(ENUM_ORDER_TYPE_FILLING &lastFilledPendingOrderTypeFilling, string symbol, ulong magic); bool LastFilledPendingOrderTypeTime(datetime &lastFilledPendingOrderTypeTime, string symbol, ulong magic); bool LastFilledPendingOrderComment(string &lastFilledPendingOrderComment, string symbol, ulong magic); //-- bool GetLastCanceledPendingOrderData(PendingOrderData &lastCanceledPendingOrderData, string symbol, ulong magic); bool LastCanceledPendingOrderType(ENUM_ORDER_TYPE &lastCanceledPendingOrderType, string symbol, ulong magic); bool LastCanceledPendingOrderSymbol(string &lastCanceledPendingOrderSymbol, string symbol, ulong magic); bool LastCanceledPendingOrderTicket(ulong &lastCanceledPendingOrderTicket, string symbol, ulong magic); bool LastCanceledPendingOrderPriceOpen(double &lastCanceledPendingOrderPriceOpen, string symbol, ulong magic); bool LastCanceledPendingOrderSlPrice(double &lastCanceledPendingOrderSlPrice, string symbol, ulong magic); bool LastCanceledPendingOrderTpPrice(double &lastCanceledPendingOrderTpPrice, string symbol, ulong magic); bool LastCanceledPendingOrderSlPips(int &lastCanceledPendingOrderSlPips, string symbol, ulong magic); bool LastCanceledPendingOrderTpPips(int &lastCanceledPendingOrderTpPips, string symbol, ulong magic); bool LastCanceledPendingOrderTimeSetup(datetime &lastCanceledPendingOrderTimeSetup, string symbol, ulong magic); bool LastCanceledPendingOrderTimeDone(datetime &lastCanceledPendingOrderTimeDone, string symbol, ulong magic); bool LastCanceledPendingOrderExpirationTime(datetime &lastCanceledPendingOrderExpirationTime, string symbol, ulong magic); bool LastCanceledPendingOrderPositionId(ulong &lastCanceledPendingOrderPositionId, string symbol, ulong magic); bool LastCanceledPendingOrderMagic(ulong &lastCanceledPendingOrderMagic, string symbol, ulong magic); bool LastCanceledPendingOrderReason(ENUM_ORDER_REASON &lastCanceledPendingOrderReason, string symbol, ulong magic); bool LastCanceledPendingOrderTypeFilling(ENUM_ORDER_TYPE_FILLING &lastCanceledPendingOrderTypeFilling, string symbol, ulong magic); bool LastCanceledPendingOrderTypeTime(datetime &lastCanceledPendingOrderTypeTime, string symbol, ulong magic); bool LastCanceledPendingOrderComment(string &lastCanceledPendingOrderComment, string symbol, ulong magic); //-- string BoolToString(bool boolVariable); datetime GetPeriodStart(int periodType); #import //+------------------------------------------------------------------+

Practical Implementation and Overview of the History Manager EX5 Library

We will now examine the library functions, organizing them into their respective categories for better clarity and usability. Along the way, we will describe their roles and provide simple use cases to demonstrate how they can be used to accomplish various tasks.

1. Printing Trade Histories for a Specified Time Range

These functions enable you to print trade history data directly to the MetaTrader 5 terminals' log, making it convenient for quick reference and debugging. They are of type void, meaning they do not return any values, and accept two parameters of the datetime type, which are used to specify the time range of the history to be processed:

| Function Prototype Definition | Description | Example Use Case |

|---|---|---|

void PrintDealsHistory( datetime fromDateTime, datetime toDateTime ); | Prints details of all deals within a specified time range. | // Print the deals history for the last 24 hours (1 day)

PrintDealsHistory(ONE_DAY, NOW); |

void PrintOrdersHistory( datetime fromDateTime, datetime toDateTime ); | Prints details of all orders within a specified time range. | // Print the orders history for the last 24 hours (1 day)

PrintOrdersHistory(ONE_DAY, NOW); |

void PrintPositionsHistory( datetime fromDateTime, datetime toDateTime ); | Prints details of all closed positions within a specified time range. | // Print the positions history for the last 24 hours (1 day)

PrintPositionsHistory(ONE_DAY, NOW); |

void PrintPendingOrdersHistory( datetime fromDateTime, datetime toDateTime ); | Prints details of all pending orders within a specified time range. | // Print the pending orders history for the last 24 hours (1 day)

PrintPendingOrdersHistory(ONE_DAY, NOW); |

2. Retrieving Trade History Data for a Specified Time Range

These functions allow you to programmatically retrieve trade history data, filtered by symbol and magic number, for a specified period. The retrieved data is stored in data structure arrays, enabling further analysis or processing:

| Function Prototype Definition | Description | Example Use Case |

|---|---|---|

bool GetDealsData( DealData &dealsData[], // [out] datetime fromDateTime, datetime toDateTime, string symbol, // Optional parameter ulong magic // Optional parameter ); | This function searches for and retrieves deal data within a specified time range. Additionally, it offers the option to filter the retrieved data by symbol and magic number, allowing for more targeted processing. | // Print the total account net profit for the last 7 days DealData dealsData[]; if( GetDealsData( dealsData, ONE_WEEK, NOW, ALL_SYMBOLS, 0 ) && ArraySize(dealsData) > 0 ) { double totalGrossProfit = 0.0, totalSwap = 0.0, totalCommission = 0.0; int totalDeals = ArraySize(dealsData); for(int k = 0; k < totalDeals; k++) { if(dealsData[k].entry == DEAL_ENTRY_OUT) { totalGrossProfit += dealsData[k].profit; totalSwap += dealsData[k].swap; totalCommission += dealsData[k].commission; } } double totalExpenses = totalSwap + totalCommission; double totalNetProfit = totalGrossProfit - MathAbs(totalExpenses); Print("-------------------------------------------------"); Print( "Account No: ", AccountInfoInteger(ACCOUNT_LOGIN), " [ 7 DAYS NET PROFIT ]" ); Print( "Total Gross Profit: ", DoubleToString(totalGrossProfit, 2), " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print( "Total Swap: ", DoubleToString(totalSwap, 2), " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print( "Total Commission: ", DoubleToString(totalCommission, 2), " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print( "Total Net Profit: ", DoubleToString(totalNetProfit, 2), " ", AccountInfoString(ACCOUNT_CURRENCY) ); } |

bool GetOrdersData( OrderData &ordersData[], // [out] datetime fromDateTime, datetime toDateTime, string symbol, // Optional parameter ulong magic // Optional parameter ); | This function queries for and retrieves order data within a specified time range. Additionally, it offers the option to filter the retrieved data by symbol and magic number. | // Print the total BUY Orders filled in the last 7 days OrderData ordersData[]; if( GetOrdersData(ordersData, ONE_WEEK, NOW) && ArraySize(ordersData) > 0 ) { int totalBuyOrdersFilled = 0, totalOrders = ArraySize(ordersData); for(int w = 0; w < totalOrders; w++) { if(ordersData[w].type == ORDER_TYPE_BUY) ++totalBuyOrdersFilled; } Print(""); Print("-------------------------------------------------"); Print("Account No: ", AccountInfoInteger(ACCOUNT_LOGIN)); Print(totalBuyOrdersFilled, " BUY Orders Filled in the last 7 days!"); } |

bool GetPositionsData( PositionData &positionsData[], // [out] datetime fromDateTime, datetime toDateTime, string symbol, // Optional parameter ulong magic // Optional parameter ); | This function searches and retrieves closed position history data within a specified time range. You have the option of filtering the retrieved data by symbol and magic number values. | // Print total pips earned in last 24hrs for specified symbol and magic string symbol = _Symbol; long magic = 0; PositionData positionsData[]; if( GetPositionsData(positionsData, ONE_DAY, NOW, symbol, magic) && ArraySize(positionsData) > 0 ) { int totalPipsEarned = 0, totalPositions = ArraySize(positionsData); for(int k = 0; k < totalPositions; k++) { totalPipsEarned += positionsData[k].pipProfit; } Print(""); Print("-------------------------------------------------"); Print("Account No: ", AccountInfoInteger(ACCOUNT_LOGIN)); Print( totalPipsEarned, " pips earned in the last 24hrs for ", symbol, " with magic no. ", magic ); } |

bool GetPendingOrdersData( PendingOrderData &pendingOrdersData[], // [out] datetime fromDateTime, datetime toDateTime, string symbol, // Optional parameter ulong magic // Optional parameter ); | This function gets the pending orders data history within a specified time range. It also gives you the option of filtering the pending orders history data by symbol and magic number. | // Print total number of buy and sell stops filled for symbol and magic // in the last 7 days string symbol = _Symbol; long magic = 0; PendingOrderData pendingOrdersData[]; if( GetPendingOrdersData(pendingOrdersData, ONE_WEEK, NOW, symbol, magic) && ArraySize(pendingOrdersData) > 0 ) { int totalBuyStopsFilled = 0, totalSellStopsFilled = 0, totalPendingOrders = ArraySize(pendingOrdersData); for(int k = 0; k < totalPendingOrders; k++) { if(pendingOrdersData[k].type == ORDER_TYPE_BUY_STOP) ++totalBuyStopsFilled; if(pendingOrdersData[k].type == ORDER_TYPE_SELL_STOP) ++totalSellStopsFilled; } Print(""); Print("-------------------------------------------------"); Print("Account No: ", AccountInfoInteger(ACCOUNT_LOGIN), ", Magic No = ", magic); Print( symbol, " --> Total Filled - (Buy Stops = ", totalBuyStopsFilled, ") (Sell Stops = ", totalSellStopsFilled, ") in the last 7 days." ); } |

3. Retrieving All Historical Trade

These functions provide a comprehensive way to fetch all available trade history data in the account, with optional filters for symbol and magic number, without the requirement of inputting a specific time range:

| Function Prototype Definition | Description | Example Use Case |

|---|---|---|

bool GetAllDealsData( DealData &dealsData[], // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | The function retrieves all deal data, with the option of filtering the deals history data by symbol and magic number. | // Find and list total deposited funds in the account DealData dealsData[]; if(GetAllDealsData(dealsData) && ArraySize(dealsData) > 0) { double totalDeposits = 0.0; int totalDeals = ArraySize(dealsData); Print(""); for(int k = 0; k < totalDeals; k++) { if(dealsData[k].type == DEAL_TYPE_BALANCE) { totalDeposits += dealsData[k].profit; Print( dealsData[k].profit, " ", AccountInfoString(ACCOUNT_CURRENCY), " --> Cash deposit on: ", dealsData[k].time ); } } Print("-------------------------------------------------"); Print( "Account No: ", AccountInfoInteger(ACCOUNT_LOGIN), " Total Cash Deposits: ", totalDeposits, " ", AccountInfoString(ACCOUNT_CURRENCY) ); } |

bool GetAllOrdersData( OrderData &ordersData[], // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function fetches all order data while providing the option to filter the orders history by symbol and magic number. | // Find if the account has ever gotten a Stop Out/Margin Call OrderData ordersData[]; if(GetAllOrdersData(ordersData) && ArraySize(ordersData) > 0) { int totalStopOuts = 0; int totalOrders = ArraySize(ordersData); Print(""); for(int k = 0; k < totalOrders; k++) { if(ordersData[k].reason == ORDER_REASON_SO) { ++totalStopOuts; Print( EnumToString(ordersData[k].type), " --> on: ", ordersData[k].timeDone ); } } Print("-------------------------------------------------"); Print("Account No: ", AccountInfoInteger(ACCOUNT_LOGIN)); Print("Total STOP OUT events: ", totalStopOuts); } |

bool GetAllPositionsData( PositionData &positionsData[], // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | The function obtains all position history data, with the option of filtering the closed positions data by symbol and magic number. | // Find the average trade duration in seconds PositionData positionsData[]; if(GetAllPositionsData(positionsData) && ArraySize(positionsData) > 0) { long totalTradesDuration = 0; int totalPositions = ArraySize(positionsData); Print(""); for(int k = 0; k < totalPositions; k++) { totalTradesDuration += positionsData[k].duration; } long averageTradesDuration = totalTradesDuration / totalPositions; Print("-------------------------------------------------"); Print("Account No: ", AccountInfoInteger(ACCOUNT_LOGIN)); Print("Average trade duration: ", averageTradesDuration, " seconds."); } |

bool GetAllPendingOrdersData( PendingOrderData &pendingOrdersData[], // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function retrieves all pending order data, with the option of filtering the pending orders history data by symbol and magic number. | // Find the total expired pending orders in the account PendingOrderData pendingOrdersData[]; if(GetAllPendingOrdersData(pendingOrdersData) && ArraySize(pendingOrdersData) > 0) { int totalExpiredPendingOrders = 0; int totalPendingOrders = ArraySize(pendingOrdersData); Print(""); Print("-- EXPIRED PENDING ORDERS --"); for(int k = 0; k < totalPendingOrders; k++) { if(pendingOrdersData[k].state == ORDER_STATE_EXPIRED) { ++totalExpiredPendingOrders; Print("Symbol = ", pendingOrdersData[k].symbol); Print("Time Setup = ", pendingOrdersData[k].timeSetup); Print("Ticket = ", pendingOrdersData[k].ticket); Print("Price Open = ", pendingOrdersData[k].priceOpen); Print( "SL Price = ", pendingOrdersData[k].slPrice, ", TP Price = ", pendingOrdersData[k].tpPrice ); Print("Expiration Time = ", pendingOrdersData[k].expirationTime); Print(""); } } Print("-------------------------------------------------"); Print("Account No: ", AccountInfoInteger(ACCOUNT_LOGIN)); Print("Total Expired Pending Orders: ", totalExpiredPendingOrders); } |

4. Analyzing Last Closed Positions

These functions are designed to obtain comprehensive details about the most recently closed positions, providing insights into key aspects such as profit or loss, trade volume, and the timing of each position's closure. Each function serves a unique purpose, ensuring you have access to every critical aspect of your last trade. The functions also give you the option of filtering the position history data to be processed by symbol and magic number:

| Function Prototype Definition | Description | Example Use Case |

|---|---|---|

bool GetLastClosedPositionData( PositionData &lastClosedPositionInfo, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | The function fetches a complete snapshot of the final closed position, including all relevant details. You have the option of filtering the result by symbol and magic number. | // Get the last closed position in the account PositionData lastClosedPositionInfo; if( GetLastClosedPositionData(lastClosedPositionInfo) && lastClosedPositionInfo.ticket > 0 ) { // Process the last closed position data Print("---LAST CLOSED POSITION--"); Print("Symbol: ", lastClosedPositionInfo.symbol); Print("Type: ", EnumToString(lastClosedPositionInfo.type)); Print("Open Time: ", lastClosedPositionInfo.openTime); Print("Close Time: ", lastClosedPositionInfo.closeTime); Print("Profit: ", lastClosedPositionInfo.profit); // Place more position properties analysis code.... } //- // Get the last closed position for GBPUSD and magic 0 PositionData lastClosedPositionInfo; string symbol = "GBPUSD"; if( GetLastClosedPositionData(lastClosedPositionInfo, symbol, 0) && lastClosedPositionInfo.ticket > 0 ) { // Process the last closed position data Print("---LAST CLOSED POSITION FOR ", symbol, " --"); Print("Symbol: ", lastClosedPositionInfo.symbol); Print("Type: ", EnumToString(lastClosedPositionInfo.type)); Print("Open Time: ", lastClosedPositionInfo.openTime); Print("Close Time: ", lastClosedPositionInfo.closeTime); Print("Profit: ", lastClosedPositionInfo.profit); // Place more position properties analysis code.... } |

bool LastClosedPositionType( ENUM_POSITION_TYPE &lastClosedPositionType, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function reveals whether the last position was a buy or sell trade. It has the option of filtering the data by symbol and magic number. | // Get the last closed position type in the account ENUM_POSITION_TYPE lastClosedPositionType; LastClosedPositionType(lastClosedPositionType); Print( "Account's last closed position type: ", EnumToString(lastClosedPositionType) ); //-- // Get the last closed position type for EURUSD and magic 0 ENUM_POSITION_TYPE lastClosedPositionType; LastClosedPositionType(lastClosedPositionType, "EURUSD", 0); Print( "EURUSD: last closed position type: ", EnumToString(lastClosedPositionType) ); |

bool LastClosedPositionVolume( double &lastClosedPositionVolume, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function provides the trade volume of the most recently closed position. The function also gives you the option of filtering the data by symbol and magic number. | // Get the last closed position volume in the account double lastClosedPositionVolume; LastClosedPositionVolume(lastClosedPositionVolume); Print( "Account's last closed position volume: ", lastClosedPositionVolume ); //-- // Get the last closed position volume for GBPUSD and magic 0 double lastClosedPositionVolume; LastClosedPositionVolume(lastClosedPositionVolume, "GBPUSD", 0); Print( "GBPUSD: last closed position volume: ", lastClosedPositionVolume ); |

bool LastClosedPositionSymbol( string &lastClosedPositionSymbol, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | The function obtains the symbol of the most recently closed position. Gives you the option of filtering the result by symbol and magic number. | // Get the last closed position's symbol in the account string lastClosedPositionSymbol; LastClosedPositionSymbol(lastClosedPositionSymbol); Print( lastClosedPositionSymbol, " is the last closed position symbol ", "in the account" ); //-- // Get the last closed position's symbol for magic 0 string lastClosedPositionSymbol; LastClosedPositionSymbol(lastClosedPositionSymbol, ALL_SYMBOLS, 0); Print( lastClosedPositionSymbol, " is the last closed position symbol ", "for magic no: 0." ); |

bool LastClosedPositionTicket( ulong &lastClosedPositionTicket, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function retrieves the ticket number of the most recently closed position. The function hast the option of filtering the result by symbol and magic number. | // Get the last closed position's ticket in the account long lastClosedPositionTicket; LastClosedPositionTicket(lastClosedPositionTicket); Print( "Account's last closed position's ticket: ", lastClosedPositionTicket ); //-- // Get the last closed position's ticket for EURUSD and magic 0 long lastClosedPositionTicket; LastClosedPositionTicket(lastClosedPositionTicket, "EURUSD", 0); Print( "EURUSD: last closed position's ticket: ", lastClosedPositionTicket ); |

bool LastClosedPositionProfit( double &lastClosedPositionProfit, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function delivers the gross profit generated by the last trade. You also get the option of filtering the data by symbol and magic number. | // Get the last closed position's profit in the account double lastClosedPositionProfit; LastClosedPositionProfit(lastClosedPositionProfit); Print( "Account's last closed position's profit: ", lastClosedPositionProfit, " ", AccountInfoString(ACCOUNT_CURRENCY) ); //-- // Get the last closed position's profit for EURUSD and magic 0 //double lastClosedPositionProfit; LastClosedPositionProfit(lastClosedPositionProfit, "EURUSD", 0); Print( "EURUSD: last closed position's profit: ", lastClosedPositionProfit, " ", AccountInfoString(ACCOUNT_CURRENCY) ); |

Here are the remaining library functions responsible for retrieving the properties of the last closed position. For implementation details, refer to the code examples above, including functions like LastClosedPositionVolume(), LastClosedPositionType(), and others, as they all follow a similar approach.

| Function Prototype Definition | Description |

|---|---|

bool LastClosedPositionNetProfit( double &lastClosedPositionNetProfit, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Calculates the net profit of the last trade, factoring in swaps and commissions. The function has the option of filtering the data by symbol and magic number. |

bool LastClosedPositionPipProfit( int &lastClosedPositionPipProfit, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Obtains the profit measured in pips for the final closed position. Data can be filtered by symbol and magic number. |

bool LastClosedPositionClosePrice( double &lastClosedPositionClosePrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the price at which the position was closed. The function provides the option of filtering the result by symbol and magic number. |

bool LastClosedPositionOpenPrice( double &lastClosedPositionOpenPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Reveals the price at which the position was initially opened. You can optionally filter the data by symbol and magic number. |

bool LastClosedPositionSlPrice( double &lastClosedPositionSlPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Fetches the stop-loss price set for the last closed position. The function gives you the option of filtering the result by symbol and magic number. |

bool LastClosedPositionTpPrice( double &lastClosedPositionTpPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Provides the take-profit price assigned to the last closed trade. An option to filter the data by symbol and magic number is also provided. |

bool LastClosedPositionSlPips( int &lastClosedPositionSlPips, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Indicates the stop-loss distance in pips for the last closed position. Data filtering by symbol and magic number is also supported. |

bool LastClosedPositionTpPips( int &lastClosedPositionTpPips, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Shows the take-profit distance in pips for the most recently closed trade. The function can also optionally filter the result by symbol and magic number. |

bool LastClosedPositionOpenTime( datetime &lastClosedPositionOpenTime, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the timestamp when the last closed position was opened. Data filtering by symbol and magic number is also provided. |

bool LastClosedPositionCloseTime( datetime &lastClosedPositionCloseTime, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Provides the exact time when the most recently closed position was closed. You can also optionally filter the result by symbol and magic number. |

bool LastClosedPositionSwap( double &lastClosedPositionSwap, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Reveals the swap value associated with the last closed position. The information can also be optionally filtered by symbol and magic number values. |

bool LastClosedPositionCommission( double &lastClosedPositionCommission, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Fetches the commission charged for the last closed trade. Filtering by symbol and magic number is also supported. |

bool LastClosedPositionInitiatingOrderType( ENUM_ORDER_TYPE &lastClosedPositionInitiatingOrderType, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Identifies the type of order that initiated the last closed position. You can optionally filter the result by symbol and magic number. |

bool LastClosedPositionId( ulong &lastClosedPositionId, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the unique identifier for the most recent closed position. The symbol and magic parameters are optional and only required when you need to filter the result. |

bool LastClosedPositionInitiatedByPendingOrder( bool &lastClosedPositionInitiatedByPendingOrder, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Checks if the last closed position was triggered or initiated by a pending order. You can optionally filter the data by symbol and magic number. |

bool LastClosedPositionOpeningOrderTicket( ulong &lastClosedPositionOpeningOrderTicket, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Provides the ticket number of the order that opened the position. The function can also optionally filter the data by symbol and magic number. |

bool LastClosedPositionOpeningDealTicket( ulong &lastClosedPositionOpeningDealTicket, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Fetches the ticket number of the deal that initiated the position. You have the option of filtering the result by symbol and magic number. |

bool LastClosedPositionClosingDealTicket( ulong &lastClosedPositionClosingDealTicket, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the ticket number of the deal that closed the position. Filtering the data by symbol and magic is also an option. |

bool LastClosedPositionMagic( ulong &lastClosedPositionMagic, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Reveals the magic number associated with the last closed position. You have the option of filtering the data by symbol and magic number. |

bool LastClosedPositionComment( string &lastClosedPositionComment, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves any comments or notes attached to the most recently closed trade. Filtering the result by symbol and magic number is also a provided option. |

bool LastClosedPositionDuration( long &lastClosedPositionDuration, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Calculates the total duration (in seconds) that the position remained open. You have the option of filtering the result by symbol and magic number. |

5. Analyzing The Last Closed Profitable and Loss-Making Positions

When you need to retrieve the properties of the last closed profitable or loss-making position, the History Manager library provides two dedicated functions for this task. These functions allow you to quickly access all relevant details with a single function call, enabling you to analyze the most recent closed position based on its profitability. By providing essential data, they help in evaluating trading performance and refining strategies. Additionally, these functions offer the flexibility to filter results by a specific symbol and magic number, allowing you to focus on particular trades and assess the performance of individual strategies or assets more effectively.

| Function Prototype Definition | Description | Example Use Case |

|---|---|---|

bool GetLastClosedProfitablePositionData( PositionData &lastClosedProfitablePositionInfo, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the details and properties of the most recently closed position that closed with a profit. The function also gives you the option of filtering the results by symbol and magic number. | // Get the symbol, ticket, and net and pip profit of // the last closed profitable position PositionData lastClosedProfitablePosition; if( GetLastClosedProfitablePositionData(lastClosedProfitablePosition) && lastClosedProfitablePosition.ticket > 0 ) { Print("-------------------------------------------------"); Print( lastClosedProfitablePosition.symbol, " --> LAST CLOSED PROFITABLE POSITION" ); Print("Ticket = ", lastClosedProfitablePosition.ticket); Print( "Net Profit = ", lastClosedProfitablePosition.netProfit, " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print("Pip Profit = ", lastClosedProfitablePosition.pipProfit); } //-- // Get the ticket, and net and pip profit of // the last closed profitable position for EURUSD and magic 0 PositionData lastClosedProfitablePosition; if( GetLastClosedProfitablePositionData( lastClosedProfitablePosition, "EURUSD", 0 ) && lastClosedProfitablePosition.ticket > 0 ) { Print("-------------------------------------------------"); Print("EURUSD --> LAST CLOSED PROFITABLE POSITION"); Print("Ticket = ", lastClosedProfitablePosition.ticket); Print( "Net Profit = ", lastClosedProfitablePosition.netProfit, " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print("Pip Profit = ", lastClosedProfitablePosition.pipProfit); } |

bool GetLastClosedLossPositionData( PositionData &lastClosedLossPositionData, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the details and properties of the most recently closed position that closed or resulted in a loss. The function also enables you to optionally filter the results by symbol and magic number. | // Get the symbol, ticket, and net and pip profit of // the last closed loss position PositionData lastClosedLossPosition; if( GetLastClosedLossPositionData(lastClosedLossPosition) && lastClosedLossPosition.ticket > 0 ) { Print("-------------------------------------------------"); Print( lastClosedLossPosition.symbol, " --> LAST CLOSED LOSS POSITION" ); Print("Ticket = ", lastClosedLossPosition.ticket); Print( "Net Profit = ", lastClosedLossPosition.netProfit, " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print("Pip Profit = ", lastClosedLossPosition.pipProfit); } //-- // Get the ticket, and net and pip profit of // the last closed loss position for GBPUSD and magic 0 PositionData lastClosedLossPosition; if( GetLastClosedLossPositionData( lastClosedLossPosition, "GBPUSD", 0 ) && lastClosedLossPosition.ticket > 0 ) { Print("-------------------------------------------------"); Print("GBPUSD --> LAST CLOSED LOSS POSITION"); Print("Ticket = ", lastClosedLossPosition.ticket); Print( "Net Profit = ", lastClosedLossPosition.netProfit, " ", AccountInfoString(ACCOUNT_CURRENCY) ); Print("Pip Profit = ", lastClosedLossPosition.pipProfit); } |

6. Analyzing Last Filled and Canceled Pending Orders

To retrieve detailed information about the most recently filled or canceled pending order, the History Manager library provides specialized functions for this purpose. These functions allow you to fetch all relevant order details with a single function call, making it easier to analyze the execution or cancellation of pending orders. By providing key data, they help in assessing order handling, execution efficiency, and trading strategy adjustments. Additionally, these functions offer the flexibility to filter results by a specific symbol and magic number, enabling you to focus on particular orders and refine your approach based on precise historical data.

Since the last filled and canceled pending order functions are imported and implemented using the same approach as those that process the last closed position history data, only their function prototypes and brief descriptions will be provided. If you need an example of how to implement these functions, refer to the "Analyzing Last Closed Positions" section above.

To obtain complete details of the last filled pending order, the GetLastFilledPendingOrderData() function retrieves all relevant properties, offering a broad view of the order's execution. If you only need specific attributes, the following dedicated functions will allow you to extract individual details or properties:

| Function Prototype Definition | Description |

|---|---|

bool GetLastFilledPendingOrderData( PendingOrderData &lastFilledPendingOrderData, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function retrieves all pertinent details of the most recent pending order that has been filled, giving a complete picture of how the order was executed. |

bool LastFilledPendingOrderType( ENUM_ORDER_TYPE &lastFilledPendingOrderType, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Fetches the order type, helping you determine whether it was a buy stop, sell limit, or another pending order variant. |

bool LastFilledPendingOrderSymbol( string &lastFilledPendingOrderSymbol, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Identifies the trading instrument, allowing you to focus on orders associated with a particular asset. |

bool LastFilledPendingOrderTicket( ulong &lastFilledPendingOrderTicket, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Provides the unique order ticket, essential for referencing or tracking a specific executed order. |

bool LastFilledPendingOrderPriceOpen( double &lastFilledPendingOrderPriceOpen, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the price at which the order was triggered, crucial for analyzing entry conditions. |

bool LastFilledPendingOrderSlPrice( double &lastFilledPendingOrderSlPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastFilledPendingOrderTpPrice( double &lastFilledPendingOrderTpPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | These functions return the stop-loss and take-profit levels, respectively, ensuring you can assess risk management settings. |

bool LastFilledPendingOrderSlPips( int &lastFilledPendingOrderSlPips, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastFilledPendingOrderTpPips( int &lastFilledPendingOrderTpPips, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | These functions express stop-loss and take-profit distances in pips, giving a clearer view of the trade’s risk-to-reward ratio. |

bool LastFilledPendingOrderTimeSetup( datetime &lastFilledPendingOrderTimeSetup, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastFilledPendingOrderTimeDone( datetime &lastFilledPendingOrderTimeDone, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | LastFilledPendingOrderTimeSetup() records when the order was placed, while LastFilledPendingOrderTimeDone() logs when it was executed. This helps in analyzing the time duration between when the pending order was set up and when it was triggered or filled. |

bool LastFilledPendingOrderExpirationTime( datetime &lastFilledPendingOrderExpirationTime, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Checks and provides the expiration time, useful for time-sensitive trading strategies. |

bool LastFilledPendingOrderPositionId( ulong &lastFilledPendingOrderPositionId, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the position ID which is critical for linking the order to its corresponding position, ensuring accurate tracking. |

bool LastFilledPendingOrderMagic( ulong &lastFilledPendingOrderMagic, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the magic number, letting you filter orders based on automated strategies or trading bots. |

bool LastFilledPendingOrderReason( ENUM_ORDER_REASON &lastFilledPendingOrderReason, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Captures the reason for execution, offering insight into system-initiated or manual order processing. |

bool LastFilledPendingOrderTypeFilling( ENUM_ORDER_TYPE_FILLING &lastFilledPendingOrderTypeFilling, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastFilledPendingOrderTypeTime( datetime &lastFilledPendingOrderTypeTime, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | LastFilledPendingOrderTypeFilling() and LastFilledPendingOrderTypeTime() define the order filling method and time model, respectively, aiding in execution analysis. |

bool LastFilledPendingOrderComment( string &lastFilledPendingOrderComment, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Fetches any associated comments of the last filled pending order, which can be useful for labeling and categorizing trades. |

Similarly, if you need to examine the last canceled pending order, the GetLastCanceledPendingOrderData() function retrieves all details in one call. Alternatively, you can extract individual properties using the following specialized functions:

| Function Prototype Definition | Description |

|---|---|

bool GetLastCanceledPendingOrderData( PendingOrderData &lastCanceledPendingOrderData, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | This function provides a comprehensive record of the most recently canceled pending order, including all its properties and attributes. |

bool LastCanceledPendingOrderType( ENUM_ORDER_TYPE &lastCanceledPendingOrderType, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves and specifies the type of the last canceled pending order. |

bool LastCanceledPendingOrderSymbol( string &lastCanceledPendingOrderSymbol, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Gets and identifies the trading symbol for the most recently canceled pending order, allowing for targeted analysis. |

bool LastCanceledPendingOrderTicket( ulong &lastCanceledPendingOrderTicket, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Provides the last canceled pending order’s unique ticket number for reference |

bool LastCanceledPendingOrderPriceOpen( double &lastCanceledPendingOrderPriceOpen, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Gets and saves the original intended entry price of the last canceled pending order. |

bool LastCanceledPendingOrderSlPrice( double &lastCanceledPendingOrderSlPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastCanceledPendingOrderTpPrice( double &lastCanceledPendingOrderTpPrice, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | LastCanceledPendingOrderSlPrice() and LastCanceledPendingOrderTpPrice() retrieve the mostly recently canceled pending order’s stop-loss and take-profit price levels. |

bool LastCanceledPendingOrderSlPips( int &lastCanceledPendingOrderSlPips, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastCanceledPendingOrderTpPips( int &lastCanceledPendingOrderTpPips, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | LastCanceledPendingOrderSlPips() and LastCanceledPendingOrderTpPips() express the last canceled pending order's stop-loss and take-profit distances in pips. |

bool LastCanceledPendingOrderTimeSetup( datetime &lastCanceledPendingOrderTimeSetup, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastCanceledPendingOrderTimeDone( datetime &lastCanceledPendingOrderTimeDone, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | LastCanceledPendingOrderTimeSetup() provides the time when the last canceled pending order was placed, while LastCanceledPendingOrderTimeDone() records the time when it was removed by cancellation. |

bool LastCanceledPendingOrderExpirationTime( datetime &lastCanceledPendingOrderExpirationTime, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves and saves the time when the canceled pending order was set to expire. |

bool LastCanceledPendingOrderMagic( ulong &lastCanceledPendingOrderMagic, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Gets and stores the magic number associated with the last canceled pending order allowing for filtering based on automated strategy identifiers. |

bool LastCanceledPendingOrderReason( ENUM_ORDER_REASON &lastCanceledPendingOrderReason, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Retrieves the order reason of the last canceled pending order and allows us to identify on which platform the order was initiated from. |

bool LastCanceledPendingOrderTypeFilling( ENUM_ORDER_TYPE_FILLING &lastCanceledPendingOrderTypeFilling, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); bool LastCanceledPendingOrderTypeTime( datetime &lastCanceledPendingOrderTypeTime, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | LastCanceledPendingOrderTypeFilling() and LastCanceledPendingOrderTypeTime() retrieve and save the filling and time type settings for the last canceled pending order. |

bool LastCanceledPendingOrderComment( string &lastCanceledPendingOrderComment, // [Out] string symbol, // Optional parameter ulong magic // Optional parameter ); | Fetches any user-defined comments saved when opening the last canceled pending order for tracking purposes. |

| Function Prototype Definition | Description |

|---|---|

string BoolToString(bool boolVariable); | The utility function converts a boolean value to a string ("TRUE" or "FALSE") for easier readability and logging. |

datetime GetPeriodStart(int periodType); | This utility function returns the datetime value for the start of the year, month, week (starting on Sunday), or day, depending on the input type. It accepts predefined macros from the header file as input, namely TODAY, THIS_WEEK, THIS_MONTH, and THIS_YEAR. This function simplifies the process of obtaining the datetime value for these periods, allowing you to do so with a single line of code. |

In the next section, we will explore practical examples demonstrating how the History Management library can be used to generate insightful trading analytics. Additionally, we will develop an Expert Advisor that leverages the history library to determine the optimal volume or lot and position direction for executing new trades. This will highlight how historical data can be effectively incorporated into automated trading systems, improving both strategy execution and decision-making.

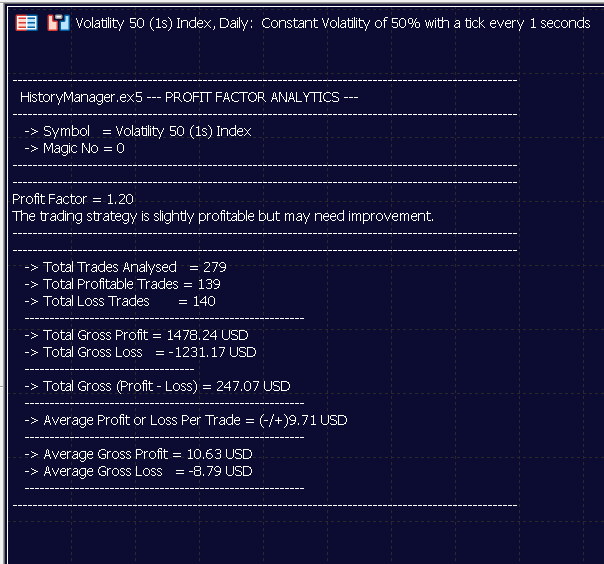

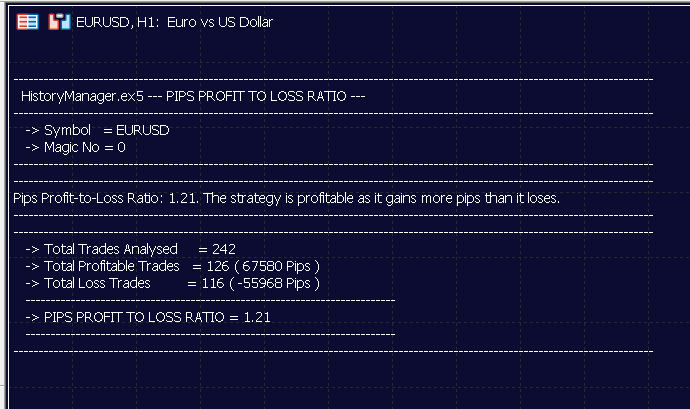

How To Calculate an Expert Advisor's or Symbol's Profit Factor, Gross Profit/Loss, and Average Gross Profit and Loss Per Trade

When evaluating the performance of an Expert Advisor or a trading strategy in MetaTrader 5, one of the most important metrics to consider is the Profit Factor. The Profit Factor is a ratio that measures the gross profit against the gross loss over a specific period. It provides a clear indication of how profitable a trading strategy is by comparing the total gains to the total losses.

A high Profit Factor indicates that the strategy is generating more profits relative to its losses, which is a desirable trait for any trading system. Conversely, a low Profit Factor suggests that the strategy may not be as effective and might need further optimization.

The Profit Factor is calculated using the following formula:Profit Factor = Gross Profit / Gross Loss

Where:

- Gross Profit is the total amount of money earned from all profitable trades.

- Gross Loss is the total amount of money lost from all losing trades.

A Profit Factor greater than 1 indicates that the strategy is profitable, as the gross profit exceeds the gross loss. A Profit Factor of 1 means that the gross profit and gross loss are equal, suggesting a break-even scenario. A Profit Factor less than 1 indicates that the strategy is losing money, as the gross loss exceeds the gross profit.

Understanding and calculating the Profit Factor is crucial for traders and developers to make informed decisions about the viability and performance of their trading strategies.

In this example, I will use the HistoryManager.ex5 library to demonstrate how easy it is to implement this calculation in your MQL5 code.

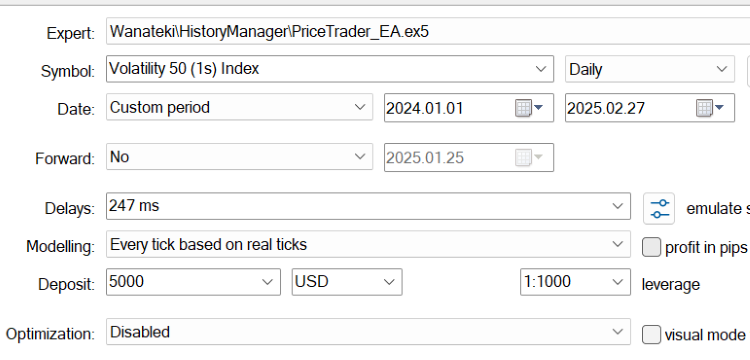

Start by creating a new Expert Advisor and naming it GetProfitFactor.mq5. Save it in the following folder path: Experts\Wanateki\HistoryManager\GetProfitFactor.mq5. Note that the directory where you save the Expert Advisor is important, as it will influence the path used to include the header file containing the library function prototype definitions.

The GetProfitFactor.mq5 Expert Advisor will help you analyze the performance of your trading strategies by calculating key metrics such as gross profit, gross loss, and the profit factor itself.

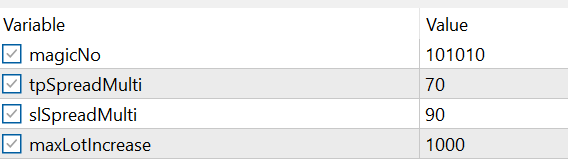

First, we need to include the HistoryManager.ex5 library and define an enumeration that we will use to input the symbol string value in our Expert Advisor. The symbolName enumeration will allow us to specify whether we want to analyze the current chart symbol or all symbols in the account. This enumeration together with the magic number input will allow us to filter the results to suit our targeted symbols and Expert Advisors.

#include <Wanateki/Toolkit/HistoryManager/HistoryManager.mqh> //-- enum symbolName { CURRENT_CHART_SYMBOL, ALL_ACCOUNT_SYMBOLS, };

Next, we define the input parameters the Expert Advisor user will use to filter the output.

//--- input parameters input ulong magicNo = 0; //Magic Number (0 to disable) input symbolName getSymbolName = ALL_ACCOUNT_SYMBOLS;

We initialize the variables that will be used to store our calculations and display the results.

string currency = " " + AccountInfoString(ACCOUNT_CURRENCY); double totalGrossProfit = 0.0, totalGrossLoss = 0.0, averageGrossProfit = 0.0, averageGrossLoss = 0.0, averageProfitOrLossPerTrade = 0.0, profitFactor = 0.0; int totalTrades = 0, totalLossPositions = 0, totalProfitPositions = 0; string symbol, printedSymbol, profitFactorSummery, commentString;

In the OnInit() function, we will use a switch statement to determine the symbol to analyze. Once the symbol is identified, we will call the CalcProfitFactor() function, which is responsible for calculating the Profit Factor. As the first task when the Expert Advisor loads, we will then display all the results on the chart using the Comment() function.

int OnInit() { //--- switch(getSymbolName) { case CURRENT_CHART_SYMBOL: symbol = _Symbol; break; case ALL_ACCOUNT_SYMBOLS: symbol = ALL_SYMBOLS; break; default: symbol = ALL_SYMBOLS; } printedSymbol = symbol; if(symbol == "") printedSymbol = "ALL_SYMBOLS"; //-- CalcProfitFactor(); Comment(commentString); //--- return(INIT_SUCCEEDED); }

Before we can proceed, let us code the CalcProfitFactor() function, as it contains most of the code that runs the GetProfitFactor Expert Advisor.

We will begin the CalcProfitFactor() function by coding the function signature, and then proceed by resetting all variables to their initial values. This ensures that any previous calculations do not interfere with the current analysis.

totalGrossProfit = 0.0; totalGrossLoss = 0.0; averageProfitOrLossPerTrade = 0.0; averageGrossProfit = 0.0; averageGrossLoss = 0.0; profitFactor = 0.0; totalTrades = 0; totalLossPositions = 0; totalProfitPositions = 0;

Next, we use the GetAllPositionsData() function to retrieve historical trade data. This function populates the positionsData array with all the trade positions based on the specified symbol and magic number. Likewise, we check if the function returns true and if the array size exceeds zero to ensure that we have valid data to process. This step is essential for accessing the necessary trade information to perform our calculations.

if(GetAllPositionsData(positionsData, symbol, magicNo) && ArraySize(positionsData) > 0) { //-- }

We then loop through each trade in the positionsData array to calculate the total gross profit and loss. For each trade, we check if the profit exceeds zero to determine if it is a profitable trade. If it is, we increment the totalProfitPositions counter and add the profit to totalGrossProfit. If the profit is less than or equal to zero, we increment the totalLossPositions counter and add the absolute value of the profit to totalGrossLoss. This loop helps us accumulate the total gains and losses from all trades.

totalTrades = ArraySize(positionsData); for(int r = 0; r < totalTrades; r++) { if(positionsData[r].profit > 0) // profitable trade { ++totalProfitPositions; totalGrossProfit += positionsData[r].profit; } else // loss trade { ++totalLossPositions; totalGrossLoss += MathAbs(positionsData[r].profit); } } // Calculate the profit factor and other data if(totalGrossProfit > 0 || totalGrossLoss > 0) averageProfitOrLossPerTrade = NormalizeDouble( (totalGrossProfit + totalGrossLoss) / totalTrades, 2 ); if(totalGrossProfit > 0) averageGrossProfit = NormalizeDouble( (totalGrossProfit / totalProfitPositions), 2 ); if(totalGrossLoss > 0) averageGrossLoss = NormalizeDouble( (totalGrossLoss / totalLossPositions), 2 ); //-- if(totalGrossLoss == 0.0) profitFactor = 0.0; // Avoid division by zero, indicating no losses profitFactor = totalGrossProfit / totalGrossLoss; }

After accumulating the total gross profit and loss, we proceed to calculate various metrics. First, we compute the average profit or loss per trade by dividing the sum of total gross profit and loss by the total number of trades. Furthermore, we then calculate the average gross profit by dividing the total gross profit by the number of profitable trades. Similarly, we calculate the average gross loss by dividing the total gross loss by the number of loss trades. Finally, we calculate the profit factor by dividing the total gross profit by the total gross loss. These metrics provide a comprehensive view of the trading strategy's performance.

profitFactorSummery = "Profit Factor = " + DoubleToString(profitFactor, 2); if(profitFactor > 2.0) { profitFactorSummery = profitFactorSummery + "\nThe trading strategy is HIGHLY PROFITABLE and efficient."; } else if(profitFactor > 1.5) { profitFactorSummery = profitFactorSummery + "\nThe trading strategy is profitable and well-balanced."; } else if(profitFactor > 1.0) { profitFactorSummery = profitFactorSummery + "\nThe trading strategy is slightly profitable but may need improvement."; } else if(profitFactor == 1.0) { profitFactorSummery = profitFactorSummery + "\nThe strategy is break-even with no net gain or loss."; } else { profitFactorSummery = profitFactorSummery + "\nThe trading strategy is unprofitable and needs optimization."; }

We analyze the profit factor to generate a summary string that describes the trading strategy's performance. Here’s how we interpret the profit factor:

- Profit Factor > 2.0: The strategy is highly profitable and efficient.

- Profit Factor between 1.0 and 1.5: The strategy is slightly profitable but may need improvement.

- Profit Factor = 1.0: The strategy breaks even, with no net gain or loss.

- Profit Factor < 1.0: The strategy is unprofitable and requires optimization.

This profit factor analysis provides a quick understanding of the overall effectiveness of the trading strategy.

Lastly, we generate a detailed comment string that includes all the calculated metrics and the profit factor summary. This string is formatted to display the symbol being analyzed, the magic number, the total number of trades, the number of profitable and loss trades, the total gross profit and loss, the average profit or loss per trade, the average gross profit and loss, and the profit factor summary.

Here is the full CalcProfitFactor() function with all the code segments in their place.