Piyush Lalsingh Ratnu / Profil

Piyush Lalsingh Ratnu

- Trader & Analyst in Piyush Ratnu XAUUSD Spot Gold Research

- Vereinigte Arabische Emirate

- 156

- Information

|

nein

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

3

Signale

|

1

Abonnenten

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Freunde

15

Anfragen

Ausgehend

Piyush Lalsingh Ratnu

09 May - 10 May 2024: XAUUSD

Net price movement after IJC: 2308-2380 (10 May high)

30% RT = 30%*72= $21 RT

2381-21= 2360 (2360.60 achieved at 17.15 hours)

#XAUUSD #PiyushRatnu #PRDXB #Forex #ForexTrading #Gold

Net price movement after IJC: 2308-2380 (10 May high)

30% RT = 30%*72= $21 RT

2381-21= 2360 (2360.60 achieved at 17.15 hours)

#XAUUSD #PiyushRatnu #PRDXB #Forex #ForexTrading #Gold

Piyush Lalsingh Ratnu

WHY GOLD PRICE IS RISING? (we alerted in advance) CMP $2358

✔️ Gold price rises as central banks either cut or signal a willingness to cut interest rates, reducing Gold's "opportunity-cost".

✔️ The World Gold Council publishes its monthly report, highlighting Asian demand and central-bank buying.

✔️ Gold price is rising as central banks around the world start cutting interest rates after keeping them high for several years to fight inflation.

In Sweden the Riksbank made the move to cut interest rates by 0.25% to 3.75% for the first time since 2016 and in the UK, the Bank of England (BoE) voted by a narrower 7-2 margin to keep rates unchanged instead of cutting them. This was one vote more than the 8-1 of the previous meeting, showing an increased willingness on the part of policymakers to entertain rate cuts.

Furthermore, The Swiss National Bank (SNB) was the first major central bank to cut its interest rates at its March meeting, and the Reserve Bank of Australia (RBA) made a dovish hold which suprised markets at its last policy meeting. In addition, the European Central Bank (ECB) has all but guaranteed it will go ahead with an interest-rate cut in June.

🔘 Gold price also saw gains on Thursday after Chinese trade data showed a greater-than-expected rise in Chinese exports of 1.5% year-over-year in April, rebounding from a 7.5% drop a month earlier.

According to the data, imports rose 8.4%, beating the 5.4% forecast and the previous 1.9% drop. China is a key player in the global market for Gold so strong economic data from the country impacts its valuation.

🆘 XAUUSD above PPZ

Crucial B/S Entries

SZ R2 $2379/2385 - 2407/2424

BZ S2 $2323/2313 - 2288/2277

Piyush Ratnu Financial Market Research | #XAUUSD

#PiyushRatnu #PRDXB #GoldPrice #Forex #Trading

✔️ Gold price rises as central banks either cut or signal a willingness to cut interest rates, reducing Gold's "opportunity-cost".

✔️ The World Gold Council publishes its monthly report, highlighting Asian demand and central-bank buying.

✔️ Gold price is rising as central banks around the world start cutting interest rates after keeping them high for several years to fight inflation.

In Sweden the Riksbank made the move to cut interest rates by 0.25% to 3.75% for the first time since 2016 and in the UK, the Bank of England (BoE) voted by a narrower 7-2 margin to keep rates unchanged instead of cutting them. This was one vote more than the 8-1 of the previous meeting, showing an increased willingness on the part of policymakers to entertain rate cuts.

Furthermore, The Swiss National Bank (SNB) was the first major central bank to cut its interest rates at its March meeting, and the Reserve Bank of Australia (RBA) made a dovish hold which suprised markets at its last policy meeting. In addition, the European Central Bank (ECB) has all but guaranteed it will go ahead with an interest-rate cut in June.

🔘 Gold price also saw gains on Thursday after Chinese trade data showed a greater-than-expected rise in Chinese exports of 1.5% year-over-year in April, rebounding from a 7.5% drop a month earlier.

According to the data, imports rose 8.4%, beating the 5.4% forecast and the previous 1.9% drop. China is a key player in the global market for Gold so strong economic data from the country impacts its valuation.

🆘 XAUUSD above PPZ

Crucial B/S Entries

SZ R2 $2379/2385 - 2407/2424

BZ S2 $2323/2313 - 2288/2277

Piyush Ratnu Financial Market Research | #XAUUSD

#PiyushRatnu #PRDXB #GoldPrice #Forex #Trading

Piyush Lalsingh Ratnu

Short positions at $2323 gave us good returns

$2313 achieved : $10 Profit achieved.

$2313 achieved : $10 Profit achieved.

Piyush Lalsingh Ratnu

#PiyushRatnu Financial Market Research

Trading Performance & Accuracy #XAUUSD

🍎 Duration: The most volatile months:

February 2024 - 09 May 2024

https://www.reddit.com/r/prgoldanalysis/comments/1cnquoz/piyush_ratnu_financial_market_research_trading/

📱 Connect at https://t.me/PiyushRatnuOfficial for trading ideas & business queries.

Trading Performance & Accuracy #XAUUSD

🍎 Duration: The most volatile months:

February 2024 - 09 May 2024

https://www.reddit.com/r/prgoldanalysis/comments/1cnquoz/piyush_ratnu_financial_market_research_trading/

📱 Connect at https://t.me/PiyushRatnuOfficial for trading ideas & business queries.

Piyush Lalsingh Ratnu

#XAUUSD #PiyushRatnu #PRDXB #GoldPrice #Forex

https://www.reddit.com/r/prgoldanalysis/comments/1cnoa7w/factors_driving_xauusd_gold_price_higher_as/

https://www.reddit.com/r/prgoldanalysis/comments/1cnoa7w/factors_driving_xauusd_gold_price_higher_as/

Piyush Lalsingh Ratnu

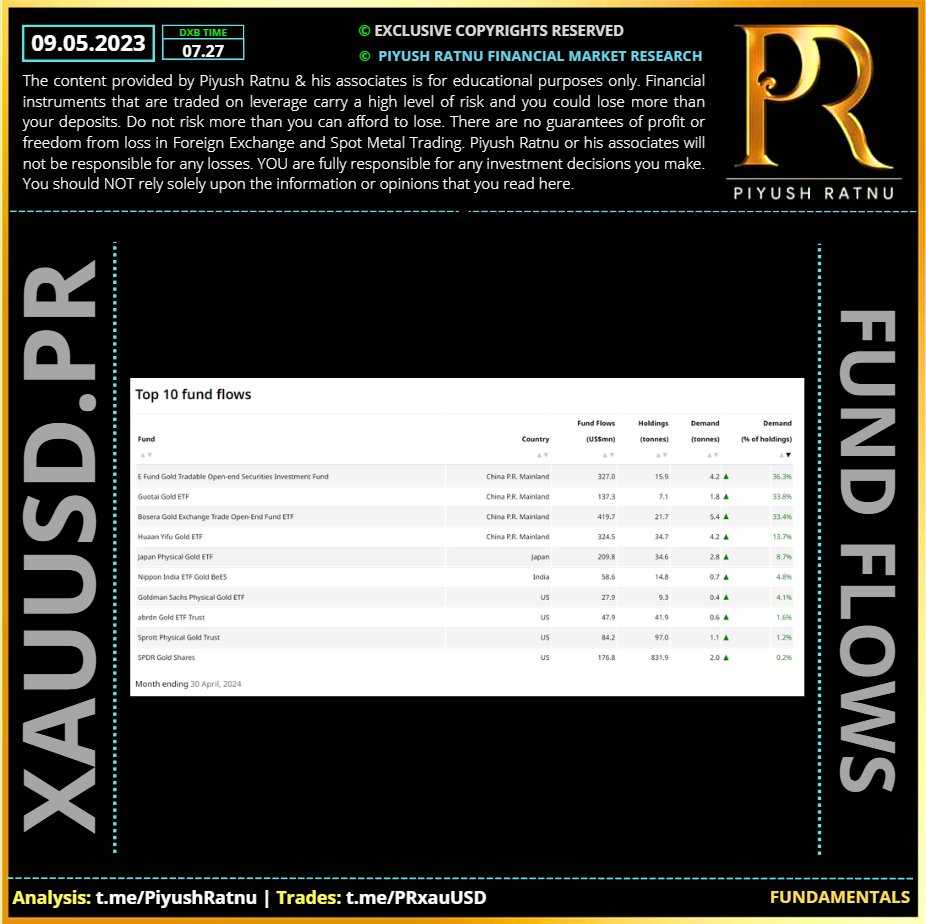

Highlights

🔘Global gold ETFs saw a continuation of monthly outflows, despite early-April inflows spurred by the gold price strength.

🔘Asia led global inflows and North American funds registered positive demand; but these were dwarfed by European outflows.

End April saw global gold ETF holdings fall to 3,079t, the lowest since February 2020. But the higher gold price in the month extended total AUM by 3% to US$229bn.

🔘Gold ETF trading volumes increased across all regions, with a surge in North America, indicating continued investor interest despite outflows.

April in review

Physically backed gold ETFs saw outflows of US$2bn in April, further extending aggregate monthly losses.2 Continued gold price strength, especially during the first half of April, spurred fresh buying although failed to counter wider selling. Collective holdings fell by 33t, ending the month at 3,079t, 6% below the previous 12-month average. Meanwhile, gold’s positive price trend pushed total assets under management (AUM) up by 3% m/m to US$229bn, the highest since April 2022.

Asia and North America captured inflows while Europe continued to register outflows. Asia led global inflows and North American funds witnessed positive ETF demand two months in a row. But similar to March, European outflows offset inflows elsewhere.

Gold trading activities continued to rise

🔺The average daily trading volume across global gold markets rose by 12% m/m, ending April at US$247bn. Trading volumes at the over-the-counter (OTC) market averaged US$126bn per day, 6% higher than March. And while traders at the COMEX cooled slightly (-8% m/m), average trading volumes at the Shanghai Futures Exchange (+92% m/m) and the Shanghai Gold Exchange (+34%) both jumped. But it is worth noting that volumes in Shanghai remain comparatively smaller than the COMEX despite recent surges.

🔺Gold ETF trading volumes also rocketed (+70% m/m), with activities rising across all regions, indicating that investor interest in gold ETFs remains intact, in spite of continued outflows. North American gold ETFs were heavily traded, registering a 66% m/m surge.

🍎 Total net longs at COMEX rose to 717t by the end of April, a 6% m/m rise. Money manager net longs reached a 45-month-end peak, arriving at 520t. This is 29t higher than March and 66% above the 2023 average (312t), mainly supported by a 4% gold price rise in the month.

✔️ Interestingly, as projected by me on 29 January 2024: China is driving the GOLD demand and Price, once again!

🔘Global gold ETFs saw a continuation of monthly outflows, despite early-April inflows spurred by the gold price strength.

🔘Asia led global inflows and North American funds registered positive demand; but these were dwarfed by European outflows.

End April saw global gold ETF holdings fall to 3,079t, the lowest since February 2020. But the higher gold price in the month extended total AUM by 3% to US$229bn.

🔘Gold ETF trading volumes increased across all regions, with a surge in North America, indicating continued investor interest despite outflows.

April in review

Physically backed gold ETFs saw outflows of US$2bn in April, further extending aggregate monthly losses.2 Continued gold price strength, especially during the first half of April, spurred fresh buying although failed to counter wider selling. Collective holdings fell by 33t, ending the month at 3,079t, 6% below the previous 12-month average. Meanwhile, gold’s positive price trend pushed total assets under management (AUM) up by 3% m/m to US$229bn, the highest since April 2022.

Asia and North America captured inflows while Europe continued to register outflows. Asia led global inflows and North American funds witnessed positive ETF demand two months in a row. But similar to March, European outflows offset inflows elsewhere.

Gold trading activities continued to rise

🔺The average daily trading volume across global gold markets rose by 12% m/m, ending April at US$247bn. Trading volumes at the over-the-counter (OTC) market averaged US$126bn per day, 6% higher than March. And while traders at the COMEX cooled slightly (-8% m/m), average trading volumes at the Shanghai Futures Exchange (+92% m/m) and the Shanghai Gold Exchange (+34%) both jumped. But it is worth noting that volumes in Shanghai remain comparatively smaller than the COMEX despite recent surges.

🔺Gold ETF trading volumes also rocketed (+70% m/m), with activities rising across all regions, indicating that investor interest in gold ETFs remains intact, in spite of continued outflows. North American gold ETFs were heavily traded, registering a 66% m/m surge.

🍎 Total net longs at COMEX rose to 717t by the end of April, a 6% m/m rise. Money manager net longs reached a 45-month-end peak, arriving at 520t. This is 29t higher than March and 66% above the 2023 average (312t), mainly supported by a 4% gold price rise in the month.

✔️ Interestingly, as projected by me on 29 January 2024: China is driving the GOLD demand and Price, once again!

Piyush Lalsingh Ratnu

🔷 Key Economic Data today:

16:30 USD Continuing Jobless Claims 1,790K 1,774K

16:30 USD Initial Jobless Claims 212K 208K

21:00 USD 30-Year Bond Auction 4.671%

22:00 USD FOMC Member Daly Speaks

16:30 USD Continuing Jobless Claims 1,790K 1,774K

16:30 USD Initial Jobless Claims 212K 208K

21:00 USD 30-Year Bond Auction 4.671%

22:00 USD FOMC Member Daly Speaks

Piyush Lalsingh Ratnu

🆘 Accuracy Check:

C targets: $2323 and $2288 achieved and proved a perfect buying zone, as projected by me in my analysis on 16 April 2024.

Verify at: https://t.me/c/1654158888/8672

#XAUUSD #PRDXB #PiyushRatnu #GoldPrice #forex

C targets: $2323 and $2288 achieved and proved a perfect buying zone, as projected by me in my analysis on 16 April 2024.

Verify at: https://t.me/c/1654158888/8672

#XAUUSD #PRDXB #PiyushRatnu #GoldPrice #forex

Piyush Lalsingh Ratnu

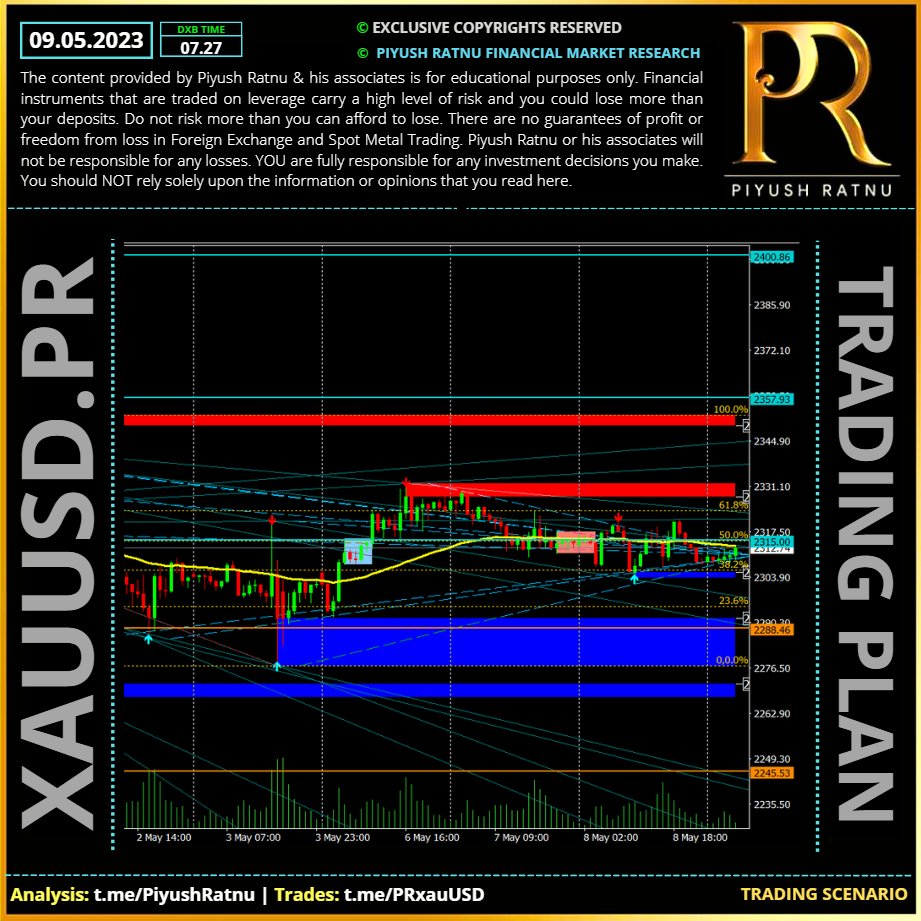

Piyush Ratnu Financial Market Research | XAUUSD Trading Plan | 09 May 24

#XAUUSD #PRDXB #PiyushRatnu #GoldPrice #forex

#XAUUSD #PRDXB #PiyushRatnu #GoldPrice #forex

Piyush Lalsingh Ratnu

Trading Scenario: #XAUUSD

M5A M15A M30A achieved at $2304 zone

RT $2314 achieved

H1A618 @ 2298

H1A100 @ 2278

Stay Alert! $30+ price rally on the way. CMP $2314

USDJPY $155.555 zone once again.

Today's price movement: 1000 P completed

US S 82

DXY 105.480

US10YT (-) 4.468

USDCNY RT (+) 7.2266

USD F Stable (alarming)

🟢 PRSRD1 R2/S2 crucial Entries

#PiyushRatnu #PRDXB #Forex #ForexTrading

M5A M15A M30A achieved at $2304 zone

RT $2314 achieved

H1A618 @ 2298

H1A100 @ 2278

Stay Alert! $30+ price rally on the way. CMP $2314

USDJPY $155.555 zone once again.

Today's price movement: 1000 P completed

US S 82

DXY 105.480

US10YT (-) 4.468

USDCNY RT (+) 7.2266

USD F Stable (alarming)

🟢 PRSRD1 R2/S2 crucial Entries

#PiyushRatnu #PRDXB #Forex #ForexTrading

Piyush Lalsingh Ratnu

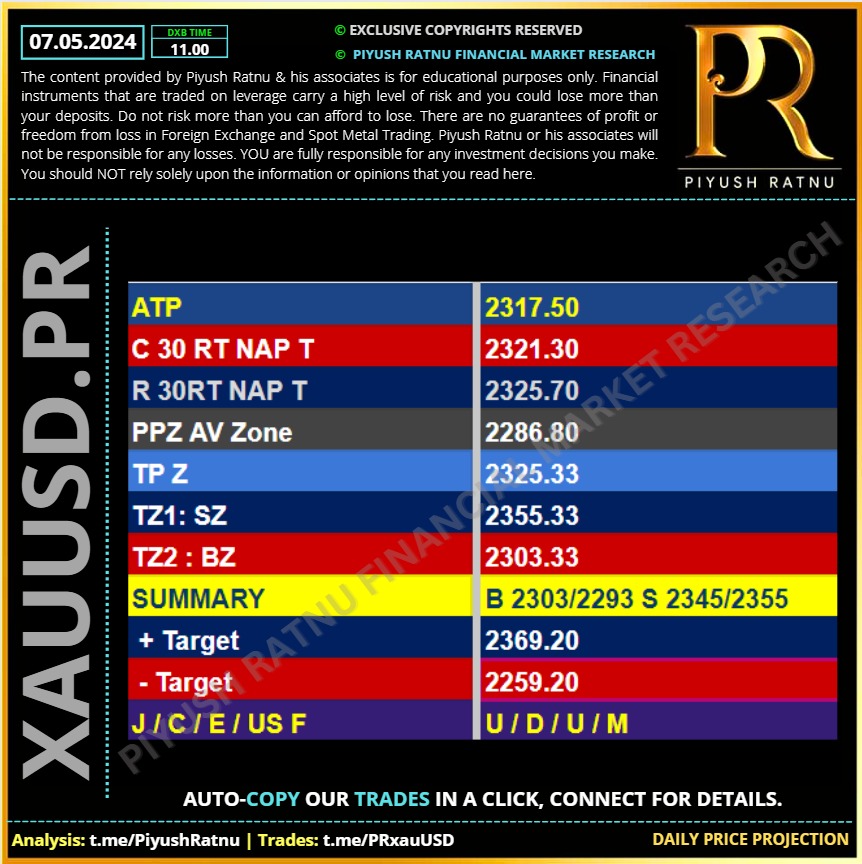

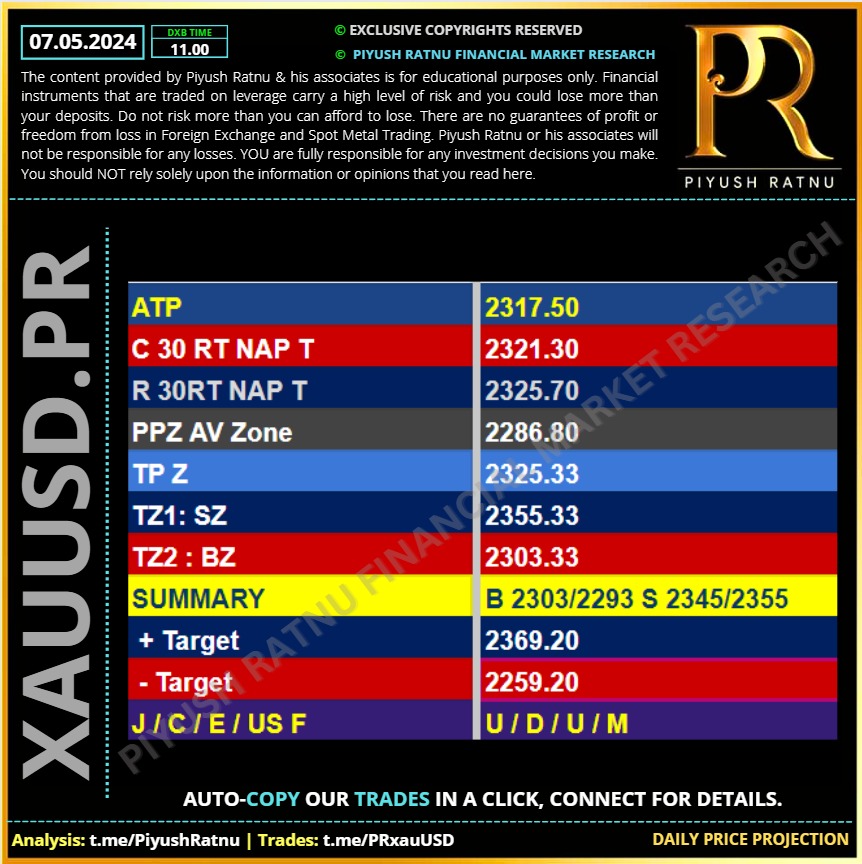

07.05.2024 | XAUUSD: Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

#Xauusdgold #XAUUSD #GOLD #PiyushRatnu

Central Bank acquisitions of Gold remain net positive

According to data from the World Gold Council (WGC) tracking central bank acquisitions of Gold in March, buying showed a net positive of 15 tonnes from central banks, who have become one of the largest consumers of Gold in recent years.

The figure was in line with previous months, keeping the positive trend in demand alive.

“Buying strength has continued into 2024, with emerging market banks the main driving force for both purchases and sales,” said Krishan Gopaul Senior Analyst, EMEA at the World Gold Council.

Central Bank acquisitions of Gold remain net positive

According to data from the World Gold Council (WGC) tracking central bank acquisitions of Gold in March, buying showed a net positive of 15 tonnes from central banks, who have become one of the largest consumers of Gold in recent years.

The figure was in line with previous months, keeping the positive trend in demand alive.

“Buying strength has continued into 2024, with emerging market banks the main driving force for both purchases and sales,” said Krishan Gopaul Senior Analyst, EMEA at the World Gold Council.

Piyush Lalsingh Ratnu

🟢 Co-relation alert:

USDJPY today:

1300 + | RT (-) 500

Possible impact on XAUUSD: $25+

$2315-2330 achieved | CMP $2328

#XAUUSD

USDJPY today:

1300 + | RT (-) 500

Possible impact on XAUUSD: $25+

$2315-2330 achieved | CMP $2328

#XAUUSD

: