JPY Exchange Rate Nervous Movements, Watching U.S. and European Stock Markets; U.S. Retail Sales Today

The yen has shown nervous movements recently. Last Friday, the Bank of Japan's (BOJ) decision meeting hinted at reducing government bond purchases in July. The market expected a reduction at the June meeting, leading to yen selling. BOJ Governor Ueda's remarks have added uncertainty, suggesting a potential rate hike in July depending on conditions. However, the reduction postponement is a fact, while Ueda's comments are hypothetical.

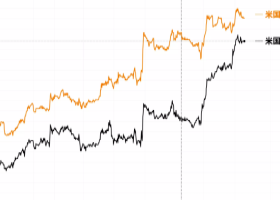

After the BOJ meeting, the market is focusing on U.S. and European stock movements. European stocks have been under pressure, with political tensions in France causing bond yields to rise. Conversely, the U.S. Nasdaq index has hit new highs for six consecutive days, driven by tech stocks and AI-related companies.

Today, U.S. economic fundamentals are in focus, with the release of retail sales (May), industrial production (May), business inventories (April), and securities investments (April). Retail sales are expected to rise by 0.3%, and industrial production by 0.3%.

A busy day of speeches from various central bank officials is also expected.

It is anticipated that today's U.S. retail sales will cause significant movements. Although an increase is expected, further USD buying might be limited, leading to a recent BTC/USD buy.