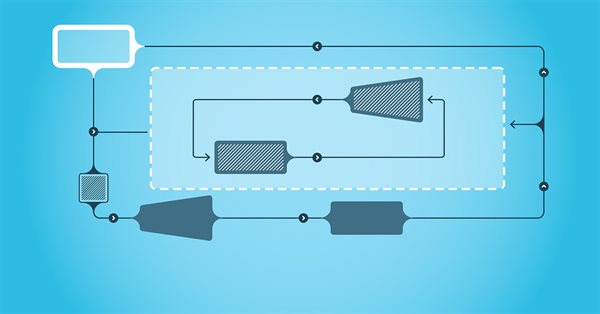

Developing a Replay System — Market simulation (Part 11): Birth of the SIMULATOR (I)

In order to use the data that forms the bars, we must abandon replay and start developing a simulator. We will use 1 minute bars because they offer the least amount of difficulty.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 3): Added symbols prefixes and/or suffixes and Trading Time Session

Several fellow traders sent emails or commented about how to use this Multi-Currency EA on brokers with symbol names that have prefixes and/or suffixes, and also how to implement trading time zones or trading time sessions on this Multi-Currency EA.

Developing a Replay System — Market simulation (Part 09): Custom events

Here we'll see how custom events are triggered and how the indicator reports the state of the replay/simulation service.

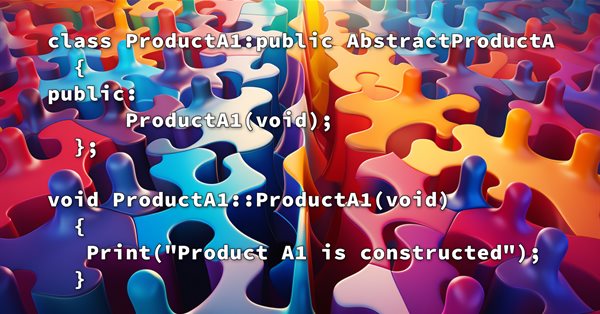

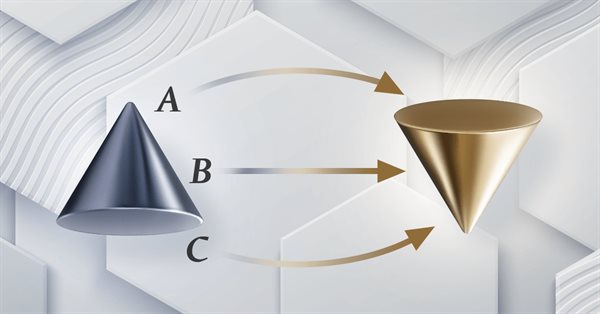

Design Patterns in software development and MQL5 (Part I): Creational Patterns

There are methods that can be used to solve many problems that can be repeated. Once understand how to use these methods it can be very helpful to create your software effectively and apply the concept of DRY ((Do not Repeat Yourself). In this context, the topic of Design Patterns will serve very well because they are patterns that provide solutions to well-described and repeated problems.

Neural networks made easy (Part 49): Soft Actor-Critic

We continue our discussion of reinforcement learning algorithms for solving continuous action space problems. In this article, I will present the Soft Actor-Critic (SAC) algorithm. The main advantage of SAC is the ability to find optimal policies that not only maximize the expected reward, but also have maximum entropy (diversity) of actions.

Neural networks made easy (Part 48): Methods for reducing overestimation of Q-function values

In the previous article, we introduced the DDPG method, which allows training models in a continuous action space. However, like other Q-learning methods, DDPG is prone to overestimating Q-function values. This problem often results in training an agent with a suboptimal strategy. In this article, we will look at some approaches to overcome the mentioned issue.

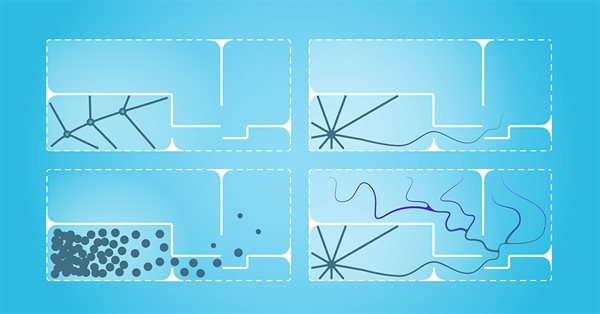

Neural networks made easy (Part 47): Continuous action space

In this article, we expand the range of tasks of our agent. The training process will include some aspects of money and risk management, which are an integral part of any trading strategy.

Neural networks made easy (Part 46): Goal-conditioned reinforcement learning (GCRL)

In this article, we will have a look at yet another reinforcement learning approach. It is called goal-conditioned reinforcement learning (GCRL). In this approach, an agent is trained to achieve different goals in specific scenarios.

Neural networks made easy (Part 45): Training state exploration skills

Training useful skills without an explicit reward function is one of the main challenges in hierarchical reinforcement learning. Previously, we already got acquainted with two algorithms for solving this problem. But the question of the completeness of environmental research remains open. This article demonstrates a different approach to skill training, the use of which directly depends on the current state of the system.

Neural networks made easy (Part 44): Learning skills with dynamics in mind

In the previous article, we introduced the DIAYN method, which offers the algorithm for learning a variety of skills. The acquired skills can be used for various tasks. But such skills can be quite unpredictable, which can make them difficult to use. In this article, we will look at an algorithm for learning predictable skills.

Neural networks made easy (Part 43): Mastering skills without the reward function

The problem of reinforcement learning lies in the need to define a reward function. It can be complex or difficult to formalize. To address this problem, activity-based and environment-based approaches are being explored to learn skills without an explicit reward function.

Neural networks made easy (Part 42): Model procrastination, reasons and solutions

In the context of reinforcement learning, model procrastination can be caused by several reasons. The article considers some of the possible causes of model procrastination and methods for overcoming them.

Permuting price bars in MQL5

In this article we present an algorithm for permuting price bars and detail how permutation tests can be used to recognize instances where strategy performance has been fabricated to deceive potential buyers of Expert Advisors.

Integrate Your Own LLM into EA (Part 2): Example of Environment Deployment

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Integrate Your Own LLM into EA (Part 1): Hardware and Environment Deployment

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Learn how to deal with date and time in MQL5

A new article about a new important topic which is dealing with date and time. As traders or programmers of trading tools, it is very crucial to understand how to deal with these two aspects date and time very well and effectively. So, I will share some important information about how we can deal with date and time to create effective trading tools smoothly and simply without any complicity as much as I can.

Launching MetaTrader VPS: A step-by-step guide for first-time users

Everyone who uses trading robots or signal subscriptions sooner or later recognizes the need to rent a reliable 24/7 hosting server for their trading platform. We recommend using MetaTrader VPS for several reasons. You can conveniently pay and manage the subscription through your MQL5.community account.

Mastering ONNX: The Game-Changer for MQL5 Traders

Dive into the world of ONNX, the powerful open-standard format for exchanging machine learning models. Discover how leveraging ONNX can revolutionize algorithmic trading in MQL5, allowing traders to seamlessly integrate cutting-edge AI models and elevate their strategies to new heights. Uncover the secrets to cross-platform compatibility and learn how to unlock the full potential of ONNX in your MQL5 trading endeavors. Elevate your trading game with this comprehensive guide to Mastering ONNX

Category Theory in MQL5 (Part 23): A different look at the Double Exponential Moving Average

In this article we continue with our theme in the last of tackling everyday trading indicators viewed in a ‘new’ light. We are handling horizontal composition of natural transformations for this piece and the best indicator for this, that expands on what we just covered, is the double exponential moving average (DEMA).

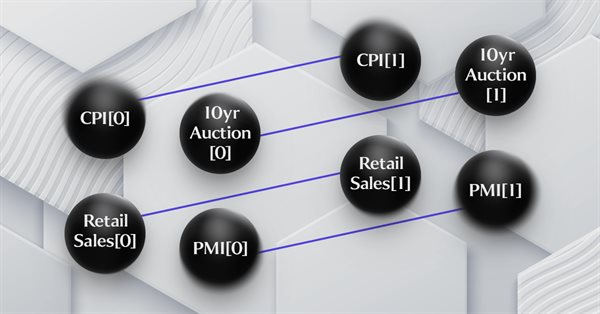

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 2): Indicator Signals: Multi Timeframe Parabolic SAR Indicator

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than 1 symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Parabolic SAR or iSAR in multi-timeframes starting from PERIOD_M15 to PERIOD_D1.

Category Theory in MQL5 (Part 22): A different look at Moving Averages

In this article we attempt to simplify our illustration of concepts covered in these series by dwelling on just one indicator, the most common and probably the easiest to understand. The moving average. In doing so we consider significance and possible applications of vertical natural transformations.

Developing a Replay System — Market simulation (Part 08): Locking the indicator

In this article, we will look at how to lock the indicator while simply using the MQL5 language, and we will do it in a very interesting and amazing way.

Category Theory in MQL5 (Part 21): Natural Transformations with LDA

This article, the 21st in our series, continues with a look at Natural Transformations and how they can be implemented using linear discriminant analysis. We present applications of this in a signal class format, like in the previous article.

Category Theory in MQL5 (Part 20): A detour to Self-Attention and the Transformer

We digress in our series by pondering at part of the algorithm to chatGPT. Are there any similarities or concepts borrowed from natural transformations? We attempt to answer these and other questions in a fun piece, with our code in a signal class format.

Understanding order placement in MQL5

When creating any trading system, there is a task we need to deal with effectively. This task is order placement or to let the created trading system deal with orders automatically because it is crucial in any trading system. So, you will find in this article most of the topics that you need to understand about this task to create your trading system in terms of order placement effectively.

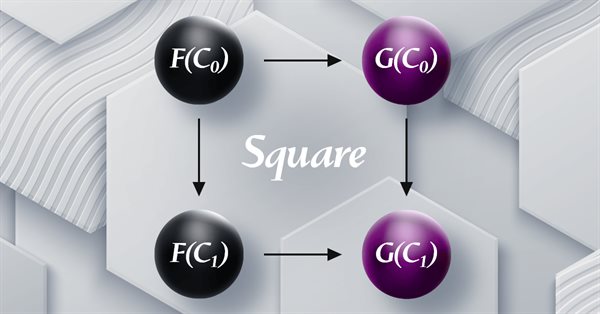

Category Theory in MQL5 (Part 19): Naturality Square Induction

We continue our look at natural transformations by considering naturality square induction. Slight restraints on multicurrency implementation for experts assembled with the MQL5 wizard mean we are showcasing our data classification abilities with a script. Principle applications considered are price change classification and thus its forecasting.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 1): Indicator Signals based on ADX in combination with Parabolic SAR

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders an more) for more than 1 symbol pair only from one symbol chart.

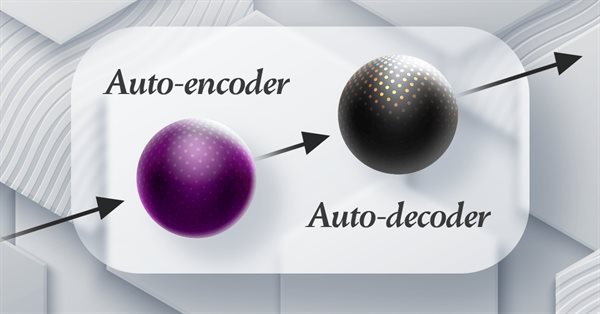

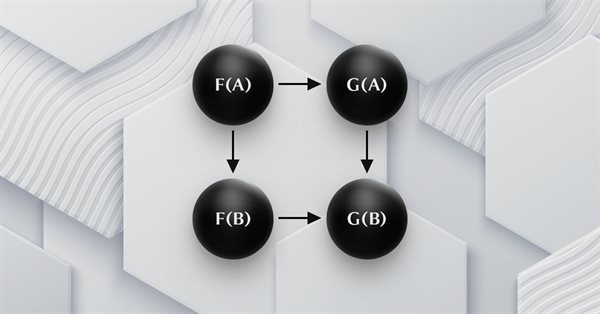

Category Theory in MQL5 (Part 18): Naturality Square

This article continues our series into category theory by introducing natural transformations, a key pillar within the subject. We look at the seemingly complex definition, then delve into examples and applications with this series’ ‘bread and butter’; volatility forecasting.

Testing different Moving Average types to see how insightful they are

We all know the importance of the Moving Average indicator for a lot of traders. There are other Moving average types that can be useful in trading, we will identify these types in this article and make a simple comparison between each one of them and the most popular simple Moving average type to see which one can show the best results.

Category Theory in MQL5 (Part 17): Functors and Monoids

This article, the final in our series to tackle functors as a subject, revisits monoids as a category. Monoids which we have already introduced in these series are used here to aid in position sizing, together with multi-layer perceptrons.

Category Theory in MQL5 (Part 16): Functors with Multi-Layer Perceptrons

This article, the 16th in our series, continues with a look at Functors and how they can be implemented using artificial neural networks. We depart from our approach so far in the series, that has involved forecasting volatility and try to implement a custom signal class for setting position entry and exit signals.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part III): Simple Movable Trading GUI

Join us in Part III of the "Improve Your Trading Charts With Interactive GUIs in MQL5" series as we explore the integration of interactive GUIs into movable trading dashboards in MQL5. This article builds on the foundations set in Parts I and II, guiding readers to transform static trading dashboards into dynamic, movable ones.

The RSI Deep Three Move Trading Technique

Presenting the RSI Deep Three Move Trading Technique in MetaTrader 5. This article is based on a new series of studies that showcase a few trading techniques based on the RSI, a technical analysis indicator used to measure the strength and momentum of a security, such as a stock, currency, or commodity.

Developing a Replay System — Market simulation (Part 04): adjusting the settings (II)

Let's continue creating the system and controls. Without the ability to control the service, it is difficult to move forward and improve the system.

Everything you need to learn about the MQL5 program structure

Any Program in any programming language has a specific structure. In this article, you will learn essential parts of the MQL5 program structure by understanding the programming basics of every part of the MQL5 program structure that can be very helpful when creating our MQL5 trading system or trading tool that can be executable in the MetaTrader 5.

Trading strategy based on the improved Doji candlestick pattern recognition indicator

The metabar-based indicator detected more candles than the conventional one. Let's check if this provides real benefit in the automated trading.

Understanding functions in MQL5 with applications

Functions are critical things in any programming language, it helps developers apply the concept of (DRY) which means do not repeat yourself, and many other benefits. In this article, you will find much more information about functions and how we can create our own functions in MQL5 with simple applications that can be used or called in any system you have to enrich your trading system without complicating things.

Developing a Replay System — Market simulation (Part 02): First experiments (II)

This time, let's try a different approach to achieve the 1 minute goal. However, this task is not as simple as one might think.

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.

Revisiting an Old Trend Trading Strategy: Two Stochastic oscillators, a MA and Fibonacci

Old trading strategies. This article presents one of the strategies used to follow the trend in a purely technical way. The strategy is purely technical and uses a few technical indicators and tools to deliver signals and targets. The components of the strategy are as follows: A 14-period stochastic oscillator. A 5-period stochastic oscillator. A 200-period moving average. A Fibonacci projection tool (for target setting).