Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

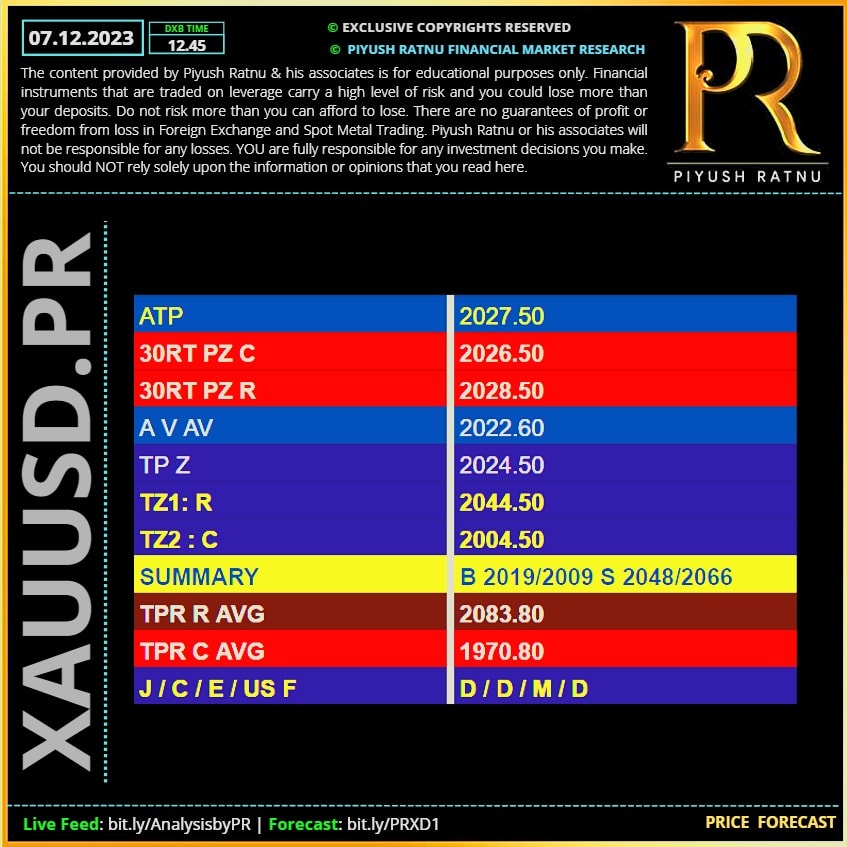

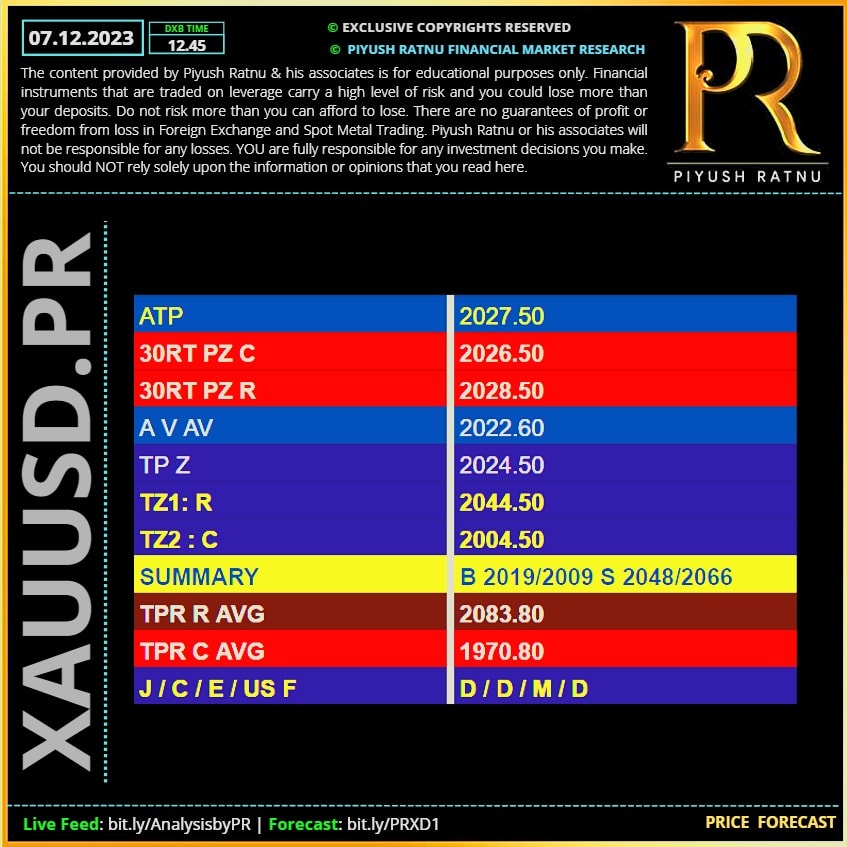

07.12.2023 | XAUUSD: Daily Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

✔️R2: $2040 zone achieved | Sell Positions in NAP.

🆘Exit SELL Positions.

✔️Net Profitable Pips: 900+

🟢CMP $2031

🆘Exit SELL Positions.

✔️Net Profitable Pips: 900+

🟢CMP $2031

Piyush Lalsingh Ratnu

🆘 ALERT:

Asian equities attracted substantial foreign investment in November, signalling the prospects of continued inflows next year, bolstered by a decrease in U.S. Treasury yields and rising optimism for potential Federal Reserve rate cuts.

According to data from stock exchanges across Taiwan, South Korea, India, Indonesia, the Philippines, Thailand, and Vietnam, foreign investors bought a net $11.16 billion in stocks last month, the most since May.

The inflows were underpinned by cooler-than-expected U.S. October inflation data and dovish comments from Federal Reserve officials, which led to sharp declines in both U.S. Treasury yields and the dollar last month.

In the last month, Taiwanese stocks attracted foreign inflows of $7.58 billion, the highest since at least 2008. South Korean shares attracted $3.26 billion, while Indian equities received net inflows of $1.08 billion.

Over the medium term, Asia's strong fundamentals and growth prospects mean the region is well-placed to attract large capital inflows.

🟢Impact: -USD DXY +US F + XAUSD XAGUSD

🆘 Expected Date:

First week of January or Quadruple witching (Dec/Jan)

Why is it called witching day?

Witching days refer to sessions when multiple options and futures contracts expire simultaneously. Normally, options expire on the third Friday of each month. Witching sessions occur only four times a year, on the third Fridays of March, June, September and December.

What is the witching hour in trading?

The witching hour is the last hour of trading on the third Friday of each month when options and futures on stocks and stock indexes expire. This period is often characterized by heavy volumes as traders close out options and futures contracts before expiry.

Asian equities attracted substantial foreign investment in November, signalling the prospects of continued inflows next year, bolstered by a decrease in U.S. Treasury yields and rising optimism for potential Federal Reserve rate cuts.

According to data from stock exchanges across Taiwan, South Korea, India, Indonesia, the Philippines, Thailand, and Vietnam, foreign investors bought a net $11.16 billion in stocks last month, the most since May.

The inflows were underpinned by cooler-than-expected U.S. October inflation data and dovish comments from Federal Reserve officials, which led to sharp declines in both U.S. Treasury yields and the dollar last month.

In the last month, Taiwanese stocks attracted foreign inflows of $7.58 billion, the highest since at least 2008. South Korean shares attracted $3.26 billion, while Indian equities received net inflows of $1.08 billion.

Over the medium term, Asia's strong fundamentals and growth prospects mean the region is well-placed to attract large capital inflows.

🟢Impact: -USD DXY +US F + XAUSD XAGUSD

🆘 Expected Date:

First week of January or Quadruple witching (Dec/Jan)

Why is it called witching day?

Witching days refer to sessions when multiple options and futures contracts expire simultaneously. Normally, options expire on the third Friday of each month. Witching sessions occur only four times a year, on the third Fridays of March, June, September and December.

What is the witching hour in trading?

The witching hour is the last hour of trading on the third Friday of each month when options and futures on stocks and stock indexes expire. This period is often characterized by heavy volumes as traders close out options and futures contracts before expiry.

Piyush Lalsingh Ratnu

The Japanese Yen (JPY) catches aggressive bids on Thursday and advances to over a three-month top against the US Dollar (USD) in the wake of firming expectations for an imminent shift in the Bank of Japan's (BoJ) policy stance. BoJ Governor Kazuo Ueda met Japanese Prime Minister Fumio Kishida and said that his explanation of monetary policy included the wage hike outlook. This, in turn, fueled speculations that a second consecutive year of significant wage hikes will offer an opportunity for the BoJ to consider stepping away from a decade-long monetary stimulus.

JPY Price Movers: (ref. FxS)

Japanese Yen strengthens across the board amid bets for a hawkish BoJ pivot

• Signs that a tight US job market is loosening raise concerns about an economic slowdown and weigh on investors' sentiment, benefitting the safe-haven Japanese Yen.

• The US Labor Department reported Tuesday that job openings declined by 617K to 8.73 million in October, or their lowest level in two-and-a-half-years.

• The ADP report showed that US private-sector employers added just 103K jobs in November, down from the previous month's downwardly revised 106K.

• The readings reaffirmed market expectations about an imminent shift in the Federal Reserve's policy stance and bets for a 25 basis points rate cut at the March policy meeting.

• The slew of key US jobs data will continue on Thursday and Friday with the release of Weekly Initial Jobless Claims and the key Nonfarm Payrolls, respectively.

• Israeli forces stormed southern Gaza's main city on Tuesday in the most intense day of combat of ground operations against Hamas militants, worsening the humanitarian crisis.

• The mixed Trade Balance data from China showed that imports unexpectedly declined by 0.6% in November, fueling concerns about weak domestic demand amid looming recession risks.

• BoJ Governor Ueda told PMI Kishida that the central bank hopes to che whether wages will rise sustainably, whether wage rises will push up service prices and whether demand will be strong.

• Bank of Japan Governor Kazuo Ueda said this Thursday that accommodative monetary policy and stimulus measures are supporting the Japanese economy.

• Ueda added that his explanation of monetary policy to PM Kishida included the wage hike outlook for next year, reaffirming bets that the central bank will move away from negative interest rates regime.

• Ueda earlier said that they have not yet reached a situation in which they can achieve the price target sustainably and stably and with sufficient certainty.

CMP $145.300 | Net crash today till now: 2000+ pips

JPY Price Movers: (ref. FxS)

Japanese Yen strengthens across the board amid bets for a hawkish BoJ pivot

• Signs that a tight US job market is loosening raise concerns about an economic slowdown and weigh on investors' sentiment, benefitting the safe-haven Japanese Yen.

• The US Labor Department reported Tuesday that job openings declined by 617K to 8.73 million in October, or their lowest level in two-and-a-half-years.

• The ADP report showed that US private-sector employers added just 103K jobs in November, down from the previous month's downwardly revised 106K.

• The readings reaffirmed market expectations about an imminent shift in the Federal Reserve's policy stance and bets for a 25 basis points rate cut at the March policy meeting.

• The slew of key US jobs data will continue on Thursday and Friday with the release of Weekly Initial Jobless Claims and the key Nonfarm Payrolls, respectively.

• Israeli forces stormed southern Gaza's main city on Tuesday in the most intense day of combat of ground operations against Hamas militants, worsening the humanitarian crisis.

• The mixed Trade Balance data from China showed that imports unexpectedly declined by 0.6% in November, fueling concerns about weak domestic demand amid looming recession risks.

• BoJ Governor Ueda told PMI Kishida that the central bank hopes to che whether wages will rise sustainably, whether wage rises will push up service prices and whether demand will be strong.

• Bank of Japan Governor Kazuo Ueda said this Thursday that accommodative monetary policy and stimulus measures are supporting the Japanese economy.

• Ueda added that his explanation of monetary policy to PM Kishida included the wage hike outlook for next year, reaffirming bets that the central bank will move away from negative interest rates regime.

• Ueda earlier said that they have not yet reached a situation in which they can achieve the price target sustainably and stably and with sufficient certainty.

CMP $145.300 | Net crash today till now: 2000+ pips

Piyush Lalsingh Ratnu

🟢 USDJPY approaching 145.600 zone

Net crash observed: 1800 pips.

Possible impact on XAUUSD: $50+ price move

RT in USDJPY might push XAUUSD to $2009/1985 zone.

Net crash observed: 1800 pips.

Possible impact on XAUUSD: $50+ price move

RT in USDJPY might push XAUUSD to $2009/1985 zone.

Piyush Lalsingh Ratnu

Santa Rally Ahead: Stay Alert. BUY DIPS. PG 100

Exit in NAP | Exit Dates: 09/10 Jan or NAP.

Exit in NAP | Exit Dates: 09/10 Jan or NAP.

Piyush Lalsingh Ratnu

https://www.bloomberg.com/news/articles/2023-12-05/israel-would-consider-another-cease-fire-to-get-back-hostages?srnd=premium-middle-east

🟢 Probable IMPACT:

Scenario A: Rejection of truce/surprise attack might result in another + rally of $75

Scenario B: Reversal: XAUUSD might make enter in next set of technical correction extending to $1985/1966.

🟢 Probable IMPACT:

Scenario A: Rejection of truce/surprise attack might result in another + rally of $75

Scenario B: Reversal: XAUUSD might make enter in next set of technical correction extending to $1985/1966.

Piyush Lalsingh Ratnu

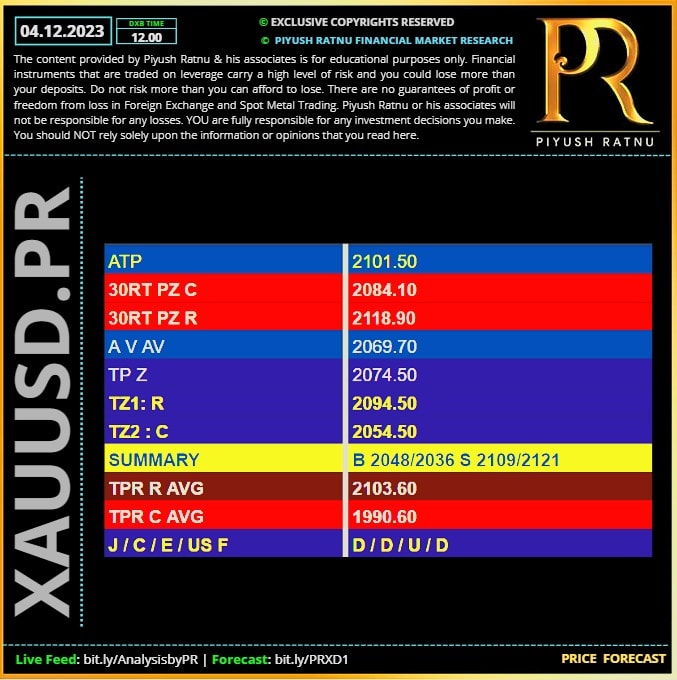

The US Dollar (USD) appreciated significantly in the European trading session on Tuesday after rating agency Moody’s downgraded China’s credit outlook from stable to negative due to rising debt.

More US Dollar Strength comes from European Central Bank (ECB) member Isabel Schnabel, who said she is surprised by the substantial decline in inflation and no more interest-rate hikes are further needed.

XAUUSD price factors: Pressure building to Nonfarm Payrolls

• Rating agency Moody’s has issued a negative outlook for China, a downgrade from the previous “stable” label.

• European Central Bank (ECB) board member Isabel Schnabel said that she is surprised by the shere speed of decline in inflation in the Eurozone, and no further hikes should be needed. Schnabel is considered to be a hawk, which makes these comments even more important and signals a change in the stance and outlook of the ECB.

• At 18.45, the S&P Global Purchasing Managers Indices are expected:

1. The Services PMI is expected to stay stable from its preliminary reading at 50.8.

2. The Composite flash reading for November stood at 50.7.

• Chunky batch of data at 19:00 GMT:

1. The Institute for Supply Management (ISM) will release its November numbers:

2. Headline Services PMI for November expected to increase from 51.8 to 52.

3. Services Employment Index for October was at 50.2. No forecast.

4. Services New Orders Index for October was at 55.5. No forecast pencilled in.

5. Services Prices Paid for October was at 58.6. No forecast.

6. JOLTS Job Openings for October is expected to decline a little from 9.553 million to 9.3 million.

• Equities are bleeding severely this Tuesday with nearly all Asian equity indices down over 1%, with China’s leading indices down more than 2%. European equities are trading in the red, and US futures trade directionless.

• The CME Group’s FedWatch Tool shows that markets are pricing in a 97.5% chance that the Federal Reserve will keep interest rates unchanged at its meeting next week.

• The benchmark 10-year US Treasury Note steadies at 4.23%. Yields in Europe, on the other hand, are falling.

🟢 Crucial zones:

C: $2009/1985/1966

R: $2048/2069/2096

More US Dollar Strength comes from European Central Bank (ECB) member Isabel Schnabel, who said she is surprised by the substantial decline in inflation and no more interest-rate hikes are further needed.

XAUUSD price factors: Pressure building to Nonfarm Payrolls

• Rating agency Moody’s has issued a negative outlook for China, a downgrade from the previous “stable” label.

• European Central Bank (ECB) board member Isabel Schnabel said that she is surprised by the shere speed of decline in inflation in the Eurozone, and no further hikes should be needed. Schnabel is considered to be a hawk, which makes these comments even more important and signals a change in the stance and outlook of the ECB.

• At 18.45, the S&P Global Purchasing Managers Indices are expected:

1. The Services PMI is expected to stay stable from its preliminary reading at 50.8.

2. The Composite flash reading for November stood at 50.7.

• Chunky batch of data at 19:00 GMT:

1. The Institute for Supply Management (ISM) will release its November numbers:

2. Headline Services PMI for November expected to increase from 51.8 to 52.

3. Services Employment Index for October was at 50.2. No forecast.

4. Services New Orders Index for October was at 55.5. No forecast pencilled in.

5. Services Prices Paid for October was at 58.6. No forecast.

6. JOLTS Job Openings for October is expected to decline a little from 9.553 million to 9.3 million.

• Equities are bleeding severely this Tuesday with nearly all Asian equity indices down over 1%, with China’s leading indices down more than 2%. European equities are trading in the red, and US futures trade directionless.

• The CME Group’s FedWatch Tool shows that markets are pricing in a 97.5% chance that the Federal Reserve will keep interest rates unchanged at its meeting next week.

• The benchmark 10-year US Treasury Note steadies at 4.23%. Yields in Europe, on the other hand, are falling.

🟢 Crucial zones:

C: $2009/1985/1966

R: $2048/2069/2096

Piyush Lalsingh Ratnu

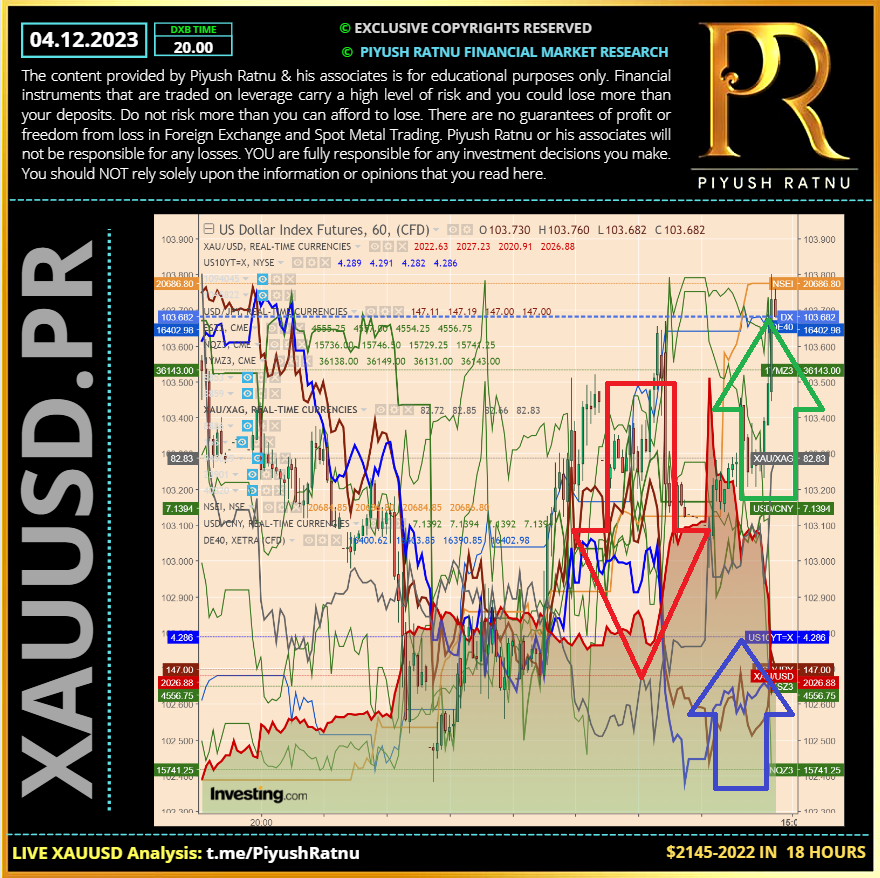

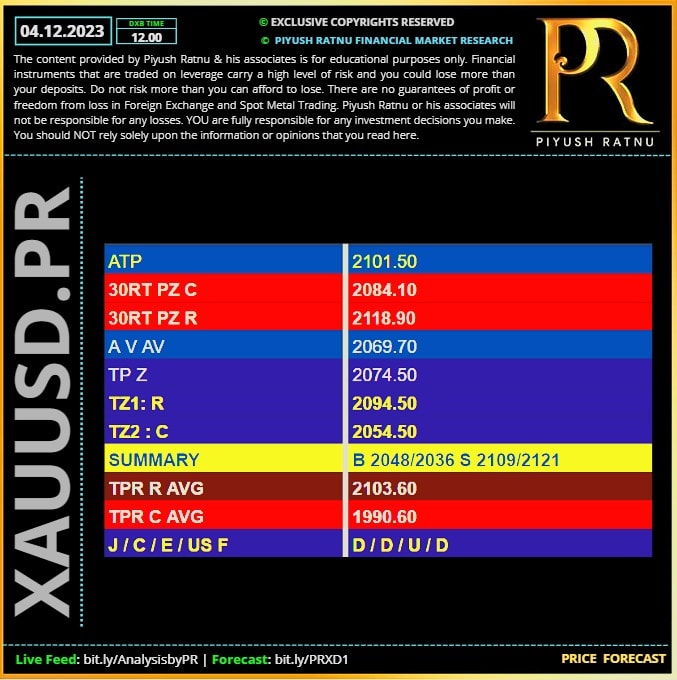

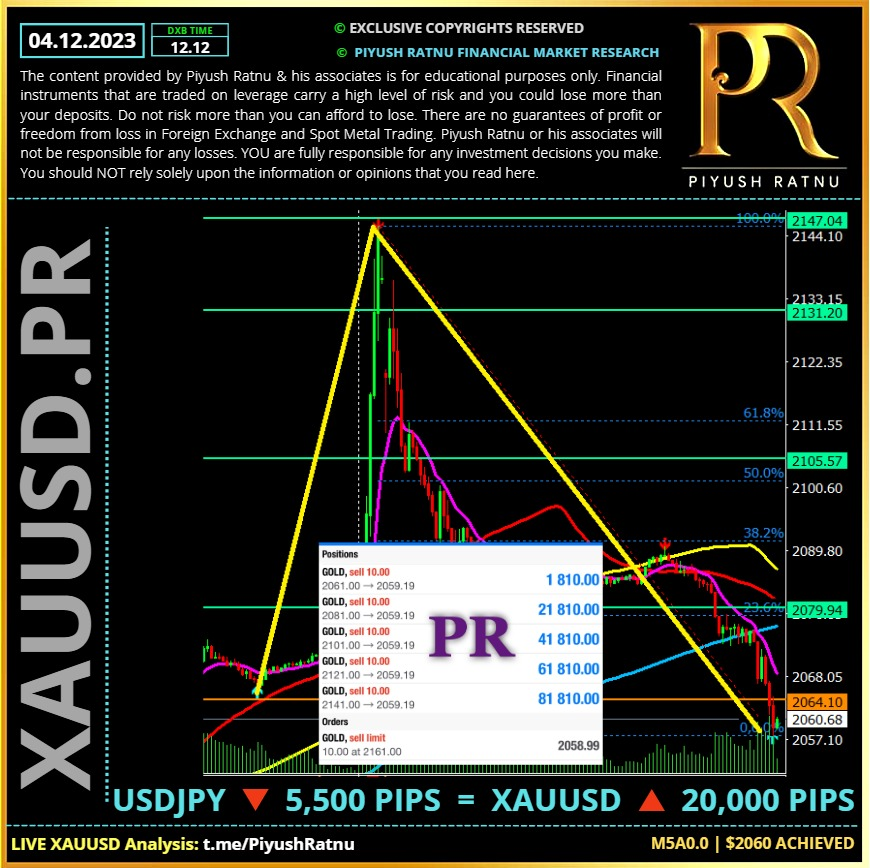

04.12.2023 | XAUUSD: Daily Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

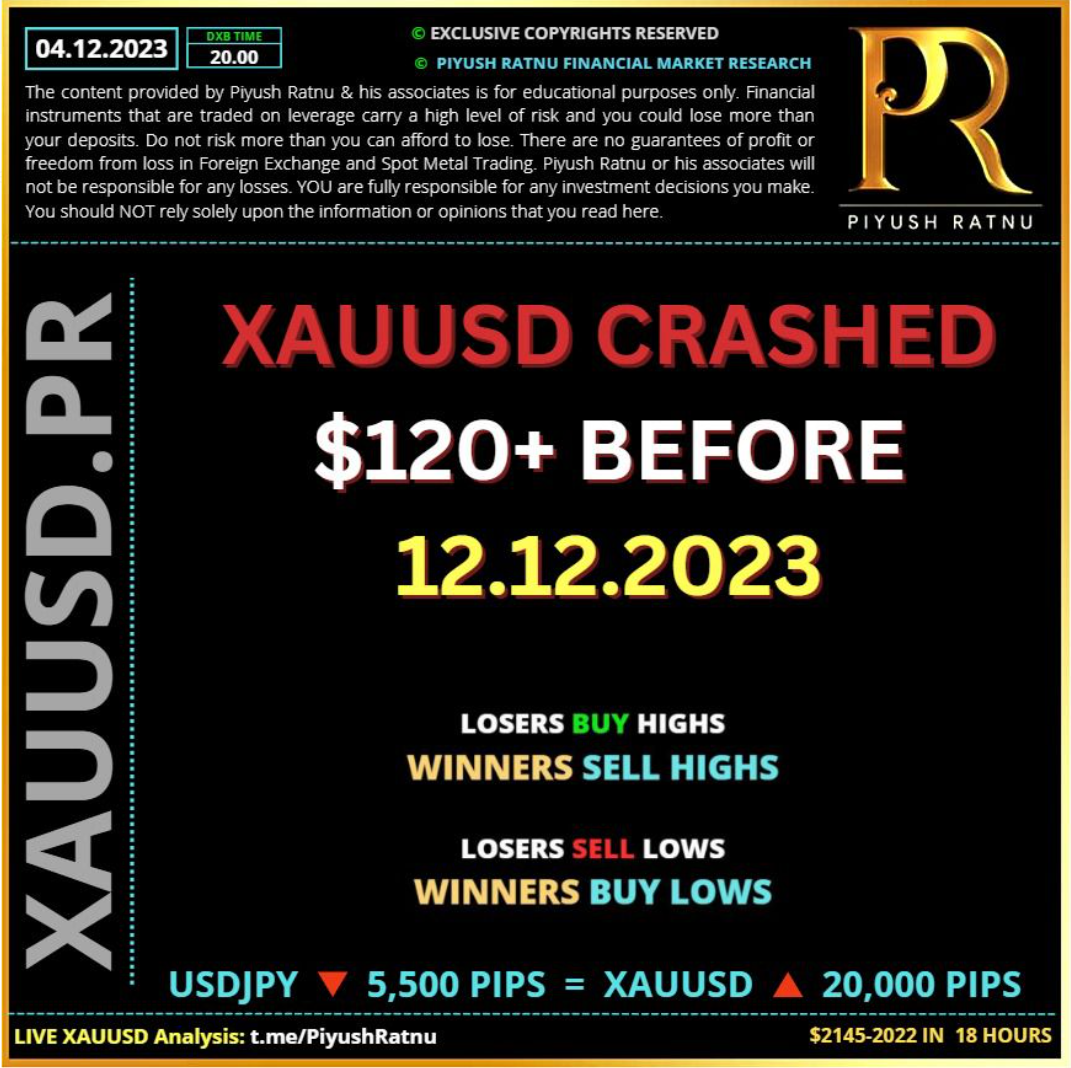

28/11/2023: I had projected $50 crash before 12.12.2023, however we witnessed (-)$120+ crash before 12.12.2023

Piyush Lalsingh Ratnu

28/11/2023: I had projected $50 crash before 12.12.2023, however we witnesses (-)$120+ crash before 12.12.2023.

Piyush Lalsingh Ratnu

♾USDJPY Update:

Despite the 3.5% strengthening of the yen against the US dollar from the levels of the November lows, hedge funds have increased their short positions in the Japanese currency to the highest level since April 2022. They are betting on maintaining a wide US-Japanese yield spread. According to speculators, it would be strange if all central banks, including the Fed, eased monetary policy in 2024, but the BoJ tightened it.

Insurance companies also do not believe in market pricing and have reduced currency hedging of transactions with foreign securities to 47.8%. This is the lowest level since the beginning of accounting in 2011. For comparison, six months ago, the ratio was 52.7%. Its decline results from a lack of concern about the strengthening of the yen, which reduces profits from foreign investments.

Thus, hedge funds and insurance companies trust the Bank of Japan more than the market. Kazuo Ueda has spoken many times about the regulator's commitment to an ultra-ease monetary policy and ignored the fact that inflation in the country has been exceeding the target of 2% for 19 months. They say deflation is structural, and a sustainable wage increase is required to ensure victory over it.

The market has a different opinion. Derivatives suggest the BoJ should end its policy of sub-zero interest rates in June and raise borrowing costs even higher by the end of 2024. The consensus forecast of Bloomberg experts indicates that the first increase in the BoJ rate from its current level of -0.1% will occur in April. At the same time, the derivatives market expects the Fed to ease monetary policy as early as March, followed by a reduction in the federal funds rate by 125 basis points to 4.25% by the end of next year.

🟢 Probable IMPACT: USD - JPY + = XAUUSD +

Despite the 3.5% strengthening of the yen against the US dollar from the levels of the November lows, hedge funds have increased their short positions in the Japanese currency to the highest level since April 2022. They are betting on maintaining a wide US-Japanese yield spread. According to speculators, it would be strange if all central banks, including the Fed, eased monetary policy in 2024, but the BoJ tightened it.

Insurance companies also do not believe in market pricing and have reduced currency hedging of transactions with foreign securities to 47.8%. This is the lowest level since the beginning of accounting in 2011. For comparison, six months ago, the ratio was 52.7%. Its decline results from a lack of concern about the strengthening of the yen, which reduces profits from foreign investments.

Thus, hedge funds and insurance companies trust the Bank of Japan more than the market. Kazuo Ueda has spoken many times about the regulator's commitment to an ultra-ease monetary policy and ignored the fact that inflation in the country has been exceeding the target of 2% for 19 months. They say deflation is structural, and a sustainable wage increase is required to ensure victory over it.

The market has a different opinion. Derivatives suggest the BoJ should end its policy of sub-zero interest rates in June and raise borrowing costs even higher by the end of 2024. The consensus forecast of Bloomberg experts indicates that the first increase in the BoJ rate from its current level of -0.1% will occur in April. At the same time, the derivatives market expects the Fed to ease monetary policy as early as March, followed by a reduction in the federal funds rate by 125 basis points to 4.25% by the end of next year.

🟢 Probable IMPACT: USD - JPY + = XAUUSD +

Piyush Lalsingh Ratnu

04.12.2023: XAUUSD breached $2121 zone, as projected in advance, read more:

https://www.piyushratnu.com/why-gold-price-xauusd-2023-2121-2145-in-2023/

https://www.piyushratnu.com/why-gold-price-xauusd-2023-2121-2145-in-2023/

Piyush Lalsingh Ratnu

⏰XAUUSD: This week:

A high ($2145) before NFP: will RT result in $2145 again?

A high ($2145) before NFP: a technical correction on the way?

🆘Crucial Zones this week:

R: $2145/2169

C: $2009/1985

A high ($2145) before NFP: will RT result in $2145 again?

A high ($2145) before NFP: a technical correction on the way?

🆘Crucial Zones this week:

R: $2145/2169

C: $2009/1985

Piyush Lalsingh Ratnu

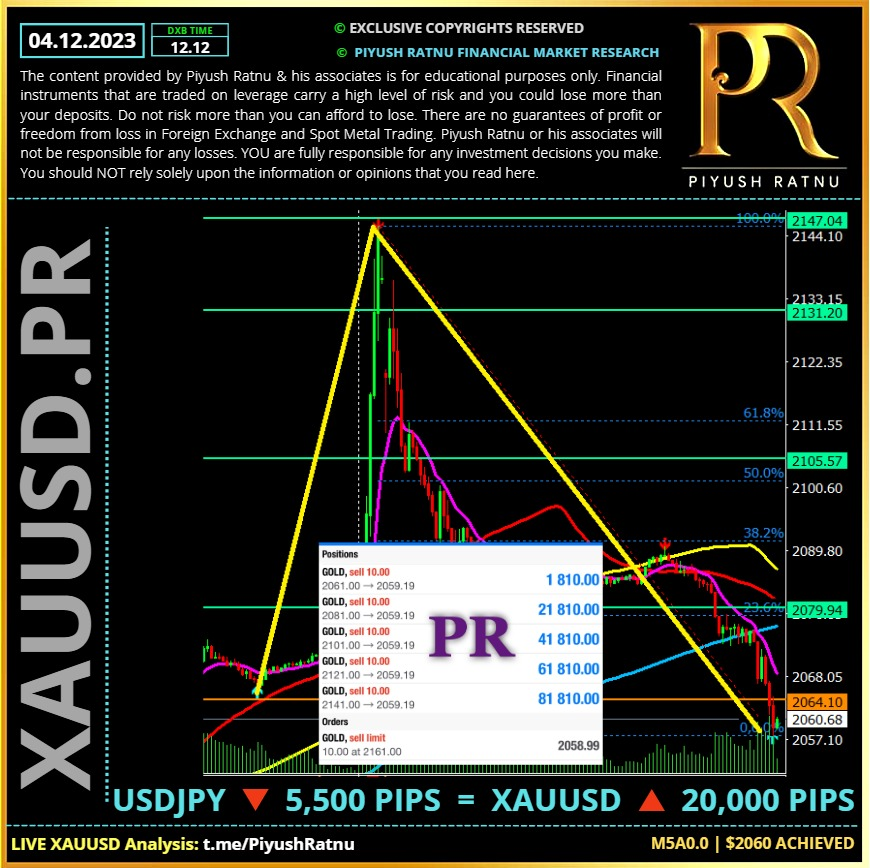

Selling at V, above V proved a perfect trade scenario ONCE AGAIN. 2069-2096-2121-2145-2121-2096-2069 (z) achieved | As projected in advance on Friday, SHORTS above 2069: proved an ideal plan!

: