There are several areas of research that I have been working on for a long time. One of them is the bold assumption that the increments of a quotation process are essentially a superposition of several, simpler processes. This "superposition" could be a sum, a product or a more complex transformation.

Why? If only because the quoting process is supercomplex, but not random at all (they are different classes of processes and can be distinguished if desired). This is a separate topic for conversations over a cup of some liquid, but by the way, there is proof.

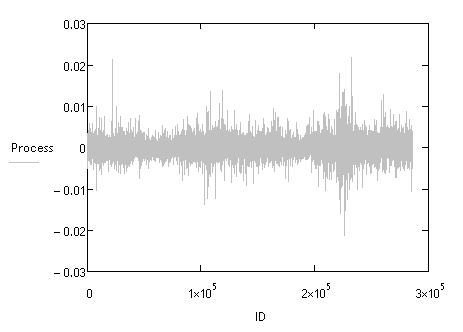

The phenomenon that I want to present, perhaps, is known to someone, and maybe not, or known not to all. Anyway, I haven't seen its mentioning anywhere. Let's take EURUSD M15 (Alpari data for approximately 10 years) and look at its increments.

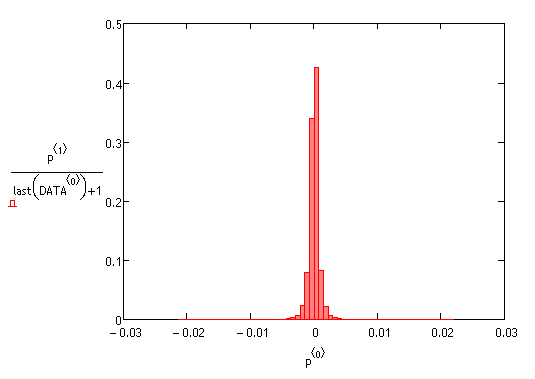

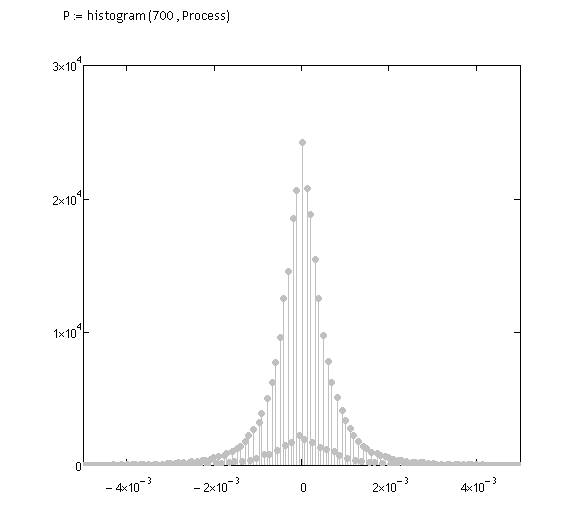

Now let's look at the histogram, but usually they are looked at like this

or like this:

I looked for this manifestation of superposition in every way, applying the most perverted methods and, ... and it appeared, directly, in plain sight, or rather one of manifestations. And it suggested the place of search - the so-called "subtle structures", if one can say so, and that's what I found.

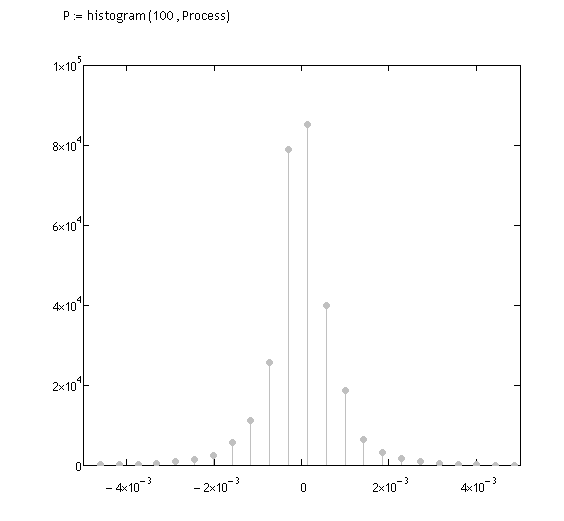

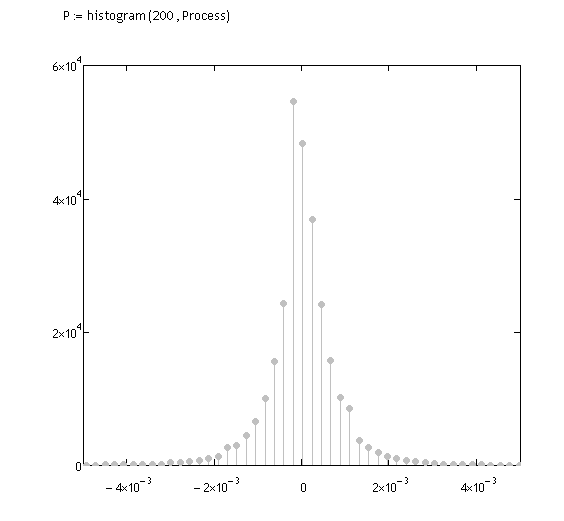

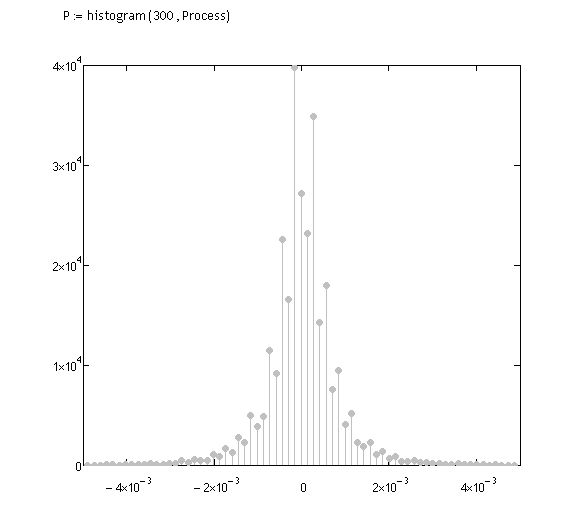

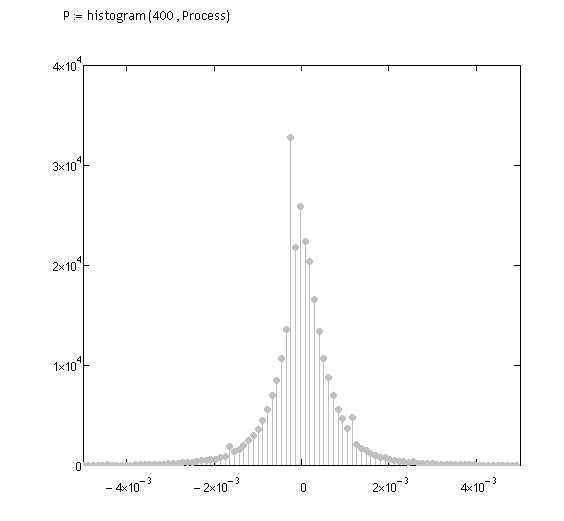

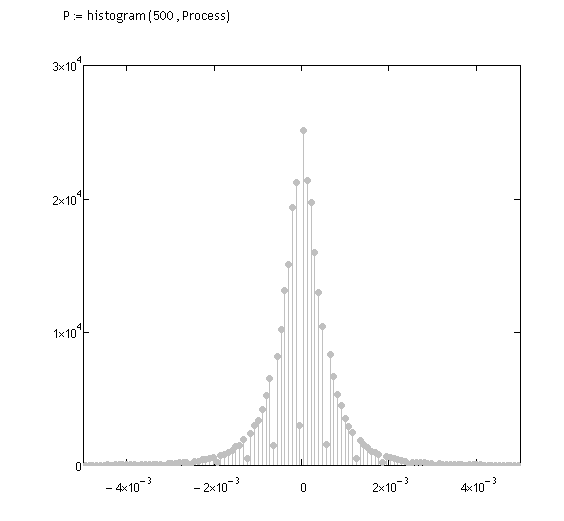

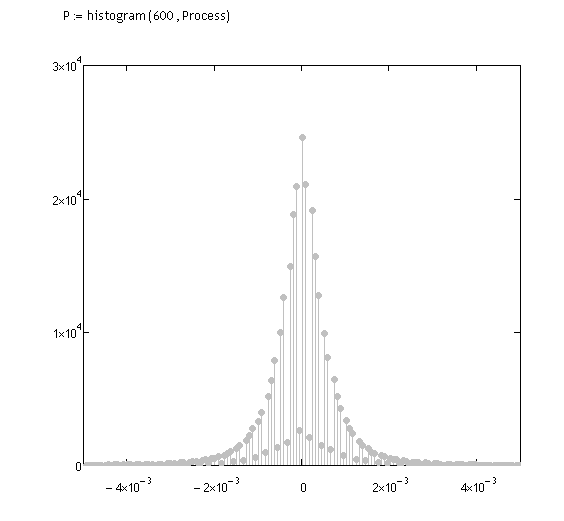

Now look closely, first argument of histogram function is number of intervals, by which frequency of events will be counted (graph is limited, i.e. very long tails), graph appearance is changed:

h=100

h=200

h=300

h=400

h=500 (something appears)

h=166

h=700

Further increasing h already merges everything, nothing will be visible.

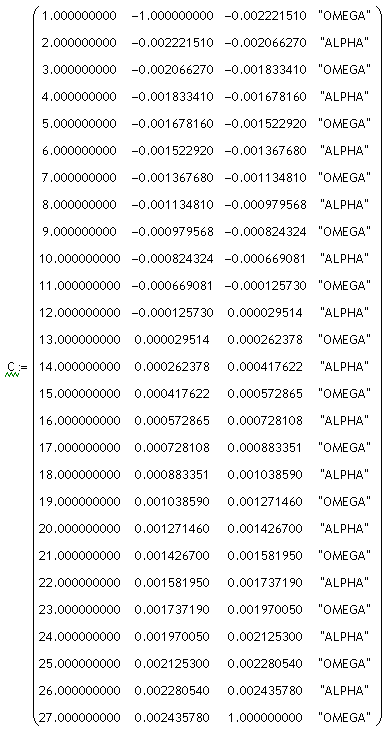

You can clearly see that a small process sits inside the big one; I gave them names, processes "alpha" and "omega". I've named them "alpha" and "omega". Now I need to classify them applying scientific groping method I've got the following matrix for classification of two processes:

Column designations:

- first column - number of system state

- Second column - beginning of interval for the class

- The third column - end of price interval for the class

- fourth column - type of the process

Now we need to go through the whole time series of M15 increments and collect these two processes, which I am doing. To clarify, "assemble" means to add up all the increments taken over these intervals for each process class. Clearly there will be omissions, but I don't take them into account now, i.e. if zero is added for the opposite class event.

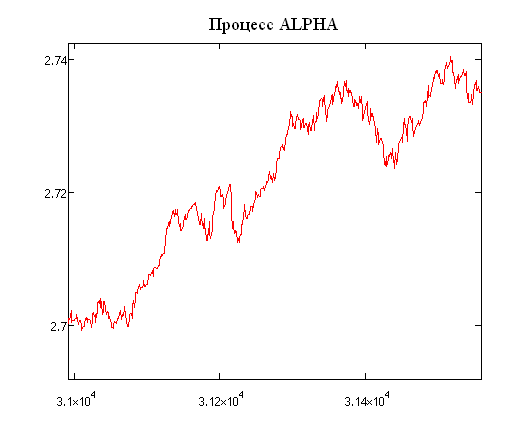

ALPHA process (the whole process and a fragment of its increments):

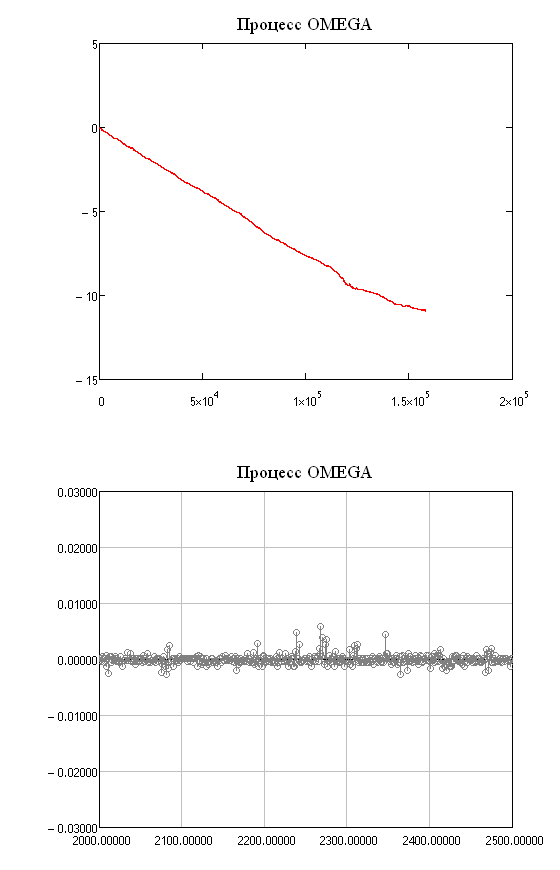

OMEGA process (the whole process and a fragment of its increments):

Here they are, the bulls and the bears.:о) But no, I don't believe in those animals, I think this zoo is bigger in Forex, it's a jungle there. Now we can move on to the market model. It fits well, well ... almost well with the basic model, which I use - stochastic systems with random structure (described briefly here https://www.mql5.com/ru/forum/129406/page15).

It turns out that there are almost (!!!) two linear processes, between which there is switching, i.e. there is another possibility to describe an adequate model, well ... theoretical at least :o). You can calculate the transition matrix from state to state. And it may seem - this is "it", no, this is not "it" yet. When "it" comes - I will tell :o) there are really complexities, processes are not linear, here is an increase in a fragment:

Or you need to be more precise (I've done that), but there is a lot of noise in it, poor linear correlation, transitions are not clear yet, but there seems to be no "Markovianness", i.e. there is a dependence and you can't find it.

In general, colleagues, it is possible to discuss the philosophy, theory and practice. By the way, the phenomenon works on all relatively small t.frames.Although the word Phenomenon is used relatively often, it is better to specify its meaning in order to avoid misunderstandings.

Taki managed, though a bear cub, but clever :o)

We should, I think, take these:

According to the generally accepted definition, Phenomenon (from Greek phainomenon = being), 1) an unusual phenomenon, a rare fact. 2) A philosophical concept denoting a phenomenon apprehended in sensory experience (see Essence and phenomenon (see Essence and phenomenon)). Aristotle (see Aristotle) used the term "F." in the sense of "visible", "illusory", H. W. Leibniz (see Leib) (see Ley) called facts known from experience F., while distinguishing "real, well-grounded phenomena". For J. Berkeley, D. Hume and the supporters of positivism and Mahism. F. = data of the mind, elements of experience (understood in a subjective-idealistic way), which constitute the only reality. According to I. Kant, F. = everything that can be the subject of possible experience; F. opposes the noumen, or 'thing in itself'. In E. Husserl's phenomenology, F. = the immediately given in the mind as the content of the intensional act (see Intention (see Int.)). ? V. F. Asmus.

One can make up one's own.

Taki made it in time, even though he's a bear, he's nimble :o)

We should, I think we can take these:

you can make up your own.

In short - an uncommon phenomenon.

In short - an unusual phenomenon.

It is ***not* uncommon, for example, the one described can be observed for at least the last 10 years. I suggest we leave the term "phenomenon" out and leave room in our heads for other, pleasant events and processes, e.g. beer, girls, etc.

I suggest we leave the term "phenomenon" out of the steam, and leave room in our heads for other, pleasurable events and processes, a.k.a. beer, girls, etc.

In general, colleagues, it is possible to discuss the philosophy, theory and practice. By the way, the phenomenon works on all relatively small t.frames.

It is ***not* uncommon, e.g. the one described can be observed for at least the last 10 years. I suggest you leave the term "phenomenon" out of your head, and leave room in your head for other, pleasurable events and processes, e.g. beer, girls, etc.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I have decided to organize such a branch, I hope colleagues will support it (from those who are not very greedy for knowledge :o), and will also put some observations, curious "phenomena", properties of quoting process proved strictly and not so strictly, or proved purely in character. I hope, the branch will be useful to all, new ideas and interesting discussions will appear.

Well, since I was the first to start, so as they say, flag, drum and tanks to the front...