Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

3

sinais

|

1

assinantes

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

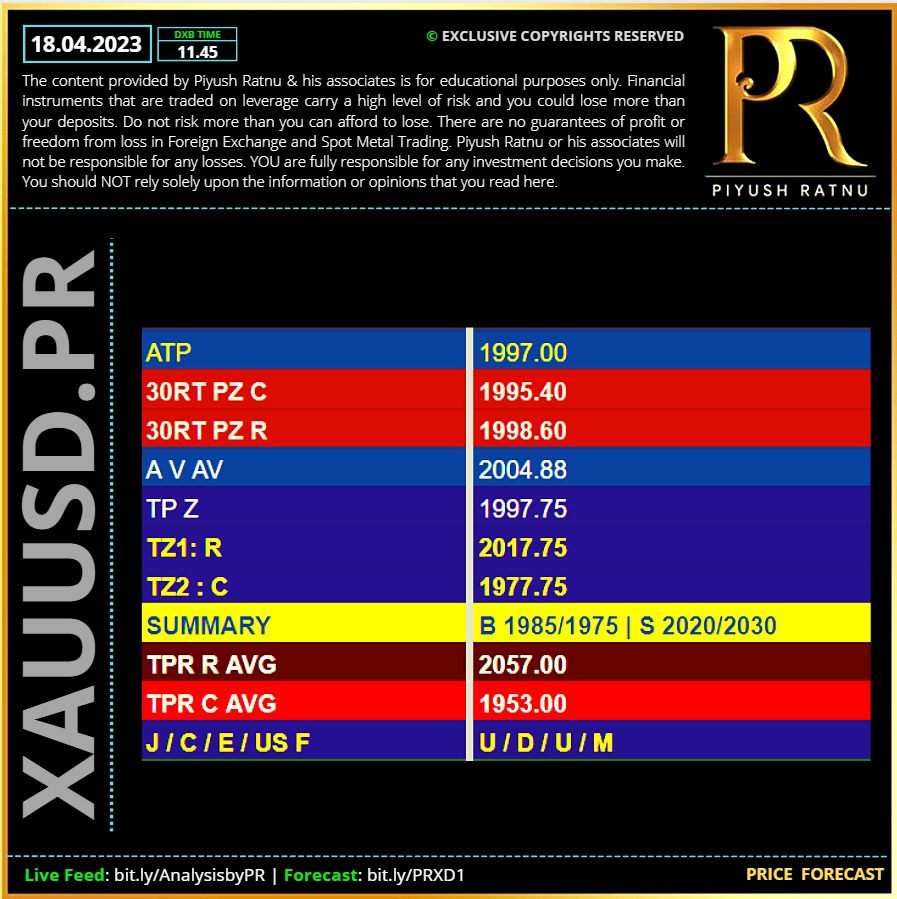

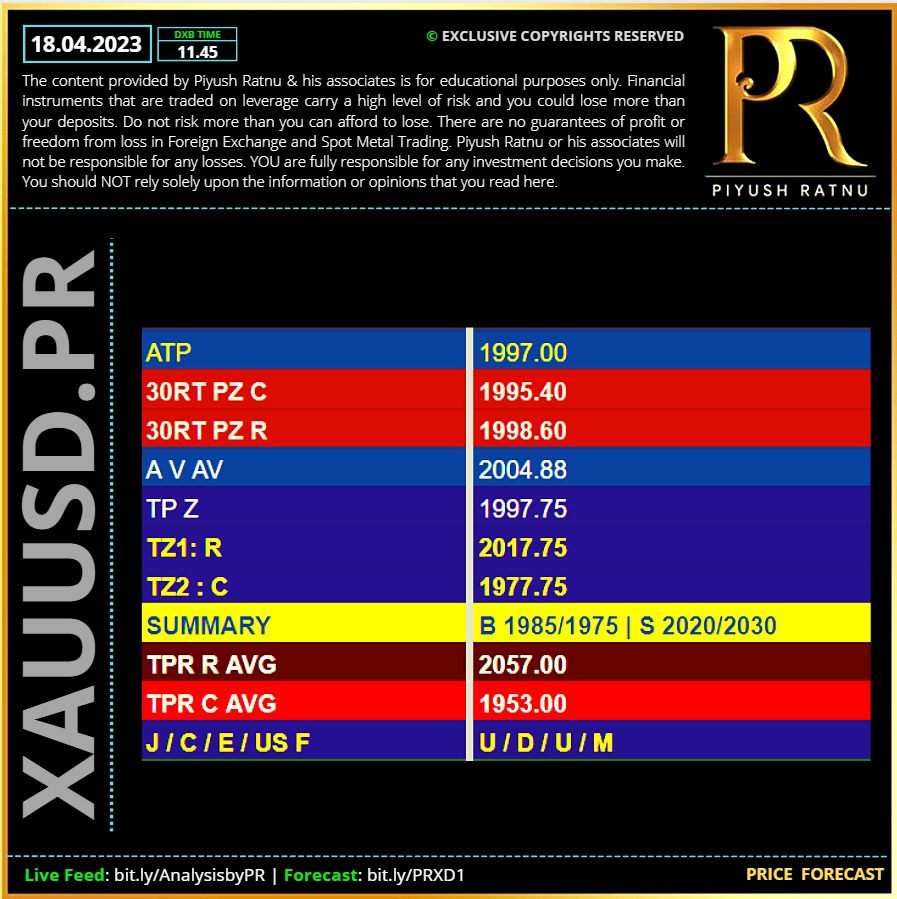

18.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

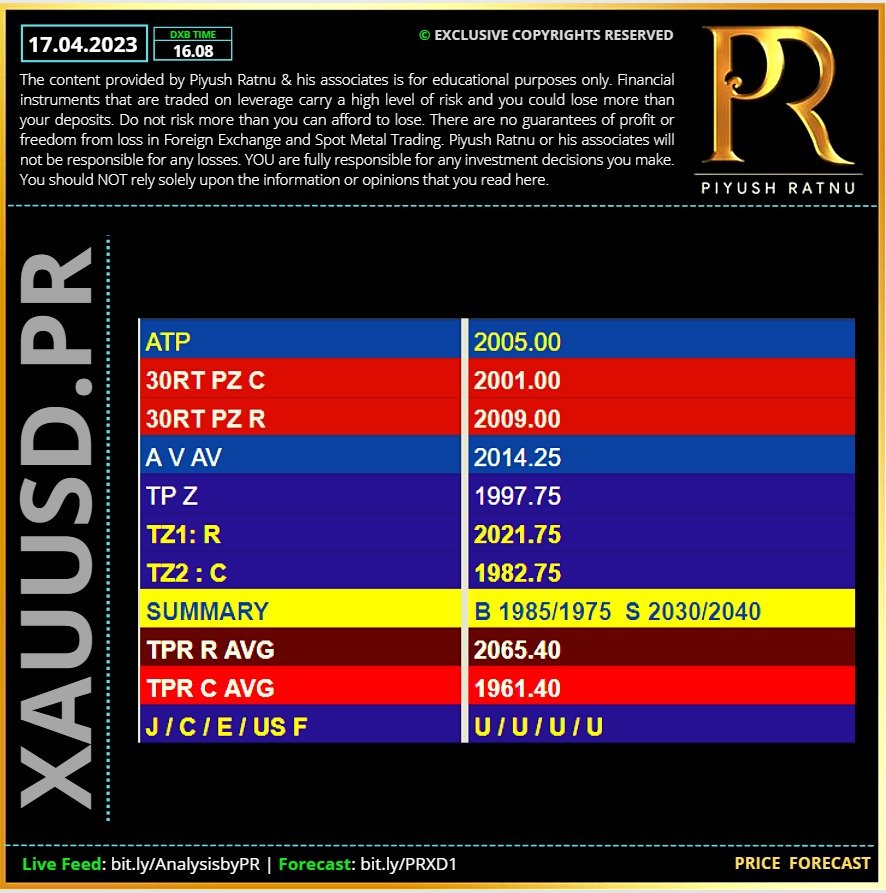

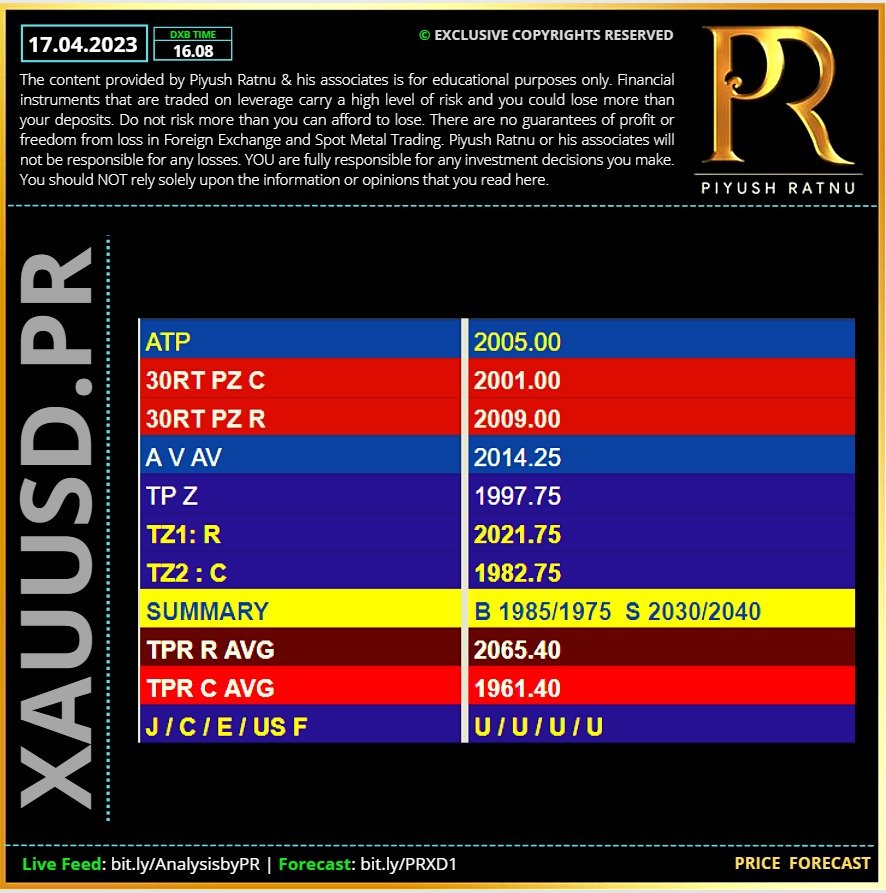

17.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

POF: Impact on USD due to following factors: Chinese Data

Market Cycle

Earnings

TIC NLT

US T Bonds

GBP Claimant Count

Housing-Building Data

Bowman Speech Co-relations:

USD S

JPY S

DXY

US F

XAUXAG

USDCNY

USDJPY

Miners Stocks

XAGUSD SD

PRSDBS

PLZ XAUUSD

Fed M Statements

WGC ETF SD Data

3 years: track record/patterns

PRFIB

PRSRZ D1 MN W1

PRTP AV Zones

All eyes will be on the comments from Fed officials and Friday’s S&P Global Preliminary PMIs from the United States for Fed rate hike prospects, which will have a significant bearing on the US Dollar valuations, as well as, on the USD-denominated Gold price. From the United States economic docket, the Housing Starts and Building Permits could be eyed ahead of a speech from Federal Reserve Governor Michelle Bowman. Crucial Price Zones: R: 2020-2045-2069 (S)

C: 1985-1966-1947 (B) 🆘Those who are not well versed with economics, market cycles, trading zones, price factors, co-relations and fundamentals, should not assume/gamble on the basis of their own assumptions/flukes, please first read, backtrack, understand, analyse and then implement trades with risk management in place. Always remember to invest only as much as you can afford to lose and recover.

Market Cycle

Earnings

TIC NLT

US T Bonds

GBP Claimant Count

Housing-Building Data

Bowman Speech Co-relations:

USD S

JPY S

DXY

US F

XAUXAG

USDCNY

USDJPY

Miners Stocks

XAGUSD SD

PRSDBS

PLZ XAUUSD

Fed M Statements

WGC ETF SD Data

3 years: track record/patterns

PRFIB

PRSRZ D1 MN W1

PRTP AV Zones

All eyes will be on the comments from Fed officials and Friday’s S&P Global Preliminary PMIs from the United States for Fed rate hike prospects, which will have a significant bearing on the US Dollar valuations, as well as, on the USD-denominated Gold price. From the United States economic docket, the Housing Starts and Building Permits could be eyed ahead of a speech from Federal Reserve Governor Michelle Bowman. Crucial Price Zones: R: 2020-2045-2069 (S)

C: 1985-1966-1947 (B) 🆘Those who are not well versed with economics, market cycles, trading zones, price factors, co-relations and fundamentals, should not assume/gamble on the basis of their own assumptions/flukes, please first read, backtrack, understand, analyse and then implement trades with risk management in place. Always remember to invest only as much as you can afford to lose and recover.

Piyush Lalsingh Ratnu

XAUUSD under PPZ: ideal to avoid trades and enter below S1-6/9 or R1+6/9 | Target Exit NAP. 🟢

US Economic Data: None

ECB Speech 19.00 hours.

Technically - in co-relation:

USDJPY has crossed V: R1 zone: further rise can add pressure on XAUUSD resulting in 1985/1966 zone, reversal: USDJPY S1/-300/600 = XAUUSD $2036/2046 🆘

What is moving XAUUSD price: Please note:

Gold and the USDX have been moving in a mirror-like fashion for about a year.

Silver trading volume increased visibly as well during Friday’s decline. When did that happen after a sizable short-term rally as well? In early 2023. And yes – that’s when the rally ended.

Excitement is building among precious metals investors as gold prices continue to push up toward record highs.

Gold is on track to post its highest ever weekly close at over $2,000 per ounce. If the upside momentum carries forward in this week, a powerful breakout could ensue as short sellers are forced to capitulate.

Metals markets are being buoyed by dollar weakness. On Thursday, the U.S. Dollar Index sunk to a new low for the year (100.450).

Growing worries about a deeper global economic downturn turns out to be a key factor lending some support to the safe-haven Gold price amid expectations for an imminent pause in the rate-hiking cycle by the Federal Reserve (Fed).

⚠️Fears surrounding China’s ties with Russia and the resulting geopolitical tension, as well as the recent retreat in the US Treasury bond yields weigh on the Gold price.

An impressive bank earning seem to have eased fears about a banking crisis that unfolded in March. Adding to this, the Retail Sales report released from the United States (US) on Friday suggested that the economy is not so bad and remained supportive of a generally positive tone around the equity markets.

⚠️Despite the softer US consumer inflation and the Producer Price Index released last week, Fed Governor Christopher Waller on Friday called for further rate hikes and said that the job was still not done as inflation remains far too high. The markets were quick to react and are now pricing in a greater chance of another 25 basis point (bps) lift-off at the next Federal Open Market Committee (FOMC) policy meeting in May.

This remains supportive of elevated US Treasury bond yields, which, in turn, assists the USD to build on Friday's goodish rebound from a one-year low and gain follow-through traction for the second successive day. A stronger Greenback tends to undermine demand for the US Dollar-denominated Gold price.

14.04.2023: The data from China, the biggest gold consumer of the world, showed on Thursday that the trade surplus narrowed to $89.19 billion in March from $116.8 billion in February. This reading came in much better than the market expectation for a surplus of $39.2 billion and provided an additional boost to Gold price.

First-quarter Gross Domestic Product (GDP) growth figure alongside March Retail Sales data will be featured in the Chinese economic docket on Tuesday. Considering the positive impact of the upbeat Chinese trade balance data on Gold price, XAU/USD could be expected to push higher on upbeat data and vice versa.

Static resistance seems to have formed at $2,040 following the action seen in the second half of the week. Above that level, $2,050 (static level from March 2022) aligns as the next resistance ahead of $2,070 (March 8, 2022, high).

POF:

Gold price remains indecisive after luring bears the previous day.

US Dollar tracks Treasury bond yields amid mixed concerns about recession, US debt ceiling talks.

China-linked headlines, light calendar adds strength to the XAU/USD inaction.

US PMIs, central bank talks will be important to watch for clear directions.

Hawkish Federal Reserve talks, resilient United States data underpin US Dollar’s corrective bounce

US Dollar rebound prods XAU/USD bulls ahead of Purchasing Managers Indexes for April

Looking forward, the Gold price may remain sluggish ahead of Tuesday’s China GDP, which in turn can allow the XAU/USD to witness a pullback in case of downbeat growth numbers from the world’s biggest Gold consumers. Following that, Friday’s preliminary readings of US PMIs for April will be important for clear directions.

🆘Important Price Zones:

C: $2000/1966/1947

R: $2036/2066/2096

Overall, Gold price struggles for clear directions but the buyers seem running out of fuel of late. The early-month swing high around $2,033 and the monthly peak surrounding $2,049 can lure the XAU/USD bulls.

US Economic Data: None

ECB Speech 19.00 hours.

Technically - in co-relation:

USDJPY has crossed V: R1 zone: further rise can add pressure on XAUUSD resulting in 1985/1966 zone, reversal: USDJPY S1/-300/600 = XAUUSD $2036/2046 🆘

What is moving XAUUSD price: Please note:

Gold and the USDX have been moving in a mirror-like fashion for about a year.

Silver trading volume increased visibly as well during Friday’s decline. When did that happen after a sizable short-term rally as well? In early 2023. And yes – that’s when the rally ended.

Excitement is building among precious metals investors as gold prices continue to push up toward record highs.

Gold is on track to post its highest ever weekly close at over $2,000 per ounce. If the upside momentum carries forward in this week, a powerful breakout could ensue as short sellers are forced to capitulate.

Metals markets are being buoyed by dollar weakness. On Thursday, the U.S. Dollar Index sunk to a new low for the year (100.450).

Growing worries about a deeper global economic downturn turns out to be a key factor lending some support to the safe-haven Gold price amid expectations for an imminent pause in the rate-hiking cycle by the Federal Reserve (Fed).

⚠️Fears surrounding China’s ties with Russia and the resulting geopolitical tension, as well as the recent retreat in the US Treasury bond yields weigh on the Gold price.

An impressive bank earning seem to have eased fears about a banking crisis that unfolded in March. Adding to this, the Retail Sales report released from the United States (US) on Friday suggested that the economy is not so bad and remained supportive of a generally positive tone around the equity markets.

⚠️Despite the softer US consumer inflation and the Producer Price Index released last week, Fed Governor Christopher Waller on Friday called for further rate hikes and said that the job was still not done as inflation remains far too high. The markets were quick to react and are now pricing in a greater chance of another 25 basis point (bps) lift-off at the next Federal Open Market Committee (FOMC) policy meeting in May.

This remains supportive of elevated US Treasury bond yields, which, in turn, assists the USD to build on Friday's goodish rebound from a one-year low and gain follow-through traction for the second successive day. A stronger Greenback tends to undermine demand for the US Dollar-denominated Gold price.

14.04.2023: The data from China, the biggest gold consumer of the world, showed on Thursday that the trade surplus narrowed to $89.19 billion in March from $116.8 billion in February. This reading came in much better than the market expectation for a surplus of $39.2 billion and provided an additional boost to Gold price.

First-quarter Gross Domestic Product (GDP) growth figure alongside March Retail Sales data will be featured in the Chinese economic docket on Tuesday. Considering the positive impact of the upbeat Chinese trade balance data on Gold price, XAU/USD could be expected to push higher on upbeat data and vice versa.

Static resistance seems to have formed at $2,040 following the action seen in the second half of the week. Above that level, $2,050 (static level from March 2022) aligns as the next resistance ahead of $2,070 (March 8, 2022, high).

POF:

Gold price remains indecisive after luring bears the previous day.

US Dollar tracks Treasury bond yields amid mixed concerns about recession, US debt ceiling talks.

China-linked headlines, light calendar adds strength to the XAU/USD inaction.

US PMIs, central bank talks will be important to watch for clear directions.

Hawkish Federal Reserve talks, resilient United States data underpin US Dollar’s corrective bounce

US Dollar rebound prods XAU/USD bulls ahead of Purchasing Managers Indexes for April

Looking forward, the Gold price may remain sluggish ahead of Tuesday’s China GDP, which in turn can allow the XAU/USD to witness a pullback in case of downbeat growth numbers from the world’s biggest Gold consumers. Following that, Friday’s preliminary readings of US PMIs for April will be important for clear directions.

🆘Important Price Zones:

C: $2000/1966/1947

R: $2036/2066/2096

Overall, Gold price struggles for clear directions but the buyers seem running out of fuel of late. The early-month swing high around $2,033 and the monthly peak surrounding $2,049 can lure the XAU/USD bulls.

Piyush Lalsingh Ratnu

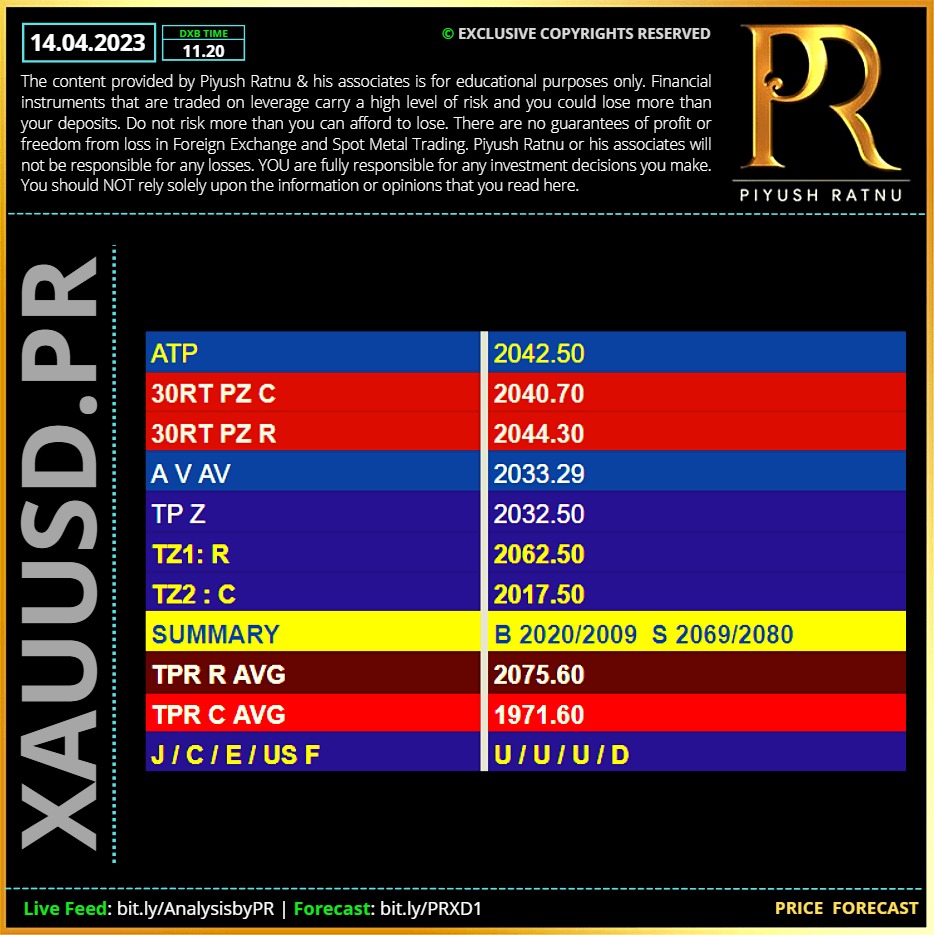

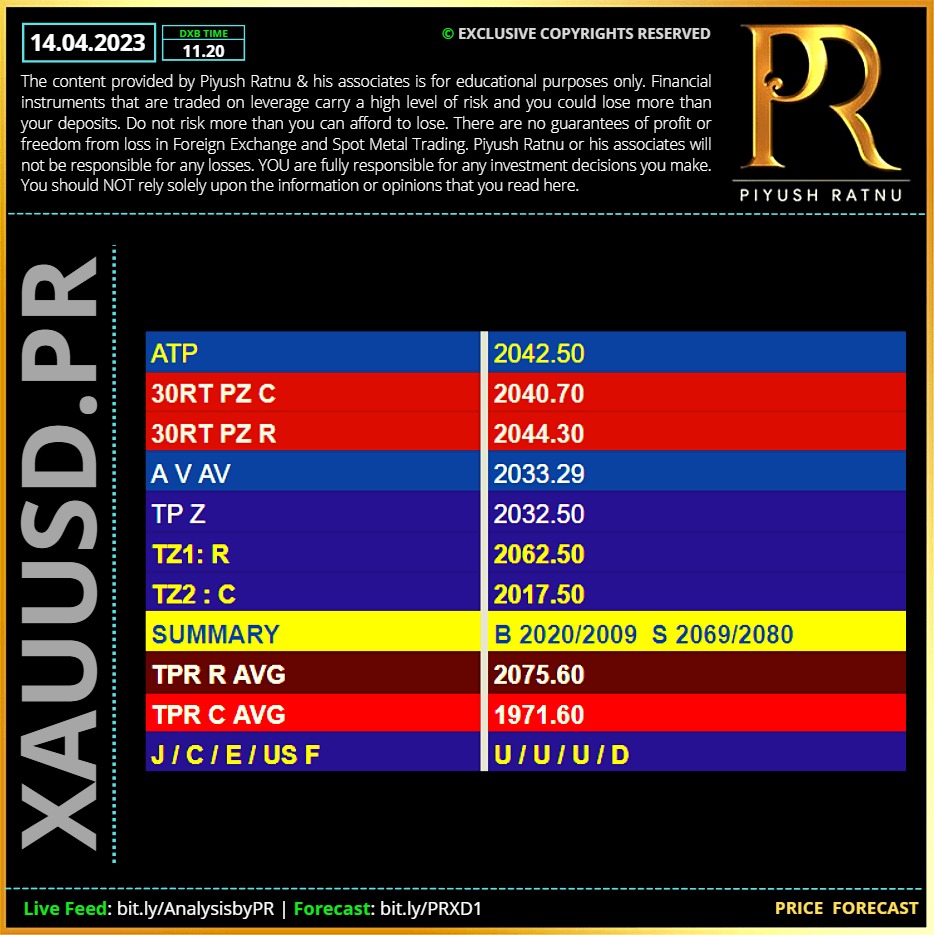

14.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

POF:

🟢Core Retail Sales (MoM) (Mar) 16.30

Export Price Index (MoM) (Mar)

Import Price Index (MoM) (Mar) 16.30

Retail Sales (MoM) (Mar) 16.30

🆘Bank Earnings

FED Balance Sheet

Reserve Balances FRB

US10YT 3.447

DXY 100.600 ⏰

USDJPY 132.500

USDCNY 6.8456

US F +++ SYN

USD S 61

JPY 2 40

AUD S 20

A gauge of global stocks headed for its highest close in 10 weeks on speculation the Federal Reserve and other central banks are nearing the end of their hiking cycles. The dollar extended declines. Impact: USD - XAUUSD +

Investors will remain wary of any indication that the regional banking turmoil has translated into materially tighter lending standards throughout the system. As US banks kick off the earnings season later on Friday, “even confirmation that lenders are taking a more conservative approach will offer no ‘obvious’ market implications in light of the fact 10-year yields are already trading in a sub-3.50% range.

🆘China’s largest banks are planning at least 40 billion yuan ($5.9 billion) of bond sales, kicking off a major funding push to comply with global capital requirements by early 2025.

Regional banks across the US reported a surge in lending to a group of well-connected people: their own directors, officers and major shareholders. WHY? 🟢

None of the lenders or their officers, directors or major shareholders has been accused of wrongdoing. The banks have said they extended credit on similar terms to insiders as they did to other clients. And lending, more broadly, at regional banks was up during the period. Some of the reported increase in insider loans was new borrowing, while some was the result of changes on boards, in executive suites and among top shareholders.

Such financing has featured in a number of decades-old financial scandals. Loans to officers, directors and major shareholders now require public disclosures and are regularly scrutinized as part of the Fed’s ongoing supervision of banks.

In general, loans to insiders tend to represent a small share of the overall credit that regional banks extend to customers. But regulators have long focused on the transactions because of their potential for abuse.

In the savings-and-loan crisis, more than 1,000 small and midsize lenders failed, and the government spent years scrutinizing the role that abuse and fraud by owners and executives played in encouraging risky lending practices. Taxpayers wound up on the hook for as much as $124 billion to resolve the industry’s troubled firms.

XAUUSD: A PULLBACK on the cards before a rise.

Earlier this week, the US Consumer Price Index data showed an annual increase in the inflation rate by 5.0%, while the month-on-month CPI rise was 0.1% in March. The all-items index increased 5.0% for the 12 months ending March, registering the smallest 12-month increase since the period ending May 2021. In the face of softening inflation in the United States, markets are now convinced that the Fed could pause its tightening cycle in June and deliver rate cuts before the end of the year.

The 5-year Consumer Inflation Expectations will be reported and could likely have a strong bearing on the Fed expectations.

The US Retail Sales are seen falling by 0.4% in March on a monthly basis while the Core Retail Sales are seen lower by 0.3% MoM in the reported period. The University of Michigan's Preliminary Consumer Sentiment data is expected to hold steady at 62.0 in April.

Implement range based trading: $2069/2009 crucial.🆘

CMP $2038.00 🟢

🟢Core Retail Sales (MoM) (Mar) 16.30

Export Price Index (MoM) (Mar)

Import Price Index (MoM) (Mar) 16.30

Retail Sales (MoM) (Mar) 16.30

🆘Bank Earnings

FED Balance Sheet

Reserve Balances FRB

US10YT 3.447

DXY 100.600 ⏰

USDJPY 132.500

USDCNY 6.8456

US F +++ SYN

USD S 61

JPY 2 40

AUD S 20

A gauge of global stocks headed for its highest close in 10 weeks on speculation the Federal Reserve and other central banks are nearing the end of their hiking cycles. The dollar extended declines. Impact: USD - XAUUSD +

Investors will remain wary of any indication that the regional banking turmoil has translated into materially tighter lending standards throughout the system. As US banks kick off the earnings season later on Friday, “even confirmation that lenders are taking a more conservative approach will offer no ‘obvious’ market implications in light of the fact 10-year yields are already trading in a sub-3.50% range.

🆘China’s largest banks are planning at least 40 billion yuan ($5.9 billion) of bond sales, kicking off a major funding push to comply with global capital requirements by early 2025.

Regional banks across the US reported a surge in lending to a group of well-connected people: their own directors, officers and major shareholders. WHY? 🟢

None of the lenders or their officers, directors or major shareholders has been accused of wrongdoing. The banks have said they extended credit on similar terms to insiders as they did to other clients. And lending, more broadly, at regional banks was up during the period. Some of the reported increase in insider loans was new borrowing, while some was the result of changes on boards, in executive suites and among top shareholders.

Such financing has featured in a number of decades-old financial scandals. Loans to officers, directors and major shareholders now require public disclosures and are regularly scrutinized as part of the Fed’s ongoing supervision of banks.

In general, loans to insiders tend to represent a small share of the overall credit that regional banks extend to customers. But regulators have long focused on the transactions because of their potential for abuse.

In the savings-and-loan crisis, more than 1,000 small and midsize lenders failed, and the government spent years scrutinizing the role that abuse and fraud by owners and executives played in encouraging risky lending practices. Taxpayers wound up on the hook for as much as $124 billion to resolve the industry’s troubled firms.

XAUUSD: A PULLBACK on the cards before a rise.

Earlier this week, the US Consumer Price Index data showed an annual increase in the inflation rate by 5.0%, while the month-on-month CPI rise was 0.1% in March. The all-items index increased 5.0% for the 12 months ending March, registering the smallest 12-month increase since the period ending May 2021. In the face of softening inflation in the United States, markets are now convinced that the Fed could pause its tightening cycle in June and deliver rate cuts before the end of the year.

The 5-year Consumer Inflation Expectations will be reported and could likely have a strong bearing on the Fed expectations.

The US Retail Sales are seen falling by 0.4% in March on a monthly basis while the Core Retail Sales are seen lower by 0.3% MoM in the reported period. The University of Michigan's Preliminary Consumer Sentiment data is expected to hold steady at 62.0 in April.

Implement range based trading: $2069/2009 crucial.🆘

CMP $2038.00 🟢

Piyush Lalsingh Ratnu

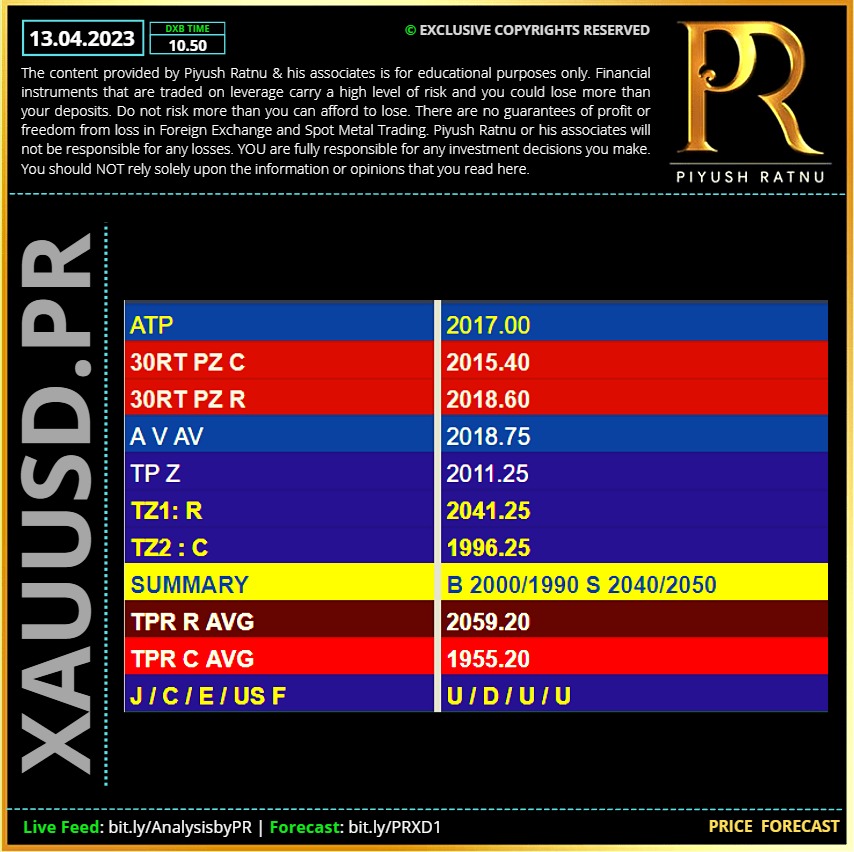

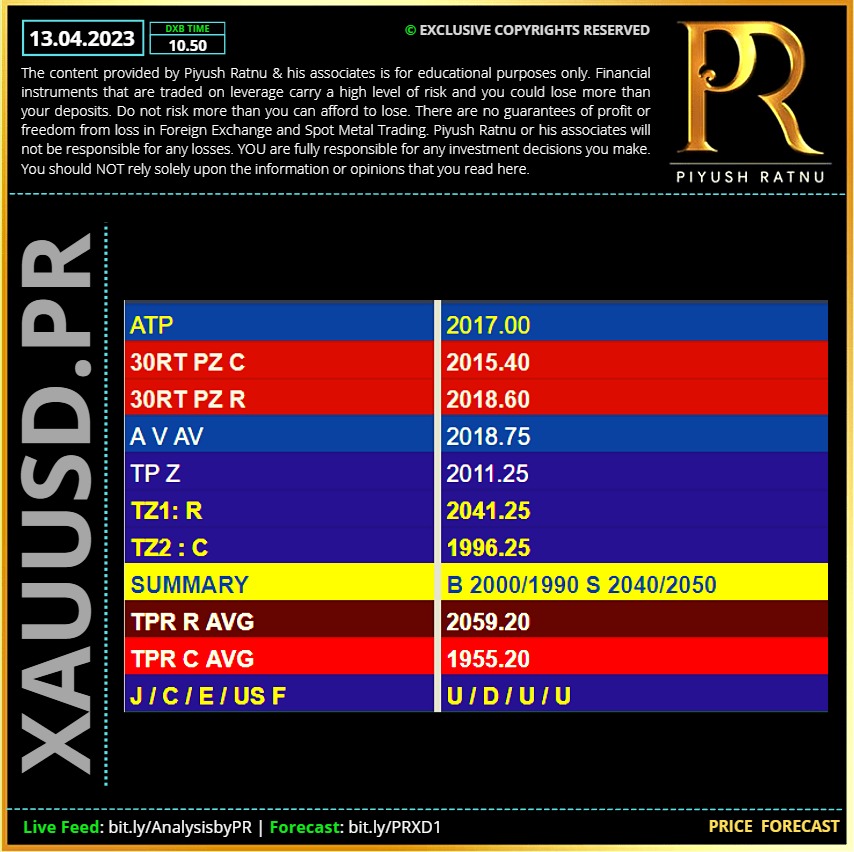

13.04.2023 | PRSDBS | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

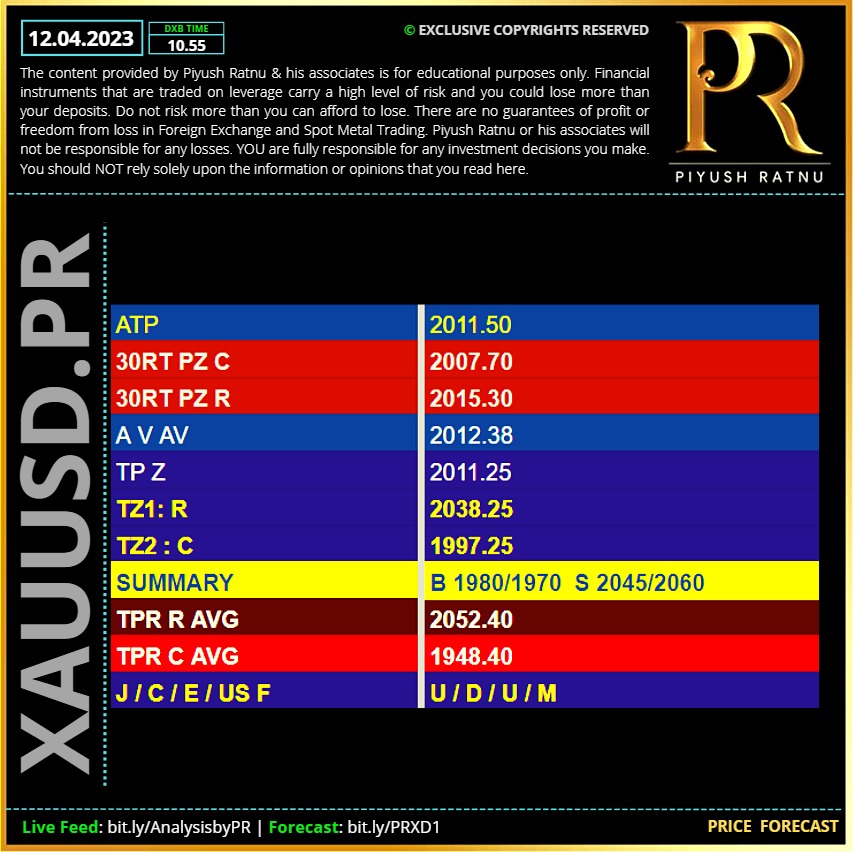

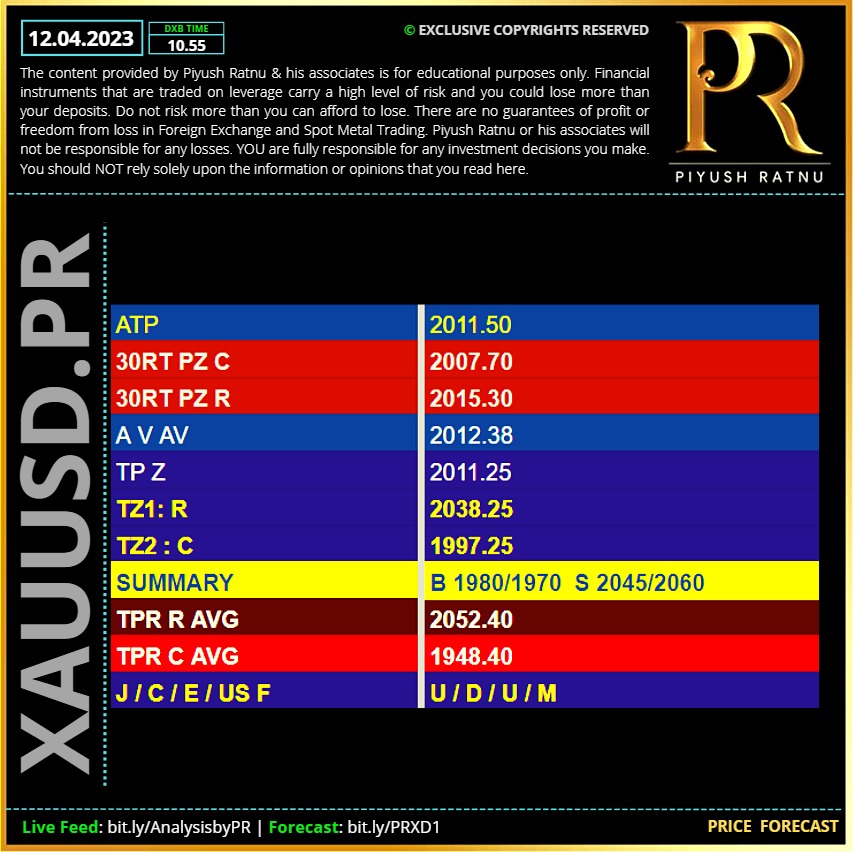

Piyush Lalsingh Ratnu

12.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

Current status: FUNDAMENTALS:

Why Gold is rising?

Full markets returned on Tuesday, following the Easter long holiday. However, that failed to cheer the United States Dollar (USD) bulls, as the Greenback snapped the previous week’s recovery mode and turned south, tracking the pullback in the US Treasury bond yields. Investors resorting to position adjustment, gearing up for the high-impact economic events from the United States due midweek.

On Good Friday, the US Dollar rallied hard after a strong US labor market report boosted the odds of 25 basis points May rate hike by the Federal Reserve to 71%. With expectations of soft inflation data on Wednesday, markets are now pricing a 67% probability of a quarter percentage point rate increase next month. The revival of the dovish Federal Reserve interest rate bet weighs heavily on the US Dollar, boding well for the non-interest-bearing and the USD-denominated Gold price.

Economists are expected the United States Consumer Price Index to drop sharply to 5.2% YoY in March vs. 6.0% seen previously while the monthly headline figure is seen a tad lower at 0.3% in the reported month. Meanwhile, the annualized Core Consumer Price Index is likely to accelerate from 5.5% to 5.6% in March. The Core CPI MoM is foreseen at 0.4% in March as against a 0.5% growth booked in February.

Softer-than-expected headline numbers combined with a downside surprise in the annualized Core CPI clip could reinforce expectations of a Federal Reserve pause as early as next month while bringing Fed rate cuts bets for this year back on the table.

The dovish Fed outlook could trigger a fresh downswing in the US Treasury bond yields across the curve, eventually smashing the US Dollar bulls across the board. As a result, Gold price could extend the renewed upside to test the $2045.

Reversal: XAUUSD can crash back to $1990/1966 zone.

Fears over a potential US recession could resurface on hot US inflation data, especially after the International Monetary Fund (IMF) revised the global real Gross Domestic Product growth for 2023 to 2.8% from 2.9% in January's report.

The Fed Minutes will be also closely scrutinized for the future rate path debated by the board members in the March policy meeting. Any surprise in the Minutes could also stir volatility around the Gold price.

Meanwhile, concerns about a recession keep growing. Sluggish macroeconomic data and the unexpected OPEC+ decision to cut oil output fueled a dismal market mood, which seems to be temporarily on pause. Still, risk-averse environments hardly benefit the Greenback these days, with Gold making the most of it.

Why Gold is rising?

Full markets returned on Tuesday, following the Easter long holiday. However, that failed to cheer the United States Dollar (USD) bulls, as the Greenback snapped the previous week’s recovery mode and turned south, tracking the pullback in the US Treasury bond yields. Investors resorting to position adjustment, gearing up for the high-impact economic events from the United States due midweek.

On Good Friday, the US Dollar rallied hard after a strong US labor market report boosted the odds of 25 basis points May rate hike by the Federal Reserve to 71%. With expectations of soft inflation data on Wednesday, markets are now pricing a 67% probability of a quarter percentage point rate increase next month. The revival of the dovish Federal Reserve interest rate bet weighs heavily on the US Dollar, boding well for the non-interest-bearing and the USD-denominated Gold price.

Economists are expected the United States Consumer Price Index to drop sharply to 5.2% YoY in March vs. 6.0% seen previously while the monthly headline figure is seen a tad lower at 0.3% in the reported month. Meanwhile, the annualized Core Consumer Price Index is likely to accelerate from 5.5% to 5.6% in March. The Core CPI MoM is foreseen at 0.4% in March as against a 0.5% growth booked in February.

Softer-than-expected headline numbers combined with a downside surprise in the annualized Core CPI clip could reinforce expectations of a Federal Reserve pause as early as next month while bringing Fed rate cuts bets for this year back on the table.

The dovish Fed outlook could trigger a fresh downswing in the US Treasury bond yields across the curve, eventually smashing the US Dollar bulls across the board. As a result, Gold price could extend the renewed upside to test the $2045.

Reversal: XAUUSD can crash back to $1990/1966 zone.

Fears over a potential US recession could resurface on hot US inflation data, especially after the International Monetary Fund (IMF) revised the global real Gross Domestic Product growth for 2023 to 2.8% from 2.9% in January's report.

The Fed Minutes will be also closely scrutinized for the future rate path debated by the board members in the March policy meeting. Any surprise in the Minutes could also stir volatility around the Gold price.

Meanwhile, concerns about a recession keep growing. Sluggish macroeconomic data and the unexpected OPEC+ decision to cut oil output fueled a dismal market mood, which seems to be temporarily on pause. Still, risk-averse environments hardly benefit the Greenback these days, with Gold making the most of it.

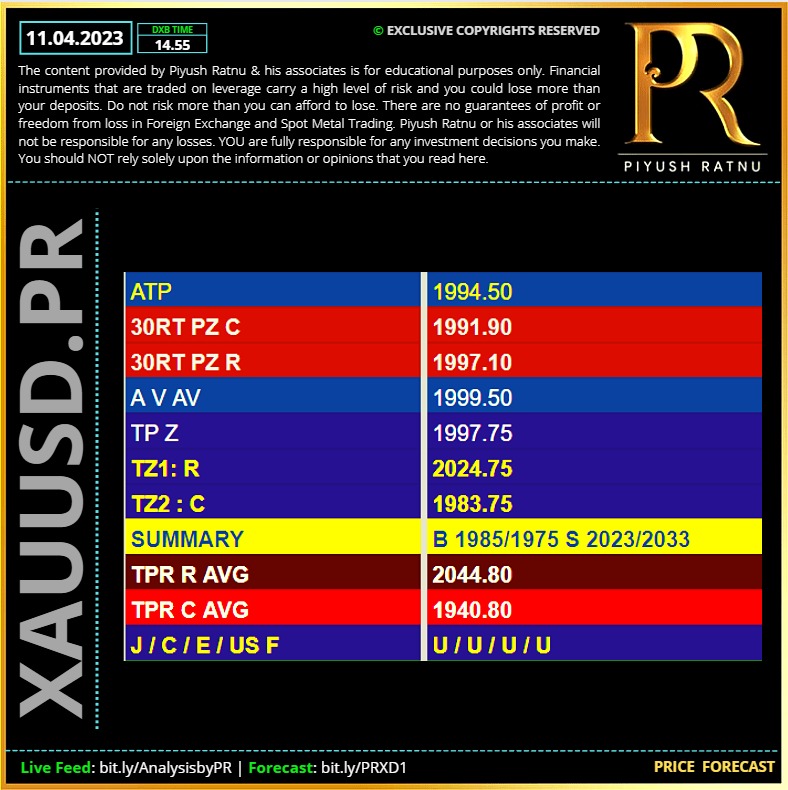

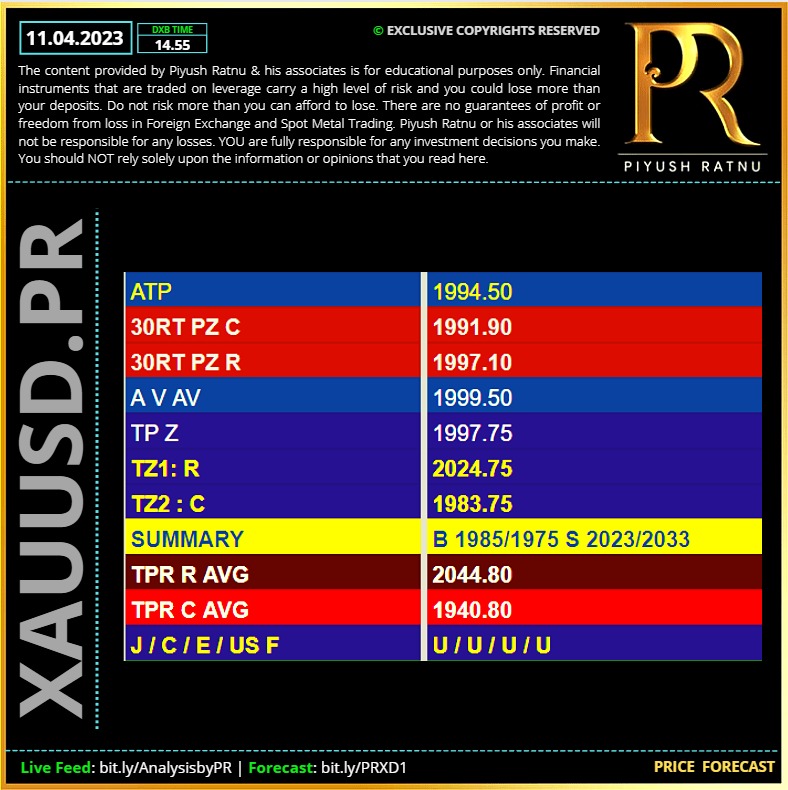

Piyush Lalsingh Ratnu

11.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

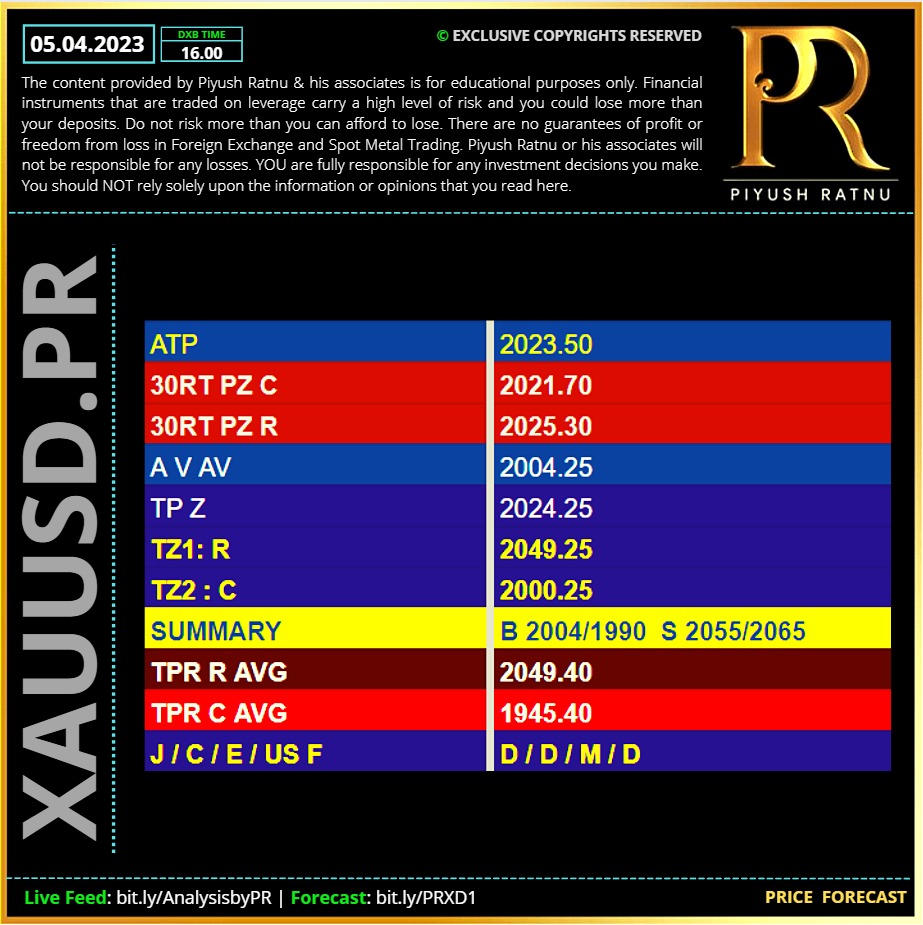

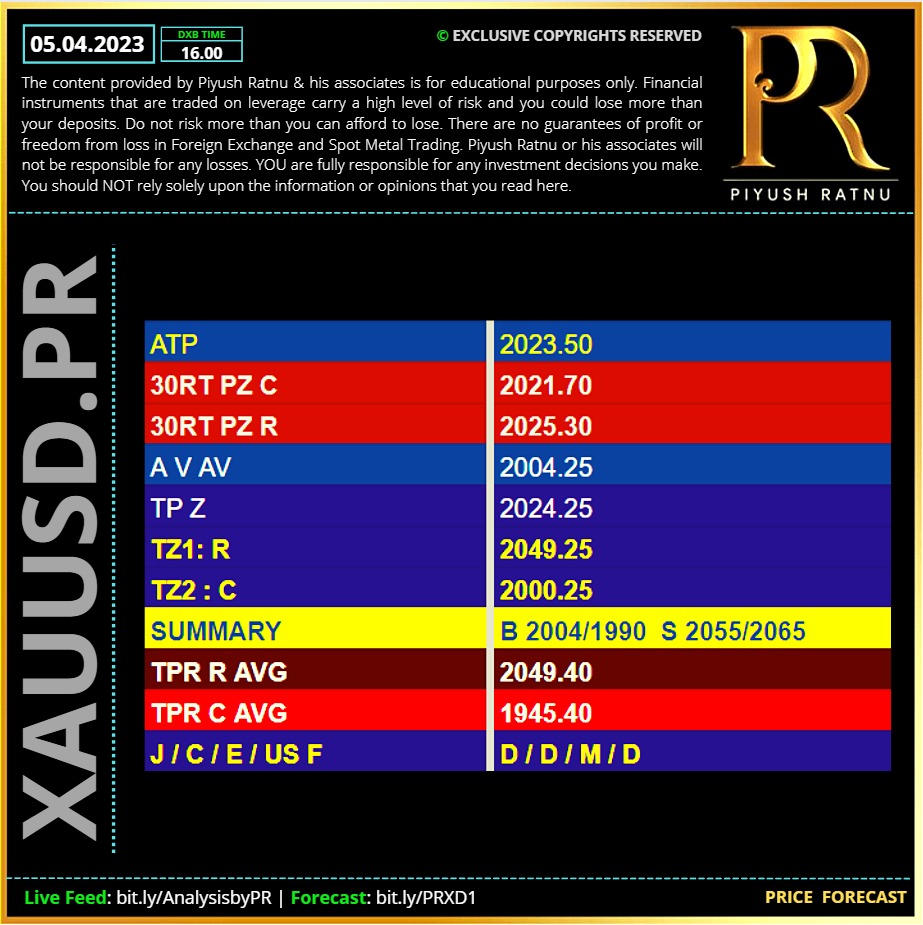

04.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

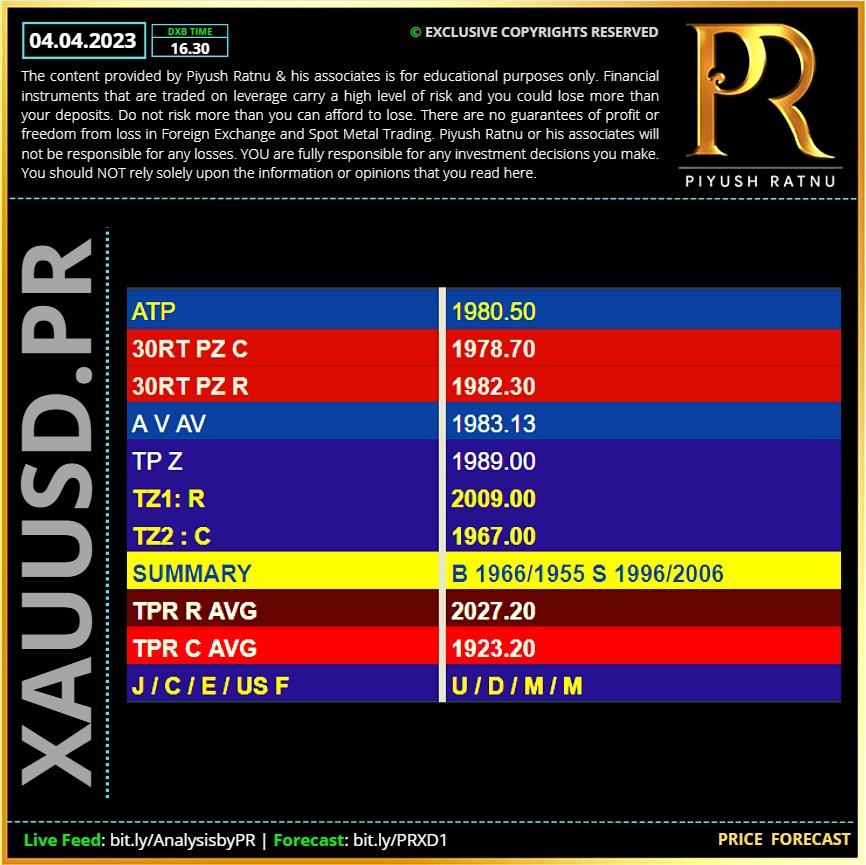

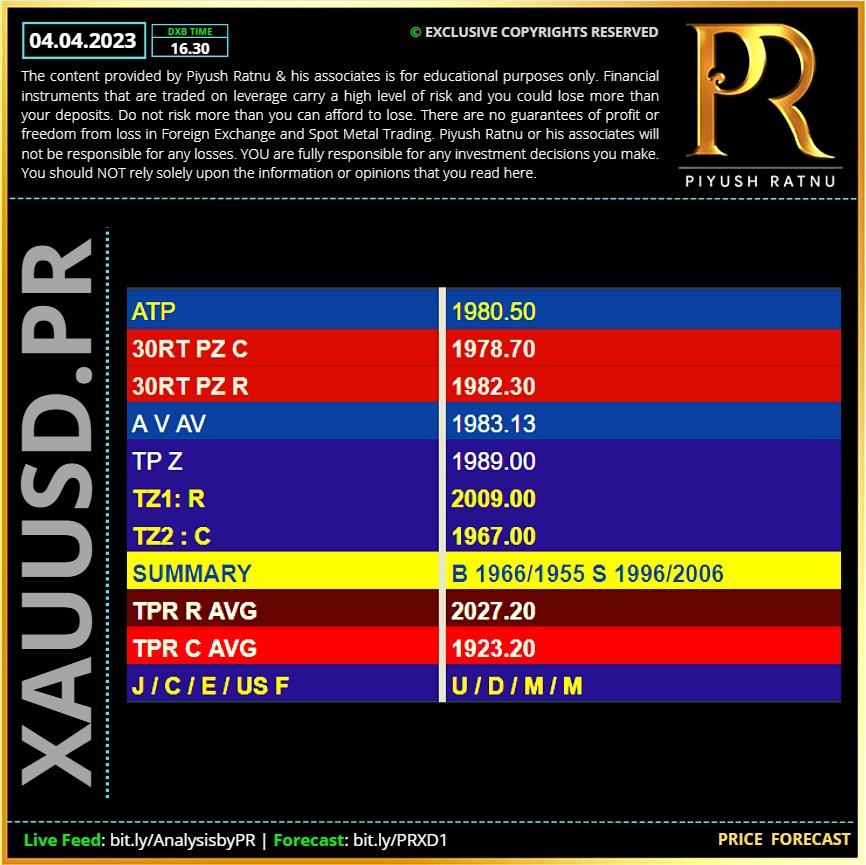

Piyush Lalsingh Ratnu

The US Dollar falls alongside Wall Street, with the three major indexes trading deep in the red, while US government bond yields are also down amid signs of a slowing labor market. The 10-year Treasury note yields 3.34%, down 9 basis points, while the 2-year note offers 3.84%, down 13 bps for the day.

Yesterday, The US published the February Job Openings and Labor Turnover Survey (JOLTS), which showed that the number of available positions in the month totalled 9.93 million, below 10 million for the first time in nearly two years. At the same time, the January figure was downwardly revised to 10.56 million. The poor figures suggest that the Federal Reserve (Fed) measures are actually cooling the labor market. Meanwhile, Factory Orders in the same month declined by 0.7%, worse than the 0.5% fall anticipated.

With the United States economic data emerging back as the market movers, Gold traders eagerly await the Automatic Data Processing (ADP) Employment Change and ISM Services PMI data for fresh hints on the next Federal Reserve interest rate move.

Disappointing US economic data will exacerbate the pain in the US Dollar, triggering a renewed upswing in the USD-denominated Gold price. Markets will resort to repricing the Fed rate hike expectations on the data releases, eventually impacting the US Treasury bond yields, US Dollar and the non-yielding Gold price.

Yesterday, The US published the February Job Openings and Labor Turnover Survey (JOLTS), which showed that the number of available positions in the month totalled 9.93 million, below 10 million for the first time in nearly two years. At the same time, the January figure was downwardly revised to 10.56 million. The poor figures suggest that the Federal Reserve (Fed) measures are actually cooling the labor market. Meanwhile, Factory Orders in the same month declined by 0.7%, worse than the 0.5% fall anticipated.

With the United States economic data emerging back as the market movers, Gold traders eagerly await the Automatic Data Processing (ADP) Employment Change and ISM Services PMI data for fresh hints on the next Federal Reserve interest rate move.

Disappointing US economic data will exacerbate the pain in the US Dollar, triggering a renewed upswing in the USD-denominated Gold price. Markets will resort to repricing the Fed rate hike expectations on the data releases, eventually impacting the US Treasury bond yields, US Dollar and the non-yielding Gold price.

Piyush Lalsingh Ratnu

04.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

WHY YEN is rising?

The Bank of Japan (BOJ) purchased a record $1 trillion of Japanese government bonds (JGBs) last fiscal year, as it tried to fend off investors' attack on its ultra-low rate policy.

The central bank's outright purchases of JGBs rose to an all-time high of 135.989 trillion yen ($1.02 trillion) in the year through March, almost double the amount a year earlier, a BOJ filing showed on Monday.

In a sign that the BOJ may continue aggressive bond buying, the central bank on Friday raised the maximum size of its planned Japanese government bond (JGB) purchases for all maturities over the next three months.

In the previous fiscal year, the central bank made purchases of 72.87 trillion yen in JGBs.

IMPACT: USDJPY crashed from 133.600 second time till 132.000 zone. 🆘

Impact of OIL:

Oil prices jumped around 6% on the move by the group known as OPEC+. Investors in contracts tied to the Fed's benchmark overnight interest rate, who as of Friday viewed any further rate increase as a toss-up, on Monday put a nearly 60% probability of a hike at the central bank's May 2-3 policy meeting.

A surprise announcement on Sunday by the Organization of Petroleum Exporting Countries and their allies that they would cut production by about 1.1 million barrels per day put the Fed's dilemma back on display, offering the sort of shock that could keep inflation stickier than otherwise.

USD under pressure. US F all set to crash

A Goldman Sachs Group (NYSE:GS) Inc-led group of banks will hold an investor call on Monday to sell $3.8 billion in Citrix Systems (NASDAQ:CTXS) bonds, according to two sources familiar with the matter, in a sign that the market for junk debt that was roiled by last month's banking crisis is starting to thaw.

It is by far the biggest junk debt sale since the failures last month of U.S. regional banks Silicon Valley Bank and Signature Bank (OTC:SBNY) and the forced sale of Credit Suisse Group AG to Swiss peer UBS Group AG (SIX:UBSG).

Issuance of junk bonds in the U.S. dropped from $13.9 billion in February to $4.45 billion in March, according to Informa, as the market turmoil soured risk appetite.

In addition to Citrix, banks are expected to market to investors a portion of the $5.4 billion in debt which last year financed auto parts supplier Tenneco's buyout by Apollo Global Management

USDJPY: current status:

The USDJPY experienced fluctuations in today's trading session as market participants reacted to the weekend's oil production cut news. Initially, the JPY was sold, causing the USDJPY to rise.

The pair approached the 50% retracement level from the March high to the March low at 133.769, coming within 11 pips of the declining 100-day moving average at 133.900.

This level has not been breached since March 10. At this point, buyers turned into sellers (as per volume and momentum based observations), and the price fell back towards the session lows near 132.813.

Yesterday, during US session low reached 132.300, with the current trading price at 132.700.

US10YT 3.423

USDJPY 132.75

USDCNY 6.8833

XAUXAG 82.93

DXY 101.825

US F + (stable)

XAUUSD CMP 1978.50

I had projected selling at $1990 yesterday.

The Bank of Japan (BOJ) purchased a record $1 trillion of Japanese government bonds (JGBs) last fiscal year, as it tried to fend off investors' attack on its ultra-low rate policy.

The central bank's outright purchases of JGBs rose to an all-time high of 135.989 trillion yen ($1.02 trillion) in the year through March, almost double the amount a year earlier, a BOJ filing showed on Monday.

In a sign that the BOJ may continue aggressive bond buying, the central bank on Friday raised the maximum size of its planned Japanese government bond (JGB) purchases for all maturities over the next three months.

In the previous fiscal year, the central bank made purchases of 72.87 trillion yen in JGBs.

IMPACT: USDJPY crashed from 133.600 second time till 132.000 zone. 🆘

Impact of OIL:

Oil prices jumped around 6% on the move by the group known as OPEC+. Investors in contracts tied to the Fed's benchmark overnight interest rate, who as of Friday viewed any further rate increase as a toss-up, on Monday put a nearly 60% probability of a hike at the central bank's May 2-3 policy meeting.

A surprise announcement on Sunday by the Organization of Petroleum Exporting Countries and their allies that they would cut production by about 1.1 million barrels per day put the Fed's dilemma back on display, offering the sort of shock that could keep inflation stickier than otherwise.

USD under pressure. US F all set to crash

A Goldman Sachs Group (NYSE:GS) Inc-led group of banks will hold an investor call on Monday to sell $3.8 billion in Citrix Systems (NASDAQ:CTXS) bonds, according to two sources familiar with the matter, in a sign that the market for junk debt that was roiled by last month's banking crisis is starting to thaw.

It is by far the biggest junk debt sale since the failures last month of U.S. regional banks Silicon Valley Bank and Signature Bank (OTC:SBNY) and the forced sale of Credit Suisse Group AG to Swiss peer UBS Group AG (SIX:UBSG).

Issuance of junk bonds in the U.S. dropped from $13.9 billion in February to $4.45 billion in March, according to Informa, as the market turmoil soured risk appetite.

In addition to Citrix, banks are expected to market to investors a portion of the $5.4 billion in debt which last year financed auto parts supplier Tenneco's buyout by Apollo Global Management

USDJPY: current status:

The USDJPY experienced fluctuations in today's trading session as market participants reacted to the weekend's oil production cut news. Initially, the JPY was sold, causing the USDJPY to rise.

The pair approached the 50% retracement level from the March high to the March low at 133.769, coming within 11 pips of the declining 100-day moving average at 133.900.

This level has not been breached since March 10. At this point, buyers turned into sellers (as per volume and momentum based observations), and the price fell back towards the session lows near 132.813.

Yesterday, during US session low reached 132.300, with the current trading price at 132.700.

US10YT 3.423

USDJPY 132.75

USDCNY 6.8833

XAUXAG 82.93

DXY 101.825

US F + (stable)

XAUUSD CMP 1978.50

I had projected selling at $1990 yesterday.

Piyush Lalsingh Ratnu

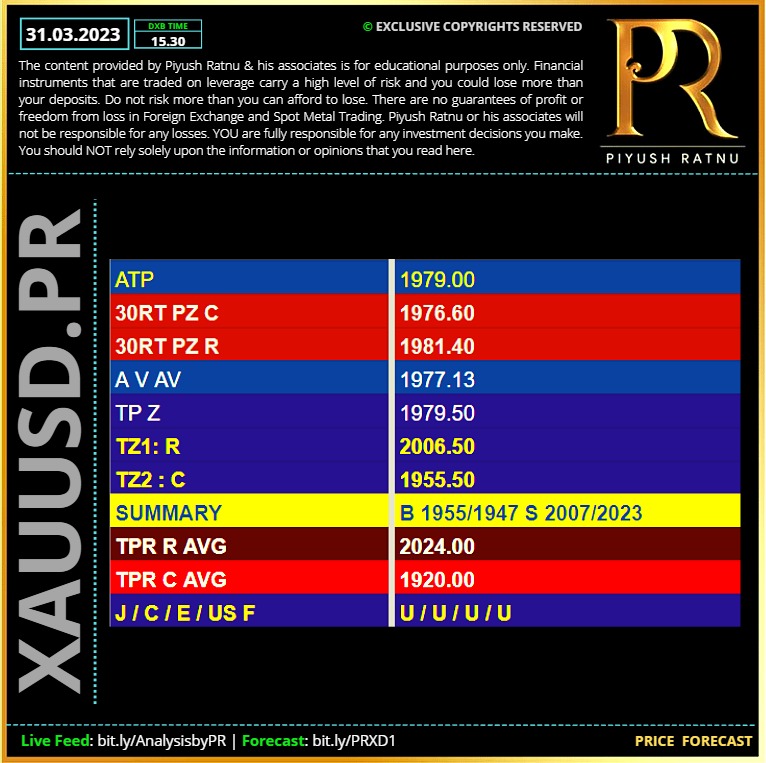

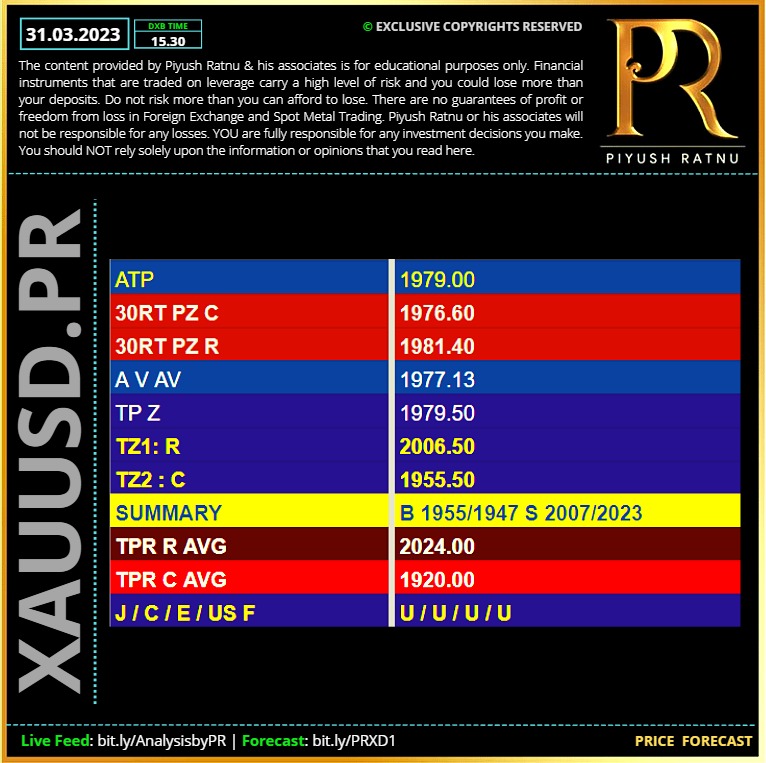

31.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

UPDATE: U.S. money market funds 🆘

Money continued to flow into safer U.S. money market funds for a third consecutive week as investors remained unsettled about the banking sector crisis, with slowdown worries also affecting the sentiment.

According to Refinitiv Lipper data, U.S. money market funds received a net $59.31 billion worth of inflows in the week to March 29. They have received about $273.3 billion worth of inflows so far this month.

Meanwhile, investors turned net sellers of $20.68 billion worth of U.S. equity funds after $10.17 billion worth of net purchases in the previous week.

They exited large, small and mid-cap equity funds of $8.25 billion, $2.43 billion and $1 billion, respectively.

They sold high yield and short/intermediate investment-grade funds of $2.28 billion and $2.2 billion, respectively, but government funds drew a net $4.08 billion, marking a seventh weekly inflow in a row.

Among sector funds, financials, industrials and consumer staples saw withdrawals of $931 million, $617 million and $499 million, respectively, although tech received $926 million worth of inflows after witnessing outflows for six weeks in a row.

IMPACT: US F, XAUUSD, DXY, USD Pairs, Bonds

Money continued to flow into safer U.S. money market funds for a third consecutive week as investors remained unsettled about the banking sector crisis, with slowdown worries also affecting the sentiment.

According to Refinitiv Lipper data, U.S. money market funds received a net $59.31 billion worth of inflows in the week to March 29. They have received about $273.3 billion worth of inflows so far this month.

Meanwhile, investors turned net sellers of $20.68 billion worth of U.S. equity funds after $10.17 billion worth of net purchases in the previous week.

They exited large, small and mid-cap equity funds of $8.25 billion, $2.43 billion and $1 billion, respectively.

They sold high yield and short/intermediate investment-grade funds of $2.28 billion and $2.2 billion, respectively, but government funds drew a net $4.08 billion, marking a seventh weekly inflow in a row.

Among sector funds, financials, industrials and consumer staples saw withdrawals of $931 million, $617 million and $499 million, respectively, although tech received $926 million worth of inflows after witnessing outflows for six weeks in a row.

IMPACT: US F, XAUUSD, DXY, USD Pairs, Bonds

Piyush Lalsingh Ratnu

*Gold price uptrend continues despite shrinking volatility.

*US PCE inflation data on Friday has huge market implications.

*Federal Reserve future rate hike bets are shaping precious metal markets.

*Gold price (XAU/USD) continues to trade within a solid uptrend, even in a calmer week in the financial markets.

Things could get lively again on Friday as the market gets ready for the biggest data release of the week, the United States Personal Consumption Expenditures (PCE) inflation numbers, scheduled to be released at 16.30 hours DXB

On the contrary, if the Core PCE eases, it would be great news for the Fed, but not for the Dollar. Signs that inflation continued to slowdown would alleviate the pressure for the Fed to do more. US bond yields could resume the slide and the US Dollar print fresh monthly lows.

Gold price uptrend has slowed down in the past days, but bulls still keep the edge, with the bright metal comfortably trading above $1,980 currently.

“Gold is well supported by US recession fears, easing inflationary pressure and more dovish monetary policy. Nevertheless, the upside looks limited in the near term amid easing banking risks and further Fed rate hikes.” - ANZ Bank

Gold price can target $2,000 on lower-than-expected PCE inflation

Gold is trading within a solid uptrend, making relative highs and lows in several timeframes. Despite the XAU/USD price action having calmed down this week on easing bank fears and a light economic calendar, it found solid support at the 23.6% Fibonacci retracement level from the March 8-17 rally early in the week. Since then, Gold bulls have slowly resumed the uptrend ahead of crucial US PCE inflation data.

Immediate resistance target for Gold bulls is located at the $2,000 round and psychological level, which has acted as a difficult level to break already three times in the last 10 days. That could be reached on a lower-than-expected US PCE release. With the Relative Strength Index (RSI) still short of overbought territory, it adds credence to such a potential rally (always data dependant, of course.)

On the other hand, a higher-than-expected Fed preferred inflation measure could trigger a correction on the bright metal, and immediate support would be right back at the aforementioned 23.6% Fibonacci retracement, located at $1,951.

*US PCE inflation data on Friday has huge market implications.

*Federal Reserve future rate hike bets are shaping precious metal markets.

*Gold price (XAU/USD) continues to trade within a solid uptrend, even in a calmer week in the financial markets.

Things could get lively again on Friday as the market gets ready for the biggest data release of the week, the United States Personal Consumption Expenditures (PCE) inflation numbers, scheduled to be released at 16.30 hours DXB

On the contrary, if the Core PCE eases, it would be great news for the Fed, but not for the Dollar. Signs that inflation continued to slowdown would alleviate the pressure for the Fed to do more. US bond yields could resume the slide and the US Dollar print fresh monthly lows.

Gold price uptrend has slowed down in the past days, but bulls still keep the edge, with the bright metal comfortably trading above $1,980 currently.

“Gold is well supported by US recession fears, easing inflationary pressure and more dovish monetary policy. Nevertheless, the upside looks limited in the near term amid easing banking risks and further Fed rate hikes.” - ANZ Bank

Gold price can target $2,000 on lower-than-expected PCE inflation

Gold is trading within a solid uptrend, making relative highs and lows in several timeframes. Despite the XAU/USD price action having calmed down this week on easing bank fears and a light economic calendar, it found solid support at the 23.6% Fibonacci retracement level from the March 8-17 rally early in the week. Since then, Gold bulls have slowly resumed the uptrend ahead of crucial US PCE inflation data.

Immediate resistance target for Gold bulls is located at the $2,000 round and psychological level, which has acted as a difficult level to break already three times in the last 10 days. That could be reached on a lower-than-expected US PCE release. With the Relative Strength Index (RSI) still short of overbought territory, it adds credence to such a potential rally (always data dependant, of course.)

On the other hand, a higher-than-expected Fed preferred inflation measure could trigger a correction on the bright metal, and immediate support would be right back at the aforementioned 23.6% Fibonacci retracement, located at $1,951.

Piyush Lalsingh Ratnu

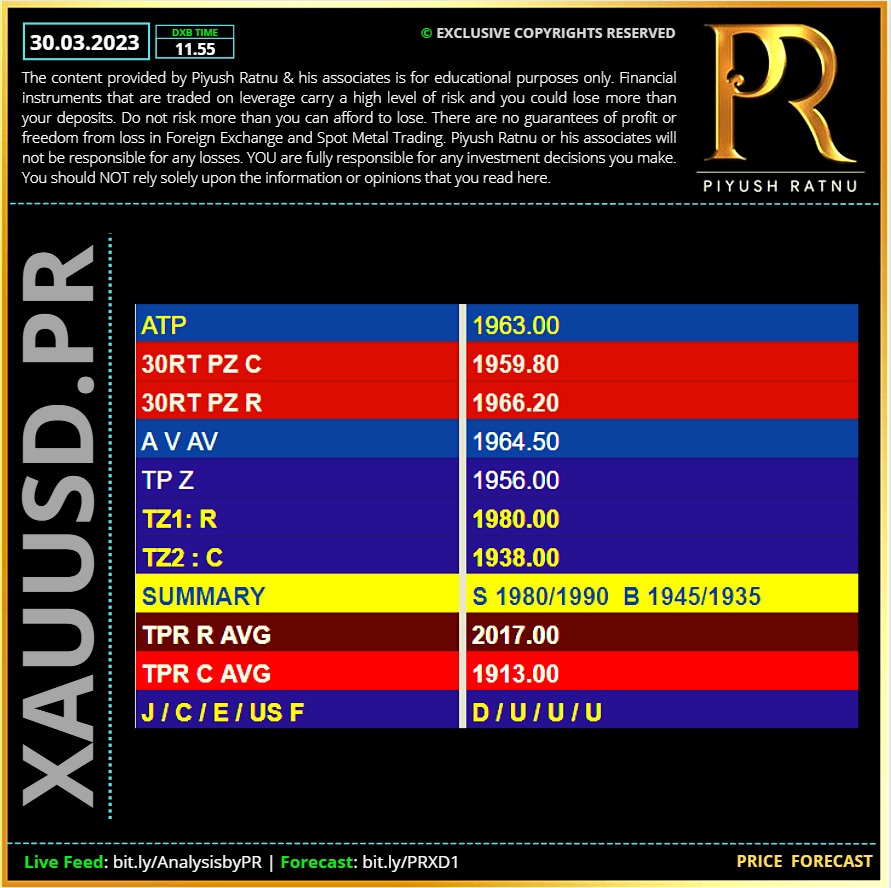

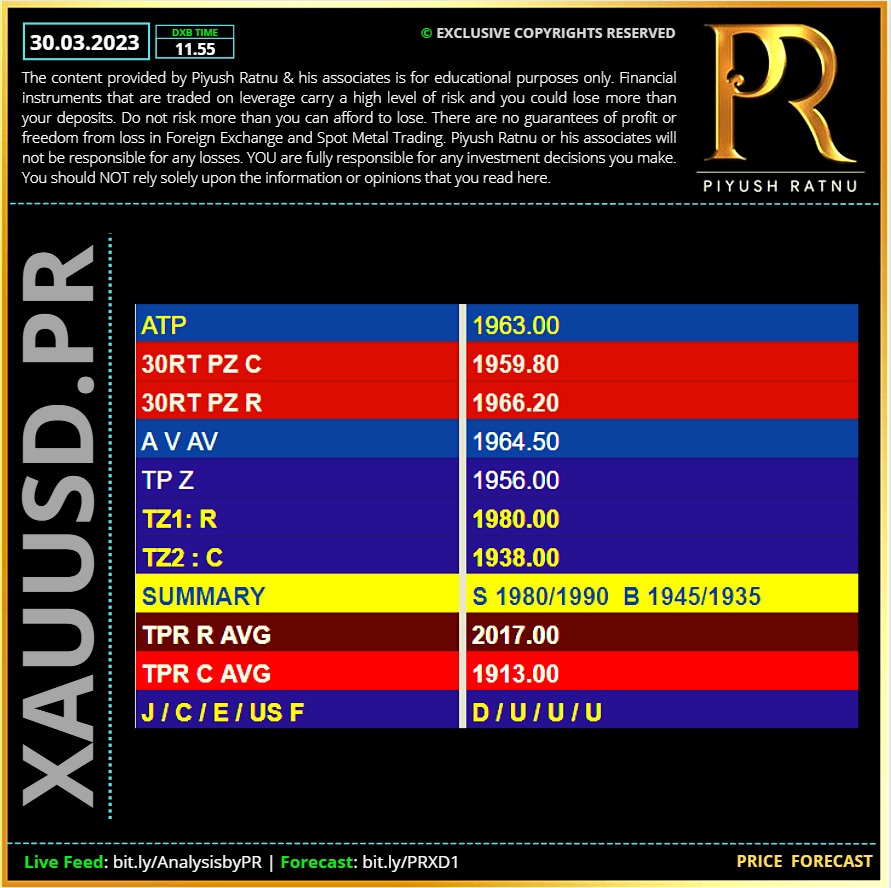

30.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

Alert: BOJ is Buying Bonds! BOJ Bought $3.4 T in Govt. Bonds.🆘

Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.

Just over a week before a momentous leadership change at the BOJ, investors are gearing up for the seemingly inevitable end to a decade of ultra-low interest rates that punished domestic savers and sent a wall of money overseas. The exodus accelerated after Kuroda moved to suppress bond yields in 2016, culminating in a mountain of offshore investments worth more than two-thirds Japan’s economy.

All this risks unraveling under the new governor Ueda, who may have little choice but to end the world’s boldest easy-money experiment just as rising interest rates elsewhere are already jolting the international banking sector and threatening financial stability. The stakes are enormous: Japanese investors are the biggest foreign holders of US government bonds and own everything from Brazilian debt to European power stations to bundles of risky loans stateside.

An increase in Japan’s borrowing costs threatens to amplify the swings in global bond markets, which are being rocked by the Federal Reserve’s year-long campaign to combat inflation and the new danger of a credit crunch. Against this backdrop, tighter monetary policy by the BOJ is likely to intensify scrutiny of its country’s lenders in the wake of recent bank turmoil in the US and Europe.

Ueda, the first ever academic to captain the BOJ, is largely expected to speed up the pace of policy tightening sometime later this year. Part of that may include further loosening the central bank’s control on yields and unwinding a titanic bond-buying program designed to suppress borrowing costs and boost Japan’s moribund economy.

The BOJ has bought 465 trillion yen ($3.55 trillion) of Japanese government bonds since Kuroda implemented quantitative easing a decade ago, according to central bank data, depressing yields and fueling unprecedented distortions in the sovereign debt market. As a result, local funds sold 206 trillion yen of the securities during the period to seek better returns elsewhere.

Impact might be seen on:

USDJPY NZDUSD NZDJPY EURJPY AUDJPY AUDUSD XAUUSD

Algorithm Setting: PR S W1 🆘

Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.

Just over a week before a momentous leadership change at the BOJ, investors are gearing up for the seemingly inevitable end to a decade of ultra-low interest rates that punished domestic savers and sent a wall of money overseas. The exodus accelerated after Kuroda moved to suppress bond yields in 2016, culminating in a mountain of offshore investments worth more than two-thirds Japan’s economy.

All this risks unraveling under the new governor Ueda, who may have little choice but to end the world’s boldest easy-money experiment just as rising interest rates elsewhere are already jolting the international banking sector and threatening financial stability. The stakes are enormous: Japanese investors are the biggest foreign holders of US government bonds and own everything from Brazilian debt to European power stations to bundles of risky loans stateside.

An increase in Japan’s borrowing costs threatens to amplify the swings in global bond markets, which are being rocked by the Federal Reserve’s year-long campaign to combat inflation and the new danger of a credit crunch. Against this backdrop, tighter monetary policy by the BOJ is likely to intensify scrutiny of its country’s lenders in the wake of recent bank turmoil in the US and Europe.

Ueda, the first ever academic to captain the BOJ, is largely expected to speed up the pace of policy tightening sometime later this year. Part of that may include further loosening the central bank’s control on yields and unwinding a titanic bond-buying program designed to suppress borrowing costs and boost Japan’s moribund economy.

The BOJ has bought 465 trillion yen ($3.55 trillion) of Japanese government bonds since Kuroda implemented quantitative easing a decade ago, according to central bank data, depressing yields and fueling unprecedented distortions in the sovereign debt market. As a result, local funds sold 206 trillion yen of the securities during the period to seek better returns elsewhere.

Impact might be seen on:

USDJPY NZDUSD NZDJPY EURJPY AUDJPY AUDUSD XAUUSD

Algorithm Setting: PR S W1 🆘

Piyush Lalsingh Ratnu

Surprises Ahead! Geo-political Drama awaits HVPR!🆘

Russia will no longer give the U.S. advance notice about its missile tests, a senior Moscow diplomat said Wednesday, as its military deployed mobile launchers in Siberia in a show of the country’s massive nuclear capability amid fighting in Ukraine.

Deputy Foreign Minister Sergei Ryabkov said in remarks carried by Russian news agencies that Moscow has halted all information exchanges with Washington after previously suspending its participation in the last remaining nuclear arms pact with the U.S.

long with the data about the current state of the countries’ nuclear forces routinely released every six months in compliance with the treaty, the parties also have exchanged advance warnings about test launches. Such notices have been an essential element of strategic stability for decades, allowing Russia and the United States to correctly interpret each other’s moves and make sure that neither country mistakes a test launch for a missile attack.

The termination of missile test warnings marks yet another attempt by Moscow to discourage the West from ramping up its support for Ukraine by pointing to Russia’s massive nuclear arsenal. In recent days, President Vladimir Putin announced the deployment of tactical nuclear weapons to the territory of Moscow’s ally Belarus.

Patrushev alleged that some American politicians believe the U.S. could launch a preventative missile strike on Russia to which Moscow would be unable to respond, a purported belief that he described as “short-sighted stupidity, which is very dangerous.”🆘

Russia will no longer give the U.S. advance notice about its missile tests, a senior Moscow diplomat said Wednesday, as its military deployed mobile launchers in Siberia in a show of the country’s massive nuclear capability amid fighting in Ukraine.

Deputy Foreign Minister Sergei Ryabkov said in remarks carried by Russian news agencies that Moscow has halted all information exchanges with Washington after previously suspending its participation in the last remaining nuclear arms pact with the U.S.

long with the data about the current state of the countries’ nuclear forces routinely released every six months in compliance with the treaty, the parties also have exchanged advance warnings about test launches. Such notices have been an essential element of strategic stability for decades, allowing Russia and the United States to correctly interpret each other’s moves and make sure that neither country mistakes a test launch for a missile attack.

The termination of missile test warnings marks yet another attempt by Moscow to discourage the West from ramping up its support for Ukraine by pointing to Russia’s massive nuclear arsenal. In recent days, President Vladimir Putin announced the deployment of tactical nuclear weapons to the territory of Moscow’s ally Belarus.

Patrushev alleged that some American politicians believe the U.S. could launch a preventative missile strike on Russia to which Moscow would be unable to respond, a purported belief that he described as “short-sighted stupidity, which is very dangerous.”🆘

: