Today's Focus: U.S. Consumer Price Index Release - How Will Early Rate Cut Expectations Shift?

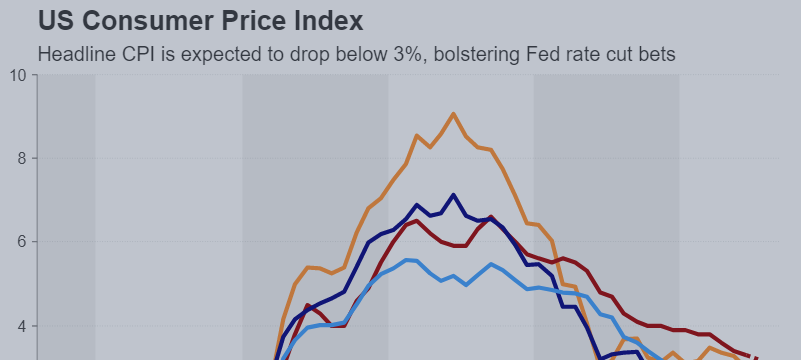

Today, the U.S. Consumer Price Index (CPI) for July will be released. Yesterday’s U.S. Producer Price Index (PPI) showed a sharper-than-expected slowdown, leading to a rise in U.S. stock markets and selling pressure on the dollar in the forex market. As a result, the probability of a significant 50 basis point rate cut in September has increased to about 55%.

Expectations and Market Reaction

The U.S. Consumer Price Index (CPI) expected today is forecasted as follows:

- Month-over-month: +0.2% (previous +0.1%)

- Year-over-year: +3.0% (previous +3.0%)

- Core Index: +0.2% (previous +0.1%)

- Year-over-year Core Index: +3.2% (previous +3.3%)

While not expected to slow as much as yesterday’s PPI, if the CPI shows a greater-than-expected slowdown, expectations for an early rate cut could strengthen further, potentially leading to higher stock prices and a weaker dollar.

Impact of Gasoline Prices and Points of Caution

On the other hand, there is a possibility that the CPI could exceed expectations due to rising gasoline prices, in which case the market reaction could be unpredictable. Therefore, it is important to be cautious of unexpected movements.

Other Key Points

- Speeches: There are no scheduled speeches from major financial officials today, typical of the quiet summer season.

- Oil-Related: The U.S. weekly oil inventory report will be released.

- U.S. Corporate Earnings: Cisco Systems' earnings report is drawing attention.

The U.S. dollar’s movements after the 21:30 CPI release will be closely watched, with a high likelihood of significant fluctuations following the announcement.