NY Market Reopens After Holiday, Focus on ISM Manufacturing Index

Today marks the reopening of the NY market after a long weekend, and it's a day when significant U.S. economic indicators will be released. As a prelude to the U.S. employment report later this week, the various indicators being announced from today will be the market's focus.

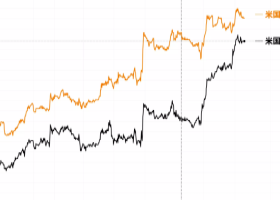

First, the final U.S. Manufacturing PMI for August will be released. Market expectations suggest a slight upward revision from the previous 48.0 to 48.1. U.S. construction spending (July) is also expected to recover from the previous -0.3% to +0.1%. The most closely watched release will be the U.S. ISM Manufacturing Index for August. Consensus estimates suggest an improvement from 46.8 in the previous report to 47.5, though it's not expected to reach the 48.5 level seen two reports ago. If the ISM Manufacturing Index significantly exceeds expectations, the U.S. dollar could see temporary buying pressure, but without a shift in expectations for a rate cut in September, sustained dollar strength may not follow.

In the European and London markets, scheduled releases include France's fiscal balance (July), Switzerland's real GDP (Q2 2024), Turkey's consumer price index (August) and producer price index (August), and South Africa's real GDP (Q2 2024). In the morning NY session, Mexico's unemployment rate (July) and Brazil's real GDP (Q2 2024) will also be released.

In terms of speeches, BoE Deputy Governor Breeden will attend the joint ECB-European Banking Authority (EBA) meeting, where banking regulation is expected to be the main topic. Additionally, Bundesbank President Nagel is scheduled to participate in a panel discussion in the European afternoon.

Strategy: The focus will be on the U.S. ISM Manufacturing Index release, and the plan is to respond to the resulting USD movement accordingly. The aim is to assess the market's reaction to the indicator results and identify appropriate entry points.