Focus on U.S. PCE Deflator Heading into the Weekend: Outlook for the Dollar as the Month Ends

30 8月 2024, 12:48

0

4

Focus on U.S. PCE Deflator Heading into the Weekend: Outlook for the Dollar as the Month Ends

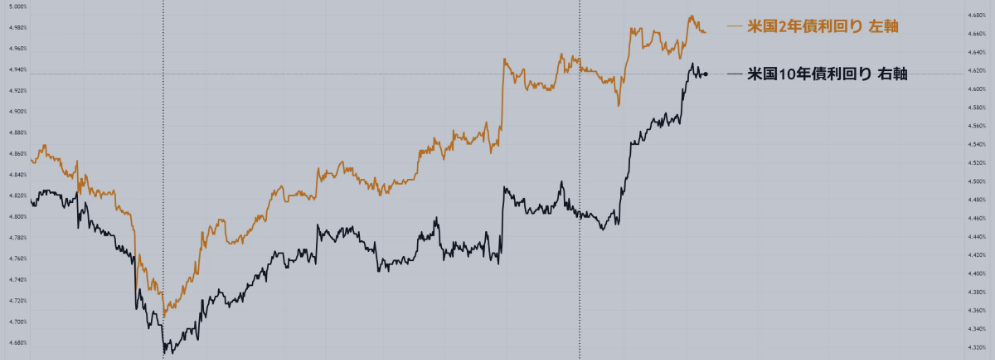

This week, the dollar's depreciation has shown signs of stabilizing. Following the intensified dollar selling triggered by Powell's remarks last weekend, the dollar continued to weaken at the beginning of the week but has since shifted to a buying trend. This appears to be influenced by the adjustment of short positions and the typical end-of-month dollar-buying flows. USD/JPY dropped below the mid-143 yen range before recovering to around 145 yen. Meanwhile, EUR/USD briefly reached the 1.12 range but was pushed back down to the high 1.10 range.

The dollar index had been in a downtrend since July but is now moving above the short-term resistance of the 10-day moving average, indicating a correction in the dollar's depreciation. However, for a more sustained change in the dollar's trend, fundamental factors such as U.S. economic statistics that support dollar buying will be necessary.

In yesterday's New York session, the revised U.S. GDP for Q2 was upwardly adjusted, driven by strong personal consumption, which spurred dollar buying. Today, the U.S. PCE Deflator (price index), an inflation indicator closely watched by the Federal Reserve, will be released. The market consensus expects a year-over-year increase of +2.5%, the same as the previous figure, with the core year-over-year figure expected to rise slightly from +2.6% to +2.7%. Depending on the outcome, the dollar could react significantly.

In addition, U.S. personal income and spending (July), Chicago PMI (August), University of Michigan Consumer Sentiment Index (final) (August), and Canada's real GDP (Q2 2024 and June) are also scheduled for release.

During the European session, ECB Executive Board member Schnabel, along with the central bank governors of Latvia, Lithuania, Finland, and Estonia, will participate in an event on "Eurozone Inflation and Monetary Policy."

Strategy: Focus will be on the U.S. core PCE Deflator. This is a crucial inflation-related indicator, and depending on the results, the USD could see significant movement. I plan to monitor the movements of USD/JPY closely and look for trading opportunities.