Record-Breaking Week for Japanese Stocks! Huge Success with USD Selling Post-US CPI! Trading Results from July 8 to Jul

Record-Breaking Week for Japanese Stocks! Huge Success with USD Selling Post-US CPI!

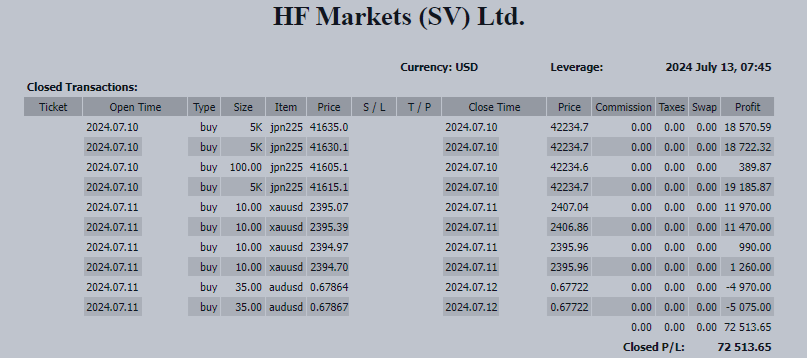

Trading Results from July 8 to July 12: Total +72,513 USD

Market Overview

It was a successful week, with significant gains made from the rising Japanese stock market and the USD selling pressure following the US CPI release. The June US Consumer Price Index (CPI) showed a month-over-month decline for the first time since May 2020, and the year-over-year rate was the lowest since June 2023. This sparked expectations for three rate cuts within the year, suggesting that US monetary easing could accelerate, which will likely keep the USD under pressure for a while. Moving forward, I plan to continue targeting USD selling opportunities.

Key Points Moving Forward

- Potential Follow-Up Intervention by Japanese Authorities Amid US Rate Cut Expectations

There is speculation in the market that the Japanese government and the Bank of Japan (BOJ) intervened by buying yen and selling dollars during the night of July 11, following the release of the June US CPI, which raised expectations for a US rate cut. The yen rose sharply from the 161 yen level to the 157 yen level within about 30 minutes, prompting some to believe that an "unexpected follow-up intervention" may have occurred.

Since the yen fell below 160 yen in late June, it had reached a low of 161.90 yen on July 3, marking the lowest level in about 37.5 years, without clear verbal intervention from the authorities. This led some market participants to believe that 165 yen was becoming a defense line for the authorities.

The direction of the USD/JPY exchange rate hinges on the US interest rate differential, which will be influenced by the timing of US rate cuts. The June US CPI released on the night of July 11 indicated a slowdown in inflation, leading to market perceptions that the "tide has turned." Following the CPI release, the likelihood of a rate cut in September exceeded 90% in the US interest rate futures market. Speculators began to buy back yen, with Mizuho Securities' Chief Forex Strategist Masafumi Yamamoto suggesting that an "unexpected follow-up intervention" was likely executed.

(Source: Jiji Press)

- Focus on Australian Employment Statistics for June

With the Reserve Bank of Australia (RBA) still expected to raise rates within the year, the release of the June employment statistics will be closely watched. The minutes from the RBA's June meeting mentioned downside risks to the labor market, but if the labor market remains robust as it did in the previous statistics, expectations for rate hikes will rise, potentially strengthening the AUD.

(Source: FISCO)

Currency Focus

USD (US Dollar): Bearish

The USD/JPY is expected to experience an unstable market with heavy resistance at the top due to rising US rate cut expectations. The June US CPI showed a month-over-month decline for the first time in four years and the lowest year-over-year growth since June 2023, raising expectations for three rate cuts within the year. The US CPI report also indicated potential currency intervention by the Japanese government and BOJ, suggesting a volatile market.

Next week, key US economic indicators include the NY Empire State Manufacturing Index (July 15), Retail Sales (June 16), Housing Starts (June 17), Industrial Production (June 17), and the Philadelphia Fed Manufacturing Index (July 18). With heightened rate cut expectations, the market may overreact to these indicators.

JPY (Japanese Yen): Neutral

The yen is expected to have a stable market against the USD but remains firmly under pressure due to the strong yen depreciation trend. The BOJ's intervention is seen as temporary, with market caution persisting. Opinions on reducing government bond purchases were divided at the "Bond Market Participants Meeting" held on July 9-10, leaving uncertainty about the BOJ's future actions.

EUR (Euro): Neutral

The euro is finding it difficult to establish a direction amid rising US rate cut expectations. The French legislative election's run-off saw the far-right party "National Rally (RN)" finish as the third-largest party, while the left-wing coalition emerged as the largest force, increasing political uncertainty. Moody's warned that a grand coalition government could make decision-making and debt management difficult.

AUD (Australian Dollar): Bullish

The AUD is expected to remain strong. The US CPI underperformed expectations, causing US rates to drop sharply, which supports the AUD due to differing monetary policy directions between the US and Australia. Although intervention concerns exist for the AUD/JPY, the lack of measures to curb yen depreciation provides upward potential. If the June employment statistics on the 18th show strength, the AUD could rise further.

NZD (New Zealand Dollar): Bearish

The NZD is expected to remain weak. The Reserve Bank of New Zealand (RBNZ) kept the policy rate unchanged but indicated in their statement that the headline inflation rate is expected to return to the 1-3% target range in the second half of the year. The RBNZ's dovish stance contrasts with the RBA's, keeping the NZD under pressure. Upcoming NZ data includes the June trade balance (July 22) and the July ANZ Consumer Confidence Index (July 26).

ZAR (South African Rand): Bullish

The ZAR is expected to remain strong. The establishment of a Government of National Unity (GNU) with the participation of the business-friendly Democratic Alliance (DA) raises hopes for improved economic policies. The South African Reserve Bank (SARB) will announce its policy rate on July 18, but significant movements in the ZAR due to monetary policy are unlikely.

GBP (British Pound): Neutral

The GBP is expected to remain volatile. The Labour Party is expected to take power in the UK general election, with Keir Starmer likely to become prime minister. The June Consumer Price Index (CPI) will be released on July 17, and the results could impact the GBP's movements. The market's view on the Bank of England's next meeting will be watched closely.

CAD (Canadian Dollar): Neutral

The CAD is expected to remain unstable, influenced by US interest rates. The June CPI release on July 16 will be important, with US inflation trends also being a factor. If Canadian CPI follows the US trend, expectations for further rate cuts may increase.

P.S.

This week, I am spending time at the Nijigen no Mori, a theme park in Hyogo Prefecture's Awaji Island Park.

Nijigen no Mori is Japan's first experiential entertainment park that combines Japanese manga and anime with media art in a natural environment. As someone who has enjoyed anime since childhood, I have always wanted to experience it.

Although there is still room for improvement, the experience of enjoying anime while being active in nature is wonderful. It would be even better with the addition of 3D technology for a more realistic experience. I highly recommend it!