Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Gold price action witnessed heavy buying from $2424 as fears of possible Iranian attack on Israel triggered safe haven rush to safety and Gold demand increased as store of value taking the precious metal to $2478 in a short span of time.

Iran-Israel issue is widely believed to be extremely delicate and sensitive in the sense that both sides are adamant and far from negotiation and refuse any restraint, especially at a point where any escalation can lead to uncontrollable geo political hazzards and turn into a much wider scale conflict.

Iran-Israel issue is widely believed to be extremely delicate and sensitive in the sense that both sides are adamant and far from negotiation and refuse any restraint, especially at a point where any escalation can lead to uncontrollable geo political hazzards and turn into a much wider scale conflict.

Piyush Lalsingh Ratnu

Gold (XAU/USD) trades in the $2,450s on Monday, clocking up around a 0.45% gain from the previous day on a combination of safe-haven demand due to geopolitical risk and rising bets the Federal Reserve (Fed) will move to cut interest rates at its next meeting. The expectation of interest rates falling is positive for Gold since it lowers the opportunity cost of holding Gold which is a non-interest paying asset.

Piyush Lalsingh Ratnu

Gold (XAU/USD) suffered heavy losses at the beginning of the week as a combination of factors triggered a broad market selloff. The metal, however, recovered sharply in the second half of the week and stabilized comfortably above $2,400. Market participants await July inflation data from the US for the next directional clue.

Gold price is trading on the back foot near $2,430 early Monday, consolidating the previous week’s late recovery. Traders appear non-committal and refrain from placing fresh bets on Gold price, bracing for an action-packed week, with US Consumer Price Index (CPI) inflation data in the spotlight.

Gold price braces for Iran-Israel escalation and key US data

Traders take account of the latest developments surrounding the Middle-East geopolitical tensions, with Israel preparing for an imminent attack by Iran, in retaliation for the assassination of Hamas leader Ismail Haniyeh in Tehran in late July.

On Sunday, Axios reported that the Israeli intelligence community is put on a high alert, as it is believed that Iran has decided to attack Israel directly and may do so within days.

Meanwhile, ABC News reported early Monday that the Israel Defense Forces (IDF) intercepted roughly 30 "projectiles" that were identified as crossing from Lebanon into northern Israel. This comes even as Hamas proposed a cease-fire implementation plan after a diplomatic push from the United States, Egypt and Qatar for a new round of talks to take place between Israel and Hamas on Aug. 15 in either Doha or Cairo.

If the Iran-backed militant groups, Hezbollah and Hamas, turn down any cease-fire attempts and attack Israel, the escalation could very well translate into a wider regional conflict. Mounting geopolitical tensions are likely to keep the safe-haven US Dollar (USD) buoyed, weighing negatively on the USD-denominated Gold price. Gold failed to benefit from escalating geopolitical tensions at the beginning of the week and declined sharply. The unwinding of Japanese Yen (JPY) carry trade, growing fears over a recession in the US and heightened concerns about a deepening conflict in the Middle East triggered a global market selloff on Monday, causing a variety of financial assets, except for the JPY, to suffer heavy losses.

Markets remain in a wait-and-see mode before taking any calls on the next Gold price direction, as position readjustments could be seen heading into Wednesday’s US CPI showdown. The headline annual CPI is set to rise 2.9% in July after increasing by 3.0% in June. Meanwhile, the core inflation is expected to edge a tad lower to 3.2% YoY in July versus June’s 3.3% print.

Gold investors might implement large positions based on US inflation data

Next week’s economic calendar will feature July inflation data from the US. The Consumer Price Index (CPI) is forecast to rise 0.2% on a monthly basis and the core CPI, which excludes volatile food and energy prices, is also seen increasing 0.2% in the same period. On a yearly basis, the headline CPI inflation is forecast to edge lower to 2.9% from 3% in June.

The CME FedWatch Tool shows that markets are pricing in a more-than-50% probability of a 50 basis points (bps) Federal Reserve (Fed) rate cut in September. In case the monthly core CPI rises more than forecast, investors could reassess the probability of a 50 bps cut in September and help the USD gather strength with the immediate reaction. On the flip side, a reading at or below the market expectation in this data could weigh on the USD, opening the door for another leg higher in XAU/USD.

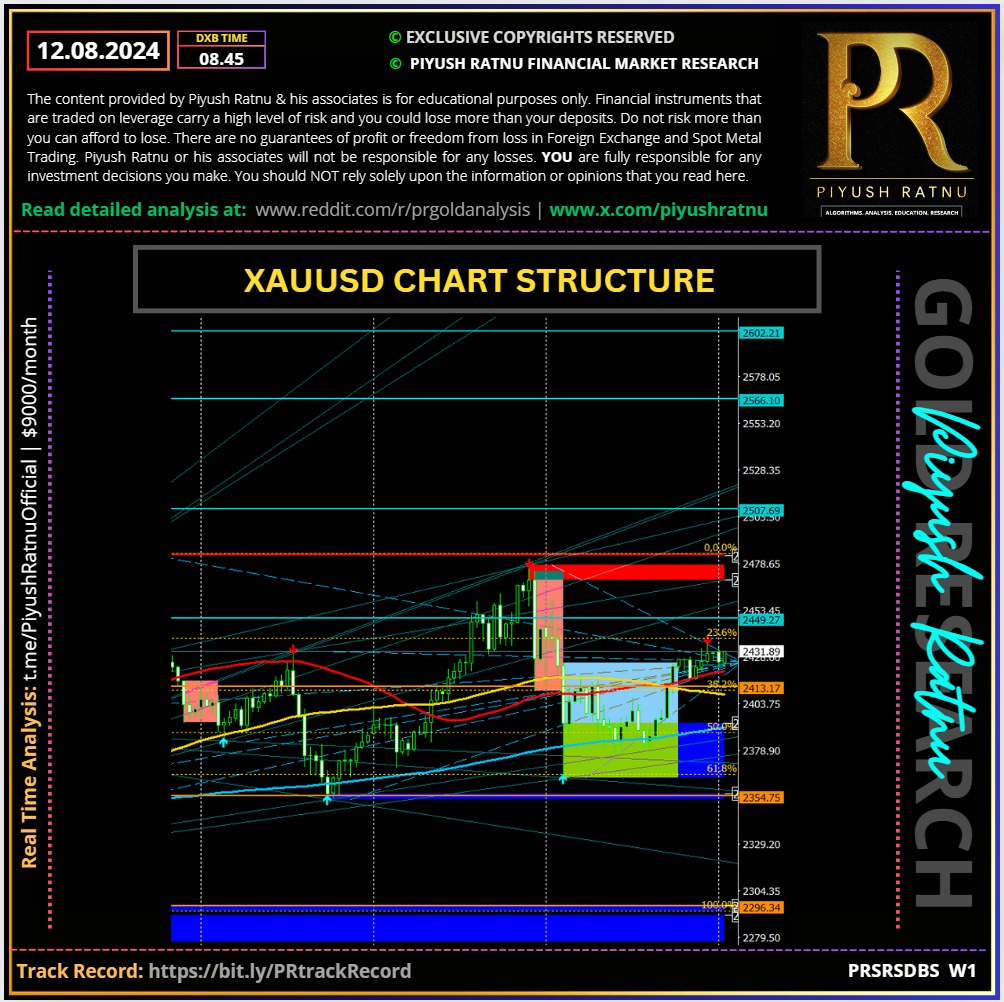

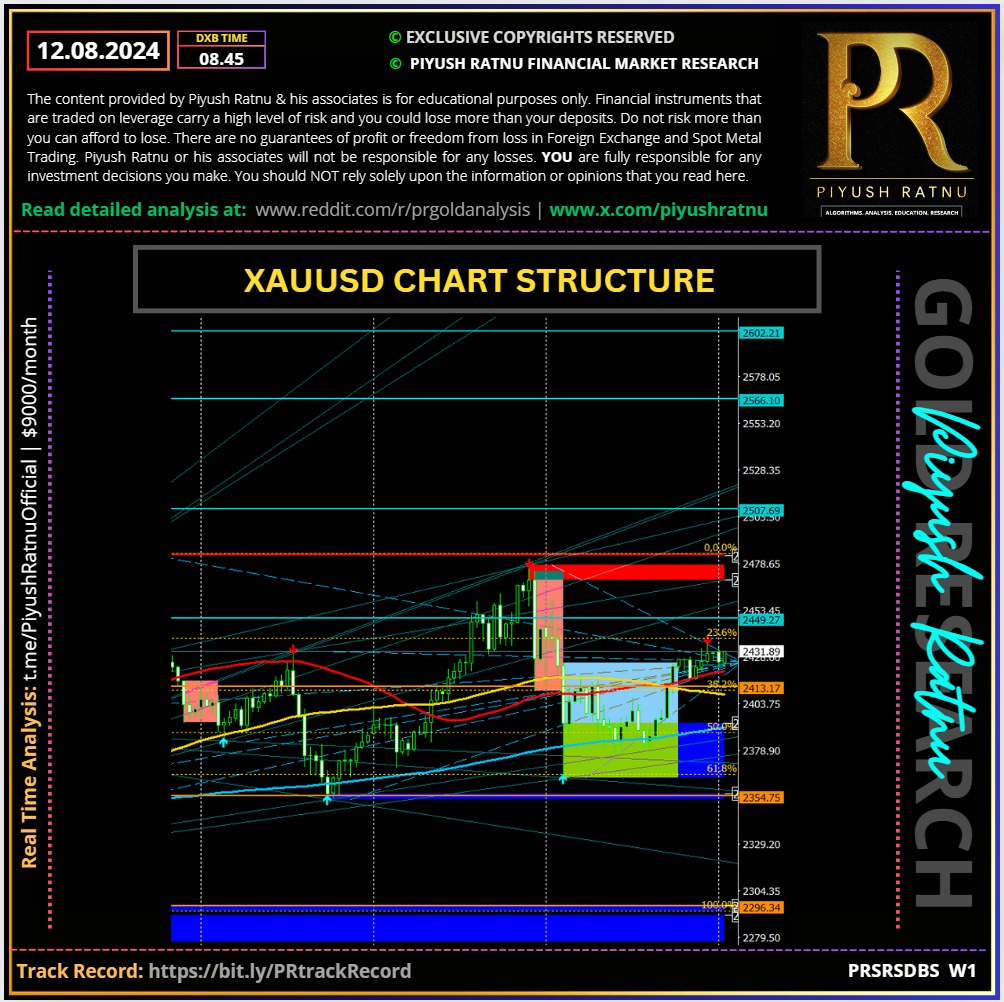

Crucial Price Zones:

🔻BZ $2407/2385/2369/2332

🔺SZ $2469/2485/2525/2552

Gold price is trading on the back foot near $2,430 early Monday, consolidating the previous week’s late recovery. Traders appear non-committal and refrain from placing fresh bets on Gold price, bracing for an action-packed week, with US Consumer Price Index (CPI) inflation data in the spotlight.

Gold price braces for Iran-Israel escalation and key US data

Traders take account of the latest developments surrounding the Middle-East geopolitical tensions, with Israel preparing for an imminent attack by Iran, in retaliation for the assassination of Hamas leader Ismail Haniyeh in Tehran in late July.

On Sunday, Axios reported that the Israeli intelligence community is put on a high alert, as it is believed that Iran has decided to attack Israel directly and may do so within days.

Meanwhile, ABC News reported early Monday that the Israel Defense Forces (IDF) intercepted roughly 30 "projectiles" that were identified as crossing from Lebanon into northern Israel. This comes even as Hamas proposed a cease-fire implementation plan after a diplomatic push from the United States, Egypt and Qatar for a new round of talks to take place between Israel and Hamas on Aug. 15 in either Doha or Cairo.

If the Iran-backed militant groups, Hezbollah and Hamas, turn down any cease-fire attempts and attack Israel, the escalation could very well translate into a wider regional conflict. Mounting geopolitical tensions are likely to keep the safe-haven US Dollar (USD) buoyed, weighing negatively on the USD-denominated Gold price. Gold failed to benefit from escalating geopolitical tensions at the beginning of the week and declined sharply. The unwinding of Japanese Yen (JPY) carry trade, growing fears over a recession in the US and heightened concerns about a deepening conflict in the Middle East triggered a global market selloff on Monday, causing a variety of financial assets, except for the JPY, to suffer heavy losses.

Markets remain in a wait-and-see mode before taking any calls on the next Gold price direction, as position readjustments could be seen heading into Wednesday’s US CPI showdown. The headline annual CPI is set to rise 2.9% in July after increasing by 3.0% in June. Meanwhile, the core inflation is expected to edge a tad lower to 3.2% YoY in July versus June’s 3.3% print.

Gold investors might implement large positions based on US inflation data

Next week’s economic calendar will feature July inflation data from the US. The Consumer Price Index (CPI) is forecast to rise 0.2% on a monthly basis and the core CPI, which excludes volatile food and energy prices, is also seen increasing 0.2% in the same period. On a yearly basis, the headline CPI inflation is forecast to edge lower to 2.9% from 3% in June.

The CME FedWatch Tool shows that markets are pricing in a more-than-50% probability of a 50 basis points (bps) Federal Reserve (Fed) rate cut in September. In case the monthly core CPI rises more than forecast, investors could reassess the probability of a 50 bps cut in September and help the USD gather strength with the immediate reaction. On the flip side, a reading at or below the market expectation in this data could weigh on the USD, opening the door for another leg higher in XAU/USD.

Crucial Price Zones:

🔻BZ $2407/2385/2369/2332

🔺SZ $2469/2485/2525/2552

Piyush Lalsingh Ratnu

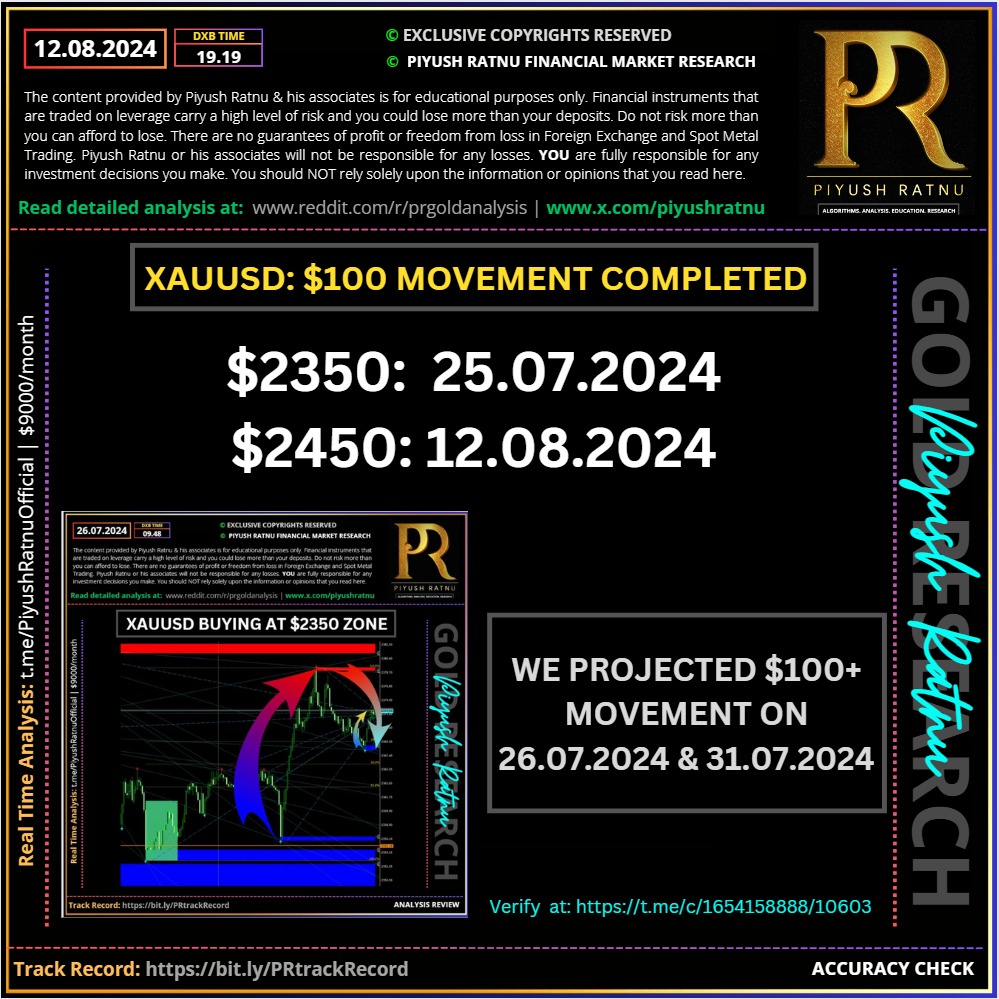

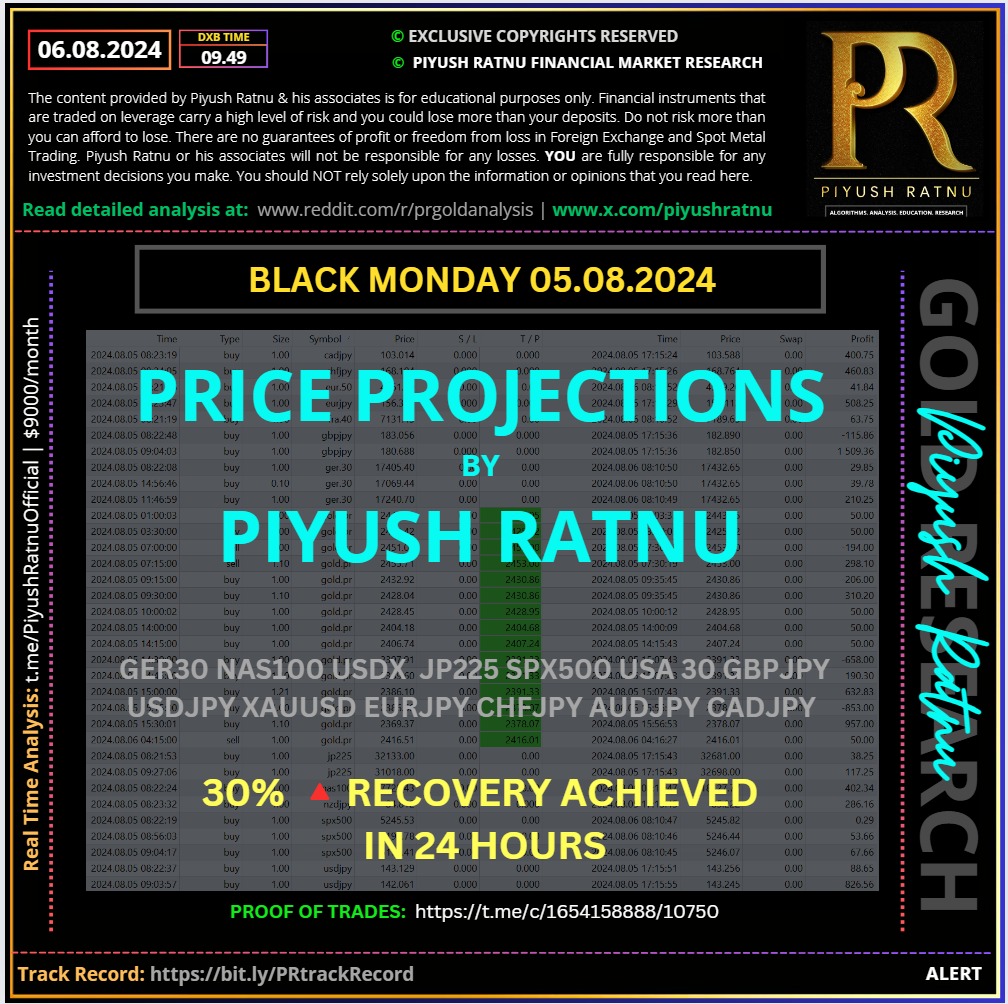

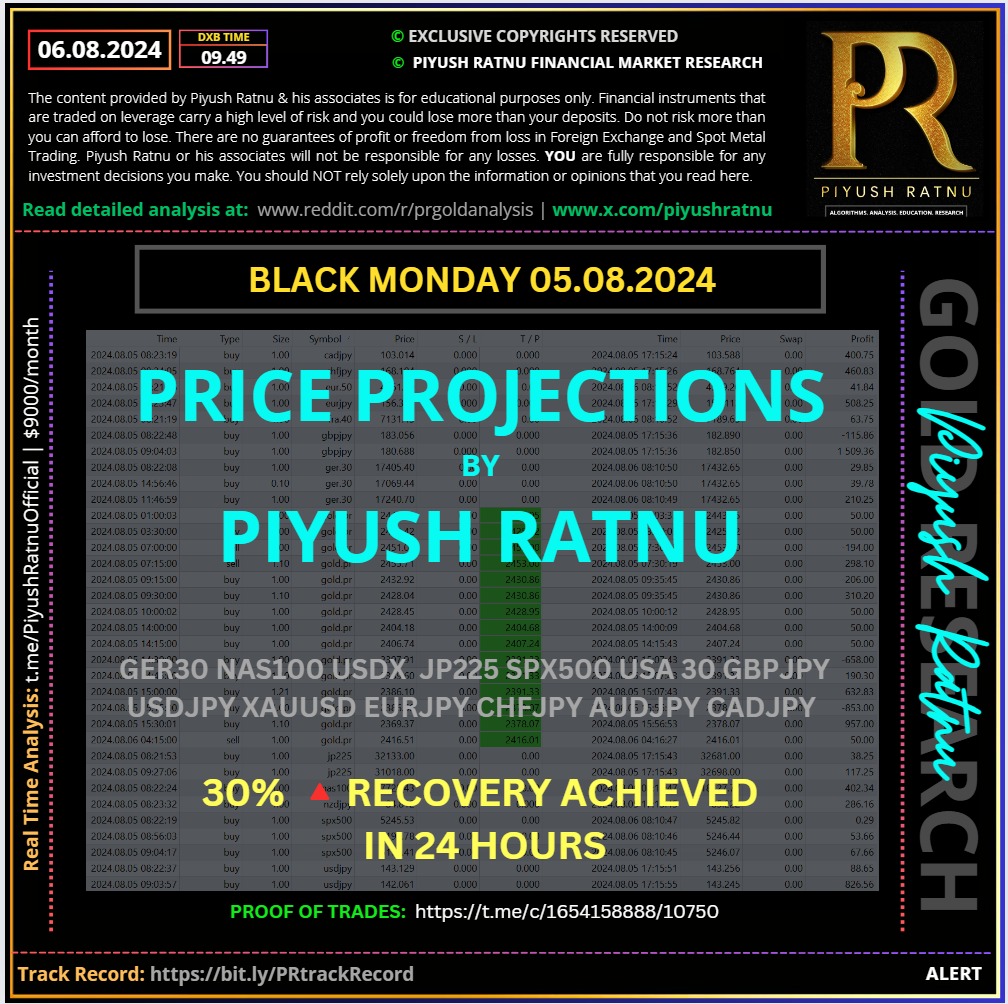

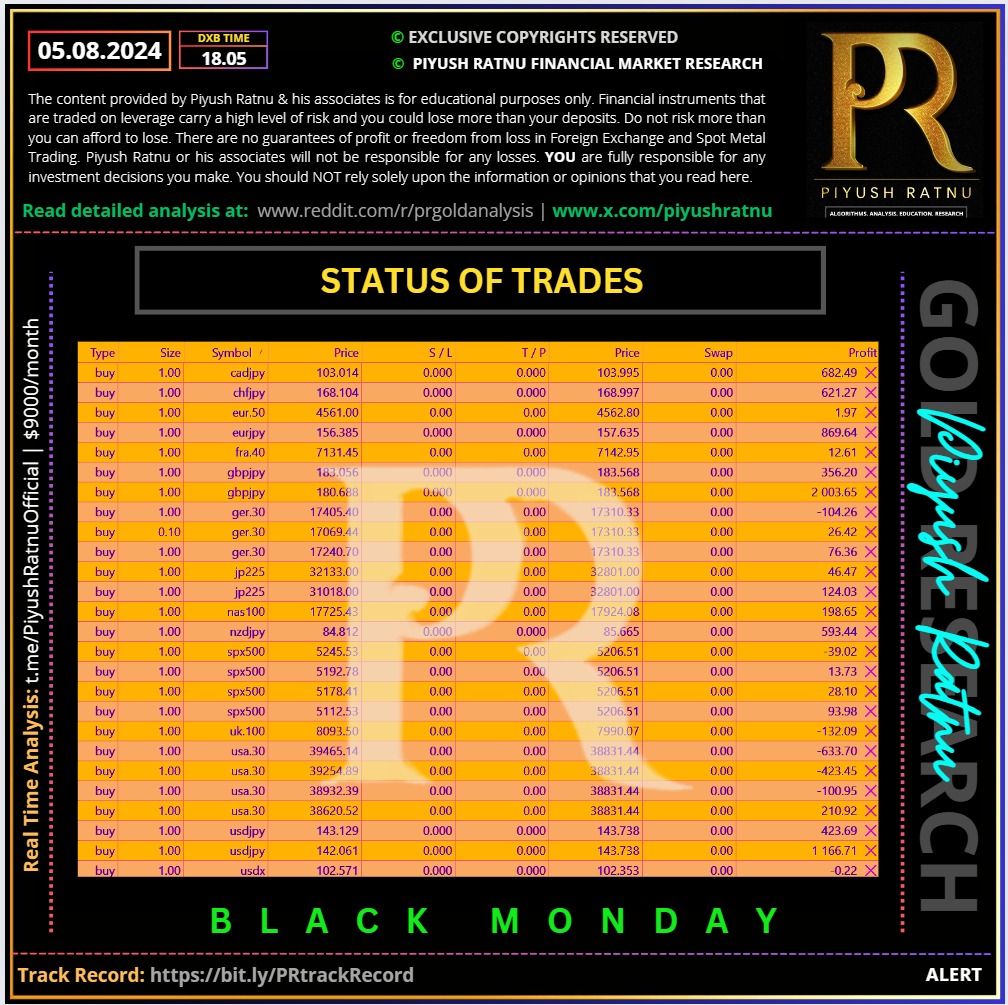

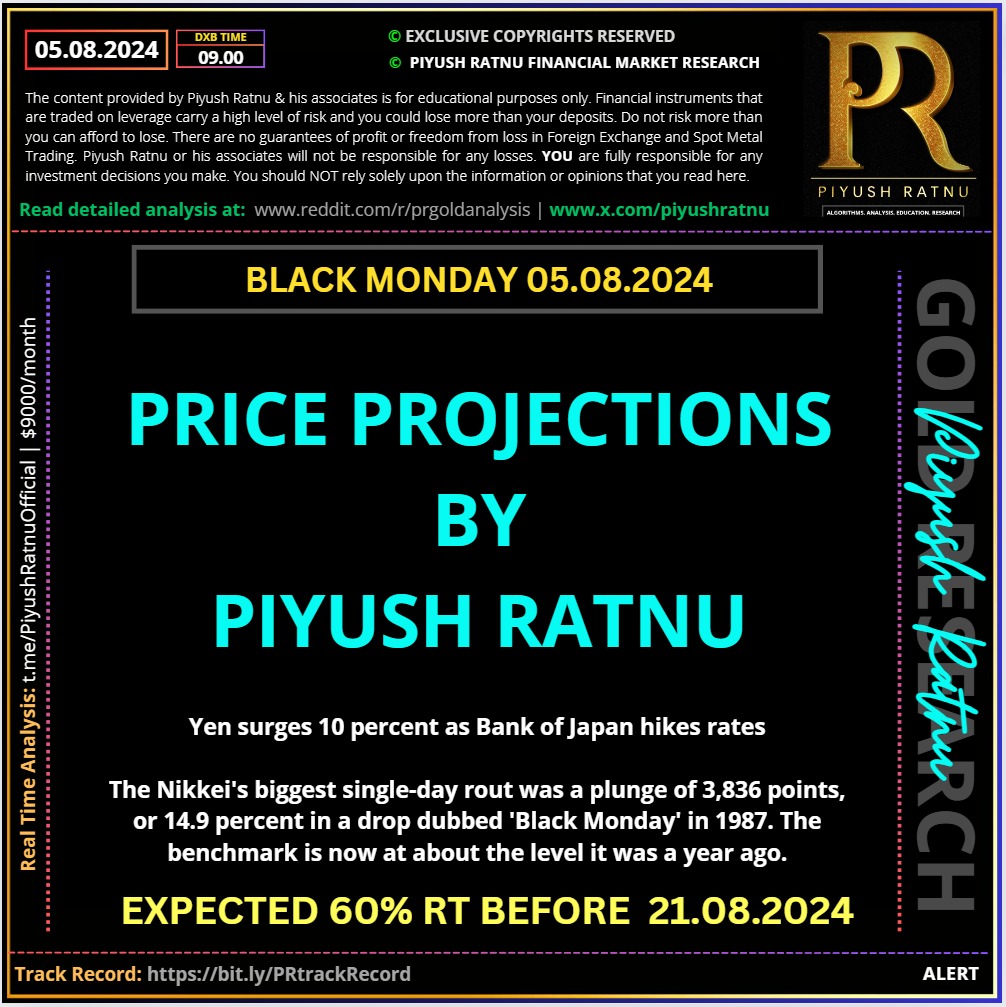

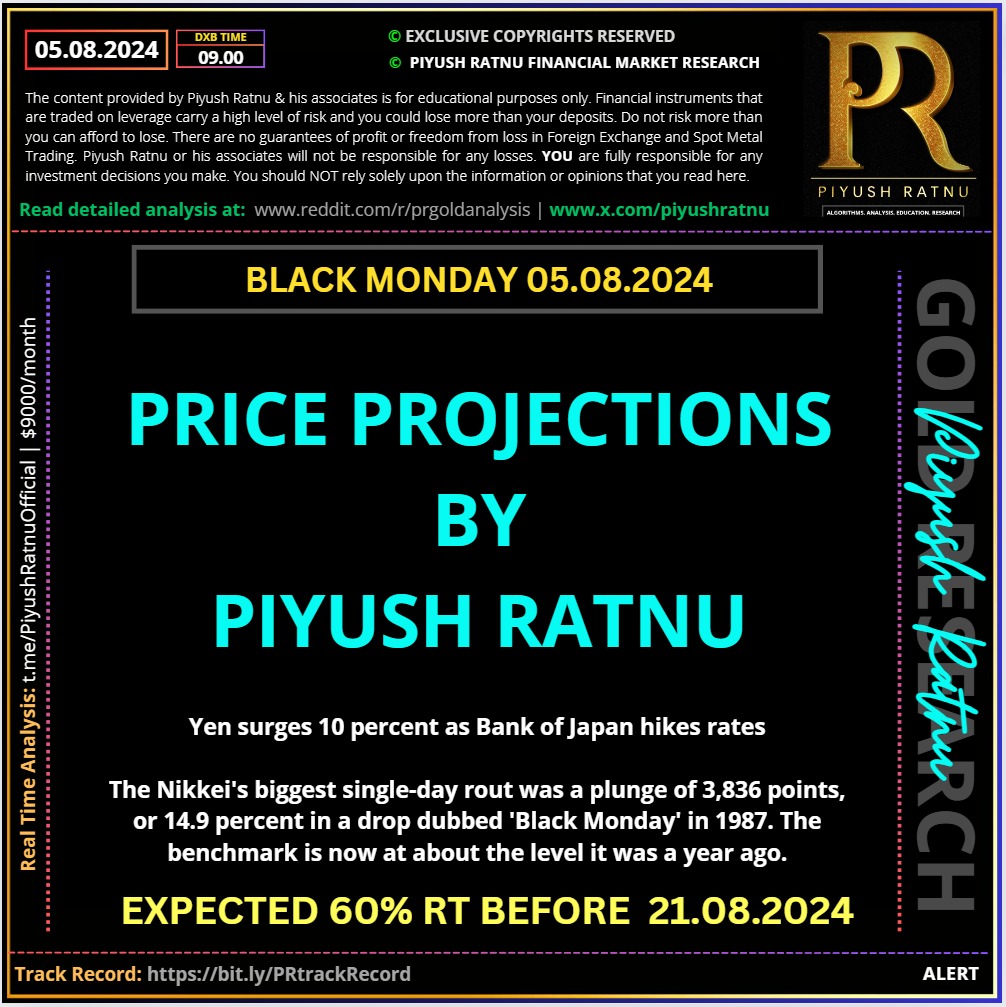

#blackmonday2024 Trading Performance | Analysis Review

#BlackMonday #blackmonday2024 #Forex #PiyushRatnu

https://www.piyushratnu.com/most-accurate-black-monday-august-2024-forex-trading-and-analysis-by-piyush-ratnu/

#BlackMonday #blackmonday2024 #Forex #PiyushRatnu

https://www.piyushratnu.com/most-accurate-black-monday-august-2024-forex-trading-and-analysis-by-piyush-ratnu/

Piyush Lalsingh Ratnu

Gold price is consolidating the previous swift rebound to near the $2,410 region early Tuesday, as traders absorb Monday’s volatile trading. Gold price struggles to build on the recovery mode amid a solid comeback staged by the US Dollar, alongside the US Treasury bond yields.

Following the assurances by the US and Japanese authorities to calm nerves, markets are witnessing a massive positive shift in risk sentiment. The Asian stocks attempt a turnaround, with the Japanese benchmark index - the Nikkei 225, jumping nearly 10% so far, reversing the 12% historic sell-off seen Monday.

With the return of risk flows, the haven demand for the US government bonds fades, putting a fresh bid under the US Treasury bond yields and helping lift the US Dollar across the board at the expense of the non-interest-bearing Gold price.

The diplomats from the US and Arab nations attempt to de-escalate the tensions between Iran and Israel that flared up since Wednesday, when Hamas leader Ismail Haniyeh was killed in Tehran in an attack. Iran blamed Israel, vowing to retaliate, with US intelligence noting that the attack could be panned over multiple days.

The diplomatic efforts to diffuse the situation seem to provide some support to the recovery in risk sentiment. However, traders remain wary of Iran striking back against Israel, as the former said “it didn’t care if the response triggered a war.”

Iran's foreign ministry spokesperson, Nasser Kanaani, stated on Monday that while Iran does not intend to heighten regional tensions, it believes it must punish Israel to deter further instability.

As the Middle East geopolitical situation remains in a delicate spot, traders are glued to the upcoming developments, refraining from placing any fresh position in the Gold price. However, the downside in Gold price could remain limited, as markets continue pricing in a nearly 90% chance that the US Federal Reserve (Fed) will cut interest rates by 50 basis points (bps) in September, according to the CME Group’s FedWatch Tool.

Additionally, the market has around 115 basis points of easing priced in for this year, and a similar amount for 2025, per Reuters.

Monday’s sell-off in Gold price, despite broad risk-aversion, could be attributed to investors locking in gains in their Gold longs to cover losses elsewhere. Global stock markets were in turmoil amid escalating Middle East tensions and US economic slowdown fears, following the weak US jobs report on Friday.

Crucial Price Zones:

🔺SZ $2442/2469/2485

🔻BZ $2385/2369/2342

Key Economic Data ahead:

12:30 GBP S&P Global / CIPS UK Construction PMI (Jul) 52.5 52.2

16:30 USD Exports (Jun) 261.70B

16:30 USD Imports (Jun) 336.70B

16:30 USD Trade Balance (Jun) -72.50B -75.10B

18:30 USD Atlanta Fed GDPNow (Q3) 2.5% 2.5%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 3-Year Note Auction 4.399%

Following the assurances by the US and Japanese authorities to calm nerves, markets are witnessing a massive positive shift in risk sentiment. The Asian stocks attempt a turnaround, with the Japanese benchmark index - the Nikkei 225, jumping nearly 10% so far, reversing the 12% historic sell-off seen Monday.

With the return of risk flows, the haven demand for the US government bonds fades, putting a fresh bid under the US Treasury bond yields and helping lift the US Dollar across the board at the expense of the non-interest-bearing Gold price.

The diplomats from the US and Arab nations attempt to de-escalate the tensions between Iran and Israel that flared up since Wednesday, when Hamas leader Ismail Haniyeh was killed in Tehran in an attack. Iran blamed Israel, vowing to retaliate, with US intelligence noting that the attack could be panned over multiple days.

The diplomatic efforts to diffuse the situation seem to provide some support to the recovery in risk sentiment. However, traders remain wary of Iran striking back against Israel, as the former said “it didn’t care if the response triggered a war.”

Iran's foreign ministry spokesperson, Nasser Kanaani, stated on Monday that while Iran does not intend to heighten regional tensions, it believes it must punish Israel to deter further instability.

As the Middle East geopolitical situation remains in a delicate spot, traders are glued to the upcoming developments, refraining from placing any fresh position in the Gold price. However, the downside in Gold price could remain limited, as markets continue pricing in a nearly 90% chance that the US Federal Reserve (Fed) will cut interest rates by 50 basis points (bps) in September, according to the CME Group’s FedWatch Tool.

Additionally, the market has around 115 basis points of easing priced in for this year, and a similar amount for 2025, per Reuters.

Monday’s sell-off in Gold price, despite broad risk-aversion, could be attributed to investors locking in gains in their Gold longs to cover losses elsewhere. Global stock markets were in turmoil amid escalating Middle East tensions and US economic slowdown fears, following the weak US jobs report on Friday.

Crucial Price Zones:

🔺SZ $2442/2469/2485

🔻BZ $2385/2369/2342

Key Economic Data ahead:

12:30 GBP S&P Global / CIPS UK Construction PMI (Jul) 52.5 52.2

16:30 USD Exports (Jun) 261.70B

16:30 USD Imports (Jun) 336.70B

16:30 USD Trade Balance (Jun) -72.50B -75.10B

18:30 USD Atlanta Fed GDPNow (Q3) 2.5% 2.5%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 3-Year Note Auction 4.399%

Piyush Lalsingh Ratnu

Piyush Ratnu Market Research Analysis Trading Performance

Black Monday | 05 August 2024 | Duration: 12 hours

Black Monday | 05 August 2024 | Duration: 12 hours

Piyush Lalsingh Ratnu

Why Yen carry-trades are in focus| Explained

The popular Yen-carry trade is in focus following the currency's sharp appreciation after the Bank of Japan raised interest rates for the first time in 17 years. Here's what it means.

What is carry-trade?

A carry-trade is an immensely popular trading strategy, where an investor borrows money from a country with low interest rates, through a weaker currency(Japan in this case), and reinvests the money in another country’s assets, which gives a higher rate of return. Carry trade has been one of the biggest sources of flows in the global currency market.

Why is Japan's Yen important for Carry Trade

With low volatility, yen-funded carry trades were the most popular as investors bet Japanese interest rates would remain at rock bottom. The Bank of Japan, however, raised its rates for a second time in 17 years in its July 31 meeting, and has hinted at more, reported Bloomberg. Traders are now looking at the Chinese yuan, betting on the currency’s weakening amid concerns about the country’s economy.

The popular Yen-carry trade is in focus following the currency's sharp appreciation after the Bank of Japan raised interest rates for the first time in 17 years. Here's what it means.

What is carry-trade?

A carry-trade is an immensely popular trading strategy, where an investor borrows money from a country with low interest rates, through a weaker currency(Japan in this case), and reinvests the money in another country’s assets, which gives a higher rate of return. Carry trade has been one of the biggest sources of flows in the global currency market.

Why is Japan's Yen important for Carry Trade

With low volatility, yen-funded carry trades were the most popular as investors bet Japanese interest rates would remain at rock bottom. The Bank of Japan, however, raised its rates for a second time in 17 years in its July 31 meeting, and has hinted at more, reported Bloomberg. Traders are now looking at the Chinese yuan, betting on the currency’s weakening amid concerns about the country’s economy.

Piyush Lalsingh Ratnu

#XAUUSD CMP $2404

H4AS5

H1AS2 achieved

Approaching D1AS5

Currently at PRSRSDBS S2

S3: $2385

S4: $2369

S5: $2342

#Gold #forex #PiyushRatnu #PRxauusd

H4AS5

H1AS2 achieved

Approaching D1AS5

Currently at PRSRSDBS S2

S3: $2385

S4: $2369

S5: $2342

#Gold #forex #PiyushRatnu #PRxauusd

Piyush Lalsingh Ratnu

Key Economic Data today:

17:45 USD S&P Global Composite PMI (Jul) 55.0 54.8

17:45 USD S&P Global Services PMI (Jul) 56.0 55.3

18:00 USD ISM Non-Manufacturing Employment (Jul) 46.1

18:00 USD ISM Non-Manufacturing PMI (Jul) 51.4 48.8

18:00 USD ISM Non-Manufacturing Prices (Jul) 56.3

17:45 USD S&P Global Composite PMI (Jul) 55.0 54.8

17:45 USD S&P Global Services PMI (Jul) 56.0 55.3

18:00 USD ISM Non-Manufacturing Employment (Jul) 46.1

18:00 USD ISM Non-Manufacturing PMI (Jul) 51.4 48.8

18:00 USD ISM Non-Manufacturing Prices (Jul) 56.3

Piyush Lalsingh Ratnu

BlackMonday #Yen #Japan #Gold #Dollar #Forex

Check Price projections by Piyush Ratnu Market Research:

https://bit.ly/BlackMondayScenariosbyPR

Check Price projections by Piyush Ratnu Market Research:

https://bit.ly/BlackMondayScenariosbyPR

Piyush Lalsingh Ratnu

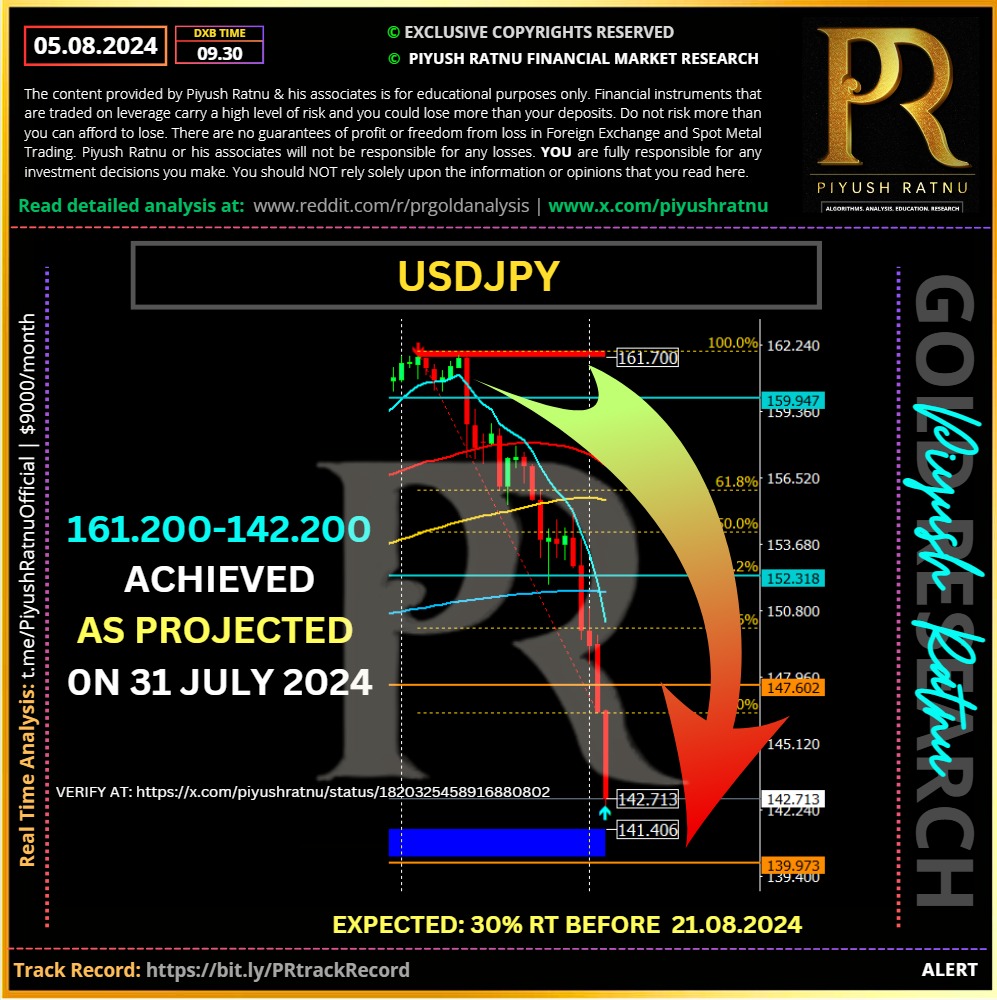

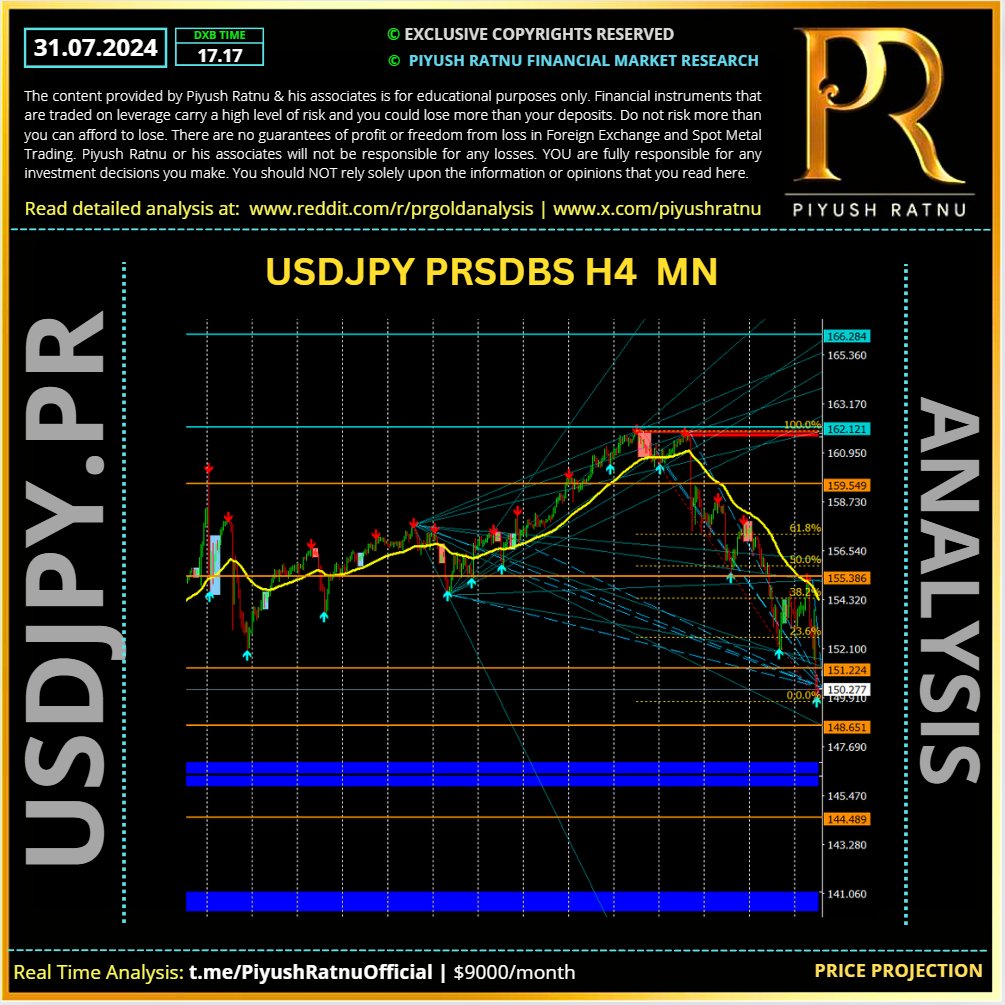

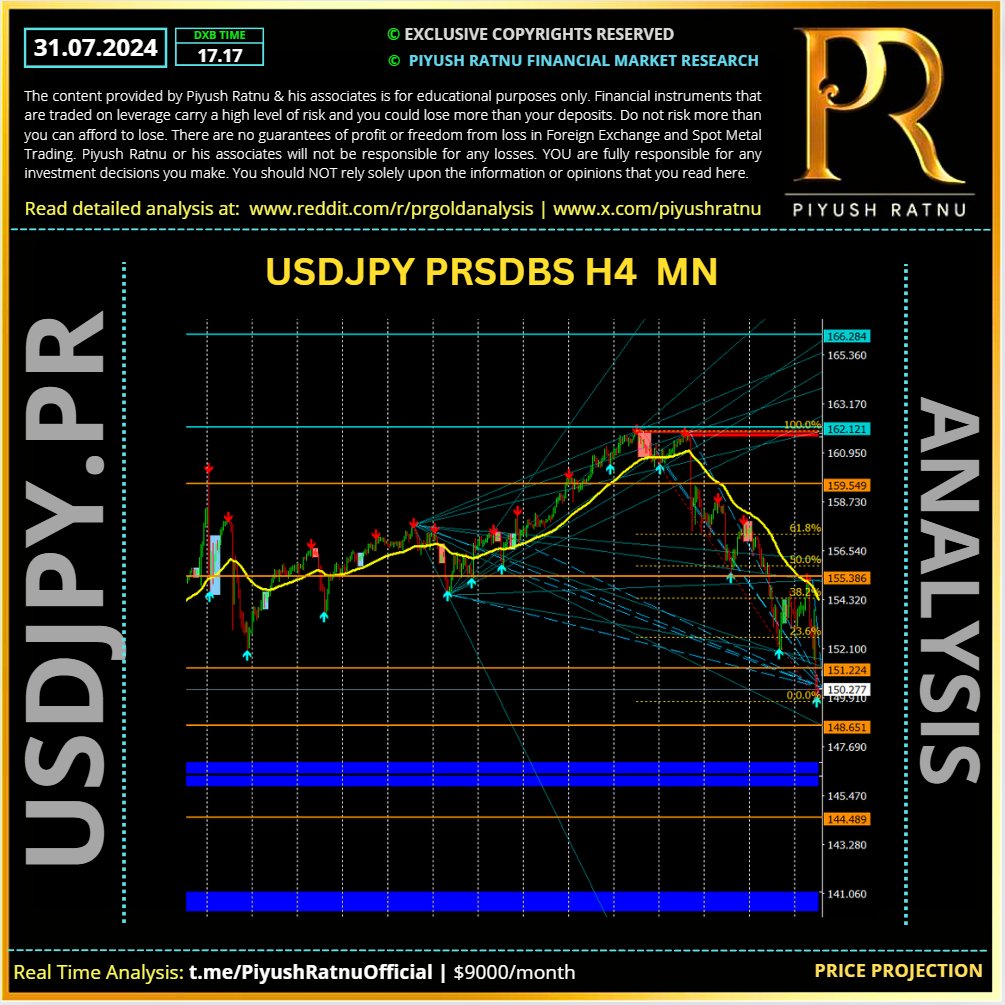

#USDJPY #Yen #Forex #Trading #PiyushRatnu

$142.170 target achieved

Buying zone As projected on 31.07.2024

Power of YEN! We alerted in advance!

https://www.cnbc.com/2024/08/02/carry-trade-how-japans-yen-could-be-ripping-through-us-stocks.html

https://www.reuters.com/markets/currencies/yen-rises-7-month-highs-us-slowdown-fears-carry-over-2024-08-05/

Verify at: https://x.com/piyushratnu/status/1818639008752075226

$142.170 target achieved

Buying zone As projected on 31.07.2024

Power of YEN! We alerted in advance!

https://www.cnbc.com/2024/08/02/carry-trade-how-japans-yen-could-be-ripping-through-us-stocks.html

https://www.reuters.com/markets/currencies/yen-rises-7-month-highs-us-slowdown-fears-carry-over-2024-08-05/

Verify at: https://x.com/piyushratnu/status/1818639008752075226

Piyush Lalsingh Ratnu

NFP Impact:

Data: Negative

indicates: IRC chances higher

USD - XAUUSD +

USDJPY crashed: 149.080-147.080

Net crash 2000P

Possible impact on XAUUSD: $55-65++ observed till now $20

Target zones of USDJPY: $147849-146.967 was projected by me on 31 July 2024.Achieved successfully on 02 Aug. 2024.

Target Zones: $2469+ / $2472 R2 PRSRSDBS D1 format,

$2478 PRSRSDBS MN format projected by me today morning 08.35 hours: achieved successfully at 16.45 hours after NFP data.

CMP $2475 Avoid Short orders.

#NFP #Gold #XAUUSD #PiyushRatnu #Trading #forex

Data: Negative

indicates: IRC chances higher

USD - XAUUSD +

USDJPY crashed: 149.080-147.080

Net crash 2000P

Possible impact on XAUUSD: $55-65++ observed till now $20

Target zones of USDJPY: $147849-146.967 was projected by me on 31 July 2024.Achieved successfully on 02 Aug. 2024.

Target Zones: $2469+ / $2472 R2 PRSRSDBS D1 format,

$2478 PRSRSDBS MN format projected by me today morning 08.35 hours: achieved successfully at 16.45 hours after NFP data.

CMP $2475 Avoid Short orders.

#NFP #Gold #XAUUSD #PiyushRatnu #Trading #forex

Piyush Lalsingh Ratnu

#Iran #Israel #XAUUSD #NFP #PiyushRatnu Iranian commanders are considering a combination of drones and missiles on military targets around Tel Aviv and Haifa while avoiding civilian targets, the New York Times reported. Iran is also considered a coordinated attack with its proxies in Yemen, Syria and Iraq, it said.

This might result in $50+ price rise in XAUUSD in a single day, hence avoid big SHORT positions.

This might result in $50+ price rise in XAUUSD in a single day, hence avoid big SHORT positions.

: