MTF indicators as the technical analysis tool

Introduction

Most of traders agree that the current market state analysis starts with the evaluation of higher chart timeframes. The analysis is performed downwards to lower timeframes until the one, at which deals are performed. This analysis method seems to be a mandatory part of professional approach for successful trading. To perform multi-timeframe analysis, users often have to open several windows or switch between chart periods if the same set of instruments is used. Thus the preliminary analysis is performed.

What to do next? Does one have to ignore older timeframes or keep switching between windows and periods? When the working timeframe is Н1 or above, the user has time for careful evaluation of the general situation. However, there is no time for checking required information form higher periods when working on the M1-M15 timeframes. While this information can sometimes be vital. Moreover, the data should be available right here and now, not on another tab or anywhere else. This is especially important for MTF strategies based on the simultaneous evaluation of different TFs, such as the Wolfe Waves or the Elder's Three Screens.

Thus traders using these strategies are often in the state of mental strain. When performing trades on lower TFs, one can miss profitable signals on higher periods. This may lead to messy decisions, early closing of positions or missing of market reversal points. The consequences can be very upsetting. In these situations, the user can only rely on their experience or information accessing speed.

The solution to this problem is an indicator which receives information from different timeframes or multiple trading symbols and displays the comprehensive data on the screen, so that the user can efficiently assess the market state. In addition to basic information, these indicators can display the real state of the market trend and recommend further trading activities.

Algorithm features

The main difference from the classical indicators is that MTF indicators can process generalized information from all time intervals or financial instruments and then pass data to the current chart. Any indicator type (oscillator, trend, volume, etc.) or a combination of them can operate on multiple timeframes. They are calculated according to their basic algorithm and pass information in accordance with the time interval specified in the settings.

No special setup is needed for MTF versions as compared to classical ones, except for the additional parameter (or group of parameters) to specify time intervals or list of symbols to use data from. The result can be output in the main chart window or separately, as well as be displayed as a signal while combining groups based on the instrument type.

Classification of multi-timeframe indicators

These indicators are presented in all standard classes, while most of them are of the complex type, i.e. combine calculations and graphical elements. The indicator groups are shown below:

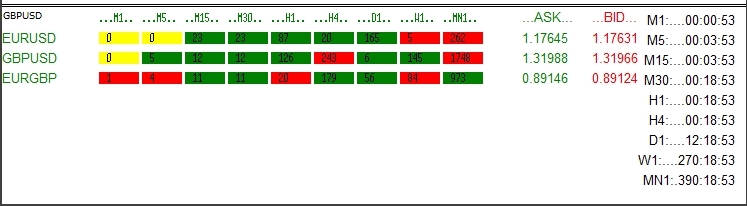

1. Informational: such indicators displays data and additional information without signals or graphics. A classic example is the MultiTimeFrame indicator. It shows candlestick closing time on each timeframe, Ask and Bid for the selected currency pairs, the candlestick state (UP, DOWN, DOJI) and the volume. The indicator screen is filled with a large amount of useful information, which however is hard to use in trading and can only be viewed.

Fig. 1. Information indicators

This group also features independent tools which can be used to make trading decisions. They display the analysis results of several standard indicators without the need to install such indicators on a chart (the calculation is performed automatically), as well as generate trade recommendations.

Fig. 2. Signals of information indicators

Fig. 3. Signals of information indicators

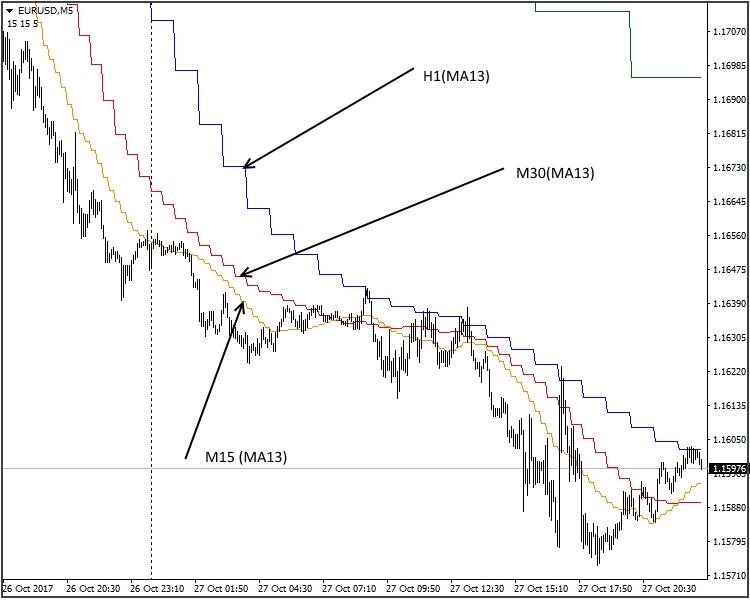

2. Graphical indicators show graphics of the same tool on different TFs. Here is the standard Envelope MA(13) from three different timeframes.

Fig. 4. Graphical indicators

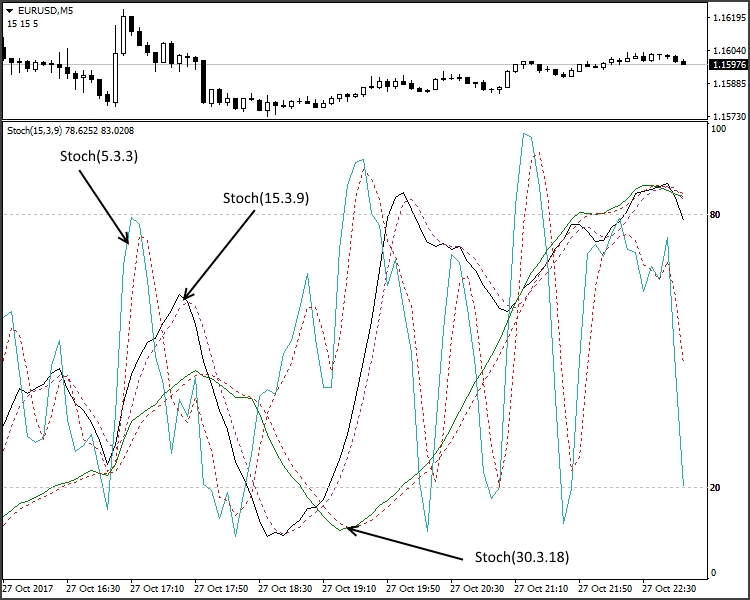

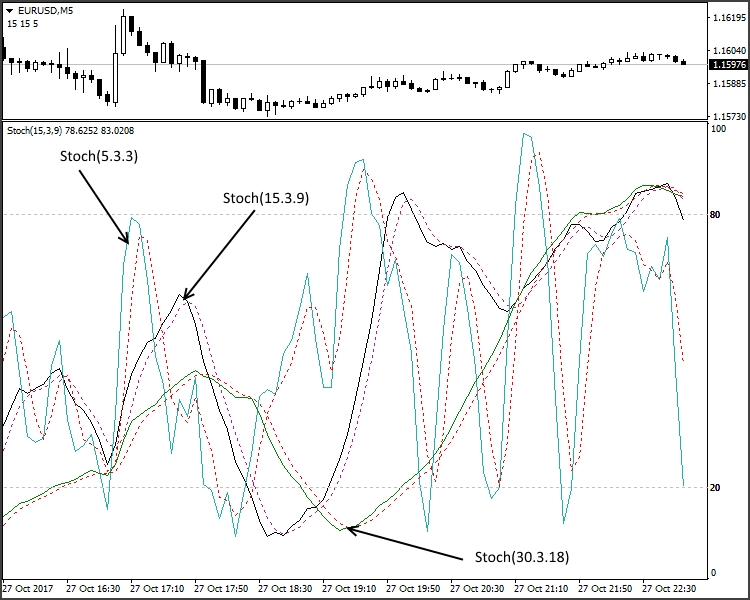

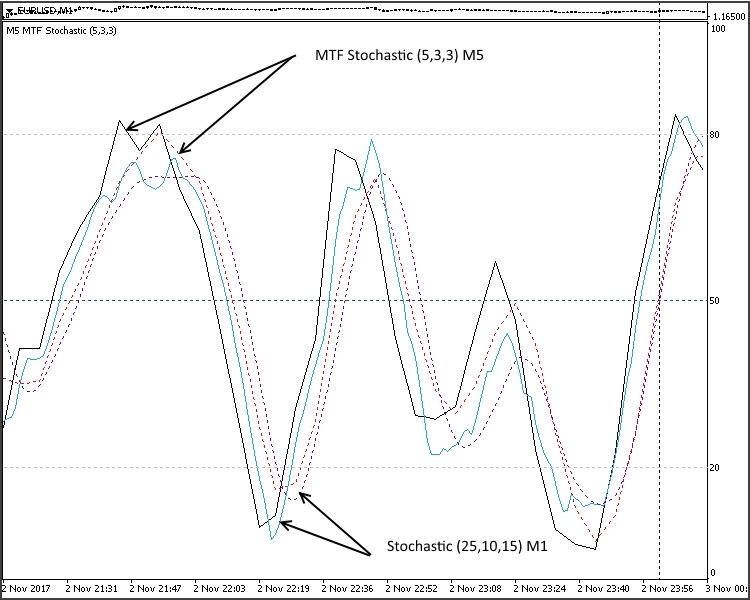

Another type of graphical construction is the group of charts with different calculation period. This approach is based on pure mathematics. I.e. the Stochastic indicator (5.3.3) on M5 will have the parameters of (15.3.9) from M15 and (30.3.18) from M30.

Fig. 5. Graphical indicators with different calculation periods

The above version can be referred to the MTF class with some reservation. It is not always possible to implement this approach, while the disadvantages of this solution can be so significant that the use of it would be inappropriate. We will dwell on cases where the method is applicable as well as on its advantages and disadvantages later.

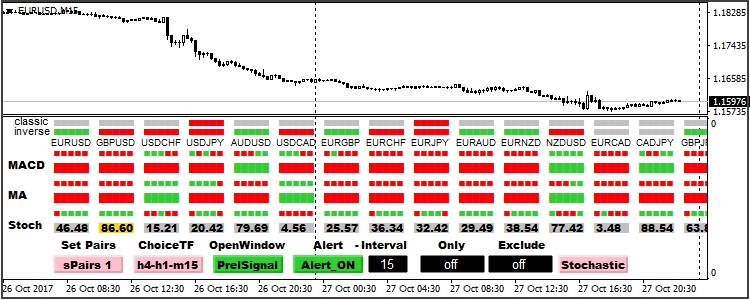

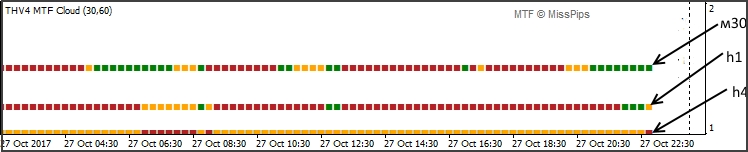

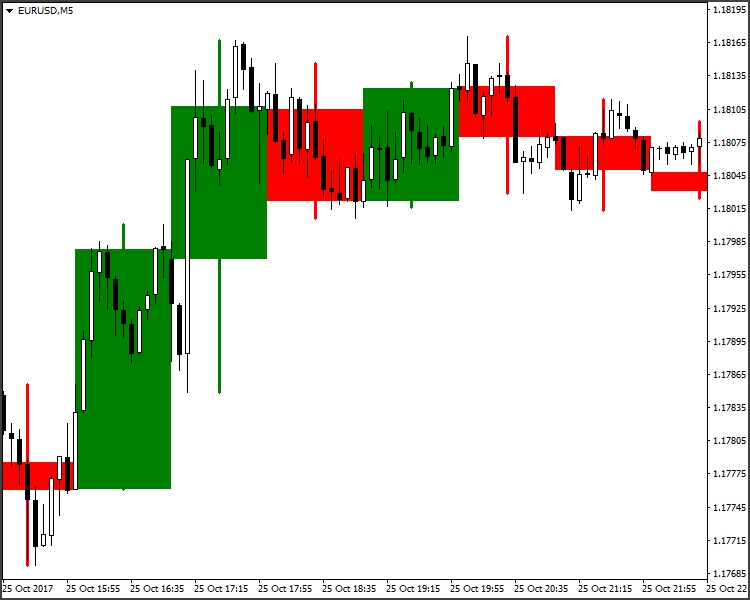

A separate group consists of the so called signal indicators. In order to avoid too many graphical constructions on the working area, the indicator forms signal lines or graphical blocks reflecting the trend direction or other parameters. See the standard MTF_Coral indicator with the above MTF solution:

Fig. 6. Signal indicators

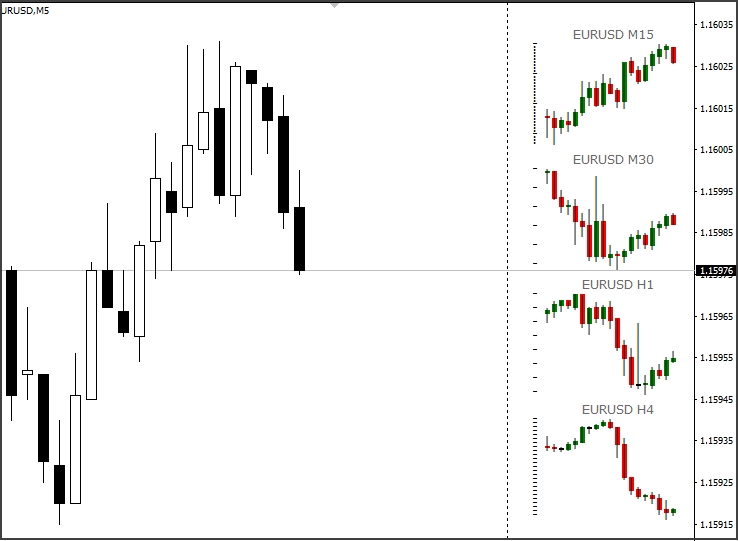

Another group can be called "Window in a window". Charts of different timeframes or indicators are shown within the main chart window.

Fig. 7. "Window in window" indicators

Fig. 7.1. "Window in window" indicator

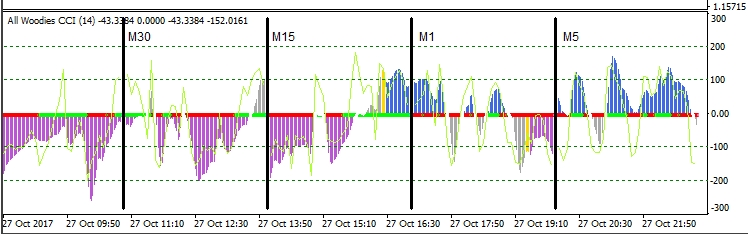

Another example of All_Woodies CCI.

Fig. 7.1. "Window in window" indicator All_Woodies CCI

A separate group includes MTF volatility indicators. These include MTF Candles.

Fig. 8. Volatility indicator MTF Candles

Implementation methods

We have considered the main types of MTF indicators. Now let us view simple examples which show the main methods for linear implementation. We will also analyze the specific features of each solution.

Multiperiod indicators.

Let us consider the MA indicator and try to solve the following task: Create an indicator version with a changing calculation period to show three different TFs.

Let us set the main parameters and our variables:

//---- indicator settings #property indicator_chart_window #property indicator_buffers 3 #property indicator_plots 3 #property indicator_type1 DRAW_LINE #property indicator_type2 DRAW_LINE #property indicator_type3 DRAW_LINE #property indicator_color1 Blue #property indicator_color2 Red #property indicator_color3 Lime #property indicator_width1 1 #property indicator_width2 1 #property indicator_width3 1 //---- input parameters input ENUM_TIMEFRAMES tf1 = 1; // Time Frame (1) input ENUM_TIMEFRAMES tf2 = 5; // Time Frame (2) input ENUM_TIMEFRAMES tf3 = 15; // Time Frame (3) input int maPeriod = 13; // MA period input int Shift = 0; // Shift input ENUM_MA_METHOD InpMAMethod = MODE_SMA; // Moving average method input ENUM_APPLIED_PRICE InpAppliedPrice = PRICE_CLOSE; // Applied price //---- indicator buffers double ExtBuf1[]; double ExtBuf2[]; double ExtBuf3[]; //---- handles for moving averages int ExtHandle1; int ExtHandle2; int ExtHandle3; //--- bars minimum for calculation int ExtBarsMinimum; //--- int period1=0; int period2=0; int period3=0;

Now implement array data with the condition that the TF it is attached to is <= than those specified in variables.

void OnInit() { int timeframe; //---- indicator buffers mapping SetIndexBuffer(0,ExtBuf1,INDICATOR_DATA); SetIndexBuffer(1,ExtBuf2,INDICATOR_DATA); SetIndexBuffer(2,ExtBuf3,INDICATOR_DATA); //--- timeframe =_Period; //--- if(tf1>=timeframe) { period1=maPeriod*(int)MathFloor(tf1/timeframe); PlotIndexSetInteger(0,PLOT_DRAW_BEGIN,period1-1); //sets first bar from what index will be drawn PlotIndexSetInteger(0,PLOT_SHIFT,Shift); //line shifts when drawing PlotIndexSetString(0,PLOT_LABEL,"MA("+string(period1)+")"); //name for DataWindow ExtHandle1=iMA(NULL,0,period1,0,InpMAMethod,InpAppliedPrice); //get MA's handles } //---- if(tf2>=timeframe) { period2=maPeriod*(int)MathFloor(tf2/timeframe); PlotIndexSetInteger(1,PLOT_DRAW_BEGIN,period2-1); //sets first bar from what index will be drawn PlotIndexSetInteger(1,PLOT_SHIFT,Shift); //line shifts when drawing PlotIndexSetString(1,PLOT_LABEL,"MA("+string(period2)+")"); //name for DataWindow ExtHandle2=iMA(NULL,0,period2,0,InpMAMethod,InpAppliedPrice); //get MA's handles } //---- if(tf3>=timeframe) { period3=maPeriod*(int)MathFloor(tf3/timeframe); PlotIndexSetInteger(2,PLOT_DRAW_BEGIN,period3-1); //sets first bar from what index will be drawn PlotIndexSetInteger(2,PLOT_SHIFT,Shift); //line shifts when drawing PlotIndexSetString(2,PLOT_LABEL,"MA("+string(period3)+")"); //name for DataWindow ExtHandle3=iMA(NULL,0,period3,0,InpMAMethod,InpAppliedPrice); //get MA's handles } //--- set accuracy IndicatorSetInteger(INDICATOR_DIGITS,_Digits); //--- bars minimum for calculation int per=MathMax(period3,MathMax(period1,period2)); ExtBarsMinimum=per+Shift; //--- initialization done }

The main loop to check initialization and calculation:

int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[]) { //--- check for rates total if(rates_total<ExtBarsMinimum) return(0); // not enough bars for calculation //--- not all data may be calculated int calculated=BarsCalculated(ExtHandle1); if(calculated<rates_total&&period1!=0) { Print("Not all data of ExtHandle1 is calculated (",calculated,"bars ). Error",GetLastError()); return(0); } calculated=BarsCalculated(ExtHandle2); if(calculated<rates_total&&period2!=0) { Print("Not all data of ExtHandle2 is calculated (",calculated,"bars ). Error",GetLastError()); return(0); } calculated=BarsCalculated(ExtHandle3); if(calculated<rates_total&&period3!=0) { Print("Not all data of ExtHandle3 is calculated (",calculated,"bars ). Error",GetLastError()); return(0); } //--- we can copy not all data int to_copy; if(prev_calculated>rates_total || prev_calculated<0) to_copy=rates_total; else { to_copy=rates_total-prev_calculated; if(prev_calculated>0) to_copy++; } //---- get ma buffers if(IsStopped()) return(0); //Checking for stop flag if(period1!=0) if(CopyBuffer(ExtHandle1,0,0,to_copy,ExtBuf1)<=0) { Print("getting ExtHandle1 is failed! Error",GetLastError()); return(0); } if(IsStopped()) return(0); //Checking for stop flag if(period2!=0) if(CopyBuffer(ExtHandle2,0,0,to_copy,ExtBuf2)<=0) { Print("getting ExtHandle2 is failed! Error",GetLastError()); return(0); } if(IsStopped()) return(0); //Checking for stop flag if(period3!=0) if(CopyBuffer(ExtHandle3,0,0,to_copy,ExtBuf3)<=0) { Print("getting ExtHandle3 is failed! Error",GetLastError()); return(0); } //--- return value of prev_calculated for next call return(rates_total); } //+------------------------------------------------------------------+

Let's look at the result.

Fig. 9. Implementation of an MTF indicator

We have considered the example of using the same indicator in different timeframes using the calculation period increase. With a slight alteration, we can use while providing the possibility to set individual periods for each line. This method may seem inefficient. It is very easy to calculate the period and apply multiple indicators simultaneously. However, in some cases this method is the optimal one despite all its disadvantages. One of them is the necessity to simultaneously observe two (three) non-normalized oscillators in one window. Due to the amplitude range, these oscillators are shifted relative to the center line and thus their interpretation becomes difficult. This method eliminates the above disadvantage.

Multi-timeframe indicators

Instead of the well known MQL4 functions iClose(), iHigh(), iLow(), iOpen(), iTime(), iVolume(), MQL5 provides functions CopyTime(), CopyClose(), CopyHigh(), CopyLow(), CopyOpen(), CopyTime(), CopyVolume(), while functions iCustom, iMA, iCCI, iMACD and others are implemented via CopyBuffer(). Each of them has its advantages and disadvantages. In our case we will only consider MQL5. For our indicator we need the entire list of timeframes from M1 to MN1, i.e. 26 versions. Further, if you need to use several trade symbols or instruments, this number increases many times. In most cases there is no need to copy the entire history. For most of information indicators the number of bars is limited by two. Therefore, in order to prevent the code from becoming too lengthy, it is better to write these commands as separate functions and call them repeatedly.

For the timeseries function CopyClose(), the function will be as follows:

//+------------------------------------------------------------------+ double _iClose(string symbol,int tf,int index) { if(index < 0) return(-1); double buf[]; ENUM_TIMEFRAMES timeframe=TFMigrate(tf); if(CopyClose(symbol,timeframe, index, 1, buf)>0) return(buf[0]); else return(-1); } //+------------------------------------------------------------------+

For WPR call:

//+------------------------------------------------------------------+ double _iWPR(string symbol, int tf, int period, int shift) { ENUM_TIMEFRAMES timeframe=TFMigrate(tf); int handle=iWPR(symbol,timeframe,period); if(handle<0) { Print("The iWPR object not created: Error ",GetLastError()); return(-1); } else return(_CopyBuffer(handle,shift)); } //+------------------------------------------------------------------+ double _CopyBuffer(int handle,int shift) { double buf[]; if(CopyBuffer(handle,0,shift,1,buf)>0) return(buf[0]); return(EMPTY_VALUE); } //+------------------------------------------------------------------+

If there are several lines, _CopyBuffer can be written as follows:

//+------------------------------------------------------------------+ double _CopyBuffer(int handle,int index,int shift) { double buf[]; switch(index) { case 0: if(CopyBuffer(handle,0,shift,1,buf)>0) return(buf[0]); break; case 1: if(CopyBuffer(handle,1,shift,1,buf)>0) return(buf[0]); break; case 2: if(CopyBuffer(handle,2,shift,1,buf)>0) return(buf[0]); break; case 3: if(CopyBuffer(handle,3,shift,1,buf)>0) return(buf[0]); break; case 4: if(CopyBuffer(handle,4,shift,1,buf)>0) return(buf[0]); break; default: break; } return(EMPTY_VALUE); } //+------------------------------------------------------------------+

while the _iWPR function will change the line

return(_CopyBuffer(handle,shift)

to

return(_CopyBuffer(handle,0,shift)

in both cases TFMigrate() will look as follows:

//+------------------------------------------------------------------+ ENUM_TIMEFRAMES TFMigrate(int tf) { switch(tf) { case 0: return(PERIOD_CURRENT); case 1: return(PERIOD_M1); case 5: return(PERIOD_M5); case 15: return(PERIOD_M15); case 30: return(PERIOD_M30); case 60: return(PERIOD_H1); case 240: return(PERIOD_H4); case 1440: return(PERIOD_D1); case 10080: return(PERIOD_W1); case 43200: return(PERIOD_MN1); case 2: return(PERIOD_M2); case 3: return(PERIOD_M3); case 4: return(PERIOD_M4); case 6: return(PERIOD_M6); case 10: return(PERIOD_M10); case 12: return(PERIOD_M12); case 20: return(PERIOD_M20); case 16385: return(PERIOD_H1); case 16386: return(PERIOD_H2); case 16387: return(PERIOD_H3); case 16388: return(PERIOD_H4); case 16390: return(PERIOD_H6); case 16392: return(PERIOD_H8); case 16396: return(PERIOD_H12); case 16408: return(PERIOD_D1); case 32769: return(PERIOD_W1); case 49153: return(PERIOD_MN1); default: return(PERIOD_CURRENT); } } //+------------------------------------------------------------------+

As we have already mentioned, a limited number of elements (bars) is needed for this calculation type. But sometimes it is advisable to calculate the entire history. One has to be careful here. Do not forget that there will be more historical bars on lower TFs than on higher ones. This fact should be taken into account when creating such a tool. The easiest way is to determine the smallest number of bars and use this value for calculation. A more difficult method is to determine this value for each TF separately. Often (especially in information indicators) data are only needed after the close of a bar, so there is no meed to recalculated older TFs at each tick of the lower one. If we provide for this aspect in our development, this will significantly reduce the code complexity.

The development of informational indicators (Fig. 1, Fig. 2, Fig. 3) does not differ from the development of classical indicators, therefore let us proceed immediately to the class of graphical indicators, which is the most interesting one in my opinion. Informational indicators only need the current data on the market state and on the used symbols, graphical indicators have additional requirements for the graphics. The M5 period is formed of 5 M1 bars, M15 is formed of three 5 bars, etc. That is, when a line is formed on M5, a line from M15 is drawn during three bars. The line position is not fixed and can be change until the М15 candlestick is closed. Therefore we need to bind the formation to the candlestick opening time. Let us implement this using the example of MA.

//---- indicator settings #property indicator_chart_window #property indicator_buffers 1 #property indicator_plots 1 #property indicator_type1 DRAW_LINE #property indicator_color1 Blue #property indicator_width1 1 //---- input parameters input ENUM_TIMEFRAMES tf = 5; // Time Frame input int maPeriod = 13; // MA period input int Shift = 0; // Shift input ENUM_MA_METHOD InpMAMethod = MODE_SMA; // Moving average method input ENUM_APPLIED_PRICE InpAppliedPrice = PRICE_CLOSE; // Applied price input int Bars_Calculated = 500; //---- indicator buffers double ExtMA[]; //---- handles for moving averages int MA_Handle; //--- bars minimum for calculation int ExtBarsMinimum; ENUM_TIMEFRAMES _tf; int pf; //--- we will keep the number of values in the Moving Average indicator int bars_calculated=0; //+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int OnInit() { _tf=tf; ENUM_TIMEFRAMES timeframe; int draw_shift=Shift;// initial value PLOT_SHIFT int draw_begin=maPeriod;// initial value PLOT_DRAW_BEGIN //--- timeframe=_Period; if(_tf<=timeframe)_tf=timeframe;// if the TF is less than or is equal to the current one, set it to PERIOD_CURRENT pf=(int)MathFloor(_tf/timeframe);// calculate coefficient for PLOT_DRAW_BEGIN, PLOT_SHIFT and the number of calculation bars. draw_begin=maPeriod*pf;// calculate PLOT_DRAW_BEGIN draw_shift=Shift*pf;// calculate PLOT_SHIFT //---- indicator buffers mapping SetIndexBuffer(0,ExtMA,INDICATOR_DATA); //--- PlotIndexSetInteger(0,PLOT_DRAW_BEGIN,draw_begin-pf); //sets first bar from what index will be drawn PlotIndexSetInteger(0,PLOT_SHIFT,draw_shift); //line shifts when drawing PlotIndexSetString(0,PLOT_LABEL,"MA("+string(tf)+" "+string(maPeriod)+")");//name for DataWindow //--- MA_Handle=iMA(NULL,_tf,maPeriod,0,InpMAMethod,InpAppliedPrice); //get MA's handles if(MA_Handle==INVALID_HANDLE) { Print("getting MA Handle is failed! Error",GetLastError()); return(INIT_FAILED); } //--- set accuracy IndicatorSetInteger(INDICATOR_DIGITS,_Digits); //--- bars minimum for calculation ExtBarsMinimum=draw_begin+draw_shift;// calculate the minimum required number of bars for the calculation //--- initialization done return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Custom indicator iteration function | //+------------------------------------------------------------------+ int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[]) { //--- check for rates total if(rates_total<ExtBarsMinimum) return(0); // not enough bars for calculation int limit; //--- apply timeseries indexing to array elements ArraySetAsSeries(time,true); ArraySetAsSeries(ExtMA,true); //--- detect start position //--- calculations of the necessary amount of data to be copied //--- and the 'limit' starting index for the bars recalculation loop if(prev_calculated>rates_total || prev_calculated<=0|| calculated!=bars_calculated)// checking for the first start of the indicator calculation { limit=rates_total-ExtBarsMinimum-1; // starting index for calculation of all bars } else { limit=(rates_total-prev_calculated)+pf+1; // starting index for calculation of new bars } if(Bars_Calculated!=0) limit=MathMin(Bars_Calculated,limit);

We will not search by the bar index (iBarShift()), but will directly copy values by time.

//--- main cycle for(int i=limit;i>=0 && !IsStopped();i--) { ExtMA[i]=_CopyBuffer(MA_Handle,time[i]); } //--- bars_calculated=calculated; Use here the above mentioned function. //+--------- CopyBuffer MA Handle ----------------------------------+ double _CopyBuffer(int handle,datetime start_time) { double buf[]; if(CopyBuffer(handle,0,start_time,1,buf)>0) return(buf[0]); return(EMPTY_VALUE); } //+-------------------- END -----------------------------------------+

Here is the result:

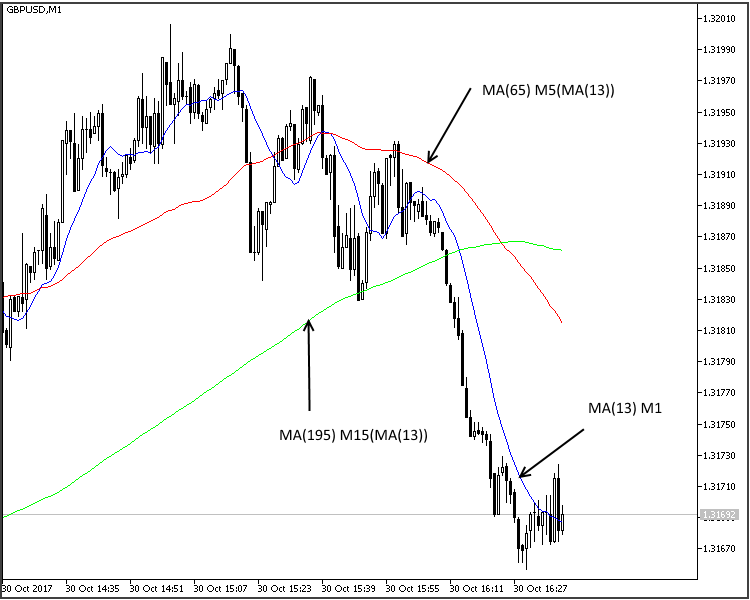

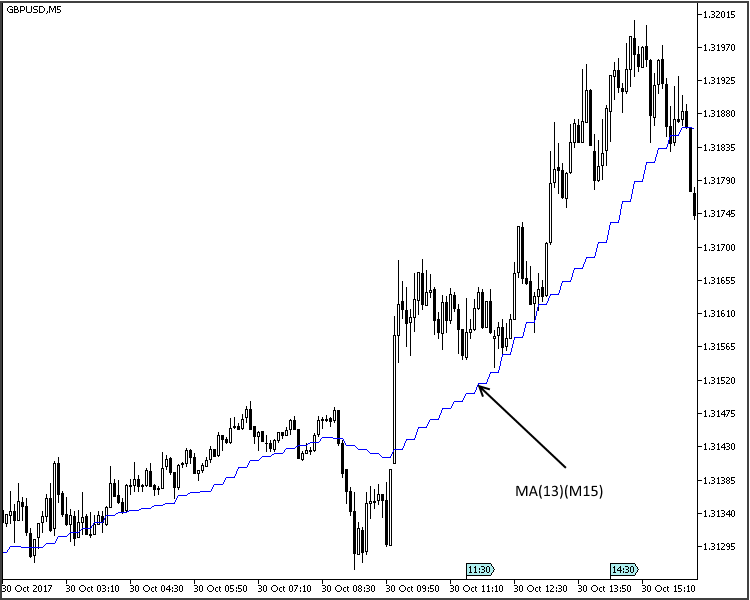

Fig. 10. MTF indicator line

This method can be used for all types of linear indicators. The main disadvantage is obvious from the above screenshot: the steps. For MA such a behavior is not a problem and can even be useful, as this enables clear defining of support and resistance levels. But for oscillators in which we use patterns, this behavior hinders identification and drawing of such patterns. Moreover, the solution is unacceptable for WPR, CCI and similar indicators, as the line appearance changes beyond recognition.

To solve this problem, the last bar should be calculated taking into account the weighting factors. Let's add the 'Interpolate' global variable, which allows using both solutions.

input bool Interpolate = true; //--- main cycle for(int i=limit;i>=0 && !IsStopped();i--) { int n; datetime t=time[i]; ExtMA[i]=_CopyBuffer(MA_Handle,t); if(!Interpolate) continue; //--- datetime times= _iTime(t); for(n = 1; i+n<rates_total && time[i+n]>= times; n++) continue; double factor=1.0/n; for(int k=1; k<n; k++) ExtMA[i+k]=k*factor*ExtMA[i+n]+(1.0-k*factor)*ExtMA[i]; } //---

In this variant we need to add the _iTime function, which will determine the bar number based in the opening time, for the current chart.

//+------------------------------------------------------------------+ datetime _iTime(datetime start_time) { if(start_time < 0) return(-1); datetime Arr[]; if(CopyTime(NULL,_tf, start_time, 1, Arr)>0) return(Arr[0]); else return(-1); } //+------------------------------------------------------------------+

This looks like a normal line now.

Fig. 11. MTF indicator line with _iTime

Though development of such complex and resource intensive systems may seem inappropriate, they have their disadvantages and even can be indispensable. If classical averaging is used (MA, Alligator etc.), calculation period increase may lead to some delay compared to the MTF version. This is especially noticeable with small periods.

Fig. 12. Lagging in the MTF MA indicator

Fig. 13. Lagging in the MTF Stochastic indicator

For simple indicators, such as MAs and Alligator, this may not be so significant. But for complex systems consisting of two or more MAs, such MACD, AO, etc. this can be significant. Moreover, there is no possibility to change the averaging period for AO or AC. As for indicators with a non-smoothing line (WPR, CCI, etc.) a trivial increase of the calculation period cannot provide a satisfactory result as they are very noisy.

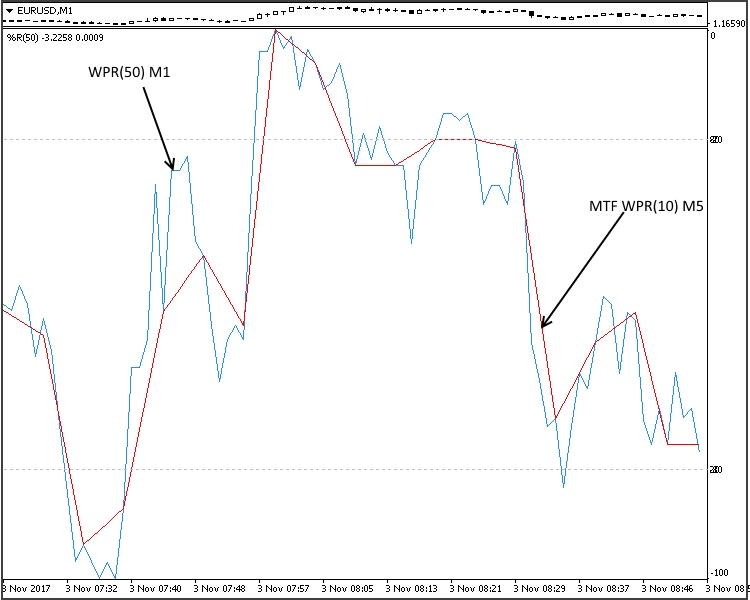

Fig. 14. MTF indicator WRP

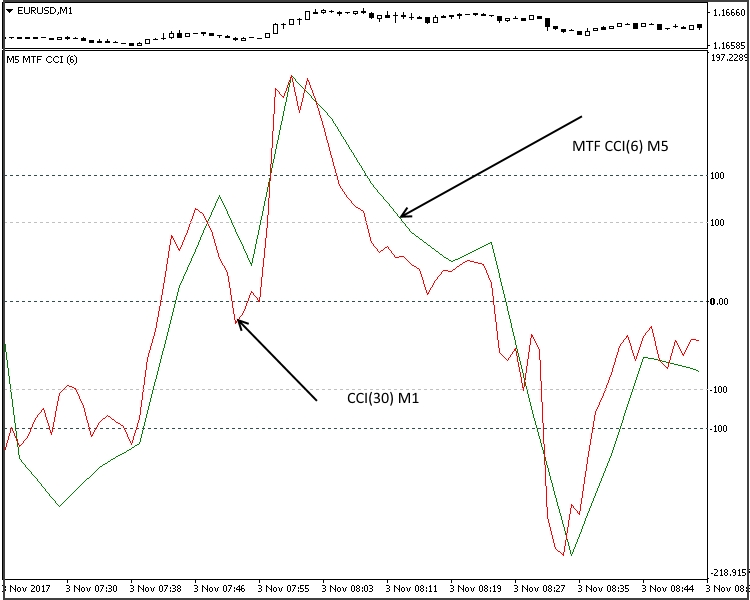

Fig. 15. MTF indicaor CCI

Figures 14-15 show that they can be successfully used for smoothing, when this possibility is not provided for in the algorithm.

In addition to its direct function, this type can compensate for the shortcomings of the visual testing mode in MetaTrader 5 Strategy Tester. When creating MTF Expert Advisors for trading or analyzing the effectiveness of this type of strategy, we cannot simultaneously observe the position of indicators from different TFs on the screen. After testing we receive a set of tabs, depending on the number of periods used. Let us view the example of the "Three Elder screens" strategy from the article MQL5 Cookbook: Developing a Framework for a Trading System Based on the Triple Screen Strategy by Anatoli Kazharski. The idea of the strategy is as follows: the first timeframe is the largest one, such as weekly, daily or 4-hour. It is used to determine the main trend. The second timeframe differs from the first one by 1 or 2 orders. It is used to determine correction. The third timeframe differs by one more order. It is used to determine the optimal entry point.

In the first screen, which is usually M30-W1, launch MACD (12,26,1) and EMA with a period of 13. In the second screen, М5-D1, launch Stochastic Oscillator (5,3,3). The third screen from M1 to H4 is used for placing Stop orders in the main trend direction.

Fig. 16. Elder's Three screens

The article author did not stick to this variant, but the concept of "Three screens" was preserved. What we see during the testing process and after it:

Fig. 17. Testing of Elder's Three screen strategy

This variant does not allow us to properly analyze the operation of the expert Advisor (strategy).

Let's create our own EA version using our tools. It will be close to the classical strategy version. Creation of Expert Advisors based on the above indicators is very similar to classical EAs. Here is the main code.

#define EXPERT_MAGIC 1234502 //--- #include <Trade\Trade.mqh> #include <Trade\SymbolInfo.mqh> #include <Trade\PositionInfo.mqh> #include <Trade\AccountInfo.mqh> #include <Trade\OrderInfo.mqh> //+------------------------------------------------------------------+ enum compTF { A, //m1-m5-m15 B, //m5-m15-h1 C, //m15-h1-h4 E //h1-h4-d1 }; //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ input string s0="//--- input parameters Lots+Trailing ---//"; input double InpLots =0.1; // Lots input int InpTakeProfit =150; // Take Profit (in pips) input int InpStopLoss =60; // StopLoss (in pips) input int InpLevel_S =20; // Level Signal input compTF InpTFreg =2; input string s1="//--- input parameters MA ---//"; input int Signal_MA_PeriodMA =21; // Period of averaging input string s2="//--- input parameters MACD ---//"; input int Signal_MACD_PeriodFast =12; // Period of fast EMA input int Signal_MACD_PeriodSlow =26; // Period of slow EMA input string s3="//--- input parameters Stochastic ---//"; input int Signal_Stoch_PeriodK =5; // K-period input int Signal_Stoch_PeriodD =3; // D-period input string s4="//--- input parameters Trailing ---//"; //--- inputs for trailing input int InpTrailingStop =25; // Trailing Stop Level (in pips) input int InpOffset =5; // Distance from the price (in pips) //--- int ExtTimeOut=10; // time interval between trading operations in seconds int barsCalculated=3; datetime t=0; datetime time[]; //+------------------------------------------------------------------+ //| AC Sample expert class | //+------------------------------------------------------------------+ class CSampleExpert { protected: double m_adjusted_point; // 3- or 5-digit value CTrade m_trade; // trading object CSymbolInfo m_symbol; // symbol information CPositionInfo m_position; // trading position CAccountInfo m_account; // account information COrderInfo m_order; // order information //--- indicators ENUM_TIMEFRAMES mas_tf[3]; // array of timeframes int handle_MACD; // MACD indicator handle int handle_MA; // MA indicator handle int handle_Stochastic; // Stochastic indicator handle //--- indicator buffers double macd_buff[]; // MACD indicator main buffer double ma_buff[]; // MA indicator main buffer double stoch_buff[]; // Stochastic indicator main buffer //--- double close[]; double open[]; double low[]; double high[]; //--- indicator data to process double macd_ind_0; double macd_ind_1; double ma_ind; double stoch_ind_0; double stoch_ind_1; int level_stoch; //--- trailing stop data to process double m_traling_stop; double m_take_profit; double m_stop_losse; public: CSampleExpert(void); ~CSampleExpert(void); bool Init(void); void Deinit(void); bool Processing(void); protected: bool InitCheckParameters(const int digits_adjust); bool Copy(void); // bool InitIndicators(void); bool LongModified(void); bool ShortModified(void); bool LongOpened(void); // check Long condition bool ShortOpened(void); // check Short condition bool OpenSellStop(void); // place the SELLSTOP order bool OpenBuyStop(void); // place the BUYSTOP order bool OrderModifySellStop(void); // modify the SELLSTOP order bool OrderModifyBuyStop(void); // modify the BUYSTOP order bool DellSellStop(void); // delete the SELLSTOP order bool DellBuyStop(void); // delete the BUYSTOP order }; //--- global expert CSampleExpert ExtExpert; //+------------------------------------------------------------------+ //| Constructor | //+------------------------------------------------------------------+ CSampleExpert::CSampleExpert(void) : m_adjusted_point(0), handle_MACD(INVALID_HANDLE), handle_Stochastic(INVALID_HANDLE), handle_MA(INVALID_HANDLE), macd_ind_0(0), macd_ind_1(0), stoch_ind_0(0), stoch_ind_1(0), ma_ind(0), m_traling_stop(0), m_take_profit(0) { ArraySetAsSeries(macd_buff,true); } //+------------------------------------------------------------------+ //| Destructor | //+------------------------------------------------------------------+ CSampleExpert::~CSampleExpert(void) { } //+------------------------------------------------------------------+ //| Initialization and verification of input parameters | //+------------------------------------------------------------------+ bool CSampleExpert::Init(void) { //--- initializing general information m_symbol.Name(Symbol()); // symbol m_trade.SetExpertMagicNumber(EXPERT_MAGIC); // magic m_trade.SetMarginMode(); m_trade.SetTypeFillingBySymbol(Symbol()); //--- tuning for 3 or 5 digits int digits_adjust=1; if(m_symbol.Digits()==3 || m_symbol.Digits()==5) digits_adjust=10; m_adjusted_point=m_symbol.Point()*digits_adjust; //--- setting the default deviation for trading m_traling_stop =InpTrailingStop*m_adjusted_point; m_take_profit =InpTakeProfit*m_adjusted_point; m_stop_losse =InpStopLoss*m_adjusted_point; //--- set default deviation for trading in adjusted points m_trade.SetDeviationInPoints(3*digits_adjust); //--- int x=InpTFreg; switch(x) { case 0: {mas_tf[0]=PERIOD_M1;mas_tf[1]=PERIOD_M5;mas_tf[2]=PERIOD_M15;} break; case 1: {mas_tf[0]=PERIOD_M5;mas_tf[1]=PERIOD_M15;mas_tf[2]=PERIOD_H1;} break; case 2: {mas_tf[0]=PERIOD_M15;mas_tf[1]=PERIOD_H1;mas_tf[2]=PERIOD_H4;} break; case 3: {mas_tf[0]=PERIOD_H1;mas_tf[1]=PERIOD_H4;mas_tf[2]=PERIOD_D1;} break; } //--- if(!InitCheckParameters(digits_adjust)) return(false); if(!InitIndicators()) return(false); //--- result return(true); } //+------------------------------------------------------------------+ //| Verification of input parameters | //+------------------------------------------------------------------+ bool CSampleExpert::InitCheckParameters(const int digits_adjust) { //--- checking source data if(InpTakeProfit*digits_adjust<m_symbol.StopsLevel()) { printf("Take Profit must be greater than %d",m_symbol.StopsLevel()); return(false); } if(InpTrailingStop*digits_adjust<m_symbol.StopsLevel()) { printf("Trailing Stop must be greater than %d",m_symbol.StopsLevel()); return(false); } //--- checking the lot value if(InpLots<m_symbol.LotsMin() || InpLots>m_symbol.LotsMax()) { printf("Lots must be in the range between %f and %f",m_symbol.LotsMin(),m_symbol.LotsMax()); return(false); } if(MathAbs(InpLots/m_symbol.LotsStep()-MathRound(InpLots/m_symbol.LotsStep()))>1.0E-10) { printf("The amount does not correspond to the lot step %f",m_symbol.LotsStep()); return(false); } //--- warning if(InpTakeProfit<=InpTrailingStop) printf("Warning: Trailing Stop must be less than Take Profit"); //--- result return(true); } //+------------------------------------------------------------------+ //| Initialization of indicators | //+------------------------------------------------------------------+ bool CSampleExpert::InitIndicators(void) { //--- create the MACD indicator if(handle_MACD==INVALID_HANDLE) { //--- handle_MACD=iCustom(NULL,0,"MTF\\Oscillators\\MTF_MACD",mas_tf[2],Signal_MACD_PeriodFast,Signal_MACD_PeriodSlow); //--- if(handle_MACD==INVALID_HANDLE) { printf("Error occurred while creating MACD"); return(false); } } //--- create the MA indicator if(handle_MA==INVALID_HANDLE) { //--- handle_MA=iCustom(NULL,0,"MTF\\Trend\\MA_MultiTF",mas_tf[2],Signal_MA_PeriodMA,0,MODE_EMA,PRICE_CLOSE); //--- if(handle_MA==INVALID_HANDLE) { printf("Error occurred while creating MA"); return(false); } } //--- create the Stochastic indicator if(handle_Stochastic==INVALID_HANDLE) { //--- handle_Stochastic=iCustom(NULL,0,"MTF\\Oscillators\\MTF_Stochastic",mas_tf[1],Signal_Stoch_PeriodK,Signal_Stoch_PeriodD); //--- if(handle_Stochastic==INVALID_HANDLE) { printf("Error occurred while creating Stochastic"); return(false); } } //--- result return(true); } //+------------------------------------------------------------------+ //| Modifying the long position | //+------------------------------------------------------------------+ bool CSampleExpert::LongModified(void) { bool res=false; //--- checking the trailing stop if(InpTrailingStop>0) { if(m_symbol.Bid()-m_position.PriceOpen()>m_adjusted_point*InpTrailingStop) { double sl=NormalizeDouble(m_symbol.Bid()-m_traling_stop,m_symbol.Digits()); double tp=m_position.TakeProfit(); if(m_position.StopLoss()<sl || m_position.StopLoss()==0.0) { //--- modifying the position if(m_trade.PositionModify(Symbol(),sl,tp)) printf("Long position by %s to be modified",Symbol()); else { printf("Error modifying position by %s : '%s'",Symbol(),m_trade.ResultComment()); printf("Modify parameters : SL=%f,TP=%f",sl,tp); } //--- was modified and must exit the Expert Advisor res=true; } } } //--- result return(res); } //+------------------------------------------------------------------+ //| Modifying the short position | //+------------------------------------------------------------------+ bool CSampleExpert::ShortModified(void) { bool res=false; //--- checking the trailing stop if(InpTrailingStop>0) { if((m_position.PriceOpen()-m_symbol.Ask())>(m_adjusted_point*InpTrailingStop)) { double sl=NormalizeDouble(m_symbol.Ask()+m_traling_stop,m_symbol.Digits()); double tp=m_position.TakeProfit(); if(m_position.StopLoss()>sl || m_position.StopLoss()==0.0) { //--- modifying the position if(m_trade.PositionModify(Symbol(),sl,tp)) printf("Short position by %s to be modified",Symbol()); else { printf("Error modifying position by %s : '%s'",Symbol(),m_trade.ResultComment()); printf("Modify parameters : SL=%f,TP=%f",sl,tp); } //--- was modified and must exit the Expert Advisor res=true; } } } //--- result return(res); } //+------------------------------------------------------------------+ //| Checking conditions for opening a long position | //+------------------------------------------------------------------+ bool CSampleExpert::LongOpened(void) { bool res=false; level_stoch=InpLevel_S; //--- checking the possibility to open a long (BUY) position if(stoch_ind_1<level_stoch && stoch_ind_0>level_stoch && macd_ind_1>macd_ind_0 && ma_ind<close[1] && ma_ind<open[1])//&& ma_ind<close[1] && ma_ind<open[1] { //--- exit the EA res=true; } //--- result return(res); } //+------------------------------------------------------------------+ //| Opening a Buy Stop order | //+------------------------------------------------------------------+ bool CSampleExpert::OpenBuyStop(void) { bool res=false; double tp=0,sl=0; //--- if(LongOpened()) { res=true; //--- declare and initialize the trade request and result MqlTradeRequest request={0}; MqlTradeResult result={0}; //--- pending order placing parameters request.action =TRADE_ACTION_PENDING; // trading operation type request.symbol =Symbol(); // symbol request.deviation=5; // allowed deviation from the price request.volume =InpLots; // volume in lots request.magic =EXPERT_MAGIC; // order MagicNumber double offset=InpOffset; // point distance from the current price to place the order double price; // order trigger price double point=SymbolInfoDouble(_Symbol,SYMBOL_POINT); // point size int digits=(int)SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); // number of decimal places (digits) //--- operation type request.type=ORDER_TYPE_BUY_STOP; // order type price=high[1]+offset*m_adjusted_point; // open price request.price=NormalizeDouble(price,digits); // normalized open price tp=price+m_take_profit; sl=price-m_stop_losse; request.sl =NormalizeDouble(sl,_Digits); // add the new Stop Loss value to the structure request.tp =NormalizeDouble(tp,_Digits); // add the new Take Profit value to the structure //--- sending a request if(!OrderSend(request,result)) {res=false;printf("OrderSend error %d",GetLastError());} // if unable to send the request, output the error code //--- information about the operation printf("retcode=%u deal=%I64u order=%I64u",result.retcode,result.deal,result.order); //--- exit the EA } //--- result return(res); } //+------------------------------------------------------------------+ //| Checking conditions for opening a short position | //+------------------------------------------------------------------+ bool CSampleExpert::ShortOpened(void) { bool res=false; level_stoch=100-InpLevel_S; //--- checking the possibility of a short position (SELL) if(stoch_ind_1>level_stoch && stoch_ind_0<level_stoch && macd_ind_1<macd_ind_0 && ma_ind>close[1] && ma_ind>open[1]) { //--- exit the EA res=true; } //--- result return(res); } //+------------------------------------------------------------------+ //| Opening a Sell Stop order | //+------------------------------------------------------------------+ bool CSampleExpert::OpenSellStop(void) { bool res=false; double tp=0,sl=0; //--- if(ShortOpened()) { res=true; //--- declare and initialize the trade request and result MqlTradeRequest request={0}; MqlTradeResult result={0}; //--- pending order placing parameters request.action =TRADE_ACTION_PENDING; // trading operation type request.symbol =Symbol(); // symbol request.deviation=5; // allowed deviation from the price request.volume=InpLots; // volume in lots request.magic=EXPERT_MAGIC; // order MagicNumber int offset=InpOffset; // point distance from the current price to place the order double price; // order trigger price int digits=(int)SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); // number of decimal places (digits) request.type=ORDER_TYPE_SELL_STOP; // order type price=low[1]-offset*m_adjusted_point; // open price request.price=NormalizeDouble(price,digits); // normalized open price tp=price-m_take_profit; sl=price+m_stop_losse; request.sl =NormalizeDouble(sl,_Digits); // add the new Stop Loss value to the structure request.tp =NormalizeDouble(tp,_Digits); // add the new Take Profit value to the structure //--- sending a request if(!OrderSend(request,result)) {res=false;printf("OrderSend error %d",GetLastError());} // if unable to send the request, output the error code //--- information about the operation printf("retcode=%u deal=%I64u order=%I64u",result.retcode,result.deal,result.order); //--- exit the EA } //--- result return(res); } //+------------------------------------------------------------------+ //| The main function returns true if any of the positions | //| is being processed | //+------------------------------------------------------------------+ bool CSampleExpert::Processing(void) { // MqlDateTime dt; //--- Update frequency if(!m_symbol.RefreshRates()) return(false); //--- Update indicators if(BarsCalculated(handle_Stochastic)<barsCalculated) return(false); if(CopyBuffer(handle_Stochastic,0,0,barsCalculated,stoch_buff)!=barsCalculated) return(false); //--- if(BarsCalculated(handle_MACD)<barsCalculated) return(false); if(CopyBuffer(handle_MACD,0,0,barsCalculated,macd_buff)!=barsCalculated) return(false); //--- if(BarsCalculated(handle_MA)<barsCalculated) return(false); if(CopyBuffer(handle_MA,0,0,barsCalculated,ma_buff)!=barsCalculated) return(false); //--- if(!Copy())return(false); //--- to simplify programming and provide a faster access //--- data are located in internal variables macd_ind_0 = macd_buff[1]; macd_ind_1 = macd_buff[0]; ma_ind = ma_buff[1]; stoch_ind_0 = stoch_buff[1]; stoch_ind_1 = stoch_buff[0]; //--- it is important to correctly exit it ... //--- First check if the position exists - try to select it bool bord=false,sord=false; ulong ticket; //+--- There are open positions and trailing stop is enabled --------+ if(m_position.Select(Symbol()) && PositionsTotal()>0 && m_traling_stop!=0) { if(m_position.PositionType()==POSITION_TYPE_BUY) { bord=true; //--- modifying the long position if(LongModified()) return(true); } else { sord=true; //--- modifying the short position if(ShortModified()) return(true); } } //+--------- trading STOP orders ------------------------------------+ // In this cycle, check all placed pending orders one by one for(int i=0;i<OrdersTotal();i++) { // select each of orders and getting its ticket ticket=OrderGetTicket(i); // handling Buy Stop orders if(m_order.OrderType()==ORDER_TYPE_BUY_STOP) { // setting the flag indicating that there is a Buy Stop order bord=true; //--- It is important to enter the market correctly, move the order if necessary if(bord)OrderModifyBuyStop(); // modify the BUYSTOP order } // handling Sell Stop orders if(m_order.OrderType()==ORDER_TYPE_SELL_STOP) { // setting the flag indicating that there is a Sell Stop order sord=true; //--- It is important to enter the market correctly, move the order if necessary if(sord)OrderModifySellStop(); // modify the SELLSTOP order } } //--- If there are no orders, place --------------------------------+ if(!sord)if(OpenSellStop()){sord=true;return(true);} if(!bord)if(OpenBuyStop()){bord=true;return(true);} //--- exit without position handling return(false); } //+------------------------------------------------------------------+ //|Changing parameters of the earlier placed Sell Stop trading order | //+------------------------------------------------------------------+ bool CSampleExpert::OrderModifySellStop(void) { bool res=true; ulong ticket; double tp=0,sl=0; double offset=InpOffset; // point distance from the current price to place the order double price; // order trigger price int digits=(int)SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); // number of decimal places (digits) // declare and initialize the trade request and result MqlTradeRequest request={0}; MqlTradeResult result={0}; int total=OrdersTotal(); // number of pending orders //--- iterate over all placed pending orders for(int i=total-1; i>=0; i--) { // select each of orders and getting its ticket ticket=OrderGetTicket(i); // handling Sell Stop orders if(m_order.OrderType()==ORDER_TYPE_SELL_STOP) { ulong magic=OrderGetInteger(ORDER_MAGIC); // order MagicNumber //--- if MagicNumber matches if(magic==EXPERT_MAGIC) { price=low[1]-offset*m_adjusted_point; // open price if(price>m_order.PriceOpen()) // check the conditions if(low[1]>low[2]) // check the conditions { request.action=TRADE_ACTION_MODIFY; // trading operation type request.order = OrderGetTicket(i); // order ticket request.symbol =Symbol(); // symbol request.deviation=InpOffset; // allowed deviation from the price price=low[1]-offset*m_adjusted_point; // open price request.price=NormalizeDouble(price,digits); // normalized open price tp=price-m_take_profit; sl=price+m_stop_losse; request.sl =NormalizeDouble(sl,_Digits); // add the new Stop Loss value to the structure request.tp =NormalizeDouble(tp,_Digits); // add the new Take Profit value to the structure //--- sending a request if(!OrderSend(request,result)) { // setting the flag indicating that the Sell Stop order has not been deleted res=true; printf("OrderSend error %d",GetLastError()); } // if unable to send the request, output the error code //--- information about the operation printf("retcode=%u deal=%I64u order=%I64u",result.retcode,result.deal,result.order); } } } } return(res); } //+------------------------------------------------------------------+ //|Changing parameters of the earlier placed Buy Stop trading order | //+------------------------------------------------------------------+ bool CSampleExpert::OrderModifyBuyStop(void) { bool res=true; ulong ticket; double tp=0,sl=0; double offset=InpOffset; // point distance from the current price to place the order double price; // order trigger price int digits=(int)SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); // number of decimal places (digits) //--- declare and initialize the trade request and result MqlTradeRequest request={0}; MqlTradeResult result={0}; int total=OrdersTotal(); // number of pending orders //--- iterate over all placed pending orders for(int i=total-1; i>=0; i--) { // select each of orders and getting its ticket ticket=OrderGetTicket(i); // handling Buy Stop orders if(m_order.OrderType()==ORDER_TYPE_BUY_STOP) { ulong magic=OrderGetInteger(ORDER_MAGIC); // order MagicNumber //--- if MagicNumber matches if(magic==EXPERT_MAGIC) { price=high[1]+offset*m_adjusted_point; // open price if(price<m_order.PriceOpen()) // check the conditions { request.action=TRADE_ACTION_MODIFY; // trading operation type request.symbol =Symbol(); // symbol request.action=TRADE_ACTION_MODIFY; // trading operation type request.order = OrderGetTicket(i); // order ticket request.symbol =Symbol(); // symbol request.deviation=InpOffset; // allowed deviation from the price //--- set the price level, take profit and stop loss request.price=NormalizeDouble(price,digits); // normalized open price tp=price+m_take_profit; sl=price-m_stop_losse; request.sl =NormalizeDouble(sl,_Digits); // add the new Stop Loss value to the structure request.tp =NormalizeDouble(tp,_Digits); // add the new Take Profit value to the structure //--- sending a request if(!OrderSend(request,result)) { // setting the flag indicating that the Buy Stop order has not been deleted res=true; printf("OrderSend error %d",GetLastError()); } // if unable to send the request, output the error code //--- information about the operation printf("retcode=%u deal=%I64u order=%I64u",result.retcode,result.deal,result.order); } } } } return(res); } //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit(void) { //--- creating all required object if(!ExtExpert.Init()) return(INIT_FAILED); //--- ok return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Tick processing function | //+------------------------------------------------------------------+ void OnTick(void) { static datetime limit_time=0; // the last trade processing time + timeout //--- do not handle is timeout if(TimeCurrent()>=limit_time) { //--- checking data if(Bars(Symbol(),Period())>barsCalculated) { //--- checking the limit time in terms of timeout in seconds, if processed if(ExtExpert.Processing()) limit_time=TimeCurrent()+ExtTimeOut; } } } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ bool CSampleExpert::Copy(void) { //--- amount to copy int copied=3; //--- ArrayResize(high,copied); ArrayResize(low,copied); ArrayResize(close,copied); ArrayResize(open,copied); //+------- Setting the array indexing direction ---------------------+ ArraySetAsSeries(high,true); ArraySetAsSeries(low,true); ArraySetAsSeries(close,true); ArraySetAsSeries(open,true); //--- copying bar prices if(CopyHigh(NULL,mas_tf[0],0,copied,high)<0) {printf("No copied High",GetLastError());return(false);} //--- if(CopyLow(NULL,mas_tf[0],0,copied,low)<0) {printf("No copied Low",GetLastError());return(false);} //--- if(CopyClose(NULL,mas_tf[2],0,copied,close)<0) {printf("No copied Close",GetLastError());return(false);} //--- if(CopyOpen(NULL,mas_tf[2],0,copied,open)<0) {printf("No copied Open",GetLastError());return(false);} //--- return(true); } //+------------------------------------------------------------------+

The use of this EA is much more convenient:

Fig. 18. EA testing with the implemented MTF tools

Conclusion

Although the authors of the MQL5 software modules do not provide for the direct possibility to create such algorithms, these indicators can be very useful. In some cases, they enable the simultaneous market state analysis at different TFs, improvement of the strategy tester efficiency and the improvement of the smoothing. The presented code examples may have disadvantages, so there are a lot of opportunities for further development of the MTF indicator idea using the MQL5 programming language.

Attachments

| Name | Type | Location |

|---|---|---|

| MA_MultiPeriod | Trend | MQL5\Indicators\MA_MultiPeriod.mq5 |

| MA_MultiTF | Trend | MQL5\Indicators\MTF\Trend\MA_MultiTF.mq5 |

| MTF_BB | Trend | MQL5\Indicators\MTF\Trend\MTF_BB.mq5 |

| MTF_Envelopes | Trend | MQL5\Indicators\MTF\Trend\MTF_Envelopes.mq5 |

| MTF_ParabolicSAR | Trend | MQL5\Indicators\MTF\Trend\MTF_ParabolicSAR.mq5 |

| MTF_StdDev | Trend | MQL5\Indicators\MTF\Trend\MTF_StdDev.mq5 |

| MTF_CCI | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_CCI.mq5 |

| MTF_Force_Index | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_Force_Index.mq5 |

| MTF_MACD | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_MACD.mq5 |

| MTF_Momentum | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_Momentum.mq5 |

| MTF_RSI | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_RSI.mq5 |

| MTF_RVI | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_RVI.mq5 |

| MTF_Stochastic | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_Stochastic.mq5 |

| MTF_WPR | Oscillators | MQL5\Indicators\MTF\Oscillators\MTF_WPR.mq5 |

| Triple Screen Trading System 1.0 | Expert Advisor |

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/2837

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Using MATLAB 2018 computational capabilities in MetaTrader 5

Using MATLAB 2018 computational capabilities in MetaTrader 5

A DLL for MQL5 in 10 Minutes (Part II): Creating with Visual Studio 2017

A DLL for MQL5 in 10 Minutes (Part II): Creating with Visual Studio 2017

Extracting structured data from HTML pages using CSS selectors

Extracting structured data from HTML pages using CSS selectors

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Can you send me the link to the first indicator in your article?

It's attached.

Hello,

error in code when i compile it:

cannot convert 0 to enum 'ENUM_TRADE_REQUEST_ACTIONS' Triple Screen Trading System 1.0.mq5 406 32

cannot convert 0 to enum 'ENUM_TRADE_REQUEST_ACTIONS' Triple Screen Trading System 1.0.mq5 348 32

cannot convert 0 to enum 'ENUM_TRADE_REQUEST_ACTIONS' Triple Screen Trading System 1.0.mq5 532 29

Can you please correct it ?

Hello,

error in code when i compile it:

cannot convert 0 to enum 'ENUM_TRADE_REQUEST_ACTIONS' Triple Screen Trading System 1.0.mq5 406 32

.....

Can you please correct it ?

Hi,

Thank you very much for this article on MTF, it has been super useful.

One thing I noted however, is that when I load the indicator (say in the 1m chart) for the first time, it loads fine. If I change the TF to 5 minutes I get this error:

The strange thing, is that if I load any other indicator, the indicator of the MA_MultiTF in 5M will appear just fine. Do you know how to fix this behavior?