Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

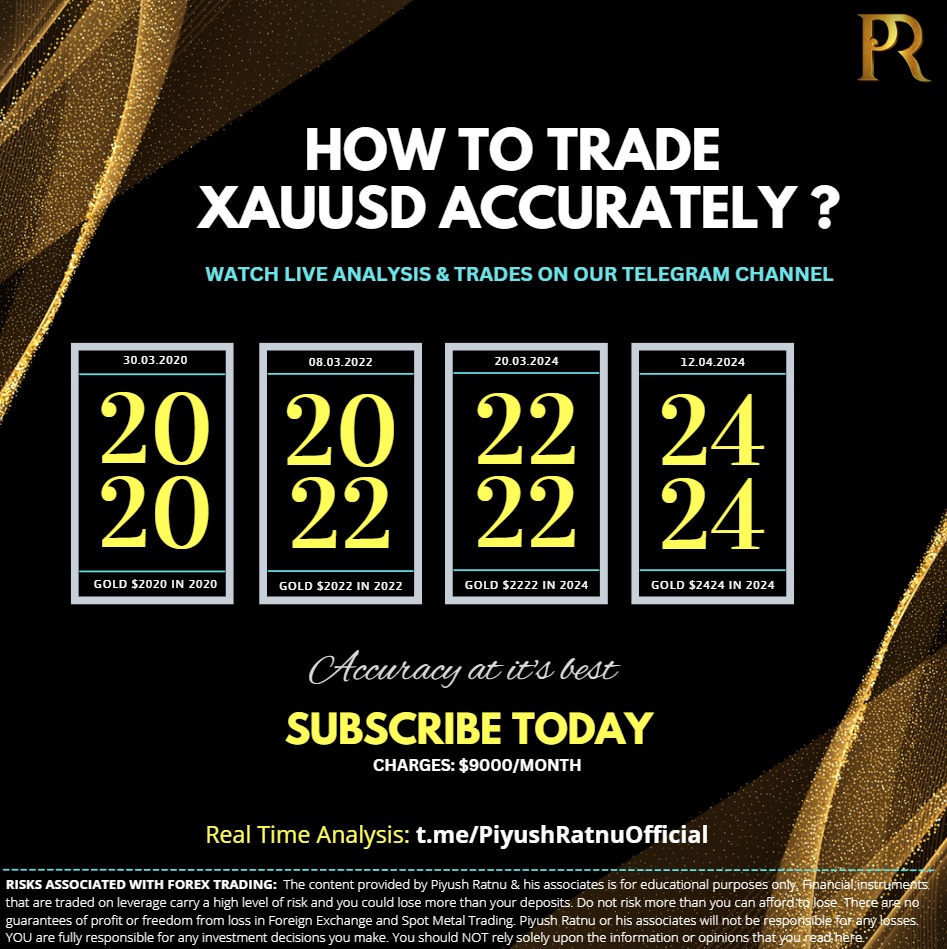

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

XAUUSD: $2300 or $2400 next week?

⏰ US PCE Inflation Data to drive XAUUSD to a new range

Gold price is consolidating the previous bounce but remains confined in a narrow range near $2,350 early Friday. Gold price awaits the highly anticipated US Core Personal Consumption Expenditure (PCE) Price Index, the Federal Reserve’s preferred inflation measure, for a fresh directional impetus.

Markets have heavily pared back expectations for more than one Fed interest rate hike this year, in the wake of inflation persistence combined with the recent hawkish Fed commentaries. According to the CME Fed Watch Tool (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html) (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html) , markets are pricing about 50% odds that the Fed will hold rates in September while the probability of a November rate cut stands at around 64%.

The hawkish Fed expectations had revived the demand for the US Dollar across the board, as the US Treasury bond yields rallied to multi-week highs. However, Thursday’s downward revision to the annualized first-quarter US Gross Domestic Product (GDP) data to 1.3% from 1.6% in the first estimate and a modest increase in the Initial Jobless Claims acted as a headwind to the US Dollar’s upside, fuelling a Greenback sel-off alongside the US Treasury bond yields.

This helped 🔺Gold price attempt a modest comeback, having incurred steep losses on Wednesday. Looking ahead, it remains to be seen if Gold price can hold its renewed upside, as its fate hinges on the US Core PCE inflation data due later in American trading on Friday. Core PCE Price Index is expected to rise 2.8% YoY in April, at the same pace as seen in March.

🆘A surprise uptick in the Core figure will reinforce delayed and less aggressive Fed rate cut expectations, providing extra legs to the US Dollar decline while smashing Gold price.

⚠️ A 🔺 hot US Core PCE inflation print could trigger🔻 XAUUSD to $2323/2303/2288

🆘Conversely, the Gold price could build on the rebound should the data show an unexpected softness in the Core PCE inflation, ramping up bets for a September Fed rate cut.

⚠️ Alternative scenario: 🔻US inflation data might push XAUUSD to $2369/2385/2407 zone.

⏰ US PCE Inflation Data to drive XAUUSD to a new range

Gold price is consolidating the previous bounce but remains confined in a narrow range near $2,350 early Friday. Gold price awaits the highly anticipated US Core Personal Consumption Expenditure (PCE) Price Index, the Federal Reserve’s preferred inflation measure, for a fresh directional impetus.

Markets have heavily pared back expectations for more than one Fed interest rate hike this year, in the wake of inflation persistence combined with the recent hawkish Fed commentaries. According to the CME Fed Watch Tool (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html) (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html) , markets are pricing about 50% odds that the Fed will hold rates in September while the probability of a November rate cut stands at around 64%.

The hawkish Fed expectations had revived the demand for the US Dollar across the board, as the US Treasury bond yields rallied to multi-week highs. However, Thursday’s downward revision to the annualized first-quarter US Gross Domestic Product (GDP) data to 1.3% from 1.6% in the first estimate and a modest increase in the Initial Jobless Claims acted as a headwind to the US Dollar’s upside, fuelling a Greenback sel-off alongside the US Treasury bond yields.

This helped 🔺Gold price attempt a modest comeback, having incurred steep losses on Wednesday. Looking ahead, it remains to be seen if Gold price can hold its renewed upside, as its fate hinges on the US Core PCE inflation data due later in American trading on Friday. Core PCE Price Index is expected to rise 2.8% YoY in April, at the same pace as seen in March.

🆘A surprise uptick in the Core figure will reinforce delayed and less aggressive Fed rate cut expectations, providing extra legs to the US Dollar decline while smashing Gold price.

⚠️ A 🔺 hot US Core PCE inflation print could trigger🔻 XAUUSD to $2323/2303/2288

🆘Conversely, the Gold price could build on the rebound should the data show an unexpected softness in the Core PCE inflation, ramping up bets for a September Fed rate cut.

⚠️ Alternative scenario: 🔻US inflation data might push XAUUSD to $2369/2385/2407 zone.

Piyush Lalsingh Ratnu

WHY XAUUSD 🔺 after GDP data?

Annualized US GDP growth in Q1 was revised down to 1.3% from a first estimate of 1.6%, according to data from the US Bureau of Economic Analysis, released on Thursday. The reading was below the 3.4% in Q4 but in line with analysts' expectations. The data led to a fall in US Treasury yields which are negatively correlated to Gold.

The GDP data suggests the US economy is not as strong as analysts had previously thought, and could indicate declining inflation, which in turn might lead the Federal Reserve (Fed) to lower interest rates – a positive for Gold since lower interest rates reduce the opportunity cost of holding the precious metal.

#XAUUSD

Annualized US GDP growth in Q1 was revised down to 1.3% from a first estimate of 1.6%, according to data from the US Bureau of Economic Analysis, released on Thursday. The reading was below the 3.4% in Q4 but in line with analysts' expectations. The data led to a fall in US Treasury yields which are negatively correlated to Gold.

The GDP data suggests the US economy is not as strong as analysts had previously thought, and could indicate declining inflation, which in turn might lead the Federal Reserve (Fed) to lower interest rates – a positive for Gold since lower interest rates reduce the opportunity cost of holding the precious metal.

#XAUUSD

Piyush Lalsingh Ratnu

Important Economic Data today:

16:30 USD Continuing Jobless Claims 1,800K 1,794K

16:30 USD Core PCE Prices (Q1) 3.70% 2.00%

16:30 USD GDP (QoQ) (Q1) 1.6% 3.4%

16:30 USD GDP Price Index (QoQ) (Q1) 3.1% 1.7%

16:30 USD Goods Trade Balance (Apr) -91.90B -91.54B

16:30 USD Initial Jobless Claims 218K 215K

16:30 USD Retail Inventories Ex Auto (Apr) -0.2%

18:00 USD Pending Home Sales (MoM) (Apr) -1.1% 3.4%

19:00 USD Crude Oil Inventories -1.600M 1.825M

19:00 USD Cushing Crude Oil Inventories 1.325M

20:05 USD FOMC Member Williams Speaks

22:50 GBP BoE Gov Bailey Speaks

16:30 USD Continuing Jobless Claims 1,800K 1,794K

16:30 USD Core PCE Prices (Q1) 3.70% 2.00%

16:30 USD GDP (QoQ) (Q1) 1.6% 3.4%

16:30 USD GDP Price Index (QoQ) (Q1) 3.1% 1.7%

16:30 USD Goods Trade Balance (Apr) -91.90B -91.54B

16:30 USD Initial Jobless Claims 218K 215K

16:30 USD Retail Inventories Ex Auto (Apr) -0.2%

18:00 USD Pending Home Sales (MoM) (Apr) -1.1% 3.4%

19:00 USD Crude Oil Inventories -1.600M 1.825M

19:00 USD Cushing Crude Oil Inventories 1.325M

20:05 USD FOMC Member Williams Speaks

22:50 GBP BoE Gov Bailey Speaks

Piyush Lalsingh Ratnu

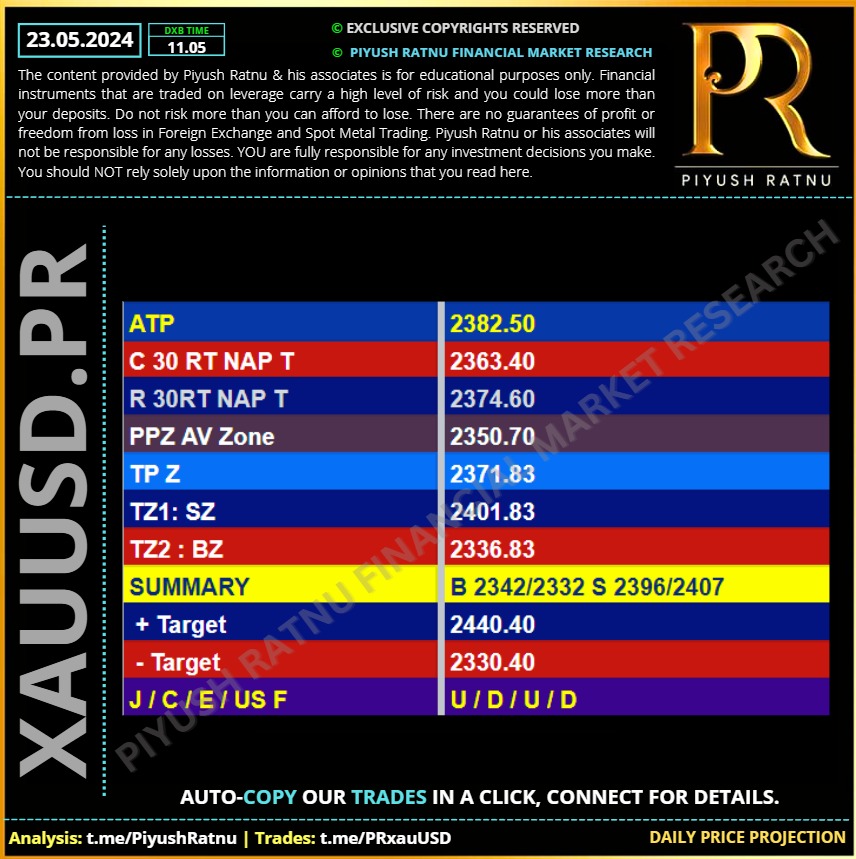

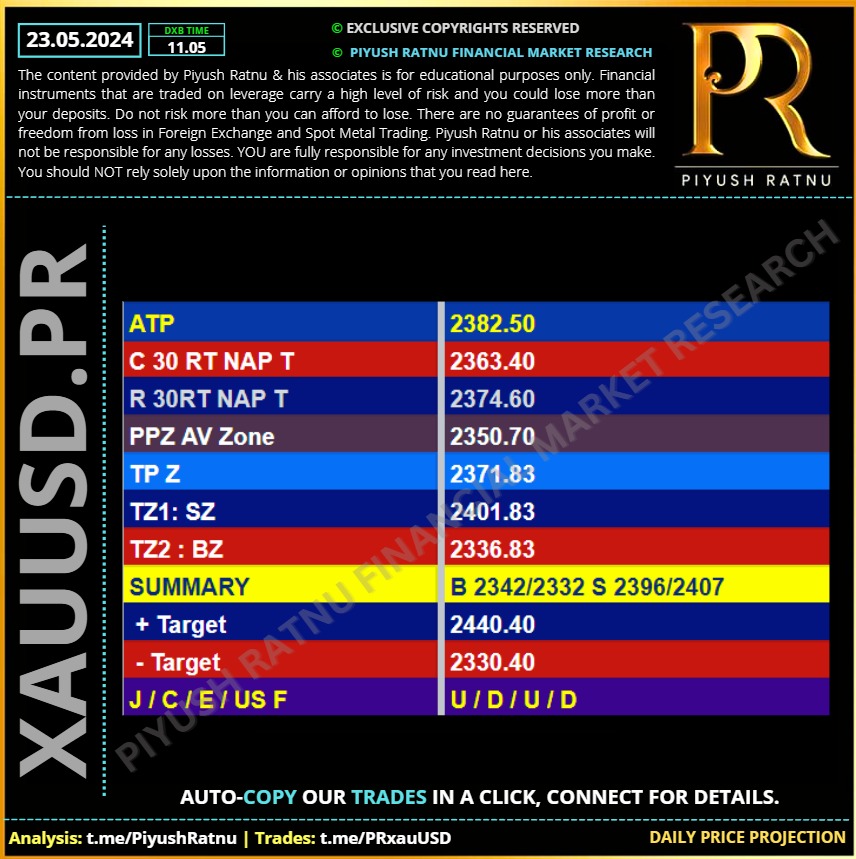

23.05.2024 | XAUUSD Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

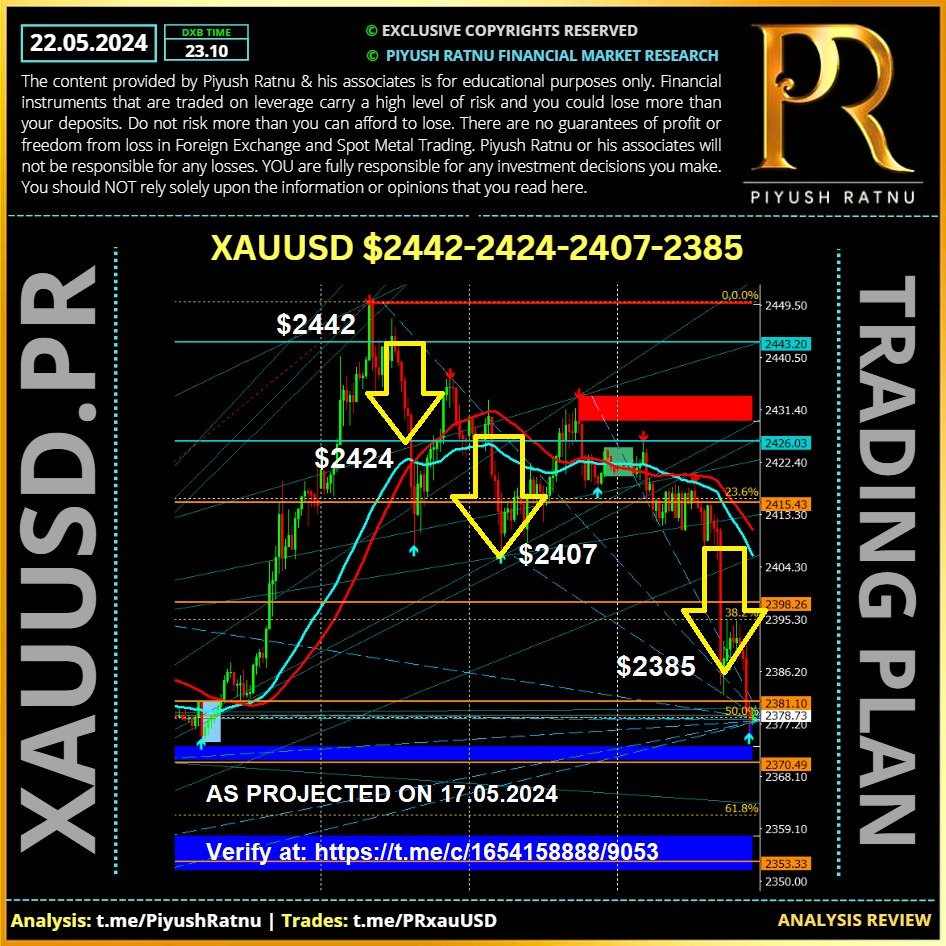

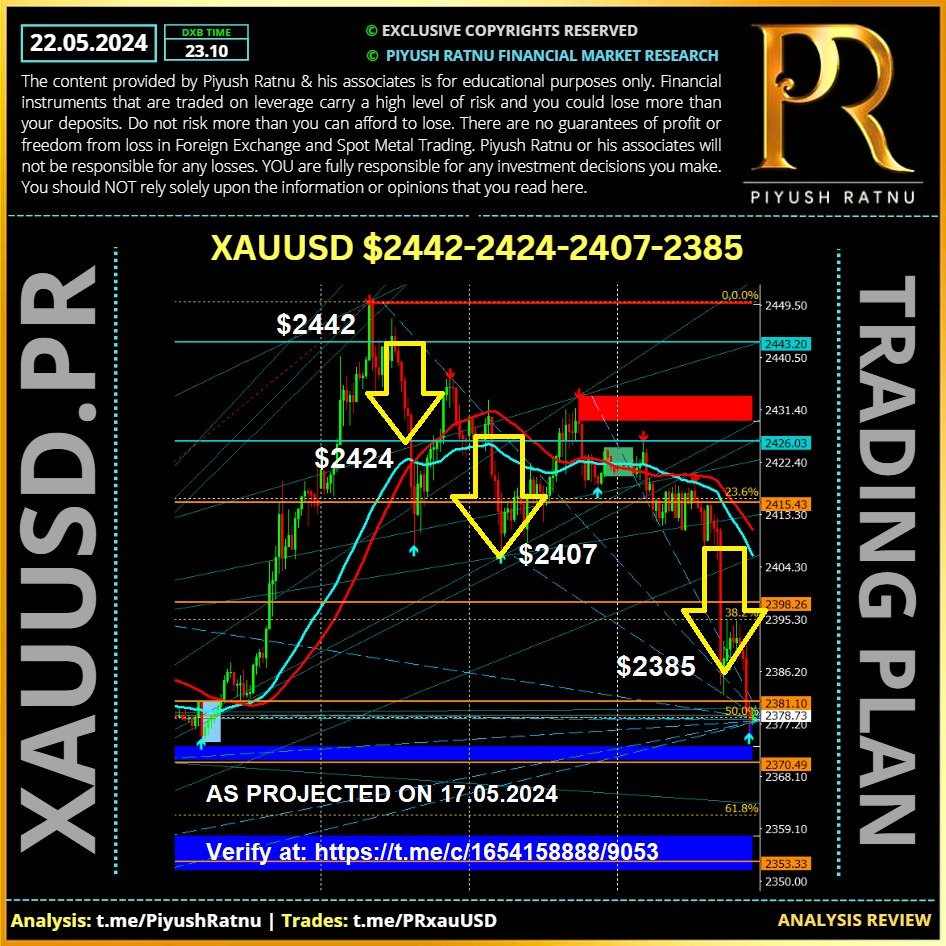

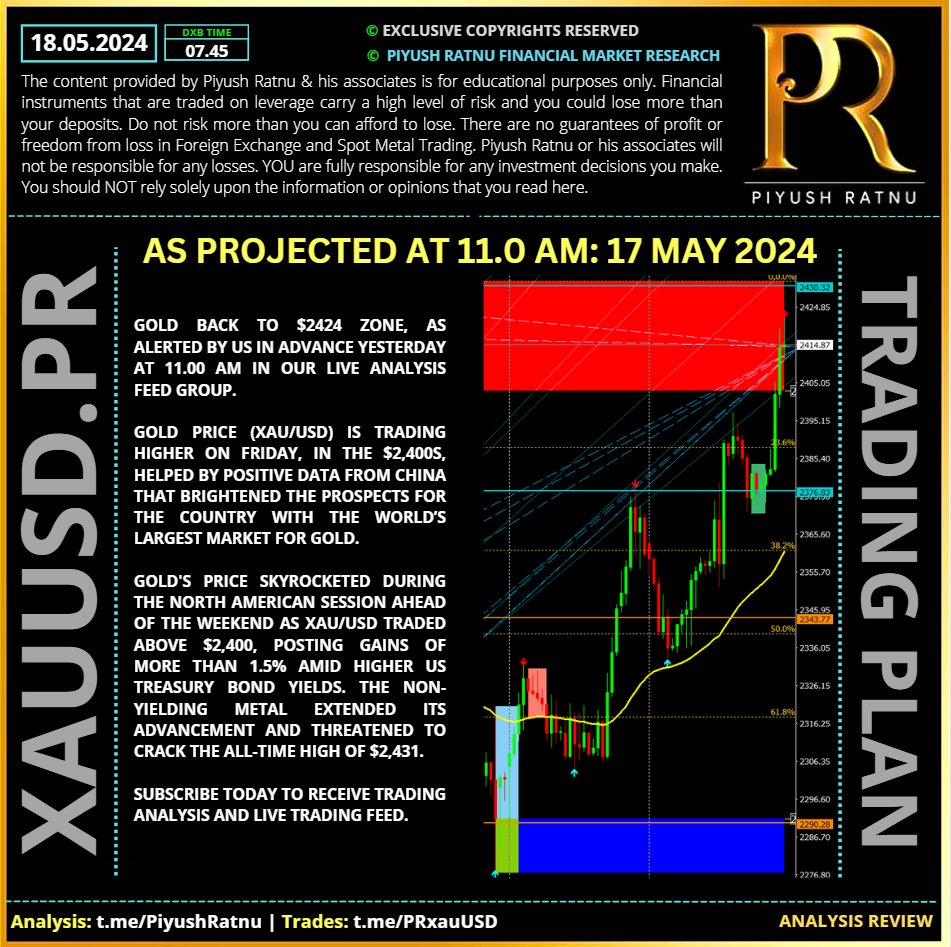

#XAUUSD | Trading Plan as projected on 17 May 2024

Witnessed on 22 May 2024

#PiyushRatnu #PRDXB #Gold #XAUUSD #PRDXB

Witnessed on 22 May 2024

#PiyushRatnu #PRDXB #Gold #XAUUSD #PRDXB

Piyush Lalsingh Ratnu

Co-relations: ALERT:

Today's + USDJPY move: 600 P

Expected Impact on XAUUSD:

$2424-20 = $2404

$2404 achieved at H1A618 zone | 15.57 hours DXB

#XAUUSD #PiyushRatnu #PRDXB #Gold

Today's + USDJPY move: 600 P

Expected Impact on XAUUSD:

$2424-20 = $2404

$2404 achieved at H1A618 zone | 15.57 hours DXB

#XAUUSD #PiyushRatnu #PRDXB #Gold

Piyush Lalsingh Ratnu

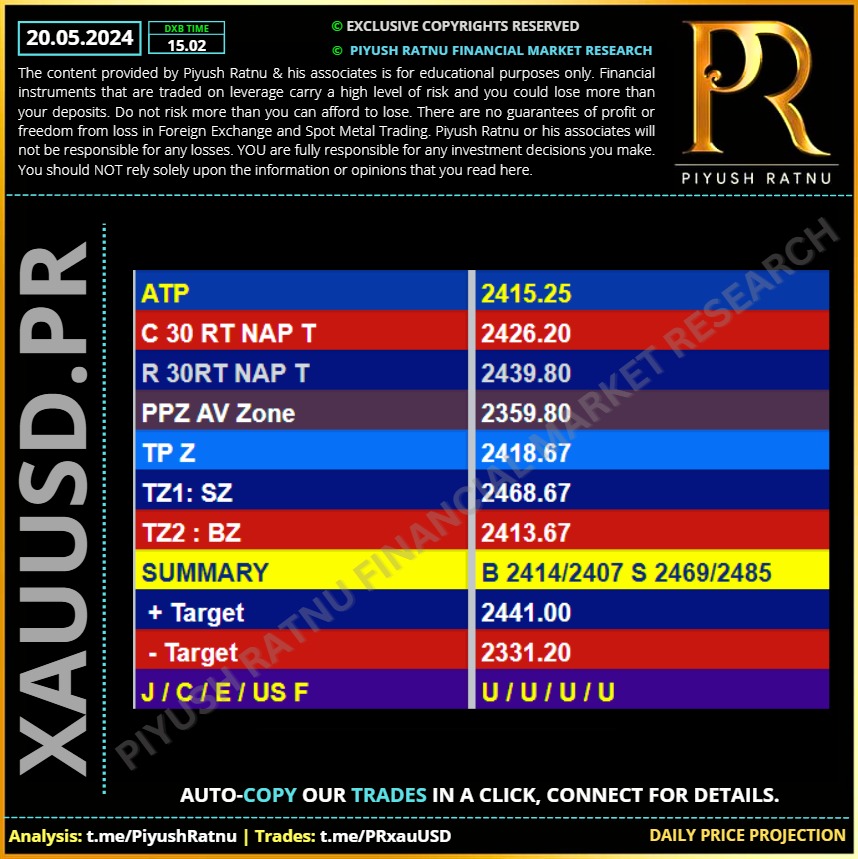

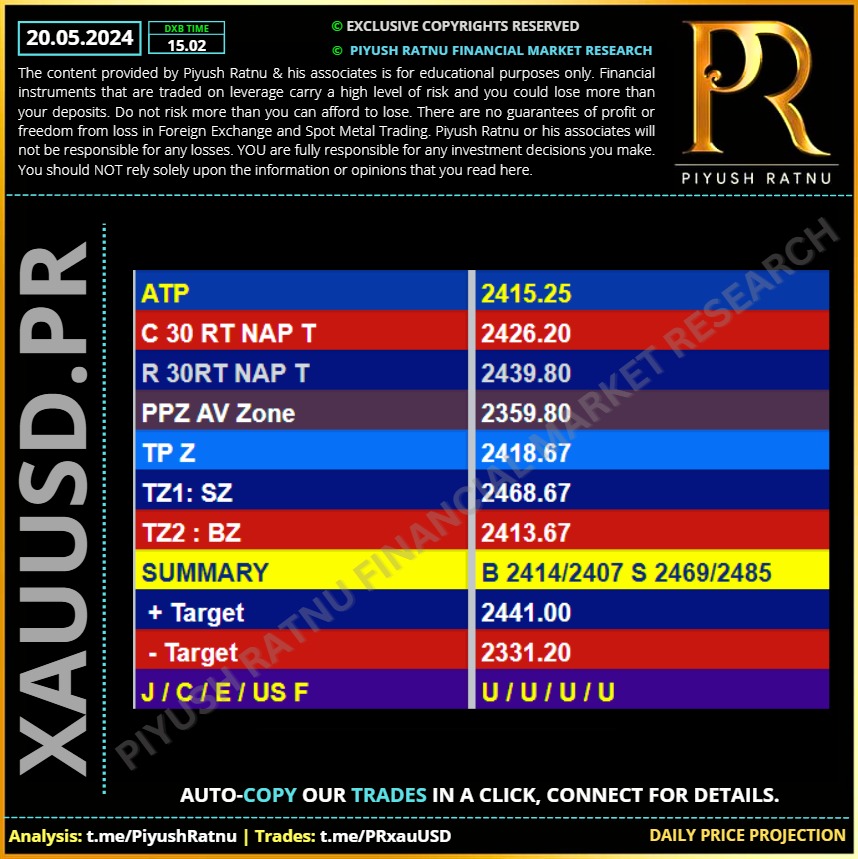

20.05.2024 | XAUUSD: Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

USD S 88

GBP 92

AUD 14

JPY 22

DXY +

US10YT +

USDCNY +

XAUXAG 77.89

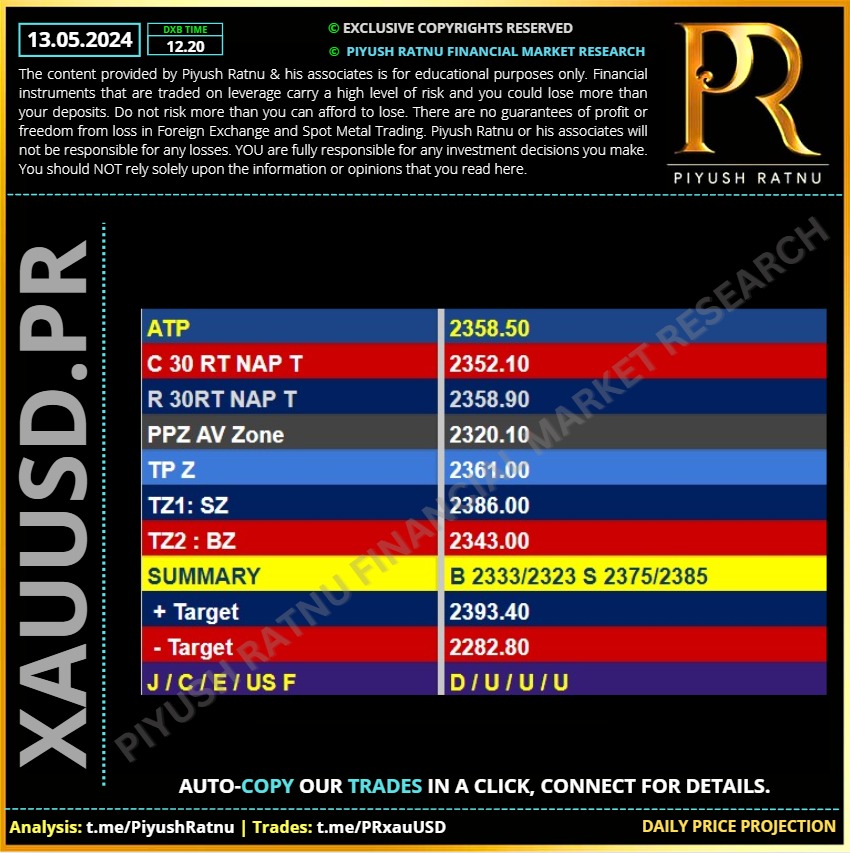

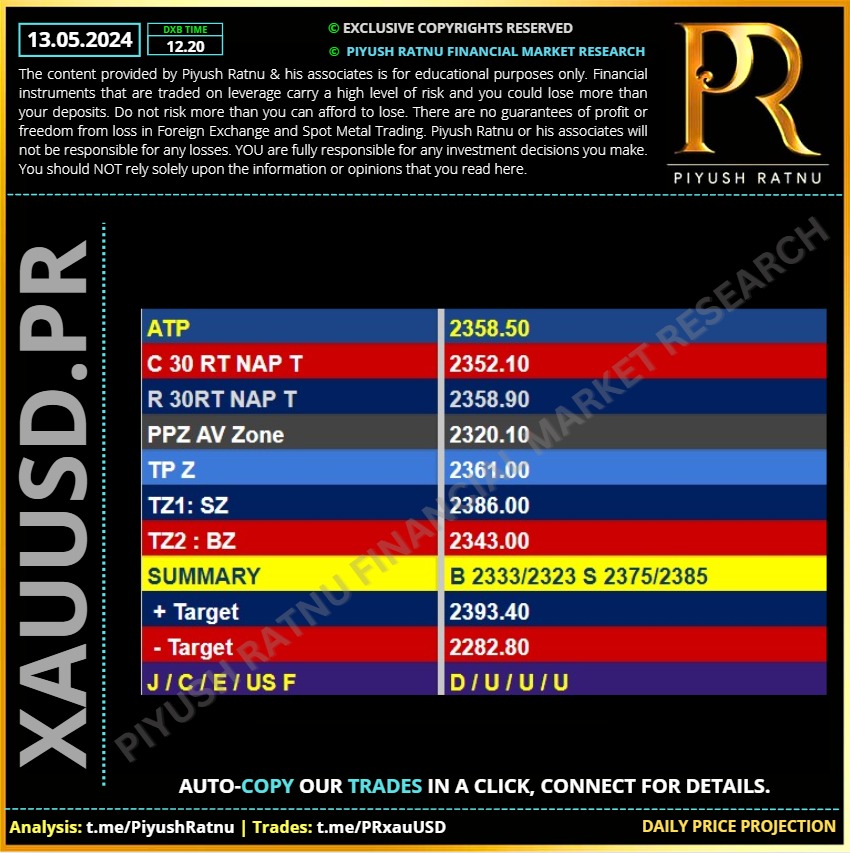

#XAUUSD CMP $2416 RT from $2442 - SZ alerted on 13 May 2024

GBP 92

AUD 14

JPY 22

DXY +

US10YT +

USDCNY +

XAUXAG 77.89

#XAUUSD CMP $2416 RT from $2442 - SZ alerted on 13 May 2024

Piyush Lalsingh Ratnu

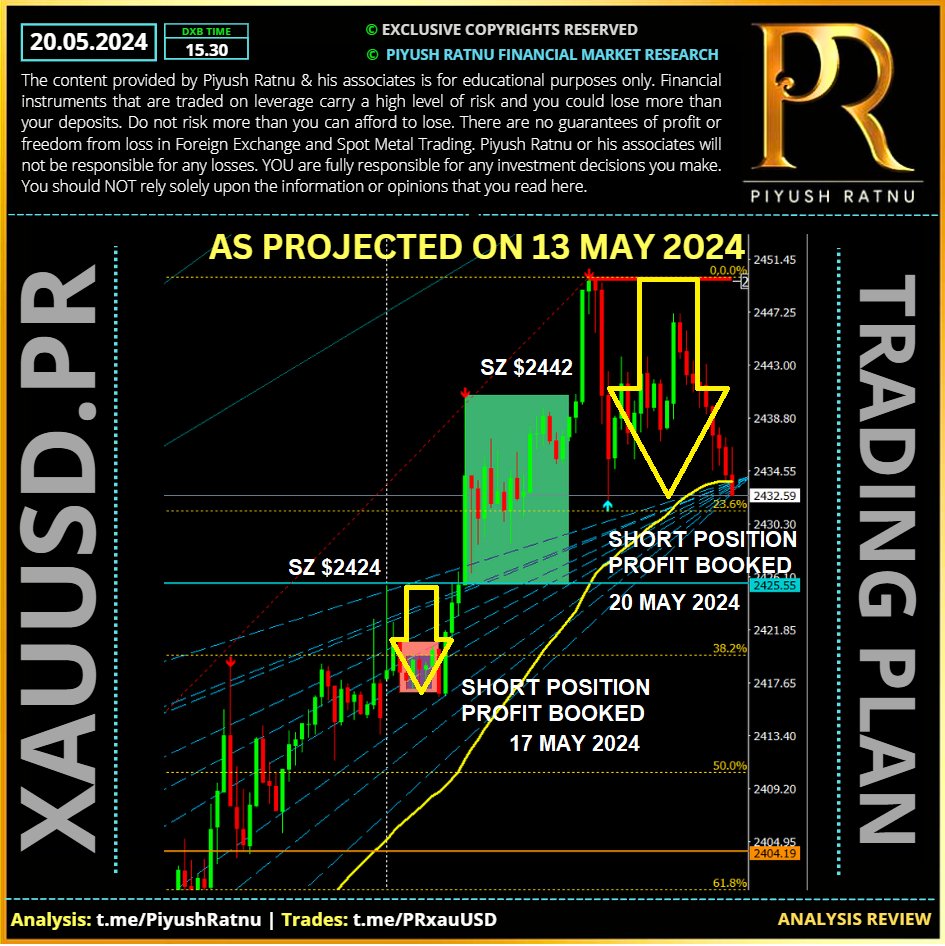

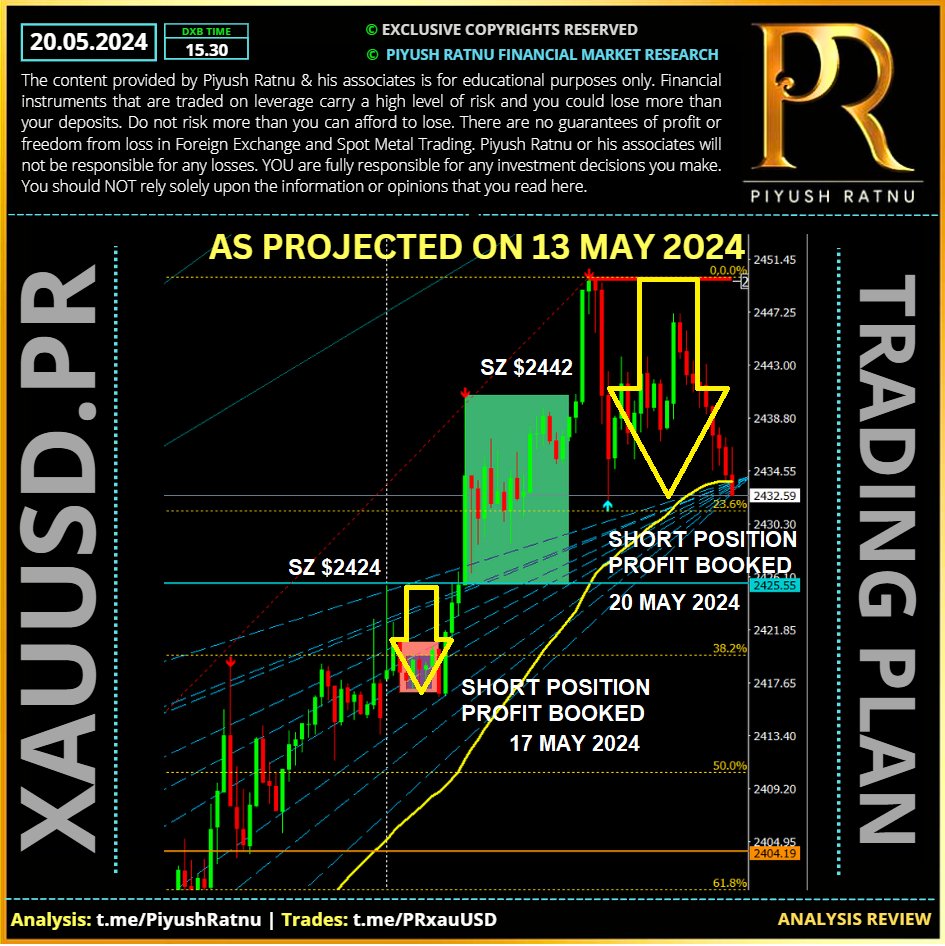

#XAUUSD

Piyush Ratnu Financial Market Research

Trading Plan Review: 17 May - 20 May 2024

#PiyushRatnu #PRDXB #Forex #Gold #Trading

Piyush Ratnu Financial Market Research

Trading Plan Review: 17 May - 20 May 2024

#PiyushRatnu #PRDXB #Forex #Gold #Trading

Piyush Lalsingh Ratnu

As projected by Piyush Ratnu Financial Market Research on 13 May 2024: $2424/2442 was the highs target for the last week, $2424 was successfully achieved on Friday, 17 May 2024. $2442 was achieved on 20 May 2024, early morning post PBOC Loan Prime Rate as projected by us on Friday repeatedly.

Verify at: https://t.me/c/1654158888/8976

🆘 We projected following Short Positions (XAUUSD)

1) $2424: SZ | RT 2414 - 17 May 2024: booked in Profit

2) $2442: SZ | RT 2442-2450-2431 - 20 May 2024: booked in Profit

Next Entry zones: $2469, 2485, 2505 and 2525

Stay Alert, Avoid BIG Lots.

Multiple factors are impacting XAUUSD price and world markets, the rising demand for Safe haven is driving Gold Price high and higher.

Some of the key factors:

1. Israel - Iran tensions, Iran President death

2. US - China Sanctions

3. FED path, Interest Rate Cut Projections

4. Economic Data of US Economy

5. Saudi King Health issues

6. The US Dollar (USD) is struggling alongside the US Treasury bond yields, as risk sentiment remains in a sweeter spot on China’s stimulus measures.

7. Gold buyers continue to capitalize on Fed Chair Jerome Powell’s last week's speech, where he affirmed that an interest rate hike is not on the table. Meanwhile, bets of two 25 basis points (bps) interest rate hikes this year keep Gold price on an upward trajectory.

🟢Additionally, China, a top Gold consumer, announced "historic" steps to stabiilze the crisis-hit property sector on Friday, contributing to the upside in Gold price. Topping up to the constructive outlook for Gold price, the recent official data published by the People’s Bank of China (PBOC) showed that the central bank ramped up its Gold reserves for the 18th straight month in April.

#XAUUSD #PiyushRatnu #PRDXB #Forex

What's next?

Subscribe today to receive real time XAUUSD trading analysis and live trading feed.

Verify at: https://t.me/c/1654158888/8976

🆘 We projected following Short Positions (XAUUSD)

1) $2424: SZ | RT 2414 - 17 May 2024: booked in Profit

2) $2442: SZ | RT 2442-2450-2431 - 20 May 2024: booked in Profit

Next Entry zones: $2469, 2485, 2505 and 2525

Stay Alert, Avoid BIG Lots.

Multiple factors are impacting XAUUSD price and world markets, the rising demand for Safe haven is driving Gold Price high and higher.

Some of the key factors:

1. Israel - Iran tensions, Iran President death

2. US - China Sanctions

3. FED path, Interest Rate Cut Projections

4. Economic Data of US Economy

5. Saudi King Health issues

6. The US Dollar (USD) is struggling alongside the US Treasury bond yields, as risk sentiment remains in a sweeter spot on China’s stimulus measures.

7. Gold buyers continue to capitalize on Fed Chair Jerome Powell’s last week's speech, where he affirmed that an interest rate hike is not on the table. Meanwhile, bets of two 25 basis points (bps) interest rate hikes this year keep Gold price on an upward trajectory.

🟢Additionally, China, a top Gold consumer, announced "historic" steps to stabiilze the crisis-hit property sector on Friday, contributing to the upside in Gold price. Topping up to the constructive outlook for Gold price, the recent official data published by the People’s Bank of China (PBOC) showed that the central bank ramped up its Gold reserves for the 18th straight month in April.

#XAUUSD #PiyushRatnu #PRDXB #Forex

What's next?

Subscribe today to receive real time XAUUSD trading analysis and live trading feed.

Piyush Lalsingh Ratnu

#XAUUSD #PiyushRatnu #PRDXB #Forex

Subscribe today to receive trading analysis and live trading feed.

Subscribe today to receive trading analysis and live trading feed.

Piyush Lalsingh Ratnu

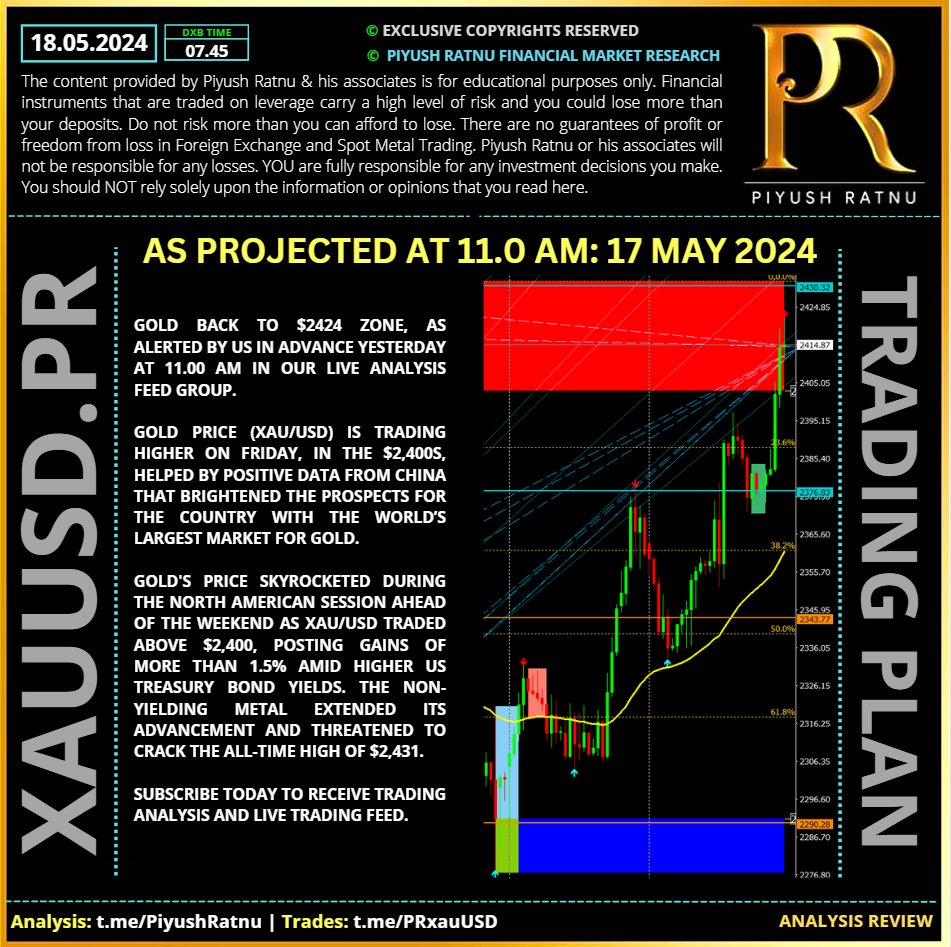

GOLD back to $2424 zone, as alerted by us in advance yesterday at 11.00 AM in our LIVE ANALYSIS FEED GROUP.

Gold price (XAU/USD) is trading higher on Friday, in the $2,400s, helped by positive data from China that brightened the prospects for the country with the world’s largest market for Gold.

Gold's price skyrocketed during the North American session ahead of the weekend as XAU/USD traded above $2,400, posting gains of more than 1.5% amid higher US Treasury bond yields. The non-yielding metal extended its advancement and threatened to crack the all-time high of $2,431.

A lower April inflationary reading in the United States (US) sponsored Gold’s leg up above the $2,400 mark, although US Treasury yields climbed. However, the Greenback is battered across the board and tumbled some 0.03%, according to the US Dollar Index (DXY), standing at 104.45.

That revived speculation that the Federal Reserve (Fed) could lower rates in 2024. However, Fed officials stressed that one positive read for inflation is not enough with most regional Fed presidents maintaining a cautious stance.

According to the fed funds rate December 2024 futures contract, expectations that the Fed would lower rates dropped from 36 basis points (bps) to 35 bps toward the end of the year.

#XAUUSD #PiyushRatnu #PRDXB #Forex

Subscribe today to receive trading analysis and live trading feed.

Gold price (XAU/USD) is trading higher on Friday, in the $2,400s, helped by positive data from China that brightened the prospects for the country with the world’s largest market for Gold.

Gold's price skyrocketed during the North American session ahead of the weekend as XAU/USD traded above $2,400, posting gains of more than 1.5% amid higher US Treasury bond yields. The non-yielding metal extended its advancement and threatened to crack the all-time high of $2,431.

A lower April inflationary reading in the United States (US) sponsored Gold’s leg up above the $2,400 mark, although US Treasury yields climbed. However, the Greenback is battered across the board and tumbled some 0.03%, according to the US Dollar Index (DXY), standing at 104.45.

That revived speculation that the Federal Reserve (Fed) could lower rates in 2024. However, Fed officials stressed that one positive read for inflation is not enough with most regional Fed presidents maintaining a cautious stance.

According to the fed funds rate December 2024 futures contract, expectations that the Fed would lower rates dropped from 36 basis points (bps) to 35 bps toward the end of the year.

#XAUUSD #PiyushRatnu #PRDXB #Forex

Subscribe today to receive trading analysis and live trading feed.

Piyush Lalsingh Ratnu

Short positions: $2407-2414:

XAUUSD: Current Status:

M1A618

M5A382

M15A236

M30A236

CMP 2305 | All trades closed | Running trades: 0

XAUUSD: Current Status:

M1A618

M5A382

M15A236

M30A236

CMP 2305 | All trades closed | Running trades: 0

Piyush Lalsingh Ratnu

🆘 Sunday, May 19, 2024

23:30 USD Fed Chair Powell Speaks

🆘 Monday, May 20, 2024

05:15 CNY China Loan Prime Rate 5Y (May) 3.95% 3.95%

05:15 CNY PBoC Loan Prime Rate 3.45% 3.45%

High Volatility might be faced during Monday early morning session. Avoid BIG LOTS.

23:30 USD Fed Chair Powell Speaks

🆘 Monday, May 20, 2024

05:15 CNY China Loan Prime Rate 5Y (May) 3.95% 3.95%

05:15 CNY PBoC Loan Prime Rate 3.45% 3.45%

High Volatility might be faced during Monday early morning session. Avoid BIG LOTS.

Piyush Lalsingh Ratnu

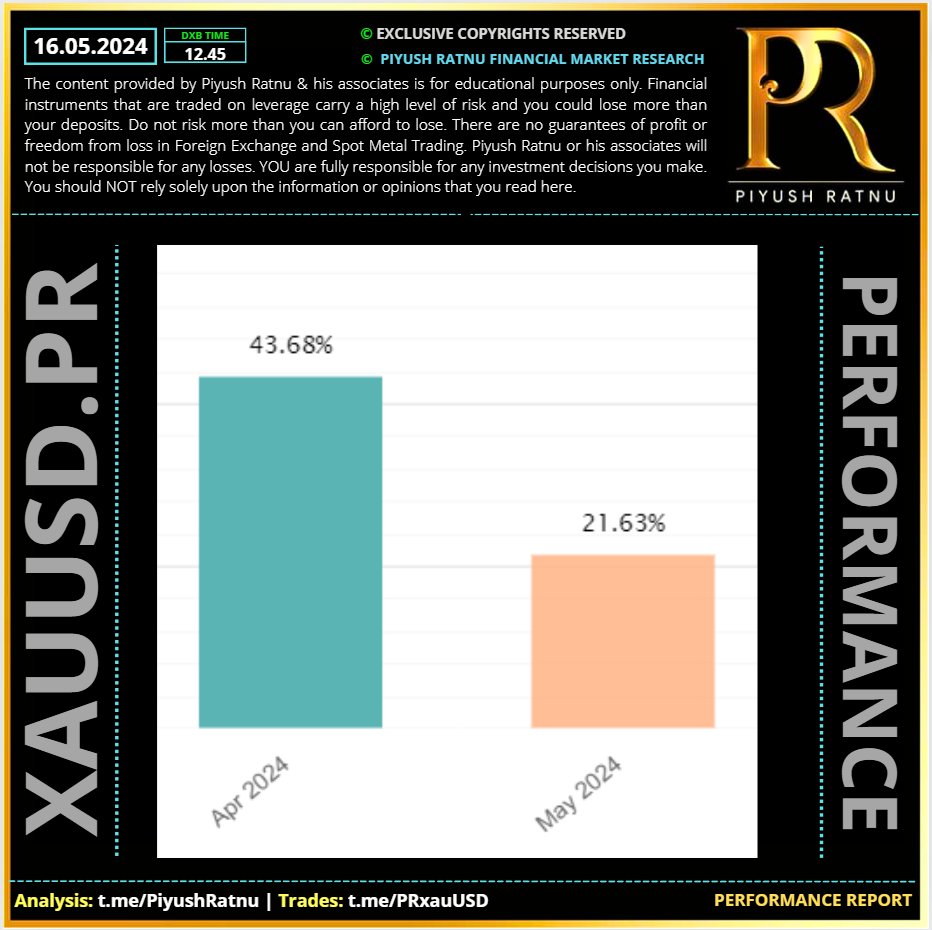

16.05.2024 | XAUUSD: Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

: