Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

3

sinais

|

1

assinantes

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

🍎 Short positions in XAUUSD at and above $2194 and 2204 gave us good returns: CMP $2180

Kindly exit all SHORT TRADES.

Active Trades: 0

Kindly exit all SHORT TRADES.

Active Trades: 0

Piyush Lalsingh Ratnu

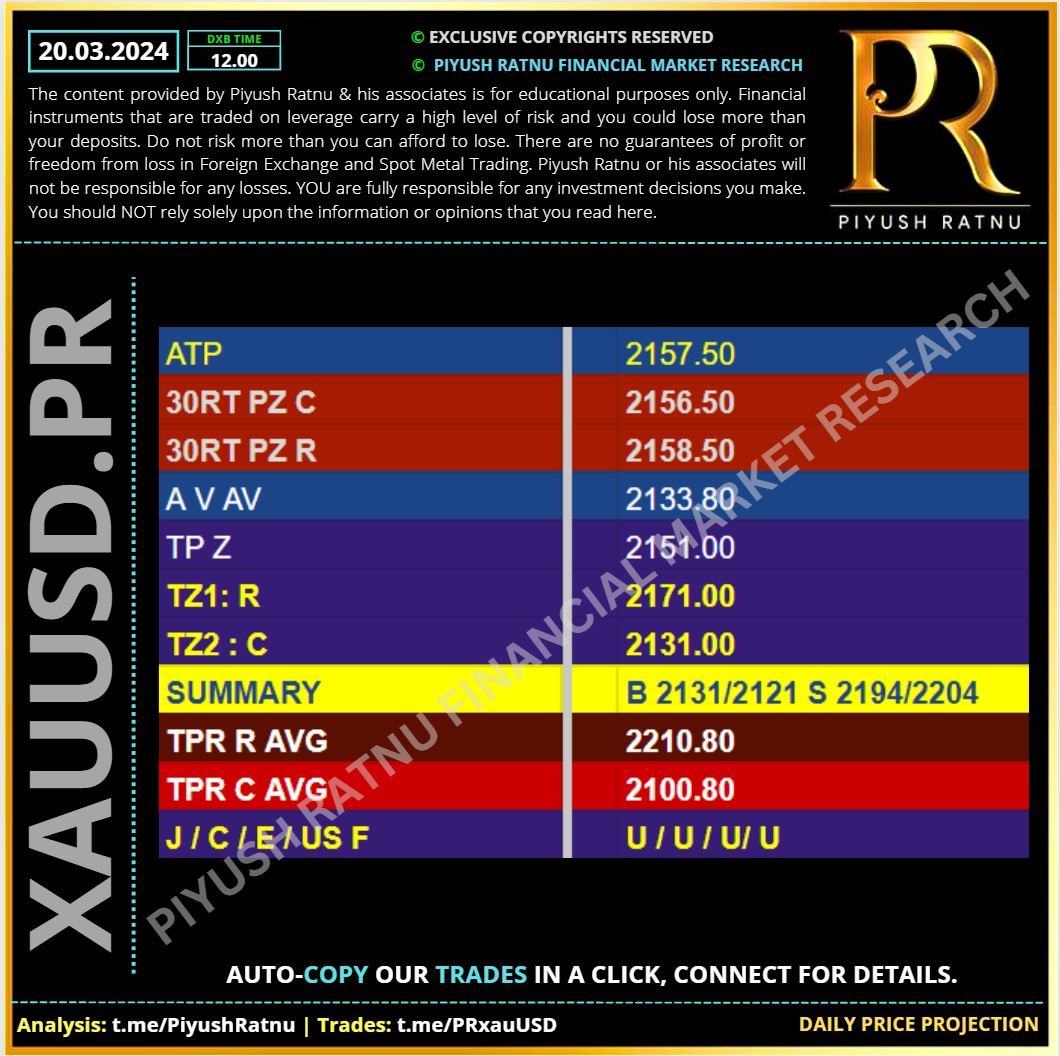

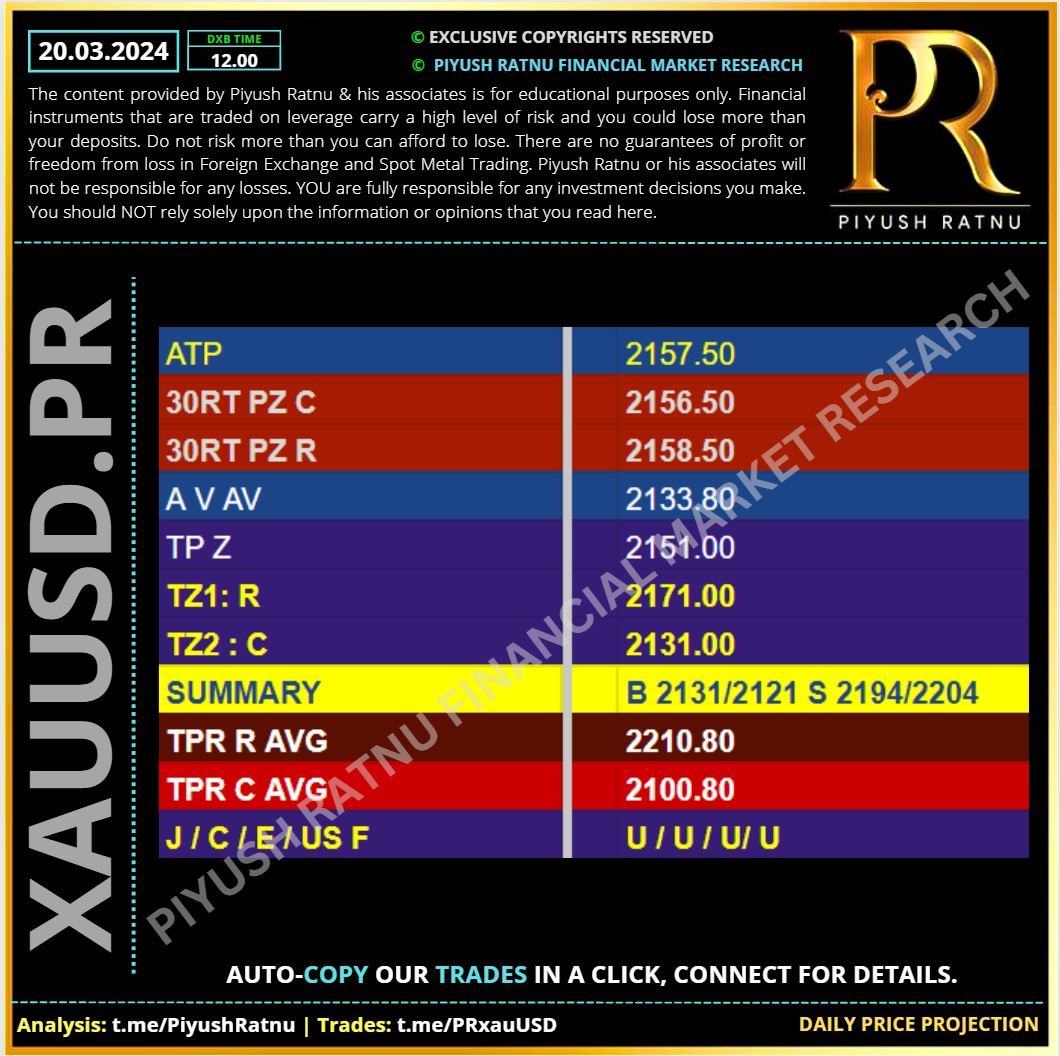

20.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

Subscribe to our Telegram channel to receive live analysis without delay

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️ XAUUSD breaches the $2222 mark!

Gold price outshines for the second straight day on Thursday, resuming its record-setting rally, inspired by the Fed’s dovish outlook on interest rates.

The US Dollar tumbled alongside the US Treasury bond yields after the Fed's economic projections, the so-called Dot Plot chart, still predicted three rate cuts this year as seen in December. Markets had begun pricing two Fed rate cuts this year after two consecutive months of higher inflation readings.

The median Fed dot plot for 2024 was unchanged despite a 0.2% increase in the median 2024 Core PCE inflation. This was perceived as dovish by markets, throwing the Greenback under the bus while driving Gold price to a new all-time high beyond the $2,200 threshold.

The Fed kept the key rates unchanged between the 5.25% to 5.50% target range on Wednesday, with Chair Jerome Powell emphasizing that recent high inflation readings had not changed the underlying "story" of slowly easing price pressures in the United States (US).

Markets are now wagering a 75% probability that the Fed will begin easing in June, up from 59% on Tuesday, according to the CME Group's FedWatch Tool.

🆘 Looking ahead, the S&P Global US preliminary PMIs and Fed speak will remain in focus for a fresh boost to Gold price.

Gold price outshines for the second straight day on Thursday, resuming its record-setting rally, inspired by the Fed’s dovish outlook on interest rates.

The US Dollar tumbled alongside the US Treasury bond yields after the Fed's economic projections, the so-called Dot Plot chart, still predicted three rate cuts this year as seen in December. Markets had begun pricing two Fed rate cuts this year after two consecutive months of higher inflation readings.

The median Fed dot plot for 2024 was unchanged despite a 0.2% increase in the median 2024 Core PCE inflation. This was perceived as dovish by markets, throwing the Greenback under the bus while driving Gold price to a new all-time high beyond the $2,200 threshold.

The Fed kept the key rates unchanged between the 5.25% to 5.50% target range on Wednesday, with Chair Jerome Powell emphasizing that recent high inflation readings had not changed the underlying "story" of slowly easing price pressures in the United States (US).

Markets are now wagering a 75% probability that the Fed will begin easing in June, up from 59% on Tuesday, according to the CME Group's FedWatch Tool.

🆘 Looking ahead, the S&P Global US preliminary PMIs and Fed speak will remain in focus for a fresh boost to Gold price.

Piyush Lalsingh Ratnu

Read detailed analysis here: as published on 20.03.2024:

https://www.reddit.com/r/prgoldanalysis/comments/1bj6eqk/xauusd_2222_or_2121_today_22442048_in_next_15/

#XAUUSD #GOLD #forextrading #forexeducation #piyushratnu

https://www.reddit.com/r/prgoldanalysis/comments/1bj6eqk/xauusd_2222_or_2121_today_22442048_in_next_15/

#XAUUSD #GOLD #forextrading #forexeducation #piyushratnu

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

Federal Reserve holds rates steady once more in March, sticks with call for 3 rate cuts

Central bank policymakers have decided to hold interest rates at their current target range of 5.25% to 5.50%. The move was widely expected by the markets.

The Fed also stuck with its earlier forecast for three rate cuts before the year is out, based on its dot plot.

Following its two-day policy meeting, the central bank’s rate-setting Federal Open Market Committee said it will keep its benchmark overnight borrowing rate in a range between 5.25%-5.5%.

Along with the decision, Fed officials penciled in three quarter-percentage point cuts by the end of 2024, which would be the first reductions since the early days of the Covid pandemic in March 2020.

The current federal funds rate level is the highest in more than 23 years. The rate sets what banks charge each other for overnight lending but feeds through to many forms of consumer debt.

Raises GDP forecast

Officials sharply accelerated their projections for GDP growth this year and now see the economy running at a 2.1% annualized rate, up from the 1.4% estimate in December. The unemployment rate forecast moved slightly lower from the previous estimate to 4%, while the projection for core inflation as measured by personal consumption expenditures rose to 2.6%, up 0.2 percentage point from before but slightly below the most recent level of 2.8%. The unemployment rate for February was 3.9%.

The outlook for GDP also rose incrementally for the next two years. Core PCE inflation is expected to get back to target by 2026, same as in December.

The FOMC’s post-meeting statement was almost identical to the one delivered at its last meeting in January save for an upgrade on its job growth assessment to “strong” from the January characterization that gains had “moderated.” The decision to stand pat on rates was approved unanimously.

Higher than expected inflation data to start 2024 triggered caution from top Fed officials, and the January FOMC meeting concluded with the central bank saying it needed more evidence that prices were decelerating before it would gain “greater confidence” on inflation and start cutting.

Statements from Chair Jerome Powell and other policymakers since then added to the sentiment of a patient, data-driven approach, and markets have had to reprice. Powell and his cohorts have indicated that with the economy still growing at a healthy pace and unemployment below 4%, they can take a more measured approach when loosening monetary policy.

In a process that began in June 2022, the central bank is allowing up to $60 billion a month in maturing proceeds from Treasurys plus up to $35 billion in mortgage-backed securities to roll off each month rather than be reinvested. The process is often referred to as “quantitative tightening” and has resulted in about a $1.4 trillion drawdown in the Fed’s holdings.

🟢 However, there was no immediate information provided about changes in QT, though Powell has indicated several times that the matter was to be discussed at this meeting. More insight could be forthcoming from Powell’s post-meeting news conference and the release of meeting minutes in three weeks.

Federal Reserve holds rates steady once more in March, sticks with call for 3 rate cuts

Central bank policymakers have decided to hold interest rates at their current target range of 5.25% to 5.50%. The move was widely expected by the markets.

The Fed also stuck with its earlier forecast for three rate cuts before the year is out, based on its dot plot.

Following its two-day policy meeting, the central bank’s rate-setting Federal Open Market Committee said it will keep its benchmark overnight borrowing rate in a range between 5.25%-5.5%.

Along with the decision, Fed officials penciled in three quarter-percentage point cuts by the end of 2024, which would be the first reductions since the early days of the Covid pandemic in March 2020.

The current federal funds rate level is the highest in more than 23 years. The rate sets what banks charge each other for overnight lending but feeds through to many forms of consumer debt.

Raises GDP forecast

Officials sharply accelerated their projections for GDP growth this year and now see the economy running at a 2.1% annualized rate, up from the 1.4% estimate in December. The unemployment rate forecast moved slightly lower from the previous estimate to 4%, while the projection for core inflation as measured by personal consumption expenditures rose to 2.6%, up 0.2 percentage point from before but slightly below the most recent level of 2.8%. The unemployment rate for February was 3.9%.

The outlook for GDP also rose incrementally for the next two years. Core PCE inflation is expected to get back to target by 2026, same as in December.

The FOMC’s post-meeting statement was almost identical to the one delivered at its last meeting in January save for an upgrade on its job growth assessment to “strong” from the January characterization that gains had “moderated.” The decision to stand pat on rates was approved unanimously.

Higher than expected inflation data to start 2024 triggered caution from top Fed officials, and the January FOMC meeting concluded with the central bank saying it needed more evidence that prices were decelerating before it would gain “greater confidence” on inflation and start cutting.

Statements from Chair Jerome Powell and other policymakers since then added to the sentiment of a patient, data-driven approach, and markets have had to reprice. Powell and his cohorts have indicated that with the economy still growing at a healthy pace and unemployment below 4%, they can take a more measured approach when loosening monetary policy.

In a process that began in June 2022, the central bank is allowing up to $60 billion a month in maturing proceeds from Treasurys plus up to $35 billion in mortgage-backed securities to roll off each month rather than be reinvested. The process is often referred to as “quantitative tightening” and has resulted in about a $1.4 trillion drawdown in the Fed’s holdings.

🟢 However, there was no immediate information provided about changes in QT, though Powell has indicated several times that the matter was to be discussed at this meeting. More insight could be forthcoming from Powell’s post-meeting news conference and the release of meeting minutes in three weeks.

Piyush Lalsingh Ratnu

💡💡💡

BTCUSD back to $62,000 (second time) crashing from $72,000 price zone: another 10% ROI achieved in last 20 days.

🟢 I had projected short positions above $63,333 with PG 5 on 29.02.2024. Those who are BULLISH at BTCUSD highs - stay ALERT.

BTCUSD back to $62,000 (second time) crashing from $72,000 price zone: another 10% ROI achieved in last 20 days.

🟢 I had projected short positions above $63,333 with PG 5 on 29.02.2024. Those who are BULLISH at BTCUSD highs - stay ALERT.

Piyush Lalsingh Ratnu

TRADERS GEAR UP FOR FED RATE DECISION!

Gold trimmed Monday’s gains amid resurgent US Dollar demand, with XAU/USD trading around $2,154 in the mid-American session. The Greenback found strength following central banks’ mostly dovish announcements, as the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ) unveiled their monetary policy decisions.

The RBA left rates unchanged and maintained its cautious outlook on economic progress and easing inflation. The BoJ, on the other hand, delivered as expected, lifting rates for the first time in 17 years and dropping the Yield Curve Control (YCC) program. However, the BoJ still doubted it could maintain healthy inflation and pledged to continue buying bonds.

It’s a calm before the US Federal Reserve (Fed) interest rate decision storm, as Gold traders turn on the sidelines, refraining from placing any fresh positional bets on the bright metal. Markets are turning caution, as tensions mount in the run-up to the Fed showdown, with markets eagerly awaiting fresh hints on the timing and scope of the Fed’s first interest cut this year.

Volatility dropped in the US session as investors gear up for the Federal Reserve (Fed) announcement. The United States (US) central bank will unveil its decision on Wednesday alongside fresh economic projections. Financial markets head into the event with high levels of caution, as recent data suggest US policymakers may hold rates higher for longer.

Markets are currently pricing in just about 60% of a June Fed rate cut. While the December Fed’s Dot Plot chart projects three rate cuts, it remains to be seen what the central bank’s outlook on interest rate cuts offers. Also, of note, will be Fed Chair Jerome Powell’s comments at the post-policy meeting press conference for fresh impact on the value of the US Dollar and the non-interest-bearing Gold price.

On Tuesday, Gold price snapped its early rebound and fell as low as $2,148 before recovering losses to settle near $2,158. The downtick in the Gold price was sponsored by a renewed US Dollar buying interest.

The USD/JPY pair rallied hard, following the expected interest rate hike by the Bank of Japan (BoJ), driving the US Dollar higher while weighing on the US Dollar. However, some modest weakness in the US Treasury bond yields and a risk-on rally on Wall Street indices capped the US Dollar upside, allowing Gold price to stage a decent comeback.

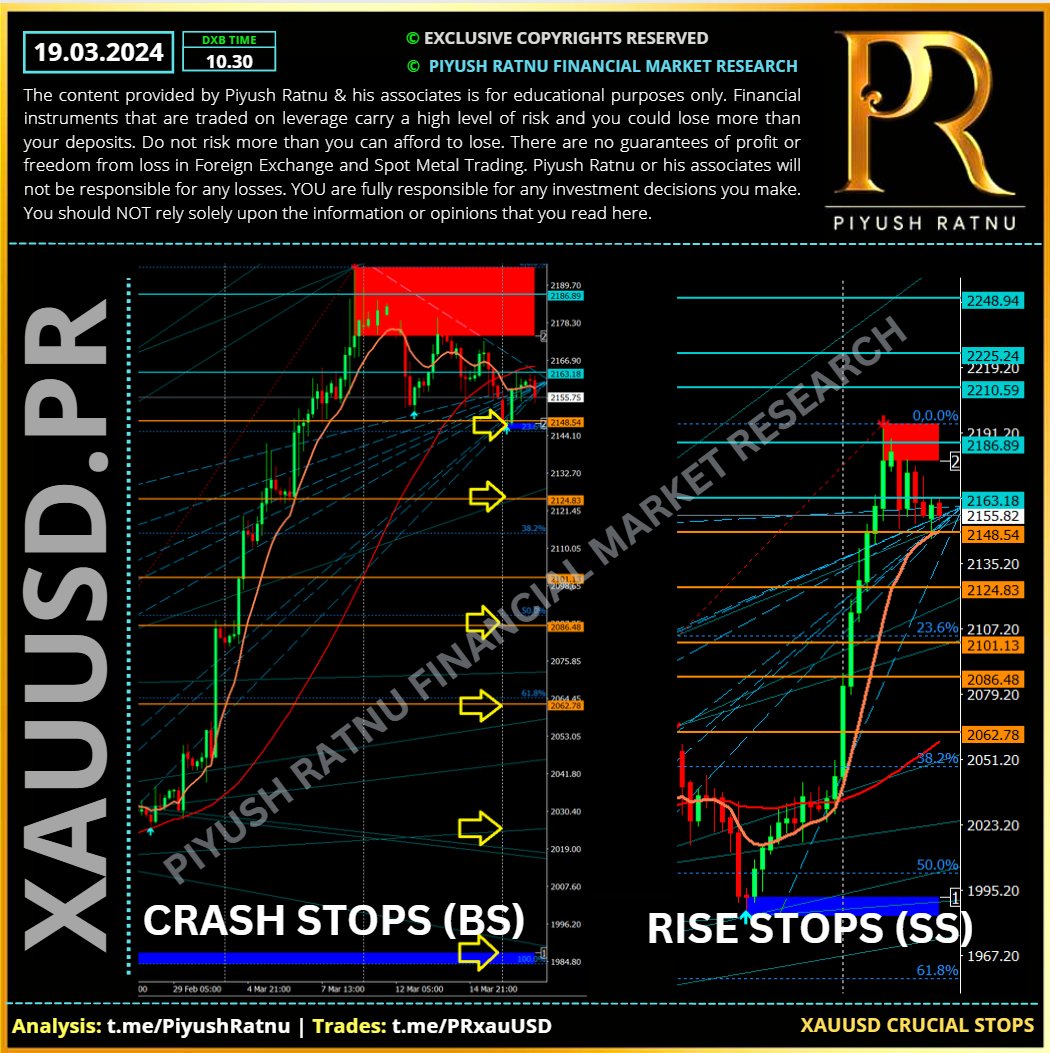

🟢 Crucial Price Zones for next 15 trading days:

BS: C: $2121/2100/2085/2048

SS: R: $2196/2200/2233/2266

🟢 I expect A pattern:

I will SELL HIGHS to pull NAP above $2130/2145 in case of higher price rallies. PG $30 | Exit NAP

🆘Current DD: 2% | Margin available: 58,000%

Current NAP: $2141 | Expected Exit: $2130/2121

🟢 D1 PRSRZ | Price Zones | XAUUSD

📌 PPZ R1 2160 S1 2154

R2 2170

R3 2179

R4 2185

R5 2194

S2 2144

S3 2135

S4 2129

S5 2118

🟢 W1 PRSRZ | Price Zones

📌 PPZ R1 2163 S1 2148

R2 2186

R3 2210

R4 2225

R5 2248

S2 2124

S3 2101

S4 2086

S5 2062

🔘 GFA Parameters:

SMA

XAUUSD at H4S5

H4S1 $2121 H4S2 $2075 crucial stops

🍎A Patterns:

H1A0.0 2144

H4A50 2121

H4A618 2101

H4A100 2042

🍎 V patterns:

H1V100 2170

H4V0.0 2196

🔘 Co-relations:

📌 USDJPY: CMP 151.555: at HIGHS of

🔺16.10.2022: Price: 151.800

🔺12.11.2023: Price: 151.800

📌 Price of XAUUSD CMP: $2157, past price track record:

🔻 16.10.2022: Price: $1626

🔻 12.11.2023: Price: $1936

🟢 Technical Co-relations:

🔺USD S 62

🔻JPY S 11

🔺AUD S 60

🔺DXY 103.500 (RT+)

🔺US10YT 4.293 RT+)

US F RT+ H1S5

Gold trimmed Monday’s gains amid resurgent US Dollar demand, with XAU/USD trading around $2,154 in the mid-American session. The Greenback found strength following central banks’ mostly dovish announcements, as the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ) unveiled their monetary policy decisions.

The RBA left rates unchanged and maintained its cautious outlook on economic progress and easing inflation. The BoJ, on the other hand, delivered as expected, lifting rates for the first time in 17 years and dropping the Yield Curve Control (YCC) program. However, the BoJ still doubted it could maintain healthy inflation and pledged to continue buying bonds.

It’s a calm before the US Federal Reserve (Fed) interest rate decision storm, as Gold traders turn on the sidelines, refraining from placing any fresh positional bets on the bright metal. Markets are turning caution, as tensions mount in the run-up to the Fed showdown, with markets eagerly awaiting fresh hints on the timing and scope of the Fed’s first interest cut this year.

Volatility dropped in the US session as investors gear up for the Federal Reserve (Fed) announcement. The United States (US) central bank will unveil its decision on Wednesday alongside fresh economic projections. Financial markets head into the event with high levels of caution, as recent data suggest US policymakers may hold rates higher for longer.

Markets are currently pricing in just about 60% of a June Fed rate cut. While the December Fed’s Dot Plot chart projects three rate cuts, it remains to be seen what the central bank’s outlook on interest rate cuts offers. Also, of note, will be Fed Chair Jerome Powell’s comments at the post-policy meeting press conference for fresh impact on the value of the US Dollar and the non-interest-bearing Gold price.

On Tuesday, Gold price snapped its early rebound and fell as low as $2,148 before recovering losses to settle near $2,158. The downtick in the Gold price was sponsored by a renewed US Dollar buying interest.

The USD/JPY pair rallied hard, following the expected interest rate hike by the Bank of Japan (BoJ), driving the US Dollar higher while weighing on the US Dollar. However, some modest weakness in the US Treasury bond yields and a risk-on rally on Wall Street indices capped the US Dollar upside, allowing Gold price to stage a decent comeback.

🟢 Crucial Price Zones for next 15 trading days:

BS: C: $2121/2100/2085/2048

SS: R: $2196/2200/2233/2266

🟢 I expect A pattern:

I will SELL HIGHS to pull NAP above $2130/2145 in case of higher price rallies. PG $30 | Exit NAP

🆘Current DD: 2% | Margin available: 58,000%

Current NAP: $2141 | Expected Exit: $2130/2121

🟢 D1 PRSRZ | Price Zones | XAUUSD

📌 PPZ R1 2160 S1 2154

R2 2170

R3 2179

R4 2185

R5 2194

S2 2144

S3 2135

S4 2129

S5 2118

🟢 W1 PRSRZ | Price Zones

📌 PPZ R1 2163 S1 2148

R2 2186

R3 2210

R4 2225

R5 2248

S2 2124

S3 2101

S4 2086

S5 2062

🔘 GFA Parameters:

SMA

XAUUSD at H4S5

H4S1 $2121 H4S2 $2075 crucial stops

🍎A Patterns:

H1A0.0 2144

H4A50 2121

H4A618 2101

H4A100 2042

🍎 V patterns:

H1V100 2170

H4V0.0 2196

🔘 Co-relations:

📌 USDJPY: CMP 151.555: at HIGHS of

🔺16.10.2022: Price: 151.800

🔺12.11.2023: Price: 151.800

📌 Price of XAUUSD CMP: $2157, past price track record:

🔻 16.10.2022: Price: $1626

🔻 12.11.2023: Price: $1936

🟢 Technical Co-relations:

🔺USD S 62

🔻JPY S 11

🔺AUD S 60

🔺DXY 103.500 (RT+)

🔺US10YT 4.293 RT+)

US F RT+ H1S5

Piyush Lalsingh Ratnu

18.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

#XAUUSD $2048 on the cards? Co-relations hint so!

Piyush Ratnu Financial Market Research | Dubai | Abu Dhabi | Mumbai

Piyush Ratnu Financial Market Research | Dubai | Abu Dhabi | Mumbai

Piyush Lalsingh Ratnu

Key Economic Data today:

10:30 JPY BoJ Press Conference

16:30 USD Building Permits (Feb) 1.500M 1.489M

16:30 USD Housing Starts (Feb) 1.430M 1.331M

16:30 USD Housing Starts (MoM) (Feb) -14.8%

20:30 USD Atlanta Fed GDPNow (Q1) 2.3% 2.3%

21:00 USD 20-Year Bond Auction 4.595%

10:30 JPY BoJ Press Conference

16:30 USD Building Permits (Feb) 1.500M 1.489M

16:30 USD Housing Starts (Feb) 1.430M 1.331M

16:30 USD Housing Starts (MoM) (Feb) -14.8%

20:30 USD Atlanta Fed GDPNow (Q1) 2.3% 2.3%

21:00 USD 20-Year Bond Auction 4.595%

Piyush Lalsingh Ratnu

📌 Summary of the BoJ policy statement

• To guide overnight call rate in range of 0% to 0.1%.

• To apply 0.1% interest to all excess reserves parked with BoJ.

• To continue its jgb purchases at broadly same amount as before.

• To end ETF, J-REIT buying.

• To gradually reduce amount of purchases of CP, corporate bond.

• To discontinue purchases of CP, corporate bonds in about one year.

• BoJ makes decision on long-term JGB buying by 8-1 vote.

• Makes decision on asset buying other than long-term JGBs by unanimous vote.

• Makes decision on treatment of new loan disbursements under fund-provisiong measuer to stimulate bank lending etc by unanimous vote.

• BoJ will nimbly increase JGB buying regardless of monthly scheduled buying amount.

• Announces change in monetary policy framework.

• Assessed virtuous cycle between wages and prices.

• Judged it came in sight that price stability target of 2% would be achieved in sustainable, stable manner toward end of projection period.

• Considers QQE, YCC and negative rate policy have fulfilled their roles.

• With price target of 2%, BoJ will conduct monetary policy as appropriate.

• Will guide short-term interest rate as primary policy tool.

• Given current outlook for economic activity and prices, BoJ antiicpates accommodative financial conditions to be kept for time being.

• BoJ will continue roughly current amount of JGB buying

• Expect to maintain accomodative monetary environment for time being

• BoJ judged that inflation-overshooting commitment on monetary base has fulfilled conditions for achievement.

• In case of rapid rise in yields, BoJ will make nimble response such as increasing amount of JGB buying.

• Japan's economy likely to continue recovering moderately for time being.

• Year-on-year increase in CPI likely to be above 2% through fiscal 2024.

• Underlying CPI inflation likely to increase gradually toward achieving price target.

• There are extremely high uncertainties on Japan's economy, prices.

• Must pay due attention to developments in markets, FX, and impact on economy.

• BoJ will continue to announce planned amount of JGB buying with range, conduct buying while taking into account of market developments, supply-demand conditions for JGBs.

🟢 Market reaction to the BoJ policy announcements

USD/JPY jumped to test 150.00 following the BoJ’s policy announcements. The pair is currently trading at 149.78, up 0.44% on the day. The hawkish policy was widely priced in by the Yen markets.

🆘 Co-relation Alert:

USDJPY: 1100+ pips +

Possible Impact on XAUUSD:

$30 crash from CMP

🟢 Expected price zone: $2121

• To guide overnight call rate in range of 0% to 0.1%.

• To apply 0.1% interest to all excess reserves parked with BoJ.

• To continue its jgb purchases at broadly same amount as before.

• To end ETF, J-REIT buying.

• To gradually reduce amount of purchases of CP, corporate bond.

• To discontinue purchases of CP, corporate bonds in about one year.

• BoJ makes decision on long-term JGB buying by 8-1 vote.

• Makes decision on asset buying other than long-term JGBs by unanimous vote.

• Makes decision on treatment of new loan disbursements under fund-provisiong measuer to stimulate bank lending etc by unanimous vote.

• BoJ will nimbly increase JGB buying regardless of monthly scheduled buying amount.

• Announces change in monetary policy framework.

• Assessed virtuous cycle between wages and prices.

• Judged it came in sight that price stability target of 2% would be achieved in sustainable, stable manner toward end of projection period.

• Considers QQE, YCC and negative rate policy have fulfilled their roles.

• With price target of 2%, BoJ will conduct monetary policy as appropriate.

• Will guide short-term interest rate as primary policy tool.

• Given current outlook for economic activity and prices, BoJ antiicpates accommodative financial conditions to be kept for time being.

• BoJ will continue roughly current amount of JGB buying

• Expect to maintain accomodative monetary environment for time being

• BoJ judged that inflation-overshooting commitment on monetary base has fulfilled conditions for achievement.

• In case of rapid rise in yields, BoJ will make nimble response such as increasing amount of JGB buying.

• Japan's economy likely to continue recovering moderately for time being.

• Year-on-year increase in CPI likely to be above 2% through fiscal 2024.

• Underlying CPI inflation likely to increase gradually toward achieving price target.

• There are extremely high uncertainties on Japan's economy, prices.

• Must pay due attention to developments in markets, FX, and impact on economy.

• BoJ will continue to announce planned amount of JGB buying with range, conduct buying while taking into account of market developments, supply-demand conditions for JGBs.

🟢 Market reaction to the BoJ policy announcements

USD/JPY jumped to test 150.00 following the BoJ’s policy announcements. The pair is currently trading at 149.78, up 0.44% on the day. The hawkish policy was widely priced in by the Yen markets.

🆘 Co-relation Alert:

USDJPY: 1100+ pips +

Possible Impact on XAUUSD:

$30 crash from CMP

🟢 Expected price zone: $2121

Piyush Lalsingh Ratnu

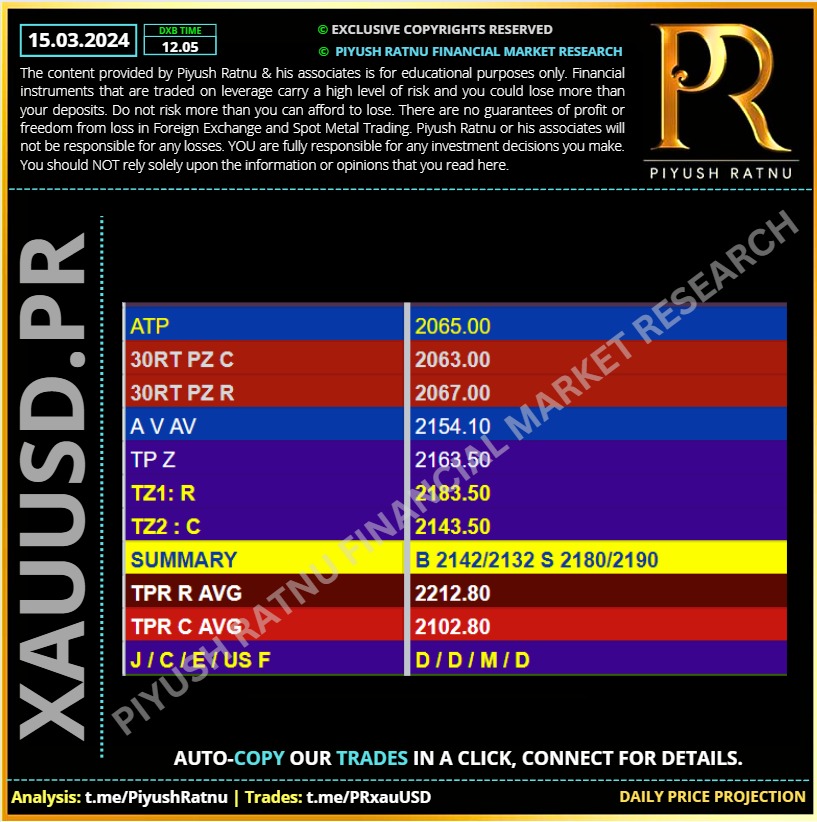

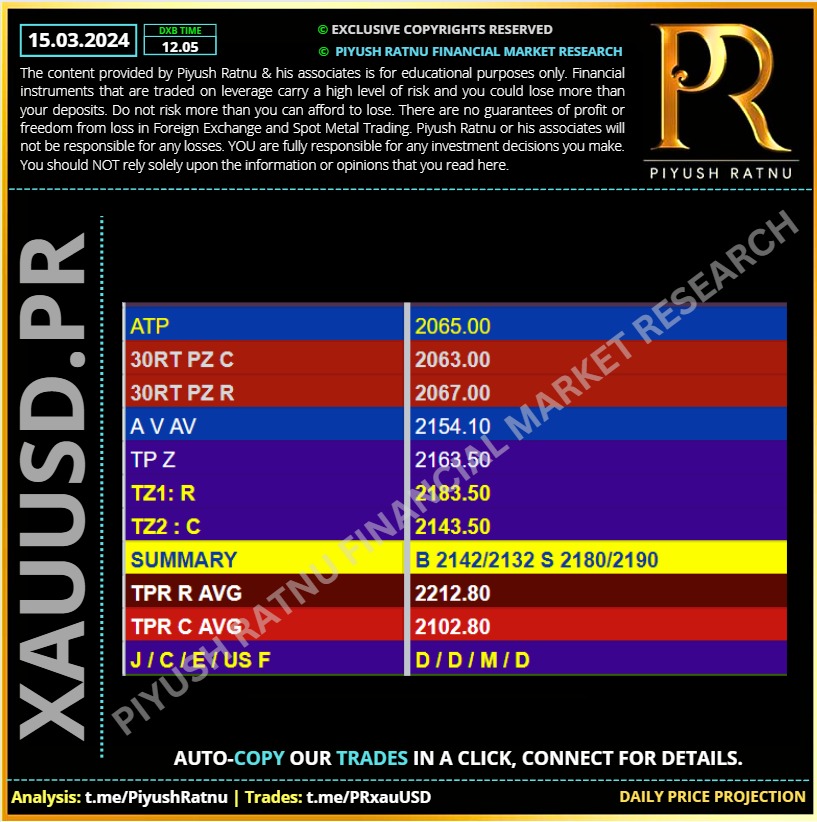

15.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

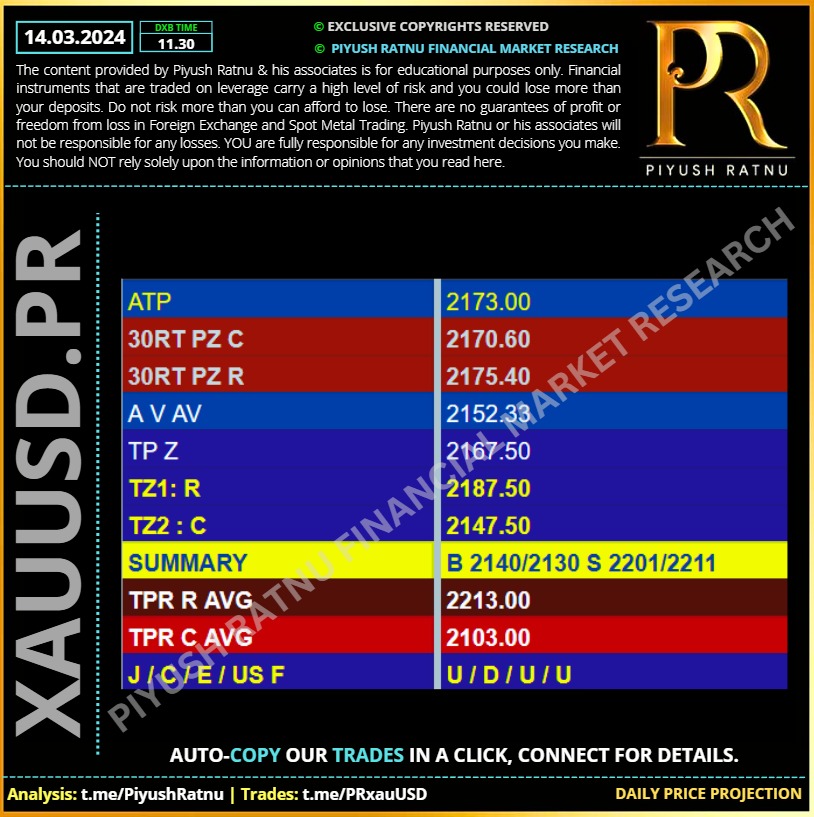

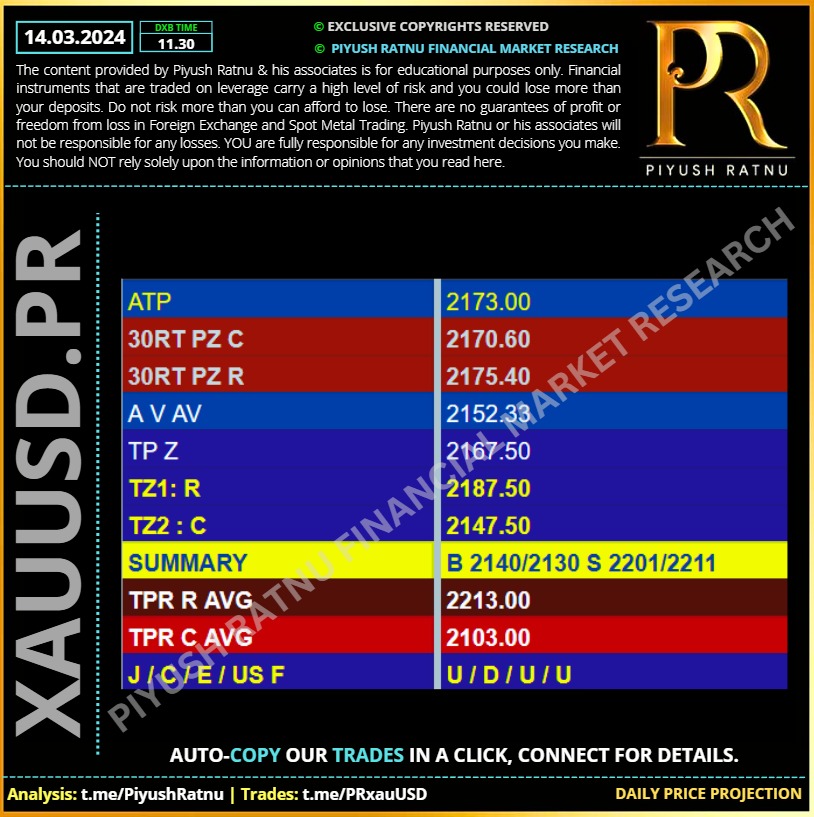

14.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

13.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

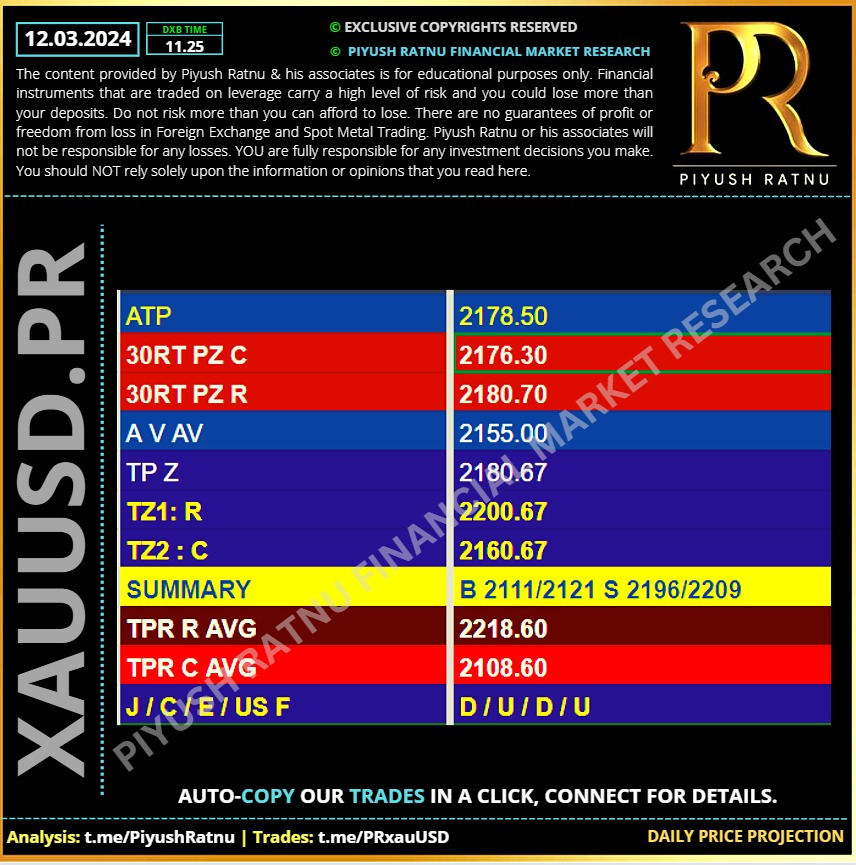

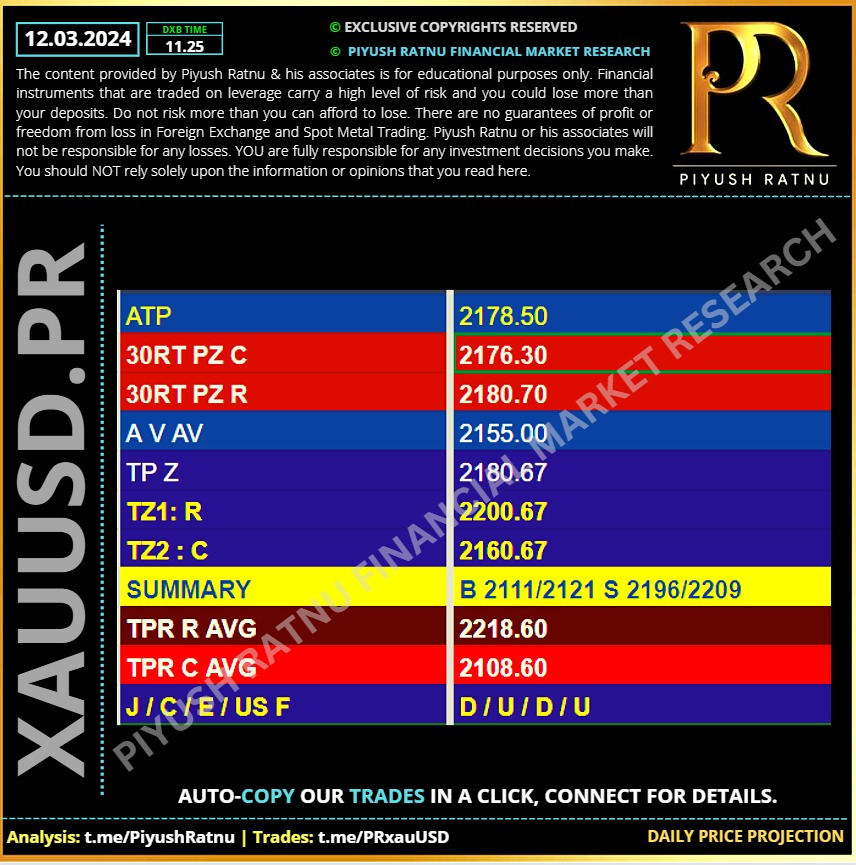

12.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 The Fed is widely expected to hold interest rates steady for a fifth straight meeting when policymakers gather March 19-20. Much of the focus by investors will be on the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

Piyush Lalsingh Ratnu

Crucial Economic Data today:

18:30 USD Crude Oil Inventories 0.900M1.367M

18:30 USD Cushing Crude Oil Inventories 0.701M

21:00 USD 30-Year Bond Auction 4.360%

#XAUUSD #forex #piyushratnu #gold #goldtrading

18:30 USD Crude Oil Inventories 0.900M1.367M

18:30 USD Cushing Crude Oil Inventories 0.701M

21:00 USD 30-Year Bond Auction 4.360%

#XAUUSD #forex #piyushratnu #gold #goldtrading

Piyush Lalsingh Ratnu

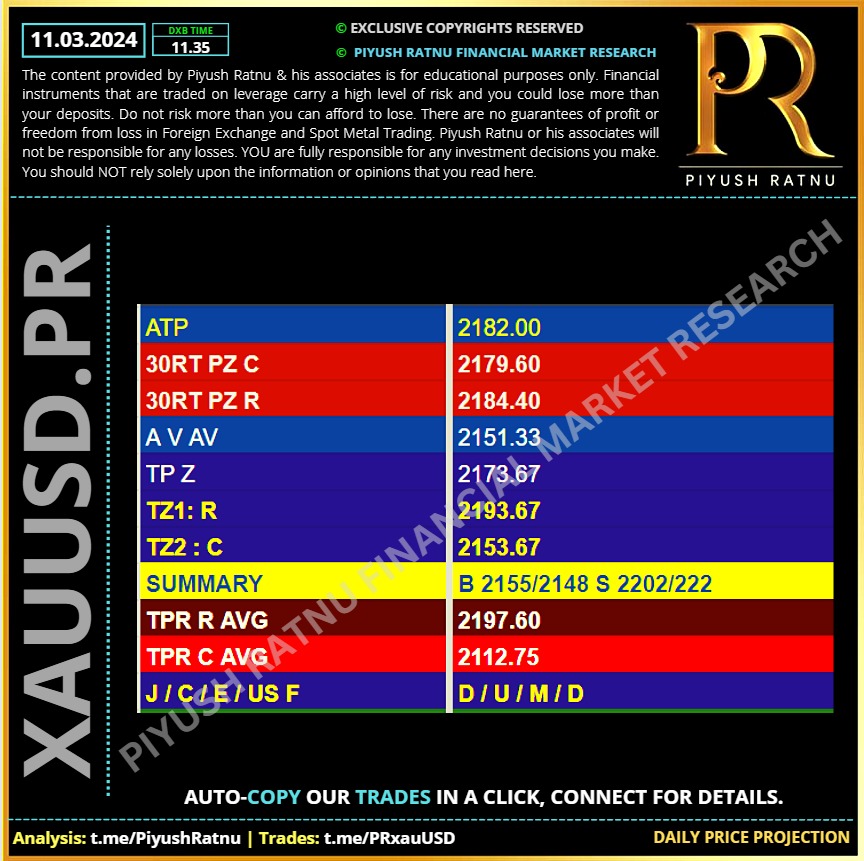

11.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Key Events today:

16:00 USD OPEC Monthly Report

16:30 USD Core CPI (MoM) (Feb) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Feb) 3.7% 3.9%

16:30 USD CPI (MoM) (Feb) 0.4% 0.3%

16:30 USD CPI (YoY) (Feb) 3.1% 3.1%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 10-Year Note Auction 4.093%

22:00 USD Federal Budget Balance (Feb) -298.5B -22.0B

The US Dollar has entered a phase of downside consolidation heading into the all-important US Consumer Price Index (CPI) inflation data release on Tuesday at 12:30 GMT. The focus remains on the key inflation gauge, especially after a sharp downward revision to the January Nonfarm Payrolls number and a slew of disappointing economic data from the United States (US).

Markets are currently pricing in about a 70% chance that the Fed could begin easing rates in June, a tad lower than a 75% probability seen on Monday, according to the CME FedWatch Tool.

📌 Check CME FedWatch Tool here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The annual US CPI is seen rising 3.1% in February, at the same pace as seen in January while the core inflation is seen easing from 3.9% in January to 3.7% YoY in the reported period. The more important monthly CPI is expected to rise 0.4% last month vs. a 0.3% increase in January. The Core CPI inflation is foreseen at 0.3% MoM vs. 0.4% in the first month of the year.

A downside surprise in the monthly headline and core CPI inflation is likely to seal in a June interest rate cut by the US Federal Reserve (Fed), triggering a fresh sell-off in the US Dollar while sending Gold price to a new record high. US Treasury bond yields will come under intense bearish pressure on a US CPI negative surprise, initiating a fresh uptrend in the non-interest-bearing Gold price.

On the other hand, Gold price could see a sharp correction if the US Inflation data comes in hotter-than-expected and weighs heavily on the expectations of a dovish Fed policy pivot as early as in June.

In the run-up to the US CPI release, Gold price is likely to maintain its cautious trading momentum, as risk sentiment remains slightly upbeat.

🟢 Summary:

🔺A downside surprise in the US CPI numbers could propel Gold price toward the all-time high of $2,195, above which a sustained break above the $2,200 threshold is needed to take on the $2222 and 2,244 price targets.

🔻On the flip side, hot US inflation data is likely to extend the Gold price correction toward the March 8 low of $2,154 and 6 March low $2121.

16:00 USD OPEC Monthly Report

16:30 USD Core CPI (MoM) (Feb) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Feb) 3.7% 3.9%

16:30 USD CPI (MoM) (Feb) 0.4% 0.3%

16:30 USD CPI (YoY) (Feb) 3.1% 3.1%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 10-Year Note Auction 4.093%

22:00 USD Federal Budget Balance (Feb) -298.5B -22.0B

The US Dollar has entered a phase of downside consolidation heading into the all-important US Consumer Price Index (CPI) inflation data release on Tuesday at 12:30 GMT. The focus remains on the key inflation gauge, especially after a sharp downward revision to the January Nonfarm Payrolls number and a slew of disappointing economic data from the United States (US).

Markets are currently pricing in about a 70% chance that the Fed could begin easing rates in June, a tad lower than a 75% probability seen on Monday, according to the CME FedWatch Tool.

📌 Check CME FedWatch Tool here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The annual US CPI is seen rising 3.1% in February, at the same pace as seen in January while the core inflation is seen easing from 3.9% in January to 3.7% YoY in the reported period. The more important monthly CPI is expected to rise 0.4% last month vs. a 0.3% increase in January. The Core CPI inflation is foreseen at 0.3% MoM vs. 0.4% in the first month of the year.

A downside surprise in the monthly headline and core CPI inflation is likely to seal in a June interest rate cut by the US Federal Reserve (Fed), triggering a fresh sell-off in the US Dollar while sending Gold price to a new record high. US Treasury bond yields will come under intense bearish pressure on a US CPI negative surprise, initiating a fresh uptrend in the non-interest-bearing Gold price.

On the other hand, Gold price could see a sharp correction if the US Inflation data comes in hotter-than-expected and weighs heavily on the expectations of a dovish Fed policy pivot as early as in June.

In the run-up to the US CPI release, Gold price is likely to maintain its cautious trading momentum, as risk sentiment remains slightly upbeat.

🟢 Summary:

🔺A downside surprise in the US CPI numbers could propel Gold price toward the all-time high of $2,195, above which a sustained break above the $2,200 threshold is needed to take on the $2222 and 2,244 price targets.

🔻On the flip side, hot US inflation data is likely to extend the Gold price correction toward the March 8 low of $2,154 and 6 March low $2121.

: