Piyush Lalsingh Ratnu / Perfil

- Informações

|

no

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

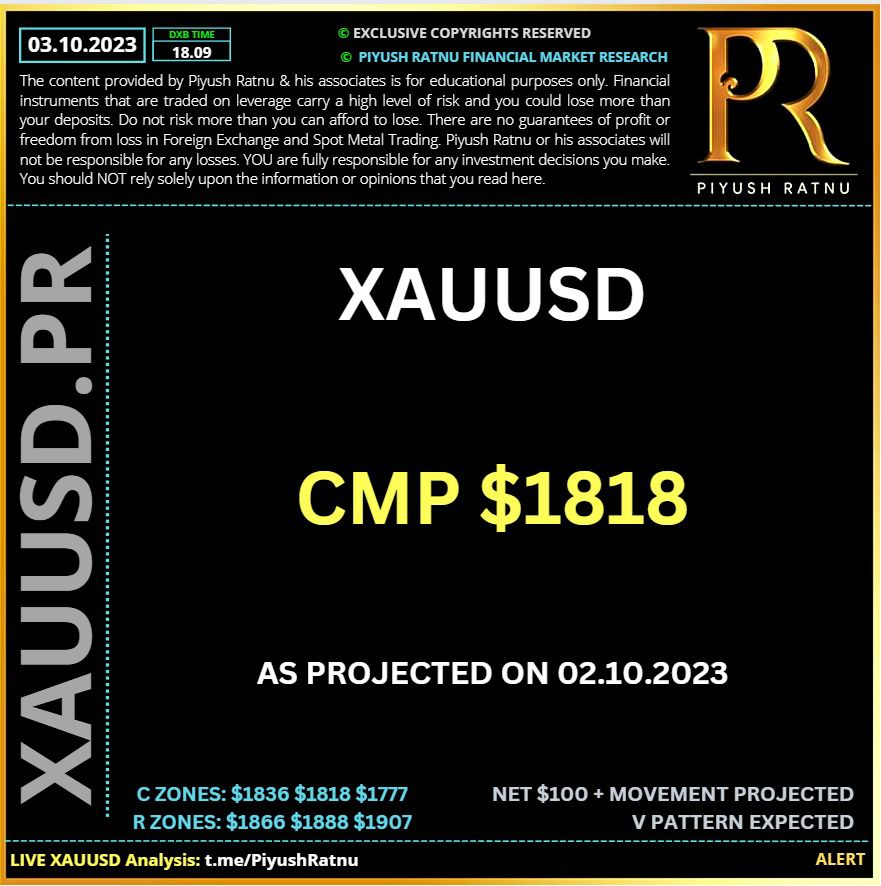

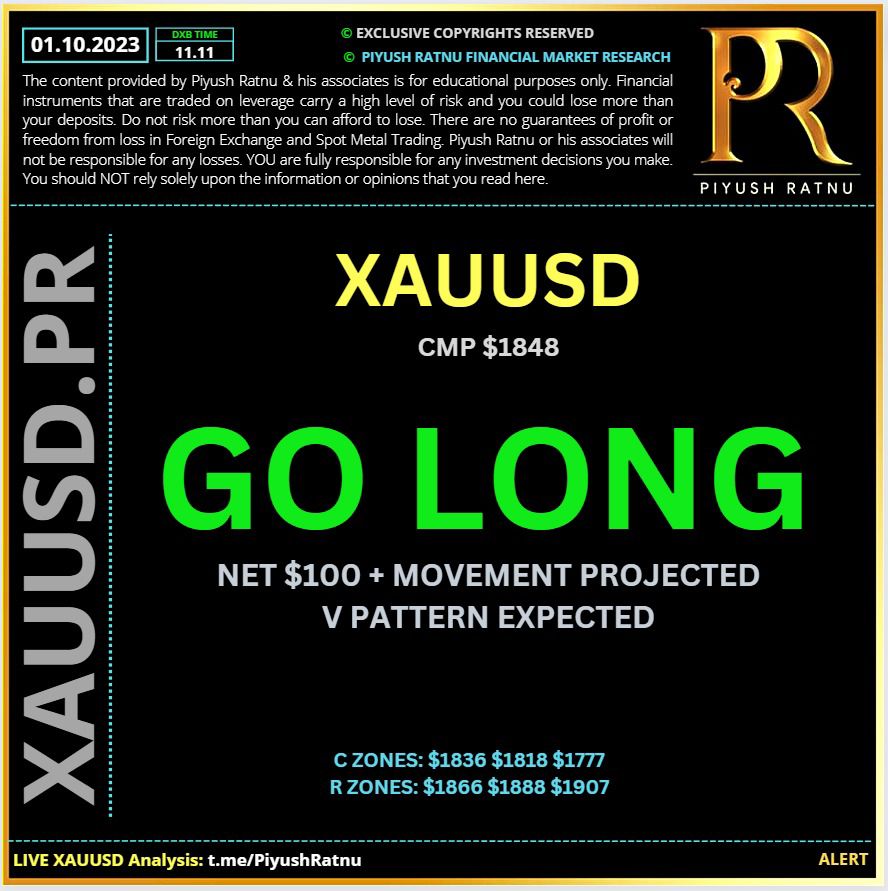

Buying at $1818 gave us good results: XAUUSD reversed from $1815 today morning back to $1827 (CMP)

Net pips achieved: 800+ in 8 hours.

Those who do not want to take higher risk can close their positions at CMP. Those who can add additional funds to increase the size of their account in case of a deeper crash: can hold their positions.

I expect V on M30 Hand H1 TF in sequence in next 10 days.⚠️

Kindly refer our algorithm: PRSDBS and PRFIBRTSQ to understand the V patterns, and retracement zones with current: ideal B/S zones.

🟢Scenario 1:

T parameters: $1836 a tough nut ahead:

Breach= $1866/1888

M15VS1

M30VS5

H1V236

🟢Scenario 2: Reversal: $1818/1800/1777

XAUUSD PRICE Current status: PRPZ:

M15V100 achieved

M30V50 achieved

H1V236 achieved

H4VE10 achieved

18.40 hours:

🆘XAUUSD back to $1828 third time, Exit BUY positions.

Buying at and below $1818: gave us neat exits since morning.

Net pips achieved: 800+ in 8 hours.

Those who do not want to take higher risk can close their positions at CMP. Those who can add additional funds to increase the size of their account in case of a deeper crash: can hold their positions.

I expect V on M30 Hand H1 TF in sequence in next 10 days.⚠️

Kindly refer our algorithm: PRSDBS and PRFIBRTSQ to understand the V patterns, and retracement zones with current: ideal B/S zones.

🟢Scenario 1:

T parameters: $1836 a tough nut ahead:

Breach= $1866/1888

M15VS1

M30VS5

H1V236

🟢Scenario 2: Reversal: $1818/1800/1777

XAUUSD PRICE Current status: PRPZ:

M15V100 achieved

M30V50 achieved

H1V236 achieved

H4VE10 achieved

18.40 hours:

🆘XAUUSD back to $1828 third time, Exit BUY positions.

Buying at and below $1818: gave us neat exits since morning.

Piyush Lalsingh Ratnu

♾Premium Portfolio Accounts: Open position status:

OP 18.18

@1820

.37 (1818 zone)

BL 18.18 @ 1800

BL 36.36 @ 1777

BL 36.36

@1735

BL 66.66 @ 1717

BL 66.66 @ 1700

TP 1896

OP 18.18

@1820

.37 (1818 zone)

BL 18.18 @ 1800

BL 36.36 @ 1777

BL 36.36

@1735

BL 66.66 @ 1717

BL 66.66 @ 1700

TP 1896

Piyush Lalsingh Ratnu

⏰USD Index looks at yields, data, Fed

The index advanced for the third consecutive session and adds to the positive start of the week, recording new yearly peaks in levels last seen in November 2022, north of 107.00 figure.

The equally sharp move higher in US yields across the curve also underpins the pronounced uptick in the dollar, which has been in place since mid-July and has entered its 12th consecutive week of gains so far.

The continuation of the upside bias in the greenback appears propped up by speculation of further tightening by the Federal Reserve (an extra rate hike is priced in before year-end), a view that has been reinforced by hawkish comments from FOMC M. Bowman on Monday.

In the US docket, the release of the JOLTs Job Openings will be in the limelight later in the NA session seconded by the speech by Atlanta Fed R. Bostic (2024 voter, hawk).

🆘What to look for around USD

The greenback trades in a firmer note and surpasses the 107.00 hurdle to print new YTD highs on Tuesday.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which at the same time appears underpinned by the renewed tighter-for-longer stance narrative from the Federal Reserve.

♾Key events in the US this week:

JOLTs Job Openings (Tuesday) – MBA Mortgage Applications, ADP Employment Change, Final Services PMI, ISM Services PMI, Factory Orders (Wednesday) - Initial Jobless Claims, Balance of Trade (Thursday) – NFP, Unemployment Rate, Consumer Credit Change (Friday).

🆘Eminent issues on the back boiler:

Persevering debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

The index advanced for the third consecutive session and adds to the positive start of the week, recording new yearly peaks in levels last seen in November 2022, north of 107.00 figure.

The equally sharp move higher in US yields across the curve also underpins the pronounced uptick in the dollar, which has been in place since mid-July and has entered its 12th consecutive week of gains so far.

The continuation of the upside bias in the greenback appears propped up by speculation of further tightening by the Federal Reserve (an extra rate hike is priced in before year-end), a view that has been reinforced by hawkish comments from FOMC M. Bowman on Monday.

In the US docket, the release of the JOLTs Job Openings will be in the limelight later in the NA session seconded by the speech by Atlanta Fed R. Bostic (2024 voter, hawk).

🆘What to look for around USD

The greenback trades in a firmer note and surpasses the 107.00 hurdle to print new YTD highs on Tuesday.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which at the same time appears underpinned by the renewed tighter-for-longer stance narrative from the Federal Reserve.

♾Key events in the US this week:

JOLTs Job Openings (Tuesday) – MBA Mortgage Applications, ADP Employment Change, Final Services PMI, ISM Services PMI, Factory Orders (Wednesday) - Initial Jobless Claims, Balance of Trade (Thursday) – NFP, Unemployment Rate, Consumer Credit Change (Friday).

🆘Eminent issues on the back boiler:

Persevering debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

Piyush Lalsingh Ratnu

✔️As projected in my analysis: dated 01.09.2023:

I had projected crash in Gold price of Gold smashes $1907 support zone.

💎Buy limits at 1888, 1866, 1836 were suggested by me with exit of $5/NAP.

Those who implemented buy limits and made an exit with bigger lot sizes: am sure made a good profit and neat exit.

♾XAUUSD PRICE ACTION so far:

$1907-1901 RT $1909

$1888-1866 RT $1881

$1836-1832 RT $1840

$1818-1815 RT $1822

🟢In all the above price movements, price zones projected by me proved accurate and an ideal buying zone to exit in NAP.

Read my analysis at: https://t.me/PiyushRatnu/6229

I had projected crash in Gold price of Gold smashes $1907 support zone.

💎Buy limits at 1888, 1866, 1836 were suggested by me with exit of $5/NAP.

Those who implemented buy limits and made an exit with bigger lot sizes: am sure made a good profit and neat exit.

♾XAUUSD PRICE ACTION so far:

$1907-1901 RT $1909

$1888-1866 RT $1881

$1836-1832 RT $1840

$1818-1815 RT $1822

🟢In all the above price movements, price zones projected by me proved accurate and an ideal buying zone to exit in NAP.

Read my analysis at: https://t.me/PiyushRatnu/6229

Piyush Lalsingh Ratnu

🍎Spot GOLD Price Movers:

• Gold price continues a five-day losing spell to near $1,840.00 in the context of ‘higher for longer’ interest rates by the Federal Reserve to tame the so-called ‘last leg’ of inflation.

• The yellow metal is expected to extend downside as the US Manufacturing PMI outperformed expectations. The economic data landed at 49.0, much higher than estimates and the former release of 47.7 and 47.6 respectively. Also, the New Orders Index jumped to 49.2 from the August reading of 46.8.

• The precious metal also faces pressure from higher US Treasury yields, which have jumped to near 4.63% as Fed policymakers still favor more interest rates to ensure price stability.

• New York Fed Bank President John C. Williams said on the weekend that the Fed is at or near peak levels of interest rates. Williams sees signs of inflation pressures waning and labor market imbalance diminishing.

• The yellow metal failed to find bids on Friday despite a soft PCE report, which is majorly used by the Fed for policy decision-making.

• Monthly Core PCE grew at a nominal pace of 0.1%, slower than expectations and the former pace of 0.2%. The annual core PCE data decelerated to 3.9% as expected against July's reading of 4.3%. The headline PCE expanded at a higher pace of 0.4% against July's reading of 0.2% but slower than expectations of 0.5%. On an annual basis, PCE inflation accelerated to 3.5% as expected due to rising energy prices.

• A soft core PCE inflation report has decreased the chances of one more interest rate hike from the Fed before the year ends. As per the CME Group Fedwatch tool, investors price in that interest rates will remain steady at 5.25%-5.50% at the November monetary policy. Meanwhile, chances for interest rates remaining unchanged at 5.25%-5.50% until the end of 2023 dropped to 56%.

• A slowdown in consumer spending on core goods has eased consumer inflation expectations, making Fed policymakers comfortable in holding interest rates.

• On a broader note, the US economy is resilient due to a stable labor demand, upbeat wage growth, and robust retail demand, which would keep hopes for a rebound in inflation intact and Gold price on the back foot.

• The market mood improves as the US government manages to ditch a government shutdown in a last-minute deal. The agreement between the US House and Senate approved a funding bill until November 17.

• China’s new home prices rose slightly after declining for four months as home-builders ramped up property selling, capitalizing on supportive measures from China’s government and expansionary monetary policy by the People’s Bank of China (PBoC).

• Improved market sentiment is restricting recovery in the US Dollar index (DXY). The USD Index aims to stabilize above the 106.00 resistance as global slowdown fears persist.

• Gold price continues a five-day losing spell to near $1,840.00 in the context of ‘higher for longer’ interest rates by the Federal Reserve to tame the so-called ‘last leg’ of inflation.

• The yellow metal is expected to extend downside as the US Manufacturing PMI outperformed expectations. The economic data landed at 49.0, much higher than estimates and the former release of 47.7 and 47.6 respectively. Also, the New Orders Index jumped to 49.2 from the August reading of 46.8.

• The precious metal also faces pressure from higher US Treasury yields, which have jumped to near 4.63% as Fed policymakers still favor more interest rates to ensure price stability.

• New York Fed Bank President John C. Williams said on the weekend that the Fed is at or near peak levels of interest rates. Williams sees signs of inflation pressures waning and labor market imbalance diminishing.

• The yellow metal failed to find bids on Friday despite a soft PCE report, which is majorly used by the Fed for policy decision-making.

• Monthly Core PCE grew at a nominal pace of 0.1%, slower than expectations and the former pace of 0.2%. The annual core PCE data decelerated to 3.9% as expected against July's reading of 4.3%. The headline PCE expanded at a higher pace of 0.4% against July's reading of 0.2% but slower than expectations of 0.5%. On an annual basis, PCE inflation accelerated to 3.5% as expected due to rising energy prices.

• A soft core PCE inflation report has decreased the chances of one more interest rate hike from the Fed before the year ends. As per the CME Group Fedwatch tool, investors price in that interest rates will remain steady at 5.25%-5.50% at the November monetary policy. Meanwhile, chances for interest rates remaining unchanged at 5.25%-5.50% until the end of 2023 dropped to 56%.

• A slowdown in consumer spending on core goods has eased consumer inflation expectations, making Fed policymakers comfortable in holding interest rates.

• On a broader note, the US economy is resilient due to a stable labor demand, upbeat wage growth, and robust retail demand, which would keep hopes for a rebound in inflation intact and Gold price on the back foot.

• The market mood improves as the US government manages to ditch a government shutdown in a last-minute deal. The agreement between the US House and Senate approved a funding bill until November 17.

• China’s new home prices rose slightly after declining for four months as home-builders ramped up property selling, capitalizing on supportive measures from China’s government and expansionary monetary policy by the People’s Bank of China (PBoC).

• Improved market sentiment is restricting recovery in the US Dollar index (DXY). The USD Index aims to stabilize above the 106.00 resistance as global slowdown fears persist.

Piyush Lalsingh Ratnu

⚠️Is it wise to invest in gold during a recession?

It’s interesting that this phrase ‘safe haven’ gets thrown about when it comes to investing in gold. It doesn’t always make sense to hold gold, which doesn’t give a yield, While gold can work as a safe haven in a lower-interest-rate environment, it doesn’t work as well if investors hold gold against the US dollar, which does produce a yield.

To counter the effects of a recession, a central bank injects liquidity into the market, which leads to inflation that lowers the value of the currency. This lowers investor confidence in the strength of the currency and increases demand for gold, which usually holds its value in weak economic environments.

It’s interesting that this phrase ‘safe haven’ gets thrown about when it comes to investing in gold. It doesn’t always make sense to hold gold, which doesn’t give a yield, While gold can work as a safe haven in a lower-interest-rate environment, it doesn’t work as well if investors hold gold against the US dollar, which does produce a yield.

To counter the effects of a recession, a central bank injects liquidity into the market, which leads to inflation that lowers the value of the currency. This lowers investor confidence in the strength of the currency and increases demand for gold, which usually holds its value in weak economic environments.

Piyush Lalsingh Ratnu

🆘XAUUSD current status:

MNAS5

W1 A50 u/1845

D1 A100 u/1803

SR D1: R2 1875 R3 1896 R4 1909 | S2 1821 S3 1800 S4 1787

SRW1: R2 1913 R3 1963 R4 1994 | S2 1782 S3 1732

SRMN: R2 1901 R3 1942 R4 1966 | S2 1795 S3 1754 S4 1729

Co-relations:

USDJPY back to 23.10.2022 range: $150.000 zone

XAUUSD on 23.10.2022: $1645

Tomorrow is Chinese holiday: I expect a major drop in volumes and sudden spike in GOLD price. Stay Alert. Avoid pile up.

Major correction on the way. I project V pattern.

MNAS5

W1 A50 u/1845

D1 A100 u/1803

SR D1: R2 1875 R3 1896 R4 1909 | S2 1821 S3 1800 S4 1787

SRW1: R2 1913 R3 1963 R4 1994 | S2 1782 S3 1732

SRMN: R2 1901 R3 1942 R4 1966 | S2 1795 S3 1754 S4 1729

Co-relations:

USDJPY back to 23.10.2022 range: $150.000 zone

XAUUSD on 23.10.2022: $1645

Tomorrow is Chinese holiday: I expect a major drop in volumes and sudden spike in GOLD price. Stay Alert. Avoid pile up.

Major correction on the way. I project V pattern.

Piyush Lalsingh Ratnu

XAUUSD @ H4A100 | $1888 zone achieved

🟢S2 ZONE 1888 | DOWN TREND (Below $1907): 1900/1888/1866/1836 | BUY LIMITS

✔️As projected in my analysis dated 01.09.2023

Read more at:

https://bit.ly/PRTrackRecordXAUUSD

🟢S2 ZONE 1888 | DOWN TREND (Below $1907): 1900/1888/1866/1836 | BUY LIMITS

✔️As projected in my analysis dated 01.09.2023

Read more at:

https://bit.ly/PRTrackRecordXAUUSD

Piyush Lalsingh Ratnu

A movement of only $6 has been observed on Interest Rate Decision, I expect higher volatility during/post speech + tomorrow EU session and US Session.

🆘Avoid Pile Up | Avoid Martingale

🟢Important price ranges to be observed:

C: $1926/1919/1907

R: $1966/1985/2009

🆘Avoid Pile Up | Avoid Martingale

🟢Important price ranges to be observed:

C: $1926/1919/1907

R: $1966/1985/2009

Piyush Lalsingh Ratnu

Daily Digest Market Movers: Gold price climbs further on neutral Fed bets

• Gold price extends its upside momentum above $1,930 as investors see the Federal Reserve keeping interest rates unchanged at 5.25%-5.50% after its September monetary policy meeting. The decision will be announced on Wednesday.

• The precious metal kept attracting bids from the past three trading sessions as the upside in the US Dollar is expected to remain restricted on expectations of unchanged rates.

• US inflation is falling and the labor market is resilient despite higher interest rates, allowing policymakers to leave interest rates unchanged.

• The recent rise in Oil prices is exerting pressure on inflation but Fed policymakers generally consider core inflation, which doesn’t include energy prices, while framing monetary policy.

• For the interest rate guidance, the Fed is expected to keep the doors open for further policy tightening to ensure price stability.

• The Fed could keep interest rates elevated long enough to bring down inflation to 2%. This is likely to continue to build pressure on the US economy, particularly for the manufacturing and housing sectors.

• Any discussion about rate cuts would improve the appeal for the risk-perceived assets and dampen the US Dollar. Economists at Goldman Sachs expect Fed officials to signal a full percentage point of cuts next year but to keep expectations of one more interest rate increase this year to a range of 5.50%-5.75%.

• Worries about an economic slowdown due to higher interest rates for longer linger despite the current economic resilience. Shorter-term US Treasury yields have surpassed the yields offered in longer time frames, a situation that has historically indicated risks of a potential recession.

• As per the CME Group Fedwatch Tool, traders undoubtedly see interest rates remaining steady at 5.25%-5.50% after the Federal Open Market Committee (FOMC) meeting on Wednesday. For the rest of the year, traders anticipate almost a 58% chance for the Fed to also keep monetary policy unchanged.

• About the US economic outlook, US Treasury Secretary Janet Yellen on Monday said that she doesn’t see any signs that the economy will enter into a downturn as inflation is coming down and the labor market is quite strong.

• However, Yellen warned that a failure by Congress to pass the legislation to keep the government in control could elevate the risk of an economic slowdown.

• Later this week, investors will watch the preliminary Manufacturing and Services PMI September data to be reported by S&P Global. US factory activity has remained vulnerable due to higher interest rates. Firms are focusing on achieving efficiency by controlling costs in a deteriorating demand environment.

• The US Dollar Index (DXY) seems well-supported above the crucial 105.00 level. Investors keep pumping money into the USD Index due to deepening fears of a global slowdown in a high-interest rate environment.

• Gold price extends its upside momentum above $1,930 as investors see the Federal Reserve keeping interest rates unchanged at 5.25%-5.50% after its September monetary policy meeting. The decision will be announced on Wednesday.

• The precious metal kept attracting bids from the past three trading sessions as the upside in the US Dollar is expected to remain restricted on expectations of unchanged rates.

• US inflation is falling and the labor market is resilient despite higher interest rates, allowing policymakers to leave interest rates unchanged.

• The recent rise in Oil prices is exerting pressure on inflation but Fed policymakers generally consider core inflation, which doesn’t include energy prices, while framing monetary policy.

• For the interest rate guidance, the Fed is expected to keep the doors open for further policy tightening to ensure price stability.

• The Fed could keep interest rates elevated long enough to bring down inflation to 2%. This is likely to continue to build pressure on the US economy, particularly for the manufacturing and housing sectors.

• Any discussion about rate cuts would improve the appeal for the risk-perceived assets and dampen the US Dollar. Economists at Goldman Sachs expect Fed officials to signal a full percentage point of cuts next year but to keep expectations of one more interest rate increase this year to a range of 5.50%-5.75%.

• Worries about an economic slowdown due to higher interest rates for longer linger despite the current economic resilience. Shorter-term US Treasury yields have surpassed the yields offered in longer time frames, a situation that has historically indicated risks of a potential recession.

• As per the CME Group Fedwatch Tool, traders undoubtedly see interest rates remaining steady at 5.25%-5.50% after the Federal Open Market Committee (FOMC) meeting on Wednesday. For the rest of the year, traders anticipate almost a 58% chance for the Fed to also keep monetary policy unchanged.

• About the US economic outlook, US Treasury Secretary Janet Yellen on Monday said that she doesn’t see any signs that the economy will enter into a downturn as inflation is coming down and the labor market is quite strong.

• However, Yellen warned that a failure by Congress to pass the legislation to keep the government in control could elevate the risk of an economic slowdown.

• Later this week, investors will watch the preliminary Manufacturing and Services PMI September data to be reported by S&P Global. US factory activity has remained vulnerable due to higher interest rates. Firms are focusing on achieving efficiency by controlling costs in a deteriorating demand environment.

• The US Dollar Index (DXY) seems well-supported above the crucial 105.00 level. Investors keep pumping money into the USD Index due to deepening fears of a global slowdown in a high-interest rate environment.

Piyush Lalsingh Ratnu

Gold Moves Higher as Political and Financial Instability is Growing

The gold price rose by almost 0.70% on Friday as disappointing macroeconomic data and social instability in the U.S. brought the dollar down and pushed metals higher.

Gold and silver are rallying on a wall of worry,' said Tai Wong, a New York-based independent metals trader. On Friday, the U.S. United Auto Workers (UAW) union started a strike at three factories in Detroit, being the largest industrial labor action in decades. In addition, the media write about the possible government shutdown at the end of the month, fuelling political concerns. Moreover, the Consumer Confidence Index published by the University of Michigan came out lower than expected, boosting hopes that the Federal Reserve (Fed) won't raise the benchmark interest rate this year. The market is currently pricing in only a 27% chance of a rate hike in November and less than a 40% probability of a rate increase in December.

🆘XAU/USD was rising during the Asian session. Today's economic calendar is relatively light, so gold probably won't fluctuate much. However, traders may change their positions ahead of this week's central banks' decisions. Therefore, XAU/USD may possibly be correct towards 1,916.

🟢'Spot gold may test a resistance zone of 1,933–1,935 USD per ounce, a break above which could lead to a gain into the 1,941–1,943 range,' said Reuters analyst Wang Tao.

The gold price rose by almost 0.70% on Friday as disappointing macroeconomic data and social instability in the U.S. brought the dollar down and pushed metals higher.

Gold and silver are rallying on a wall of worry,' said Tai Wong, a New York-based independent metals trader. On Friday, the U.S. United Auto Workers (UAW) union started a strike at three factories in Detroit, being the largest industrial labor action in decades. In addition, the media write about the possible government shutdown at the end of the month, fuelling political concerns. Moreover, the Consumer Confidence Index published by the University of Michigan came out lower than expected, boosting hopes that the Federal Reserve (Fed) won't raise the benchmark interest rate this year. The market is currently pricing in only a 27% chance of a rate hike in November and less than a 40% probability of a rate increase in December.

🆘XAU/USD was rising during the Asian session. Today's economic calendar is relatively light, so gold probably won't fluctuate much. However, traders may change their positions ahead of this week's central banks' decisions. Therefore, XAU/USD may possibly be correct towards 1,916.

🟢'Spot gold may test a resistance zone of 1,933–1,935 USD per ounce, a break above which could lead to a gain into the 1,941–1,943 range,' said Reuters analyst Wang Tao.

Piyush Lalsingh Ratnu

🔘USD/JPY moving closer to 150 will put more pressure on the government to intervene to support the Yen

Will BoJ Governor Ueda push back further against JPY weakness by talking up rate hike risks?

Market attention will now turn to comments from Governor Ueda at this week’s policy meeting to see what message he delivers over the future timing of rate hikes and what level of unease he displays over recent Yen weakness.

If BoJ Governor Ueda steps back from providing a strong signal over the possibility of rate hikes by the turn of the year, it will increase the burden on the Japanese government to support the Yen through intervention like late last year if the USD/JPY jumps back above the 150.00 level and moves to retest last year’s high at 151.95.

Will BoJ Governor Ueda push back further against JPY weakness by talking up rate hike risks?

Market attention will now turn to comments from Governor Ueda at this week’s policy meeting to see what message he delivers over the future timing of rate hikes and what level of unease he displays over recent Yen weakness.

If BoJ Governor Ueda steps back from providing a strong signal over the possibility of rate hikes by the turn of the year, it will increase the burden on the Japanese government to support the Yen through intervention like late last year if the USD/JPY jumps back above the 150.00 level and moves to retest last year’s high at 151.95.

Piyush Lalsingh Ratnu

🟢XAUUSD: CMP $1907.30

$1900 zone - $1907 zone achieved.

🆘Zone achieved | PRFZ levels:

M1V618 M5VS5 M5V618 M15V50 M30V382 H1V236

$1900 zone - $1907 zone achieved.

🆘Zone achieved | PRFZ levels:

M1V618 M5VS5 M5V618 M15V50 M30V382 H1V236

Piyush Lalsingh Ratnu

🆘The European Central Bank has hiked interest rates to a record high as policymakers look to address elevated inflation in the eurozone despite signals that the region's economy is weakening.

It is the tenth straight rate increase by the Frankfurt-based bank since it misjudged the speed of price gains early last year. The move brings the ECB's main refinancing operations, the interest rates on the marginal lending facility and the deposit facility up to 4.50%, 4.75% and 4.00%, respectively.

"Inflation continues to decline but is still expected to remain too high for too long," the ECB said in a statement. "The rate increase today reflects the Governing Council’s assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission."

Prior to the decision, debate swirled around how officials would adjust borrowing costs to account for stubbornly high price growth and flagging economic activity.

Preliminary readings show that inflation in the eurozone is now more than twice the ECB's 2% target. However, the bank's long-standing monetary tightening campaign, coupled with similar policy moves by central banks across the world and weakness in China, have begun to hit the broader eurozone economy. Manufacturing is suffering, while lending has slumped and services have showed early signs of strain, contributing to concerns that the region may slip into a recession.

Impact XAUUSD +

EURUSD -

It is the tenth straight rate increase by the Frankfurt-based bank since it misjudged the speed of price gains early last year. The move brings the ECB's main refinancing operations, the interest rates on the marginal lending facility and the deposit facility up to 4.50%, 4.75% and 4.00%, respectively.

"Inflation continues to decline but is still expected to remain too high for too long," the ECB said in a statement. "The rate increase today reflects the Governing Council’s assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission."

Prior to the decision, debate swirled around how officials would adjust borrowing costs to account for stubbornly high price growth and flagging economic activity.

Preliminary readings show that inflation in the eurozone is now more than twice the ECB's 2% target. However, the bank's long-standing monetary tightening campaign, coupled with similar policy moves by central banks across the world and weakness in China, have begun to hit the broader eurozone economy. Manufacturing is suffering, while lending has slumped and services have showed early signs of strain, contributing to concerns that the region may slip into a recession.

Impact XAUUSD +

EURUSD -

Piyush Lalsingh Ratnu

⚠️XAUUSD under price trap of $1907 PPZ S1

🆘Important Data:

16:15 EUR Deposit Facility Rate (Sep) 3.75% 3.75%

16:15 EUR ECB Marginal Lending Facility 4.50%

16:15 EUR ECB McCaul Speaks

16:15 EUR ECB Monetary Policy Statement

16:15 EUR ECB Interest Rate Decision (Sep) 4.25% 4.25%

16:30 USD Continuing Jobless Claims 1,695K 1,679K

16:30 USD Core PPI (YoY) (Aug) 2.2% 2.4%

16:30 USD Core PPI (MoM) (Aug) 0.2% 0.3%

16:30 USD Core Retail Sales (MoM) (Aug) 0.4% 1.0%

16:30 USD Initial Jobless Claims 225K 216K

16:30 USD Jobless Claims 4-Week Avg. 229.25K

16:30 USD PPI ex. Food/Energy/Transport (YoY) (Aug) 2.7%

16:30 USD PPI (MoM) (Aug) 0.4% 0.3%

16:30 USD PPI (YoY) (Aug) 1.2% 0.8%

16:30 USD PPI ex. Food/Energy/Transport (MoM) (Aug) 0.2%

16:30 USD Retail Control (MoM) (Aug) 1.0%

16:30 USD Retail Sales (YoY) (Aug) 3.17%

16:30 USD Retail Sales (MoM) (Aug) 0.2% 0.7%

🟢High Volatility expected at 16.30 hours today.

❌Avoid taking big lots / repetitive orders

♾Target Price zone: $1888/1926

🆘Important Data:

16:15 EUR Deposit Facility Rate (Sep) 3.75% 3.75%

16:15 EUR ECB Marginal Lending Facility 4.50%

16:15 EUR ECB McCaul Speaks

16:15 EUR ECB Monetary Policy Statement

16:15 EUR ECB Interest Rate Decision (Sep) 4.25% 4.25%

16:30 USD Continuing Jobless Claims 1,695K 1,679K

16:30 USD Core PPI (YoY) (Aug) 2.2% 2.4%

16:30 USD Core PPI (MoM) (Aug) 0.2% 0.3%

16:30 USD Core Retail Sales (MoM) (Aug) 0.4% 1.0%

16:30 USD Initial Jobless Claims 225K 216K

16:30 USD Jobless Claims 4-Week Avg. 229.25K

16:30 USD PPI ex. Food/Energy/Transport (YoY) (Aug) 2.7%

16:30 USD PPI (MoM) (Aug) 0.4% 0.3%

16:30 USD PPI (YoY) (Aug) 1.2% 0.8%

16:30 USD PPI ex. Food/Energy/Transport (MoM) (Aug) 0.2%

16:30 USD Retail Control (MoM) (Aug) 1.0%

16:30 USD Retail Sales (YoY) (Aug) 3.17%

16:30 USD Retail Sales (MoM) (Aug) 0.2% 0.7%

🟢High Volatility expected at 16.30 hours today.

❌Avoid taking big lots / repetitive orders

♾Target Price zone: $1888/1926

Piyush Lalsingh Ratnu

⏰Market movers today

The ECB meeting is the main event today, with the rate decision at 14.15 CET followed by Lagarde's press conference at 14.45 CET. We expect a 25bp hike, which will be mirrored 1-to-1 by Danmarks Nationalbank.

On the data front, August inflation data will be released for Sweden. We expect headline CPIF inflation to cool clearly in y/y terms to 4.9% (from 6.4%) and CPIF excluding energy to 7.3% (from 8.0%).

🟢The 60 second overview

We expect the ECB to hike by 25bp at today's meeting. The market pricing is 16bp (up 3bp since yesterday) following the Reuters story on an upward revision to the 2024 inflation forecast in today's staff projections. In our opinion, this is a natural (and expected) consequence of rising energy prices since the latest projection round in June.

✔️The key factor for today's decision will be the projected core inflation path until 2025. We expect the forecast to reflect strong underlying inflation dynamics driven by tight labour market conditions.

Combined with the latest (strong) inflation data, this should justify hiking a final 25bp. We also expect an advancement of the end to full reinvestment process of PEPP currently guided for December 2024 to be on the cards. Regardless of whether the ECB decides to hike or not, we expect Danmarks Nationalbank to follow the rate decision 1-to-1.

Looking ahead, all eyes remain on the European Central Bank (ECB) interest rate decision, which is likely to be an interesting one. ECB President Christine Lagarde faces a tough call, as the old continent risks stagnation while inflation remains more than double the central bank’s 2.0% target. A hawkish pause, with Lagarde leaving the door open for more rate hikes, will likely fuel a sharp rally in the EUR/USD pair at the expense of the US Dollar. In such a case, Gold price could capitalize on the US Dollar weakness and extend its rebound toward the critical 200-Daily Moving Average (DMA) at $1,922.

However, Gold traders will also pay close attention to the US Retail Sales and Producer Price Index data for fresh US Dollar valuations.

♾All in all, Gold price braces for another day of volatile trading on the ECB verdict and the US economic data releases.

The ECB meeting is the main event today, with the rate decision at 14.15 CET followed by Lagarde's press conference at 14.45 CET. We expect a 25bp hike, which will be mirrored 1-to-1 by Danmarks Nationalbank.

On the data front, August inflation data will be released for Sweden. We expect headline CPIF inflation to cool clearly in y/y terms to 4.9% (from 6.4%) and CPIF excluding energy to 7.3% (from 8.0%).

🟢The 60 second overview

We expect the ECB to hike by 25bp at today's meeting. The market pricing is 16bp (up 3bp since yesterday) following the Reuters story on an upward revision to the 2024 inflation forecast in today's staff projections. In our opinion, this is a natural (and expected) consequence of rising energy prices since the latest projection round in June.

✔️The key factor for today's decision will be the projected core inflation path until 2025. We expect the forecast to reflect strong underlying inflation dynamics driven by tight labour market conditions.

Combined with the latest (strong) inflation data, this should justify hiking a final 25bp. We also expect an advancement of the end to full reinvestment process of PEPP currently guided for December 2024 to be on the cards. Regardless of whether the ECB decides to hike or not, we expect Danmarks Nationalbank to follow the rate decision 1-to-1.

Looking ahead, all eyes remain on the European Central Bank (ECB) interest rate decision, which is likely to be an interesting one. ECB President Christine Lagarde faces a tough call, as the old continent risks stagnation while inflation remains more than double the central bank’s 2.0% target. A hawkish pause, with Lagarde leaving the door open for more rate hikes, will likely fuel a sharp rally in the EUR/USD pair at the expense of the US Dollar. In such a case, Gold price could capitalize on the US Dollar weakness and extend its rebound toward the critical 200-Daily Moving Average (DMA) at $1,922.

However, Gold traders will also pay close attention to the US Retail Sales and Producer Price Index data for fresh US Dollar valuations.

♾All in all, Gold price braces for another day of volatile trading on the ECB verdict and the US economic data releases.

Piyush Lalsingh Ratnu

🆘Current status:

DXY 103.540 (Stable)

US10YT 4.097 (-)

USDJPY 145.100 (500 pips today)

XAUXAG 78.93

US F SPX + NQ + YM +

USDJPY approaching H4A100

XAUUSD approaching H4V0.0

⏰Co-relation in perfect action.

DXY 103.540 (Stable)

US10YT 4.097 (-)

USDJPY 145.100 (500 pips today)

XAUXAG 78.93

US F SPX + NQ + YM +

USDJPY approaching H4A100

XAUUSD approaching H4V0.0

⏰Co-relation in perfect action.

Piyush Lalsingh Ratnu

Check Latest Trading Scenarios and Analysis by Piyush Ratnu: How to trade XAUUSD on NFP Day?

Check at: https://bit.ly/PRTrackRecordXAUUSD

Check at: https://bit.ly/PRTrackRecordXAUUSD

: