MetaTrader 4 and MetaTrader 5 Trading Signals Widgets

Recently MetaTrader 4 and MetaTrader 5 user received an opportunity to become a Signals Provider and earn additional profit. Now, you can display your trading success on your web site, blog or social network page using the new widgets. The benefits of using widgets are obvious: they increase the Signals Providers' popularity, establish their reputation as successful traders, as well as attract new Subscribers. All traders placing widgets on other web sites can enjoy these benefits.

Universal Expert Advisor: the Event Model and Trading Strategy Prototype (Part 2)

This article continues the series of publications on a universal Expert Advisor model. This part describes in detail the original event model based on centralized data processing, and considers the structure of the CStrategy base class of the engine.

Another MQL5 OOP Class

This article shows you how to build an Object-Oriented Expert Advisor from scratch, from conceiving a theoretical trading idea to programming a MQL5 EA that makes that idea real in the empirical world. Learning by doing is IMHO a solid approach to succeed, so I am showing a practical example in order for you to see how you can order your ideas to finally code your Forex robots. My goal is also to invite you to adhere the OO principles.

Simulink: a Guide for the Developers of Expert Advisors

I am not a professional programmer. And thus, the principle of "going from the simple to the complex" is of primary importance to me when I am working on trading system development. What exactly is simple for me? First of all, it is the visualization of the process of creating the system, and the logic of its work. Also, it is a minimum of handwritten code. In this article, I will attempt to create and test the trading system, based on a Matlab package, and then write an Expert Advisor for MetaTrader 5. The historical data from MetaTrader 5 will be used for the testing process.

Combination scalping: analyzing trades from the past to increase the performance of future trades

The article provides the description of the technology aimed at increasing the effectiveness of any automated trading system. It provides a brief explanation of the idea, as well as its underlying basics, possibilities and disadvantages.

Finding seasonal patterns in the forex market using the CatBoost algorithm

The article considers the creation of machine learning models with time filters and discusses the effectiveness of this approach. The human factor can be eliminated now by simply instructing the model to trade at a certain hour of a certain day of the week. Pattern search can be provided by a separate algorithm.

Dealing with Time (Part 2): The Functions

Determing the broker offset and GMT automatically. Instead of asking the support of your broker, from whom you will probably receive an insufficient answer (who would be willing to explain a missing hour), we simply look ourselves how they time their prices in the weeks of the time changes — but not cumbersome by hand, we let a program do it — why do we have a PC after all.

Testing patterns that arise when trading currency pair baskets. Part I

We begin testing the patterns and trying the methods described in the articles about trading currency pair baskets. Let's see how oversold/overbought level breakthrough patterns are applied in practice.

Design Patterns in software development and MQL5 (Part 4): Behavioral Patterns 2

In this article, we will complete our series about the Design Patterns topic, we mentioned that there are three types of design patterns creational, structural, and behavioral. We will complete the remaining patterns of the behavioral type which can help set the method of interaction between objects in a way that makes our code clean.

Learn how to design a trading system by Bear's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator here is a new article about learning how to design a trading system by Bear's Power technical indicator.

Analyzing charts using DeMark Sequential and Murray-Gann levels

Thomas DeMark Sequential is good at showing balance changes in the price movement. This is especially evident if we combine its signals with a level indicator, for example, Murray levels. The article is intended mostly for beginners and those who still cannot find their "Grail". I will also display some features of building levels that I have not seen on other forums. So, the article will probably be useful for advanced traders as well... Suggestions and reasonable criticism are welcome...

What is a trend and is the market structure based on trend or flat?

Traders often talk about trends and flats but very few of them really understand what a trend/flat really is and even fewer are able to clearly explain these concepts. Discussing these basic terms is often beset by a solid set of prejudices and misconceptions. However, if we want to make profit, we need to understand the mathematical and logical meaning of these concepts. In this article, I will take a closer look at the essence of trend and flat, as well as try to define whether the market structure is based on trend, flat or something else. I will also consider the most optimal strategies for making profit on trend and flat markets.

Using MetaTrader 5 as a Signal Provider for MetaTrader 4

Analyse and examples of techniques how trading analysis can be performed on MetaTrader 5 platform, but executed by MetaTrader 4. Article will show you how to create simple signal provider in your MetaTrader 5, and connect to it with multiple clients, even running MetaTrader 4. Also you will find out how you can follow participants of Automated Trading Championship in your real MetaTrader 4 account.

Learn how to design a trading system by Stochastic

In this article, we continue our learning series — this time we will learn how to design a trading system using one of the most popular and useful indicators, which is the Stochastic Oscillator indicator, to build a new block in our knowledge of basics.

Neural networks made easy (Part 2): Network training and testing

In this second article, we will continue to study neural networks and will consider an example of using our created CNet class in Expert Advisors. We will work with two neural network models, which show similar results both in terms of training time and prediction accuracy.

A Few Tips for First-Time Customers

A proverbial wisdom often attributed to various famous people says: "He who makes no mistakes never makes anything." Unless you consider idleness itself a mistake, this statement is hard to argue with. But you can always analyze the past mistakes (your own and of others) to minimize the number of your future mistakes. We are going to attempt to review possible situations arising when executing jobs in the same-name service.

What you can do with Moving Averages

The article considers several methods of applying the Moving Average indicator. Each method involving a curve analysis is accompanied by indicators visualizing the idea. In most cases, the ideas shown here belong to their respected authors. My sole task was to bring them together to let you see the main approaches and, hopefully, make more reasonable trading decisions. MQL5 proficiency level — basic.

Matrices and vectors in MQL5

By using special data types 'matrix' and 'vector', it is possible to create code which is very close to mathematical notation. With these methods, you can avoid the need to create nested loops or to mind correct indexing of arrays in calculations. Therefore, the use of matrix and vector methods increases the reliability and speed in developing complex programs.

CatBoost machine learning algorithm from Yandex with no Python or R knowledge required

The article provides the code and the description of the main stages of the machine learning process using a specific example. To obtain the model, you do not need Python or R knowledge. Furthermore, basic MQL5 knowledge is enough — this is exactly my level. Therefore, I hope that the article will serve as a good tutorial for a broad audience, assisting those interested in evaluating machine learning capabilities and in implementing them in their programs.

Liquid Chart

Would you like to see an hourly chart with bars opening from the second and the fifth minute of the hour? What does a redrawn chart look like when the opening time of bars is changing every minute? What advantages does trading on such charts have? You will find answers to these questions in this article.

Learn how to design a trading system by Volumes

Here is a new article from our series about learning how to design a trading system based on the most popular technical indicators. The current article will be devoted to the Volumes indicator. Volume as a concept is one of the very important factors in financial markets trading and we have to pay attention to it. Through this article, we will learn how to design a simple trading system by Volumes indicator.

Universal Expert Advisor: Trading in a Group and Managing a Portfolio of Strategies (Part 4)

In the last part of the series of articles about the CStrategy trading engine, we will consider simultaneous operation of multiple trading algorithms, will learn to load strategies from XML files, and will present a simple panel for selecting Expert Advisors from a single executable module, and managing their trading modes.

Learn how to design a trading system by Alligator

In this article, we'll complete our series about how to design a trading system based on the most popular technical indicator. We'll learn how to create a trading system based on the Alligator indicator.

Creating an EA that works automatically (Part 02): Getting started with the code

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we discussed the first steps that anyone needs to understand before proceeding to creating an Expert Advisor that trades automatically. We considered the concepts and the structure.

Neural networks made easy (Part 10): Multi-Head Attention

We have previously considered the mechanism of self-attention in neural networks. In practice, modern neural network architectures use several parallel self-attention threads to find various dependencies between the elements of a sequence. Let us consider the implementation of such an approach and evaluate its impact on the overall network performance.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal API, Part 2

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. It is a continuation of the first part: "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". In the second part, we discuss integration of custom Expert Advisors with HedgeTerminalAPI, which is a special visualization library designed for bi-directional trading in a comfortable software environment providing tools for convenient position management.

The correct way to choose an Expert Advisor from the Market

In this article, we will consider some of the essential points you should pay attention to when purchasing an Expert Advisor. We will also look for ways to increase profit, to spend money wisely, and to earn from this spending. Also, after reading the article, you will see that it is possible to earn even using simple and free products.

Exploring options for creating multicolored candlesticks

In this article I will address the possibilities of creating customized indicators with candlesticks, pointing out their advantages and disadvantages.

Synthetic Bars - A New Dimension to Displaying Graphical Information on Prices

The main drawback of traditional methods for displaying price information using bars and Japanese candlesticks is that they are bound to the time period. It was perhaps optimal at the time when these methods were created but today when the market movements are sometimes too rapid, prices displayed in a chart in this way do not contribute to a prompt response to the new movement. The proposed price chart display method does not have this drawback and provides a quite familiar layout.

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

In this article, we will develop a grider EA for trading in a trend direction within a range. Thus, the EA is to be suited mostly for Forex and commodity markets. According to the tests, our grider showed profit since 2018. Unfortunately, this is not true for the period of 2014-2018.

Neural networks made easy (Part 11): A take on GPT

Perhaps one of the most advanced models among currently existing language neural networks is GPT-3, the maximal variant of which contains 175 billion parameters. Of course, we are not going to create such a monster on our home PCs. However, we can view which architectural solutions can be used in our work and how we can benefit from them.

Statistical Carry Trade Strategy

An algorithm of statistical protection of open positive swap positions from unwanted price movements. This article features a variant of the carry trade protection strategy that allows to compensate for potential risk of the price movement in the direction opposite to that of the open position.

Learn how to design a trading system by Fractals

This article is a new one from our series about how to design a trading system based on the most popular technical indicators. We will learn a new indicator which Fractals indicator and we will learn how to design a trading system based on it to be executed in the MetaTrader 5 terminal.

Testing patterns that arise when trading currency pair baskets. Part II

We continue testing the patterns and trying the methods described in the articles about trading currency pair baskets. Let's consider in practice, whether it is possible to use the patterns of the combined WPR graph crossing the moving average. If the answer is yes, we should consider the appropriate usage methods.

Universal Regression Model for Market Price Prediction

The market price is formed out of a stable balance between demand and supply which, in turn, depend on a variety of economic, political and psychological factors. Differences in nature as well as causes of influence of these factors make it difficult to directly consider all the components. This article sets forth an attempt to predict the market price on the basis of an elaborated regression model.

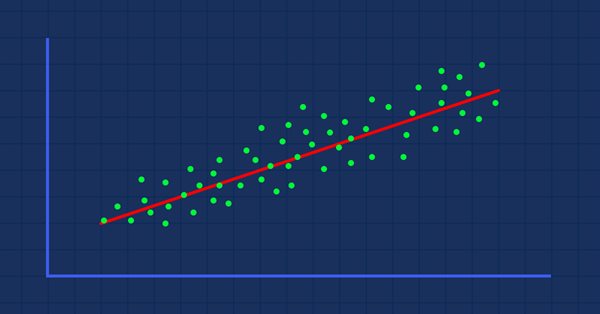

Data Science and Machine Learning (Part 01): Linear Regression

It's time for us as traders to train our systems and ourselves to make decisions based on what number says. Not on our eyes, and what our guts make us believe, this is where the world is heading so, let us move perpendicular to the direction of the wave.

Library for easy and quick development of MetaTrader programs (part XVI): Symbol collection events

In this article, we will create a new base class of all library objects adding the event functionality to all its descendants and develop the class for tracking symbol collection events based on the new base class. We will also change account and account event classes for developing the new base object functionality.

Extending Strategy Builder Functionality

In the previous two articles, we discussed the application of Merrill patterns to various data types. An application was developed to test the presented ideas. In this article, we will continue working with the Strategy Builder, to improve its efficiency and to implement new features and capabilities.

Trade Events in MetaTrader 5

A monitoring of the current state of a trade account implies controlling open positions and orders. Before a trade signal becomes a deal, it should be sent from the client terminal as a request to the trade server, where it will be placed in the order queue awaiting to be processed. Accepting of a request by the trade server, deleting it as it expires or conducting a deal on its basis - all those actions are followed by trade events; and the trade server informs the terminal about them.

Developing a trading Expert Advisor from scratch (Part 7): Adding Volume at Price (I)

This is one of the most powerful indicators currently existing. Anyone who trades trying to have a certain degree of confidence must have this indicator on their chart. Most often the indicator is used by those who prefer “tape reading” while trading. Also, this indicator can be utilized by those who use only Price Action while trading.