Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Gold Price surges ignoring US economic strength, amid geopolitical concerns

XAU/USD trades at $2,384 after hitting a daily low of $2,324 ($2323 zone) yesterday as projected by us as a buying zone in 15.15 hours analysis.

Verify at:

https://t.me/c/1654158888/8659 |

https://twitter.com/piyushratnu/status/1779885868041269429

Investors remain concerned about possible Israeli retaliation following Iran’s missile and drone attack over the weekend. Even though the White House urged Israel against retaliation, Israel's military chief said, “There will be a response to Iranian missiles and drones launched toward Israeli territory.”

Weekend news kept concerns alive as Iran launched a massive attack on Israel, spurring fears of an Israeli retaliation. Western allies called for the latter to avoid escalating the conflict, but it’s unclear what Israeli Prime Minister Benjamin Netanyahu could do next. Netanyahu is discussing with its cabinet whether or not they will hit back at Iran. Tensions affected Oil prices the most but also backed demand for the Greenback.

🔘 Fundamentals based on Economics

March's US Retail Sales saw a 0.7% MoM increase, surpassing the expected 0.4%. This rise contributes to a 2.1% growth in Q1 2024 compared to last year's period, signaling strong consumer activity.

Data from the Chicago Board of Trade (CBOT) suggests that traders expect the Fed funds rate to finish at 4.965% in 2024.

🔘 Technical Analysis

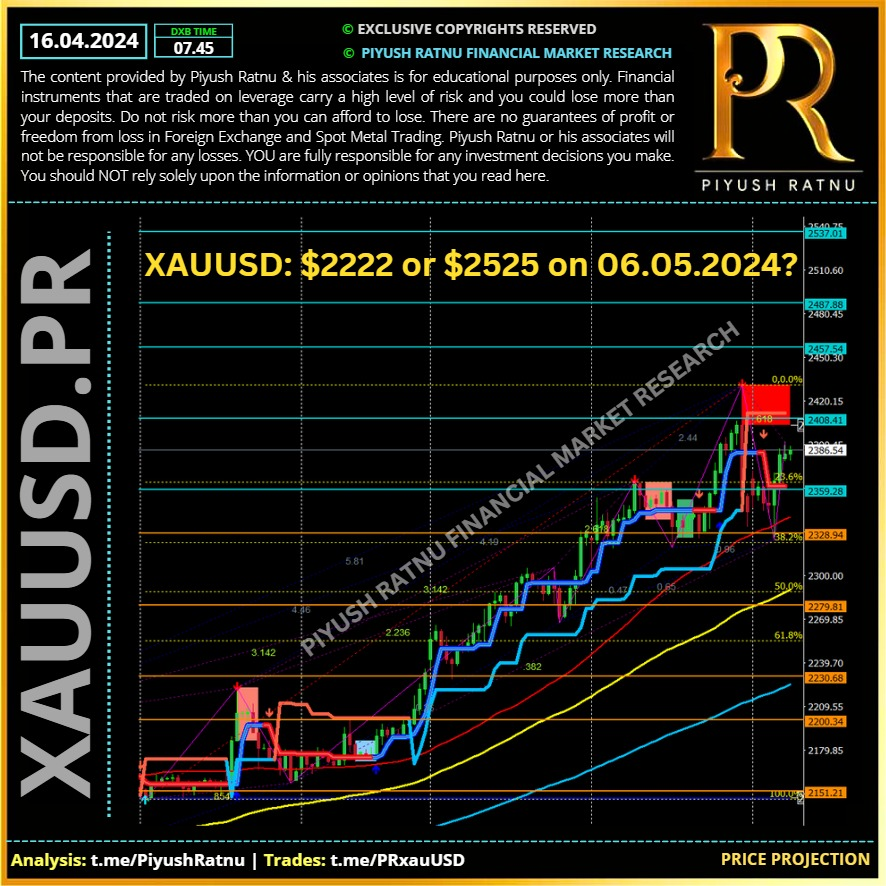

Gold’s final top?

It most likely means that “this is it”. This was the final top for the price of gold for at least some time. At least that’s what the huge-volume sessions meant previously, especially when gold was similarly overbought as it was recently. Gold’s huge-volume reversal is definitely THE news that got the spotlight last week. What does it mean?

Gold prices reversed right above the price levels that were likely to mark the end of the rally ($2424 zone) based on how far gold rallied previously and based on the Fibonacci extension techniques + projection as per PRSRLVL algorithm.

🔘 Regarding USDJPY: we observed that Friday was the third consecutive day when the currency pair closed above its 2022 and 2023 highs, and it was also the weekly close – this makes the breakout confirmed. Indeed, the pair is moving higher also today CMP $154.350

There was a time when the USDJPY was also after a major breakout, and it was starting a huge rally… And you know what happened to gold, then?

💎For the above co-relation based analysis: refer USDJPY vs XAUUSD W1 16.10.2022 chart.

What did we witness on 16.10.2022?

🔺USDJPY $151.800

🔻XAUUSD $1636.00

⚠️Considering all the above fundamental and technical scenarios, there is one very important condition to be considered while making a trading plan: GEO-political tensions.

🆘 A sudden missile strike or announcement related to Interest Rates/ Sanctions / Iran-Israel retaliation/ US action on Iran / Statement by Russia/China is expected in the next 15 trading days (before 06.05.24), hence it will be wise to maintain price gaps, implement risk management and keep additional funds (3x) ready in case of high volatility.🆘

Needless to mention, a sudden increase in margin requirement, decrease in leverage is not something we have not seen in the last 4 years.

🍎 Crucial Zones: XAUUSD:

🔺R:SZ: $2385/2424/2469/2496/2525/2552

🔻C: BZ: $2323/2288/2244/2222/2200/2169

XAU/USD trades at $2,384 after hitting a daily low of $2,324 ($2323 zone) yesterday as projected by us as a buying zone in 15.15 hours analysis.

Verify at:

https://t.me/c/1654158888/8659 |

https://twitter.com/piyushratnu/status/1779885868041269429

Investors remain concerned about possible Israeli retaliation following Iran’s missile and drone attack over the weekend. Even though the White House urged Israel against retaliation, Israel's military chief said, “There will be a response to Iranian missiles and drones launched toward Israeli territory.”

Weekend news kept concerns alive as Iran launched a massive attack on Israel, spurring fears of an Israeli retaliation. Western allies called for the latter to avoid escalating the conflict, but it’s unclear what Israeli Prime Minister Benjamin Netanyahu could do next. Netanyahu is discussing with its cabinet whether or not they will hit back at Iran. Tensions affected Oil prices the most but also backed demand for the Greenback.

🔘 Fundamentals based on Economics

March's US Retail Sales saw a 0.7% MoM increase, surpassing the expected 0.4%. This rise contributes to a 2.1% growth in Q1 2024 compared to last year's period, signaling strong consumer activity.

Data from the Chicago Board of Trade (CBOT) suggests that traders expect the Fed funds rate to finish at 4.965% in 2024.

🔘 Technical Analysis

Gold’s final top?

It most likely means that “this is it”. This was the final top for the price of gold for at least some time. At least that’s what the huge-volume sessions meant previously, especially when gold was similarly overbought as it was recently. Gold’s huge-volume reversal is definitely THE news that got the spotlight last week. What does it mean?

Gold prices reversed right above the price levels that were likely to mark the end of the rally ($2424 zone) based on how far gold rallied previously and based on the Fibonacci extension techniques + projection as per PRSRLVL algorithm.

🔘 Regarding USDJPY: we observed that Friday was the third consecutive day when the currency pair closed above its 2022 and 2023 highs, and it was also the weekly close – this makes the breakout confirmed. Indeed, the pair is moving higher also today CMP $154.350

There was a time when the USDJPY was also after a major breakout, and it was starting a huge rally… And you know what happened to gold, then?

💎For the above co-relation based analysis: refer USDJPY vs XAUUSD W1 16.10.2022 chart.

What did we witness on 16.10.2022?

🔺USDJPY $151.800

🔻XAUUSD $1636.00

⚠️Considering all the above fundamental and technical scenarios, there is one very important condition to be considered while making a trading plan: GEO-political tensions.

🆘 A sudden missile strike or announcement related to Interest Rates/ Sanctions / Iran-Israel retaliation/ US action on Iran / Statement by Russia/China is expected in the next 15 trading days (before 06.05.24), hence it will be wise to maintain price gaps, implement risk management and keep additional funds (3x) ready in case of high volatility.🆘

Needless to mention, a sudden increase in margin requirement, decrease in leverage is not something we have not seen in the last 4 years.

🍎 Crucial Zones: XAUUSD:

🔺R:SZ: $2385/2424/2469/2496/2525/2552

🔻C: BZ: $2323/2288/2244/2222/2200/2169

Piyush Lalsingh Ratnu

Key Economic Data today:

16:30 USD Core Retail Sales (MoM) (Mar) 0.5% 0.3%

16:30 USD FOMC Member Williams Speaks

16:30 USD NY Empire State Manufacturing Index (Apr) -5.20 -20.90

16:30 USD Retail Control (MoM) (Mar) 0.0%

16:30 USD Retail Sales (MoM) (Mar) 0.4% 0.6%

18:00 USD Business Inventories (MoM) (Feb) 0.3% 0.0%

18:00 USD Retail Inventories Ex Auto (Feb) 0.4% 0.3%

22:00 USD Atlanta Fed GDPNow (Q1) 2.4% 2.4%

16:30 USD Core Retail Sales (MoM) (Mar) 0.5% 0.3%

16:30 USD FOMC Member Williams Speaks

16:30 USD NY Empire State Manufacturing Index (Apr) -5.20 -20.90

16:30 USD Retail Control (MoM) (Mar) 0.0%

16:30 USD Retail Sales (MoM) (Mar) 0.4% 0.6%

18:00 USD Business Inventories (MoM) (Feb) 0.3% 0.0%

18:00 USD Retail Inventories Ex Auto (Feb) 0.4% 0.3%

22:00 USD Atlanta Fed GDPNow (Q1) 2.4% 2.4%

Piyush Lalsingh Ratnu

🍎 Why XAUUSD Crashed from $2424?

1. Technical Correction before a BIG + rally. According to news sources, Iran is preparing an attack on Israeli soil following an Israeli attack that killed seven Iranian officials two weeks ago.

2. $2424: SELL ORDERS: profit booking estimate: $75-90 ($2345 zone)

3. Post EU Rate cut proposition: Volumes increased in GOLD

4. Geo-political tensions based movement: retracement H1Az: According to news sources, Iran is preparing an attack on Israeli soil following an Israeli attack that killed seven Iranian officials two weeks ago.

5. Fed officials' comments boost the US Dollar, a headwind for Gold prices. Federal Reserve officials are crossing newswires led by Boston Fed President Susan Collins, Chicago Fed President Austan Goolsbee, and the Kansas City Fed’s Jeffrey Schmid, largely heaping more cold water on rate cut hopes.

USDJPY 153.250

USD S 90

JPY S 66

US F - - -

US10YT + + +

DXY 105.800

The US Dollar Index (DXY) also witnessed a substantial increase, soaring over 0.64% to reach a new YTD high of 106.10.

XAUXAG 83.80

USDCNY 7.237

World Gold Consortium reveals that the People’s Bank of China was the largest buyer of the yellow metal in February, increasing its reserves by 12 tonnes to 2,257 tonnes.

Impact: XAUUSD (-) $95 | CMP $2343

🔷 I expect a gap in price on Monday early morning session.

🔷 I suggest to avoid trades, it will be wise to wait for Monday opening, since 13.4.2024/17.04.2024 might be a crucial date for geo-political tensions.

1. Technical Correction before a BIG + rally. According to news sources, Iran is preparing an attack on Israeli soil following an Israeli attack that killed seven Iranian officials two weeks ago.

2. $2424: SELL ORDERS: profit booking estimate: $75-90 ($2345 zone)

3. Post EU Rate cut proposition: Volumes increased in GOLD

4. Geo-political tensions based movement: retracement H1Az: According to news sources, Iran is preparing an attack on Israeli soil following an Israeli attack that killed seven Iranian officials two weeks ago.

5. Fed officials' comments boost the US Dollar, a headwind for Gold prices. Federal Reserve officials are crossing newswires led by Boston Fed President Susan Collins, Chicago Fed President Austan Goolsbee, and the Kansas City Fed’s Jeffrey Schmid, largely heaping more cold water on rate cut hopes.

USDJPY 153.250

USD S 90

JPY S 66

US F - - -

US10YT + + +

DXY 105.800

The US Dollar Index (DXY) also witnessed a substantial increase, soaring over 0.64% to reach a new YTD high of 106.10.

XAUXAG 83.80

USDCNY 7.237

World Gold Consortium reveals that the People’s Bank of China was the largest buyer of the yellow metal in February, increasing its reserves by 12 tonnes to 2,257 tonnes.

Impact: XAUUSD (-) $95 | CMP $2343

🔷 I expect a gap in price on Monday early morning session.

🔷 I suggest to avoid trades, it will be wise to wait for Monday opening, since 13.4.2024/17.04.2024 might be a crucial date for geo-political tensions.

Piyush Lalsingh Ratnu

Gold price (XAU/USD) prolongs the recent well-established uptrend and climbs to the $2,400 neighborhood, or a fresh all-time high during the Asian session on Friday.

Investors remain concerned about the risk of a further escalation of geopolitical tensions in the Middle East, which, in turn, is seen as a key factor benefiting the safe-haven precious metal. Apart from this, expectations that major central banks will cut interest rates this year offer additional support to the non-yielding yellow metal and contribute to the positive move.

Bulls, meanwhile, seem rather unaffected by the recent US Dollar (USD) bullish run, bolstered by reduced bets for interest rate cuts by the Federal Reserve (Fed), which tends to undermine demand for the Gold price. Investors pushed back expectations about the timing of the first rate cut to September from June following the release of hot US consumer inflation figures on Wednesday. Market participants also pared their bets for the number of interest rate cuts this year to fewer than two from about three or four a few weeks ago.

That said, extremely overstretched conditions on daily, weekly and monthly charts might hold back traders from placing fresh bullish bets around the Gold price. Nevertheless, the XAU/USD remains on track to register gains for the fourth straight week, also marking the seventh in the previous eight. Moving ahead, the release of the Preliminary Michigan Consumer Sentiment Index, which, along with speeches by influential FOMC members, will drive the USD demand and produce short-term trading opportunities around the precious metal.

🆘 Crucial Zones ahead:

SZ 🔺 R: $2407/2424

BZ 🔻C: $2366/2323

Investors remain concerned about the risk of a further escalation of geopolitical tensions in the Middle East, which, in turn, is seen as a key factor benefiting the safe-haven precious metal. Apart from this, expectations that major central banks will cut interest rates this year offer additional support to the non-yielding yellow metal and contribute to the positive move.

Bulls, meanwhile, seem rather unaffected by the recent US Dollar (USD) bullish run, bolstered by reduced bets for interest rate cuts by the Federal Reserve (Fed), which tends to undermine demand for the Gold price. Investors pushed back expectations about the timing of the first rate cut to September from June following the release of hot US consumer inflation figures on Wednesday. Market participants also pared their bets for the number of interest rate cuts this year to fewer than two from about three or four a few weeks ago.

That said, extremely overstretched conditions on daily, weekly and monthly charts might hold back traders from placing fresh bullish bets around the Gold price. Nevertheless, the XAU/USD remains on track to register gains for the fourth straight week, also marking the seventh in the previous eight. Moving ahead, the release of the Preliminary Michigan Consumer Sentiment Index, which, along with speeches by influential FOMC members, will drive the USD demand and produce short-term trading opportunities around the precious metal.

🆘 Crucial Zones ahead:

SZ 🔺 R: $2407/2424

BZ 🔻C: $2366/2323

Piyush Lalsingh Ratnu

💬💬💬💬💬💬

XAUUSD approaching $2366 zone as projected by us at 11.25 AM today.

CMP $2363

XAUUSD approaching $2366 zone as projected by us at 11.25 AM today.

CMP $2363

Piyush Lalsingh Ratnu

Co-relations in action: USD/JPY pair, and gold – in a completely unsurprising way – declined.

And that IS a game-changer, even if many people fail to view it as such.

This time, the trigger came from the inflation numbers that were above the expected levels and the market now is pricing the scenarios in which the Fed doesn’t cut rates as quickly as it had previously been expected.

USD value increases, Gold decreases

In consequence, the U.S. dollar’s value increases while gold decreases. The S&P 500 Index futures declined as well.

The technical set-up was in place for days, and it didn’t really matter what kind of event or statistic triggered the move – it seems that the CPI did the trick, but in reality, the reason for the strength in the USD and the declines in gold and stocks were known previously, based on multiple technical indications. At least those who followed my analyses were prepared.

In my previous analyses, I wrote that it’s quite likely that the rally in gold would continue while the USD/JPY continues to consolidate, and then I expected gold to start to decline once the USD/JPY breaks to new highs.

💠That’s exactly what just happened. The USD/JPY rate just rallied sharply above its 2022 and 2023 highs, and gold turned south.

🟢So far, the slide in gold has been relatively small, just as the size of the rally in the USD/JPY is, but breakouts are important for a reason – this is just the first step of another big climb in the currency rate, suggesting that the decline in gold has only begun.

🆘 XAUUSD: Crucial Zones: CMP: $2334.00

H1AS1 2331

H1A618 2326

H1A100 2300

H1AS2 2300

H4A236 2310

H4AS50 2310

H4A382 2275

H4AR1 (MN PRSR) 2255 zone

H4A618 2222 zone

Crucial Price Stops:

🔻BZ: $2313/2303

🔺SZ: $2366/2376

And that IS a game-changer, even if many people fail to view it as such.

This time, the trigger came from the inflation numbers that were above the expected levels and the market now is pricing the scenarios in which the Fed doesn’t cut rates as quickly as it had previously been expected.

USD value increases, Gold decreases

In consequence, the U.S. dollar’s value increases while gold decreases. The S&P 500 Index futures declined as well.

The technical set-up was in place for days, and it didn’t really matter what kind of event or statistic triggered the move – it seems that the CPI did the trick, but in reality, the reason for the strength in the USD and the declines in gold and stocks were known previously, based on multiple technical indications. At least those who followed my analyses were prepared.

In my previous analyses, I wrote that it’s quite likely that the rally in gold would continue while the USD/JPY continues to consolidate, and then I expected gold to start to decline once the USD/JPY breaks to new highs.

💠That’s exactly what just happened. The USD/JPY rate just rallied sharply above its 2022 and 2023 highs, and gold turned south.

🟢So far, the slide in gold has been relatively small, just as the size of the rally in the USD/JPY is, but breakouts are important for a reason – this is just the first step of another big climb in the currency rate, suggesting that the decline in gold has only begun.

🆘 XAUUSD: Crucial Zones: CMP: $2334.00

H1AS1 2331

H1A618 2326

H1A100 2300

H1AS2 2300

H4A236 2310

H4AS50 2310

H4A382 2275

H4AR1 (MN PRSR) 2255 zone

H4A618 2222 zone

Crucial Price Stops:

🔻BZ: $2313/2303

🔺SZ: $2366/2376

Piyush Lalsingh Ratnu

XAUUSD: CMP $2333.33

M15V382

M30V236 achieved

Retracement observed from

H1A50, H1AS1, M30AS2

Buying at $2323 gave us good results.

Kindly exit LONG Positions.

M15V382

M30V236 achieved

Retracement observed from

H1A50, H1AS1, M30AS2

Buying at $2323 gave us good results.

Kindly exit LONG Positions.

Piyush Lalsingh Ratnu

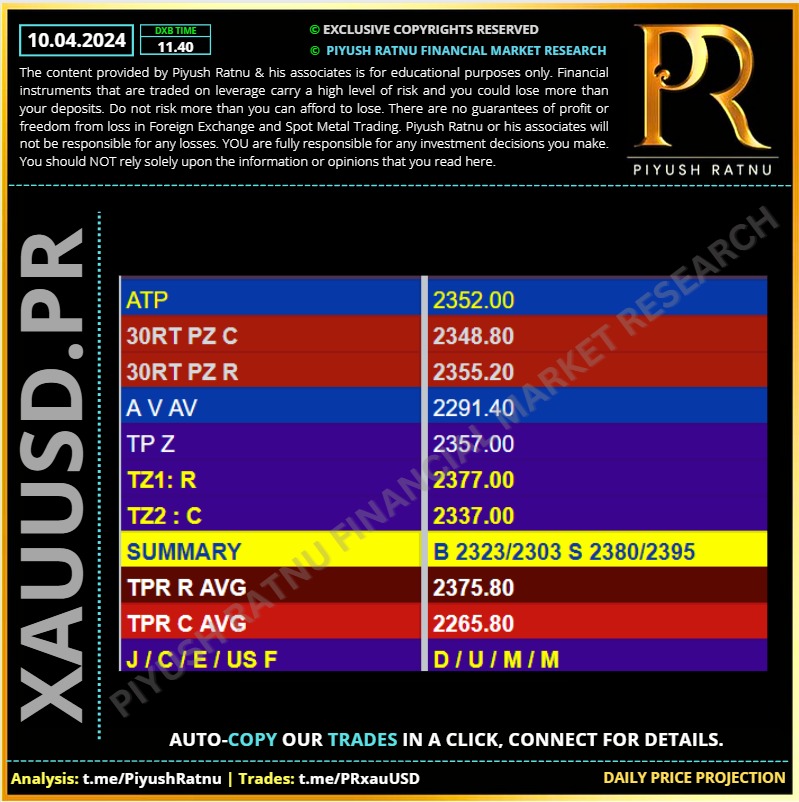

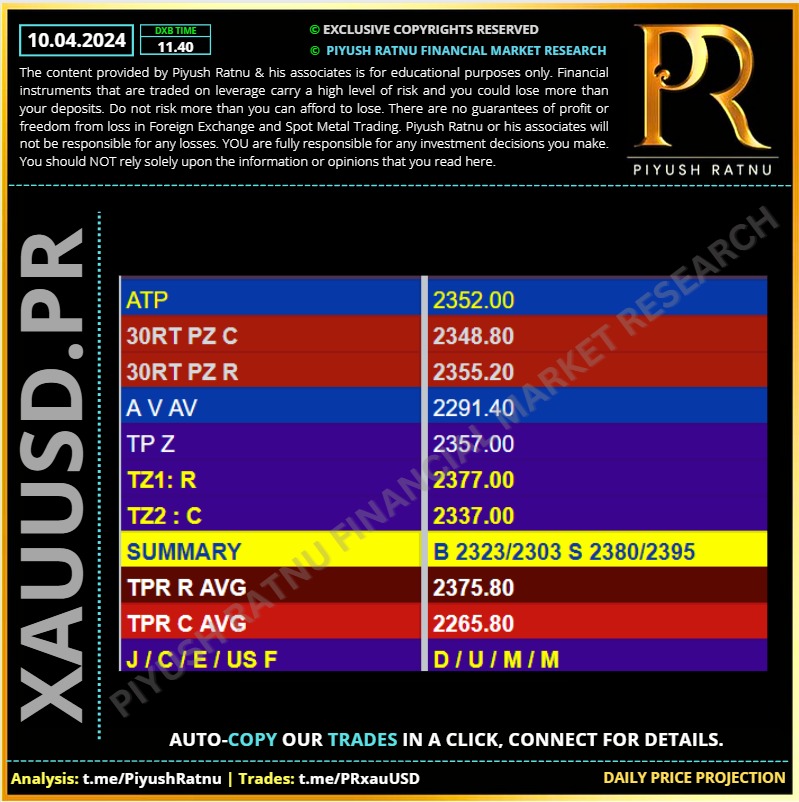

10.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

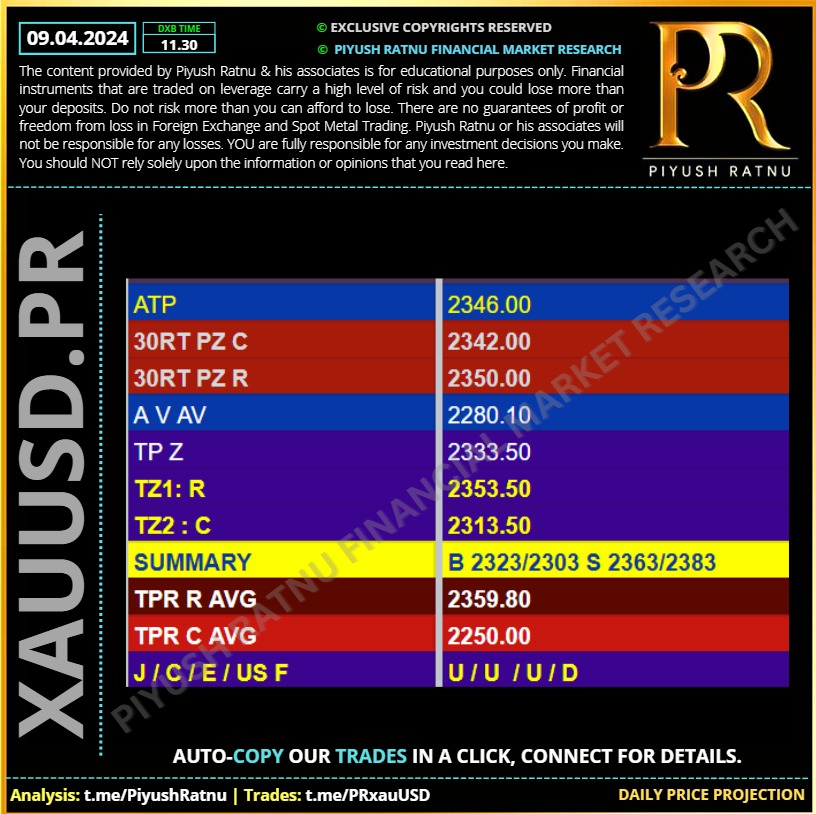

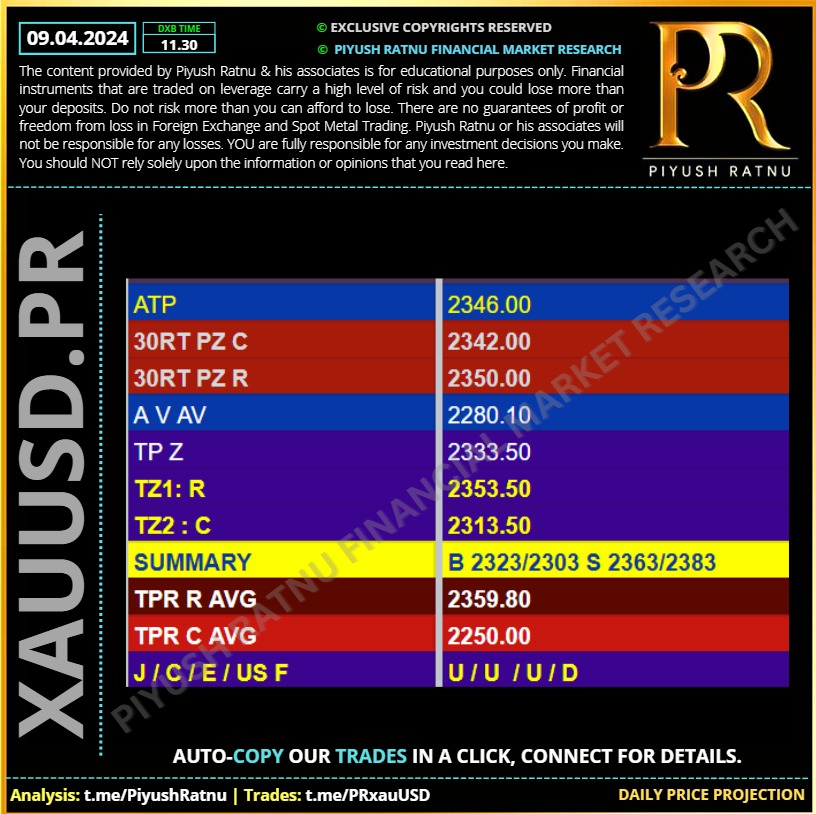

09.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🟢 Buying at and below M30AS5 gave us good returns.

CMP $2356 | Net pips achieved 1000+

🟢 Exit LONG POSITIONS.

CMP $2356 | Net pips achieved 1000+

🟢 Exit LONG POSITIONS.

Piyush Lalsingh Ratnu

GOLD / XAUUSD: $2424 in 2024? Repeatedly projected since 29.01.2024 by Piyush Ratnu Financial Market Research, Dubai

Gold price is holding the fort near $2,350 early Tuesday, having witnessed good two-way businesses on Monday. Gold price now awaits key US fundamental data for a fresh directional move. In the absence of any top-tier US economic data later on Tuesday, the focus will remain on the speeches from the US Federal Reserve (Fed) policymakers.

Gold price has entered a phase of upside consolidation in the Asian session on Tuesday, as the US Dollar licks its wounds while the US Treasury bond yields hold their corrective downside amid a negative shift in risk sentiment.

Strong US Nonfarm Payrolls data and hawkish Fed commentaries have weighed on the Fed rate cut bets, with markets now pricing in a roughly 50% chance of another hold in June. The hawkish shift in the market expectations has underpinned the recent upsurge in the US Treasury bond yields.

Stock markets trade in positive territory, although gains remain modest amid caution ahead of critical events that may set the tone for the rest of the month. Finally, it is worth adding that the odds for a Federal Reserve (Fed) June rate cut keep decreasing, and major analysts now see July as the date for the first move. Upcoming inflation data will surely be a make-it-or-break for the USD.

A Chinese official reported on Sunday, the Chinese central bank purchased Gold for its reserves for the 17th straight month in March. Bullion held by the PBOC rose to 72.74 million fine troy ounces last month, the official said. Turkey, India, Kazakhstan and some eastern European countries have also been buying gold this year, per Reuters.

Renewed central bank demand for the bright metal sent the Gold price to another record high above $2,350 on Monday, extending its record-setting rally.

Looking ahead, Gold traders will take account of Fedspeak amid a lack of top-tier US economic data. Meanwhile, position adjustment and profit-taking in Gold price cannot be ruled out, as traders gear up for key US inflation report due on Wednesday.

Crucial Price Zones Ahead:

🔻 BZ C: $2323/2288/2266/2244/2222/2200

🔺 SZ R: $ 2363/2383/2407/2424/2445/2469

⚠️ Sudden volatility due to geo-political tensions/Fed statements might push GOLD price to new record highs, it will be wise to keep price gaps: $30 minimum and exit in NAP.

#xauusd #piyushratnu #prdxb #gold #forex #forextrading

Gold price is holding the fort near $2,350 early Tuesday, having witnessed good two-way businesses on Monday. Gold price now awaits key US fundamental data for a fresh directional move. In the absence of any top-tier US economic data later on Tuesday, the focus will remain on the speeches from the US Federal Reserve (Fed) policymakers.

Gold price has entered a phase of upside consolidation in the Asian session on Tuesday, as the US Dollar licks its wounds while the US Treasury bond yields hold their corrective downside amid a negative shift in risk sentiment.

Strong US Nonfarm Payrolls data and hawkish Fed commentaries have weighed on the Fed rate cut bets, with markets now pricing in a roughly 50% chance of another hold in June. The hawkish shift in the market expectations has underpinned the recent upsurge in the US Treasury bond yields.

Stock markets trade in positive territory, although gains remain modest amid caution ahead of critical events that may set the tone for the rest of the month. Finally, it is worth adding that the odds for a Federal Reserve (Fed) June rate cut keep decreasing, and major analysts now see July as the date for the first move. Upcoming inflation data will surely be a make-it-or-break for the USD.

A Chinese official reported on Sunday, the Chinese central bank purchased Gold for its reserves for the 17th straight month in March. Bullion held by the PBOC rose to 72.74 million fine troy ounces last month, the official said. Turkey, India, Kazakhstan and some eastern European countries have also been buying gold this year, per Reuters.

Renewed central bank demand for the bright metal sent the Gold price to another record high above $2,350 on Monday, extending its record-setting rally.

Looking ahead, Gold traders will take account of Fedspeak amid a lack of top-tier US economic data. Meanwhile, position adjustment and profit-taking in Gold price cannot be ruled out, as traders gear up for key US inflation report due on Wednesday.

Crucial Price Zones Ahead:

🔻 BZ C: $2323/2288/2266/2244/2222/2200

🔺 SZ R: $ 2363/2383/2407/2424/2445/2469

⚠️ Sudden volatility due to geo-political tensions/Fed statements might push GOLD price to new record highs, it will be wise to keep price gaps: $30 minimum and exit in NAP.

#xauusd #piyushratnu #prdxb #gold #forex #forextrading

Piyush Lalsingh Ratnu

🍎 Co-relations: Market Reversal in process

.

USDJPY: M30V0.0

XAUUSD: M30V0.0

.

achieved

.

This indicated Market Reversal.

.

Avoid big lots.

.

🆘 Crucial Data tomorrow:

16:30 USD Core CPI (MoM) (Mar) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Mar) 3.7% 3.8%

16:30 USD CPI (YoY) (Mar) 3.4% 3.2%

16:30 USD CPI (MoM) (Mar) 0.3% 0.4%

21:00 USD 10-Year Note Auction 4.166%

22:00 USD Federal Budget Balance (Mar) -180.5B -296.0B

22:00 USD FOMC Meeting Minutes

#Xauusdgold #XAUUSD #forex #prdxb #piyushratnu

.

USDJPY: M30V0.0

XAUUSD: M30V0.0

.

achieved

.

This indicated Market Reversal.

.

Avoid big lots.

.

🆘 Crucial Data tomorrow:

16:30 USD Core CPI (MoM) (Mar) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Mar) 3.7% 3.8%

16:30 USD CPI (YoY) (Mar) 3.4% 3.2%

16:30 USD CPI (MoM) (Mar) 0.3% 0.4%

21:00 USD 10-Year Note Auction 4.166%

22:00 USD Federal Budget Balance (Mar) -180.5B -296.0B

22:00 USD FOMC Meeting Minutes

#Xauusdgold #XAUUSD #forex #prdxb #piyushratnu

Piyush Lalsingh Ratnu

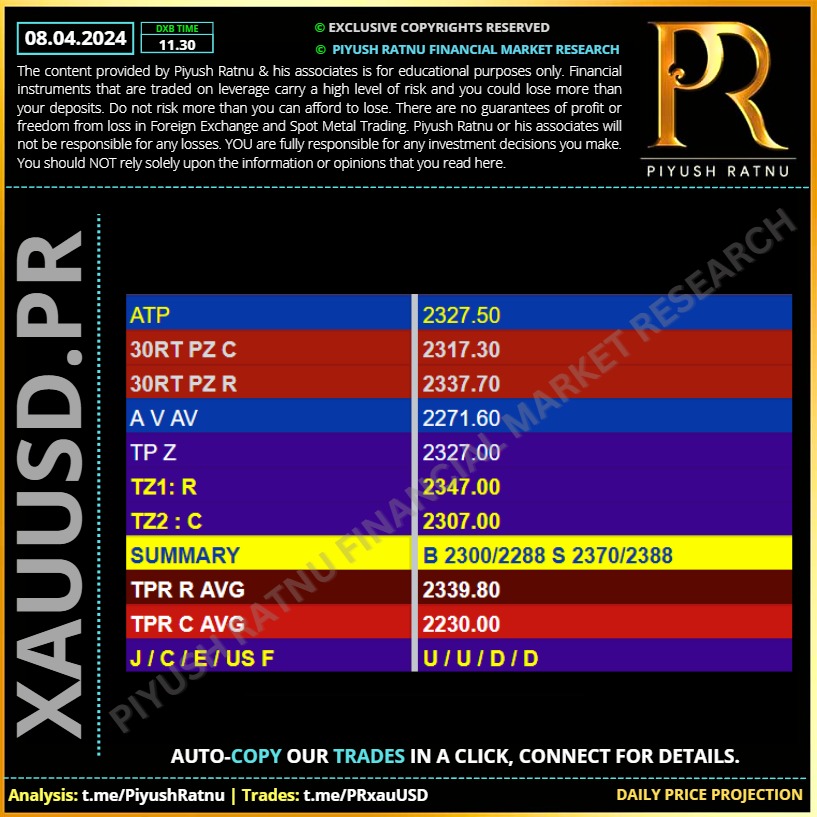

08.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Gold price witnessed a sudden $27 upswing and stormed through the $2,350 barrier to refresh an all-time high at $2,354 in Asian trading on Monday.

Despite easing geopolitical tensions between Israel and Hamas and reducing bets of a June US Federal Reserve (Fed) interest rate cut, Gold price extends its record-setting rally primarily on reports of potential robust Gold purchases by global central banks.

🆘 A Chinese official reported on Sunday, the People’s Bank of China (PBOC) purchased Gold for its reserves for the 17th straight month in March. (As projected in advance by me, buying positions by China might push GOLD to $200+)

Bullion held by the Chinese central bank rose to 72.74 million fine troy ounces last month, the official said.

Meanwhile, markets are expecting robust Gold purchases by global central banks later this year, therefore, advancing their purchases and ramping up Gold price to a new record high. gold demand from central banks totaled 1,037.4 metric tons in 2023, just below the record high set in 2022 at 1,081.9 metric tons, according to the World Gold Council (WGC).

The WGC report showed that global central banks' purchases of gold rose by 19 metric tons in February, up for a ninth consecutive month.

Refer: https://www.gold.org/goldhub/data

🆘 However, it remains to be seen if Gold price sustains the record-setting rally ahead of Wednesday’s Consumer Price Index (CPI) from the United States (US). On Friday, the US economy added 303,000 jobs in March, against expectations of 200,000 job additions and the 275,000 previous figure. Strong US Nonfarm Payrolls number diminished the odds of a June Fed rate cut from about 62% to about 48%, at the moment, according to CME Group’s FedWatch Tool.

Also, easing Middle East geopolitical tensions could act as a headwind to the Gold price upsurge. Egypt’s Al-Qahera News state-affiliated TV channel said early Monday, citing a senior Egyptian source, “progress has been made in discussions in Cairo on a Gaza conflict truce and there is agreement on the basic points between all parties involved.”

Despite easing geopolitical tensions between Israel and Hamas and reducing bets of a June US Federal Reserve (Fed) interest rate cut, Gold price extends its record-setting rally primarily on reports of potential robust Gold purchases by global central banks.

🆘 A Chinese official reported on Sunday, the People’s Bank of China (PBOC) purchased Gold for its reserves for the 17th straight month in March. (As projected in advance by me, buying positions by China might push GOLD to $200+)

Bullion held by the Chinese central bank rose to 72.74 million fine troy ounces last month, the official said.

Meanwhile, markets are expecting robust Gold purchases by global central banks later this year, therefore, advancing their purchases and ramping up Gold price to a new record high. gold demand from central banks totaled 1,037.4 metric tons in 2023, just below the record high set in 2022 at 1,081.9 metric tons, according to the World Gold Council (WGC).

The WGC report showed that global central banks' purchases of gold rose by 19 metric tons in February, up for a ninth consecutive month.

Refer: https://www.gold.org/goldhub/data

🆘 However, it remains to be seen if Gold price sustains the record-setting rally ahead of Wednesday’s Consumer Price Index (CPI) from the United States (US). On Friday, the US economy added 303,000 jobs in March, against expectations of 200,000 job additions and the 275,000 previous figure. Strong US Nonfarm Payrolls number diminished the odds of a June Fed rate cut from about 62% to about 48%, at the moment, according to CME Group’s FedWatch Tool.

Also, easing Middle East geopolitical tensions could act as a headwind to the Gold price upsurge. Egypt’s Al-Qahera News state-affiliated TV channel said early Monday, citing a senior Egyptian source, “progress has been made in discussions in Cairo on a Gaza conflict truce and there is agreement on the basic points between all parties involved.”

Piyush Lalsingh Ratnu

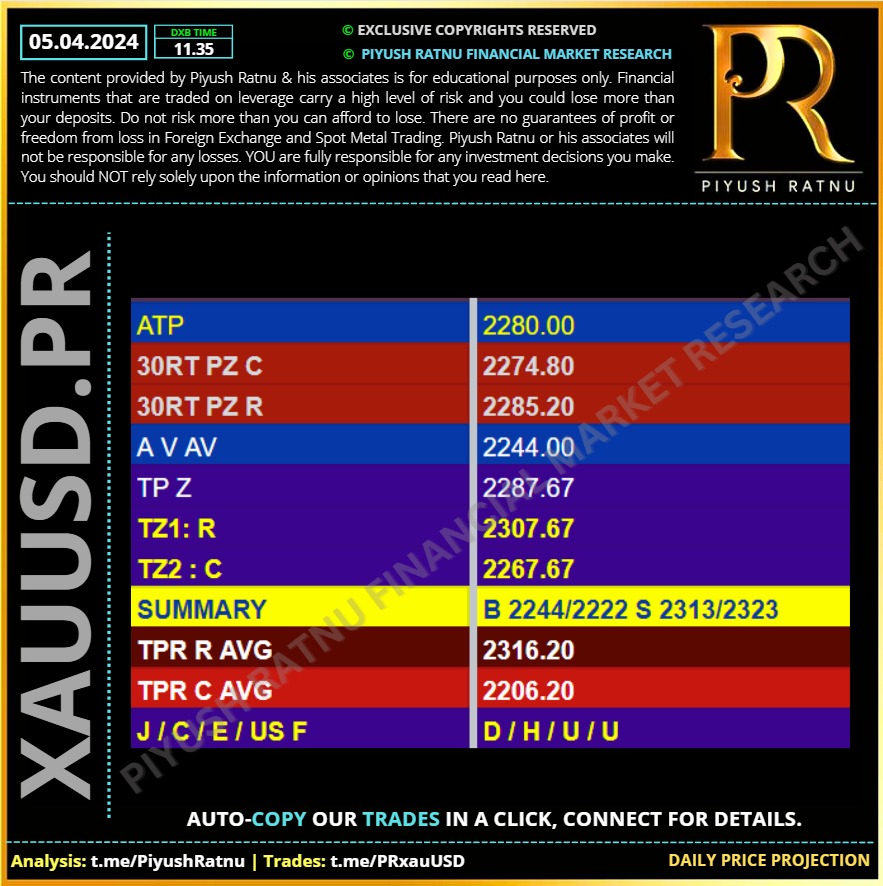

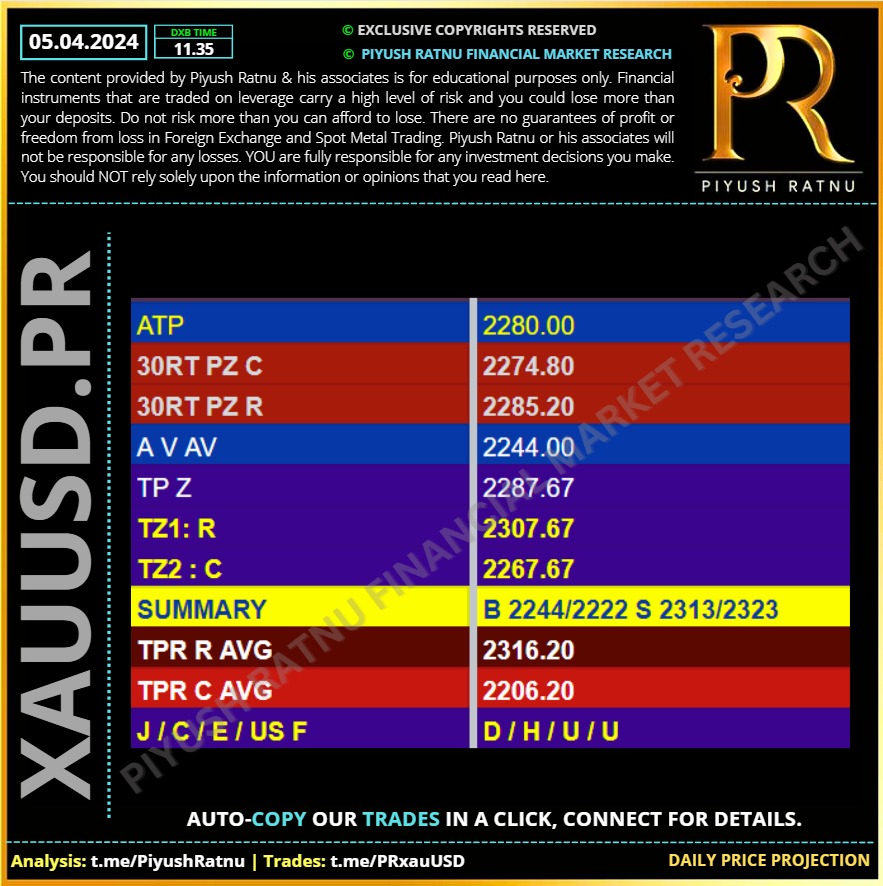

05.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

XAUUSD: I had projected $2323 - three days ago.

Those who believed in our analysis, are trading safely!

What about you?

🟢 Read detailed analysis at:

https://www.reddit.com/r/prgoldanalysis/comments/1bu02j2/xauusd_2323_in_next_4_days/

Those who believed in our analysis, are trading safely!

What about you?

🟢 Read detailed analysis at:

https://www.reddit.com/r/prgoldanalysis/comments/1bu02j2/xauusd_2323_in_next_4_days/

: