+111,986 USD: Will the U.S. CPI Trigger a Big Move? Strategy Ahead of the September FOMC

+111,986 USD: Will the U.S. CPI Trigger a Big Move? Strategy Ahead of the September FOMC

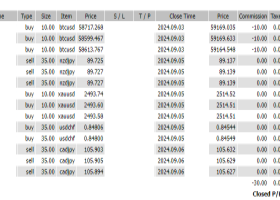

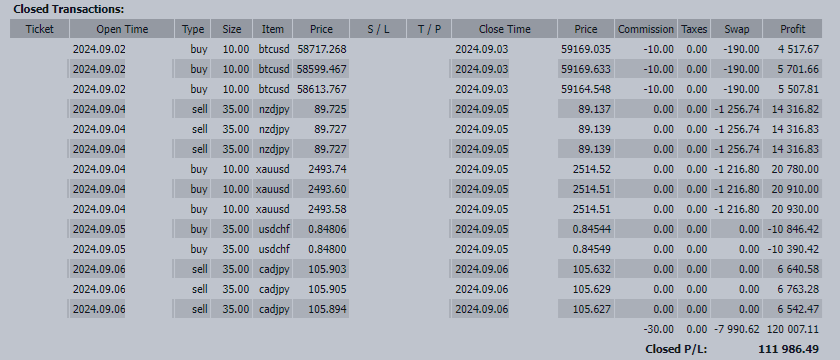

The trading for the week of September 2nd to 6th resulted in +111,986 USD. It was a week where I successfully rode the wave of USD selling and JPY buying.

Although the highly anticipated U.S. employment report showed an increase of 142,000 jobs, below expectations, the unemployment rate dropped to 4.2%, causing volatility in the USD exchange rate. The labor market slowdown was seen as orderly, raising the possibility that a significant rate cut by the Federal Reserve during the September FOMC may not be justified.

The next key event is the U.S. Consumer Price Index (CPI) release on September 11th, which could lead to heightened market volatility depending on the outcome.

Key Points Moving Forward:

1) Focus on U.S. CPI Ahead of the FOMC

Before the FOMC meeting on September 19th and 20th, the U.S. CPI for August will be released on September 11th. Given the Federal Reserve’s dual mandate of “price stability” and “maximum employment,” the inflation trends will play a crucial role in determining whether a significant rate cut is feasible.

The previous CPI for July showed a 2.9% year-over-year increase, marking the fourth consecutive month of slowdown and falling below 3% for the first time since April 2021. If the Core CPI also shows a slowdown this time, it could lead to further USD selling.

2) ECB’s Rate Cut Outlook

During the European Central Bank (ECB) meeting on September 12th, a 0.25-point rate cut is expected, though rapid cuts seem unlikely amid continued economic slowdown. Markets anticipate that the ECB will lower the deposit rate to 2.5% by 2026 and maintain it at that level.

The Euro is expected to face selling pressure due to the impact of the rate cut.

Currency Focus:

USD: Neutral to Sell

As expectations for a rate cut by the FOMC grow, the U.S. CPI results will likely cause significant fluctuations in the USD. Attention is also focused on comments from Fed watchers.

JPY: Neutral

While BoJ Governor Ueda hinted at the possibility of additional rate hikes, further yen buying is seen as unlikely. It is expected to take time for rate hikes to have any immediate effect.

EUR: Neutral to Sell

A rate cut by the ECB is widely anticipated, keeping the Euro under downward pressure. Dovish comments from ECB President Lagarde could lead to further Euro selling.

AUD: Neutral to Sell

The Australian dollar is likely to be influenced by the results of the U.S. CPI and risk-averse market trends. Domestic Australian indicators are expected to have a limited impact on the exchange rate.

NZD: Neutral to Sell

The New Zealand dollar is entering a correction phase, and caution is advised when buying it back against the yen. It is also likely to continue to show relative weakness compared to the Australian dollar.

ZAR: Neutral to Buy

South Africa's avoidance of a recession and pension reforms that are expected to boost consumption could support GDP growth, with the rand expected to remain solid.

GBP: Neutral

The focus remains on monitoring the slowdown in wage growth while gauging the pace of the BOE's rate cuts. There is a possibility that wage inflation could resurface, making the pound's movements of interest.

CAD: Neutral to Sell

Further rate cuts by the Bank of Canada are priced in, limiting upside for the Canadian dollar. Additional rate cuts are expected by the end of the year, making aggressive buying challenging.

Summary:

The U.S. CPI results are expected to have a significant impact on the market, with the volatility of the USD in particular likely to increase during the week.

Closing Remarks

Thank you all for reading this week’s FX trading report. This time, I’d like to discuss an important topic related to health, which is often linked to focus and performance in trading—specifically, cholesterol.

Cholesterol and Diet

Cholesterol is essential for our bodies, helping produce hormones, absorb vitamin D, and create bile for digestion. The issue arises when we consume too much “bad” cholesterol through our diets.

Research has shown that foods high in cholesterol, such as eggs and full-fat yogurt, don’t necessarily have a negative impact. For example, eggs are high in cholesterol but can increase HDL (the "good" cholesterol), which may help protect the heart (Harvard T.H. Chan School of Public Health, 2019).

Foods to Avoid

On the other hand, processed meats, fried foods, and fast food can raise cholesterol levels, increasing the risk of heart disease, diabetes, and obesity (Journal of Urology, 2017). Even small amounts of processed meat, like sausages and bacon, can increase the risk of heart disease by 42%.

Healthy Cholesterol Management

To lower cholesterol levels, it’s important to eat more fiber-rich foods, fruits, and vegetables, and stay active. Exercise can reduce LDL (the “bad” cholesterol) and increase HDL. Staying hydrated also helps maintain balance in the body. Fiber-rich foods like bananas can help reduce blood cholesterol levels.

Conclusion

Maintaining a healthy diet can also boost trading performance. It’s important to be mindful of cholesterol in your diet, reduce harmful foods, and incorporate good ones in a balanced way. Let’s continue to strive for better health and trading success!