Piyush Lalsingh Ratnu / Profil

Piyush Lalsingh Ratnu

- Trader & Analyst in Piyush Ratnu XAUUSD Spot Gold Research

- Vereinigte Arabische Emirate

- 156

- Information

|

nein

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

3

Signale

|

1

Abonnenten

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Freunde

15

Anfragen

Ausgehend

Piyush Lalsingh Ratnu

• The CME Fed watch tool is showing that the chances in favour of a 25-basis point (bp) rate cut in March ahave rebounded to 50% after a slowdown in underlying price pressures.

• While struggle for Fed policymakers remain unabated as the US economy is resilient on multiple grounds.

• The US economy expanded at a robust pace of 3.3% in the final quarter of 2023 while market participants projected a slower growth rate of 2.0%. This has uplifted the economic outlook, which could keep price pressures elevated.

• US Treasury Secretary Janet Yellen said surprisingly strong economic growth came from higher productivity and robust consumer spending without escalating inflation risks.

• Going forward, market participants will shift their focus towards the Fed’s first monetary policy of 2024, which will be announced next week.

• The Fed is widely anticipated to keep interest rates unchanged in the range of 5.25-5.50% for the fourth time in a row. Investors will keenly focus on the timing of when the Fed will start reducing interest rates.

• Till now, Fed policymakers have been considering expectations of rate-cuts from March as “premature” due to resilient US economic prospects and stubborn inflationary pressures.

• Fed policymakers have been warning that rate cuts at this stage would be premature, which could lead to a surge in overall demand and dampen efforts made to bring down core inflation to its current 3.9% level.

• While struggle for Fed policymakers remain unabated as the US economy is resilient on multiple grounds.

• The US economy expanded at a robust pace of 3.3% in the final quarter of 2023 while market participants projected a slower growth rate of 2.0%. This has uplifted the economic outlook, which could keep price pressures elevated.

• US Treasury Secretary Janet Yellen said surprisingly strong economic growth came from higher productivity and robust consumer spending without escalating inflation risks.

• Going forward, market participants will shift their focus towards the Fed’s first monetary policy of 2024, which will be announced next week.

• The Fed is widely anticipated to keep interest rates unchanged in the range of 5.25-5.50% for the fourth time in a row. Investors will keenly focus on the timing of when the Fed will start reducing interest rates.

• Till now, Fed policymakers have been considering expectations of rate-cuts from March as “premature” due to resilient US economic prospects and stubborn inflationary pressures.

• Fed policymakers have been warning that rate cuts at this stage would be premature, which could lead to a surge in overall demand and dampen efforts made to bring down core inflation to its current 3.9% level.

Piyush Lalsingh Ratnu

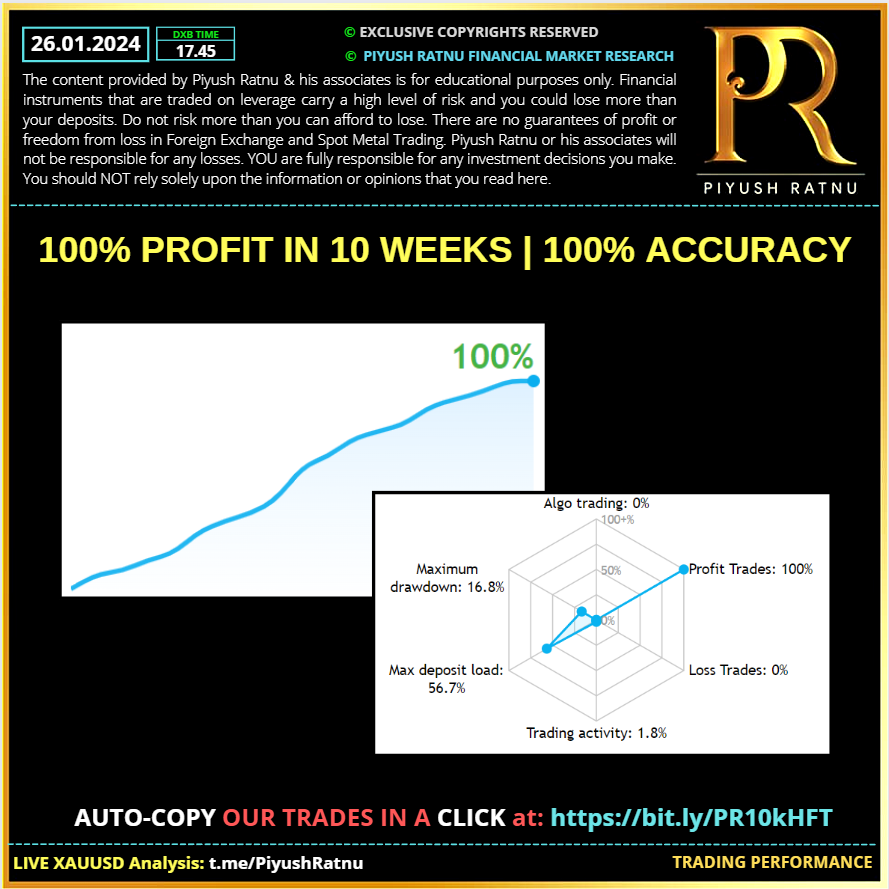

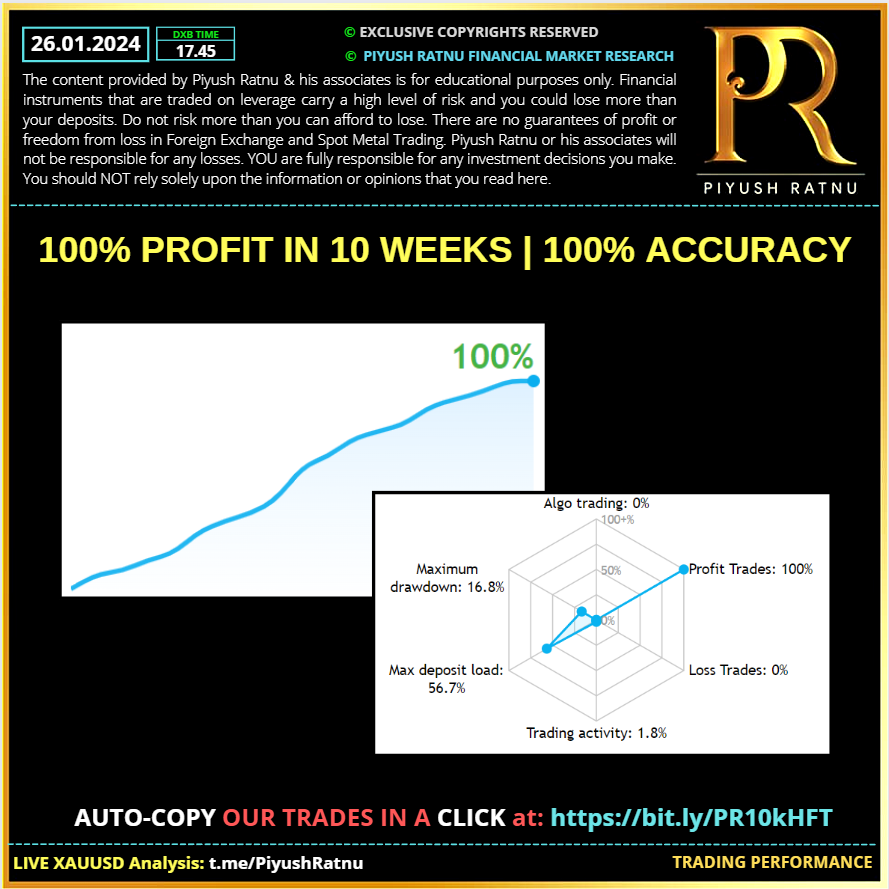

100% profit booked in 10 weeks with 100% trading accuracy.

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

Piyush Lalsingh Ratnu

100% profit booked in 10 weeks with 100% trading accuracy.

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

Piyush Lalsingh Ratnu

🟥 USDJPY and XAUUSD:

Both instruments under PPZ.

Avoid entries.

XAUUSD S2 2007 | R2 2033

USDJPY S2: 146.970 | R2: 148.348

Both instruments under PPZ.

Avoid entries.

XAUUSD S2 2007 | R2 2033

USDJPY S2: 146.970 | R2: 148.348

Piyush Lalsingh Ratnu

🟢 All LONG Trades closed in Net Average Profit.

XAUUSD: Entry Price Zones (Yesterday):

2023/2020/2017/2014/2011

XAUUSD: Entry Price Zones (Yesterday):

2023/2020/2017/2014/2011

Piyush Lalsingh Ratnu

🟥 XAUUSD: PRSRZ W1

S2: 2001

S3: 1979

S4: 1966

S5: 1944

R1: 2036

R2: 2058

R3: 2079

R4: 2093

R5: 2115

Gold price (XAU/USD) ekes out small gains on Thursday and reverses a part of the overnight heavy losses to the $2,011 area, or a multi-day low, though the uptick lacks bullish conviction. In the absence of any fresh fundamental trigger, subdued US Dollar (USD) price action is seen as a key factor lending some support to the commodity amid worries about escalating geopolitical tensions in the Middle East. Any meaningful appreciating move, however, still seems elusive in the wake of growing acceptance that the Federal Reserve (Fed) will not rush to cut interest rates.

The expectations were reaffirmed by the better-than-expected US data on Wednesday, which showed that the economy kicked off 2024 on a stronger note. The S&P Global flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January and the gauge for the services sector climbed to 52.9, or the highest reading since last June. Furthermore, the flash US Composite PMI Output Index increased to 52.3 this month, or the highest since last June. This reaffirms the view that the world's largest economy is in good shape and forces investors to further scale back their bets for a more aggressive Fed policy easing in 2024. This, in turn, allows the yield on the benchmark 10-year US government bond to hold steady near a more than one-month high touched last week, which favours the USD bulls and should cap gains for the non-yielding Gold price.

📌 Crucial Zones: BZ: $1990/1985 SZ: $2035/2042 📌

S2: 2001

S3: 1979

S4: 1966

S5: 1944

R1: 2036

R2: 2058

R3: 2079

R4: 2093

R5: 2115

Gold price (XAU/USD) ekes out small gains on Thursday and reverses a part of the overnight heavy losses to the $2,011 area, or a multi-day low, though the uptick lacks bullish conviction. In the absence of any fresh fundamental trigger, subdued US Dollar (USD) price action is seen as a key factor lending some support to the commodity amid worries about escalating geopolitical tensions in the Middle East. Any meaningful appreciating move, however, still seems elusive in the wake of growing acceptance that the Federal Reserve (Fed) will not rush to cut interest rates.

The expectations were reaffirmed by the better-than-expected US data on Wednesday, which showed that the economy kicked off 2024 on a stronger note. The S&P Global flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January and the gauge for the services sector climbed to 52.9, or the highest reading since last June. Furthermore, the flash US Composite PMI Output Index increased to 52.3 this month, or the highest since last June. This reaffirms the view that the world's largest economy is in good shape and forces investors to further scale back their bets for a more aggressive Fed policy easing in 2024. This, in turn, allows the yield on the benchmark 10-year US government bond to hold steady near a more than one-month high touched last week, which favours the USD bulls and should cap gains for the non-yielding Gold price.

📌 Crucial Zones: BZ: $1990/1985 SZ: $2035/2042 📌

Piyush Lalsingh Ratnu

ECB EURO Interest Rate Decision | How to trade EURUSD? Analysis by Piyush Ratnu

The European Central Bank (ECB) will have its first monetary policy meeting of the year on Thursday, but little is to be expected from European policymakers. The Main Refinancing Operations Rate will likely be maintained unchanged at 4.50%, and the Deposit Facility Rate at 4%. If something is, the central bank will continue “tightening” through the reduction of reinvestments in the Pandemic Emergency Purchase Programme (PEPP).

As per Economists at TD Securities:

Base Case (65%)

The ECB delivers another hold and makes no major changes to the press statement. The Governing Council emphasizes its broad reaction function and reiterates the importance of economic data in determining the ECB's policy stance. President Lagarde suggests that cuts are likely to come around the summer. That said, the President makes it clear that the exact timing is still very much up in the air, and will ultimately be decided by the data. EUR/USD -0.15%.

Hawkish (30%)

In a hawkish turn, President Lagarde pushes back hard against discussions about the potential timing of rate cuts. Lagarde argues that cuts will come, probably some time this year, and while market pricing looks too dovish, it is too early to comment on when cuts are likely to come. While inflation developments have been promising, Lagarde stresses that the tight labour market adds upside risks to the policy outlook. EUR/USD +0.75%.

Dovish (5%)

Despite recently pushing back against market expectations for spring cuts, President Lagarde fails to do so at the press conference – seemingly offering some credibility to market bets. EUR/USD -0.50%.

EURUSD under PPZ: avoid entries

ECB interest rate decision is scheduled at 15.15 hours, followed US GDP, Core Durable Goods Orders at 17.30 and press conference at 17.45 hours. Further ECB P speech is scheduled at 19.15 hours.

A dead price trap zone might be witnessed followed by a sudden spike/crash, hence kindly follow PRSR W1 strictly on XAUUSD, USDJPY and EURUSD.

🟥 EURUSD: PRSRZ

S2: 1.07979

S3: 1.07219

S4: 1.065750

R2: 1.09967

R3: 1.10727

R4: 1.11196

EURUSD: Expected recovery (50%) of crash/rise: 9 trading days.

The European Central Bank (ECB) will have its first monetary policy meeting of the year on Thursday, but little is to be expected from European policymakers. The Main Refinancing Operations Rate will likely be maintained unchanged at 4.50%, and the Deposit Facility Rate at 4%. If something is, the central bank will continue “tightening” through the reduction of reinvestments in the Pandemic Emergency Purchase Programme (PEPP).

As per Economists at TD Securities:

Base Case (65%)

The ECB delivers another hold and makes no major changes to the press statement. The Governing Council emphasizes its broad reaction function and reiterates the importance of economic data in determining the ECB's policy stance. President Lagarde suggests that cuts are likely to come around the summer. That said, the President makes it clear that the exact timing is still very much up in the air, and will ultimately be decided by the data. EUR/USD -0.15%.

Hawkish (30%)

In a hawkish turn, President Lagarde pushes back hard against discussions about the potential timing of rate cuts. Lagarde argues that cuts will come, probably some time this year, and while market pricing looks too dovish, it is too early to comment on when cuts are likely to come. While inflation developments have been promising, Lagarde stresses that the tight labour market adds upside risks to the policy outlook. EUR/USD +0.75%.

Dovish (5%)

Despite recently pushing back against market expectations for spring cuts, President Lagarde fails to do so at the press conference – seemingly offering some credibility to market bets. EUR/USD -0.50%.

EURUSD under PPZ: avoid entries

ECB interest rate decision is scheduled at 15.15 hours, followed US GDP, Core Durable Goods Orders at 17.30 and press conference at 17.45 hours. Further ECB P speech is scheduled at 19.15 hours.

A dead price trap zone might be witnessed followed by a sudden spike/crash, hence kindly follow PRSR W1 strictly on XAUUSD, USDJPY and EURUSD.

🟥 EURUSD: PRSRZ

S2: 1.07979

S3: 1.07219

S4: 1.065750

R2: 1.09967

R3: 1.10727

R4: 1.11196

EURUSD: Expected recovery (50%) of crash/rise: 9 trading days.

Piyush Lalsingh Ratnu

The European Central Bank (ECB) will have its first monetary policy meeting of the year on Thursday, but little is to be expected from European policymakers. The Main Refinancing Operations Rate will likely be maintained unchanged at 4.50%, and the Deposit Facility Rate at 4%. If something is, the central bank will continue “tightening” through the reduction of reinvestments in the Pandemic Emergency Purchase Programme (PEPP).

As per Economists at TD Securities:

Base Case (65%)

The ECB delivers another hold and makes no major changes to the press statement. The Governing Council emphasizes its broad reaction function and reiterates the importance of economic data in determining the ECB's policy stance. President Lagarde suggests that cuts are likely to come around the summer. That said, the President makes it clear that the exact timing is still very much up in the air, and will ultimately be decided by the data. EUR/USD -0.15%.

Hawkish (30%)

In a hawkish turn, President Lagarde pushes back hard against discussions about the potential timing of rate cuts. Lagarde argues that cuts will come, probably some time this year, and while market pricing looks too dovish, it is too early to comment on when cuts are likely to come. While inflation developments have been promising, Lagarde stresses that the tight labour market adds upside risks to the policy outlook. EUR/USD +0.75%.

Dovish (5%)

Despite recently pushing back against market expectations for spring cuts, President Lagarde fails to do so at the press conference – seemingly offering some credibility to market bets. EUR/USD -0.50%.

As per Economists at TD Securities:

Base Case (65%)

The ECB delivers another hold and makes no major changes to the press statement. The Governing Council emphasizes its broad reaction function and reiterates the importance of economic data in determining the ECB's policy stance. President Lagarde suggests that cuts are likely to come around the summer. That said, the President makes it clear that the exact timing is still very much up in the air, and will ultimately be decided by the data. EUR/USD -0.15%.

Hawkish (30%)

In a hawkish turn, President Lagarde pushes back hard against discussions about the potential timing of rate cuts. Lagarde argues that cuts will come, probably some time this year, and while market pricing looks too dovish, it is too early to comment on when cuts are likely to come. While inflation developments have been promising, Lagarde stresses that the tight labour market adds upside risks to the policy outlook. EUR/USD +0.75%.

Dovish (5%)

Despite recently pushing back against market expectations for spring cuts, President Lagarde fails to do so at the press conference – seemingly offering some credibility to market bets. EUR/USD -0.50%.

Piyush Lalsingh Ratnu

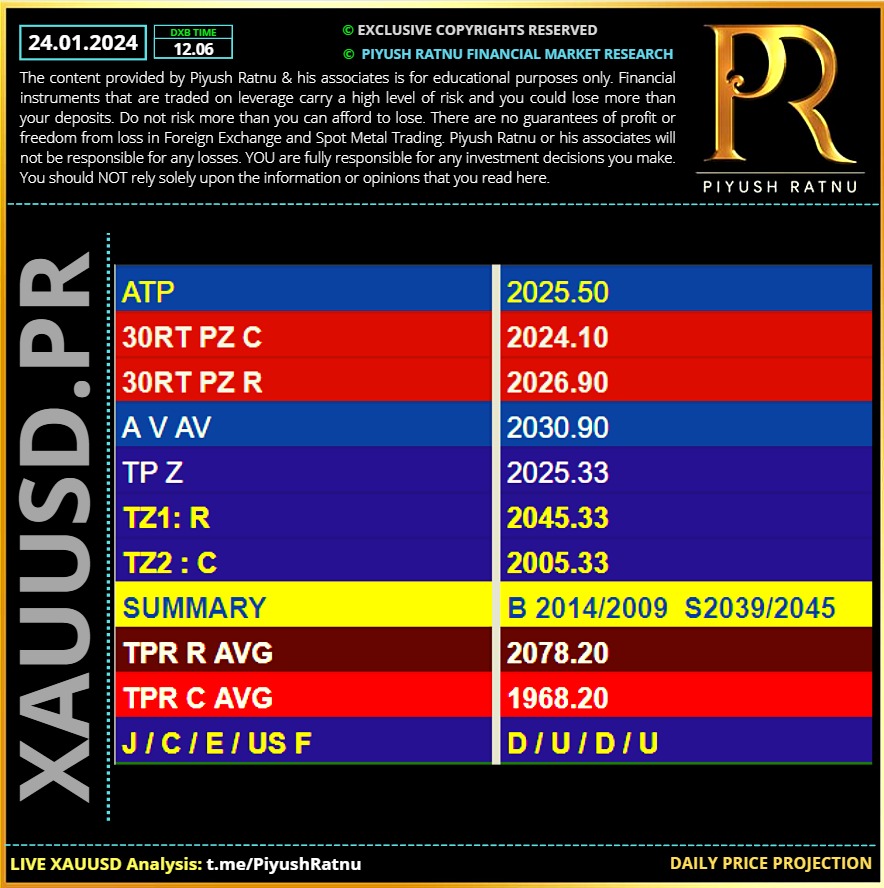

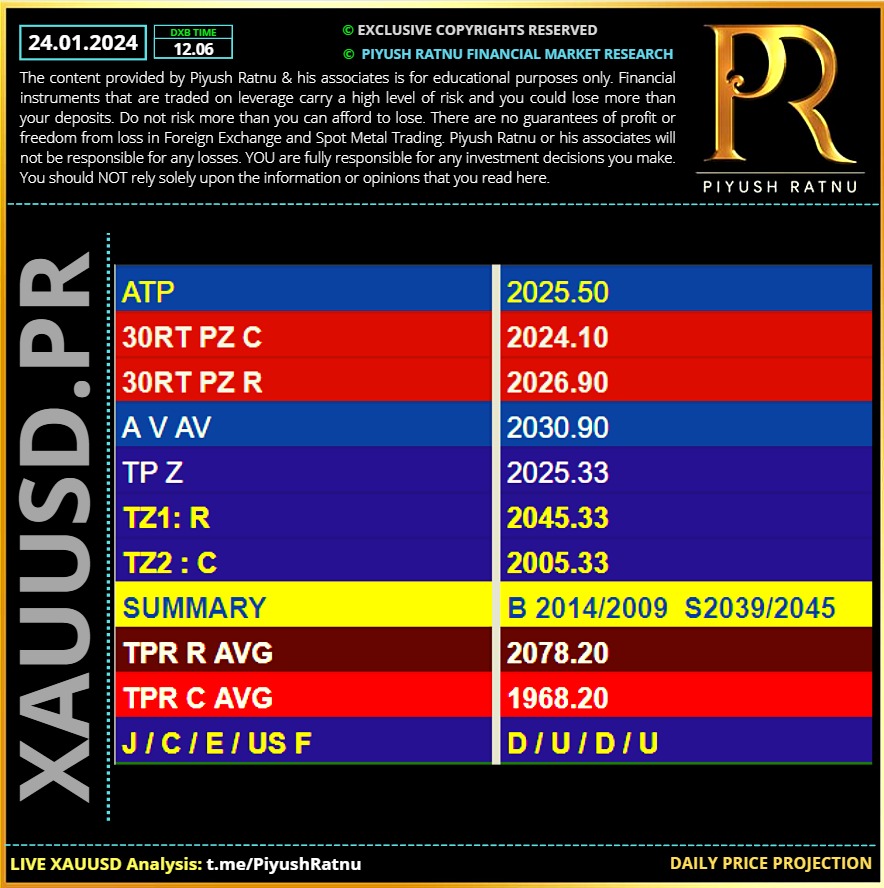

24.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

Subscribe to our Telegram channel to receive live analysis without delay

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

Piyush Lalsingh Ratnu

2024.01.25

🟢 All LONG Trades closed in Net Average Profit. XAUUSD: Entry Price Zones (Yesterday): 2023/2020/2017/2014/2011

Piyush Lalsingh Ratnu

XAUUSD CRASHED TO NEW MONTHLY LOWS BEFORE 26 JANUARY, ONCE AGAIN, AS PROJECTED EVERY YEAR IN DECEMBER.

Piyush Lalsingh Ratnu

Gold price draws support from geopolitical risks, delayed Fed rate cut bets act as a headwind CMP 🟢 $2015

• The US Dollar bulls remain on the defensive, which, along with geopolitical tensions stemming from conflicts in the Middle East, lend some support to the safe-haven Gold price.

• Iran-backed Houthi rebels in Yemen targeted two US-owned commercial ships sailing close to the Gulf of Aden on Wednesday in the face of multiple rounds of US military airstrikes.

• This comes after the US military carried out pre-emptive strikes against the Houthis to stave off what it said was an imminent attack on shipping lanes in the important Red Sea trade route.

• The S&P Global flash US Composite PMI Output Index increased to 52.3 this month, or the highest since June, suggesting that the economy kicked off 2024 on a stronger note.

• The flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January, while the gauge for the services sector climbed to 52.9, or the highest reading since last June.

• The data further pointed to a still-resilient US economy and forced investors to further pare their bets for a more aggressive monetary policy easing by the Federal Reserve in 2024.

• The yield on the benchmark 10-year US government bond hovers near the monthly peak, which should act as a tailwind for the Greenback and cap gains for the non-yielding yellow metal.

• The Advance US Q4 GDP print is due this Thursday and is expected to show that growth in the world's largest economy slowed to a 2% annualized pace from 4.9% in the previous quarter.

• Thursday's US economic docket also features the release of Durable Goods Orders and the usual Weekly Initial Jobless Claims, which might influence the Greenback and the XAU/USD.

• Apart from this, the outcome of the highly-anticipated European Central Bank meeting might infuse volatility in the markets and produce short-term trading opportunities.

• The market focus, meanwhile, will remain glued to the US Personal Consumption Expenditures Price Index data – the Fed's preferred inflation gauge – on Friday.

• The US Dollar bulls remain on the defensive, which, along with geopolitical tensions stemming from conflicts in the Middle East, lend some support to the safe-haven Gold price.

• Iran-backed Houthi rebels in Yemen targeted two US-owned commercial ships sailing close to the Gulf of Aden on Wednesday in the face of multiple rounds of US military airstrikes.

• This comes after the US military carried out pre-emptive strikes against the Houthis to stave off what it said was an imminent attack on shipping lanes in the important Red Sea trade route.

• The S&P Global flash US Composite PMI Output Index increased to 52.3 this month, or the highest since June, suggesting that the economy kicked off 2024 on a stronger note.

• The flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January, while the gauge for the services sector climbed to 52.9, or the highest reading since last June.

• The data further pointed to a still-resilient US economy and forced investors to further pare their bets for a more aggressive monetary policy easing by the Federal Reserve in 2024.

• The yield on the benchmark 10-year US government bond hovers near the monthly peak, which should act as a tailwind for the Greenback and cap gains for the non-yielding yellow metal.

• The Advance US Q4 GDP print is due this Thursday and is expected to show that growth in the world's largest economy slowed to a 2% annualized pace from 4.9% in the previous quarter.

• Thursday's US economic docket also features the release of Durable Goods Orders and the usual Weekly Initial Jobless Claims, which might influence the Greenback and the XAU/USD.

• Apart from this, the outcome of the highly-anticipated European Central Bank meeting might infuse volatility in the markets and produce short-term trading opportunities.

• The market focus, meanwhile, will remain glued to the US Personal Consumption Expenditures Price Index data – the Fed's preferred inflation gauge – on Friday.

Piyush Lalsingh Ratnu

PBOC Governor Pan Gongsheng said Wednesday the RRR will be cut by 0.5 percentage points on Feb. 5 to inject 1 trillion yuan ($140 billion) in long-term liquidity. The regulators followed up the PBOC announcement by adding more measures to bolster the slumping property and stocks.

Piyush Lalsingh Ratnu

🆘 Key events today:

EUR

17:15 EUR ECB Marginal Lending Facility 4.75%

17:15 EUR ECB Monetary Policy Statement

17:15 EUR ECB Interest Rate Decision (Jan) 4.50% 4.50%

USD

17:30 USD Core Durable Goods Orders (MoM) (Dec) 0.2% 0.5%

17:30 USD Core PCE Prices (Q4) 2.00% 2.00%

17:30 USD Durable Goods Orders (MoM) (Dec) 1.1% 5.4%

17:30 USD Durables Excluding Defense (MoM) (Dec) 6.5%

17:30 USD GDP (QoQ) (Q4) 2.0% 4.9%

17:30 USD GDP Price Index (QoQ) (Q4) 2.3% 3.3%

17:30 USD GDP Sales (Q4) 3.6%

17:30 USD Goods Orders Non Defense Ex Air (MoM) (Dec) 0.1% 0.8%

17:30 USD Goods Trade Balance (Dec) -88.70B -90.27B

17:30 USD Initial Jobless Claims 200K 187K

🟥 Crucial Zones: BZ $1990/1985 | SZ 2035/2042

EUR

17:15 EUR ECB Marginal Lending Facility 4.75%

17:15 EUR ECB Monetary Policy Statement

17:15 EUR ECB Interest Rate Decision (Jan) 4.50% 4.50%

USD

17:30 USD Core Durable Goods Orders (MoM) (Dec) 0.2% 0.5%

17:30 USD Core PCE Prices (Q4) 2.00% 2.00%

17:30 USD Durable Goods Orders (MoM) (Dec) 1.1% 5.4%

17:30 USD Durables Excluding Defense (MoM) (Dec) 6.5%

17:30 USD GDP (QoQ) (Q4) 2.0% 4.9%

17:30 USD GDP Price Index (QoQ) (Q4) 2.3% 3.3%

17:30 USD GDP Sales (Q4) 3.6%

17:30 USD Goods Orders Non Defense Ex Air (MoM) (Dec) 0.1% 0.8%

17:30 USD Goods Trade Balance (Dec) -88.70B -90.27B

17:30 USD Initial Jobless Claims 200K 187K

🟥 Crucial Zones: BZ $1990/1985 | SZ 2035/2042

Piyush Lalsingh Ratnu

🆘 Target zone achieved:

USDJPY: BZ 147.000 as projected yesterday at 12.35 hours: achieved | CMP 147.009

🟢 XAUUSD: SZ Target Zone achieved

CMP $2036

SZ projected yesterday at 12.38 hours

USDJPY: BZ 147.000 as projected yesterday at 12.35 hours: achieved | CMP 147.009

🟢 XAUUSD: SZ Target Zone achieved

CMP $2036

SZ projected yesterday at 12.38 hours

Piyush Lalsingh Ratnu

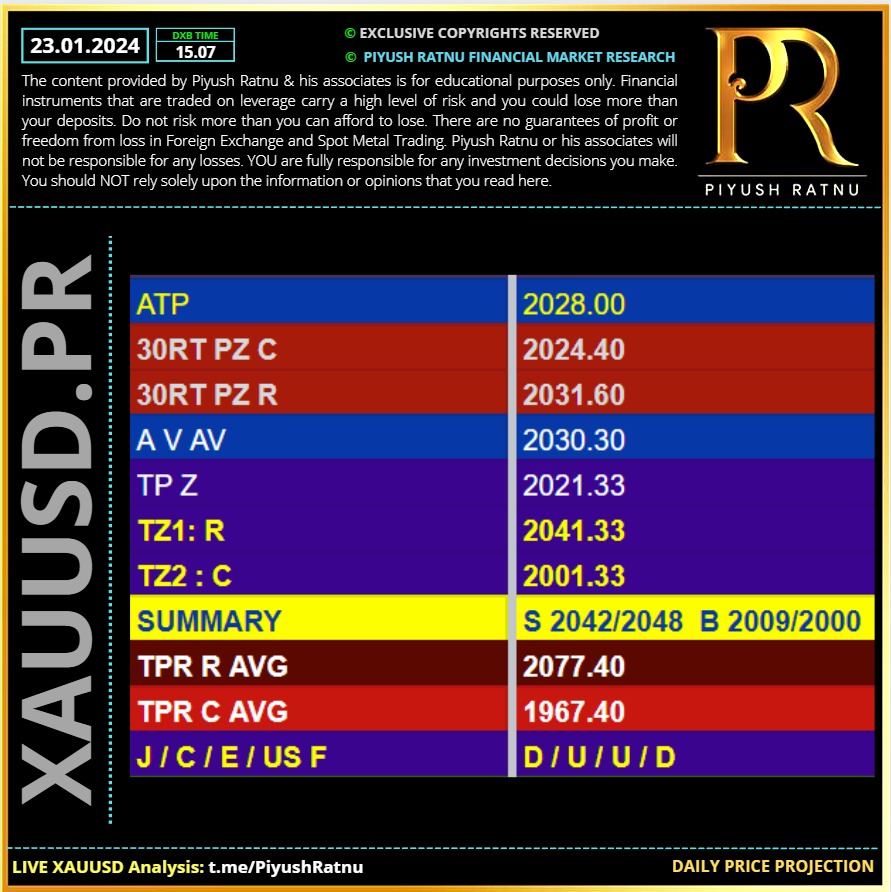

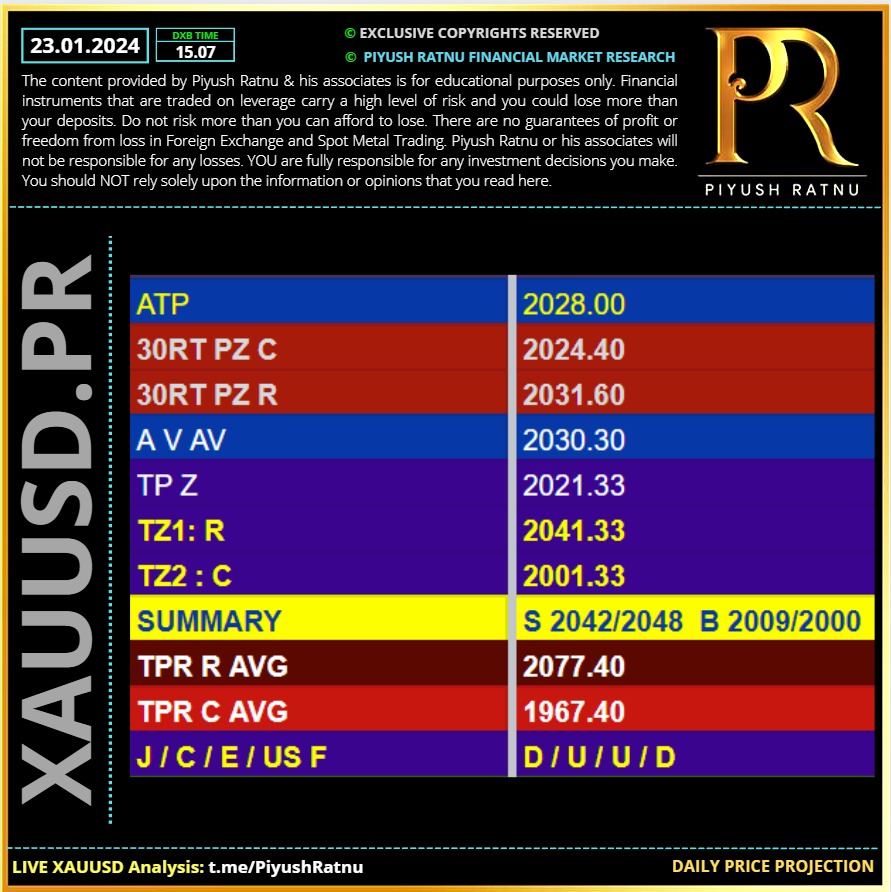

23.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

The yen strengthened on Wednesday as investors firmed up bets that the Bank of Japan will exit stimulus in coming months, while the dollar broadly held its ground against major rivals amid expectations that the Federal Reserve won't rush to cut interest rates.

The Japanese currency gained as much as 0.41% to 147.76 per dollar during Tokyo trading hours as Japanese government bond yields leapt to six-week highs after central bank chief Kazuo Ueda said on Tuesday that the prospects of achieving the BOJ's inflation target were gradually increasing.

The yen got an additional tailwind from a pullback in long-term U.S. Treasury yields in Wednesday trading, which the dollar-yen pair tends to track, as traders fine-tuned Fed easing wagers.

The dollar was down 0.3% at 147.90 yen as of 0624 GMT, although its gain for the year is still almost 5% amid lessening expectations of early Fed cuts and, until Tuesday's hawkish tilt, a pushing back of bets for a BOJ stimulus exit.

The U.S. rate futures market on Tuesday priced in a roughly 47% chance of a March rate cut, up from late on Monday, but down from as much 80% about two weeks ago, according to LSEG's rate probability app.

For 2024, futures traders are betting on five quarter-point rate cuts. Two weeks ago they expected six. 🔔

The Japanese currency gained as much as 0.41% to 147.76 per dollar during Tokyo trading hours as Japanese government bond yields leapt to six-week highs after central bank chief Kazuo Ueda said on Tuesday that the prospects of achieving the BOJ's inflation target were gradually increasing.

The yen got an additional tailwind from a pullback in long-term U.S. Treasury yields in Wednesday trading, which the dollar-yen pair tends to track, as traders fine-tuned Fed easing wagers.

The dollar was down 0.3% at 147.90 yen as of 0624 GMT, although its gain for the year is still almost 5% amid lessening expectations of early Fed cuts and, until Tuesday's hawkish tilt, a pushing back of bets for a BOJ stimulus exit.

The U.S. rate futures market on Tuesday priced in a roughly 47% chance of a March rate cut, up from late on Monday, but down from as much 80% about two weeks ago, according to LSEG's rate probability app.

For 2024, futures traders are betting on five quarter-point rate cuts. Two weeks ago they expected six. 🔔

Piyush Lalsingh Ratnu

🟢 Co-relation in perfect proportion:

USDJPY (-) 0.70% CMP 147.160

XAUUSD (+) 0.70% CMP 2035

USDJPY (-) 0.70% CMP 147.160

XAUUSD (+) 0.70% CMP 2035

Piyush Lalsingh Ratnu

1000 pips crash witnessed in USDJPY | Pending impact on XAUUSD: +$30

RT USDJPY + = XAUUSD -

RT USDJPY + = XAUUSD -

: