Piyush Lalsingh Ratnu / Profil

- Informations

|

Aucun

expérience

|

0

produits

|

0

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Gold price has slipped below the psychological support of $1,900.00 as investors are bracing for hawkish guidance by the Federal Reserve in its monetary policy meet in May. An interest rate elevation by 50 bps is on the cards.

US F crashed again, pattern A C extension.

The forecasts from the economic indicators are indicating that the economy is passed from the ultra-loose policy environment and a tight stance on liquidity distribution will remain the talk of the town. Meanwhile, the US dollar index (DXY) is eyeing to reclaim its five-year high at 102.99, considering the firmer price action and strong fundamentals.

US10YT 2.785

DXY 102.330

Yuan: down, Yen in recovery phase

JPY 20

USD 44

AUD 82

EUR 59

Today my POF will be buying below 1888/1866, in case of reversal: selling above 1907/1926

TARGET NAP

The renewed uptick in Gold Price could be viewed as a ‘dead cat bounce’ or ‘sell the bounce’ trade, as the US dollar is likely to resume its uptrend to clinch fresh two-year highs on China’s covid concerns and hawkish Fed hike bets. Rising worries over the economic impact of China's COVID-19 lockdowns will likely underpin the greenback's safe-haven appeal and aggressive US interest rate hike expectations will keep the US Treasury yields elevated.

Amidst the dynamics of the dollar and yields, attention may also turn towards a set of top-tier US economic releases, in the form of Durable Goods Orders and CB Consumer Confidence data.

It’s a blackout period for the Fed speakers this week, therefore, the upcoming US macro news and rate hike expectations will continue to affect the dollar valuations, in turn, Gold Price.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

US F crashed again, pattern A C extension.

The forecasts from the economic indicators are indicating that the economy is passed from the ultra-loose policy environment and a tight stance on liquidity distribution will remain the talk of the town. Meanwhile, the US dollar index (DXY) is eyeing to reclaim its five-year high at 102.99, considering the firmer price action and strong fundamentals.

US10YT 2.785

DXY 102.330

Yuan: down, Yen in recovery phase

JPY 20

USD 44

AUD 82

EUR 59

Today my POF will be buying below 1888/1866, in case of reversal: selling above 1907/1926

TARGET NAP

The renewed uptick in Gold Price could be viewed as a ‘dead cat bounce’ or ‘sell the bounce’ trade, as the US dollar is likely to resume its uptrend to clinch fresh two-year highs on China’s covid concerns and hawkish Fed hike bets. Rising worries over the economic impact of China's COVID-19 lockdowns will likely underpin the greenback's safe-haven appeal and aggressive US interest rate hike expectations will keep the US Treasury yields elevated.

Amidst the dynamics of the dollar and yields, attention may also turn towards a set of top-tier US economic releases, in the form of Durable Goods Orders and CB Consumer Confidence data.

It’s a blackout period for the Fed speakers this week, therefore, the upcoming US macro news and rate hike expectations will continue to affect the dollar valuations, in turn, Gold Price.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

Good morning all!

Key Highlights for today:

Technical:

GOLD approaching D1E1 (as alerted earlier as next stop)

M15 M20 S5 crashed down to 1904 zone (R1)

US10YT 2.862 | DXY 101.650 ( and rising)

US F recovering, as of now 45% recovered from the fall

Crucial Stops:

GOLD is still struggling to hold the psychological level 1900

As alerted in earlier posts, heavy buying below 1926 was observed, and more buying might means a crash till 1907 and 1888 due to buying pressures, and the same was observed yesterday, GOLD achieved the daily low of 1891.

Today my POF will be buying below 1888/1866, in case of reversal: selling above 1907/1926

TARGET NAP

D1 618-100 zone might be a crash slide for GOLD price pushing the price till 1777, once again.

However a reversal from D1618 zone should park the price between 1888-1907-1926 price trap

Fundamental:

CHINA economy related concerns might trigger high volatility + volumes in GOLD

Rising COVID cases in China are a matter of concern for economy and investors

In addition, European banks are also under pressure due to their exposure in China and Russia

A sudden UP rally is quite possible due to uncertainty + Russia-Ukraine related statements

Last but not the least, as always NFP + HAWKISH FED will be the game changer, obviously

Dramatic rallies are on the way, APRIL end + first week of MAY always have been volatile for GOLD traders considering Rate Hike policy, NFP and monetary policy related statements on the way.

I expect a V by and till the end of first week of May, 2022 hence I will be BUYING the session and daily lows with NAP as my exit.

Wish you all a + & profitable day ahead!

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Key Highlights for today:

Technical:

GOLD approaching D1E1 (as alerted earlier as next stop)

M15 M20 S5 crashed down to 1904 zone (R1)

US10YT 2.862 | DXY 101.650 ( and rising)

US F recovering, as of now 45% recovered from the fall

Crucial Stops:

GOLD is still struggling to hold the psychological level 1900

As alerted in earlier posts, heavy buying below 1926 was observed, and more buying might means a crash till 1907 and 1888 due to buying pressures, and the same was observed yesterday, GOLD achieved the daily low of 1891.

Today my POF will be buying below 1888/1866, in case of reversal: selling above 1907/1926

TARGET NAP

D1 618-100 zone might be a crash slide for GOLD price pushing the price till 1777, once again.

However a reversal from D1618 zone should park the price between 1888-1907-1926 price trap

Fundamental:

CHINA economy related concerns might trigger high volatility + volumes in GOLD

Rising COVID cases in China are a matter of concern for economy and investors

In addition, European banks are also under pressure due to their exposure in China and Russia

A sudden UP rally is quite possible due to uncertainty + Russia-Ukraine related statements

Last but not the least, as always NFP + HAWKISH FED will be the game changer, obviously

Dramatic rallies are on the way, APRIL end + first week of MAY always have been volatile for GOLD traders considering Rate Hike policy, NFP and monetary policy related statements on the way.

I expect a V by and till the end of first week of May, 2022 hence I will be BUYING the session and daily lows with NAP as my exit.

Wish you all a + & profitable day ahead!

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

25.04.2022 | Gold 618 - 100 Zone Achieved | Target 2 Achieved | PR Gold Analysis | XAUUSD Analysis | Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

HEAVY BUYING should take place below 1926 zone

What it means:

Scenario A:

GOLD might retrace from 1926 to 1947 within 24H

Scenario B:

Gold might crash till 1907/1888 before rising back to 1926/1933 cluster.

Just like past trend: GOLD is struggling heavily at 1933 zone, the way it struggled while rising to 1947/1966 zone.

BIG whales will definitely play the STOPLOSSHUNTING game.

I wont be surprised with an extended movement of $18-26 in sequence.

POF

C: 1926/1907/1888

R: 1947/1966

Maintain PRICE GAPS: observe MARGIN carefully.

Implement GR 88 55 33 22 11 or single set.

Targeting NAP, intraday.

MONDAY: market might open with a GAP.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

What it means:

Scenario A:

GOLD might retrace from 1926 to 1947 within 24H

Scenario B:

Gold might crash till 1907/1888 before rising back to 1926/1933 cluster.

Just like past trend: GOLD is struggling heavily at 1933 zone, the way it struggled while rising to 1947/1966 zone.

BIG whales will definitely play the STOPLOSSHUNTING game.

I wont be surprised with an extended movement of $18-26 in sequence.

POF

C: 1926/1907/1888

R: 1947/1966

Maintain PRICE GAPS: observe MARGIN carefully.

Implement GR 88 55 33 22 11 or single set.

Targeting NAP, intraday.

MONDAY: market might open with a GAP.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

GOLD in PZ

S1-6/S2-6 POF

R1+6 /R2+6 POF

KEY STOPS: 1926/1966

US10YT 2.936

DXY 100.530

USDJPY 128.09

USD S 47

AUD 24

JPY 81

POF

Powell Speech

.50 POINT HIKE

IPO BIG SISTER China

CHINA: Urges investors to buy AFTER Market Tumbles

Hawkish Central Banks

YEN recovering: BOND BUYING TRAP neutralising

US F crashed ~600

THREE 0.50 HIKES

US China Tensions

US - Russia Sanctions

Ukraine War Status: Nuclear Missile a threat?

Today's Economic Events

GBP Retail Sales M PMI C PMI S PMI

EUR G M PMI

17.00 ECB P Lagarde Speech

18.30 BOE Gov. Speech

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

S1-6/S2-6 POF

R1+6 /R2+6 POF

KEY STOPS: 1926/1966

US10YT 2.936

DXY 100.530

USDJPY 128.09

USD S 47

AUD 24

JPY 81

POF

Powell Speech

.50 POINT HIKE

IPO BIG SISTER China

CHINA: Urges investors to buy AFTER Market Tumbles

Hawkish Central Banks

YEN recovering: BOND BUYING TRAP neutralising

US F crashed ~600

THREE 0.50 HIKES

US China Tensions

US - Russia Sanctions

Ukraine War Status: Nuclear Missile a threat?

Today's Economic Events

GBP Retail Sales M PMI C PMI S PMI

EUR G M PMI

17.00 ECB P Lagarde Speech

18.30 BOE Gov. Speech

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

FED: The Federal Reserve Bank, the central bank of the United States, or the FOMC (Federal Open Market Committee), the policy-setting committee of the Federal Reserve.

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

14.04.2022 | PRCH PRBX | PR Gold Analysis | XAUUSD Analysis | Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

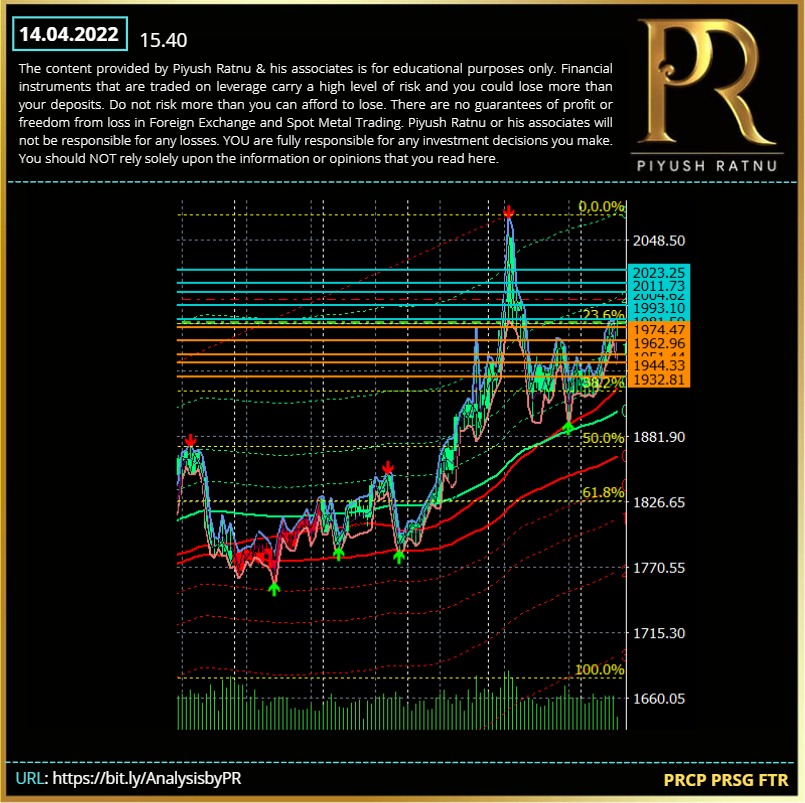

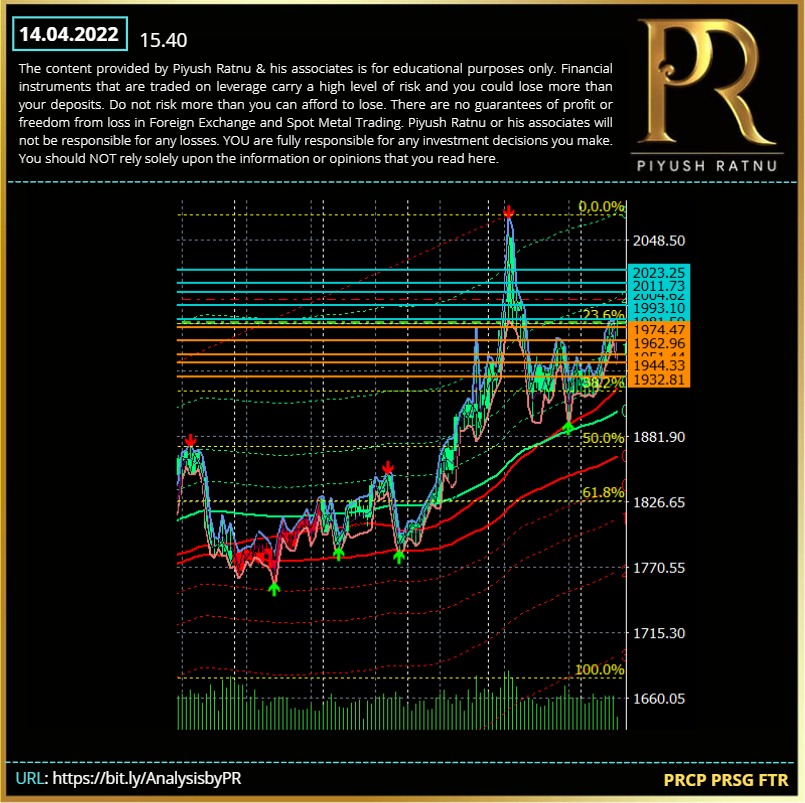

14.04.2022 | PRCP PRSG FTR | Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

14.04.2022 | Co relations | Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

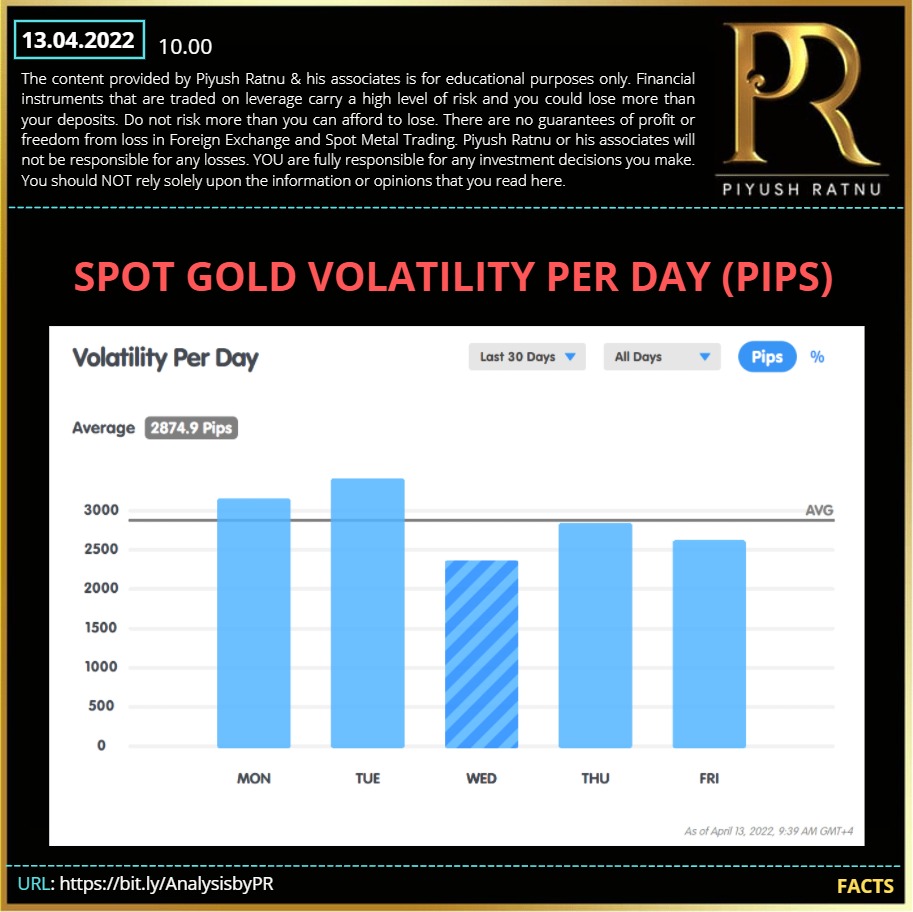

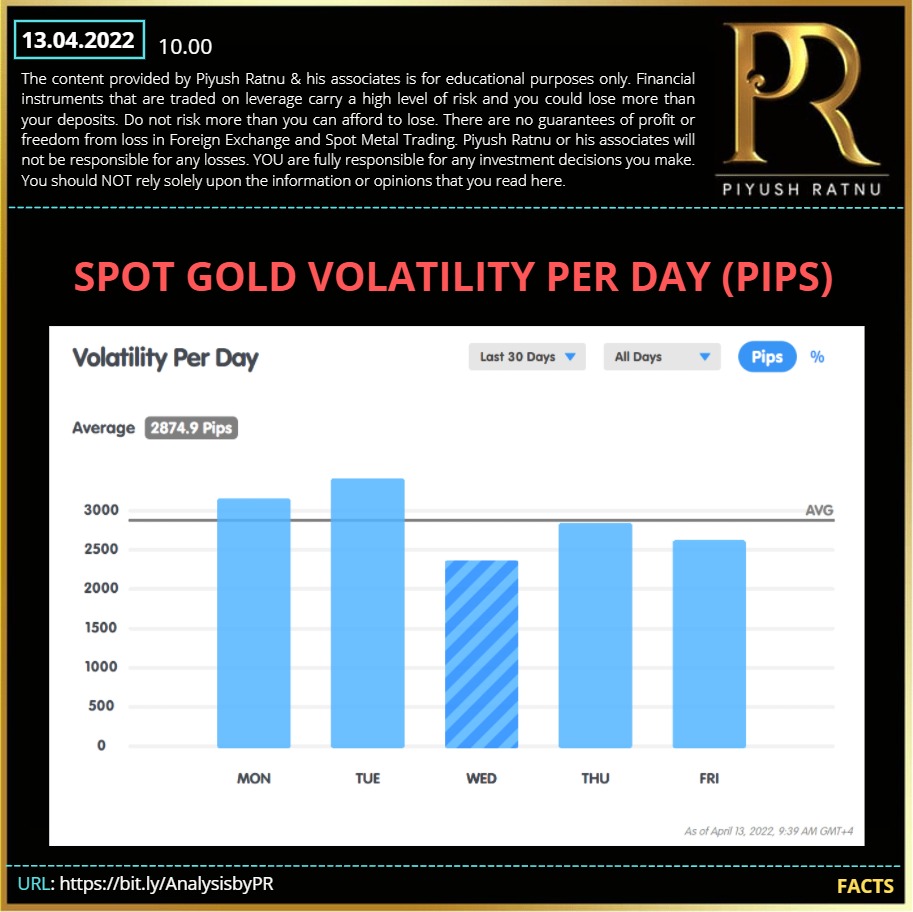

13.04.2022 | Facts - Spot Gold Volatility Per Day (Pips) | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

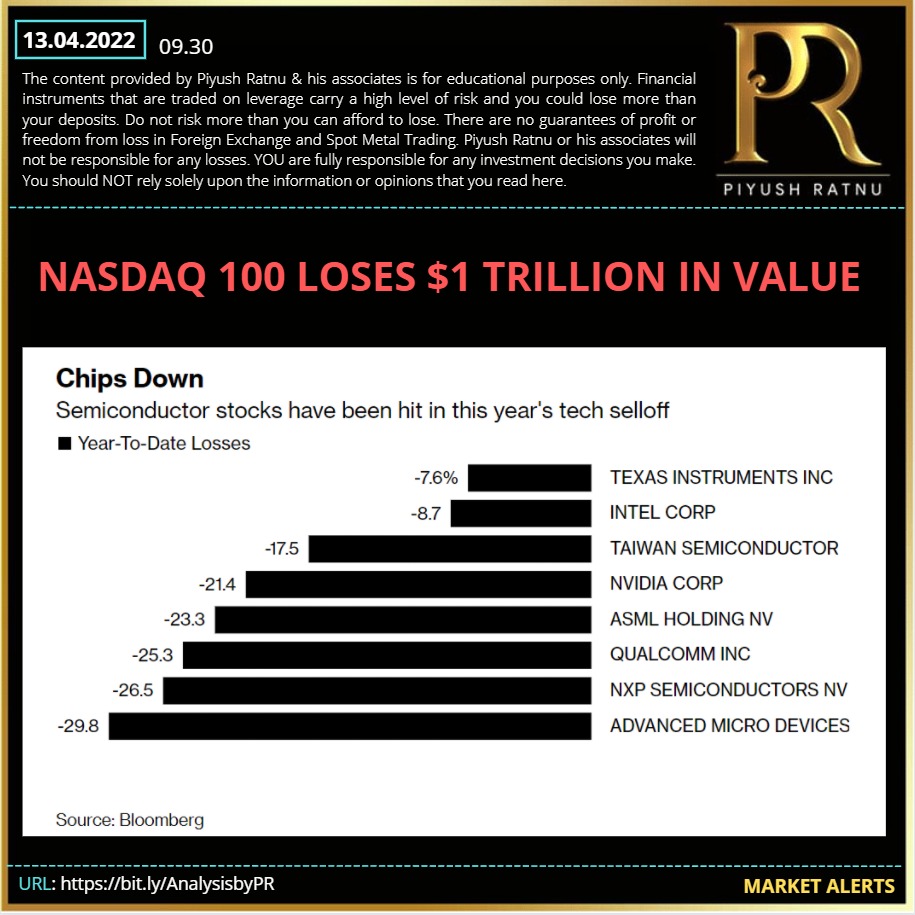

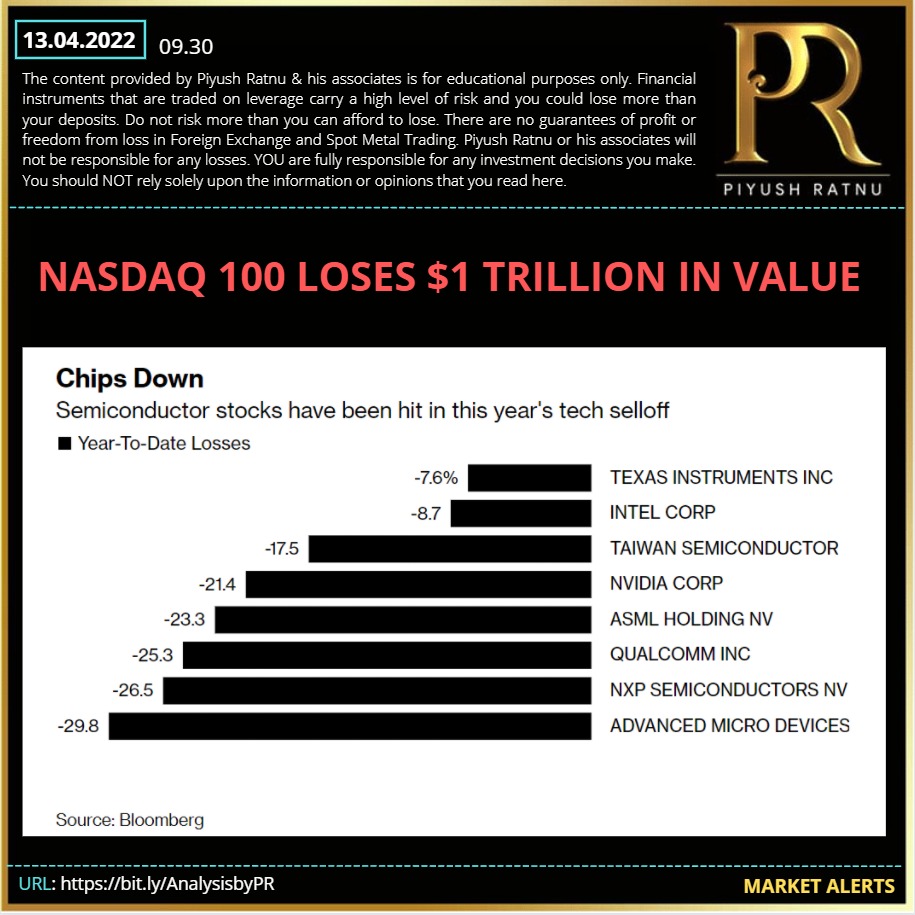

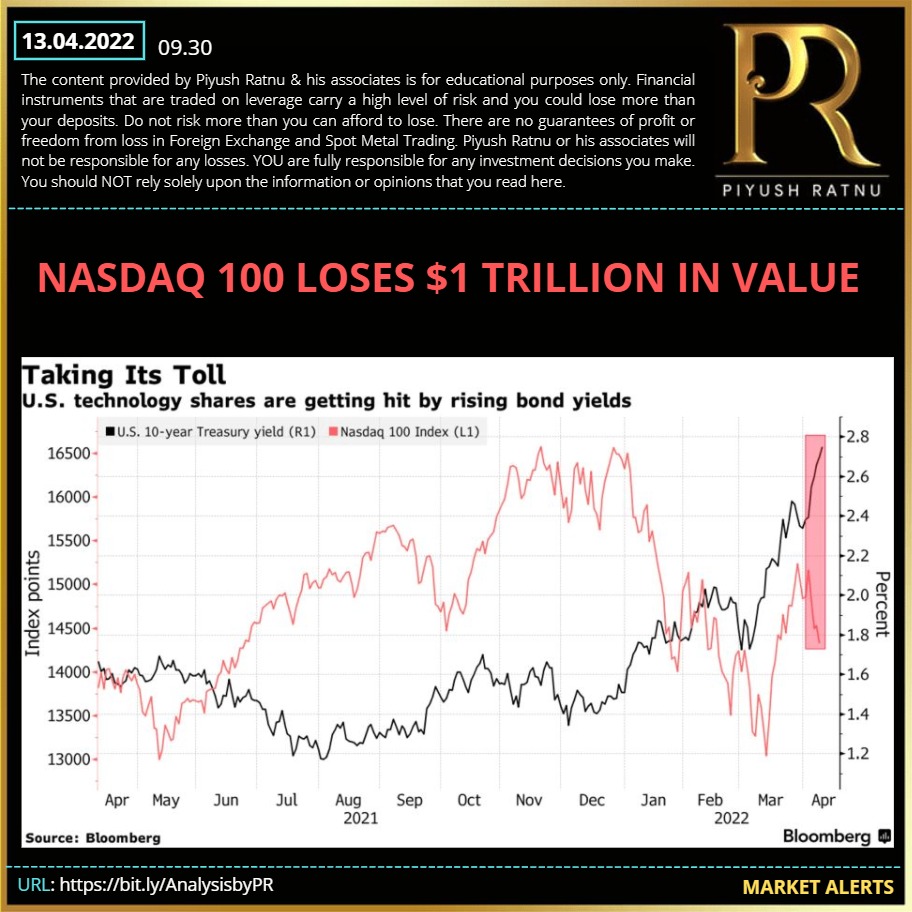

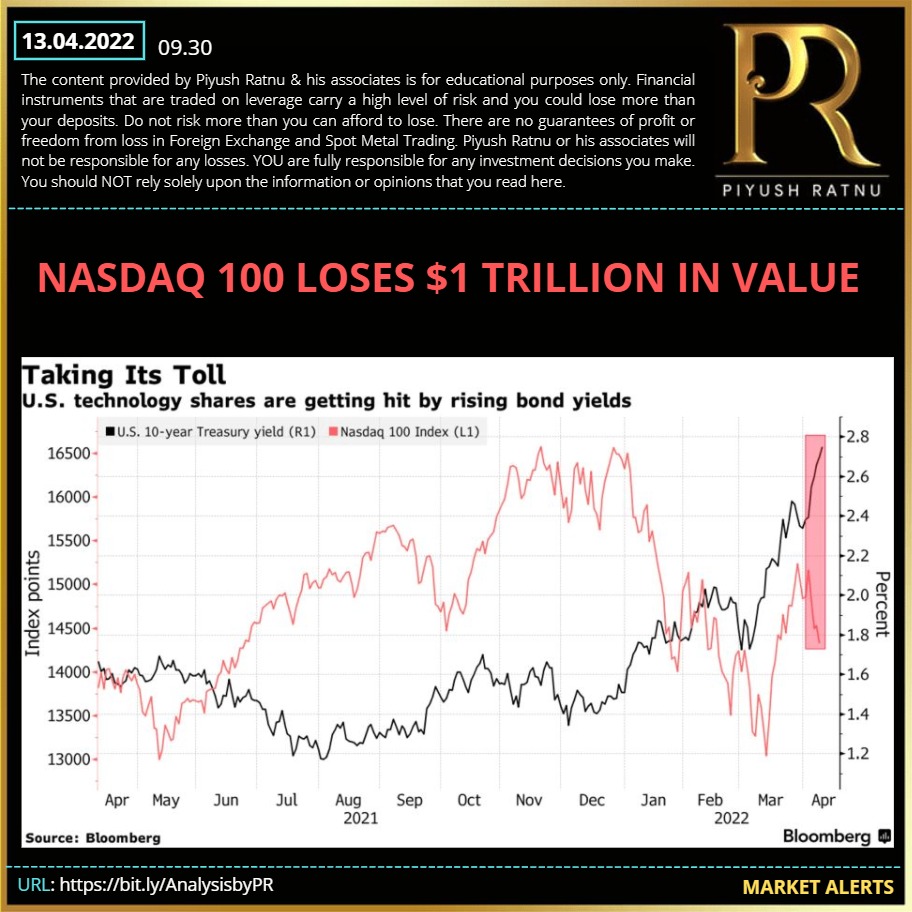

13.04.2022 | Nasdaq - Market Alerts | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai #Bonds #Nasdaq

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai #Bonds #Nasdaq

Piyush Lalsingh Ratnu

13.04.2022 | Market Alerts | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai #Bonds #Nasdaq

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai #Bonds #Nasdaq

Piyush Lalsingh Ratnu

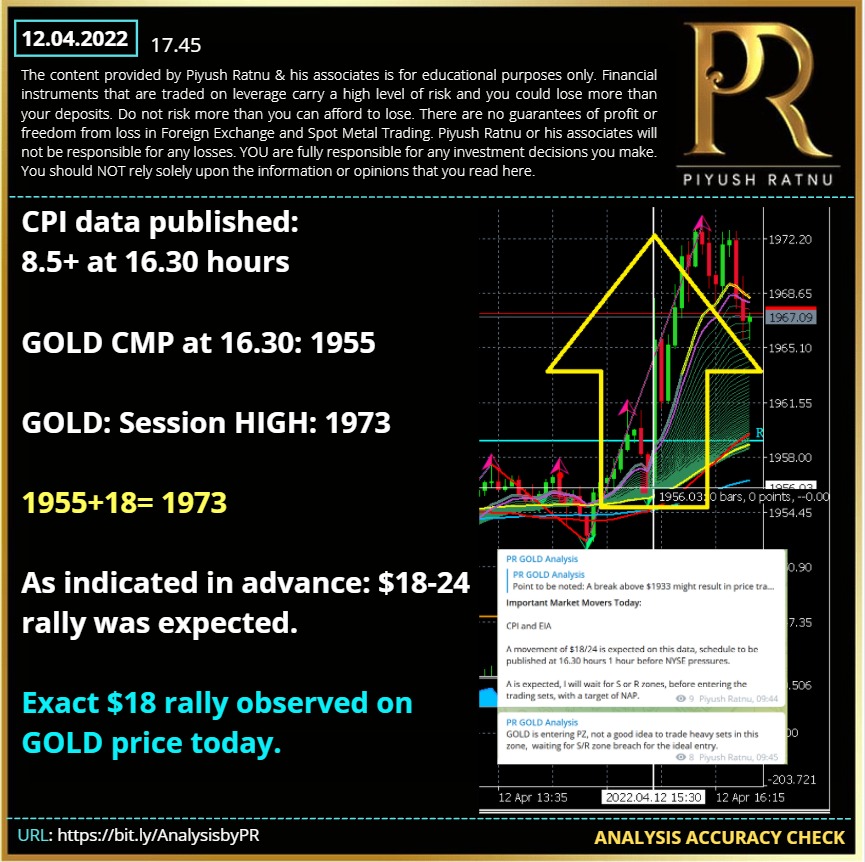

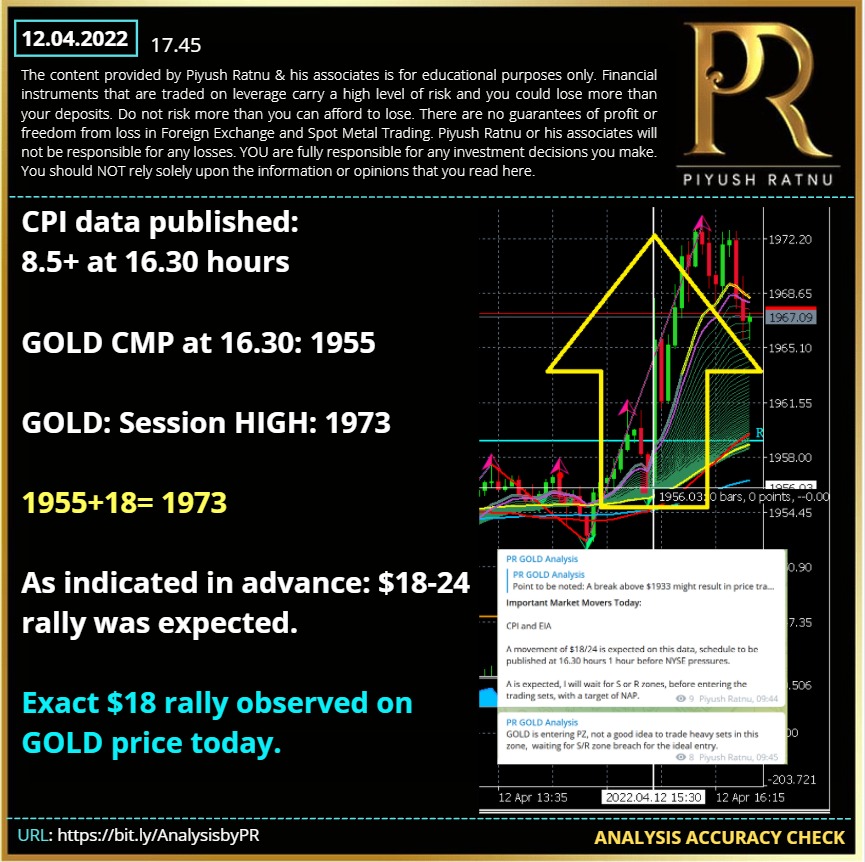

12.04.2022 | CPI Data Analysis Accuracy Check | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

12.04.2022 | Trading Ranges | Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

12.04.2022 | Session Shifts | Trading Hours | Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

12.04.2022 | Co relations | Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

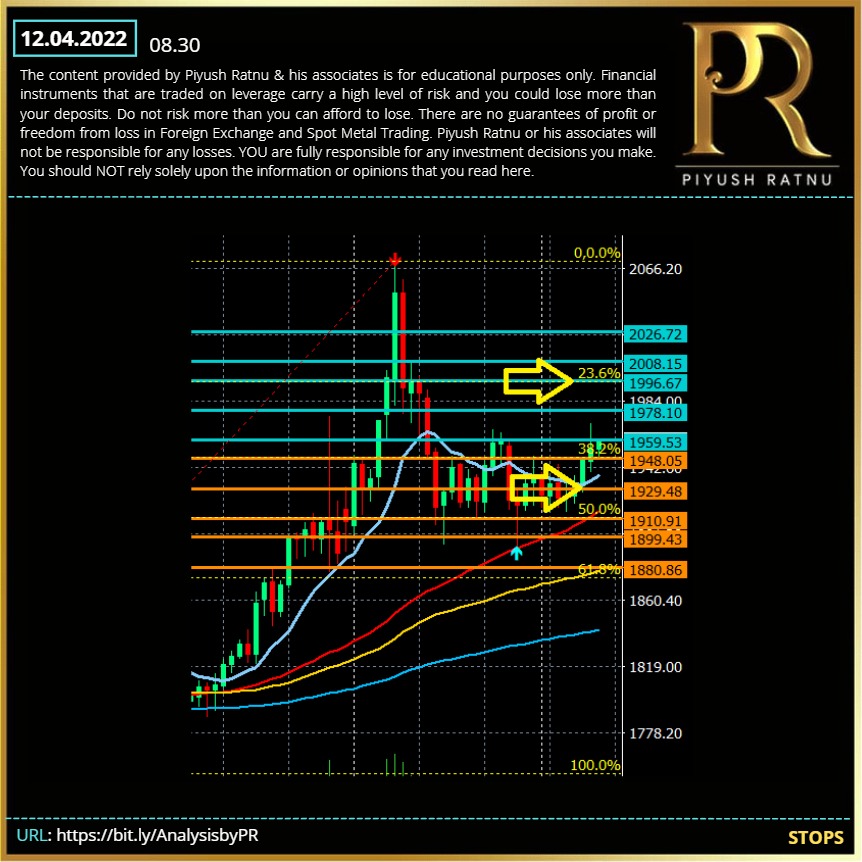

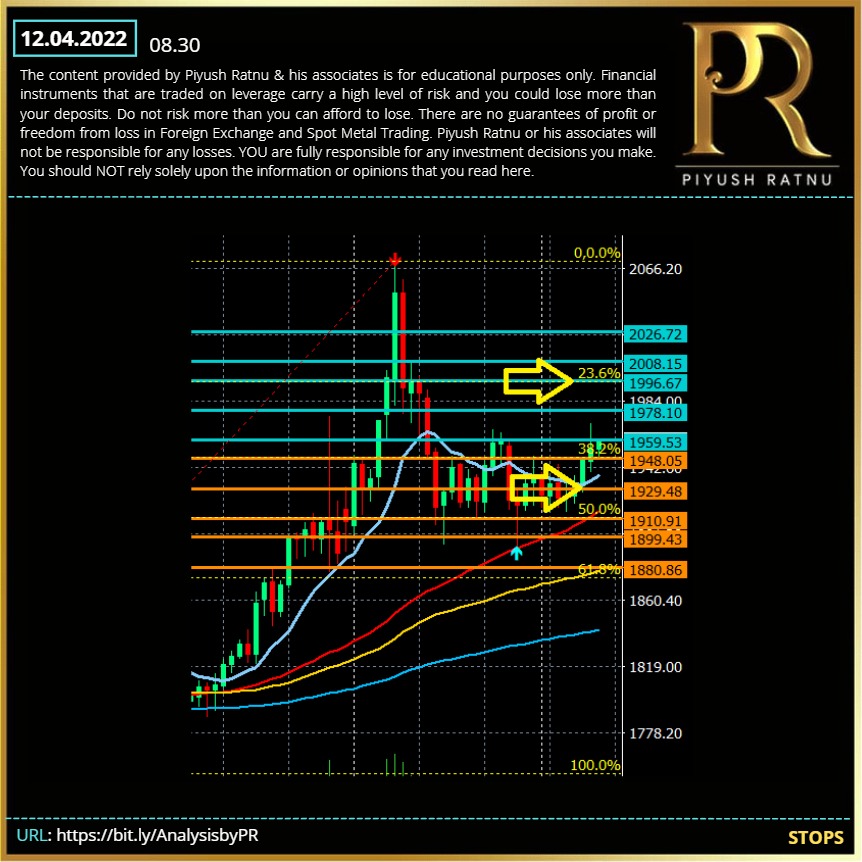

12.04.2022 | Gold Stops | Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

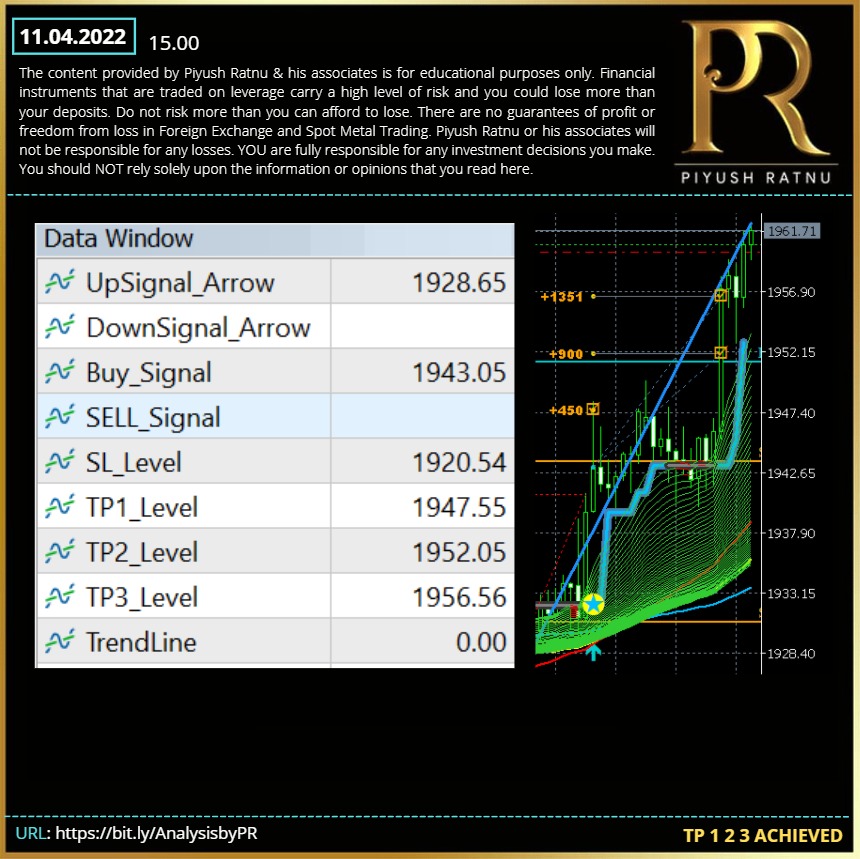

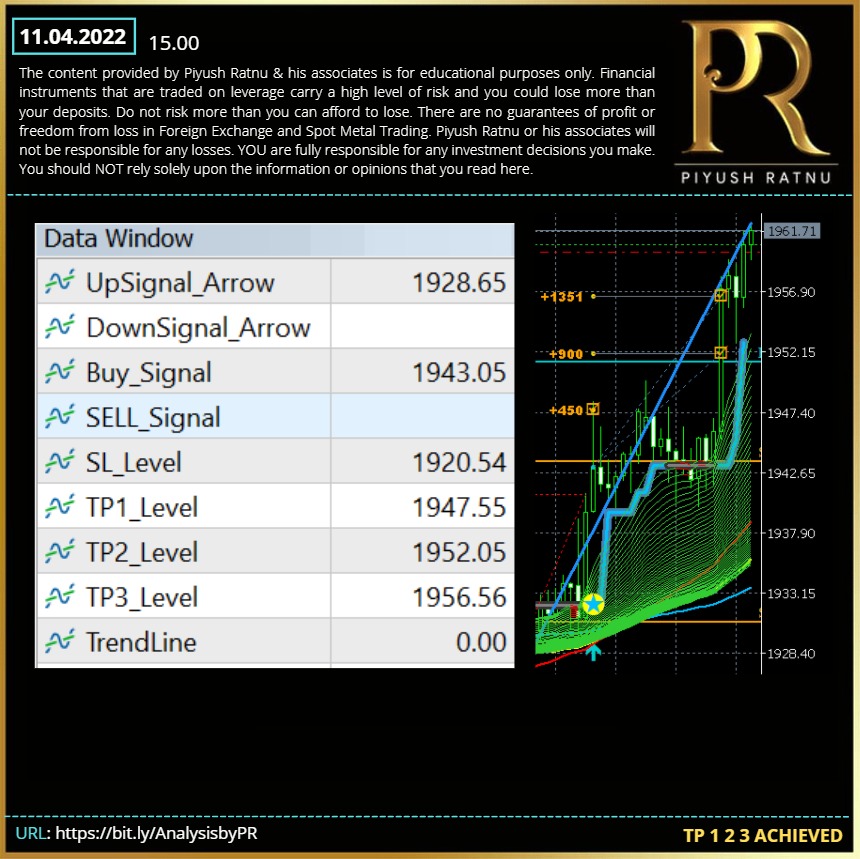

11.04.2022 | Buy Target 1 2 3 Achieved| Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

11.04.2022 | SR Zones| Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

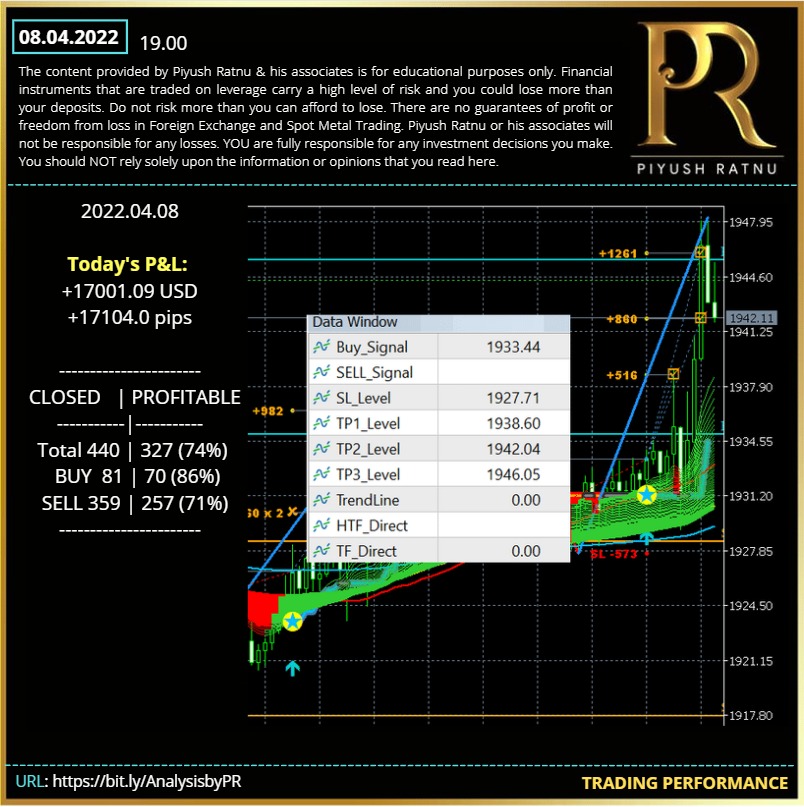

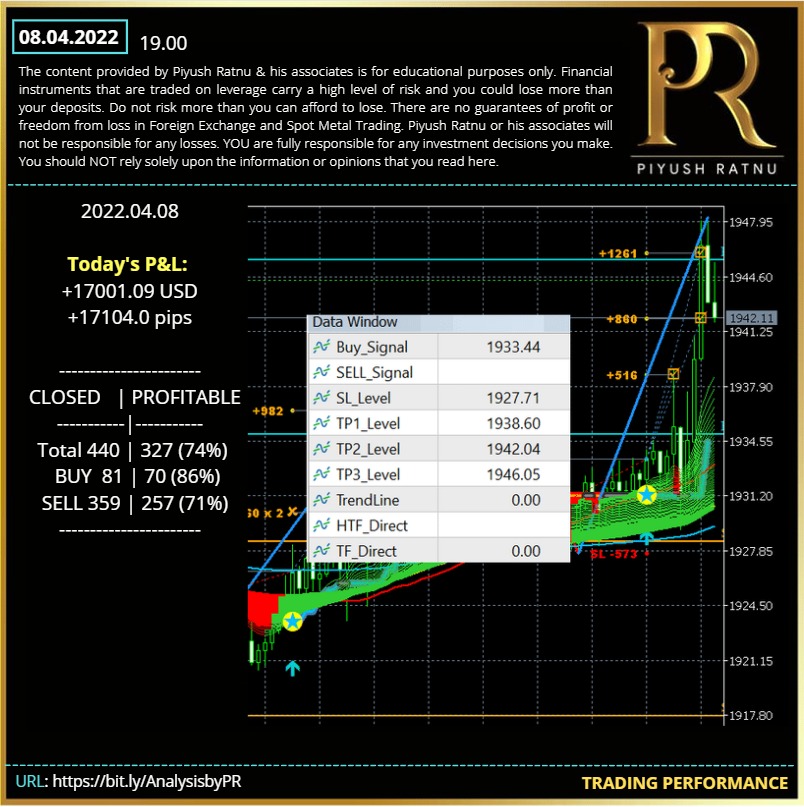

08.04.2022 | Trading Performance| Spot Gold Analysis | PR Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

: