Published article "Mutual information as criteria for Stepwise Feature Selection".

In this article, we present an MQL5 implementation of Stepwise Feature Selection based on the mutual information between an optimal predictor set and a target variable.

Published article "Data Science and ML (Part 32): Keeping your AI models updated, Online Learning".

In the ever-changing world of trading, adapting to market shifts is not just a choice—it's a necessity. New patterns and trends emerge everyday, making it harder even the most advanced machine learning models to stay effective in the face of evolving conditions. In this article, we’ll explore how to keep your models relevant and responsive to new market data by automatically retraining.

The most downloaded free products:

The most popular forum topics:

- Machine learning in trading: theory, models, practice and algo-trading 101 new comments

- Gallery of UIs written in MQL 7 new comments

- Trailing stop loss and Tp when current candle close below or above MA 6 new comments

Bestsellers in the Market:

Published article "Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part)".

In this article, we continue the implementation of the approaches of the ATFNet model, which adaptively combines the results of 2 blocks (frequency and time) within time series forecasting.

Published article "Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)".

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

Published article "Connexus Observer (Part 8): Adding a Request Observer".

In this final installment of our Connexus library series, we explored the implementation of the Observer pattern, as well as essential refactorings to file paths and method names. This series covered the entire development of Connexus, designed to simplify HTTP communication in complex applications.

Published article "Chemical reaction optimization (CRO) algorithm (Part I): Process chemistry in optimization".

In the first part of this article, we will dive into the world of chemical reactions and discover a new approach to optimization! Chemical reaction optimization (CRO) uses principles derived from the laws of thermodynamics to achieve efficient results. We will reveal the secrets of decomposition, synthesis and other chemical processes that became the basis of this innovative method.

The most downloaded free products:

Most downloaded source codes this month

- Simplified "EuroSurge" Expert Advisor This expert opens trades based on signals from multiple technical indicators.

- Volume Profile This is an indicator for showing volume profile on the chart, using simple calculations and very fast execution.

- Examples from the book "Neural networks for algorithmic trading with MQL5" The book "Neural networks in algorithmic trading with MQL5" is a comprehensive guide, covering both the theoretical foundations of artificial intelligence and neural networks and practical aspects of their application in financial trading using the MQL5 programming language.

Most read articles this month

How to earn money by fulfilling traders' orders in the Freelance service

MQL5 Freelance is an online service where developers are paid to create trading applications for traders customers. The service has been successfully operating since 2010, with over 100,000 projects completed to date, totaling $7 million in value. As we can see, a substantial amount of money is involved here.

How to purchase a trading robot from the MetaTrader Market and to install it?

A product from the MetaTrader Market can be purchased on the MQL5.com website or straight from the MetaTrader 4 and MetaTrader 5 trading platforms. Choose a desired product that suits your trading style, pay for it using your preferred payment method, and activate the product.

In this article, we demonstrate an easy way to install MetaTrader 5 on popular Linux versions — Ubuntu and Debian. These systems are widely used on server hardware as well as on traders’ personal computers.

Bestsellers in the Market:

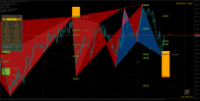

Published article "Visualizing deals on a chart (Part 2): Data graphical display".

Here we are going to develop a script from scratch that simplifies unloading print screens of deals for analyzing trading entries. All the necessary information on a single deal is to be conveniently displayed on one chart with the ability to draw different timeframes.

Published article "Developing a Replay System (Part 52): Things Get Complicated (IV)".

In this article, we will change the mouse pointer to enable the interaction with the control indicator to ensure reliable and stable operation.

The most downloaded free products:

Bestsellers in the Market:

The most popular forum topics:

- Machine learning in trading: theory, models, practice and algo-trading 91 new comments

- Performance Discrepancy Between Local and Remote Systems for MT5 GUI Uploads 7 new comments

- Withdraw problems 7 new comments

The most downloaded free products:

Bestsellers in the Market:

Most downloaded source codes this week

- simple mt5 trade copier this is a copier template

- SuperTrend SuperTrend indicator.

- SUPERMACBOT The SUPERMACBOT is a fully automated trading robot that combines the power of the Moving Average Crossover strategy with the MACD Indicator to deliver precise and reliable trade signals. This Expert Advisor is designed to work seamlessly on all symbols and timeframes, offering versatility and adaptability for traders across various market conditions.

Most read articles this week

How to earn money by fulfilling traders' orders in the Freelance service

MQL5 Freelance is an online service where developers are paid to create trading applications for traders customers. The service has been successfully operating since 2010, with over 100,000 projects completed to date, totaling $7 million in value. As we can see, a substantial amount of money is involved here.

How to purchase a trading robot from the MetaTrader Market and to install it?

A product from the MetaTrader Market can be purchased on the MQL5.com website or straight from the MetaTrader 4 and MetaTrader 5 trading platforms. Choose a desired product that suits your trading style, pay for it using your preferred payment method, and activate the product.

In this article, we demonstrate an easy way to install MetaTrader 5 on popular Linux versions — Ubuntu and Debian. These systems are widely used on server hardware as well as on traders’ personal computers.

Bestsellers in the Market:

New publications in CodeBase

- Get min margin in to csv The script MinMargins.mq5 is designed to help traders quickly calculate and document the minimum amount of money required to open a position with the smallest lot size for all symbols available in the Market Watch. This data is saved to a CSV file for easy review and analysis.

- MT4 to MT5 Convertor (MT5Compat.mqh) A new interface library has been developed to simplify the process of converting MT4 indicators and Expert Advisors (EAs) to MT5. This library supports most of the MetaTrader 4 functions, offering developers a unified solution for cross-platform compatibility.

- MT4 to MT5 Convertor (MT5Compat.mqh) A new interface library has been developed to simplify converting MT4 indicators and Expert Advisors (EAs) to MT5. This library supports most of the MetaTrader 4 functions, offering developers a unified solution for cross-platform compatibility.

The most downloaded free products:

The most popular forum topics:

- Machine learning in trading: theory, models, practice and algo-trading 48 new comments

- Discussing the article: "Fast trading strategy tester in Python using Numba" 30 new comments

- Fastest way to get news data 8 new comments

Bestsellers in the Market:

Published article "MQL5 Wizard Techniques you should know (Part 48): Bill Williams Alligator".

The Alligator Indicator, which was the brain child of Bill Williams, is a versatile trend identification indicator that yields clear signals and is often combined with other indicators. The MQL5 wizard classes and assembly allow us to test a variety of signals on a pattern basis, and so we consider this indicator as well.

New publications in CodeBase

- SUPERMACBOT The SUPERMACBOT is a fully automated trading robot that combines the power of the Moving Average Crossover strategy with the MACD Indicator to deliver precise and reliable trade signals. This Expert Advisor is designed to work seamlessly on all symbols and timeframes, offering versatility and adaptability for traders across various market conditions.

- Comment A simple replacement for a comment. Works in the tester 50 times faster than the standard function.

- PPF - Past Present Future The same PNB from Yousufkhodja Sultonov.

Published article "Developing a multi-currency Expert Advisor (Part 13): Automating the second stage — selection into groups".

We have already implemented the first stage of the automated optimization. We perform optimization for different symbols and timeframes according to several criteria and store information about the results of each pass in the database. Now we are going to select the best groups of parameter sets from those found at the first stage.