Will the Trend of Yen Appreciation Continue? U.S. Existing Home Sales and Major U.S. Company Earnings Reports in Focus

23 7月 2024, 14:49

0

4

Will the Trend of Yen Appreciation Continue? U.S. Existing Home Sales and Major U.S. Company Earnings Reports in Focus

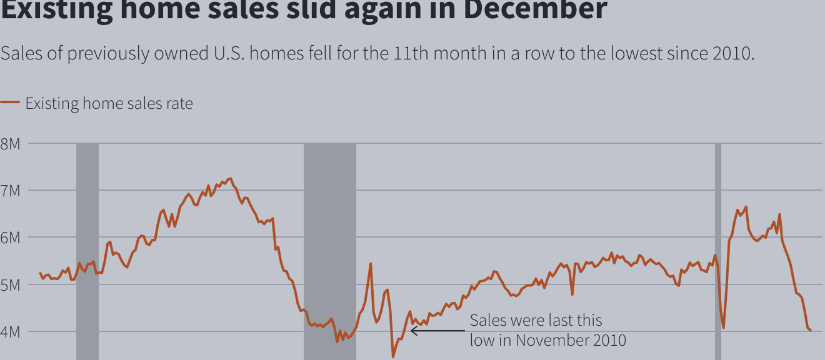

Today is relatively light on events. The main economic indicator is the U.S. existing home sales (June) to be released. The market expects 3.99 million units, down from the previous 4.11 million units. The expected ratio is -0.3% month-on-month. This forecast could potentially lead to dollar depreciation.

Other scheduled economic indicators include the Central Bank of Turkey’s policy rate (expected to remain at 50%), and the preliminary Eurozone consumer confidence index for July (expected to slightly improve to -13.5 from the previous -14.0).

Additionally, major U.S. companies are in the midst of announcing their earnings. Coca-Cola, Alphabet, Tesla, Spotify, VISA, and Texas Instruments are among the notable companies set to report. While semiconductor stocks rebounded yesterday, the sector has been showing strong signs of adjustment recently, and the market is likely to react nervously to related companies' earnings announcements.

In the Tokyo market today, comments from LDP Secretary-General Motegi were highlighted as yen appreciation factors: "Excessive yen depreciation is clearly a negative for the Japanese economy, as there is a risk of prolonged price increases," and "It is necessary to more clearly state the policy of normalizing monetary policy, including considering gradual interest rate hikes."

This month, the decline in U.S. Consumer Price Index growth and the Japanese government and Bank of Japan's intervention accelerated the fall in USD/JPY. Subsequently, the movement pattern has been such that the upper limits of USD/JPY and cross yen pairs have been lowered. The market also views this as position adjustment before the summer lull. Today will be a day to check whether the recent yen appreciation trend can maintain its continuity.

Except for the Japanese yen, there are no significant movements. I plan to focus on trading cross-currency pairs for clearer trends.