Focus on U.S. Producer Price Index: Will the Recovery Mood Continue?

In recent days, the market has shown signs of recovery, but whether this trend continues will depend on today’s U.S. Producer Price Index (PPI). Since late last week and into the start of this week, the stock market has regained strength, and the yen has been trending weaker. However, the market remains cautious, and it seems to be in a consolidation phase following the recent volatility.

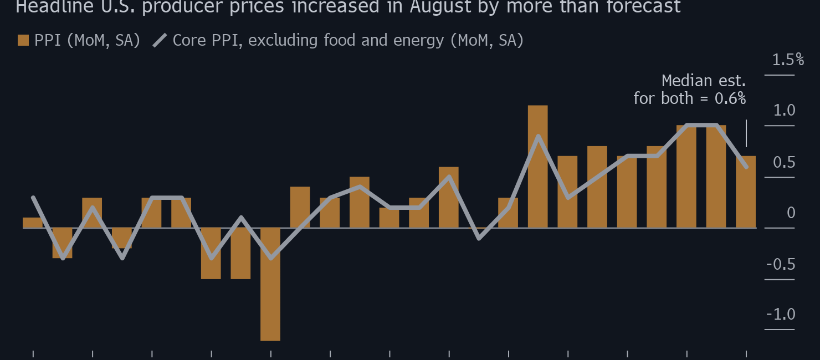

The continuation of the recovery will likely hinge on the results of today’s PPI. Market expectations are for PPI to increase by +0.2% month-over-month, the same as the previous month, with a year-over-year increase of +2.3%, indicating continued easing of inflation. The core PPI, which is closely watched, is also expected to show a similar slowdown. If the results align with market expectations, the confirmation of easing inflation could lead to further gains in stocks and a weaker yen.

However, with the U.S. Consumer Price Index (CPI) being released tomorrow, which is of greater importance to the market, any movements following the PPI release may be short-term position adjustments. The PPI release is scheduled.

Other important data releases today include Turkey’s current account balance, Germany’s ZEW Economic Sentiment Index, and South Africa’s unemployment rate. Additionally, speeches by Atlanta Fed President Bostic and earnings from Home Depot are notable events to watch.

It is crucial to keep a close eye on the movements of the U.S. dollar, especially after the PPI release. The market’s reaction ahead of the CPI release will be key.