Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

Introduction

In the previous part, we dded the ability to restore the EA's state after a restart. It does not matter what the reason was - rebooting the terminal, changing the timeframe on the chart with the EA, launching a more recent version of the EA - in all cases, restoring the state allowed the EA not to start working from scratch and not to lose already open positions, but to continue handling them.

However, the size of the opened positions remained the same for each instance of the strategy throughout the entire testing period. Their size was set at the EA launch. If, as a result of the EA's operation, the trading account balance increased, then this would allow the use of an increased position size without increasing risk. It would be reasonable to take advantage of this, so let’s start implementing the use of variable position sizes.

Concepts

First of all, we need to agree on the concepts based on a common goal - achieving optimal collaboration between multiple instances of trading strategies.

Fixed strategy size (Fixed Lot) — a certain size used to calculate the sizes of all open positions in a trading strategy. In the simplest case, all opened positions can have a size equal to this value. When using any tricks to increase or decrease the size of the second and subsequent opened positions in a series, a fixed size can set the size of the first position in the series, and subsequent ones are calculated based on it and the number of already open positions. This is not considered a very good technique.

Normalized strategy balance (Fitted Balance) — initial balance, at which the drawdown during the entire testing period reaches, but does not exceed, 10% of the initial balance for the selected fixed strategy size. Why exactly 10%? This number is not yet a very large drawdown, which psychologically seems acceptable and turns out to be more convenient for quick rough mental calculations. In general, we can take any value - 1%, 5% or even 50%. This is nothing more than a normalization parameter.

Normalized trading strategy — a trading strategy, for which a fixed strategy size and normalized strategy balance were selected. Therefore, when launching such a strategy on the selected testing period, we should get a maximum drawdown value of approximately 10% of the normalized strategy balance.

Having a trading strategy, we can turn it into a normalized trading strategy by performing the following actions:

- Select a fixed strategy size, for example, 0.01.

- Select the testing period (start and end date)

- Launch the strategy on the selected testing period with a large initial balance and look at the value of the maximum absolute drawdown by equity.

- Find the value of the normalized strategy balance multiplying the maximum absolute drawdown by equity by 10.

Let us consider the following example. Suppose that we get a maximum absolute drawdown of USD 440 for the fixed strategy size of 0.01. If we want this value to be exactly 10% of the initial balance, we can divide USD 440 by 0.10 or multiply by 10 (which is the same thing):

USD 440 / 0.10 = USD 440 * 10 = USD 4400

We set these two values (0.01 and 4400) in the parameters for creating a trading strategy instance and get a normalized trading strategy.

Now, for a normalized trading strategy, we can calculate the size of open positions for any balance value while maintaining the maximum relative drawdown by equity equal to 10%. To do this, it is sufficient to change the size of the opened positions in proportion to the ratio of the current total balance (Total Balance) and normalized balance (Fitted Balance).

CurrentLot = FixedLot * (TotalBalance / FittedBalance)

For example, for the values of 0.01 and 4400 used in the above example, with a balance value of USD 10,000, the size of open positions should be calculated based on the base value:

CurrentLot = 0.01 * (10,000 / 4400) = 0.0227

It will not be possible to open exactly this size. We will have to round it to 0.02, so the drawdown in this case may be slightly less than 10% on the test. If we round up (to 0.03), then the drawdown may be slightly more than 10%. As the balance increases, rounding errors will decrease.

If we have introduced the concept of a fixed position size for a strategy, then we can entrust any options for managing the size of the strategy positions to the strategy itself. Therefore, we only need to implement three possible options for a money management strategy at the level of the EA that combines various instances of trading strategies:

- Fixed size or the absence of a money management strategy. The fixed size specified in the strategy is applied regardless of the trading account balance. The strategy will be used when testing a separate instance of the strategy to determine the normalized strategy balance.

- Constant size for a specified fixed balance. At the start, the size proportional to the fixed balance for the strategy is calculated based on the strategy normalized balance and fixed size. This size is used throughout the testing period. This strategy will be used to check the uniformity (linearity) of the funds growth curve throughout the entire testing period, subject to the stated maximum absolute drawdown.

- Variable size for the current balance. For each position opening, the size is determined in proportion to the current account balance based on the strategy normalized balance and fixed size. The strategy will be used for real work providing the expected value of the maximum relative drawdown.

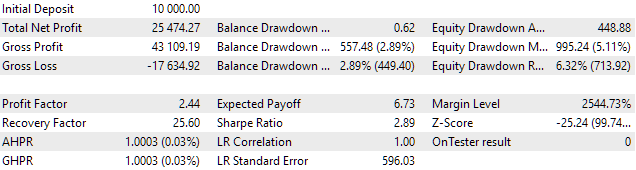

Let's provide examples of using these three options. Let's take the EA with one copy of the strategy, set a large starting balance of USD 100,000 and start testing for the period of 2018-2022 with the fixed size of open positions of 0.01 lots. We get the following results:

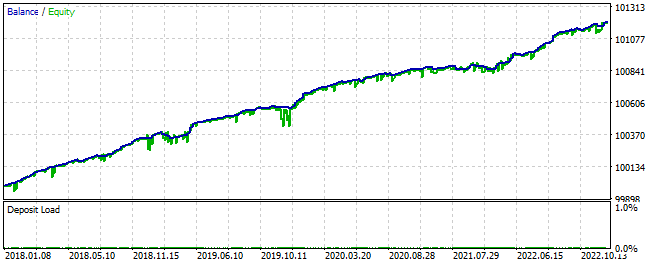

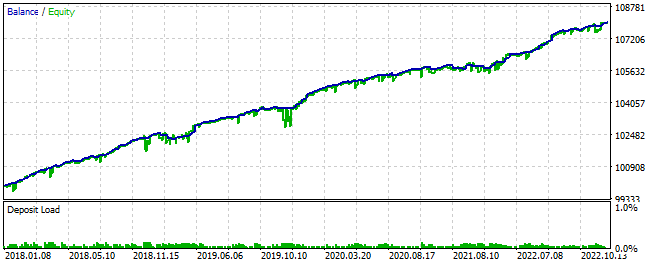

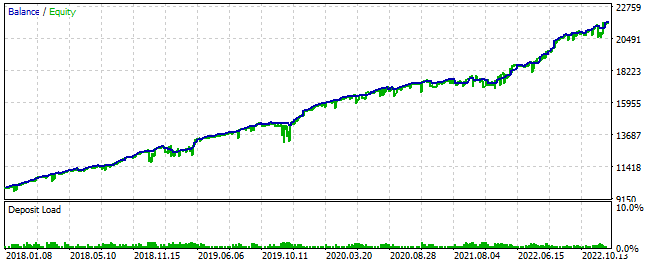

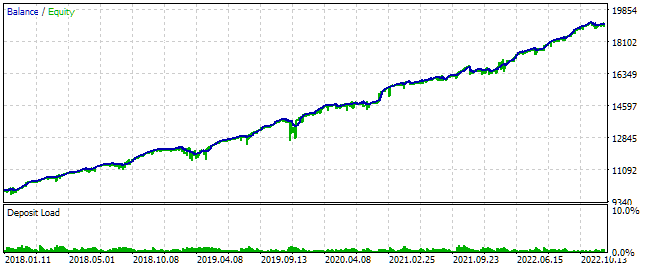

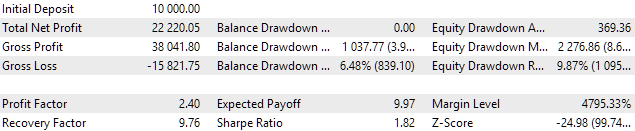

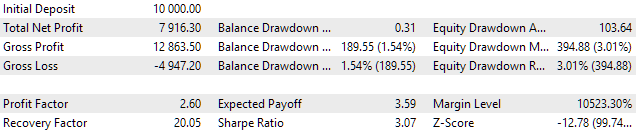

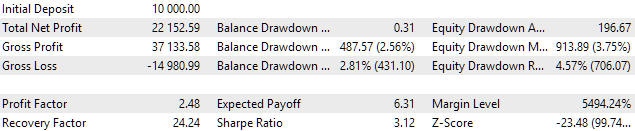

Fig. 1. Results with the fixed size and the balance of USD 100,000

As we can see, during this testing period there was a maximum absolute drawdown in equity of about USD 153, which amounted to approximately 0.15% of the account balance. More precisely, it is more correct for us to evaluate the relative drawdown regarding the initial account balance. But since the difference between the initial and final balance is small (about 1% of the initial balance), a drawdown of 0.15% will, with good accuracy, amount to the absolute value of USD 150 at whatever point in the test period it occurs.

Let's calculate what size of the initial balance can be set so that the maximum absolute drawdown is 10% of the initial balance:

FittedBalance = MaxDrawdown / 10% = 153 / 0.10 = 153 * 10 = USD 1530

Let's check our calculations:

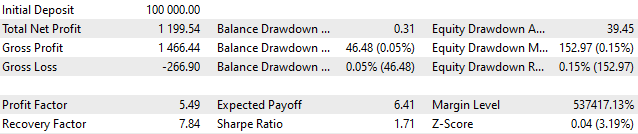

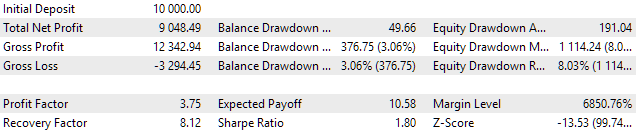

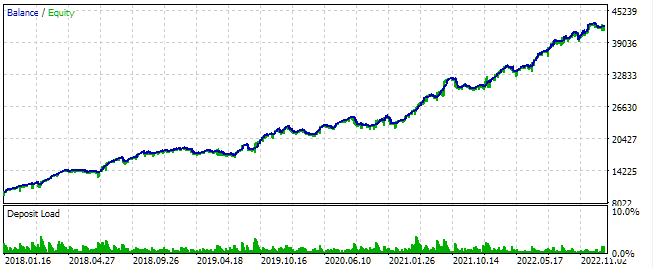

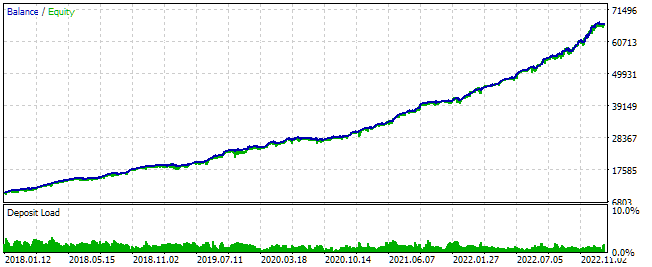

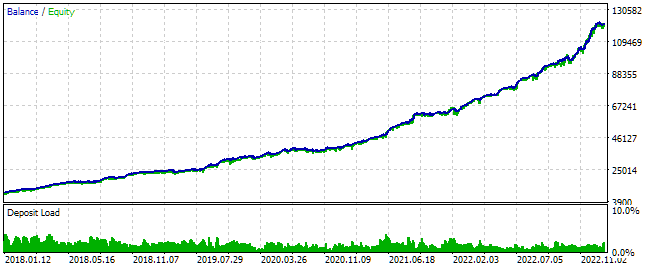

Fig. 2. Results with the fixed size and the balance of USD 1530

We can see that the absolute drawdown in equity amounted to the same value of USD 153, but the relative drawdown was not 10%, but only 7.2%. This is normal, since it only means that the largest drawdown occurred when the account balance had already grown somewhat from its initial value, and the value of USD 153 was already less than 10% of the current balance.

Now let's check the second option - a constant size for a given fixed balance. Set a large initial balance of USD 100,000, while allowing to use, say, only the tenth of it, that is, USD 10,000. This is the Current Balance value, which remains the same throughout the entire testing period. Under these conditions, the size of the opened positions should be:

CurrentBalance = TotalBalance * 0.1 = 10,000

CurrentLot = FixedLot * (CurrentBalance / FittedBalance) = 0.01 * (10,000 / 1530) = 0.0653

During operation, this value will be rounded to a multiple of the lot change step. We get the following results:

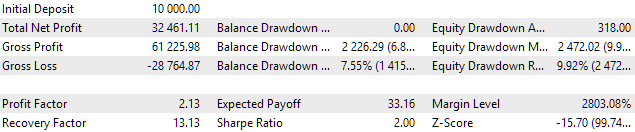

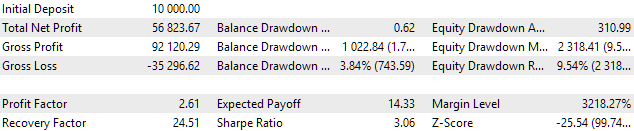

Fig. 3. Results with the fixed size for the fixed balance of USD 10,000 out of the available USD 100,000

As you can see, the absolute drawdown was USD 1016, which with sufficient accuracy is 10% of the USD 10,000 allocated to this strategy. However, this amounted to only 1% relative to the entire balance.

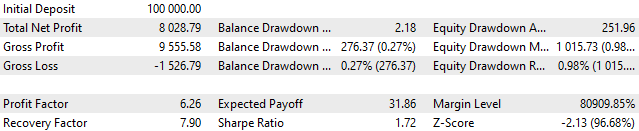

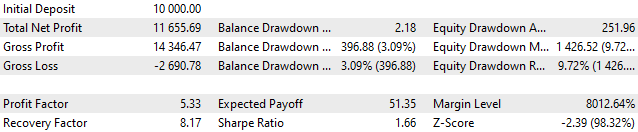

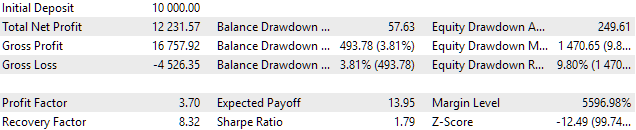

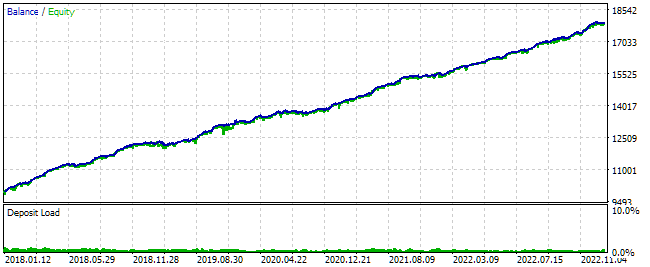

Finally, let's look at the third option - variable size for the current balance. Set the initial balance equal to USD 10,000 and allow it to be used in full. Here is what happens:

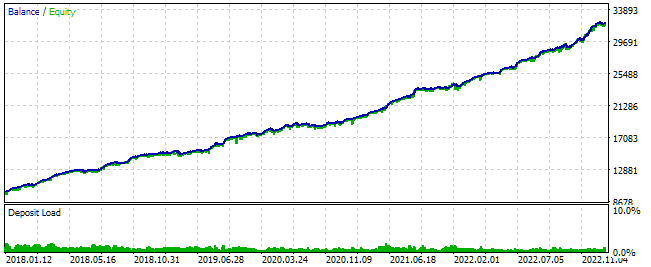

Fig. 4. Results with the variable size for the current balance

Here we see that the maximum absolute drawdown already exceeds 10% of the initial balance, but the relative drawdown continues to remain within the acceptable 10%. We have obtained a normalized trading strategy, for which the value of Fitted Balance = 1530, and now we can easily calculate the sizes of open positions to ensure a given drawdown of 10%.

Position size calculation

When considering the following money management options, the following observations can be made:

- If we are talking about one copy of the strategy, then could options with a variable lot be useful? Looks like they could not. We only need to use the first option. We can use the second and third ones a couple of times to demonstrate performance, but then we will not need them.

- If we are working with an EA that already combines several instances of trading strategies, can trading with a fixed lot be useful? Looks like it cannot. In this case, the second option may be useful to us at the testing stage, and the third one will be the main one used.

This allows us to come to the following conclusion: virtual orders always have a fixed size calculated from the fixed strategy size parameter. In the strategies discussed here, it is enough to use the minimum lot as a fixed size, which for most instruments is equal to 0.01.

Based on the workflow, it turns out that the recipient object or symbolic recipients will have to be recalculated into the real position open size. To do this, they will have to receive the value of the normalized balance, which ensures a drawdown of 10% of this balance, from the strategy, or more precisely, from a virtual order.

But what if we want to provide a smaller or larger drawdown? To do this, it is sufficient to change the size of the opened positions in one way or another in proportion to how many times we want to change the expected maximum drawdown compared to the value of 10%.

One of these methods is the explicit introduction of a weighting multiplier, showing what part of the current account balance can be used by the EA.

Allocated balance (Current Balance) is a part of the total account balance allocated to this EA for trading.

Balance multiplier (Depo Part) — ratio of the allocated strategy balance to the total account balance.

DepoPart = CurrentBalance / TotalBalance

Then the initial position size can be calculated as follows:

CurrentLot = FixedLot * (CurrentBalance / FittedBalance)

CurrentLot = FixedLot * (DepoPart * TotalBalance / FittedBalance)

Here we can make an important remark, which will be very useful for our implementation. If we recalculate the normalized balance after creating a strategy instance, the total balance will be used in the position size calculation equation instead of the current strategy balance:

FittedBalance = FittedBalance / DepoPart

CurrentLot = FixedLot * (TotalBalance / FittedBalance)

We will perform the recalculation of the normalized balance once when initializing the EA. We will not need the Depo Part multiplier after that.

Combining multiple strategies

The previous discussions were made for the case of using one instance of a strategy in an EA. Let's now think about what we need to do case we want to take several standardized strategies and combine them in one EA that allows a drawdown of no more than 10% (or another value specified in advance) during the entire testing period. For now, we will consider the specified drawdown value of exactly 10%.

If we focus on the worst case that can happen when combining strategies, then this is the event of simultaneous achievement of the maximum drawdown of 10% by all strategy instances. In this case, we will have to reduce the position size of each strategy in proportion to the number of instances. For example, if we combine three copies of a strategy, then we need to reduce the size of positions by three times.

This can be achieved by reducing the balance allocated to the strategy by a given number of times, or increasing the normalized balance of strategies by a given number of times. We will use the second option.

If we denote the number of strategies in a group via StrategiesCount, then the equation for recalculating the normalized balance looks as follows:

FittedBalance = StrategiesCount * FittedBalance

However, the likelihood of such a worst case is very much reduced as the number of strategy instances increases, if they are selected so that they are as dissimilar from each other as possible. In this case, drawdowns occur at different times, and not simultaneously. This can be seen during the test. Then we can introduce another scaling factor (Scale), which will be equal to one by default, but if desired, it can be made larger in order to increase the size of positions by reducing the normalized balance of strategies:

FittedBalance = StrategiesCount * FittedBalance

FittedBalance = FittedBalance / Scale

Due to the selection of the Scale multiplier, we can again ensure that a group of strategies provides a specified drawdown throughout the entire testing period. In this case, we will obtain a normalized group of strategies.

Normalized group of strategies — a group of normalized trading strategies, for which a scaling factor has been selected that ensures a maximum drawdown of no more than 10% when the group works together.

Then, if we have made several normalized groups of strategies, then they can all be combined again into a new normalized group according to the same principle used when combining normalized strategies. In other words, we should choose a multiplier for the group of groups, so that the maximum drawdown is no more than 10% when all strategies from all groups work simultaneously. This unification process can be continued to any number of levels. In this case, the initial normalized balance of each strategy will simply be multiplied by the number of strategies or groups in the group at each level of association and divided by the scaling factors of each level:

FittedBalance = StrategiesCount1 * FittedBalance

FittedBalance = StrategiesCount2 * FittedBalance

...

FittedBalance = FittedBalance / Scale1

FittedBalance = FittedBalance / Scale2

...

Then the final equation for recalculating the normalized balance of each strategy will look like this:

FittedBalance = (StrategiesCount1 * StrategiesCount1 * ... ) * FittedBalance / (Scale1 * Scale2 * ... )

Finally, apply the last scaling Depo Part multiplier in the position size calculation equation for the possible transformation of the normalized group of strategies, which is at the highest level of the combination, into a group with a different specified drawdown instead of 10%:

CurrentLot = FixedLot * (DepoPart * TotalBalance / FittedBalance)

There are two new classes for implementation. The first class CVirtualStrategyGroup will be responsible for recalculating the normalized balances of strategies when combining them into groups. The second class CMoney will be responsible for calculating the actual opening volumes based on the strategy fixed size, normalized balance and the allocated balance.

Trading strategy group class

This class will be used to create objects that represent either a group of strategies or a group of strategy groups. In both cases, when creating a group, a scaling factor will be applied via calling the single Scale() method.

//+------------------------------------------------------------------+ //| Class of trading strategies group(s) | //+------------------------------------------------------------------+ class CVirtualStrategyGroup { protected: void Scale(double p_scale); // Scale normalized balance public: CVirtualStrategyGroup(CVirtualStrategy *&p_strategies[], double p_scale = 1); // Constructor for a group of strategies CVirtualStrategyGroup(CVirtualStrategyGroup *&p_groups[], double p_scale = 1); // Constructor for a group of strategy groups CVirtualStrategy *m_strategies[]; // Array of strategies CVirtualStrategyGroup *m_groups[]; // Array of strategy groups };

The constructors will take a scaling factor as parameters and either an array of pointers to strategies or an array of pointers to strategy groups. The resulting array is copied to the corresponding property of the created object, and the Scale() method is applied to each array element. We will need to add this method to the strategy class for strategy objects.

//+------------------------------------------------------------------+ //| Constructor for strategy groups | //+------------------------------------------------------------------+ CVirtualStrategyGroup::CVirtualStrategyGroup( CVirtualStrategy *&p_strategies[], double p_scale ) { ArrayCopy(m_strategies, p_strategies); Scale(p_scale / ArraySize(m_strategies)); } //+------------------------------------------------------------------+ //| Constructor for a group of strategy groups | //+------------------------------------------------------------------+ CVirtualStrategyGroup::CVirtualStrategyGroup( CVirtualStrategyGroup *&p_groups[], double p_scale ) { ArrayCopy(m_groups, p_groups); Scale(p_scale / ArraySize(m_groups)); } //+------------------------------------------------------------------+ //| Scale normalized balance | //+------------------------------------------------------------------+ void CVirtualStrategyGroup::Scale(double p_scale) { FOREACH(m_groups, m_groups[i].Scale(p_scale)); FOREACH(m_strategies, m_strategies[i].Scale(p_scale)); }

Save the code in the VirtualStrategyGroup.mqh file of the current folder.

Let's make the necessary additions to the virtual strategy class. We will need to add two new class properties to store the strategy normalized balance and fixed size. Since they should be installed, a previously unnecessary constructor is needed now. The FittedBalance() public method will simply return the value of the strategy normalized balance, while the Scale() method will scale it by a specified multiplier.

//+------------------------------------------------------------------+ //| Class of a trading strategy with virtual positions | //+------------------------------------------------------------------+ class CVirtualStrategy : public CStrategy { protected: ... double m_fittedBalance; // Strategy normalized balance double m_fixedLot; // Strategy fixed size ... public: CVirtualStrategy(double p_fittedBalance = 0, double p_fixedLot = 0.01); // Constructor ... double FittedBalance() { // Strategy normalized balance return m_fittedBalance; } void Scale(double p_scale) { // Scale normalized balance m_fittedBalance /= p_scale; } };

Save this code in the VirtualStrategy.mqh file of the current folder.

Also, we need to make minor changes in the CSimpleVolumesStrategy class. We should implement an additional parameter to the constructor for the strategy normalized balance and remove the parameter for setting the sizes of virtual positions. It will now always be the same and equal to the minimum lot of 0.01.

//+------------------------------------------------------------------+ //| Constructor | //+------------------------------------------------------------------+ CSimpleVolumesStrategy::CSimpleVolumesStrategy( string p_symbol, ENUM_TIMEFRAMES p_timeframe, int p_signalPeriod, double p_signalDeviation, double p_signaAddlDeviation, int p_openDistance, double p_stopLevel, double p_takeLevel, int p_ordersExpiration, int p_maxCountOfOrders, double p_fittedBalance = 0) : // Initialization list CVirtualStrategy(p_fittedBalance, 0.01), m_symbol(p_symbol), m_timeframe(p_timeframe), m_signalPeriod(p_signalPeriod), m_signalDeviation(p_signalDeviation), m_signaAddlDeviation(p_signaAddlDeviation), m_openDistance(p_openDistance), m_stopLevel(p_stopLevel), m_takeLevel(p_takeLevel), m_ordersExpiration(p_ordersExpiration), m_maxCountOfOrders(p_maxCountOfOrders) { ... }

Save the changes in the SimpleVolumesStrategy.mqh file of the current folder.

We need the ability to add a group of strategies, i.e. the instances of our new CVirtualStrategyGroup class, to the EA object. So, let's implement the overloaded Add() method to the EA class, which will do exactly that:

//+------------------------------------------------------------------+ //| Class of the EA handling virtual positions (orders) | //+------------------------------------------------------------------+ class CVirtualAdvisor : public CAdvisor { ... public: ... virtual void Add(CVirtualStrategyGroup &p_group); // Method for adding a group of strategies ... }; //+------------------------------------------------------------------+ //| Method for adding a group of strategies | //+------------------------------------------------------------------+ void CVirtualAdvisor::Add(CVirtualStrategyGroup &p_group) { FOREACH(p_group.m_groups, { CVirtualAdvisor::Add(p_group.m_groups[i]); delete p_group.m_groups[i]; }); FOREACH(p_group.m_strategies, CAdvisor::Add(p_group.m_strategies[i])); }

Since strategy groups are no longer needed after being added to the EA, we immediately remove them from the dynamic memory area in this method. Save the changes made to the VirtualAdvisor.mqh file in the current folder.

Money management class

This class will be responsible for determining the actual size for virtual positions according to the three possible money management strategy options.

The class object should be unique. So we can either use the Singleton design pattern for it, or, as was eventually implemented, the class can contain only static fields and methods accessible to any objects.

The main method in this class is the method for determining the real size for the Volume() virtual position (order). Two more methods allow us to set the values of two parameters that determine what part of the trading account balance is involved in trading.

//+------------------------------------------------------------------+ //| Basic money management class | //+------------------------------------------------------------------+ class CMoney { static double s_depoPart; // Used part of the total balance static double s_fixedBalance; // Total balance used public: CMoney() = delete; // Disable the constructor static double Volume(CVirtualOrder *p_order); // Determine the real size of the virtual position static void DepoPart(double p_depoPart) { s_depoPart = p_depoPart; } static void FixedBalance(double p_fixedBalance) { s_fixedBalance = p_fixedBalance; } }; double CMoney::s_depoPart = 1.0; double CMoney::s_fixedBalance = 0; //+------------------------------------------------------------------+ //| Determine the real size of the virtual position | //+------------------------------------------------------------------+ double CMoney::Volume(CVirtualOrder *p_order) { // Request the normalized strategy balance for the virtual position double fittedBalance = p_order.FittedBalance(); // If it is 0, then the real volume is equal to the virtual one if(fittedBalance == 0.0) { return p_order.Volume(); } // Otherwise, find the value of the total balance for trading double totalBalance = s_fixedBalance > 0 ? s_fixedBalance : AccountInfoDouble(ACCOUNT_BALANCE); // Return the calculated real volume based on the virtual one return p_order.Volume() * totalBalance * s_depoPart / fittedBalance ; } //+------------------------------------------------------------------+

Save this code in the Money.mqh file of the current folder.

Test EAs

Let's make changes to the EA files for testing. In the SimpleVolumesExpertSingle.mq5 file, we just need to remove the position size parameter from the list of parameters of the strategy constructor in the EA initialization function:

int OnInit() { // Create an EA handling virtual positions expert = new CVirtualAdvisor(magic_, "SimpleVolumesSingle"); expert.Add(new CSimpleVolumesStrategy( symbol_, timeframe_, fixedLot_, signalPeriod_, signalDeviation_, signaAddlDeviation_, openDistance_, stopLevel_, takeLevel_, ordersExpiration_, maxCountOfOrders_) ); // Add one strategy instance return(INIT_SUCCEEDED); }

We will not use the EA to search for new good combinations of parameters for individual strategy instances now, since we will use the combinations found earlier. But if necessary, the EA will be ready for an optimization.

Let's make more significant additions to the SimpleVolumesExpert.mq5 file. We mainly need them to demonstrate the capabilities of the added classes, so we should not consider this as final code.

First of all, we will create an enumeration to represent different ways of grouping instances of trading strategies:

enum ENUM_VA_GROUP { VAG_EURGBP, // Only EURGBP (3 items) VAG_EURUSD, // Only EURUSD (3 items) VAG_GBPUSD, // Only GBPUSD (3 items) VAG_EURGBPUSD_9, // EUR-GBP-USD (9 items) VAG_EURGBPUSD_3_3_3 // EUR-GBP-USD (3+3+3 items) };

The first three values will correspond to the use of three copies of trading strategies for one of the symbols (EURGBP, EURUSD or GBPUSD). The fourth value will correspond to the use of one group of all nine strategy instances. The fifth value will correspond to the use of a group of three normalized groups, which will include three copies of trading strategies for a specific symbol.

Let's expand the list of input parameters a bit:

//+------------------------------------------------------------------+ //| Inputs | //+------------------------------------------------------------------+ input group "::: Strategy groups" input ENUM_VA_GROUP group_ = VAG_EURGBP; // - Strategy group input group "::: Money management" input double expectedDrawdown_ = 10; // - Maximum risk (%) input double fixedBalance_ = 0; // - Used deposit (0 - use all) in the account currency input double scale_ = 1.0; // - Group scaling multiplier input group "::: Other parameters" input ulong magic_ = 27183; // - Magic

In the EA initialization function, set the money management parameters taking into account the normalization of the maximum allowable drawdown of 10%, create nine copies of strategies, arrange them in accordance with the selected grouping and add them to the EA:

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { // Set parameters in the money management class CMoney::DepoPart(expectedDrawdown_ / 10.0); CMoney::FixedBalance(fixedBalance_); // Create an EA handling virtual positions expert = new CVirtualAdvisor(magic_, "SimpleVolumes_" + EnumToString(group_)); // Create and fill the array of all strategy instances CVirtualStrategy *strategies[] = { new CSimpleVolumesStrategy("EURGBP", PERIOD_H1, 13, 0.3, 1.0, 0, 10500, 465, 1000, 3, 1600), new CSimpleVolumesStrategy("EURGBP", PERIOD_H1, 17, 1.7, 0.5, 0, 16500, 220, 1000, 3, 900), new CSimpleVolumesStrategy("EURGBP", PERIOD_H1, 51, 0.5, 1.1, 0, 19500, 370, 22000, 3, 1600), new CSimpleVolumesStrategy("EURUSD", PERIOD_H1, 24, 0.1, 0.3, 0, 7500, 2400, 24000, 3, 2300), new CSimpleVolumesStrategy("EURUSD", PERIOD_H1, 18, 0.2, 0.4, 0, 19500, 1480, 6000, 3, 2000), new CSimpleVolumesStrategy("EURUSD", PERIOD_H1, 128, 0.7, 0.3, 0, 3000, 170, 42000, 3, 2200), new CSimpleVolumesStrategy("GBPUSD", PERIOD_H1, 80, 1.1, 0.2, 0, 6000, 1190, 1000, 3, 2500), new CSimpleVolumesStrategy("GBPUSD", PERIOD_H1, 128, 2.0, 0.9, 0, 2000, 1170, 1000, 3, 900), new CSimpleVolumesStrategy("GBPUSD", PERIOD_H1, 13, 1.5, 0.8, 0, 2500, 1375, 1000, 3, 1400), }; // Create arrays of pointers to strategies, one symbol at a time, from the available strategies CVirtualStrategy *strategiesEG[] = {strategies[0], strategies[1], strategies[2]}; CVirtualStrategy *strategiesEU[] = {strategies[3], strategies[4], strategies[5]}; CVirtualStrategy *strategiesGU[] = {strategies[6], strategies[7], strategies[8]}; // Create and add selected groups of strategies to the EA switch(group_) { case VAG_EURGBP: { expert.Add(CVirtualStrategyGroup(strategiesEG, scale_)); FOREACH(strategiesEU, delete strategiesEU[i]); FOREACH(strategiesGU, delete strategiesGU[i]); break; } case VAG_EURUSD: { expert.Add(CVirtualStrategyGroup(strategiesEU, scale_)); FOREACH(strategiesEG, delete strategiesEG[i]); FOREACH(strategiesGU, delete strategiesGU[i]); break; } case VAG_GBPUSD: { expert.Add(CVirtualStrategyGroup(strategiesGU, scale_)); FOREACH(strategiesEU, delete strategiesEU[i]); FOREACH(strategiesEG, delete strategiesEG[i]); break; } case VAG_EURGBPUSD_9: { expert.Add(CVirtualStrategyGroup(strategies, scale_)); break; } case VAG_EURGBPUSD_3_3_3: { // Create a group of three strategy groups CVirtualStrategyGroup *groups[] = { new CVirtualStrategyGroup(strategiesEG, 1.25), new CVirtualStrategyGroup(strategiesEU, 2.24), new CVirtualStrategyGroup(strategiesGU, 2.64) }; expert.Add(CVirtualStrategyGroup(groups, scale_)); break; } default: return(INIT_FAILED); } // Load the previous state if available expert.Load(); return(INIT_SUCCEEDED); }

Save the changes made to the SimpleVolumesExpert.mq5 file in the current folder.

Test

Let's test the first group - three copies of the strategy working on the EURGBP symbol. We get the following results:

Fig. 5. Results for EURGBP with three strategies, Scale=1

As we can see, when combined, the maximum relative drawdown was 8% instead of 10% for each individual instance of the normalized strategy. This means we can increase our position size a little. To achieve the drawdown of 10%, we will set Scale = 10% / 8% = 1.25.

Fig. 6. Results for EURGBP with three strategies, Scale=1.25

Now the drawdown is approximately 10%. Let's perform a similar operation to select a scaling multiplier for the second and third groups. We get the following results:

Fig. 7. Results for EURUSD with three strategies, Scale=2.24

Fig. 8. Results for GBPUSD with three strategies, Scale=2.64

We use the selected values of scaling multipliers in the code to create a normalized group of three normalized groups of strategies:

// Create a group of three strategy groups CVirtualStrategyGroup *groups[] = { new CVirtualStrategyGroup(strategiesEG, 1.25), new CVirtualStrategyGroup(strategiesEU, 2.24), new CVirtualStrategyGroup(strategiesGU, 2.64) };

Now let's select a scaling multiplier for the fourth group. If we combine all 9 instances into one group, we get the following results:

Fig. 9. Results for EURGBP, EURUSD, GBPUSD (9 strategies in total), Scale=1

This allows us to raise the scaling factor to 3.3 and remain within 10% of the relative drawdown:

Fig. 10. Results for EURGBP, EURUSD and GBPUSD (9 strategies in total), Scale=3.3

Finally, the most interesting thing. Let's combine the same 9 normalized strategies, but in a different way: separately normalize groups of three strategies for individual symbols and then combine the resulting three normalized groups into a group. We get the following:

Fig. 11. Results for EURGBP, EURUSD and GBPUSD (3 + 3 + 3 strategies), Scale=1

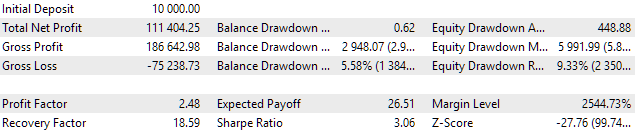

The final balance has turned out to be greater than for the fourth group with the same Scale=1, but the drawdown has also been greater: 4.57% instead of 3%. Let’s bring the fifth group to the drawdown of 10% and then compare the final result:

Fig. 12. Results for EURGBP, EURUSD, GBPUSD (3 + 3 + 3 strategies), Scale=2.18

Now it is clear that the fifth option for grouping strategies gives much better results while maintaining the maximum relative drawdown within 10%. During the selected testing period, the profit more than doubled compared to the fourth grouping option.

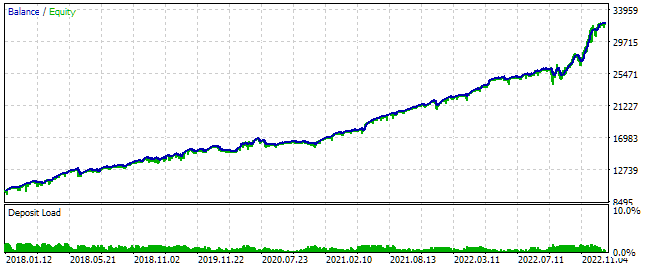

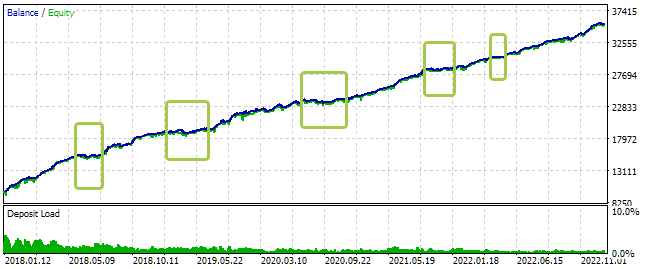

Finally, let’s look at the linearity of the balance growth for the fifth grouping option. This will allow us to assess whether there are any internal periods, in which the EA performs noticeably worse than in other internal periods throughout the testing period. To do this, set the value of the parameter FixedBalance= 10,000, so that the EA always uses only this amount of the account balance to calculate position sizes.

Fig. 13. Results for EURGBP, EURUSD, GBPUSD (3 + 3 + 3 strategies), FixedBalance = 10000, Scale=2.18

On the test graph, I marked the internal periods, during which the balance growth was near zero, with green rectangles. Their duration ranges from one to six months. Well, that means there is something to strive for. The easiest way to cope with such periods is more diversification: use more instances of trading strategies that work on different symbols and timeframes.

The maximum drawdown in terms of equity was USD 995 in absolute terms, that is, just about 10% of the USD 10,000 balance used for trading. This confirms that the implemented money management system behaves correctly.

Conclusion

Now we can run our EA on trading accounts with different initial balance values and control how the balance will be distributed for different instances of trading strategies. Some will get more, and they will open larger positions. Others will get less, and their position sizes will be smaller. Generally, with the help of tests, we can select parameters that will comply with the pre-selected maximum allowable drawdown.

It is worth noting that we can only see whether the drawdown is adhered to through tests. We cannot guarantee whether adherence is maintained when the EA is launched on a period not used for optimization. It can change both upwards and (oddly enough) downwards. Therefore, here everyone should make an independent decision about how much they can trust and how to use the results obtained during the tests.

I will continue developing the project. Thank you for reading!

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/14336

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Reimagining Classic Strategies (Part III): Forecasting Higher Highs And Lower Lows

Reimagining Classic Strategies (Part III): Forecasting Higher Highs And Lower Lows

From Novice to Expert: The Essential Journey Through MQL5 Trading

From Novice to Expert: The Essential Journey Through MQL5 Trading

Role of random number generator quality in the efficiency of optimization algorithms

Role of random number generator quality in the efficiency of optimization algorithms

Creating a Dynamic Multi-Symbol, Multi-Period Relative Strength Indicator (RSI) Indicator Dashboard in MQL5

Creating a Dynamic Multi-Symbol, Multi-Period Relative Strength Indicator (RSI) Indicator Dashboard in MQL5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

When I run SimpleVolumesExpert with (3+3+3) and scaling 2.18, the log shows open virtual trades, but no real trades in the strategy tester. Maybe I missed something?

Check that the initial balance in the tester is $10000 or more. I have this behaviour when the balance is not big enough. In this case, not every virtual position generates a real position. But the reason is probably something else, as your balance is probably correct.

Are there any real trades if the EA is run with other variants of strategy grouping?

Good afternoon. Thank you for your labour. I am very interested in your architecture and I am trying to understand it step by step. I have changed only the strategy class - I use my own. But at this stage I had difficulties with scaling the strategy. For the purity of the experiment, I used one instance of the strategy and two variants of the scale multiplier_ 1 and 2 (fixedBalance_ = 0;). In both cases, the result is the same - the lot size does not change. The place in the code where the lot size is determined

However, the parameters m_fittedBalance and m_fixedLot are set by default in the virtual strategy constructor.

so the lot size does not change.

Although logically it should scale. Can you please tell me what is the reason? I don't want to meddle with my own edits - so as not to break it, and I have already added a few methods to the CVirtualOrder class because my strategy provides for partial closing, stop loss and closing on the counter signal.

Hello.

All is correct, for variable lot trading it is necessary for a strategy instance to be given the value of m_fittedBalance > 0. This is done by the inheritors of the base class of the trading strategy. This parameter is passed to them, and they substitute it into the call of the CVirtualStrategy constructor:

When creating instances, we specify a specific value for the last parameter so that the default value of 0 is not substituted into it:

In the SimpleVolumesExpertSingle.mq5 Expert Advisor we do not do this, as the optimisation is only performed on a fixed initial position size. Note that the m_fixedLot parameter does not have to be used in the strategy exclusively as the size of all open virtual positions. It is just some base value from which we can calculate any others. In the model strategy in the article, simply the sizes of all positions are the same and this parameter is used without transformation. But nothing prevents you from opening a virtual position of size 10*m_fixedLot in another strategy and then applying its gradual closing.

Hello.

All is correct, for variable lot trading it is necessary for a strategy instance to be given the value of m_fittedBalance > 0. This is done by the inheritors of the base class of the trading strategy. This parameter is passed to them, and they substitute it into the call of the CVirtualStrategy constructor:

When creating instances, we specify a specific value for the last parameter so that the default value of 0 is not substituted into it:

In the SimpleVolumesExpertSingle.mq5 Expert Advisor we do not do this, as the optimisation is only performed on a fixed initial position size. Note that the m_fixedLot parameter does not have to be used in the strategy exclusively as the size of all open virtual positions. It is just some base value from which we can calculate any others. In the model strategy in the article, simply the sizes of all positions are the same and this parameter is used without transformation. But nothing prevents you from opening a virtual position of size 10*m_fixedLot in another strategy and then applying its gradual closing.