Piyush Lalsingh Ratnu / Profil

- Informations

|

Aucun

expérience

|

0

produits

|

0

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

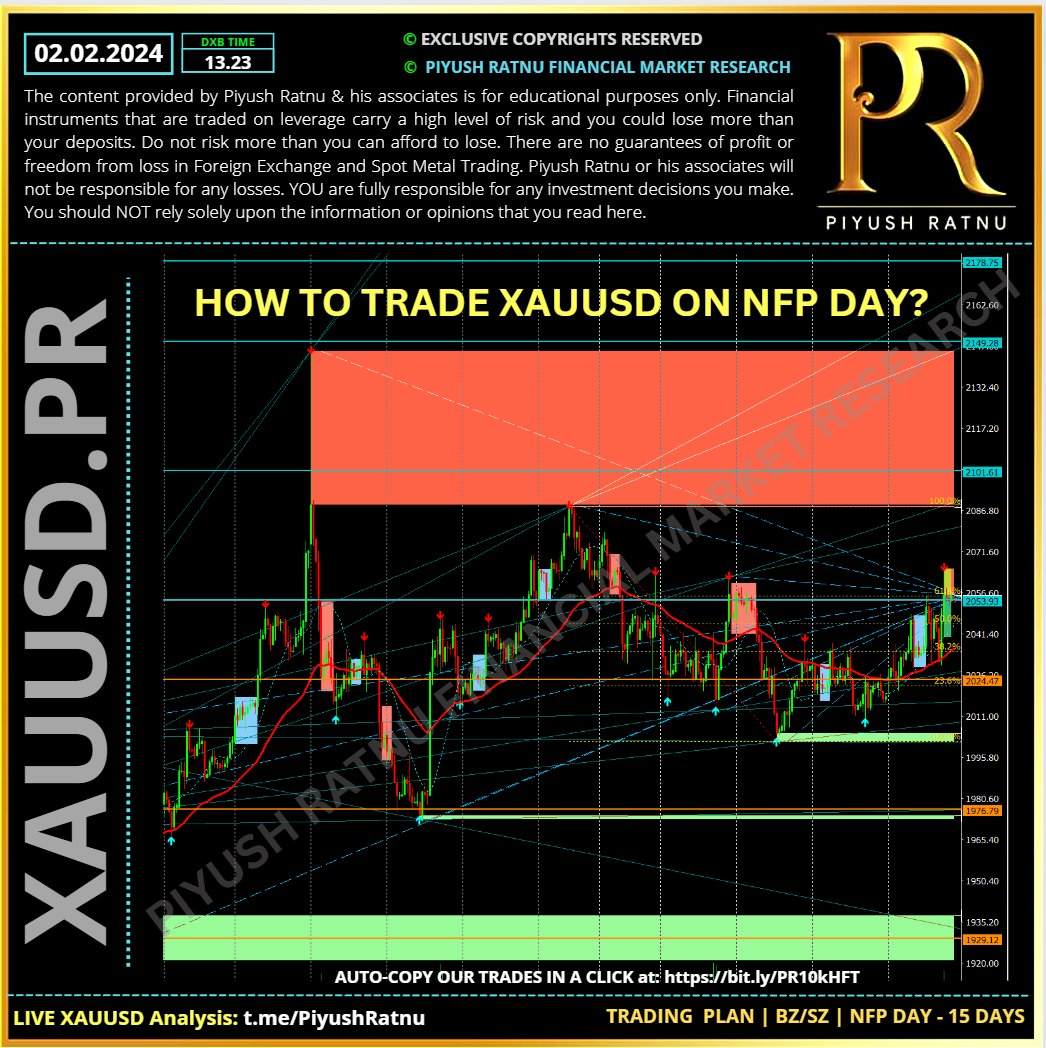

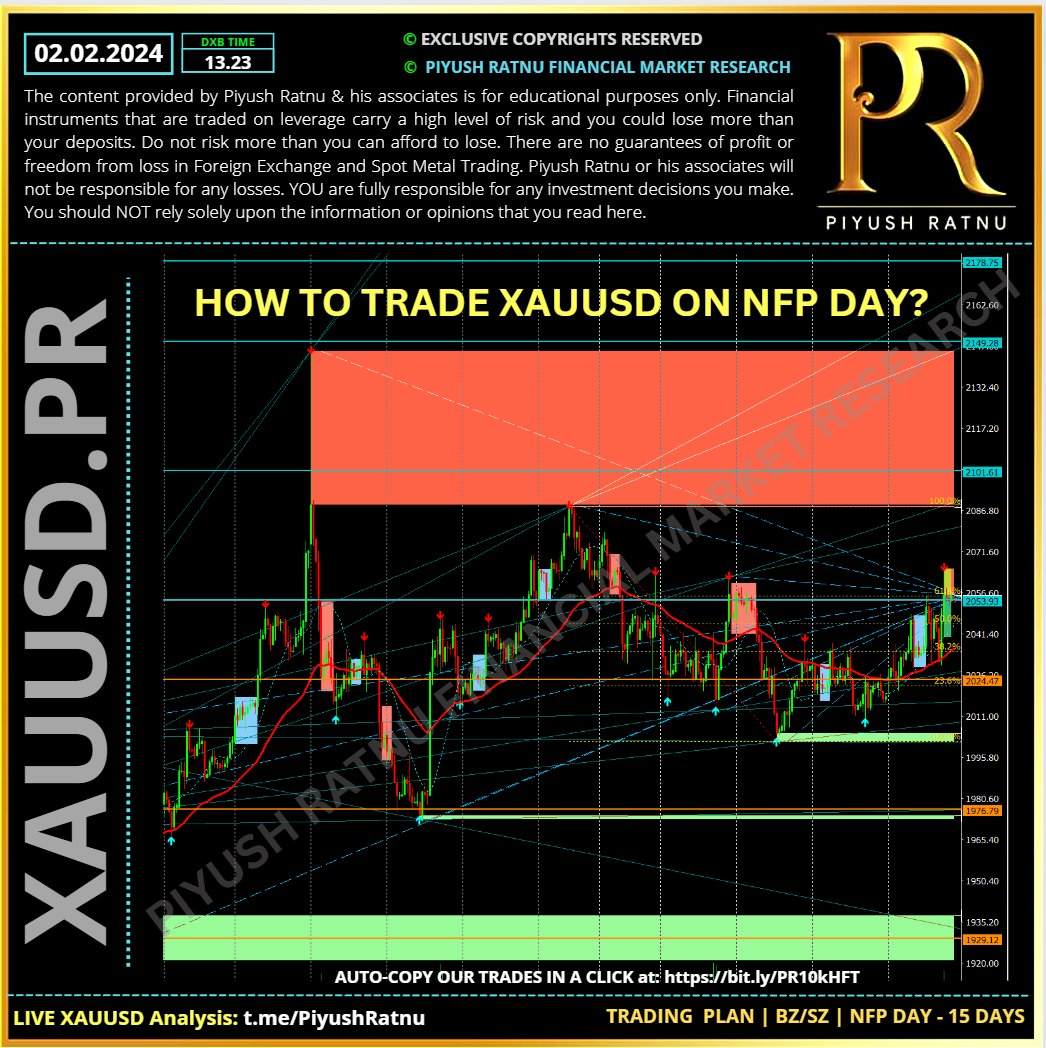

How to trade XAUUSD Spot Gold with accuracy on Non Farm Payrolls Day?

Trading Scenario and Price Analysis by Piyush Ratnu

Trading Scenario and Price Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

Key factors impacting XAUUSD Price:

• Gold price rebounds strongly from the day’s low near $2,030 despite the Federal Reserve not being interested in reducing interest rates in March.

• In his monetary policy statement on Wednesday, Fed Chair Jerome Powell turned down speculation for reducing interest rates until policymakers get greater confidence that underlying inflation will sustainably return to the 2% target.

• A strict denial for rate cuts in March has shifted expectations to the May policy meeting.

• As per the CME Fedwatch tool, traders see a 61% chance of a rate cut by 25 basis points (bps) to 5.00%-5.25% for May.

• The Fed’s decision to keep interest rates unchanged in the range of 5.25%-5.50% for the fourth straight time was widely anticipated.

• Also, Jerome Powell said, “risks to achieving full employment and 2% inflation are better balanced.”

• The US Dollar Index (DXY) faces pressure near 103.80 as investors know that rate cuts by the Fed are imminent. Meanwhile, various economic data are lined up that will guide further action in the safe-haven assets.

• In today’s session, market participants will focus on the ISM Manufacturing PMI for January and the Initial Jobless Claims (IJC) for the week ending January 26.

• According to the estimates, the Manufacturing PMI fell to 47.0 from December’s reading of 47.4. The reasoning behind lower factory output would be higher furloughs due to the festive mood.

• The Manufacturing PMI data will be followed by the official Employment data for January, which will be published on Friday.

• The private Employment Change data, reported by the ADP on Wednesday, showed that private employers recruited 107K workers in December, which was significantly lower than expectations of 145K and the former reading of 158K.

• This has set a negative undertone for the NFP data ahead. Investors anticipate that overall payroll additions slowed to 180K against 216K in December. The Unemployment Rate is expected to increase to 3.8% from 3.7%.

• Apart from employment numbers, wage growth data will in be the focus as it will guide inflation, being a major contributor to high price pressures.

• The annual Average Hourly Earnings is seen steady at 4.1%. The month-on-month wage growth may have grown at a slower pace of 0.3% against a 0.4% increase in December. A slowdown in the wage growth data would soften the inflation outlook.

• Gold price rebounds strongly from the day’s low near $2,030 despite the Federal Reserve not being interested in reducing interest rates in March.

• In his monetary policy statement on Wednesday, Fed Chair Jerome Powell turned down speculation for reducing interest rates until policymakers get greater confidence that underlying inflation will sustainably return to the 2% target.

• A strict denial for rate cuts in March has shifted expectations to the May policy meeting.

• As per the CME Fedwatch tool, traders see a 61% chance of a rate cut by 25 basis points (bps) to 5.00%-5.25% for May.

• The Fed’s decision to keep interest rates unchanged in the range of 5.25%-5.50% for the fourth straight time was widely anticipated.

• Also, Jerome Powell said, “risks to achieving full employment and 2% inflation are better balanced.”

• The US Dollar Index (DXY) faces pressure near 103.80 as investors know that rate cuts by the Fed are imminent. Meanwhile, various economic data are lined up that will guide further action in the safe-haven assets.

• In today’s session, market participants will focus on the ISM Manufacturing PMI for January and the Initial Jobless Claims (IJC) for the week ending January 26.

• According to the estimates, the Manufacturing PMI fell to 47.0 from December’s reading of 47.4. The reasoning behind lower factory output would be higher furloughs due to the festive mood.

• The Manufacturing PMI data will be followed by the official Employment data for January, which will be published on Friday.

• The private Employment Change data, reported by the ADP on Wednesday, showed that private employers recruited 107K workers in December, which was significantly lower than expectations of 145K and the former reading of 158K.

• This has set a negative undertone for the NFP data ahead. Investors anticipate that overall payroll additions slowed to 180K against 216K in December. The Unemployment Rate is expected to increase to 3.8% from 3.7%.

• Apart from employment numbers, wage growth data will in be the focus as it will guide inflation, being a major contributor to high price pressures.

• The annual Average Hourly Earnings is seen steady at 4.1%. The month-on-month wage growth may have grown at a slower pace of 0.3% against a 0.4% increase in December. A slowdown in the wage growth data would soften the inflation outlook.

Piyush Lalsingh Ratnu

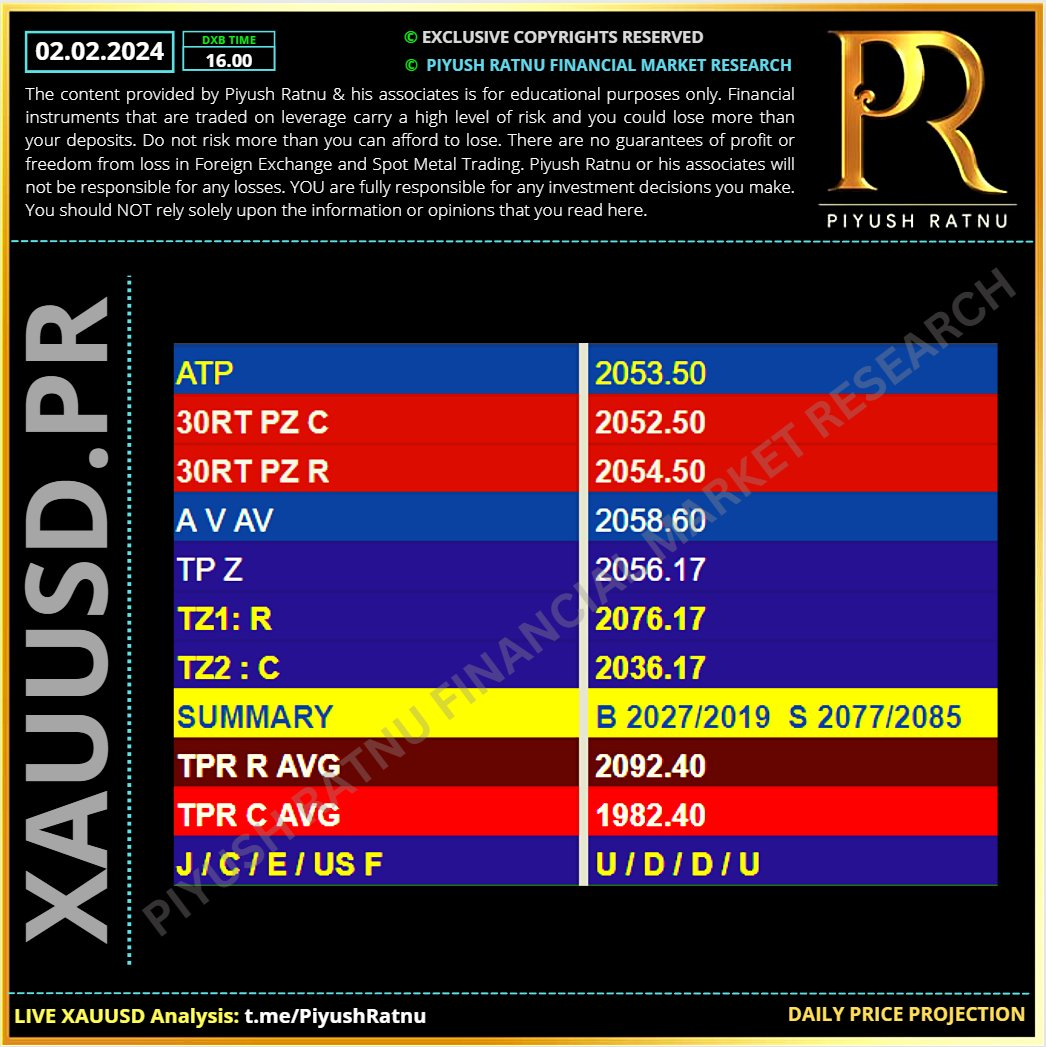

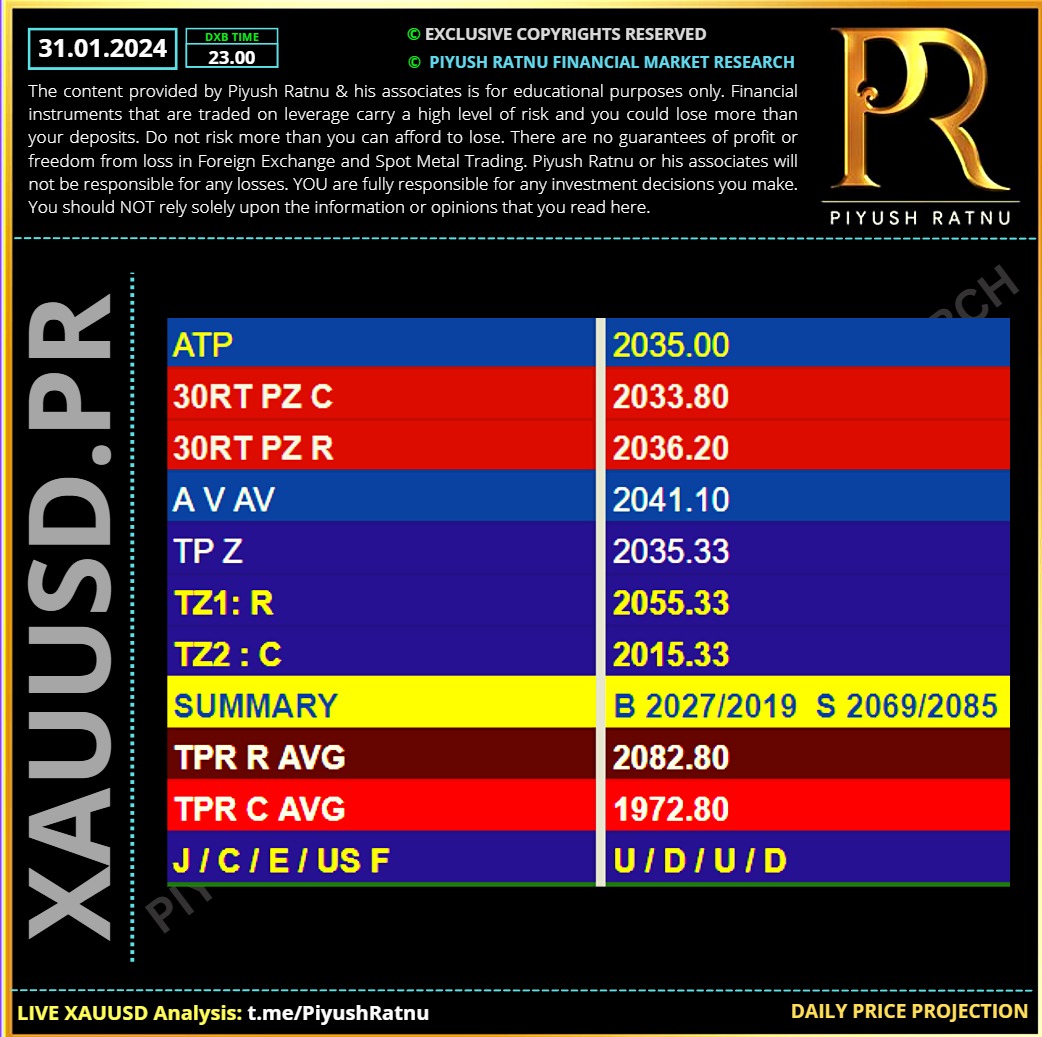

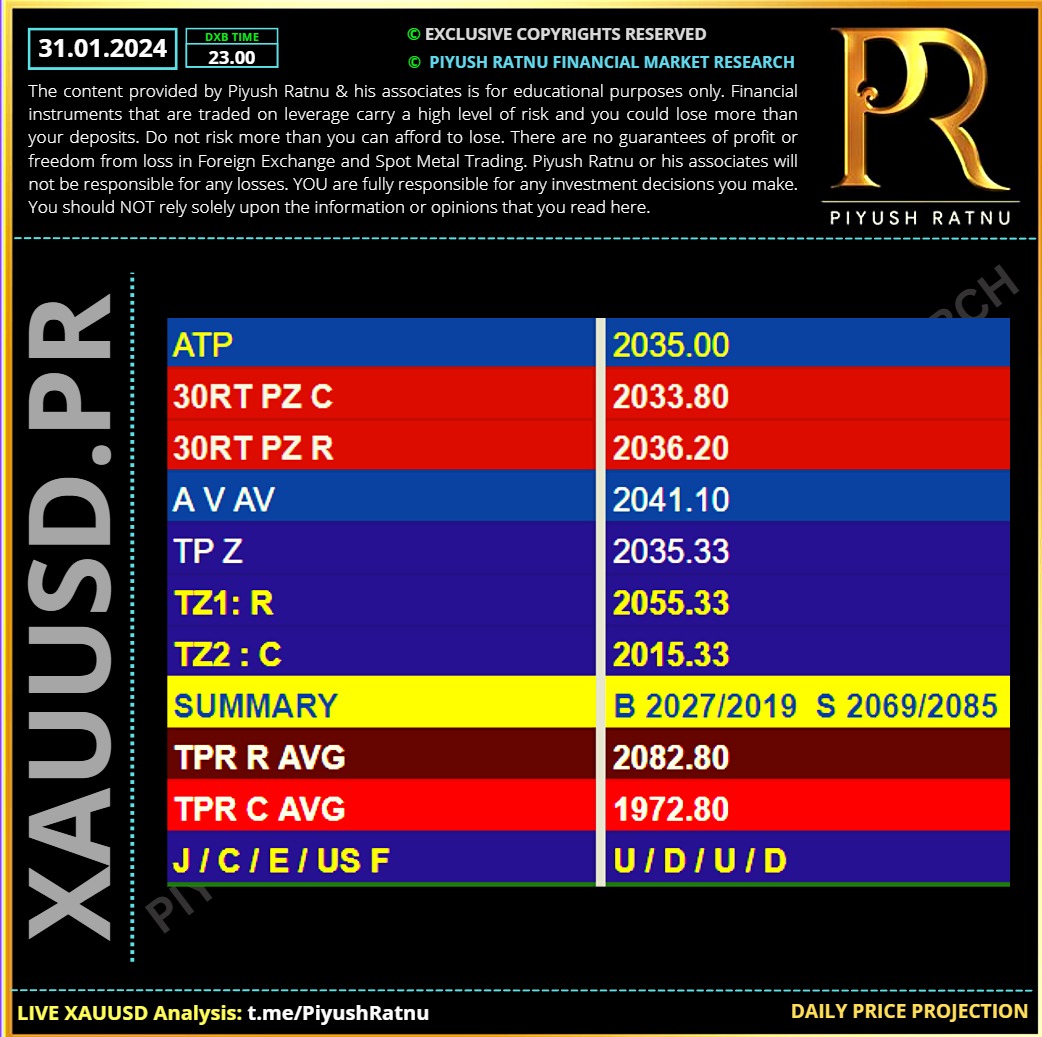

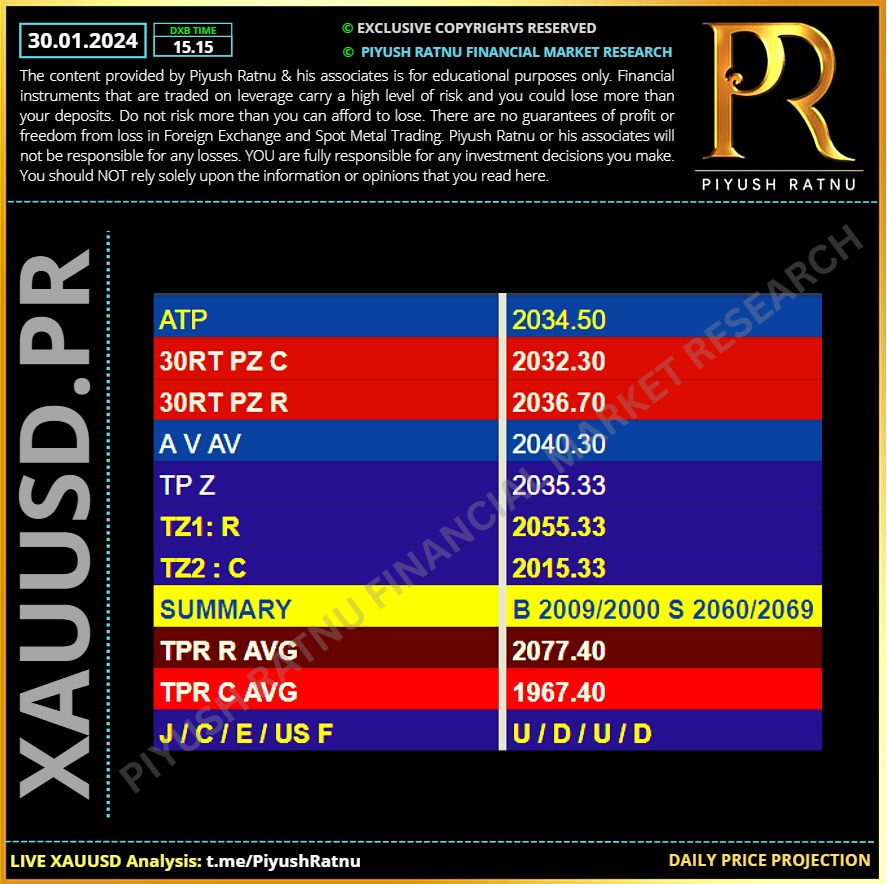

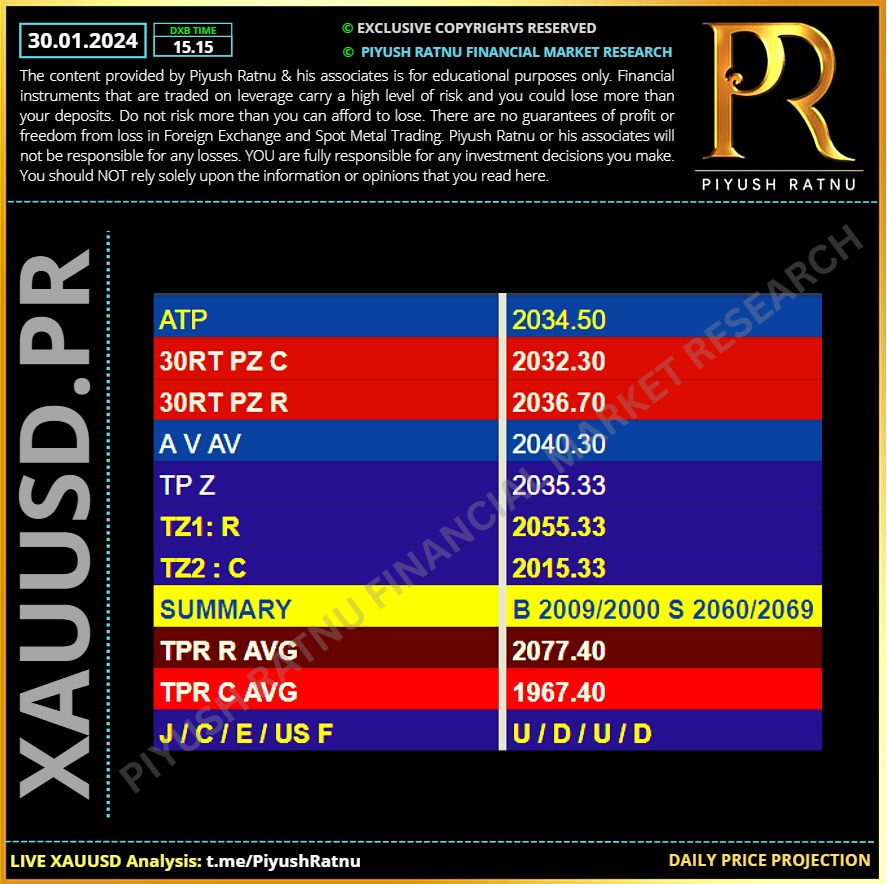

31.01.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Piyush Lalsingh Ratnu

🟢 M5A50 M15A382 M30A382 H1A23.6 achieved

XAUUSD CMP $2046

Selling at and above $2048 gave us neat exit

NEXT: $2025/2019 or $2060/2069 crucial

FUP $2009 / $2085 in Next 4 trading days.

XAUUSD CMP $2046

Selling at and above $2048 gave us neat exit

NEXT: $2025/2019 or $2060/2069 crucial

FUP $2009 / $2085 in Next 4 trading days.

Piyush Lalsingh Ratnu

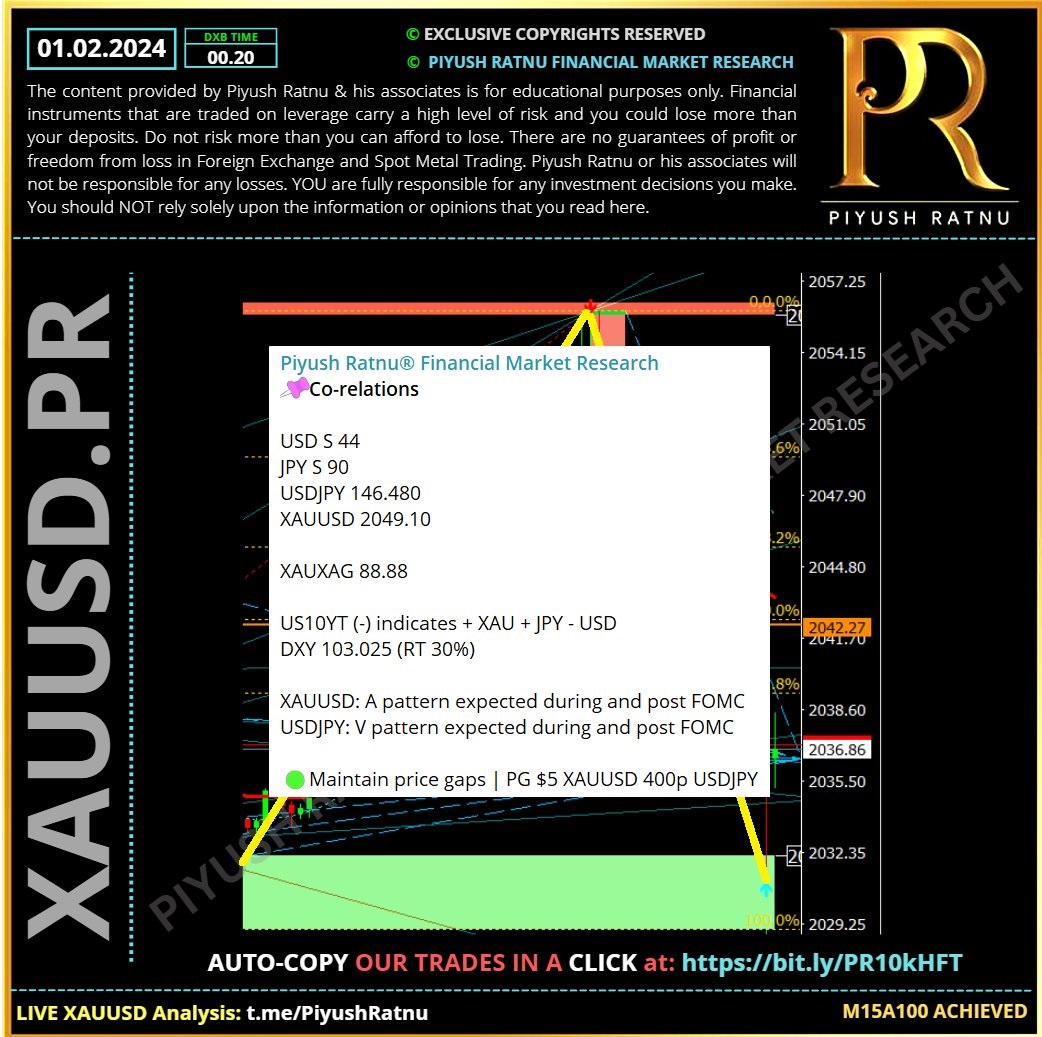

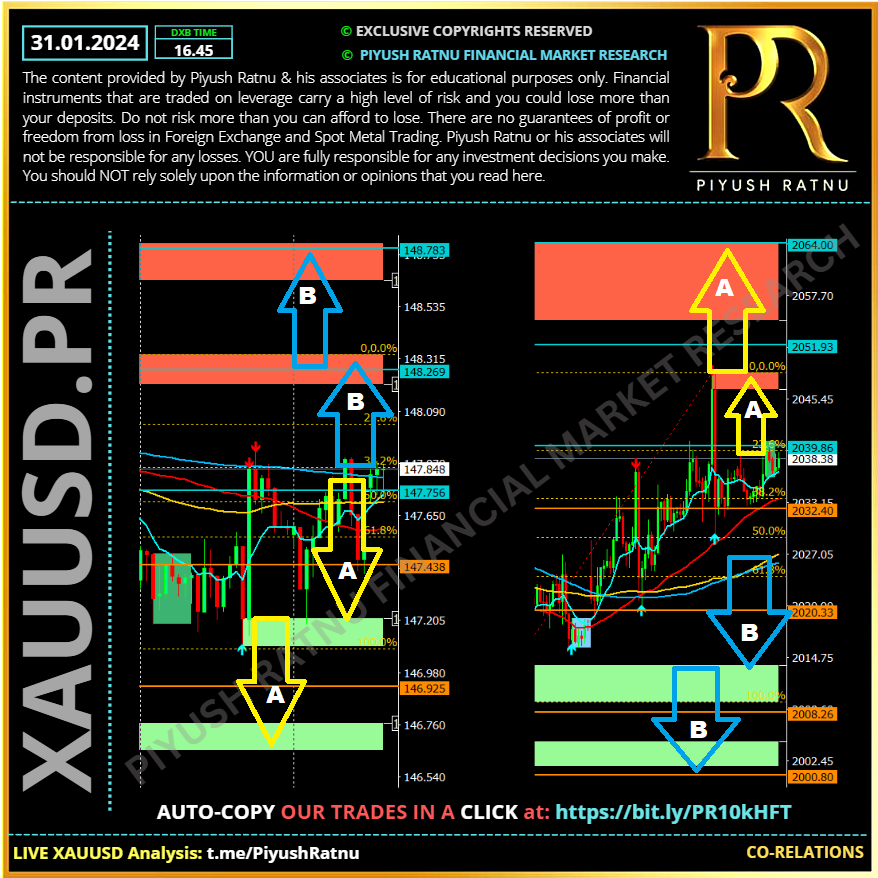

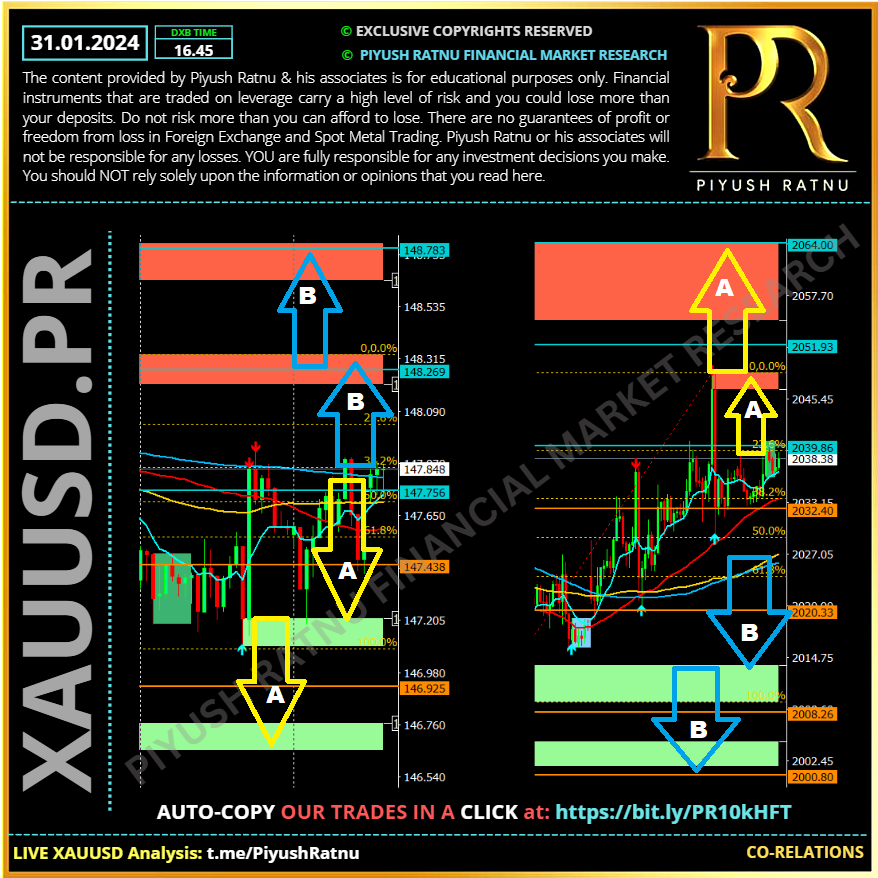

📌Co-relations

USD S 44

JPY S 90

USDJPY 146.480

XAUUSD 2049.10

XAUXAG 88.88

US10YT (-) indicates + XAU + JPY - USD

DXY 103.025 (RT 30%)

XAUUSD: A pattern expected during and post FOMC

USDJPY: V pattern expected during and post FOMC

🟢Maintain price gaps | PG $5 XAUUSD 400p USDJPY

Exit in NAP

USD S 44

JPY S 90

USDJPY 146.480

XAUUSD 2049.10

XAUXAG 88.88

US10YT (-) indicates + XAU + JPY - USD

DXY 103.025 (RT 30%)

XAUUSD: A pattern expected during and post FOMC

USDJPY: V pattern expected during and post FOMC

🟢Maintain price gaps | PG $5 XAUUSD 400p USDJPY

Exit in NAP

Piyush Lalsingh Ratnu

🆘 Crucial Price Zones: XAUUUSD:

ETF Before ⏰ 09.02.2024⏰ | 🔺 GPT based rally

🔻 BZ $2019/2009/1990

🔺 SZ: $2069/2085/2112

🟢 XAUUSD: Expected: A patterns:

🔻MA A Patterns: $2019z on radar

H1AS1 H1AS2 | H4AS5 | D1AS1 (1977z)

🔻 Fib A Patterns: $2009z on radar

H1A100

H4A0.0

D1A50.0 (1977z)

🔺 Fib V Patterns: $2069/2085/2112 on radar

📌 PRSDBS: C BZ

M30A $2019

H1A $2009

H4A $2003

📌 PRSDBS: R SZ

M30V $2048

H1V $2069

H4V $2085

ETF Before ⏰ 09.02.2024⏰ | 🔺 GPT based rally

🔻 BZ $2019/2009/1990

🔺 SZ: $2069/2085/2112

🟢 XAUUSD: Expected: A patterns:

🔻MA A Patterns: $2019z on radar

H1AS1 H1AS2 | H4AS5 | D1AS1 (1977z)

🔻 Fib A Patterns: $2009z on radar

H1A100

H4A0.0

D1A50.0 (1977z)

🔺 Fib V Patterns: $2069/2085/2112 on radar

📌 PRSDBS: C BZ

M30A $2019

H1A $2009

H4A $2003

📌 PRSDBS: R SZ

M30V $2048

H1V $2069

H4V $2085

Piyush Lalsingh Ratnu

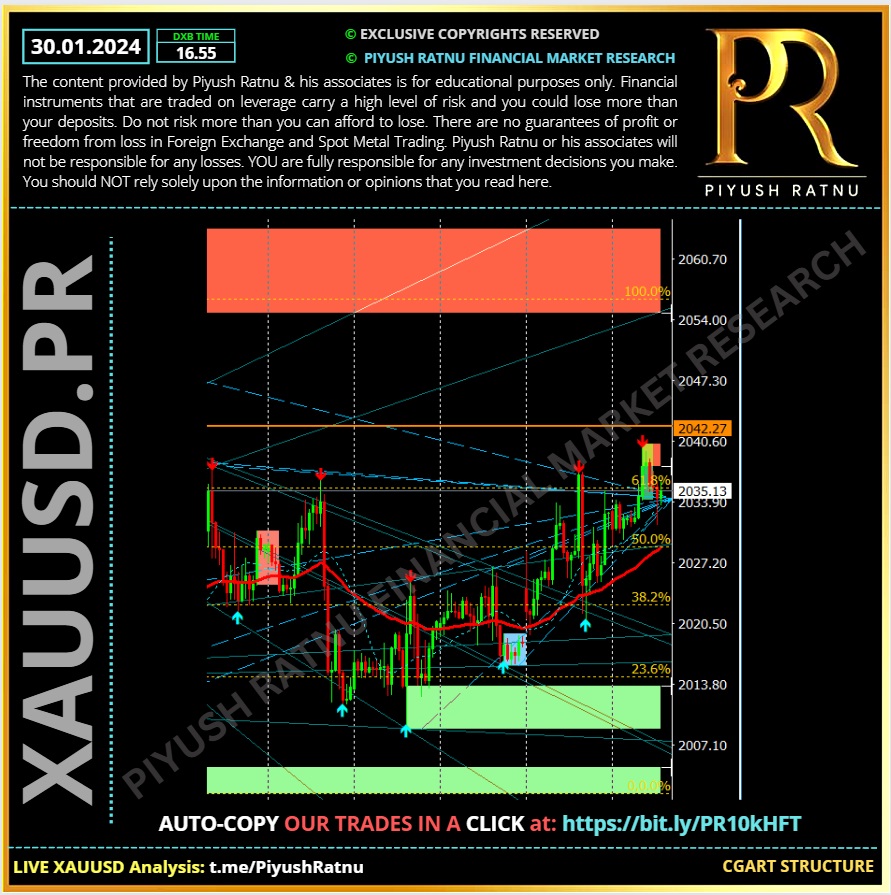

30.01.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 JUST IN: The Pentagon is considering striking Iranian personnel in "Syria or Iraq or Iranian naval assets in the Persian Gulf," according to Politico.

The outlet said that the "retaliation would likely begin in the next couple of days."

The outlet said that the "retaliation would likely begin in the next couple of days."

Piyush Lalsingh Ratnu

📌 Gold price lacks any firm direction ahead of the key central bank event risk

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

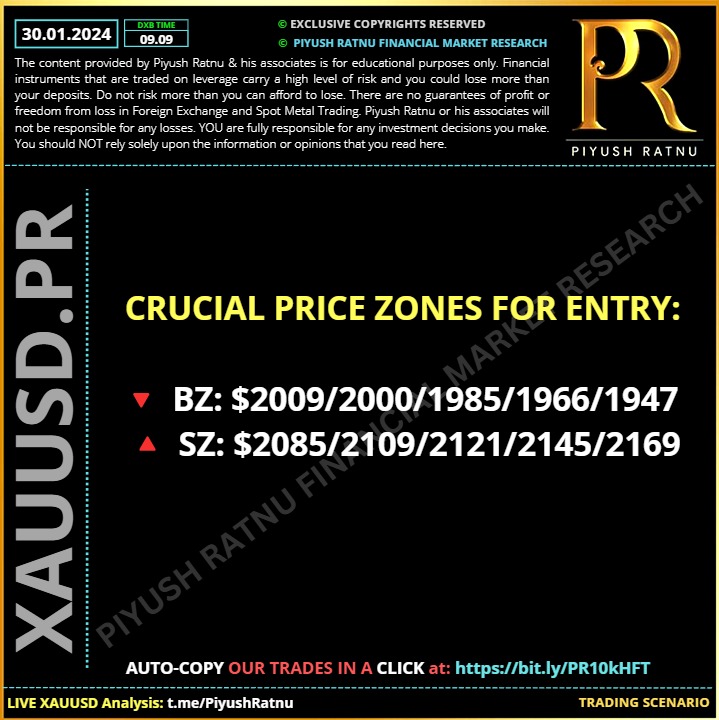

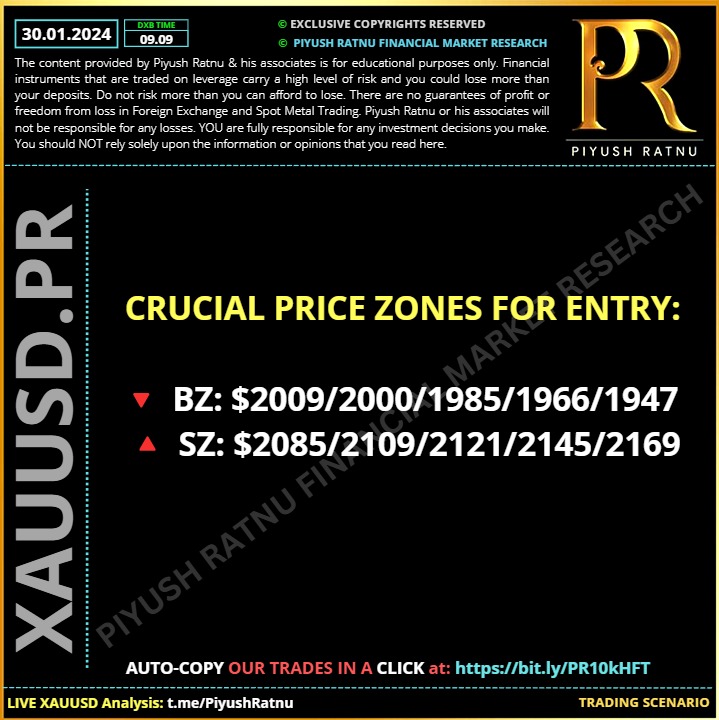

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

Piyush Lalsingh Ratnu

📌 Gold price lacks any firm direction ahead of the key central bank event risk

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

Piyush Lalsingh Ratnu

Technical Analysis:

Gold price struggles to build on strength beyond 50-day SMA, remains below a key hurdle

From a technical perspective, 🔺bulls might still wait for a sustained move beyond the $2,040-2,042 supply zone before placing fresh bets and positioning for any further gains.

💎Given that oscillators on the daily chart have just started moving into the positive territory, the Gold price could then climb to the $2,085 resistance zone before aiming to reclaim the $2,100 round-figure mark.

🔻On the flip side, the overnight swing low, around the $2,020-2,019 area, now seems to protect the immediate downside ahead of the $2,012-2,010 zone and the $2,000 psychological mark.

A convincing break below the latter will be seen as a fresh trigger for bearish traders and expose the 100-day SMA, currently near the $1,978-1,977 region. The Gold price could eventually drop to the very important 200-day SMA, near the 🆘 $1,966 region.

Gold price struggles to build on strength beyond 50-day SMA, remains below a key hurdle

From a technical perspective, 🔺bulls might still wait for a sustained move beyond the $2,040-2,042 supply zone before placing fresh bets and positioning for any further gains.

💎Given that oscillators on the daily chart have just started moving into the positive territory, the Gold price could then climb to the $2,085 resistance zone before aiming to reclaim the $2,100 round-figure mark.

🔻On the flip side, the overnight swing low, around the $2,020-2,019 area, now seems to protect the immediate downside ahead of the $2,012-2,010 zone and the $2,000 psychological mark.

A convincing break below the latter will be seen as a fresh trigger for bearish traders and expose the 100-day SMA, currently near the $1,978-1,977 region. The Gold price could eventually drop to the very important 200-day SMA, near the 🆘 $1,966 region.

Piyush Lalsingh Ratnu

📌 Co-relations alert:

USDJPY net crash observed since yesterday:

1200 pips

Possible impact on XAUUSD:

$30 | + observed: $18 | pending: $12/15

USDJPY net crash observed since yesterday:

1200 pips

Possible impact on XAUUSD:

$30 | + observed: $18 | pending: $12/15

: