USD/JPY - Strong Sell - Focus Currencies and Technical Analysis (1-Hour Chart) September 4, 2024

USD/JPY - Strong Sell - Focus Currencies and Technical Analysis (1-Hour Chart) September 4, 2024

EUR/USD - Strong Sell

The EUR/USD pair is attempting to recover around the 1.1050 level, rising from the local low on August 19. Attention is focused on today's release of the Eurozone Producer Price Index (PPI), which is expected to improve from -3.2% to -2.5% year-on-year. However, the impact on ECB monetary policy is likely to be limited. Additionally, the Eurozone Business Activity Index will be released, with forecasts for the S&P Global Manufacturing PMI at 51.2 points and the Services PMI at 53.3 points. In the U.S., factory orders and the Beige Book report could influence the Fed's rate decision.

GBP/USD - Strong Sell

The GBP/USD pair is trading higher around 1.3115. Although it recently touched a new local low on August 23, market activity remains weak, with investors awaiting U.S. labor market data to be released later this week. The consensus is that the Fed will cut rates by 25 basis points at the September meeting, but a 50 basis point cut remains a possibility. Today, the UK Business Activity data will be released, with forecasts for the Services PMI at 53.3 points and the Composite PMI at 53.4 points.

AUD/USD - Strong Sell

The AUD/USD pair is showing unstable movements around the 0.6700 level. Australia's Q2 GDP growth rate fell short of expectations, slowing to 1.0% year-on-year. However, the Services PMI rose to 52.5 points, exceeding market expectations. In China, the Services PMI declined from 52.1 points to 51.6 points, falling short of forecasts. Tomorrow, Australia's trade data and a speech by the RBA Governor will be key points to watch.

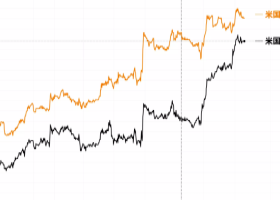

USD/JPY - Strong Sell

The USD/JPY pair is showing a slight decline around 145.20. The U.S. employment report to be released later this week could significantly impact the Fed’s monetary policy. Non-farm payrolls for August are expected to increase from 114,000 to 160,000. Meanwhile, Japan's Jibun Bank Manufacturing PMI decreased from 54.0 points to 53.7 points, maintaining pressure on the yen.

XAU/USD (Gold) - Strong Sell

The XAU/USD pair is moving sideways around the 2495.00 level. Market activity remains subdued, with attention focused on this week's U.S. labor market data. Tomorrow, the ADP employment report will be released, with non-farm payrolls expected to increase from 122,000 to 145,000 in August. The final U.S. employment report, set to be released on Friday, could impact the Fed’s rate decision.