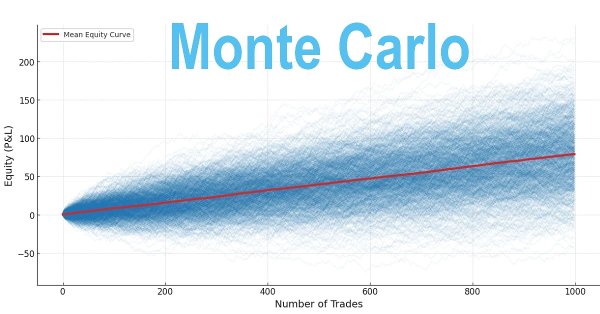

Building a Trading System (Part 1): A Quantitative Approach

Many traders evaluate strategies based on short-term performance, often abandoning profitable systems too early. Long-term profitability, however, depends on positive expectancy through optimized win rate and risk-reward ratio, along with disciplined position sizing. These principles can be validated using Monte Carlo simulation in Python with back-tested metrics to assess whether a strategy is robust or likely to fail over time.

Neural networks made easy (Part 24): Improving the tool for Transfer Learning

In the previous article, we created a tool for creating and editing the architecture of neural networks. Today we will continue working on this tool. We will try to make it more user friendly. This may see, top be a step away form our topic. But don't you think that a well organized workspace plays an important role in achieving the result.

Deep Learning GRU model with Python to ONNX with EA, and GRU vs LSTM models

We will guide you through the entire process of DL with python to make a GRU ONNX model, culminating in the creation of an Expert Advisor (EA) designed for trading, and subsequently comparing GRU model with LSTM model.

Price Action Analysis Toolkit Development (Part 13): RSI Sentinel Tool

Price action can be effectively analyzed by identifying divergences, with technical indicators such as the RSI providing crucial confirmation signals. In the article below, we explain how automated RSI divergence analysis can identify trend continuations and reversals, thereby offering valuable insights into market sentiment.

Other classes in DoEasy library (Part 69): Chart object collection class

With this article, I start the development of the chart object collection class. The class will store the collection list of chart objects with their subwindows and indicators providing the ability to work with any selected charts and their subwindows or with a list of several charts at once.

Moving Average in MQL5 from scratch: Plain and simple

Using simple examples, we will examine the principles of calculating moving averages, as well as learn about the ways to optimize indicator calculations, including moving averages.

Neural networks made easy (Part 19): Association rules using MQL5

We continue considering association rules. In the previous article, we have discussed theoretical aspect of this type of problem. In this article, I will show the implementation of the FP Growth method using MQL5. We will also test the implemented solution using real data.

MQL5 Cookbook: Handling Custom Chart Events

This article considers aspects of design and development of custom chart events system in the MQL5 environment. An example of an approach to the events classification can also be found here, as well as a program code for a class of events and a class of custom events handler.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (StockFormer)

In this article, we will discuss the hybrid trading system StockFormer, which combines predictive coding and reinforcement learning (RL) algorithms. The framework uses 3 Transformer branches with an integrated Diversified Multi-Head Attention (DMH-Attn) mechanism that improves on the vanilla attention module with a multi-headed Feed-Forward block, allowing it to capture diverse time series patterns across different subspaces.

Graphics in DoEasy library (Part 97): Independent handling of form object movement

In this article, I will consider the implementation of the independent dragging of any form objects using a mouse. Besides, I will complement the library by error messages and new deal properties previously implemented into the terminal and MQL5.

Better Programmer (Part 03): Give Up doing these 5 things to become a successful MQL5 Programmer

This is the must-read article for anyone wanting to improve their programming career. This article series is aimed at making you the best programmer you can possibly be, no matter how experienced you are. The discussed ideas work for MQL5 programming newbies as well as professionals.

Price Action Analysis Toolkit (Part 55): Designing a CPI Mini-Candle Overlay for Intra-bar Pressure

This article presents the design and MetaTrader 5 implementation of the Candle Pressure Index (CPI)—a CLV-based overlay that visualizes intra-Bar buying and selling pressure directly on price charts. The discussion focuses on candle structure, pressure classification, visualization mechanics, and a non-repainting, transition-based alert system designed for consistent behavior across timeframes and instruments.

How to add Trailing Stop using Parabolic SAR

When creating a trading strategy, we need to test a variety of protective stop options. Here is where a dynamic pulling up of the Stop Loss level following the price comes to mind. The best candidate for this is the Parabolic SAR indicator. It is difficult to think of anything simpler and visually clearer.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 7): ZigZag with Awesome Oscillator Indicators Signal

The multi-currency expert advisor in this article is an expert advisor or automated trading that uses ZigZag indicator which are filtered with the Awesome Oscillator or filter each other's signals.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 5): Sending Commands from Telegram to MQL5 and Receiving Real-Time Responses

In this article, we create several classes to facilitate real-time communication between MQL5 and Telegram. We focus on retrieving commands from Telegram, decoding and interpreting them, and sending appropriate responses back. By the end, we ensure that these interactions are effectively tested and operational within the trading environment

Automating The Market Sentiment Indicator

In this article, we automate a custom market sentiment indicator that classifies market conditions into bullish, bearish, risk-on, risk-off, and neutral. The Expert Advisor delivers real-time insights into prevailing sentiment while streamlining the analysis process for current market trends or direction.

Reimagining Classic Strategies (Part 13): Minimizing The Lag in Moving Average Cross-Overs

Moving average cross-overs are widely known by traders in our community, and yet the core of the strategy has changed very little since its inception. In this discussion, we will present you with a slight adjustment to the original strategy, that aims to minimize the lag present in the trading strategy. All fans of the original strategy, could consider revising the strategy in accordance with the insights we will discuss today. By using 2 moving averages with the same period, we reduce the lag in the trading strategy considerably, without violating the foundational principles of the strategy.

Creating an EA that works automatically (Part 05): Manual triggers (II)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. At the end of the previous article, I suggested that it would be appropriate to allow manual use of the EA, at least for a while.

Build Self Optimizing Expert Advisors With MQL5 And Python

In this article, we will discuss how we can build Expert Advisors capable of autonomously selecting and changing trading strategies based on prevailing market conditions. We will learn about Markov Chains and how they can be helpful to us as algorithmic traders.

Interview with Leonid Velichkovsky: "The Biggest Myth about Neural Networks is Super-Profitability" (ATC 2010)

The hero of our interview Leonid Velichkovski (LeoV) has already participated in Automated Trading Championships. In 2008, his multicurrency neural network was like a bright flash in the sky, earning $110,000 in a certain moment, but eventually fell victim to its own aggressive money management. Two years ago, in his interview Leonid share his own trading experience and told us about the features of his Expert Advisor. On the eve of the ATC 2010, Leonid talks about the most common myths and misconceptions associated with neural networks.

MQL5 Wizard Techniques you should know (Part 48): Bill Williams Alligator

The Alligator Indicator, which was the brain child of Bill Williams, is a versatile trend identification indicator that yields clear signals and is often combined with other indicators. The MQL5 wizard classes and assembly allow us to test a variety of signals on a pattern basis, and so we consider this indicator as well.

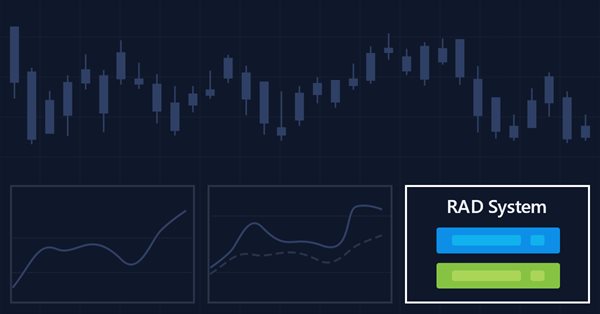

Multiple indicators on one chart (Part 05): Turning MetaTrader 5 into a RAD system (I)

There are a lot of people who do not know how to program but they are quite creative and have great ideas. However, the lack of programming knowledge prevents them from implementing these ideas. Let's see together how to create a Chart Trade using the MetaTrader 5 platform itself, as if it were an IDE.

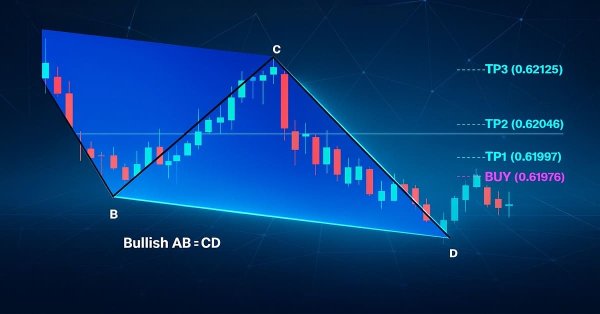

Automating Trading Strategies in MQL5 (Part 30): Creating a Price Action AB-CD Harmonic Pattern with Visual Feedback

In this article, we develop an AB=CD Pattern EA in MQL5 that identifies bullish and bearish AB=CD harmonic patterns using pivot points and Fibonacci ratios, executing trades with precise entry, stop loss, and take-profit levels. We enhance trader insight with visual feedback through chart objects.

Population optimization algorithms: Bacterial Foraging Optimization (BFO)

E. coli bacterium foraging strategy inspired scientists to create the BFO optimization algorithm. The algorithm contains original ideas and promising approaches to optimization and is worthy of further study.

How to create a custom True Strength Index indicator using MQL5

Here is a new article about how to create a custom indicator. This time we will work with the True Strength Index (TSI) and will create an Expert Advisor based on it.

Introduction to MQL5 (Part 15): A Beginner's Guide to Building Custom Indicators (IV)

In this article, you'll learn how to build a price action indicator in MQL5, focusing on key points like low (L), high (H), higher low (HL), higher high (HH), lower low (LL), and lower high (LH) for analyzing trends. You'll also explore how to identify the premium and discount zones, mark the 50% retracement level, and use the risk-reward ratio to calculate profit targets. The article also covers determining entry points, stop loss (SL), and take profit (TP) levels based on the trend structure.

Automated Risk Management for Passing Prop Firm Challenges

This article explains the design of a prop-firm Expert Advisor for GOLD, featuring breakout filters, multi-timeframe analysis, robust risk management, and strict drawdown protection. The EA helps traders pass prop-firm challenges by avoiding rule breaches and stabilizing trade execution under volatile market conditions.

Data Science and Machine Learning (Part 12): Can Self-Training Neural Networks Help You Outsmart the Stock Market?

Are you tired of constantly trying to predict the stock market? Do you wish you had a crystal ball to help you make more informed investment decisions? Self-trained neural networks might be the solution you've been looking for. In this article, we explore whether these powerful algorithms can help you "ride the wave" and outsmart the stock market. By analyzing vast amounts of data and identifying patterns, self-trained neural networks can make predictions that are often more accurate than human traders. Discover how you can use this cutting-edge technology to maximize your profits and make smarter investment decisions.

Technical Analysis: How Do We Analyze?

This article briefly describes the author's opinion on redrawing indicators, multi-timeframe indicators and displaying of quotes with Japanese candlesticks. The article contain no programming specifics and is of a general character.

Selection and navigation utility in MQL5 and MQL4: Adding "homework" tabs and saving graphical objects

In this article, we are going to expand the capabilities of the previously created utility by adding tabs for selecting the symbols we need. We will also learn how to save graphical objects we have created on the specific symbol chart, so that we do not have to constantly create them again. Besides, we will find out how to work only with symbols that have been preliminarily selected using a specific website.

Graphics in DoEasy library (Part 90): Standard graphical object events. Basic functionality

In this article, I will implement the basic functionality for tracking standard graphical object events. I will start from a double click event on a graphical object.

Price Action Analysis Toolkit Development (Part 39): Automating BOS and ChoCH Detection in MQL5

This article presents Fractal Reaction System, a compact MQL5 system that converts fractal pivots into actionable market-structure signals. Using closed-bar logic to avoid repainting, the EA detects Change-of-Character (ChoCH) warnings and confirms Breaks-of-Structure (BOS), draws persistent chart objects, and logs/alerts every confirmed event (desktop, mobile and sound). Read on for the algorithm design, implementation notes, testing results and the full EA code so you can compile, test and deploy the detector yourself.

Prices in DoEasy library (part 61): Collection of symbol tick series

Since a program may use different symbols in its work, a separate list should be created for each of them. In this article, I will combine such lists into a tick data collection. In fact, this will be a regular list based on the class of dynamic array of pointers to instances of CObject class and its descendants of the Standard library.

CCI indicator. Three transformation steps

In this article, I will make additional changes to the CCI affecting the very logic of this indicator. Moreover, we will be able to see it in the main chart window.

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

Category Theory in MQL5 (Part 1)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

MQL5 Wizard techniques you should know (Part 03): Shannon's Entropy

Todays trader is a philomath who is almost always looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders.

Risk Management (Part 1): Fundamentals for Building a Risk Management Class

In this article, we'll cover the basics of risk management in trading and learn how to create your first functions for calculating the appropriate lot size for a trade, as well as a stop-loss. Additionally, we will go into detail about how these features work, explaining each step. Our goal is to provide a clear understanding of how to apply these concepts in automated trading. Finally, we will put everything into practice by creating a simple script with an include file.

Electronic Tables in MQL5

The article describes a class of dynamic two-dimensional array that contains data of different types in its first dimension. Storing data in the form of a table is convenient for solving a wide range of problems of arrangement, storing and operation with bound information of different types. The source code of the class that implements the functionality of working with tables is attached to the article.

Developing a trading Expert Advisor from scratch (Part 22): New order system (V)

Today we will continue to develop the new order system. It is not that easy to implement a new system as we often encounter problems which greatly complicate the process. When these problems appear, we have to stop and re-analyze the direction in which we are moving.