Piyush Lalsingh Ratnu / Profil

Piyush Lalsingh Ratnu

- Trader & Analyst in Piyush Ratnu XAUUSD Spot Gold Research

- Vereinigte Arabische Emirate

- 156

- Information

|

nein

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

3

Signale

|

1

Abonnenten

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Freunde

15

Anfragen

Ausgehend

Piyush Lalsingh Ratnu

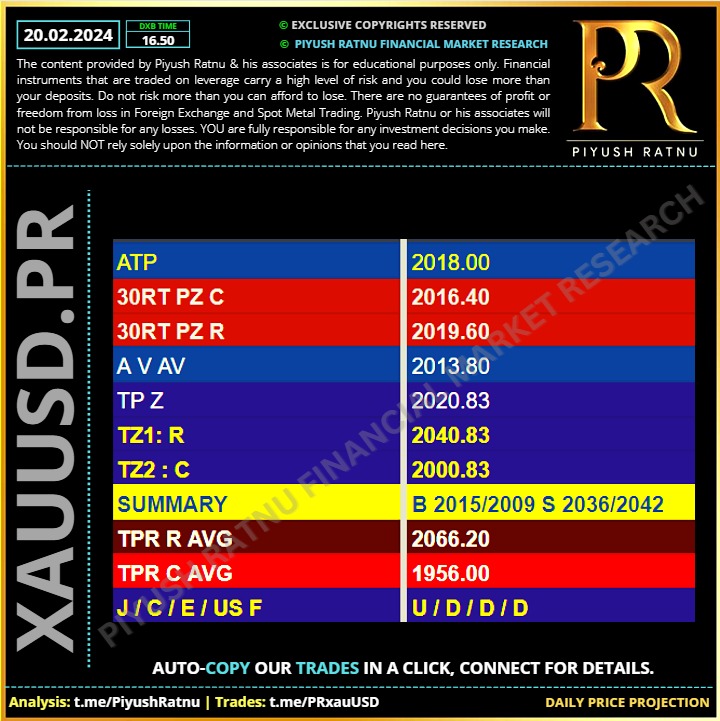

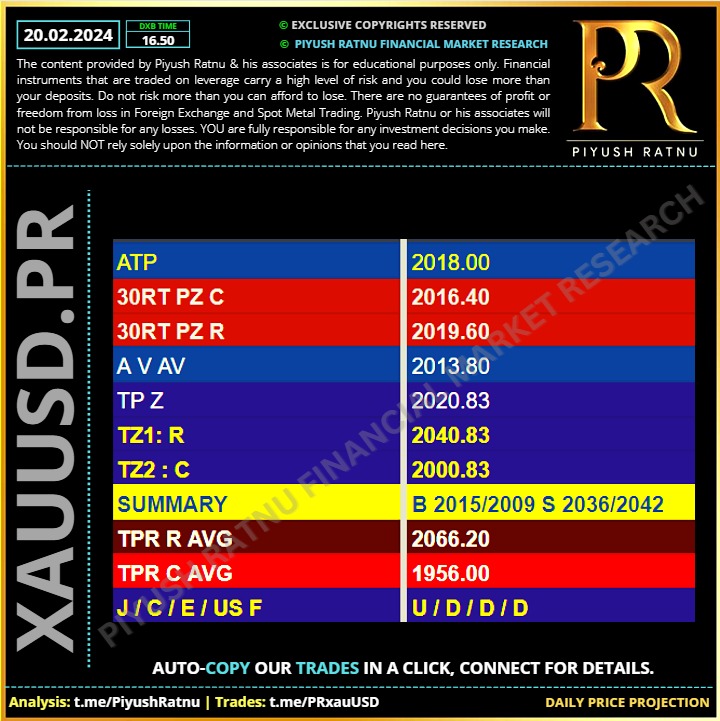

20.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

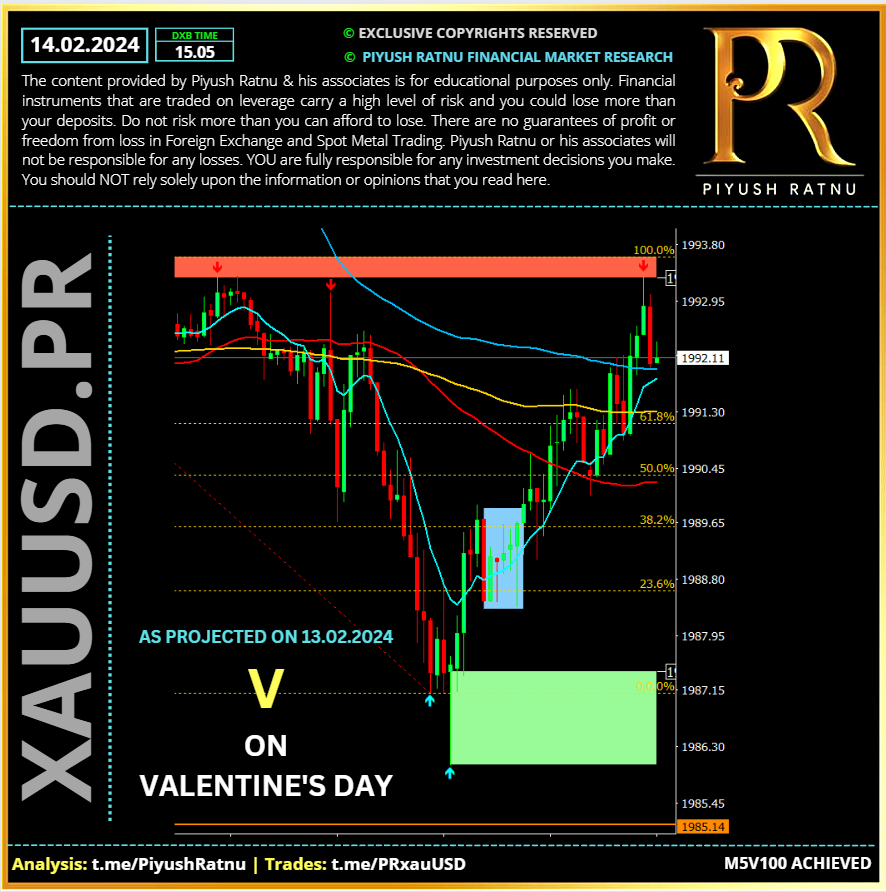

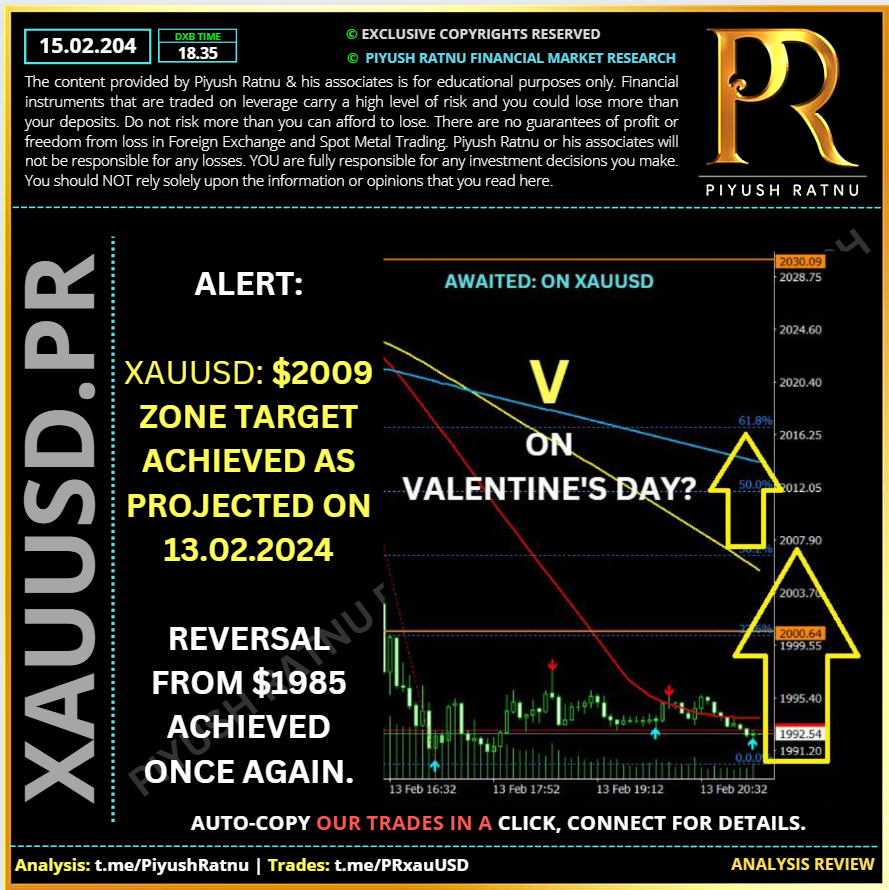

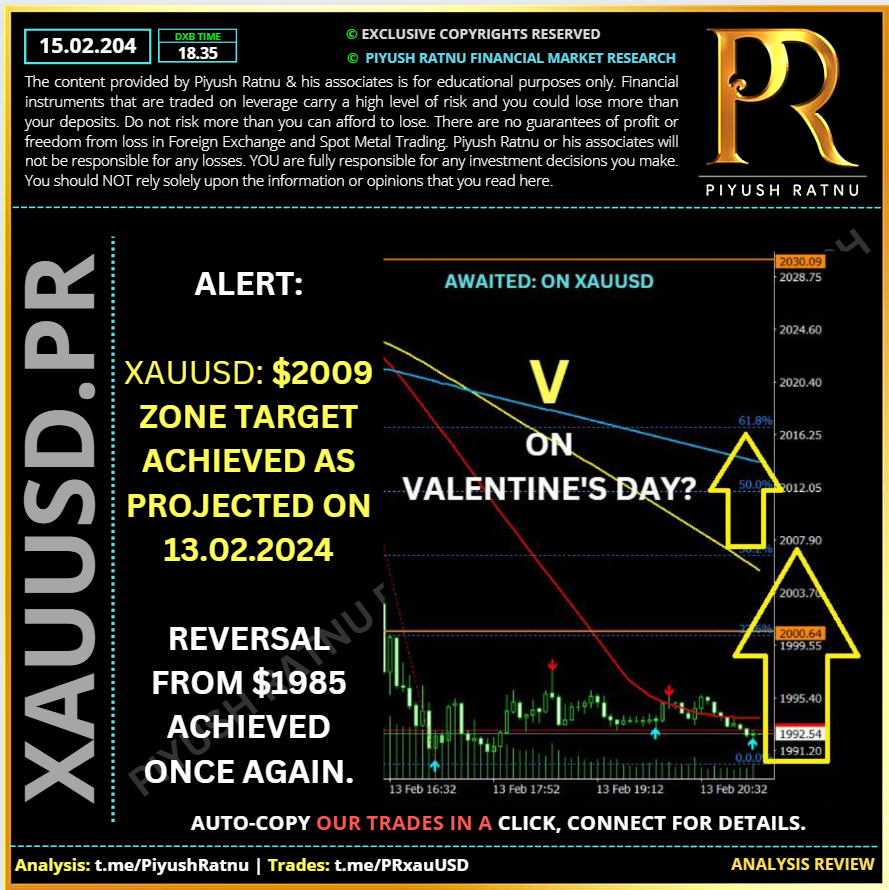

🆘 V on Valentine's Day achieved.

Crash observed from: $2023

Low achieved: $1985

High achieved: 2009 zone: 15.02.2024

High achieved: $2023 zone: 19.02.2024

Crash observed from: $2023

Low achieved: $1985

High achieved: 2009 zone: 15.02.2024

High achieved: $2023 zone: 19.02.2024

Piyush Lalsingh Ratnu

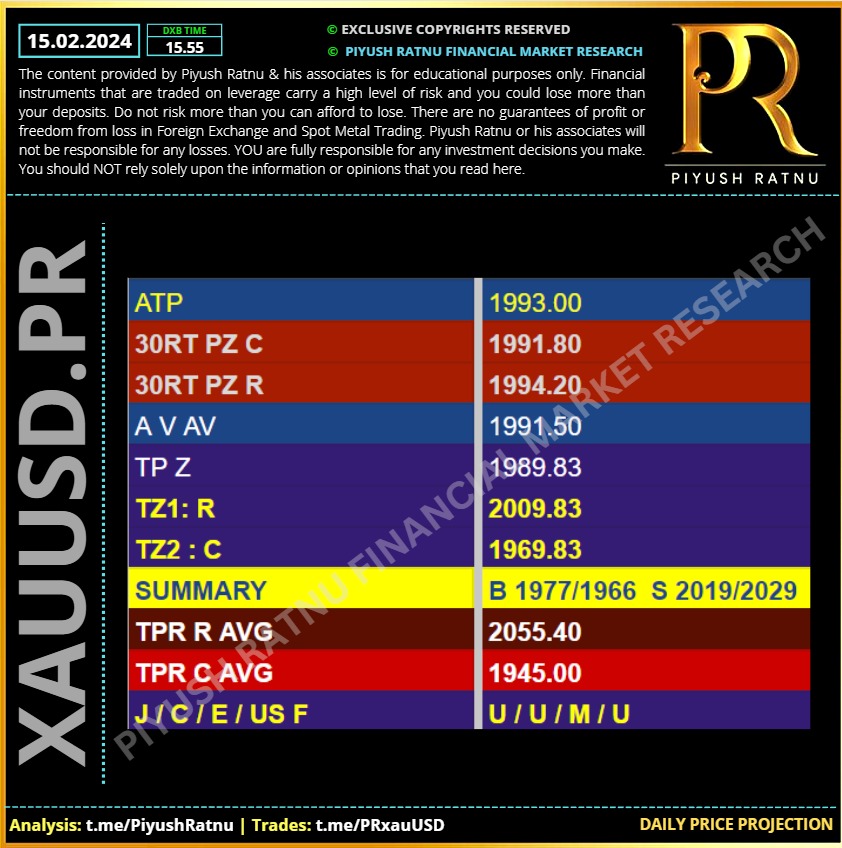

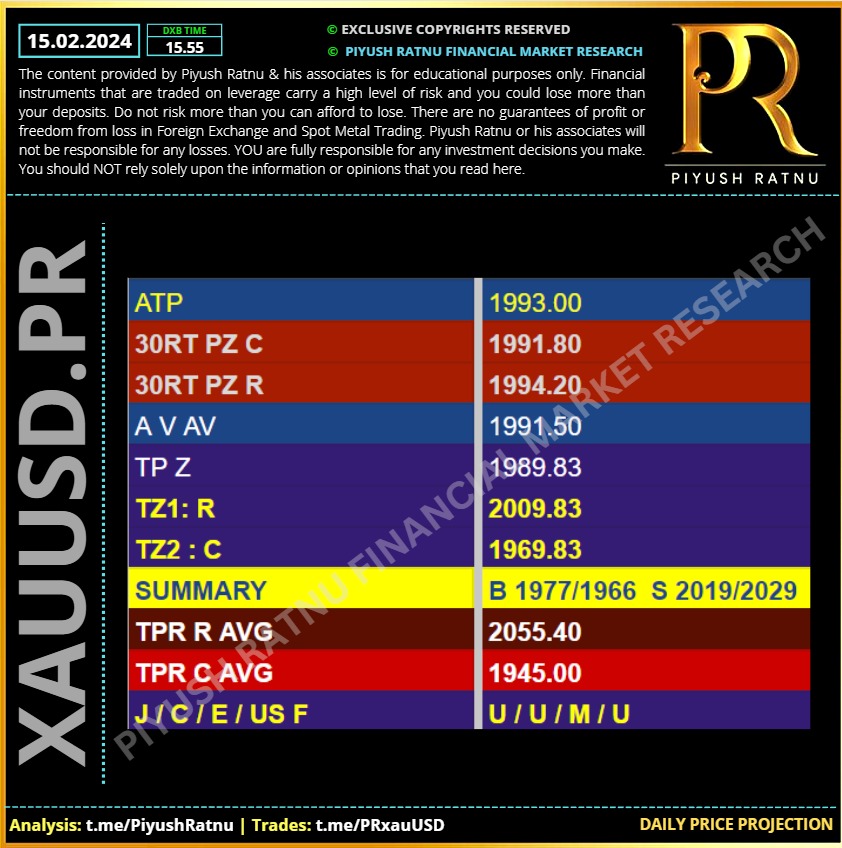

15.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Piyush Ratnu | V on Valentine's Day Projection: $2009 zone achieved after reversal from $1985 zone, as projected on 13.02.204: after CPI data, achieved after Core retail sales data was published on 15.02.2024.

Piyush Lalsingh Ratnu

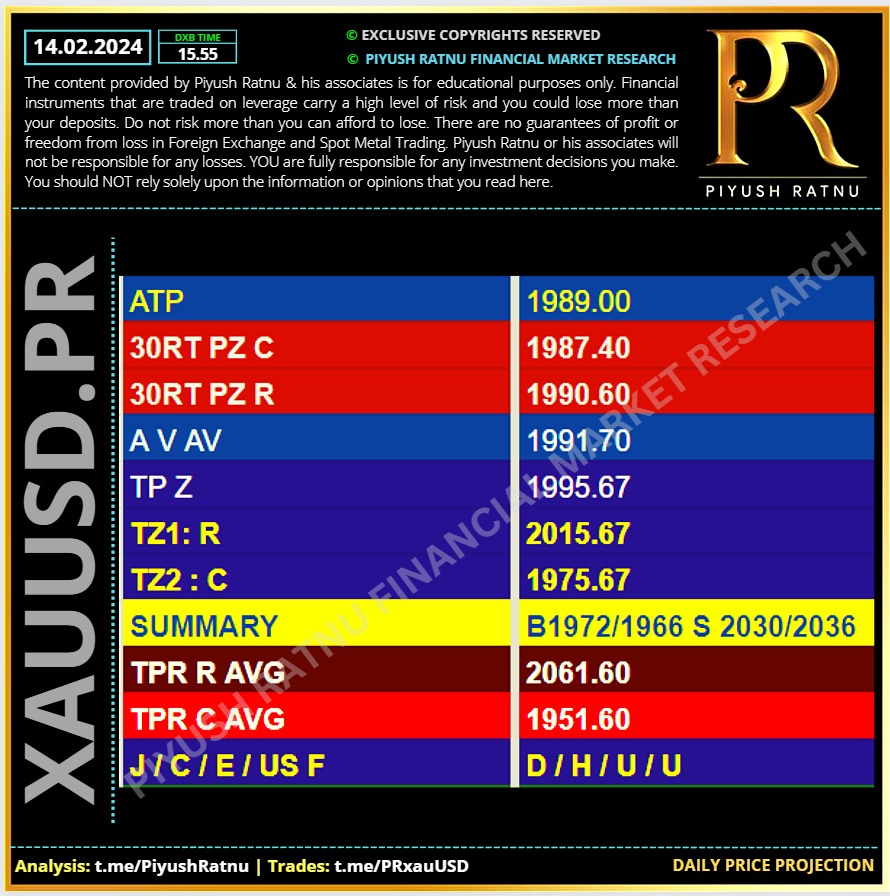

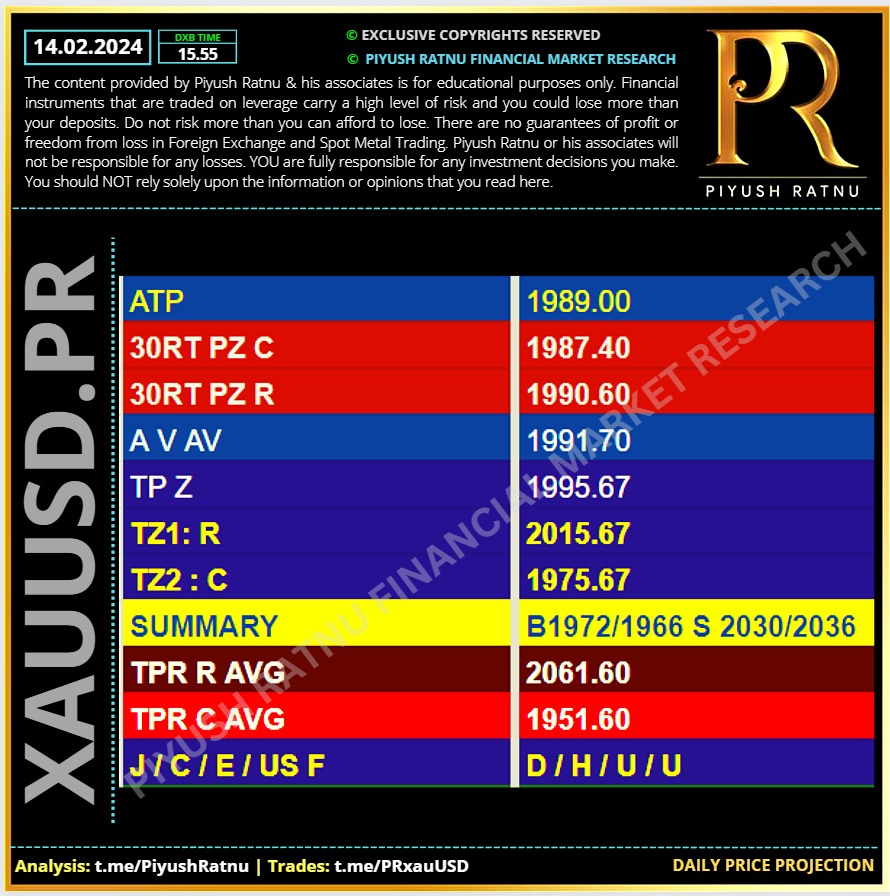

14.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

Piyush Lalsingh Ratnu

📌 Technical Approach:

🔻Key support levels are now seen at the December 13 low of $1,973 and the horizontal 200-day SMA at $1,966. A sustained move below the latter will put the $1,950 psychological level at risk.

🔺On the contrary, if Gold price manages to recapture the 100-day SMA support-turned-resistance at $1,993 on a daily closing basis, a fresh recovery toward the 21-day SMA of $2,024 cannot be ruled out.

🟢 Ahead of that, Gold price needs to find a strong foothold above the $2,000 barrier.

🔻Key support levels are now seen at the December 13 low of $1,973 and the horizontal 200-day SMA at $1,966. A sustained move below the latter will put the $1,950 psychological level at risk.

🔺On the contrary, if Gold price manages to recapture the 100-day SMA support-turned-resistance at $1,993 on a daily closing basis, a fresh recovery toward the 21-day SMA of $2,024 cannot be ruled out.

🟢 Ahead of that, Gold price needs to find a strong foothold above the $2,000 barrier.

Piyush Lalsingh Ratnu

🟢 Gold price could find fresh support from weak US Retail Sales data

The market mood remains mixed so far this Thursday’s trading, as investors assess the conflicting messages from US Federal Reserve (Fed) policymakers and its implications on the pricing of the dovish policy pivot this year.

The uncertainty around the timing of Fed interest rate cuts, following strong US Nonfarm Payrolls (NFP) and Consumer Price Index (CPI) data for January, keeps the corrective mode intact in the US Dollar, as well as, the US Treasury bond yields.

Fed Vice Chair for Supervision Michael Barr said on Wednesday, the Fed remained confident, but the January CPI numbers show the United States' path back to 2% inflation "may be a bumpy one."

Barr said that he fully supported what he called a careful approach to considering policy normalization given current conditions.

Meanwhile, investors also remain unnerved amid fresh worries concerning the Japanese economic outlook, after Japan unexpectedly slipped into recession after reporting two consecutive quarters of negative growth.

Recession fears could likely support the traditional safe-haven Gold price. Further, expectations of a drop of 0.1% in the US Retail Sales for January also help the Gold price recover some ground. Disappointing US Retail Sales data could suggest weakening consumer demand and revive the Fed rate cut expectations.

The market mood remains mixed so far this Thursday’s trading, as investors assess the conflicting messages from US Federal Reserve (Fed) policymakers and its implications on the pricing of the dovish policy pivot this year.

The uncertainty around the timing of Fed interest rate cuts, following strong US Nonfarm Payrolls (NFP) and Consumer Price Index (CPI) data for January, keeps the corrective mode intact in the US Dollar, as well as, the US Treasury bond yields.

Fed Vice Chair for Supervision Michael Barr said on Wednesday, the Fed remained confident, but the January CPI numbers show the United States' path back to 2% inflation "may be a bumpy one."

Barr said that he fully supported what he called a careful approach to considering policy normalization given current conditions.

Meanwhile, investors also remain unnerved amid fresh worries concerning the Japanese economic outlook, after Japan unexpectedly slipped into recession after reporting two consecutive quarters of negative growth.

Recession fears could likely support the traditional safe-haven Gold price. Further, expectations of a drop of 0.1% in the US Retail Sales for January also help the Gold price recover some ground. Disappointing US Retail Sales data could suggest weakening consumer demand and revive the Fed rate cut expectations.

Piyush Lalsingh Ratnu

📌 Gold price lacks direction amid mixed clues

• The stronger US consumer inflation figures prompted investors to lower bets for early rate cuts by the Federal Reserve and underpin the US Dollar, capping the upside for the non-yielding Gold price.

• Fed funds futures have priced out a rate cut in March and see a nearly 80% chance of easing at the June meeting, and about three 25 basis points rate cuts by the end of this year as against five two weeks ago.

• The US Treasury bond yields retreat further on the back of overnight comments by Chicago Fed President Austan Goolsbee, saying that the central bank should be wary of waiting too long before it cuts rates.

• Goolsbee indicated that the Fed's trajectory back towards achieving its 2% inflation target would still be on track even if price increases in the US run a bit hotter-than-expected over the next few months.

• This keeps a lid on the Greenback, which, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends some support to the safe-haven XAU/USD and helps limit the downside.

• The Israeli military said on Wednesday its fighter jets began a series of strikes in Lebanon in retaliation to a rocket fired into Northern Israel, raising the risk of a war between the two countries.

• Meanwhile, negotiations for a ceasefire between Israel and Hamas in Gaza have resumed as the former faces international pressure to stop its bombardment of the southern Gaza city of Rafah.

• The US Retail Sales figures for January are due for release later during the North American session, with consensus estimates pointing to a 0.1% fall as compared to a flat reading last month.

• Thursday's US economic docket also features the Empire State Manufacturing Index, the Philly Fed Manufacturing Index, the usual Weekly Initial Jobless Claims and Industrial Production data.

• The stronger US consumer inflation figures prompted investors to lower bets for early rate cuts by the Federal Reserve and underpin the US Dollar, capping the upside for the non-yielding Gold price.

• Fed funds futures have priced out a rate cut in March and see a nearly 80% chance of easing at the June meeting, and about three 25 basis points rate cuts by the end of this year as against five two weeks ago.

• The US Treasury bond yields retreat further on the back of overnight comments by Chicago Fed President Austan Goolsbee, saying that the central bank should be wary of waiting too long before it cuts rates.

• Goolsbee indicated that the Fed's trajectory back towards achieving its 2% inflation target would still be on track even if price increases in the US run a bit hotter-than-expected over the next few months.

• This keeps a lid on the Greenback, which, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends some support to the safe-haven XAU/USD and helps limit the downside.

• The Israeli military said on Wednesday its fighter jets began a series of strikes in Lebanon in retaliation to a rocket fired into Northern Israel, raising the risk of a war between the two countries.

• Meanwhile, negotiations for a ceasefire between Israel and Hamas in Gaza have resumed as the former faces international pressure to stop its bombardment of the southern Gaza city of Rafah.

• The US Retail Sales figures for January are due for release later during the North American session, with consensus estimates pointing to a 0.1% fall as compared to a flat reading last month.

• Thursday's US economic docket also features the Empire State Manufacturing Index, the Philly Fed Manufacturing Index, the usual Weekly Initial Jobless Claims and Industrial Production data.

Piyush Lalsingh Ratnu

🟢 Co-relations Alert:

USDJPY @ H1A382

XAUUSD below H1V236

📌 Expected recovery:

🔻USDJPY:

H1A50, H1A618 (149.900, 149,690)

🔺XAUUSD:

H1V50, H1V618 (2008, 2015)

USDJPY @ H1A382

XAUUSD below H1V236

📌 Expected recovery:

🔻USDJPY:

H1A50, H1A618 (149.900, 149,690)

🔺XAUUSD:

H1V50, H1V618 (2008, 2015)

Piyush Lalsingh Ratnu

📌Gold price continues to be weighed down by delayed Fed rate cut bets

• The US inflation data released on Tuesday tempered prospects of an early interest rate cut by the Federal Reserve and continues to undermine the non-yielding Gold price.

• The Bureau of Labor Statistics reported that the headline US CPI rose by 0.3% in January and softened to the 3.1% YoY rate from the 3.4% in December, beating expectations.

• Furthermore, the Core CPI, which excludes volatile food and energy prices, also surpassed consensus estimates and matched December's increase of 3.9%.

• Against the backdrop of the recent stronger US macro data, the still-too-high consumer inflation gives the Fed little reason to rush on cut interest rates.

• The CME Group's FedWatch Tool indicates just over a 35% chance of a rate cut in April and that the Fed will likely not cut rates until the June policy meeting.

• The expectations lift the yield on the benchmark 10-year US government bond to its highest level since December 1 and act as a tailwind for the US Dollar.

• Renewed concerns over higher for longer interest rates temper investors' appetite for riskier assets and assist the XAU/USD to defend the 100-day SMA support.

CMP $1993

💠Crucial Price Zones:

R: $2009/2019/2048

C: $1985/1966/1947

📌Crucial Events ahead:

🆘 Tomorrow:

01.00: Fed Vice Chair Speech

03.50: JPY GDP

11.00: GBP GDP

17.30 Core Retail Sales, Initial Jobless Claims

22.15: Fed Waller speech

• The US inflation data released on Tuesday tempered prospects of an early interest rate cut by the Federal Reserve and continues to undermine the non-yielding Gold price.

• The Bureau of Labor Statistics reported that the headline US CPI rose by 0.3% in January and softened to the 3.1% YoY rate from the 3.4% in December, beating expectations.

• Furthermore, the Core CPI, which excludes volatile food and energy prices, also surpassed consensus estimates and matched December's increase of 3.9%.

• Against the backdrop of the recent stronger US macro data, the still-too-high consumer inflation gives the Fed little reason to rush on cut interest rates.

• The CME Group's FedWatch Tool indicates just over a 35% chance of a rate cut in April and that the Fed will likely not cut rates until the June policy meeting.

• The expectations lift the yield on the benchmark 10-year US government bond to its highest level since December 1 and act as a tailwind for the US Dollar.

• Renewed concerns over higher for longer interest rates temper investors' appetite for riskier assets and assist the XAU/USD to defend the 100-day SMA support.

CMP $1993

💠Crucial Price Zones:

R: $2009/2019/2048

C: $1985/1966/1947

📌Crucial Events ahead:

🆘 Tomorrow:

01.00: Fed Vice Chair Speech

03.50: JPY GDP

11.00: GBP GDP

17.30 Core Retail Sales, Initial Jobless Claims

22.15: Fed Waller speech

Piyush Lalsingh Ratnu

🟢 Important Key Event today:

17:30 USDCore CPI (MoM) (Jan) 0.3%0.3%

17:30 USDCore CPI (YoY) (Jan) 3.7%3.9%

17:30 USDCore CPI Index (Jan) 313.22

17:30 USDCPI (MoM) (Jan) 0.2%0.3%

17:30 USDCPI (YoY) (Jan) 2.9%3.4%

17:30 USDCore CPI (MoM) (Jan) 0.3%0.3%

17:30 USDCore CPI (YoY) (Jan) 3.7%3.9%

17:30 USDCore CPI Index (Jan) 313.22

17:30 USDCPI (MoM) (Jan) 0.2%0.3%

17:30 USDCPI (YoY) (Jan) 2.9%3.4%

Piyush Lalsingh Ratnu

🔘2023 GOLD DEMAND TRENDS: Highlights

💎The LBMA (PM) gold price ended 2023 at US$2,078.4/oz – a record high year-end close – generating an annual return of 15%. The average 2023 gold price of US$1,940.54 /oz – also a record – was 8% higher than 2022.

💎Q4 gold demand of 1,150t (excluding OTC and stock flows) was 8% above the five-year average. But this is 12% weaker y/y when compared with the record quarter of 1,303t in Q4’22. Positive y/y comparisons in Technology and ETFs were outweighed by the y/y decline in central bank buying.

💎OTC investment was reflected in gold price strength during 2023. This source of gold demand, while opaque, was clearly evident again in Q4 as the gold price rallied despite continued ETF outflows.

💎Annual mine production increased 1% y/y to 3,644t, but fell short of the 2018 record. Full year recycling responded to high gold prices, rising to 1,237t (+9% y/y). Total gold supply was 3% higher y/y as a result.

Read more at:

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2023

💎The LBMA (PM) gold price ended 2023 at US$2,078.4/oz – a record high year-end close – generating an annual return of 15%. The average 2023 gold price of US$1,940.54 /oz – also a record – was 8% higher than 2022.

💎Q4 gold demand of 1,150t (excluding OTC and stock flows) was 8% above the five-year average. But this is 12% weaker y/y when compared with the record quarter of 1,303t in Q4’22. Positive y/y comparisons in Technology and ETFs were outweighed by the y/y decline in central bank buying.

💎OTC investment was reflected in gold price strength during 2023. This source of gold demand, while opaque, was clearly evident again in Q4 as the gold price rallied despite continued ETF outflows.

💎Annual mine production increased 1% y/y to 3,644t, but fell short of the 2018 record. Full year recycling responded to high gold prices, rising to 1,237t (+9% y/y). Total gold supply was 3% higher y/y as a result.

Read more at:

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2023

Piyush Lalsingh Ratnu

📌 Revision Process: The BLS's annual revisions aim to reflect accurate price changes by recalculating seasonal factors, affecting monthly inflation readings.

Historical Trend: Approximately 20% of a month's relative strength in initial core inflation readings has been revised in its first annual revision over the last decade.

2023 Inflation Trend: With inflation decelerating significantly throughout 2023, monthly core CPI in the latter half of the year was 0.06 percentage points below the annual average.

Projected Revisions: Goldman Sachs estimates that if 20% of the deviation in 2023H2's monthly core CPI is revised, the figures could be adjusted approximately 0.01 percentage points higher on average, translating to a 0.15 percentage point annualized basis adjustment.

Core PCE Inflation Revisions: Similar directional revisions are expected for core Personal Consumption Expenditures (PCE) inflation for 2023Q4, albeit to a lesser extent, given that not all PCE components use CPI seasonal factors.

Historical Trend: Approximately 20% of a month's relative strength in initial core inflation readings has been revised in its first annual revision over the last decade.

2023 Inflation Trend: With inflation decelerating significantly throughout 2023, monthly core CPI in the latter half of the year was 0.06 percentage points below the annual average.

Projected Revisions: Goldman Sachs estimates that if 20% of the deviation in 2023H2's monthly core CPI is revised, the figures could be adjusted approximately 0.01 percentage points higher on average, translating to a 0.15 percentage point annualized basis adjustment.

Core PCE Inflation Revisions: Similar directional revisions are expected for core Personal Consumption Expenditures (PCE) inflation for 2023Q4, albeit to a lesser extent, given that not all PCE components use CPI seasonal factors.

: