Piyush Lalsingh Ratnu / Profil

- Informations

|

Aucun

expérience

|

0

produits

|

0

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

*Trade with Confidence with Piyush Ratnu Gold Market Research*

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 109%

Highest Drawdown Faced YTD: 8%

Highest profit booked: 42%

Highest loss booked: 5%

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Verify Trading Performance at: https://bit.ly/PRinvestizo

#PiyushRatnu #PRDxB #PRGoldAnalysis #Gold #XAUUSD #Forex

Connect for an appointment at t.me/PiyushRatnuofficial

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 109%

Highest Drawdown Faced YTD: 8%

Highest profit booked: 42%

Highest loss booked: 5%

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Verify Trading Performance at: https://bit.ly/PRinvestizo

#PiyushRatnu #PRDxB #PRGoldAnalysis #Gold #XAUUSD #Forex

Connect for an appointment at t.me/PiyushRatnuofficial

Piyush Lalsingh Ratnu

XAUUSD above R1 CMP $2518

DXY-

US10YT+

USDJPY+

XAUXAG 85.40

USD S 24

JPY S 13

🟢 Key Economic Events today:

16:30 USD Core PCE Prices (Q2) 2.90% 3.70%

16:30 USD GDP (QoQ) (Q2) 2.8% 1.4%

16:30 USD GDP Price Index (QoQ) (Q2) 2.3% 3.1%

16:30 USD Goods Trade Balance (Jul) -97.70B -96.56B

16:30 USD Initial Jobless Claims 232K 232K

#XAUUSD #Gold #Forex #PiyushRatnu

DXY-

US10YT+

USDJPY+

XAUXAG 85.40

USD S 24

JPY S 13

🟢 Key Economic Events today:

16:30 USD Core PCE Prices (Q2) 2.90% 3.70%

16:30 USD GDP (QoQ) (Q2) 2.8% 1.4%

16:30 USD GDP Price Index (QoQ) (Q2) 2.3% 3.1%

16:30 USD Goods Trade Balance (Jul) -97.70B -96.56B

16:30 USD Initial Jobless Claims 232K 232K

#XAUUSD #Gold #Forex #PiyushRatnu

Piyush Lalsingh Ratnu

#XAUUSD #Gold #Forex #PiyushRatnu

Key Economic Data tomorrow:

16:30 USD Continuing Jobless Claims 1,870K 1,863K

16:30 USD Core PCE Prices (Q2) 2.90% 3.70%

16:30 USD GDP (QoQ) (Q2) 2.8% 1.4%

16:30 USD GDP Price Index (QoQ) (Q2) 2.3% 3.1%

16:30 USD Goods Trade Balance (Jul) -97.70B -96.56B

16:30 USD Initial Jobless Claims 232K 232K

16:30 USD Retail Inventories Ex Auto (Jul) 0.2%

18:00 USD Pending Home Sales (MoM) (Jul) 0.2% 4.8%

21:00 USD 7-Year Note Auction 4.162%

23:30 USD FOMC Member Bostic Speaks

Key Economic Data tomorrow:

16:30 USD Continuing Jobless Claims 1,870K 1,863K

16:30 USD Core PCE Prices (Q2) 2.90% 3.70%

16:30 USD GDP (QoQ) (Q2) 2.8% 1.4%

16:30 USD GDP Price Index (QoQ) (Q2) 2.3% 3.1%

16:30 USD Goods Trade Balance (Jul) -97.70B -96.56B

16:30 USD Initial Jobless Claims 232K 232K

16:30 USD Retail Inventories Ex Auto (Jul) 0.2%

18:00 USD Pending Home Sales (MoM) (Jul) 0.2% 4.8%

21:00 USD 7-Year Note Auction 4.162%

23:30 USD FOMC Member Bostic Speaks

Piyush Lalsingh Ratnu

#XAUUSD #Gold #Forex #trading

🟢 Key Events Impacting XAUUSD Price:

🔘 Jackson Hole Speech: 🔺 XAUUSD

US Federal Reserve (Fed) Chair Jerome Powell's speech at the Jackson Hole symposium last week, signalling 📌 “time has come” to begin lowering interest rates, might support the precious metal as it reduces the opportunity cost of holding non-interest-paying assets.

🔘 Geo-political tensions: 🔺 XAUUSD

Thousands of troops from special units mobilized for a large-scale operation in the northern West Bank, which is anticipated to take several weeks. The report said the army has conducted the largest military operation in the West Bank since 2002, and the operation will continue for several days.

🔘 GOLD ETF Holdings: 🔺 XAUUSD

“The prospect of falling interest rates is also attracting investors. According to Bloomberg, Gold ETF holdings rose by 15 tonnes last week to the highest level in six months. Speculative interest is particularly strong. The net long position of speculative investors rose to around 193,000 contracts in the week to August 20th, at the same time as Gold hit an all-time high, its highest level in almost four and a half years,” noted Commerzbank’s commodity strategist Carsten Fritsch.

🟢 Key Events Impacting XAUUSD Price:

🔘 Jackson Hole Speech: 🔺 XAUUSD

US Federal Reserve (Fed) Chair Jerome Powell's speech at the Jackson Hole symposium last week, signalling 📌 “time has come” to begin lowering interest rates, might support the precious metal as it reduces the opportunity cost of holding non-interest-paying assets.

🔘 Geo-political tensions: 🔺 XAUUSD

Thousands of troops from special units mobilized for a large-scale operation in the northern West Bank, which is anticipated to take several weeks. The report said the army has conducted the largest military operation in the West Bank since 2002, and the operation will continue for several days.

🔘 GOLD ETF Holdings: 🔺 XAUUSD

“The prospect of falling interest rates is also attracting investors. According to Bloomberg, Gold ETF holdings rose by 15 tonnes last week to the highest level in six months. Speculative interest is particularly strong. The net long position of speculative investors rose to around 193,000 contracts in the week to August 20th, at the same time as Gold hit an all-time high, its highest level in almost four and a half years,” noted Commerzbank’s commodity strategist Carsten Fritsch.

Piyush Lalsingh Ratnu

A gold bar is now worth $1 million

The price of a bar of gold is worth a million dollars for the first time, thanks to soaring prices for the precious metal.

The price of spot gold reached more than $2,500 per troy ounce Friday, hitting a record high. The average gold bar weighs 400 troy ounces – which, when you do the math, hits a million dollars.

Piyush Ratnu Gold Market Research

The price of a bar of gold is worth a million dollars for the first time, thanks to soaring prices for the precious metal.

The price of spot gold reached more than $2,500 per troy ounce Friday, hitting a record high. The average gold bar weighs 400 troy ounces – which, when you do the math, hits a million dollars.

Piyush Ratnu Gold Market Research

Piyush Lalsingh Ratnu

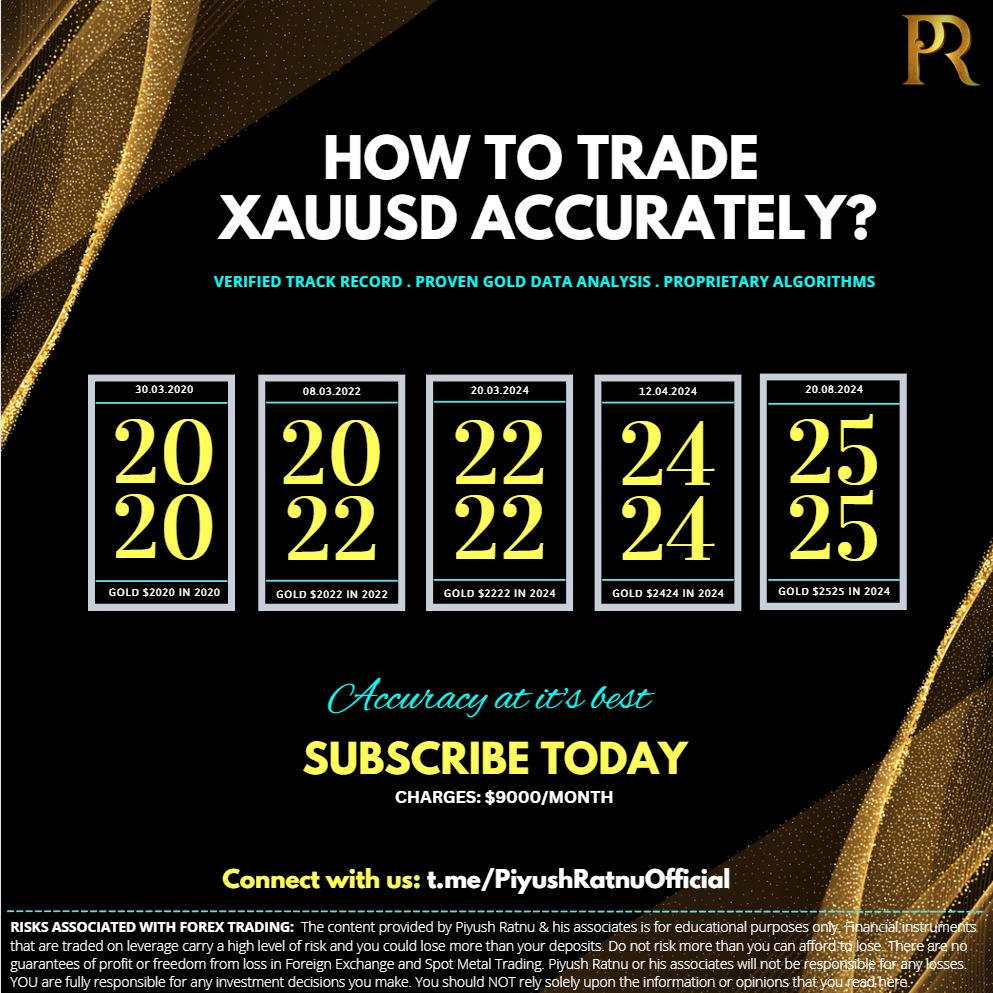

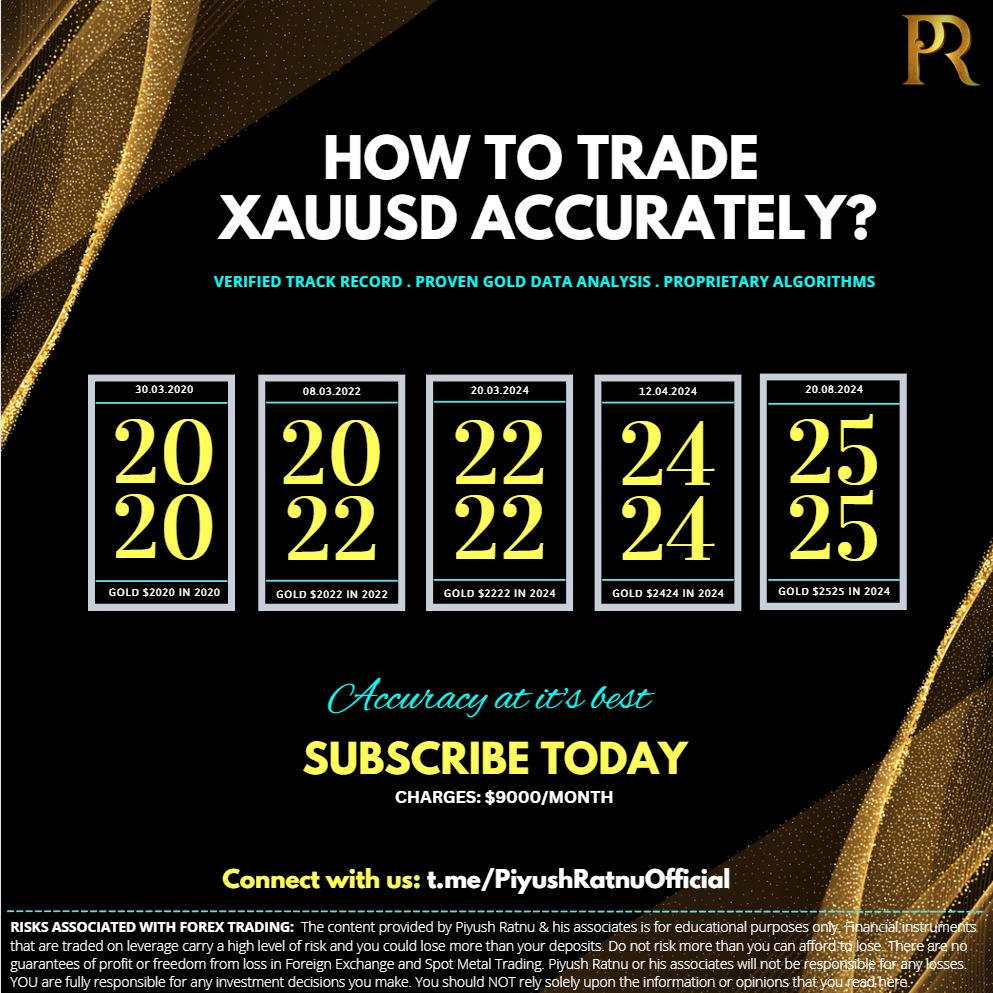

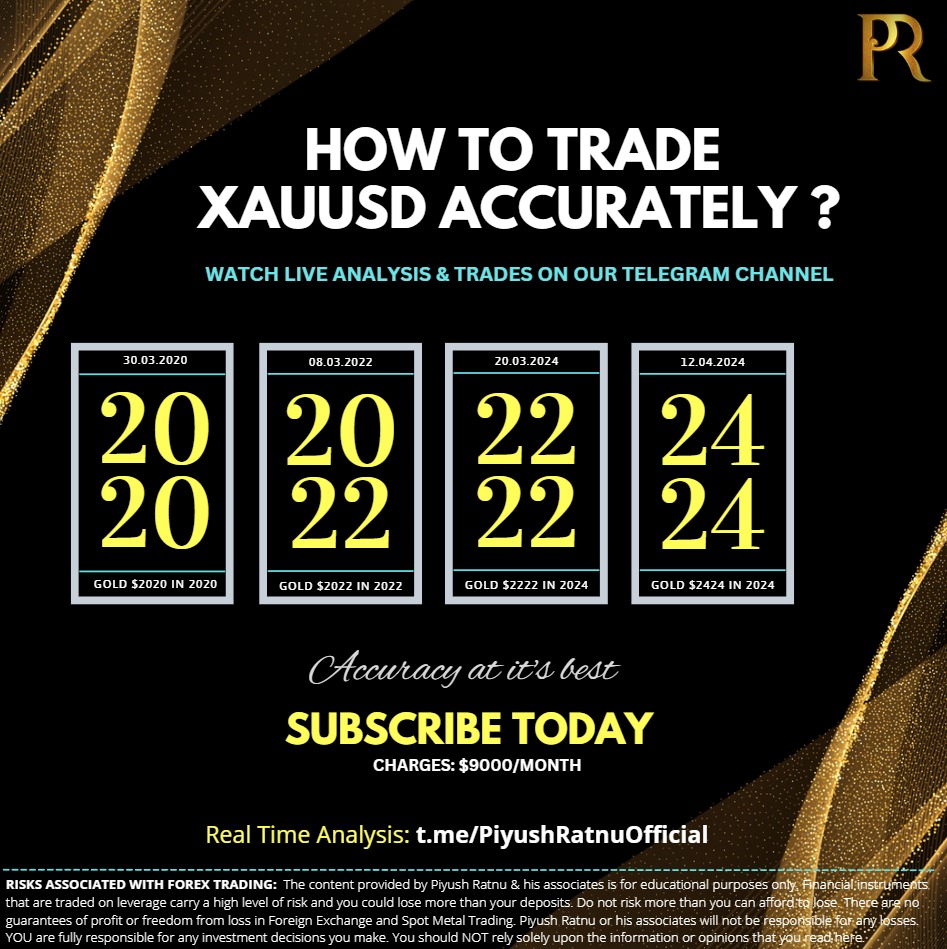

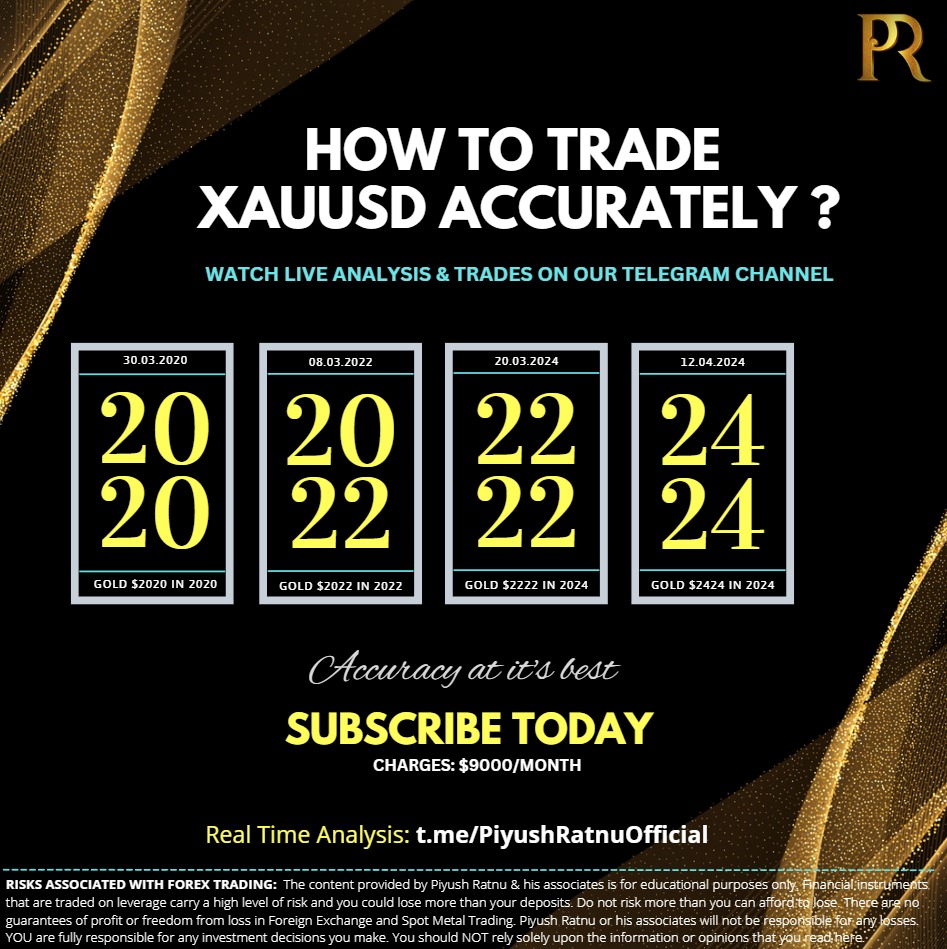

How to trade with accuracy?

Subscribe to our detailed, REAL TIME Analysis and trade with confidence!

For more details, connect at t.me/piyushratnuofficial

#XAUUSD #xauusdgold #gold #forextrading #forexmarket #forexstrategy #forexeducation

Subscribe to our detailed, REAL TIME Analysis and trade with confidence!

For more details, connect at t.me/piyushratnuofficial

#XAUUSD #xauusdgold #gold #forextrading #forexmarket #forexstrategy #forexeducation

Piyush Lalsingh Ratnu

The focus remains on today’s FOMC Minutes and Fed Chair Jerome Powell’s speech on Friday.

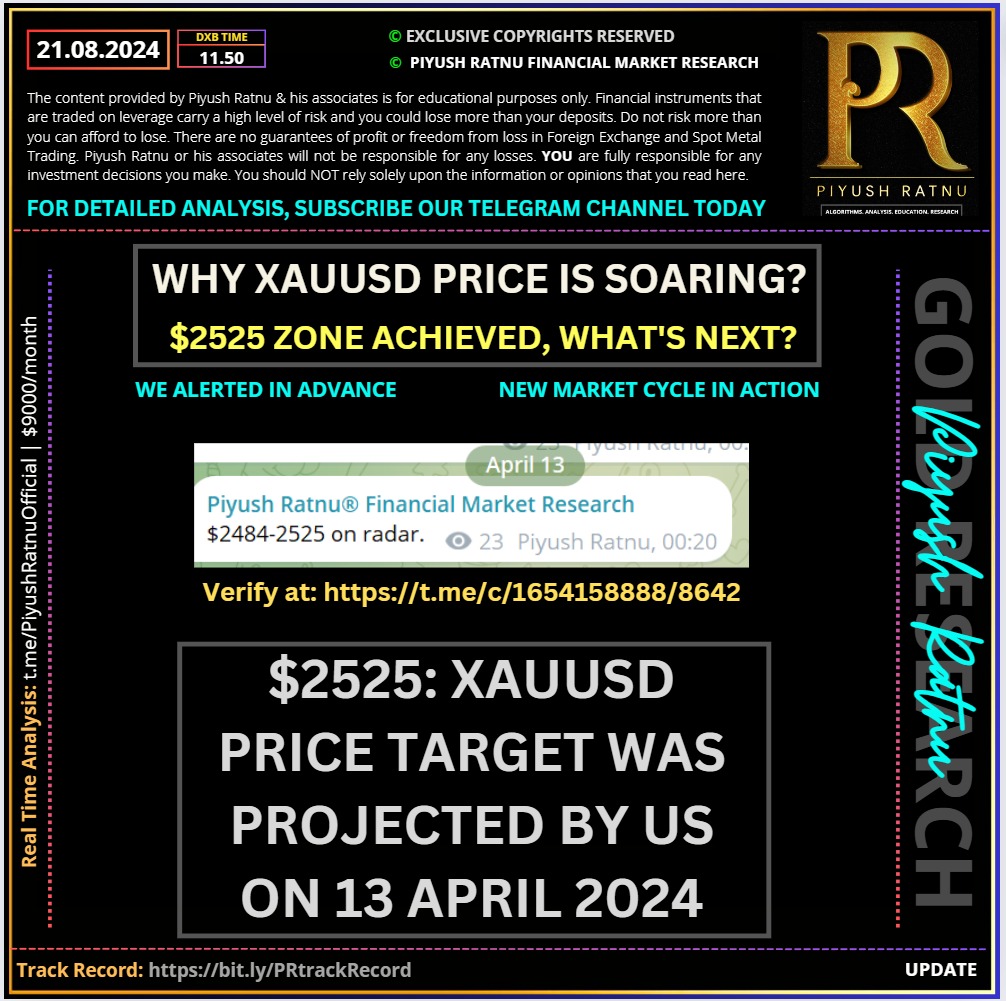

Gold price is on the front foot above $2,510 in Wednesday’s Asian trading, consolidating the previous upsurge to a new all-time high of $2,532 ($2525 zone projected by PR since 02 08 2024, crash observed till $2499.50 yesterday forming M15A100, hence selling at and above $2525 proved a right decision as per PR GOLD ANALYSIS).

Fundamentals:

Gold price reversed Monday’s brief correction and jumped back on the bids on Tuesday, registering a fresh record high above the $2,500 level. The US Dollar downtrend extended alongside falling US Treasury bond yields, courtesy of dovish expectations from the US Federal Reserve (Fed) and the USD/JPY sell-off, aiding the Gold price rebound.

Gold traders take account of broad risk-aversion and refrain from placing fresh bets ahead of the Minutes of the US Federal Reserve (Fed) July meeting due later on Wednesday.

Risk-off flows extend into Asia this Wednesday, as all the regional indices tumble. A steep sell-off in China’s tech stocks leads the declines in the Asian stock markets. JD. com Inc. plunged as much as 12% after a report on Walmart Inc.’s planned stake sale. China’s property market and growth concerns also continue to haunt markets.

The latest report from the World Gold Council (WGC) said that "anecdotal reports suggest that there has been strong buying interest from jewelry retailers as well as consumers since the duty reduction.” India's recent import tax cut on Gold triggered a downtick in prices., fuelling demand for the bright metal.

📌 Crucial Price Zones for next 7 days: Subscribe our TELEGRAM CHANNEL for latest price zones and trading scenarios by Piyush Ratnu Gold Market Research.

Gold price is on the front foot above $2,510 in Wednesday’s Asian trading, consolidating the previous upsurge to a new all-time high of $2,532 ($2525 zone projected by PR since 02 08 2024, crash observed till $2499.50 yesterday forming M15A100, hence selling at and above $2525 proved a right decision as per PR GOLD ANALYSIS).

Fundamentals:

Gold price reversed Monday’s brief correction and jumped back on the bids on Tuesday, registering a fresh record high above the $2,500 level. The US Dollar downtrend extended alongside falling US Treasury bond yields, courtesy of dovish expectations from the US Federal Reserve (Fed) and the USD/JPY sell-off, aiding the Gold price rebound.

Gold traders take account of broad risk-aversion and refrain from placing fresh bets ahead of the Minutes of the US Federal Reserve (Fed) July meeting due later on Wednesday.

Risk-off flows extend into Asia this Wednesday, as all the regional indices tumble. A steep sell-off in China’s tech stocks leads the declines in the Asian stock markets. JD. com Inc. plunged as much as 12% after a report on Walmart Inc.’s planned stake sale. China’s property market and growth concerns also continue to haunt markets.

The latest report from the World Gold Council (WGC) said that "anecdotal reports suggest that there has been strong buying interest from jewelry retailers as well as consumers since the duty reduction.” India's recent import tax cut on Gold triggered a downtick in prices., fuelling demand for the bright metal.

📌 Crucial Price Zones for next 7 days: Subscribe our TELEGRAM CHANNEL for latest price zones and trading scenarios by Piyush Ratnu Gold Market Research.

Piyush Lalsingh Ratnu

GC $2566

XAUUSD $2525

US10YT -

DXY -

USD S 19

JPY S 78

AUD S 56

XAUXAG 85.22

USDJPY $145.910 (-) 600P

#XAUUSD #Gold #PiyushRatnu

XAUUSD $2525

US10YT -

DXY -

USD S 19

JPY S 78

AUD S 56

XAUXAG 85.22

USDJPY $145.910 (-) 600P

#XAUUSD #Gold #PiyushRatnu

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

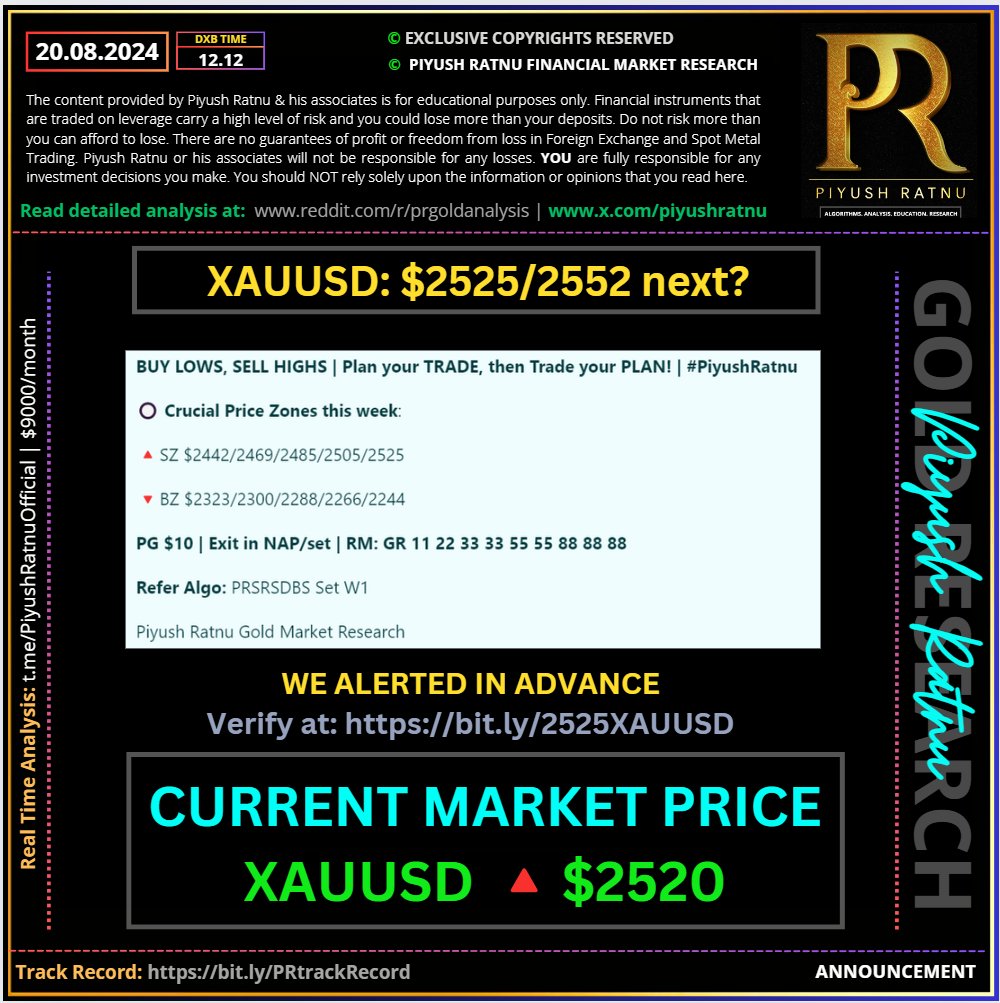

As alerted by us: NEW GOLD CYCLKES on the way from 15 August 2024 onwards:

Why XAUUSD price is rising?

Analysis by Piyush Ratnu

Gold (XAU/USD) trades up to a new all-time high in the $2,520s on Tuesday on the back of news of solid demand from China, a weakening US Dollar (in which the precious metal is mostly priced), and continued geopolitical risks stemming from the Middle East, where peace talks are at risk of running aground.

Gold at new high after news of Chinese demand

Gold continues rallying on Tuesday on the back of increased safe-haven demand from China. The People’s Bank of China (PBoC) issued new Gold import quotas to banks which “triggered speculation of a renewed wave of demand,” according to broker SP Angel. Safe-haven demand for Gold in China rose after Chinese 10-year Government Bond yields fell to record lows last week and, as a result, “Chinese buyers are seeking alternative safe-haven protection, with Gold an obvious candidate,” added the broker.

New gold import quotas for Chinese banks could foreshadow another surge in Chinese demand.

Demand for gold was white-hot in China last spring, helping drive global prices to record highs. Chinese demand slowed in recent months due to high prices, but there are signs another Chinese gold buying spree could be on the horizon.

The People's Bank of China has given several commercial banks new gold import quotas in anticipation of revived demand despite high prices.

Sources told Reuters that the Chinese central bank granted the new quotas this month after a two-month pause due to slower physical demand caused by record-high prices.

China ranks as the world's biggest consumer of gold.

(-) DXY = (+) XAUUSD

Gold is gaining a further lift as the US Dollar pushes to a new low eight-month low on Tuesday. The US Dollar Index (DXY) fell to 101.76 in early trade – a positive for Gold since the two assets share a high degree of negative correlation.

Geo-political tensions = (+) XAUUSD

Gold may be seeing safe-haven demand after an attempt to reach a peace agreement in the Middle East, spearheaded by US Secretary of State Antony Blinken, stalled with Israel ready to agree but Hamas not because it wants the agreement to include a permanent and not a temporary ceasefire as laid out in the current deal. Hamas further ratcheted up tensions by owning up to a recent suicide bomb attack in Tel Aviv. An Iranian all-out attack against Israel also remains an overhead risk factor. Middle East peace talks have hit an impasse, further increasing geopolitical risk.

Jackson Hole Symposium

This week's focus will be on the Jackson Hole Symposium, hosting policymakers from around the globe. The event will take place over the weekend, with Federal Reserve (Fed) Chairman Jerome Powell speaking on Friday.

Subscribe our TELEGRAM CHANNEL for latest price zones and trading scenarios by Piyush Ratnu Gold Market Research.

As alerted by us: NEW GOLD CYCLKES on the way from 15 August 2024 onwards:

Why XAUUSD price is rising?

Analysis by Piyush Ratnu

Gold (XAU/USD) trades up to a new all-time high in the $2,520s on Tuesday on the back of news of solid demand from China, a weakening US Dollar (in which the precious metal is mostly priced), and continued geopolitical risks stemming from the Middle East, where peace talks are at risk of running aground.

Gold at new high after news of Chinese demand

Gold continues rallying on Tuesday on the back of increased safe-haven demand from China. The People’s Bank of China (PBoC) issued new Gold import quotas to banks which “triggered speculation of a renewed wave of demand,” according to broker SP Angel. Safe-haven demand for Gold in China rose after Chinese 10-year Government Bond yields fell to record lows last week and, as a result, “Chinese buyers are seeking alternative safe-haven protection, with Gold an obvious candidate,” added the broker.

New gold import quotas for Chinese banks could foreshadow another surge in Chinese demand.

Demand for gold was white-hot in China last spring, helping drive global prices to record highs. Chinese demand slowed in recent months due to high prices, but there are signs another Chinese gold buying spree could be on the horizon.

The People's Bank of China has given several commercial banks new gold import quotas in anticipation of revived demand despite high prices.

Sources told Reuters that the Chinese central bank granted the new quotas this month after a two-month pause due to slower physical demand caused by record-high prices.

China ranks as the world's biggest consumer of gold.

(-) DXY = (+) XAUUSD

Gold is gaining a further lift as the US Dollar pushes to a new low eight-month low on Tuesday. The US Dollar Index (DXY) fell to 101.76 in early trade – a positive for Gold since the two assets share a high degree of negative correlation.

Geo-political tensions = (+) XAUUSD

Gold may be seeing safe-haven demand after an attempt to reach a peace agreement in the Middle East, spearheaded by US Secretary of State Antony Blinken, stalled with Israel ready to agree but Hamas not because it wants the agreement to include a permanent and not a temporary ceasefire as laid out in the current deal. Hamas further ratcheted up tensions by owning up to a recent suicide bomb attack in Tel Aviv. An Iranian all-out attack against Israel also remains an overhead risk factor. Middle East peace talks have hit an impasse, further increasing geopolitical risk.

Jackson Hole Symposium

This week's focus will be on the Jackson Hole Symposium, hosting policymakers from around the globe. The event will take place over the weekend, with Federal Reserve (Fed) Chairman Jerome Powell speaking on Friday.

Subscribe our TELEGRAM CHANNEL for latest price zones and trading scenarios by Piyush Ratnu Gold Market Research.

Piyush Lalsingh Ratnu

$2525 achieved as projected on 07 August 2024

#XAUUSD

#PiyushRatnu #Gold #War #Inflation #JacksonHole2024 #Powell

#XAUUSD

#PiyushRatnu #Gold #War #Inflation #JacksonHole2024 #Powell

Piyush Lalsingh Ratnu

$2509 XAUUSD GOLD Price Achieved as projected on 08 August 2024 by Piyush Ratnu Gold Market Research

Retracement achieved till $2485: $2485-2505 CMP $2505

Retracement achieved till $2485: $2485-2505 CMP $2505

Piyush Lalsingh Ratnu

https://www.gold.org/goldhub/gold-focus/2024/08/chinas-gold-market-july-wholesale-demand-remained-weak-while-etfs

Key highlights:

Both the Shanghai Gold Benchmark PM (SHAUPM) in RMB and the LBMA Gold Price AM in USD bounced higher in July, further extending their y-t-d gains

The industry withdrew 89t of gold from the Shanghai Gold Exchange (SGE) during the month, a 26t y/y fall and the weakest July since 2020. Continued weaknesses in gold jewellery consumption and physical investment weighed on wholesale gold demand

Inflows into Chinese gold ETFs were sustained during July (+RMB783mn, +US$108mn).

This is the eighth consecutive month of inflows, lifting total assets under management (AUM) to RMB53bn (US$7.3bn) and collective holdings to 94t, both the highest in history

China reported no gold purchases in July, for the third consecutive month, leaving total official gold holdings unchanged at 2,264t, 4.9% of total foreign reserves.

China has announced a 29t y-t-d addition to its gold reserves; purchases took place during the first four months of 2024.

Key highlights:

Both the Shanghai Gold Benchmark PM (SHAUPM) in RMB and the LBMA Gold Price AM in USD bounced higher in July, further extending their y-t-d gains

The industry withdrew 89t of gold from the Shanghai Gold Exchange (SGE) during the month, a 26t y/y fall and the weakest July since 2020. Continued weaknesses in gold jewellery consumption and physical investment weighed on wholesale gold demand

Inflows into Chinese gold ETFs were sustained during July (+RMB783mn, +US$108mn).

This is the eighth consecutive month of inflows, lifting total assets under management (AUM) to RMB53bn (US$7.3bn) and collective holdings to 94t, both the highest in history

China reported no gold purchases in July, for the third consecutive month, leaving total official gold holdings unchanged at 2,264t, 4.9% of total foreign reserves.

China has announced a 29t y-t-d addition to its gold reserves; purchases took place during the first four months of 2024.

Piyush Lalsingh Ratnu

XAUUSD: All time HIGH $2500 ACHIEVED.

As projected on 08 August 2024 | Verify at: https://x.com/piyushratnu/status/1821868263715844306

As projected on 08 August 2024 | Verify at: https://x.com/piyushratnu/status/1821868263715844306

Piyush Lalsingh Ratnu

XAUUSD Spot Gold | Piyush Ratnu Market Research

Connect at t.me/PiyushRatnuOfficial for more details.

Connect at t.me/PiyushRatnuOfficial for more details.

: