Greetings gentlemen!

Just recently started getting into robotics. The systems are unpretentious, but have some logical basis (if increased by so much %, then buy, etc. - price action can be said). There is no sense in giving codes. I don't use indicators at all due to my conviction in their uselessness. So, without optimization I have not managed to create ANY profitable system at the moment! What am I doing wrong? I've changed the parameters, I've swapped tp and sl and it's still a drain! But I mostly use large timeframes, daily ones in particular, with big tp and sl, so that the effect of the trade costs is minimal!

What am I doing wrong?!? Is it really the case that a trading system is almost a random choice of an entry rule (some combination of indyuks) overoptimized to the holes in history?

Gentlemen who really trade and just connoisseurs, please, describe it!

I have to give more parameters. For example: Stop Loss 1000, Take Profit 100. And so on.

You should also give the parameters. For example stoploss 1000, takeprofit 100. And so on.

SL and TP are usually identical to each other, for example, on the days something around 70-100pp

And preferably with clarification whether 70-100pp is in the fifth or fourth digit of the quotes...

In the fourth, i.e. approximately a daily candle (this applies to days).

Here is an example of a system:

To buy on the opening of the zero bar if the opening of the zero bar is above the closing of the first bar, with the closing of the first bar above the opening of the same bar and the opening of the first bar above the closing of the second bar, with the closing of the second bar above its opening. For sales, the conditions are the other way round. Exit a position at the opening of the next bar after the entry bar.

//-------Код открытия позиции--------- if (Open[0]>Close[1] && Close[1]>Open[1] && Open[1]>Close[2] && Close[2]>Open[2]) { Opn_B=true; // Критерий откр. Buy if(Opn_B) BarOpen = iTime(_Symbol,_Period,0); } if (Open[0]<Close[1] && Close[1]<Open[1] && Open[1]<Close[2] && Close[2]<Open[2]) { Opn_S=true; // Критерий откр. Sell if(Opn_S) BarOpen = iTime(_Symbol,_Period,0); } //-------Код закрытия позиции--------- if (BarOpen != iTime(_Symbol,_Period,0)) { Cls_S=true; Cls_B=true; }

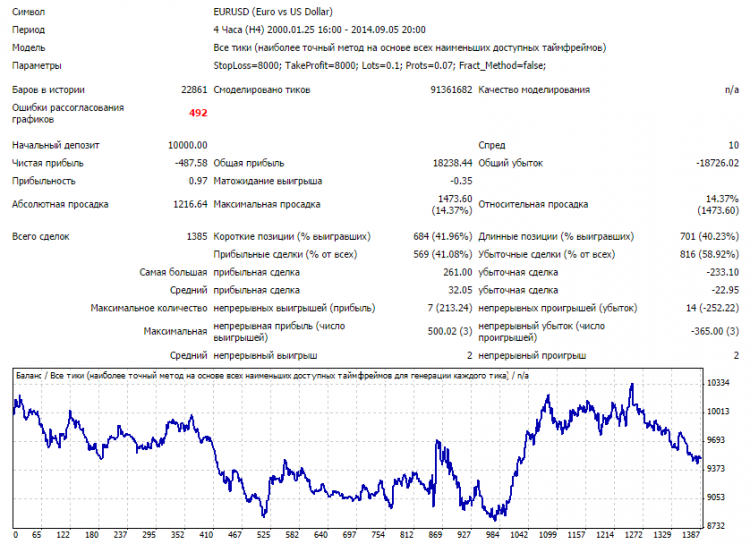

On EURUSD (1D TF), the system shows negative results and 272 trades in 14 years is approximately 1 trade in 19 days. Let's try to move to a lower timeframe (4H) to increase the number of trades. The average size of a EURUSD candle in the 4H timeframe is 45.1 points. Spread was taken at testing 1 point, i.e. trade costs are about 2.2%. As a result, we have the following result:

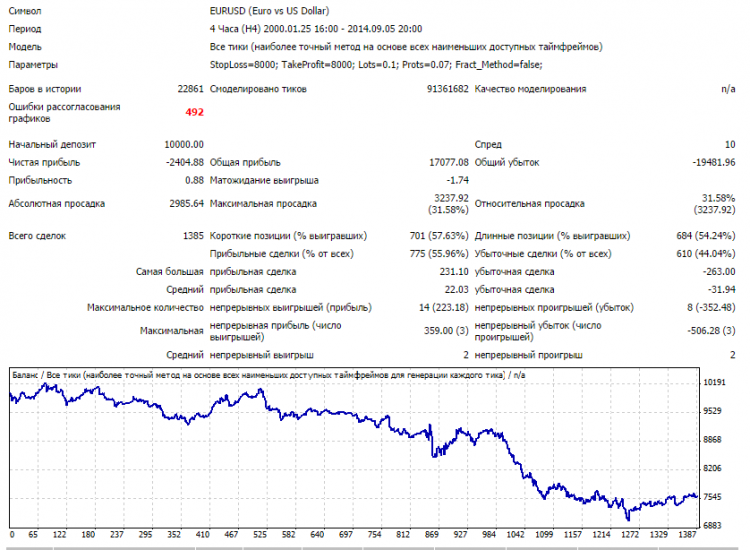

If we change the system logic and open positions vice versa according to the system rules, we have

And that's how all my systems turn out, it feels like I'm missing something or I'm doing something wrong...

Here is an example of a system:

To buy on the opening of the zero bar if the opening of the zero bar is above the closing of the first bar, with the closing of the first bar above the opening of the same bar and the opening of the first bar above the closing of the second bar, with the closing of the second bar above its opening. For sales, the conditions are the other way round. Exit a position at the opening of the next bar after the entry bar.

On EURUSD (1D TF), the system shows negative results and 272 trades in 14 years is approximately 1 trade in 19 days. Let's try to move to a lower timeframe (4H) to increase the number of trades. The average size of a EURUSD candle in the 4H timeframe is 45.1 points. Spread was taken at testing 1 point, i.e. trade costs are about 2.2%. The result is as follows:

[URL=http://www.radikal.ru][IMG]http://s018.radikal.ru/i520/1409/fd/14d227eb524b.png[/IMG][/URL]

Let's change the system logic and open positions vice versa according to the system rules we have:

[URL=http://www.radikal.ru][IMG]http://s008.radikal.ru/i306/1409/26/ebbd08036c5b.png[/IMG][/URL]

And that's how all my systems turn out, it feels like something is missing or I'm doing something wrong...

There is no limit to perfection, but you are definitely doing it wrong here! Observe the daily candles on the chart and their quotes! It's unlikely you'll find your variant!

There is no limit to perfection, but you are definitely doing it wrong here! Observe the daily candles on the chart and their quotes! It is unlikely that you will find your variant!

I do not know what you mean. If you mean the logic of the system itself, then I have also given you the reversal variant - the result is the same. And whatever logic I use, the result is the same.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Greetings gentlemen!

Just recently started getting into robotics. The systems are unpretentious, but have some logical basis (if increased by so much %, then buy, etc. - price action can be said). There is no sense in giving codes. I don't use indicators at all due to my conviction in their uselessness. So, without optimization I have not managed to create ANY profitable system at the moment! What am I doing wrong? I've changed the parameters, I've swapped tp and sl and it's still a drain! But I mostly use large timeframes, daily ones in particular, with big tp and sl, so that the effect of the trade costs is minimal!

What am I doing wrong?!? Is it really the case that a trading system is almost a random choice of an entry rule (some combination of indyuks) overoptimized to the holes in history?

Gentlemen who really trade and just connoisseurs, please, describe it!