Modified Grid-Hedge EA in MQL5 (Part II): Making a Simple Grid EA

In this article, we explored the classic grid strategy, detailing its automation using an Expert Advisor in MQL5 and analyzing initial backtest results. We highlighted the strategy's need for high holding capacity and outlined plans for optimizing key parameters like distance, takeProfit, and lot sizes in future installments. The series aims to enhance trading strategy efficiency and adaptability to different market conditions.

Category Theory in MQL5 (Part 13): Calendar Events with Database Schemas

This article, that follows Category Theory implementation of Orders in MQL5, considers how database schemas can be incorporated for classification in MQL5. We take an introductory look at how database schema concepts could be married with category theory when identifying trade relevant text(string) information. Calendar events are the focus.

MQL5 Wizard Techniques you should know (Part 08): Perceptrons

Perceptrons, single hidden layer networks, can be a good segue for anyone familiar with basic automated trading and is looking to dip into neural networks. We take a step by step look at how this could be realized in a signal class assembly that is part of the MQL5 Wizard classes for expert advisors.

Population optimization algorithms: Nelder–Mead, or simplex search (NM) method

The article presents a complete exploration of the Nelder-Mead method, explaining how the simplex (function parameter space) is modified and rearranged at each iteration to achieve an optimal solution, and describes how the method can be improved.

Developing a Replay System — Market simulation (Part 08): Locking the indicator

In this article, we will look at how to lock the indicator while simply using the MQL5 language, and we will do it in a very interesting and amazing way.

Market Reactions and Trading Strategies in Response to Dividend Announcements: Evaluating the Efficient Market Hypothesis in Stock Trading

In this article, we will analyse the impact of dividend announcements on stock market returns and see how investors can earn more returns than those offered by the market when they expect a company to announce dividends. In doing so, we will also check the validity of the Efficient Market Hypothesis in the context of the Indian Stock Market.

Developing a Replay System — Market simulation (Part 10): Using only real data for Replay

Here we will look at how we can use more reliable data (traded ticks) in the replay system without worrying about whether it is adjusted or not.

Benefiting from Forex market seasonality

We are all familiar with the concept of seasonality, for example, we are all accustomed to rising prices for fresh vegetables in winter or rising fuel prices during severe frosts, but few people know that similar patterns exist in the Forex market.

Quantitative analysis in MQL5: Implementing a promising algorithm

We will analyze the question of what quantitative analysis is and how it is used by major players. We will create one of the quantitative analysis algorithms in the MQL5 language.

Developing a Replay System — Market simulation (Part 09): Custom events

Here we'll see how custom events are triggered and how the indicator reports the state of the replay/simulation service.

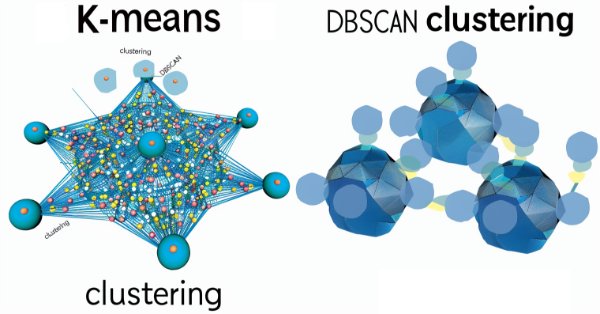

MQL5 Wizard Techniques you should know (Part 13): DBSCAN for Expert Signal Class

Density Based Spatial Clustering for Applications with Noise is an unsupervised form of grouping data that hardly requires any input parameters, save for just 2, which when compared to other approaches like k-means, is a boon. We delve into how this could be constructive for testing and eventually trading with Wizard assembled Expert Advisers

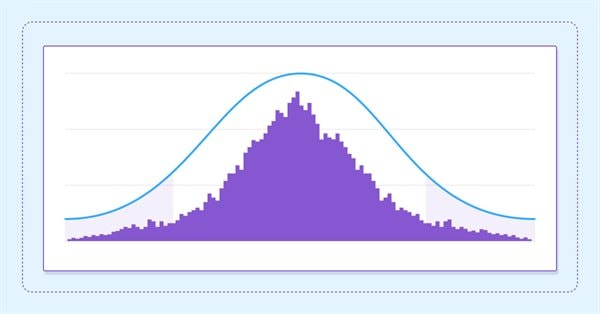

Estimate future performance with confidence intervals

In this article we delve into the application of boostrapping techniques as a means to estimate the future performance of an automated strategy.

Developing a Replay System — Market simulation (Part 13): Birth of the SIMULATOR (III)

Here we will simplify a few elements related to the work in the next article. I'll also explain how you can visualize what the simulator generates in terms of randomness.

Developing a Replay System — Market simulation (Part 23): FOREX (IV)

Now the creation occurs at the same point where we converted ticks into bars. This way, if something goes wrong during the conversion process, we will immediately notice the error. This is because the same code that places 1-minute bars on the chart during fast forwarding is also used for the positioning system to place bars during normal performance. In other words, the code that is responsible for this task is not duplicated anywhere else. This way we get a much better system for both maintenance and improvement.

Developing a Replay System — Market simulation (Part 19): Necessary adjustments

Here we will prepare the ground so that if we need to add new functions to the code, this will happen smoothly and easily. The current code cannot yet cover or handle some of the things that will be necessary to make meaningful progress. We need everything to be structured in order to enable the implementation of certain things with the minimal effort. If we do everything correctly, we can get a truly universal system that can very easily adapt to any situation that needs to be handled.

Data Science and Machine Learning (Part 20): Algorithmic Trading Insights, A Faceoff Between LDA and PCA in MQL5

Uncover the secrets behind these powerful dimensionality reduction techniques as we dissect their applications within the MQL5 trading environment. Delve into the nuances of Linear Discriminant Analysis (LDA) and Principal Component Analysis (PCA), gaining a profound understanding of their impact on strategy development and market analysis.

Developing a Replay System — Market simulation (Part 24): FOREX (V)

Today we will remove a limitation that has been preventing simulations based on the Last price and will introduce a new entry point specifically for this type of simulation. The entire operating mechanism will be based on the principles of the forex market. The main difference in this procedure is the separation of Bid and Last simulations. However, it is important to note that the methodology used to randomize the time and adjust it to be compatible with the C_Replay class remains identical in both simulations. This is good because changes in one mode lead to automatic improvements in the other, especially when it comes to handling time between ticks.

Neural networks made easy (Part 40): Using Go-Explore on large amounts of data

This article discusses the use of the Go-Explore algorithm over a long training period, since the random action selection strategy may not lead to a profitable pass as training time increases.

Population optimization algorithms: Mind Evolutionary Computation (MEC) algorithm

The article considers the algorithm of the MEC family called the simple mind evolutionary computation algorithm (Simple MEC, SMEC). The algorithm is distinguished by the beauty of its idea and ease of implementation.

Developing a Replay System — Market simulation (Part 22): FOREX (III)

Although this is the third article on this topic, I must explain for those who have not yet understood the difference between the stock market and the foreign exchange market: the big difference is that in the Forex there is no, or rather, we are not given information about some points that actually occurred during the course of trading.

Developing a Replay System — Market simulation (Part 12): Birth of the SIMULATOR (II)

Developing a simulator can be much more interesting than it seems. Today we'll take a few more steps in this direction because things are getting more interesting.

MQL5 Wizard Techniques you should know (Part 16): Principal Component Analysis with Eigen Vectors

Principal Component Analysis, a dimensionality reducing technique in data analysis, is looked at in this article, with how it could be implemented with Eigen values and vectors. As always, we aim to develop a prototype expert-signal-class usable in the MQL5 wizard.

News Trading Made Easy (Part 1): Creating a Database

News trading can be complicated and overwhelming, in this article we will go through steps to obtain news data. Additionally we will learn about the MQL5 Economic Calendar and what it has to offer.

MQL5 Wizard Techniques you should know (Part 19): Bayesian Inference

Bayesian inference is the adoption of Bayes Theorem to update probability hypothesis as new information is made available. This intuitively leans to adaptation in time series analysis, and so we have a look at how we could use this in building custom classes not just for the signal but also money-management and trailing-stops.

Population optimization algorithms: Differential Evolution (DE)

In this article, we will consider the algorithm that demonstrates the most controversial results of all those discussed previously - the differential evolution (DE) algorithm.

Category Theory in MQL5 (Part 23): A different look at the Double Exponential Moving Average

In this article we continue with our theme in the last of tackling everyday trading indicators viewed in a ‘new’ light. We are handling horizontal composition of natural transformations for this piece and the best indicator for this, that expands on what we just covered, is the double exponential moving average (DEMA).

Developing a Replay System (Part 28): Expert Advisor project — C_Mouse class (II)

When people started creating the first systems capable of computing, everything required the participation of engineers, who had to know the project very well. We are talking about the dawn of computer technology, a time when there were not even terminals for programming. As it developed and more people got interested in being able to create something, new ideas and ways of programming emerged which replaced the previous-style changing of connector positions. This is when the first terminals appeared.

MQL5 Wizard Techniques you should know (Part 11): Number Walls

Number Walls are a variant of Linear Shift Back Registers that prescreen sequences for predictability by checking for convergence. We look at how these ideas could be of use in MQL5.

Alternative risk return metrics in MQL5

In this article we present the implementation of several risk return metrics billed as alternatives to the Sharpe ratio and examine hypothetical equity curves to analyze their characteristics.

Developing a Replay System — Market simulation (Part 25): Preparing for the next phase

In this article, we complete the first phase of developing our replay and simulation system. Dear reader, with this achievement I confirm that the system has reached an advanced level, paving the way for the introduction of new functionality. The goal is to enrich the system even further, turning it into a powerful tool for research and development of market analysis.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

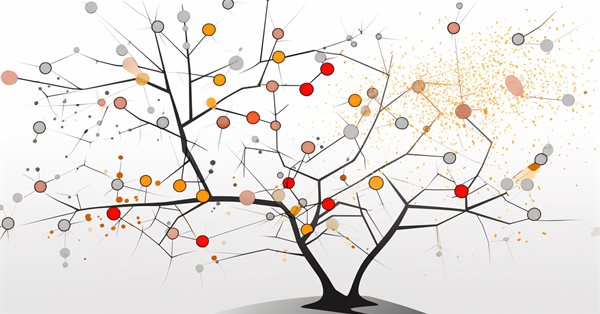

Data Science and Machine Learning (Part 17): Money in the Trees? The Art and Science of Random Forests in Forex Trading

Discover the secrets of algorithmic alchemy as we guide you through the blend of artistry and precision in decoding financial landscapes. Unearth how Random Forests transform data into predictive prowess, offering a unique perspective on navigating the complex terrain of stock markets. Join us on this journey into the heart of financial wizardry, where we demystify the role of Random Forests in shaping market destiny and unlocking the doors to lucrative opportunities

Population optimization algorithms: Changing shape, shifting probability distributions and testing on Smart Cephalopod (SC)

The article examines the impact of changing the shape of probability distributions on the performance of optimization algorithms. We will conduct experiments using the Smart Cephalopod (SC) test algorithm to evaluate the efficiency of various probability distributions in the context of optimization problems.

Developing a Replay System (Part 31): Expert Advisor project — C_Mouse class (V)

We need a timer that can show how much time is left till the end of the replay/simulation run. This may seem at first glance to be a simple and quick solution. Many simply try to adapt and use the same system that the trading server uses. But there's one thing that many people don't consider when thinking about this solution: with replay, and even m ore with simulation, the clock works differently. All this complicates the creation of such a system.

Data Science and Machine Learning (Part 16): A Refreshing Look at Decision Trees

Dive into the intricate world of decision trees in the latest installment of our Data Science and Machine Learning series. Tailored for traders seeking strategic insights, this article serves as a comprehensive recap, shedding light on the powerful role decision trees play in the analysis of market trends. Explore the roots and branches of these algorithmic trees, unlocking their potential to enhance your trading decisions. Join us for a refreshing perspective on decision trees and discover how they can be your allies in navigating the complexities of financial markets.

Developing a Replay System — Market simulation (Part 07): First improvements (II)

In the previous article, we made some fixes and added tests to our replication system to ensure the best possible stability. We also started creating and using a configuration file for this system.

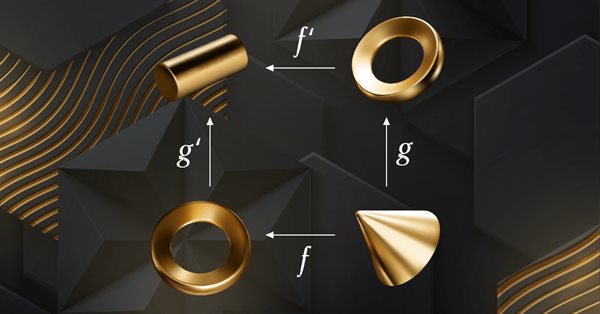

Category Theory in MQL5 (Part 6): Monomorphic Pull-Backs and Epimorphic Push-Outs

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

The case for using a Composite Data Set this Q4 in weighing SPDR XLY's next performance

We consider XLY, SPDR’s consumer discretionary spending ETF and see if with tools in MetaTrader’s IDE we can sift through an array of data sets in selecting what could work with a forecasting model with a forward outlook of not more than a year.

Population optimization algorithms: Simulated Annealing (SA) algorithm. Part I

The Simulated Annealing algorithm is a metaheuristic inspired by the metal annealing process. In the article, we will conduct a thorough analysis of the algorithm and debunk a number of common beliefs and myths surrounding this widely known optimization method. The second part of the article will consider the custom Simulated Isotropic Annealing (SIA) algorithm.

Developing a quality factor for Expert Advisors

In this article, we will see how to develop a quality score that your Expert Advisor can display in the strategy tester. We will look at two well-known calculation methods – Van Tharp and Sunny Harris.